Transcription

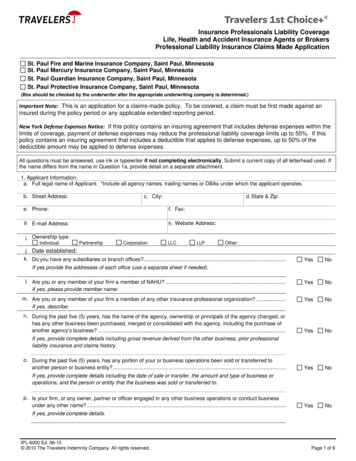

StudentHealthInsuranceProgramDesigned for theStudents ofStudent Health Insurance coverage hasa limit of 100,000 per condition. Beadvised that you may be eligible forcoverage under your parents' plan ifyou are under the age of 26. If you haveany questions or concerns about thisnotice, contact Consolidated HealthPlans at 800-633-7867.IMPORTANT NOTICEThis brochure provides a brief description of the importantfeatures of the Policy. It is not a Policy. Terms andconditions of the coverage are set forth in the Policy. Wewill notify Covered Persons of all material changes to thePolicy. Please keep this material with your importantpapers.2012-2013NATIONWIDE LIFE INSURANCE COMPANYCOLUMBUS, OHIOPolicy Number: 302-065-2910Effective August 18, 2012 to August 18, 2013NOTICE:YourStudentHealthInsurance coverage, offered byNationwide Life Insurance Company,may not meet the minimum standardsrequired by the health care reform lawfor the restrictions on annual dollarlimits for health insurance plans otherthan Student Health Insurancecoverage for the 2012/2013 policy year.Minimum restrictions for policy yeardollar limits for Student HealthInsurance coverage are 100,000 forthe 2012/2013 policy year. YourNONDISCRIMINATORYHealth care services and any other benefits to which aCovered Person is entitled are provided on anondiscriminatory basis, including benefits mandated bystate and federal law.THIS CERTIFICATE IS SUBJECT TO THE LAWS OF THE STATEOF NEW JERSEY.TABLE OF CONTENTSPrivacy Policy . 6Eligibility . 6Effective and Termination Dates . 6How to Enroll . 7Premium Rates . 7Extension of Benefits . 8Student Health Center Referral . 8State Mandated Benefits . 9Additional Benefits . 14Schedule of Benefits .Center Fold OutCoordination of Benefits . 15Automobile Related Injury Benefit . 18Sports Coverage . 20Basic Medical Benefit . 20Major Medical Benefit . 20Optional Catastrophic Coverage . 21Prescription Drug Benefit . 21Repatriation . 22Medical Evacuation . 22Definitions . 22Exclusions and Limitations . 28Claim Procedure . 30Claim Appeal . 31Travel Assist Program . 31Vision Discount Program . 31 Benefit EnhancementsNew for the 2012 – 2013 School YearIncreased Prescription Drug benefit;Inclusion of wellness and preventive carebenefits.3

WHERE TO FIND HELPFor questions about: Insurance Benefits Claims Processing Lost ID Cards (x137)Please contact:Consolidated Health Plans2077 Roosevelt AvenueSpringfield, MA 01104(800) 633-7867www.chpstudent.comFor questions about: Enrollment Waiver/Enrollment ProcessPlease contact:University Health Plans, Inc.One Batterymarch ParkQuincy, MA 02169-7454Phone: (800) 437-6448Fax: (617) 472-6419www.universityhealthplans.comEmail: info@univhealthplans.comTo: All Students and Parents:I am pleased to announce that Stevens has selectedUniversity Health Plans to provide a student healthinsurance plan for 2012-2013. This twelve (12) month planis effective from August 18, 2012 to August 18, 2013. Also,students can purchase Optional Catastrophic Coverage(see details on page 21).New Jersey law mandates that all full-time students havehealth insurance. Students are automatically enrolled in theinsurance plan and a premium for coverage is added totheir tuition bill unless proof of comparable coverage isfurnished. Students who have comparable insurancecoverage can waive the student plan on-line atwww.universityhealthplans.com and selecting StevensInstitute of Technology.The deadline to process a waiver is August 29, 2012.Waivers must be submitted online. No paper forms will beaccepted. Students who waive the plan online will be able4to print out a confirmation of their waiver request. If full-timestudents do not submit a waiver by the deadline, they willbe automatically enrolled in the plan.For most students, including those with F1 visas, theannual premium is 1,272. Benefits for InternationalStudents meet U.S. Government requirements.We recommend that all students enroll in the StudentInsurance Program. Purchasing the Student InsuranceProgram assures access to local care, eliminates thehassle of pre-authorization from family insurancecompanies, and reduces paperwork for students. Manyfamilies find it cost-effective and convenient to be enrolledin both the student plan and their family insurance plan.Varsity athletes are especially encouraged to purchase thePlan.Enrolled students can also purchase this plan for theirspouse/domestic partner and children. Students who areinterested in purchasing dependent coverage should obtaina dependent enrollment form from University Health Plansonline at www.universityhealthplans.com or by callingdirectly at (800) 437-6448.In addition to the Student Health Insurance Program,Stevens is pleased to offer our students and theirdependents a Dental Insurance Plan (DeltaCare). Youmay enroll in this plan on a VOLUNTARY basis, it is notrequired insurance. The online enrollment form, planbenefit highlights, and a list of network dentists can befound by linking to www.universityhealthplans.com andselecting Stevens Institute of Technology and thenDental.Should you have any questions about the online waiverprocess or benefits please contact University Health Plansat (800) 437-6448.I wish you all the best for the upcoming school year.Sincerely,Joseph Stahley,Assistant Vice President of Student Development5PRIVACY POLICYWe know that your privacy is important to you and westrive to protect the confidentiality of your nonpublicpersonal information. We do not disclose any nonpublicpersonal information about our customers or formercustomers to anyone, except as permitted or required bylaw. We believe we maintain appropriate physical,electronic and procedural safeguards to ensure the securityof your nonpublic personal information. You may obtain acopy of our privacy practices by calling us toll-free at (800)633-7867 or by visiting us at www.chpstudent.com.ELIGIBILITYNew Jersey law mandates that all full-time students havehealth insurance. Students enrolled in Stevens’Cooperative Education program have full-time status. Fulltime students are automatically enrolled in the insuranceplan and a premium for coverage is added to their tuitionbill unless proof of comparable coverage is furnished.Students must actively attend classes (Co-op students areconsidered actively attending) for at least the first thirty-one(31) days after the date for which coverage is purchased.The Company maintains its right to investigate studentstatus and attendance records to verify that the Policyeligibility requirements have been met. If the Companydiscovers the Eligibility requirements have not been met, itsonly obligation is to refund the premium.Eligible students who enroll may also insure theirDependents. Eligible Dependents are the spouse/domesticpartner and children up to age twenty-six (26) years, inaddition to unmarried children up to thirty-one (31) years ofage who are not self-supporting. Dependent eligibilityexpires concurrently with that of the Insured Student.EFFECTIVE AND TERMINATION DATESThe Master Policy on file at the school becomes effectiveat 12:01 a.m., August 18, 2012. Coverage becomeseffective on that date or the date application and fullpremium are received by the designated representativeacting on behalf of the group insured for remittance to theCompany, whichever is later. The Master Policy terminatesat 12:01 a.m. August 18, 2013. Coverage terminates on theend of the period through which premium is paid.Dependent coverage will not be effective prior to that of the6

Insured student. Refunds of premiums are allowed onlyupon entry into the armed forces.If the Dependent is mentally or physically handicapped andincapable of sustaining employment, termination of his orher insurance will be waived. The Company must befurnished proof of these conditions within thirty-one (31)days after the child attains the limiting age for Dependents.You must meet the Eligibility requirements listed aboveeach time You pay a premium to continue insurancecoverage. To avoid a lapse in coverage, Your premiummust be received within thirty-one (31) days after thepremium expiration date. It is the student’s responsibility tomake timely renewal payments to avoid a lapse incoverage.The Policy is a Non-Renewable One (1) Year Term Policy.It is the Insured’s responsibility to obtain coverage thefollowing year in order to maintain continuity of coverage.Insureds who have not received information regarding asubsequent Plan prior to this Certificate Termination Dateshould inquire regarding such coverage with the school.HOW TO ENROLLPremium for coverage for all eligible students isautomatically added to their tuition bill unless proof ofcomparable coverage is furnished. Payment for full-timestudent coverage should NOT be made directly to theCompany.If you are interested in obtaining coverage for YourDependents and voluntary Optional CatastrophicSupplemental plan, please visit the website atwww.universityhealthplans.com or call UHP at (800) 4376448.PREMIUM RATES8/18/128/18/13 1,2721st2ndSummer Summer1/8/13- 5/15/13- 7/14/138/18/13 8/18/13 8/18/13 855 450 249 2,752 1,776 863 394 2,051 1,342 663 322 375 375 375 tionalCatastrophicSpring7Please visit www.universityhealthplans.com to view theenrollment form for voluntary students and Dependents.Dependents are not eligible to use the SHC; and therefore,are exempt from the above limitations and requirements.EXTENSION OF BENEFITS AFTER TERMINATIONSTATE MANDATED BENEFITSThe coverage provided under this Policy ceases on theTermination Date. However, if an Insured is TotallyDisabled on the Termination Date from a covered Injury orSickness for which benefits were paid before theTermination Date, Covered Medical Expenses for suchInjury or Sickness will continue to be paid as long as thecondition continues but not to exceed ninety (90) days afterthe Termination Date.The total payments made in respect of the Insured for suchcondition both before and after the Termination Date willnever exceed the Maximum Benefit. After this “Extension ofBenefits” provision has been exhausted, all benefits ceaseto exist, and under no circumstances will further paymentsbe made.This Plan will also pay any applicable Covered MedicalExpenses for benefits mandated by New Jersey StateInsurance Law, subject to Policy limits.Note: Wellness/preventive benefits under the AffordableCare Act (ACA) are required to meet federal regulations.Under ACA, states retain the ability to mandate benefitsbeyond those established by the federal mandate. Pleasesee the Schedule of Benefits for coverage details.STUDENT HEALTH CENTER (SHC) REFERRALREQUIRED - STUDENTS ONLYThe student must use the services of the Health Centerfirst where treatment will be administered, or referralissued. Expenses incurred for medical treatment renderedoutside of the Student Health Center for which no priorapproval or referral is obtained are excluded fromcoverage. A referral will be issued by visiting the StudentHealth Center. A referral from the counseling center isrequired for mental health services rendered outside thecenter.A SHC referral for outside care is not necessary only underthe following conditions:1. Medical Emergency. The student must return to SHCfor necessary follow-up care;2. When the Student Health Center is closed;3. When service is rendered at another facility duringbreak or vacation periods;4. Medical care received when the student is more thanfifty (50) miles from campus;5. Medical care obtained when a student is no longerable to use the SHC due to a change in studentstatus; or6. Maternity.8Mammography: Benefits will be provided formammography at the following intervals: 1) one (1)baseline mammogram examination for women who are atleast thirty-five (35) but less than forty years (40) of age;and 2) one (1) mammogram every year for women ageforty (40) and over.Wellness Health: Benefits will be provided for 1) annualtests to determine blood hemoglobin, blood pressure, bloodglucose level and blood cholesterol level or, alternatively,low-density lipoprotein (LDL) level and blood high densitylipoprotein (HDL) level and an annual consultation with ahealth care provider to discuss lifestyle behaviors thatpromote health and well-being; 2) all Covered Persons 35years or older, a glaucoma eye test every five (5) years; 3)all Covered Persons forty (40) years of age or older, anannual stool examination for presence of blood; 4) allCovered Persons forty-five (45) years of age or older, aleft-sided colon examination of 35 to 60 centimeters everyfive (5) years; 5) all female Covered Persons, a pap smear;and 6) all Covered Persons, recommended immunizations.Inpatient Coverage for Mastectomy and ReconstructiveBreast Surgery: Minimum inpatient care of 72 hoursfollowing a modified radical mastectomy or 48 hoursfollowing a simple mastectomy. Reconstructive breastsurgery is payable as any other surgery, including: 1) thecost of prostheses; and 2) the cost of outpatientchemotherapy following surgical procedures in connectionwith the treatment of breast cancer.Diabetes Treatment: Equipment and supplies for thetreatment of diabetes, if recommended or prescribed by aphysician or nurse practitioner/clinical nurse specialist:9

blood glucose monitors; blood glucose monitors for thelegally blind; test strips for glucose monitors and visualreading and urine testing strips; insulin; injection aids;cartridges for the legally blind; syringes; insulin pump andappurtenances; insulin infusion devises; and oral agents forcontrolling blood sugar. We will also pay, when necessary,for expenses incurred for self-management education of aperson with diabetes.Childhood Immunizations: Childhood immunizations,including the immunizing agents, as recommend by theAdvisory Committee on Immunization Practices and theDepartment of Health.Lead Poisoning Screening: Screening by bloodmeasurement for lead poisoning for children, includingconfirmatory blood testing as specified by the Departmentof Health. The benefit includes medical evaluation andnecessary follow-up and treatment for lead poisonedchildren.Alcoholism Treatment: Treatment of alcoholism to thesame extent as for any other Sickness for: inpatient oroutpatient care in a licensed Hospital; treatment at adetoxification facility; confinement as an inpatient oroutpatient at a licensed, certified, or state approvedresidential treatment facility under a program that meetsthe minimum standards of care equivalent to thoseprescribed by the Joint Commission on HospitalAccreditation.Home Health Care Expense: Benefits will be paidfollowing confinement in a Hospital or a skilled nursingfacility for at least three (3) continuous days prior toincurring expenses for Home Health Care and the Sicknessor Injury requiring Home Health Care commenced while aCovered Person was insured under the Policy. Any visit bya member of a home health care team on any day will beconsidered one (1) home health care visit. Benefits will beprovided for no more than 60 home health care visits in anyperiod of twelve (12) consecutive months. These servicesmust be furnished and charged for by a Home Health CareProvider.Bone Marrow Transplant and Cancer Treatment:Treatment of cancer by dose-intensive chemotherapy,autologous/bone marrow transplants and peripheral bloodstem cell transplants when performed by institutionsapproved by the National Cancer Institute, or pursuant toprotocols consistent with the guidelines of the AmericanSociety of Clinical Oncology.10Prostate Cancer Screening: Annual medically recognizeddiagnostic examination including, but not limited to, a digitalrectal examination and a prostate-specific antigen test formen age fifty (50) and over who are asymptomatic and formen age forty (40) and over with a family history ofprostate cancer or other prostate cancer risk factors.Second Surgical Opinion: Second surgical opinionservices of a physician and for essential laboratory and Xray services incidental thereto.Third Surgical Opinion: If a second surgical opinion doesnot confirm that a proposed elective surgery is medicallyadvisable, a third surgical opinion will be covered in thesame manner as the second opinion.Maternity Stay: Minimum of 48 hours of inpatient carefollowing a vaginal delivery or a minimum of 96 hours of inpatient care following a cesarean section for a mother andher newly born child.Treatment of Wilm’s Tumor: Treatment of Wilm’s tumorwill include bone marrow transplants when standardchemotherapy treatment is unsuccessful, notwithstandingthat any such treatment may be deemed experimental orinvestigational shall be provided to the same extent as forany other Sickness.Inherited Metabolic Disease: Therapeutic treatment ofinherited metabolic diseases, including the purchase ofmedical foods and low protein modified food products,when diagnosed and determined to be medically necessaryby a physician.Anesthesia and Hospitalization for Dental Services:Benefits for a Covered Person who is severely disabled ora child age five (5) or under for expenses incurred for: 1)general anesthesia and Hospitalization for dental services;or 2) a medical condition covered by the contract whichrequires Hospitalization or general anesthesia for dentalservices rendered by a dentist regardless of where thedental services are provided.Home Treatment of Hemophilia: Expenses incurred inconnection with the purchase of blood products and bloodinfusion equipment required for home treatment of routinebleeding episodes associated with hemophilia when thehome treatment program is under the supervision of aState approved hemophilia treatment center.Colorectal Cancer Screening: Colorectal cancerscreening at regular intervals for persons age 50 and overand for persons of any age who are considered to be at11high risk for colorectal cancer. "High risk for colorectalcancer" means a person has: a) a family history of: familialadenomatous polyposis; hereditary non-polyposis coloncancer; or breast, ovarian, endometrial or colon cancer orpolyps; b) chronic inflammatory bowel disease; or c) abackground, ethnicity or lifestyle that the physician believesputs the person at elevated risk for colorectal cancer.Biologically Based Mental Illness: Treatment ofbiologically based mental illness the same as any otherSickness. "Biologically-based mental illness" means amental or nervous condition that is caused by a biologicaldisorder of the brain and results in a clinically significant orpsychological syndrome or pattern that substantially limitsthe functioning of the person with the illness, including butnot limited to, schizophrenia, schizoaffective disorder,major depressive disorder, bipolar disorder, paranoia andother psychotic disorders, obsessive-compulsive disorder,panic disorder and pervasive developmental disorder orautism.Screening for Newborn Hearing Loss: Screening byappropriate electrophysiologic screening measures andperiodic monitoring of infants for delayed onset hearingloss. Payment for this screening service shall be separateand distinct from payment for routine new baby care in theform of a newborn hearing-screening fee as negotiatedwith the provider and facility.Treatment of Infertility: Diagnosis and treatment ofinfertility includes, but is not limited to, the followingservices related to infertility: diagnosis and diagnostic tests;medications; surgery; in vitro fertilization; embryo transfer;artificial insemination; gamete intra fallopian transfer;zygote intra fallopian transfer; intracytoplasmic sperminjection; and four (4) completed egg retrievals per lifetimeof the covered person. Coverage for in vitro fertilization,gamete intra fallopian transfer and zygote intra fallopiantransfer shall be limited to a Covered Person who: a) hasused all reasonable, less expensive and medicallyappropriate treatments and is still unable to becomepregnant or carry a pregnancy; b) has not reached the limitof four (4) completed egg retrievals; and c) is forty-five (45)years of age or younger.Hearing Aids for Covered Persons Fifteen (15) Years orYounger: We will provide coverage that includes thepurchase of a hearing aid for each ear for a CoveredPerson fifteen (15) years of age or younger, whenMedically Necessary and as prescribed or recommended12

by a licensed physician or audiologist. The maximumbenefit provided is 1,000 per hearing aid for each hearingimpaired ear, every twenty-four (24) months.Oral Anticancer Medication: We will provide coverage forexpenses prescribed for orally administered anticancermedication used to kill or slow the growth of cancerouscells, same as any other intravenously administered orinjected anticancer medications.Sickle Cell Anemia: We will provide coverage same asany other Sickness for medical expenses for the treatmentof sickle cell anemia, including the expenses incurred forthe purchase of outpatient prescription drug expenses forthe treatment of sickle cell anemia.Positron Emission Tomography: We will providecoverage for medically necessary expenses incurred in theuse of positron emission tomography to diagnoseAlzheimer's disease. The benefit is subject to the samedollar limit, copayment deductible or coinsurance as anyother medical condition.Ovarian Cancer Screening: Coverage is provided formedically necessary expenses incurred in screening forovarian cancer for symptomatic women or women at risk ofovarian cancer. Coverage includes, but is not limited to, anannual pelvic examination, an ultrasound and blood testingfor cancer markers.Benefits for Treatment of Autism or OtherDevelopmental Disability:A) Coverage for expenses incurred in screening anddiagnosing autism or another developmental disability.B) When the primary diagnosis is autism or anotherdevelopmental disability, coverage provided forexpenses incurred for medically necessaryoccupational therapy, physical therapy, and speechtherapy, as prescribed through a treatment plan.Coverage of these therapies shall not be denied onthe basis that the treatment is not restorative.C) When the covered person is under 21 years of ageand the primary diagnosis is autism, coverageprovided for expenses incurred for medicallynecessary behavioral interventions based on theprinciples of applied behavioral analysis and relatedstructured behavioral programs, as prescribed througha treatment plan, subject to the provisions of thissubsection:13The benefits provided are payable to the sameextent as for any other medical condition underthe policy, but are not subject to limits on thenumber of visits of behavioral interventions. The benefits provided pursuant to this subsectionshall not be denied on the basis that thetreatment is not restorative.D) The treatment plan required will need to include allelements necessary for Us to appropriately providebenefits, including, but not limited to: a diagnosis;proposed treatment by type, frequency, and duration;the anticipated outcomes stated as goals; thefrequency by which the treatment plan will be updated;and the treating physician's signature. We may onlyrequest an updated treatment plan once every sixmonths from the treating physician to review medicalnecessity; unless We and the treating physician agreethat a more frequent review is necessary due toemerging clinical circumstances.E) The coverage required under this section may besubject to utilization review, including periodic review,by the insurer of the continued medical necessity ofthe specified therapies and interventions. ADDITIONAL BENEFITSNewborn Infant Coverage: Newborn Infant means anychild born of an Insured while that person is insured underthis Policy. Newborn Infants will be covered under thePolicy for the first thirty-one (31) days after birth on thesame basis as any other Dependent children. Benefits forsuch a child will be for Injury or Sickness paid on the samebasis as any other Sickness, including medically diagnosedcongenital defects and birth abnormalities.The Insured will have the right to continue such coveragefor the child beyond the first thirty-one (31) days. Tocontinue the coverage the Insured must, within the thirtyone (31) days after the child’s birth: 1) apply to theCompany; and 2) pay the required additional premium forthe continued coverage. If the Insured does not use theright as the stated here, all coverage as to that child willterminate at the end of the first thirty-one (31) days afterthe child’s birth.Audiology and Speech Language Pathology Benefit:Benefits shall be paid on the same basis as for any otherSickness for Covered Medical Expenses that are14performed or rendered to the Insured by a Physician forAudiology and Speech Language Pathology.Benefits are subject to any Deductible, coinsurance,limitations, and any provisions of the Policy.Maternity Benefit: Benefits will be paid for normalpregnancy and normal childbirth as for any other Sickness.Elective abortion is not covered.Conception must occur after the Insured’s effective date.Covered Medical Expenses include: 1) Physician’s visits;2) Diagnostic services; 3) Obstetrical/surgical procedures;4) Hospital room and board; 5) Hospital miscellaneousexpenses; and 6) Routine well-baby care while HospitalConfined not to exceed a maximum of four (4) daysconfinement expense.Benefits will be paid for normal pregnancy and normalchildbirth as for any other Sickness. Coverage is providedto services performed by and facilities used by licensedcertified nurse midwives.Complications of Pregnancy are covered as any otherSickness.Maternity Testing: The following maternity routine testsand screening exams will be paid on the same basis asany other Sickness. This includes a pregnancy test, CBC,Hepatitis B Surface Antigen, Rubella Screen, SyphilisScreen, Chlamydia, HIV, Gonorrhea, Toxoplasmosis,Blood Typing ABO, RH Blood Antibody Screen, Urinalysis,Urine Bacterial Culture, Microbial Nucleic Acid Probe, PapSmear, and Glucose Challenge Test (at 24-28 weeksgestation). One (1) ultrasound will be considered in anypregnancy, without additional diagnosis. Any subsequentultrasounds can be considered if a claim is submitted withthe pregnancy record and ultrasound report thatestablishes Medical Necessity. Additionally, the followingtests will be considered for women over thirty-five (35)years of age: AFP Blood Screening; Amniocenteses/AFPScreening; and Chromosome Testing. Fetal Stress/NonStress tests are payable.Benefits are subject to any Deductible, coinsurance,copayments, limitations, and any provisions of the Policy.COORDINATION OF BENEFITS PROVISIONDefinitions:Allowable Expenses: Any necessary, reasonable, andcustomary item of expense, a part of which is covered by atleast one (1) of the Plans covering the Insured Person.15

An Allowable Expense to a Secondary Plan includes thevalue or amount of any Deductible Amount or CoinsurancePercentage or amount of otherwise Allowable Expenseswhich was not paid by the Primary or first paying Plan.Plan: A group insurance plan or health service corporationgroup membership plan or any other group benefit planproviding medical or dental care treatment benefits orservices.Such group coverages include: a) group or blanketinsurance coverage, or any other group type contract orprovision thereof; this will not include school accidentcoverage for which the parent pays the entire premium; b)service plan contracts, group practice and other prepayment group coverage; c) any coverage under labormanagement trustees plans, union welfare plans, employerand employee organization plans; and d) coverage undergovernmental programs, including Medicare, and anycoverage required or provided by statute.Primary: The Plan which pays regular benefits.Secondary: The Plan which pays a reduced amount ofbenefits which, when added to the Primary Plan’s benefitswill not be more than the Allowable Expenses.Effect on Benefits: If an Insured Person has medicaland/or drug coverage under any other Plan, all of thebenefits provided are subject to coordination of benefits.During any Policy Year or benefit period, the sum of thebenefits that are payable by Us and those that are payablefrom another Plan my not be more than the AllowableExpenses.During any Policy Year or benefit period, We may reducethe amount We will pay so that this reduced amount plusthe amount payable by the other Plans will not be morethan the Allowable Expenses. Allowable Expenses underthe other Plan include benefits which would have beenpayable if a claim had been made.However, if: 1) the other Plan contains a section whichprovides for determining its benefits after Our benefits haveb

In addition to the Student Health Insurance Program, Stevens is pleased to offer our students and their dependents a Dental Insurance Plan (DeltaCare). You . selecting Stevens Institute of Technology and then Dental. Should you have any questions about the online waiver process or benefits please contact University Health Plans at (800) 437 .