Transcription

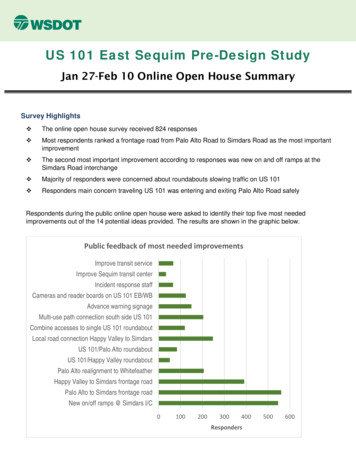

Options 101How and Why To Use OptionsBYCOREY WILLIAMS

2Options 101Table of ContentsPART ONE . 3Introduction: Who This Guide Is For . 3The Basics of Options . 3The Similarities Between Stocks and Options . 4The Only 2 Types Of Options You Need To Know About . 4How Option Prices Are Determined . 5Breaking Down An Options Quote . 5Ticker Symbols . 6A Note About Option Spreads . 7PART TWO . 7Why Use Options . 7Limited Risk, Unlimited Gain . 7Leverage . 8Options In Action: A Real Life Example . 9PART THREE . 10How To Get Started . 10Not Quite Ready For Real Money? Paper or Virtual Trading May Be For You . 10How To Open An Options Account . 11How To Place Your Option Trades .12Elite Option Trader .14PART FOUR: RESOURCES .15Further Reading . 15Option Brokerages . 15Where To Get Option Quotes . 16Industry Contacts . 17

3Options 101PART ONEIntroduction: Who This Guide Is ForHello and welcome to our primer on options and the option market. This short reportis written for the investor who is new to options or for those who want a refreshercourse on the basics. If you’ve invested in options before or are already familiar withhow options work, then I would recommend going straight to our Elite Option TraderOperating Manual. This vital report will detail the exact strategy to use in order tomaximize your profits with Elite Option Trader.I also want to point out that this primer will give you just enough of the basics to tradeoptions recommendations while using Elite Option Trader. For many, this will be allyou need. But, if you’d like a more in-depth explanation of options and how theywork, I’ve included a list of resources at the end of this report that will help you do justthat.For now, let’s get started The Basics of OptionsWe’re going to start at the beginning. An option is basically a right to buy or sell acertain number of shares of an individual stock, at a certain date, at a set price. Iknow that sounds a bit complicated right now, but it will become much easier to grasponce you’ve read this report and begin investing in options.So, an option is a security based off of, or derived from another security (in our case,individual stocks). It’s value (or price) at any given time is based primarily on theprice of the individual stock it covers.For example, let’s say you were looking at the following option:MSFT July 35 Call Option Trading for 1.25This option gives you the right to buy 100 shares of Microsoft, anytime before the 3rdFriday of July, at 35 per share. For this right, you pay what’s called a premium. (Asa side note, each option is based on 100 shares of stock.)Let’s say the premium (price) is quoted in this example as 1.25 per option. You justtake that 1.25 and multiply it by 100 to get the actual cost, in this case 125.

4Options 101So, for 125 you could buy the right to own 100 shares of Microsoft stock at 35 pershare anytime before the option expires (in July). Remember now, with Elite OptionTrader, we are generally buying and selling these options long before the date theyexpire. We are not actually buying or selling any shares of these companies at anytime.The Similarities Between Stocks and OptionsAs far as the buying and selling of options goes, stocks and options are very similar.Options trade on their own just as stocks do. That’s an important thing to remember.Options trade on their own exchange, have their own bid and ask price, and move upand down in value each trading day. So, even though option values are based on theprices of individual stocks, they are their own entity.Because of this:It is just as easy to buy or sell an option as it is to buy or sell a stock.The Only 2 Types Of Options You Need To Know AboutIn order to use Elite Option Trader, you’ll only need to be familiar with two types ofoptions.The first is a call option. A call option gives you the right to buy a stock. Thus, whenwe buy call options, WE WANT THE UNDERLYING STOCK TO GO UP.Conversely, a put option gives you the right to sell a stock. Thus, when we buy putoptions, WE WANT THE UNDERLYING STOCK TO GO DOWN.We could complicate this quite a bit, but to be successful using Elite Option Trader,that’s basically all you need to know about the different types of options.As mentioned before, if you want to learn more about the technical aspects of calls andputs, we’ve listed a number of inexpensive and free resources you can consult.For our purposes, just remember: Buy Call Option Want Stock To Go Up Buy Put Option Want Stock To Go Down

5Options 101How Option Prices Are DeterminedOption prices are determined using a number of factors that the average investordoesn’t really need to know about. To cover it quickly, the price of an option is basedon a mathematical formula that takes into account: The price of the stock it’s based on The strike price of the option (the price you can buy or sell the stock at) The volatility (how much the stock moves around in price) Time left until the option expires Interest rates and dividendsThen, you take all of these variables and put them into what’s called the Black-Scholesoption pricing model and it spits out a price.Now, since options trade on an exchange, the market makers will set prices thatgenerally correlate with this data. Note here I said “generally”. There are times whenprices for options get out of whack. Due to implied volatility, sometimes we will findover and undervalued options.This is a good thing and one of the situations we look for when makingrecommendations in Elite Option Trader.Breaking Down An Options QuoteWe briefly touched on this earlier, but I want to go over an option quote (or price) inmore detail. Once you become familiar with how option prices are quoted, readingthem will become second-nature.To recap, an option quote looks like this:GE October 2010 45 Call for 2.50The first part of the quote is the stock that the option is based on. In this case,General Electric.

6Options 101The second part is the expiration month. Expiration occurs on the 3rd Friday of theexpiration month of the option. Thus in this example, the call option expires on the3rd Friday of October.The third part is called the strike price. This is the price where you can buy thisparticular stock. So, we have the right to buy GE at 45 per share.The fourth part is whether the stock is a call or put. Obviously in this case, it is a call.And because it is a call, we want GE to go up so that our option price goes up also.The last part is the actual price of the option. In this case, 2.50. Remember, eachoption represents 100 shares, so the total cost of this option is 250.When taken as a whole, this option quote means we have the right to buy 100 sharesof General Electric at 45 anytime before the 3rd Friday in October for 250.Please note, the 250 is just for the right to buy GE. If you exercised the option, you’dhave to pony up an additional 4,500 to actually buy the 100 shares. With EliteOption Trader, we will suggest selling the option back on the market long before theexpiration date (so you don’t have to actually buy or sell any stock).Ticker SymbolsJust like individual stocks, currency options are identified by their ticker symbol. InFebruary of 2010, the symbology used for options changed dramatically.The old five character option ticker is a thing of the past. It’s beenreplaced by a new option ticker format.The new option ticker will be expressed as: Root Expiration Strike Type. Root the ticker symbol of the underlying stock. Expiration the expiration date of the option. Strike the strike price of the option. Type call or put.The good news is we give you all of this information in our trade alert.The bad news is the new ticker is a lot longer. And to top it off, individual brokeragefirms can use their own tickers for use on their platform. So check with your brokerabout how they’re handling the changeover.

7Options 101A Note About Option SpreadsBefore going on to the next section, I want to quickly go over a characteristic of optionand stock trading that you should be aware of.When you look at the price of an option, it will be quoted with a bid price and an askprice. The bid price is the price at which you can sell an option. The ask price is theprice you will pay if you want to buy that same option. The difference in these twoprices is called the spread. The ask price is always higher than the bid price.Unfortunately, this spread works against us as we are immediately out the differenceas soon as we make a trade. This is how the market makers make their money (andthey’re the ones setting the prices). This system of bid and ask prices has been used inUS markets for over a hundred years! So, it’s just something we have to accept andwork with.PART TWOWhy Use OptionsAs you’ll see, there are a lot of great reasons to use options in your investmentportfolio. The two biggest and best reasons to utilize options to potentiallysupercharge your returns are 1) the limited risk, unlimited gain potential and 2)leverage. In this section, you’ll discover why these two characteristics make optionssuch a great investment.Limited Risk, Unlimited GainYou read that right. With options, your risk is strictly limited to how much you paidfor the option (plus any commissions). So, if you buy an option (call or put) for 250,that’s the maximum you can lose on that trade. There is absolutely nothing that canoccur in the market with your option, or the stock it is based on, to change that.Conversely, the potential gain on any call option is theoretically unlimited. If theunderlying stock of a particular option keeps going up and up, the value of the optionwill keep going up and up. This is why you see option trades that go up, 100%, 200%,500%, and more!

8Options 101With a put option, your gain is limited by how far the underlying stock can go down,which is zero. But remember, if the underlying stock you bought a put option on goesto zero, you will have made a great deal of money (often in the hundreds or thousandsof percent)!I want to state that first part again here because there are a lot of misconceptionsabout options out there.When buying call and put options, your risk is NEVER, EVER more than the price youpaid for the option (plus any commissions or brokerage fees).Ok, I think I made that clear. Let’s go on to another huge benefit of options LeverageWhen many people hear the word leverage, they automatically associate it withenormous risk. That’s not so with buying options. In fact, in order to buy options,you’ll never need more in your account than the price of the option you buy (pluscommission). You’ll never get a margin call, have to deposit additional funds, and youwon’t be borrowing anything from your broker.When I talk about leverage with options, I’m talking about controlling large amountsof stock with very little capital.Let me show you what I mean.Let’s say you want to buy 100 shares of Microsoft. The current price per share is 29.45. So to get your 100 shares, you’ll need 2,945. I got that number bymultiplying 100 by 29.45.Now, let’s say you want to benefit from the shares of Microsoft going up, but you don’twant to invest 2,945. You could buy a call option. So, let’s say you decide to buy aJanuary 30 call option on Microsoft for 1.25. We know from previous examplesthat this option will cost you 125 ( 1.25 times 100).So, now you have the right to buy 100 shares of Microsoft at 30 per share anytimebefore January.Fair enough, now let’s look at what happens to these two investments if Microsoft goesup before January.

9Options 101Let’s say Microsoft soars to 38 per share by January. If you had bought the 100shares, your 2,945 investment would be worth 3,800. Not bad, that’s a 29% returnon your money.Now, let’s say Microsoft went to 38 and you owned the option. Your 125investment would be worth 800. Now we’re talking- that’s a 540% return onyour initial investment!And, the most you could have lost if Microsoft went to zero was 125, the original costof the option. If Microsoft went to zero and you actually owned the 100 shares, you‘dbe out the full 2,945!That is the real power of options.And remember, it works the same way when buying put options. The only differenceis the direction you want the underlying stock to move.When you combine the favorable characteristics of options with the selection andportfolio management recommendations found in Elite Option Trader, you’ve got avery powerful investment strategy that could potentially make large amounts ofmoney in both good and bad markets.Options In Action: A Real Life ExampleOk, before we move on I want to walk you through a fairly recent, real life option tradethat was recommended in Elite Option Trader. I think this will help you understandhow options work and how the process of buying and selling them works.On March 11, 2008, I recommended to my subscribers that they buy the followingoption:NSC June 2008 55 Call for 285What this means is they went out and bought the right to buy 100 shares of NorfolkSouthern for 55 per share anytime before the 3rd Friday in June. And for this optionthey paid approximately 285. (Since the price is constantly moving around, I’m suresome subscribers got it for a little less and some for a little more.)Thus, after getting my email, my subscribers went online and entered their trade orcalled their broker and had him or her place it for them. (I’ll go over how to do both ofthese methods of getting your trades in.)

10Options 101Remember, you can always buy more than 1 option. You could have bought 10 ofthese NSC calls for 2,850 (10 contracts times 285). I have subscribers who buy justone and I have subscribers who buy dozens!Anyway, since we were buying calls, we wanted NSC shares to rise. And rise they did.In the following two months, NSC started a nice move to the upside. At the time of myrecommendation, NSC stock was trading at about 53 per share. After a couple ofmonths, NSC shares had risen to about 65, which was about 22.6%. A nice gain.But our NSC call options went to 1,020 a piece. Then, my subscribers had theopportunity to go online, or call their broker, and sell the calls they had bought for 1,020 each. When you originally buy an option, that is called “opening a position”.When you then sell that same option, it is called “closing the position”.So, the call options my subscribers bought for 285 were sold for 1,020 two monthslater. That’s a gain of 258%. Now that’s more like it! For those subscribers whobought 10 contracts (which would be a total investment of 2,850), they wound upwith 10,200. Not bad for two months work.Now, I also want to point out that this is not the best, nor the worst, recommendationI’ve made. Some will go up much more than this, while others will go down. As longas you follow the portfolio management techniques discussed in the Elite OptionTrader Operating Manual, you will have the opportunity to make a lot of moneytrading options.PART THREEHow To Get StartedNow that you understand a little more about how options work, we’ll go over how toget started with options trading. Specifically, we’ll discuss how to open an optionsaccount and how to place and monitor your positions.Not Quite Ready For Real Money?Paper or Virtual Trading May Be For You

11Options 101Before we get into the specifics of getting an options portfolio set-up, I want to discussa way for you to “test the water” without actually having any of your money at stake. Ifyou’re still a little confused or intimidated by options, that’s ok. You can do what’scalled paper trading until you feel comfortable.With paper trading, you log each trade recommendation from Elite Option Traderonto a piece of paper. You write down the ticker symbol for the option, how much you“paid” for it, how many contracts you bought, and the date you bought it. You don’tactually execute the trade—but you write it down like you did.Then, when it’s time to sell, you write down the price you “sold” it at and the date.You can then calculate the profit or loss you made on each trade. Doing this for awhile will get you comfortable with options trading and how Elite Option Traderworks. It gives you a no-risk way to try out our service and get better acquainted withoption trading at the same time!To take paper trading one step further, many online option brokerages offer what’scalled virtual trading. With this, you maintain a “virtual” account and decide howmuch “fake” money you’d like to start with. You then proceed to enter option tradesjust like you would with a real account. Everything is handled by the brokerage.The various screens will tell you what you bought, how much you paid, how much gainor loss you have, etc. It’s just like having a real account—the only difference is there isno real money at stake. And the best part is, it generally costs you nothing to set-up.For example, OptionsXpress offers this service for free. I want to reiterate that this isa great way to familiarize yourself with options trading, before risking real money.Once you are ready to trade options with real money, you’ll need to open up abrokerage account How To Open An Options AccountIn order to open an options account, you’ll first need to decide where you’re going toopen it and with who. As far as the who part, we’ve listed a number of brokerage firmsin our resource section at the end of this guide who accept options accounts. Optionshave become very mainstream over the years and just about every brokerage companyoffers them—both online and off.Your choices for opening the account are:1. Online

12Options 1012. At a branch office near you3. Through the mailThe easiest way to get started is to open an account online through one of the manyreputable firms doing business there. But, if you’re more comfortable sitting downand talking with a live person, just about every brokerage office in your city will offeroptions trading (and that includes both discount and full-service brokers).Regardless of which broker and method you choose, there are several steps that willneed to be completed.First, you’ll need to fill out an application. This will include information such as whattype of account you want to open, your personal information (such as name andaddress), your trading experience, and so forth. They’ll also need to verify youridentity at some point.Once you’ve filled out the application, you’ll need to sign the application. Then, onceyou’re approved, you’ll need to fund your account. This can be done in a myriad ofways. You could send or give them a check, transfer directly from your checkingaccount, wire the money, and so on.The top brokerage firms will make the process very easy and very quick! The onlinecompanies have a lot of help available in the form of account reps and onlineresources should you require assistance.If you happen to be dealing with a “branch”, your account rep or broker will be morethan happy to answer any questions and help you get things set-up.Once you’ve got your account set-up, you’re ready to make your first options trade!How To Place Your Option TradesNow I’m going to go over the basics of entering an options trade. I’ll discuss bothentering these trades online and speaking with a live broker.To enter an options trade online (either buying or selling), you’ll need 5 pieces ofinformation about the option.First, you’ll need the details about the option. These are the stock symbol, optionexpiration date, strike price, and whether it’s a put or call. You’ll find this informationin our trade alert email or on the Elite Option Trader website under Latest Trade.

13Options 101Second, you’ll need to specify if this is an opening or closing transaction. If you’rebuying a new option, select ‘buy to open’. If you’re selling an option you already own,select ‘sell to close’. With Elite Option Trader, that is the only two selections you’llever make.Third, you’ll need to enter the quantity or the number of contracts you’d like to buy(or sell).Fourth, you’ll need to enter the price you’re willing to pay or get for the option.Again, Elite Option Trader will give you an idea of what you should pay. This can beentered as a market order or limit order.A market order will get your trade executed at the price currently being asked (ifbuying) or bid (if selling). A market order is generally the quickest way to get a tradeexecuted.A limit order will only execute if your specified price is reached or better. Thus, limitorders are not always executed right away as sometimes you must wait for the marketto move. And sometimes you may not get filled at all (if the option price keeps movingup).Fifth, and the last thing you’ll need to enter, is the duration or time frame of theorder. The two most popular selections here are ‘day’ and ‘GTC’.A day order is only valid for that trading day on which you placed the order. If it is notexecuted that trading day, the order goes away. A GTC, or Good-Till-Cancel, orderstays on the books until it is executed (if ever).Now, if you’re entering an order through a live person or broker, the steps you take arevery similar. The only difference is you read this information instead of entering it inyour computer.Let’s go over a brief example and show how you would get a trade done if you wereentering it online or over the phone.Elite Option Trader will show recommended trades like this:Buy the MSFT October 2010 30 Calls at 1.25 or betterIf you wanted to get this trade done over the phone, you could just open the email andread that to your broker. The only other things he or she would ask you are theduration, which would be a ‘day’ order, and how many contracts you wanted.To enter the above trade online, you’d put in the option details (stock symbol,expiration date, strike price, put or call), ‘buy to open’ as the transaction type, the

14Options 101number of contracts you want, ‘ 1.25’ limit as the type of order, and ‘day’ as theduration.All this may seem a little daunting at first, but trust me, its gets very easy over time.And remember, you can always paper or virtual trade before you begin with realmoney.Elite Option TraderOnce you are comfortable with options, how they work, how to open an account, andhow to place trades, then you’re ready for the opportunity to make some seriousmoney with Elite Option Trader.Your next step is to read the special report I prepared for my new subscribers entitled,“Elite Option Trader Operating Manual”. This is very important because it explainsthe optimal way to use this remarkable service for your chance at maximum gains.If you know exactly how to use Elite Option Trader, your chances of option tradingsuccess can be greatly increased.While I think following our service to the letter is a great way to use Elite OptionTrader, I do have subscribers who take my ideas and adapt them to their own tradingstyle. There is nothing wrong with that, in fact, we encourage it. I know of somesubscribers who do very well modifying my strategy.While I will give you specific ideas and trading strategies, remember that the ultimateresponsibility for your account lies with you. You must decide what works best for youand your particular style and situation.Remember, you are now a member of an elite group of investors who can potentiallyprofit very quickly regardless of which way the market moves. I thank you forsubscribing to Elite Option Trader and look forward to many successful investments!

15Options 101PART FOUR: RESOURCESFurther ReadingIf you’re interested in learning more about options, there are a number of books thatwill present a much more detailed explanation of options. Options have become sucha large component of the investment world that there a quite a few resourcesavailable. Here are a few you may want to check out: Chararacteristics and Risks of Standardized Options, The OptionsClearing Corporation Getting Started In Options, Michael Thomsett Options As A Strategic Investment, Lawrence McMillan Options Made Easy, Guy Cohen Understanding Options, Michael Sincere Options and Options Trading, Robert Ward The Options Doctor, Jeanette Schwarz Young Options Trading 101, Bill JohnsonOption BrokeragesAs we discussed earlier, just about every brokerage house in existence offers optionstrading. We’re going to list some of the larger online options firms here, butremember that most of the ‘brick and mortar’ brokerages, both full-service anddiscount, also offer options trading.While we do not rate the brokerages, you can get updated rankings from reputablesources such as Smart Money and Barron’s. As for whether you should use an onlinebroker or a ‘live’ broker, that really depends on several things.If you’re comfortable online and with options trading, you’ll probably want to use anonline broker. It’s easier, quicker, and more importantly, cheaper. Brokeragecommissions are a very important part of total return, so anytime you can reducethese it really benefits your account.

16Options 101Keep in mind also that many online brokers offer ‘live’ representatives who can helpyou place trades and answer questions about your account.Commissions at online brokers tend to be substantially less than those at full servicefirms. But, if you’re not comfortable online and don’t mind paying more incommissions, you may want to use a full-service broker.Anyway, here is a list of some of the larger, and better-known online brokers:Online Options BrokerWebsitePhone 20Charles Schwabwww.schwab.com866-855-9102Trade 43-3548E Tradewww.etrade.com800-387-2331TD Ameritradewww.tdameritrade.com800-454-9272Muriel rstrade.com800-869-8800Where To Get Option QuotesIf you’re looking for prices on different options, there are a number of sources online.Most of the major finance “news” sites offer them as well as the exchanges themselves.Some of the better “free” sites include: www.finance.yahoo.comYahoo Finance offers free and relatively detailed options quotes. Like nearly allfree service, the quotes are delayed 10-20 minutes.To get the actual quote, first you’ll first need to pull up the underlying stockquote. Then select “options” from the list in the left hand column to pull up theoption chain. Then you’ll need to select the correct expiration month. Andfinally, select the “symbol” next to the correct strike price under call or put.

17Options 101 www.cboe.comThe Chicago Board of Options Exchange offers a good quote system at theirwebsite. Here they are delayed 20 minutes. Your Online Brokerage FirmThis is probably the best option for most once you’ve got your accountestablished. Many of the online firms that specialize in options offer veryadvanced and real-time quotes.Industry ContactsFor more information on the exchanges and organizations that deal with options, youcan call, write, or visit the following: Chicago Board Options Exchange400 South LaSalle StreetChicago, IL 60606www.optionsclearing.com1-888-843-2263 New York Stock ExchangeOptions Products11 Wall StreetNew York, NY 10005www.nyse.com1-212-656-3000 American Stock ExchangeDerivatives Department86 Trinity PlaceNew York, NY 10006www.amex.com1-800-843-2639

Options 10118 The Options Industry CouncilOne North Wacker Drive, Suite 500Chicago, IL 60606www.optionscentral.com1-888-678-4667 The Options Clearing CorporationOne North Wacker Drive, Suite 500Chicago, IL t Hyperion Financial Group, LLC. All Rights Reserved. Protected by copyright laws of the United Statesand international treaties. This report may only be used pursuant to the subscription agreement controlling use ofthe Elite Option Trader websit

Options 101 3 PART ONE Introduction: Who This Guide Is For . Hello and welcome to our primer on options and the option market. This short report is written for the investor who is new to options or for those who want a refresher course on the basics. If you've invested in options before or are already familiar with