Transcription

Stellar Capital Partners LimitedResults: Year ended 30 November 2016

Forward-looking statements and disclaimerThis presentation contains certain forward-looking statements. These forward-looking statements are based on current information andexpectations, and involve a number or risks and uncertainties. Although Stellar Capital believes that the expectations reflected in suchforward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Actualresults may differ materially from those projected in such statements due to various factors, including but not limited to changes ineconomic and market conditions, changes in regulatory environment, fluctuations in security prices and exchange rates, and businessand operational risk management. Stellar Capital is under no obligation to update these statements once it has been posted or released.The information contained herein is provided for general information purposes only. This information does not constitute a solicitation,recommendation, guidance or proposal, and the service provided is not intended nor does it constitute financial, tax, legal, investment orother advice.Whilst reasonable steps are taken to ensure the accuracy and integrity of information contained herein, Stellar Capital accepts no liabilityor responsibility whatsoever if any information is, for whatever reason, incorrect. Stellar Capital further accepts no responsibility for anyloss or damage that may arise from reliance on information contained herein.2

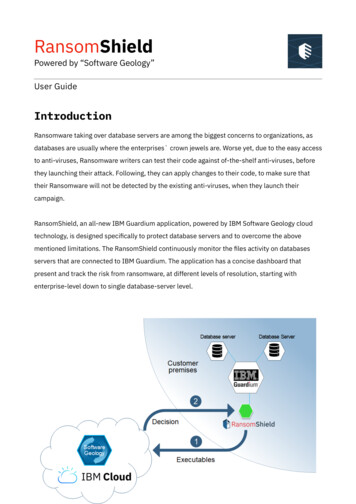

About us Stellar Capital Partners Limited (“Stellar Capital”, “the Company”, “us”, “we”) is a JSE Main Board listed investment holdingcompany (JSE ticker: SCP) Stellar Capital’s R2.5bn asset base comprises 6 financial services investments, 3 industrial investments and 2 disruptivetechnology investments At establishment, in order to build scale and introduce Dr Christo Wiese as an anchor shareholder, we acquired various noncore assets from the Wiese family in exchange for new Stellar Capital shares Stellar Capital has now successfully exited these initial non-core investments, raised new capital and repositioned the portfoliowith a strong focus on cash generative, annuity-based business within the financial services portfolio and Amecor (Industrials).The remaining industrial investments, Torre Industries and Tellumat, provide considerable upside potential to the portfolio asthe economy recovers The transition of the portfolio from the legacy asset base to the current portfolio of financial services and industrial assets,provides Stellar Capital with a more focussed investment strategy The Company’s focus remains to build out each investment in the portfolio through a combination of organic and inorganicinitiatives. We want to develop each asset such that it: has scale in terms of its profitability and business activities; and is a quality asset in terms of its management team, its ability to generate cash and its growth prospects3

Significant milestones201320142015NAV: R0,22bnNAV: R0,19bnNAV: R1,88bnSCP team conducted anextensive investigationinto the performance andviability of struggling ICTgroup, ConvergeNetHoldings Limited, andcommenced a process todispose of all operatingsubsidiaries and close thehead officeSCP team identified anopportunity to convertthe cash-shell into aninvestment holdingcompany byconsolidating a numberof sub-scale and illiquidassets held by ChristoWiese and other vendorsStellar Capital wasofficially established inJanuary 2015 with aportfolio investmentvalue of R532mIn November 2015, R1bnwas raised by way of arights issue andconvertible preferenceshare issueA process was initiated toliquidate the remainingnon-core assets, build thecore assets and focus theportfolio on annuityincome businesses, witha dual focus on theindustrial and financialservices sectors4

Significant milestones (cont.)2016NAV: R1,77bnEstablishment ofStellar Credit, fundmanager of StellarSpecialised Lendingand the InyosiSupplierDevelopment andEnterpriseDevelopment FundsPartnered withMasimongTechnologies andcompleted a 51.1%BEE transaction forTellumatLaunched amandatory offer forTorre Industries at aNAV accretivevaluation andacquired outrightcontrol of this keyassetAnnounced theacquisition of astrategic investmentin PrescientHoldingsCompleted theacquisition ofAmecor5

Investment strategy Stellar Capital’s investment strategy is to: develop a scalable portfolio of strategic or controlling interests in high quality companies operating in thefinancial services and industrial sectors; apply a hands-on investment approach, in order to assist management teams and to provide strategic input,without assuming direct operational responsibility; and apply a flexible investment approach relating to the timing and duration of investments Stellar Capital’s investment focus is to: hold a combination of strategic and controlling equity investments for capital growth as its primary objective;and earn high levels of current income from dividends and a credit investment portfolio as a secondary objective Stellar Capital’s geographic exposure comprises: Stellar Capital has initially invested in South African based investments with focused international operations,but over time intends to invest in foreign based investments which may or may not have establishedoperations within South Africa6

Investment strategy (cont.) Quantitative and qualitative targets: We seek a minimum 15% p.a return on NAV over any rolling three year period. The re-weighting of theportfolio into financial services and annuity-based industrial assets during 2016 and 2017 should enableconsistent attainment of this target going forward We run the portfolio with a lean recurring cost base in relation to NAV, which even at the current relativelysmall size, has been achieved since establishment at less than 1% of NAV We will have an active dividend policy that supports both the business strategy and optimal shareholderreturns7

Investment portfolio – Financial ServicesFinancial ServicesInvestmentManagementSpecialty Finance100%Investment:R457,8 million at30 November2016Return: R80,2million interestand dividends(annualised posttax yield of 16%)Reduced toR300m postreporting date100%Investment: R7,9million at 30November 2016Third partyAUM: R300million in SSLand R160 millionin InyosiStrategy to buildto R1 billion third party AUMover 24 months60%50%100%Investment: Upto R713 million(pending)Investment: R89,4million at 30November 2016Loan book atR38,5 millionyielding 22% perannumLocal AUM ofR77 billion, AUAof R83 billion,offshore AUA of 673 millionValuation underpinnedby liquid NAVStrategy to growto R100 million book over next 18monthsStrongly cashgenerative withannuity incomeprofileInvestment:R29,6 million at30 November2016 (equity)Investment: R5,7million at 30November 2016(equity)Efficiencymeasuresyielding results,capital structureunder reviewSignificant ITspend toenhancecapabilitiesUp to 49,9%Stable investmentteam and significantlyimproved investmentperformancePlatform foralternative investmentproducts8

Investment portfolio – Industrials and Disruptive nvestment: R709,4million at 30November 2016Investment: R359,7million at 30November 2016Investment: R239,2million at 30 November2016 (equity and pref)Highly accretivedisposal of KanuEquipmentNormalised EBITDAexceeded budget by19% (H1 FY2017)Trading improving,albeit off a lowbase. Outcome ofstrategic reviewpendingStrong cash flowgeneration, ungearedcapital structureExperienced significantexecution delays inFY16 exacerbated byhalt of government settop box migrationresulting in EBITDAR17,1 million (R2015:R34.9 million)Significant annuityrevenue base, lowworking capitalrequirement2%2%Strong EBITDAcontribution by AirTraffic Management9

Portfolio operational performanceSpecialty FinanceStellar Specialised Lending is a fund that focusses on direct lending opportunities to listed and unlistedcorporates. With the ability to invest across the capital structure and a typical loan size of betweenR50m – R200m Stellar Specialised Lending currently has over R600m in invested loan assetsStellar Credit is a subsidiary of Stellar Capital Partners Limited. A licensed Financial Services Provider,Stellar Credit manages two direct lending funds, namely Stellar Specialised Lending and Inyosi Finance.Inyosi Finance is a provider of debt funding to Black owned SMME’s in South AfricaPraxis is a leading provider of short term finance to the panel beating industry which provides a uniqueoffering to address motor body repairers’ (“MBRs”) working capital needs. The business is currentlyfinancing approximately 2,000 MBR jobs per month.The company’s proprietary information technology platform is being expanded to facilitate seamlessinteraction between MBRs, parts suppliers and insurers within the industry to drive its ultimatestrategy to institutionalise the R25bn annual MBR funding market in South AfricaIE Rentals is a specialised ICT Asset Finance Solutions company providing finance solutions tobusinesses in acquiring critical technology infrastructure via customized rental solutionsAll equipment is maintained and serviced by Integrated Equipment IT through dedicated maintenanceand support agreements over 36, 48 or 60 months.10

Portfolio operational performance (cont.)Investment ManagementThe significant units of Prescient’s financial services operations, comprise:Investment managementPrescient Investment Management manages money ( R70bn) on behalf of retirement funds, medical aidschemes, other retirement vehicles and corporate entities, trusts and individuals.SecuritiesPrescient Securities operates in a competitive stock broking market and offers efficient trade and executionservices as well as a diverse research competency.Fund servicesPrescient Fund Services (PFS) is a wholly-owned subsidiary of Prescient that offers specialist outsourcedadministration (including hedge fund administration), platform services and global execution services to assetmanagers, multi-managers and other institutional investment providers. Current third party assets underadministration exceed R60bn.Life and MancoPrescient Life holds a linked life licence under which it issues investment linked policies to institutional andretail clients.Prescient Management Company offers collective investment schemes (unit trusts) to retail and institutionalclients who wish to access Prescient Investment Management's distinctive investment style and philosophythrough an efficient vehicle.ChinaPrescient Investment Management has a representative office in Shanghai and was the first institution in Africato be granted a Qualified Foreign Institutional Investor license by the Chinese authorities.11

Portfolio operational performance (cont.)Investment Management The operations of Cadiz currently comprise the asset management business, the Life company and amanagement company Since the appointment of Shawn Stockigt as CEO, the investment and fixed income teams, under leadershipof Matt Brenzel and Alastair Sellick respectively, have stabilised and delivered consistent top-quartileresults:South African EQ GeneralAshburton Enhanced Value SATracker APSG Equity ARECM Equity BElement Islamic Equity AKagiso Islamic Equity ACadiz Mastermind AMedian3 46%11111Rank123451 year1 year11.87%12.81%*8.30%9.51%8.35%QuartileABSOLUTE YIELDBridge High Income AElement Specialist lncome ATruffle MET Income Plus AInvestec Absolute Balanced ACadiz Absolute Yield AMedian3 uartile11*31ABSOLUTE RETURNMET Flexible FoF AFlagship IP Flexible Value A1ClucasGray Future Titans PrescientA1Centaur BCI Flexible AMET Target Return APSG FlexibleCadiz Equity Ladder ACadiz Inflation PlusMedian3 months10.68%9.31%Quartile11Rank121 5%8.12%6.43%Rank3 32QuartileRank16118851163 3Rank713 564239104941Source: Morningstar January 201712

Portfolio operational performance (cont.)Investment Management Since the appointment of Shawn Stockigt as CEO, the investment and fixed income teams, under leadershipof Matt Brenzel and Alastair Sellick respectively, have stabilised and delivered consistent top-quartileresults:MA HIGH EQUITYElement Islamic Balanced ACadiz Managed Flexible AMedianMA LOW EQUITYMET Defensive FoF ABridge Stable Growth AElement Real Income ACadiz Stable AMedian3 months9.29%6.06%2.46%3 months7.70%4.54%4.27%4.03%1.85%Retail Money MarketMomentum MoM Money Market B4BCI Money Market ASygnia Money Market ACoronation Money Market ACadiz Money Market AMedian3 tile1111Quartile11111Rank12Rank1234Rank123451 year Quartile18.03%110.08%15.53%1 year13.69%13.73%11.58%7.80%5.34%1 11*11Rank216Rank325183 years4.58%4.23%7.27%3 years4.23%11.59%5.10%5.68%7.05%Rank13743 : Morningstar January 201713

Portfolio operational performance (cont.)IndustrialsTorre Industries Ltd is an African industrial group which is listed on the JSE. Torre provides equipment andmachinery, auto parts and support services to its customers in selected high growth markets in the industrialsectors across Africa. These sectors include but are not limited to the agricultural, automotive, construction,earthmoving, engineering, mining, manufacturing, and condition monitoring industries.Torre Industries’ core business is the value added sale and rental of branded capital equipment andmachinery, the distribution of high quality parts and components, the delivery of critical support services andthe provision of financing solutions which are needed to support our customer’s expansion programmes.Amalgamated Electronic Corporation Limited (“Amecor”) offers a range of exclusive technologies relating tosecurity and electronics.Amecor’s core activities comprise of:FSK Electronics: The manufacture and supply of sophisticated security transmission technology andapplicationsSabre Radio Networks: A licensed Radio Frequency and GSM global network for data transmission and off siteequipment and /or security controlTellumat offers world-class, progressive technology products, custom solutions and services. As leaders inelectronic technology in the telecommunications, defence, transport and energy industries, it serves SouthAfrica and select world markets.14

Sum-of-the-partsAudited as at30 November 2016%Unaudited as at31 May 2016Financial ServicesCadiz Holdings (Pty) LtdPraxis Financial Services (Pty) Ltd Integrated Equipment Rentals (Pty) Ltd Stellar Credit (Pty) ustrialsTorre Industries LtdAmalgamated Electronic Corporation LtdTellumat (Pty) 0%13%900,833100,11936%0%4%Corporate AssetsCash and cash equivalentsLoan portfolio Venture capital portfolioFinancial assetsOther 2370,52532,63132%3%0%15%1%R'000Portfolio weighting tofinancial servicesexpected tosignificantly increasepost investment inPrescientSignificant movementscomprise specialdividend of excesscapital from Cadiz,additional investmentin Torre Industries,Amecor and reductionin SSL investment inanticipation of thePrescient transactioncloseAudited as at% 30 November 2015Total assetsPreference share ,277(548,478)Trade and other payablesSum-of-the-parts 2,021Sum-of-the-parts value per share (Rand)1.661.572.03Sum-of-the-parts value per sharepost preference share conversion (Rand)1.821.762.13% Praxis Financial Services and Integrated Equipment Rentals valuations include amounts advanced by Stellar Specialised Lending as term debt in the amountof R109,9m and R45,6m respectively which amounts are not shown in the Loan portfolio line item15

Valuation methodologiesValuation methodologySelected multipleValuation(discount)/premium to 3year trailing multipleFund NAVN/AN/AN/AStellar CreditSustainable NPAT multiple10.6-8%-26%Praxis Financial ServicesSustainable NPAT multiple10.9-5%-24%Integrated Equipment RentalsSustainable NPAT multiple10.9-5%-24%Adjusted NAVN/AN/AN/AQuoted market priceEV/EBITDA multipleEV/EBITDA N/ATictracCostN/AN/AN/AInvestmentsFinancial ServicesSpecialty FinanceStellar Specialised LendingInvestment ManagementCadizIndustrialsTorre m tospot multipleVenture Capital16

Condensed Statement of Comprehensive IncomeFair value adjustments ofR437m result from excesscapital distributions (R232mSSL, R203m Cadiz, R2mStellar Credit).Dividend revenue comprisesthe R437m capitaldistributions and earningsdistributions of R43m (R33mSSL, R10m Torre Industries)Operating expenses includeR21,3m non-recurringtransaction costsManagement fees are shownnet of R7m recoveries fornon-regulatory expensesincurred by Stellar Capital onbehalf of MancoR'000Fair value adjustmentsRealised and unrealised fair value gains and lossesFair value losses resulting from capital distributions by portfoliocompaniesDividend revenueCapital distributions declared by portfolio companiesEarnings distributions declared by portfolio companiesOther dividends receivedYear endedYear ended30 November 2016 30 November 262(21,334)(21,334)99-Interest revenueImpairment of loan to portfolio companyGross (loss)/ income from investments98,188(2,289)(172,579)24,3082,983Other incomeFinance costsNet (loss)/income before operating gement feeOperating expensesTransaction costsImpairments and loss on disposal of Consolidated SubsidiariesLoss before 1,296)(4,887)(15,108)(29,446)TaxationNet loss from continuing operations(25,990)(309,514)1,505(27,941)17

Condensed Statement of Financial PositionCash and cashequivalents increasedfollowing reportingdate from redemptionof SSL investment inanticipation ofPrescient transactionAs at30 November 2016As at30 November 8-2187,0267,15923382,854797,760Total 0Investments at fair valueLoans to portfolio companiesOther financial assetsProperty, plant and equipmentDeferred taxationTrade and other receivablesCash and cash equivalentsPreference share liabilityCurrent tax payableTrade and other payablesTotal liabilities18

Condensed Statement of Cash FlowsR'000Net cash flows from operating activities andcapital distributions received as dividendsNet cash flows from investing activitiesNet cash flows from financing activitiesTotal movement for the yearCash and cash equivalents at the beginning of the yearCash and cash equivalents at the end of the yearYear endedYear ended30 November 201630 November 2,854(279,154)1,028,122794,4263,334797,760Net cash flows from operating activities: Materially includes once-off distributions from SSL of R232 million and Cadiz R41 million Adjustments for non-cash items include R748 million fair value adjustments, R98 million interest revenue shown separately, R71m finance costsshown separately and R166 million non-cash distributionsNet cash flows from investing activities: Additional investments made in Amecor (R258 million), Tellumat (R167 million), Cadiz (R106 million), Stellar Credit (R5 million) and the venture capitalportfolio (R30 million) Net loan to SSL of R503m (capitalised to the equity investment) Return of R200m deposit; Goliath Gold proceeds of R47m; repayment of loan R34m; disposal of Cadiz funds of R43m received as dividend in specieNet cash flows from financing activities: Includes rights issue proceeds of R89 million as well as cash outflows for the purchase of treasury shares of R21 million and preference sharepayments of R54 million19

Capital structure During November 2015, Stellar Capital raised R1 billion by way of a R400 million underwritten rights issue and R600 millionconvertible preference share issue (“CPS”) The CPS terms are as follows:Face valueMaturityCouponPaymentsConversion price per shareMaximum number of shares to be issued on conversionR600m30 May 201995% of PrimeSemi-annuallyR2.78215.827 m The CPS finance cost of R60 million per annum is currently, and for the foreseeable future, materially covered by the R300million investment in the Stellar Specialised Lending fund which yields c. 16% pa A R225 million bridge loan, repayable on 30 June 2017, has been secured to fund a portion of Stellar Capital’s investment inPrescient Holdings. The facility will be reduced to the extent that any Prescient Ltd shareholders elect the re-investment optionon the transaction. The balance of the facility is anticipated to be repaid from a combination of additional special dividendsfrom Cadiz, Amecor and SSL Stellar Capital may engage in a limited share placement in the coming months in order to strengthen the balance sheet andfacilitate an increased BEE shareholding in the company. No immediate further capital raises are envisaged or required as SCP’sportfolio is forecast to generate sufficient cash flow to fund its planned investment requirements Proceeds from investment exits will be used to reduce preference share debt in the absence of any identified acquisition targetsat date of exit20

Strategic initiatives and outlook We believe Stellar Capital is a unique and attractive investment proposition as it provides a listed access point to a quality unlisted portfoliowhich is managed, at low cost, by a committed and fully invested teamFinancial Services: Stellar Capital will continue to build on its financial services themes of niche lending, investment management, disruptive financialtechnology opportunities and potentially explore investment in the insurance sector over time A significant opportunity exists to explore synergies between Stellar Capital’s portfolio investments and other companies in the larger Titannetwork We view financial services as a sector that provides stable returns through the economic cycle with some disruption opportunitiespotentially yielding above average growthIndustrials: We are a patient investor in Torre Industries as it awaits the outcome of a full strategic review. We believe we are positioned for a recoveryin operational performance of the asset, albeit that – in the absence of economic tailwinds - this process could be slow. We support adeliberate process to manage costs tightly whilst cautiously seeking expansion and diversification through market share gains and a wellexecuted acquisition strategy Amecor is well positioned to continue its growth in a buoyant and consolidating South African security sector. The asset delivers sustainableannuity revenue growth and is expected to continue its double digit EBITDA growth trajectoryBEE: Stellar Capital will continue its strategy of partnering with best-in-class BEE groups within the underlying investment portfolio as well asStellar Capital, where it will actively seek to increase BEE shareholding to at least 10% from current levels of c. 5%21

Strategic initiatives and outlookPortfolio weighting: Following the conclusion of the Prescient transaction, the portfolio will be approximately equally weighted between financialservices and industrial investments This weighting provides shareholders with access to an attractive portfolio that has exposure to a cyclical recovery in the SAeconomy as well as stable, consistent growth businesses with good cash flows and international expansion possibilities Over time the intention is for the portfolio to be increasingly weighted towards financial services and various options will beconsidered in order to achieve thisOutlook: Stellar Capital will continue the processes that commenced in 2016 through the conclusion of the Prescient acquisition. Certainother value accretive transactions are expected to be concluded over the course of the year ahead but these will all be withinexisting portfolio companies NAV growth will largely be driven by the performance of the new investments (Prescient and Amecor) although all investmentsare now expected to have solid years in terms of profitability and cash generation. We expect the performance of Torre tostabilise and then recover strongly in the years ahead22

Share informationShares in issue at 15 February 20171,069,606,625Market capitalisation at 15 February 2017R1,4bnMajor ordinary shareholders at 30 November 2016ShareholderAsgard Capital AssetsThunder Securitisations (Pty) Ltd Wiese and related (various entities)SJP Capital LtdLCF Securities LtdPercentage12.75%10.00%9.94%7.38%6.01% Held 35% Pettit, 35% Thunder Capital Assets, 30% WieseMajor preference shareholders at 30 November 2016ShareholderRand Merchant BankWiese and related (various entities)Asgard Capital AssetsPercentage41.00%31.34%16.67%23

Corporate informationDirectorsDD Tabata (Chairman)* , CE Pettit (Chief Executive Officer),CB de Villiers (Chief Financial Officer), CJ Roodt* , PJ VanZyl , MVZ Wentzel* , MM Ngoasheng* , L Potgieter* (* Independent) ( Non–executive)Company SecretaryS GrahamRegistered officeThird FloorThe Terraces25 Protea RoadClaremontCape Town7708Postal addressSuite 229, Private Bag X1005ClaremontCape Town7735Transfer SecretariesComputershare Investor Services (Pty) Ltd70 Marshall StreetJohannesburg2001SponsorRand Merchant Bank (a division of First Rand Bank Ltd)24

Annexure: peer group multiplesSpecialty financeMarketcapitalisation (Rm)P/E ratio3 year trailing ave.P/E ratiospotTransaction yAverageIndustrialsEntityMarketcapitalisation (Rm)EV/EBITDA3 year trailing ave.EV/EBITDAspotAnsys590n/a7.0Mix age25

Stellar Credit is a subsidiary of Stellar Capital Partners Limited. A licensed Financial Services Provider, Stellar Credit manages two direct lending funds, namely Stellar Specialised Lending and Inyosi Finance. Inyosi Finance is a provider of debt funding to Black owned SMME'sin South Africa