Transcription

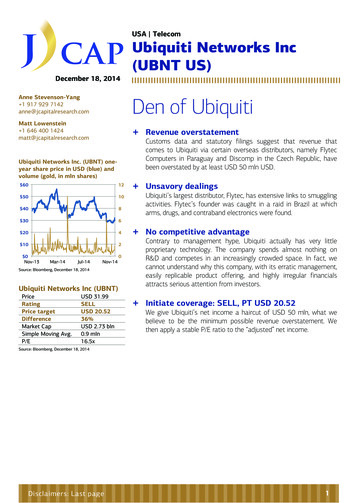

USA TelecomDecember 18, 2014Anne Stevenson-Yang 1 917 929 7142anne@jcapitalresearch.comUbiquiti Networks Inc(UBNTUS)Den of UbiquitiMatt Lowenstein 1 646 400 1424matt@jcapitalresearch.com Revenue overstatement Unsavory dealings No competitive advantage Initiate coverage: SELL, PT USD 20.52Ubiquiti Networks Inc. (UBNT) oneyear share price in USD (blue) andvolume (gold, in mln shares) 6012 5010 408 306 204 102 0Nov-130Mar-14Jul-14Nov-14Source: Bloomberg, December 18, 2014Ubiquiti Networks Inc (UBNT)PriceRatingPrice targetDifferenceMarket CapSimple Moving Avg.P/EUSD 31.99SELLUSD 20.5236%USD 2.73 bln0.9 mln16.5xCustoms data and statutory filings suggest that revenue thatcomes to Ubiquiti via certain overseas distributors, namely FlytecComputers in Paraguay and Discomp in the Czech Republic, havebeen overstated by at least USD 50 mln USD.Ubiquiti’s largest distributor, Flytec, has extensive links to smugglingactivities. Flytec’s founder was caught in a raid in Brazil at whicharms, drugs, and contraband electronics were found.Contrary to management hype, Ubiquiti actually has very littleproprietary technology. The company spends almost nothing onR&D and competes in an increasingly crowded space. In fact, wecannot understand why this company, with its erratic management,easily replicable product offering, and highly irregular financialsattracts serious attention from investors.We give Ubiquiti’s net income a haircut of USD 50 mln, what webelieve to be the minimum possible revenue overstatement. Wethen apply a stable P/E ratio to the “adjusted” net income.Source: Bloomberg, December 18, 2014Disclaimers: Last page1

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comTable of ContentsWILL O’ THE WISP4COMPANY BACKGROUND5OUTSIZED MARGINS7DISTRIBUTOR ISSUES8FLYTEC8910HOW BIG IS FLYTEC?FLYTEC’S MANAGEMENTDISCOMPSOUTH AMERICA REVENUEOTHER DISTRIBUTORSIRAN PROBLEMSREVENUE OVERSTATED1011121314ACCOUNTING ISSUES1414TAX-FREE OVERSEAS?DEFERRED REVENUEPRODUCT AND TECHNOLOGY1516COMPETITION1818MIMOSACORPORATE GOVERNANCE18MIDDLE KINGDOM192023MISCELLANEOUSOVERSEAS PRODUCTENDGAMESDisclaimers: Last page24December 18, 20142

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comVALUATION24RISKS25DISCLAIMER30Disclaimers: Last pageDecember 18, 20143

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comWill o’ the WISPUbiquiti’s problems All told, Ubiquiti’s sales have increased 26 times since 2008, aare ubiquitous 72% CAGR, to USD 572 mln in 2014, at margins higher thanCisco’s. No other company making networking gear has achievedthis, to our knowledge. On closer inspection, we find much that iswrong with Ubiquiti. Specifically: We question what Ubiquiti is doing to have such anamazing product. Customers and suppliers are notparticularly impressed. We conclude that we just can’t seewhat’s so special about this business, and that might bebecause it’s not being fully disclosed. Our analysis suggests that Ubiquiti does not have theoverseas revenue the company reports. Scrutiny ofstatutory filings and trade data indicates that Ubiquitiwildly overstates revenue to certain of its overseasdistributors and therefore to itself. We believe that revenueis overstated by at least USD 50 mln. Ubiquiti has a mediocre product in a space that is gettingincreasingly competitive. We find Ubiquiti has essentially notechnological advantage over peers, but competesaggressively on price. Well-capitalized competitors Ruckusand Mimosa appear to be moving into Ubiquiti’s turf, aboutto offer superior networking solutions at a discount toUbiquiti’s prices. Ubiquiti’s IP battle with a Chinese OEM makes no sense. AChinese OEM accused of counterfeiting Ubiquiti’s productand trademark has alleged that Ubiquiti hired gangsters toattack the factory. Ubiquiti’s management team exhibits erratic behavior andoperates with limited corporate oversight.Despite these problems, the market gives Ubiquiti a multiplecomparable to that for Juniper and Cisco.We are not yet clear on the exact nature of Ubiquiti’s business. Butwe are confident that the company does not earn the returns itclaims—at least not by selling networking equipment. In short, webelieve investors should beware this will o’ the “WISP.”Disclaimers: Last pageDecember 18, 20144

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comCompany backgroundUbiquiti is a manufacturer and supplier of networking equipment.The company produces routers, high-powered Wi-Fi equipment,antennae, and software solutions to manage the products. Themain customer base consists of enterprises and Wireless InternetService Providers (WISPs). For example, the signature “airMax”product line is advertised as being usable for WISP backhaul or forbuilding-to-building WiFi to be used by enterprises. This is usefulfor areas where copper wire or LTE has not yet penetrated.Ubiquiti’s main customers tend to be in rural areas and in thedeveloping world, where there is insufficient copper wire, fiber,and/or LTE infrastructure. This is why Ubiquiti derives a significantchunk of its business from Latin America.Chart 1.Revenue by Geography, Q1 201510%35%North AmericaSouth America34%Europe, ME, AfricaAsia Pacific21%Source: Company filingsIn 2013, Ubiquiti was in crisis. According to management,counterfeited product coming out of a Chinese OEM had floodedthe market, displacing real Ubiquiti products and underminingdistributors’ faith in Ubiquiti. Revenue tumbled by almost 10%, andprofits by a quarter.Disclaimers: Last pageDecember 18, 20145

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comTable 1.Ubiquiti spends very littleon R&D, making its claimto superior product morepuzzling.2013 ResultsUSD '000sRevenues2012353,5172013320,823YoY-9%Cost of revenues202,514185,489-8%Gross profitResearch anddevelopmentSales, general andadministrativeTotal operatingexpensesIncome : Company filingsThe Chinese OEM in question was called Hoky Technology.According to court records, Hoky claimed to own the rights to theUbiquiti brand within China. Hoky also claims that Ubiquiti sentorganized groups to attack employees at its factory, a charge thatUbiquiti disputes. Whatever the truth, Hoky’s founder, Deng Kai,appears to have been imprisoned for IP violations.In 2014, the company managed to stage a recovery.Chart 2.700,000Revenue GrowthUSD 102011201220132014Source: Company filingsAll told, Ubiquiti’s sales have increased 26 times since 2008, aCAGR of 72% annually, to USD 572 mln in 2014. To quote founderand CEO Robert J. Pera, “We've tripled up to this point within threeyears, and my aim is to triple the service provider business againin the next few years.”Disclaimers: Last pageDecember 18, 20146

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comBut not all seems right with Ubiquiti. We find numerous instancesof management duplicity, corporate governance red flags, andreason to doubt Ubiquiti’s reported margins.Outsized marginsUbiquiti’s margins seemUbiquiti operates in a crowded space but enjoys margins wildly inunlikely when compared excess of those enjoyed by its peers.with those of peers.Pera has attributed higher margins to Ubiquiti’s distributionstrategy, which employs virtually no sales staff or direct sales, butinstead relies on distributors. To quote Pera, “It's very hard for atraditional company to compete with our margins and ouroperating structure.” Pera has also said that the Ubiquiticommunity forum acts as a kind of free advertising, as Ubiquitiusers “evangelize” the brand.Of course, virtually every company in the industry maintains anactive user forum. It seems that WISP and network operators mustbe an especially social bunch.Chart 3.50%Ubiquiti margins vs. -20%-30%-40%UbiquityCiscoRuckus Wireless:AerohiveAruba NetworksSource: Company filingsRuckus Wireless, operating at a similar scale, and Aruba Networks.at nearly twice Ubiquiti’s revenue, only almost broke even in theirmost recent reporting year. Meanwhile, Ubiquiti’s operatingmargins went to 34%. We note that this is even higher thanCisco’s operating margin.Disclaimers: Last pageDecember 18, 20147

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comManagement attributes this success to proprietary technology and“disruptive price points.” But the financial statements show thatUbiquiti’s profits stem from lack of spend on R&D or on sales andmarketing.Chart 4.180,000Ubiquity: R&D Spend vs. CompetitorsUSD 000s160,000140,000120,000100,00080,00060,000The major distributorsseem not to have the scalethat is claimed.40,00020,0000Ubiquiti2012Aerohive Networks2013Aruba Networks2014Ruckus WirelessSource: Company filingsHow can Ubiquiti have superior technology if it barely invests intechnology?Finally, the idea that Ubiquiti has managed to dispense with salesand marketing costs by selling only to distributors is puzzling.None of Ubiquiti’s distributors is exclusive. Ubiquiti hardly inventedthe idea of selling through distributors; if it were that simple,competitors would do the same. Moreover, distributors do notcome free; Ubiquiti in theory should have to sell at a discount topromote sales flowing through the channel.Distributor issuesAccording to Ubiquiti’s financial statements, 99% of sales go viadistributors. This in itself is unusual for the industry. Moreover,Ubiquiti’s customers show a troubling pattern.FlytecUbiquiti’s most important distributor is Flytec Computers. Flytec islocated in Paraguay’s Ciudad del Este and in Doral, Florida. TheU.S. branch was founded in 2007, and, by 2010, the company wasDisclaimers: Last pageDecember 18, 20148

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comdoing sales for Ubiquiti to the tune of USD 23 mln. In 2014, Flytecbrought in USD 74 mln, accounting for fully 19% of Ubiquity’sParaguay’s Ciudad del Este revenue growth and 16% of Ubiquiti’s revenue.is famous as a center formoney-laundering but not Chart 5. Flytec Revenuefamous for networkingUSD s2012Sales to flytec20132014% of GrowthSource: Company filingsHow Big is Flytec?According to Ubiquiti filings, as of the most recent quarterUbiquiti’s largest customer accounted for 10% of its revenues.Presumably this refers to Flytec. This means that Flytec should bepurchasing approximately USD 15 million of Ubiquiti equipmentevery quarter, or USD 60 mln per year. But according to Alexa,Flytec’s Paraguayan and US websites combined provide fewerthan five daily page views.Moreover, Import Genius records to Paraguay show FOB values forimports, meaning the value of freight on board. While FOB is not aperfect measure, FOB values should roughly approximate productvalue. According to the Import Genius records, Ubiquiti shipmentsto Flytec in Paraguay had an FOB value of only USD 13 mln USDfor the 12 months ending on August 2014.We take all this information as advisory. Of course it is possiblethat Flytec purchases roughly USD 50 mln USD of product in theU.S., but this would make Flytec a third of reported North Americasales. Moreover, Flytec simply does not look like a company buyingUSD 60 mln USD in Ubiquiti equipment every year.Disclaimers: Last pageDecember 18, 20149

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comFlytec’s ManagementWhat is even more problematic than Flytec’s purported purchases,however, is the company’s provenance. Flytec’s hometown ofCiudad del Este is one of Latin America’s great money-launderinghubs. According to the U.S. Embassy in Paraguay:“Ciudad del Este, on Paraguay’s border with Brazil andArgentina, represents the heart of Paraguay’s undergroundor “informal” economy. The area is well known for arms andnarcotics trafficking and violations of intellectual propertyrights with the illicit proceeds from these crimes a sourceof laundered funds. Some proceeds of these illicit activitieshave been supplied to terrorist organizations.”1Flytec’s founder appears to be a Brazilian national by the name ofOsni Arruda. As has been pointed out by other analysts, accordingto media reports, Arruda was arrested in Brazil in 2006, as part ofa “gang specializing in smuggling goods and [in] tax evasion.”2Flytec’s founder is a shady Another article singles out Flytec as a purveyor of the illicit goods.3character. According to Brazilian court documents, Arruda was accused ofdrug trafficking in 2009. The document reads, “There is concreteevidence that the investigated is involved in drug trafficking.”4 Onequestions why Ubiquiti is deeply involved in centers known forlaundering money on behalf of arms and drugs traffickers—businesses with much higher margins than network gear generallycan command.DiscompDiscomp is a Czech company listed as one of Ubiquiti’s Europeandistributors. Discomp and Ubiquiti have a long history. WhenUbiquiti first listed, it claimed Czech distributor Discomp wasworth 12% of its sales. This would put Discomp sales at roughlyUSD 42 mln. That is indeed an impressive showing in the Czechmarket. But Discomp’s 2012 filings with the Czech Ministry ofJustice cast serious doubt on these sales.1http://paraguay.usembassy.gov/volume licia/news/169079/?noticia CAI REI DO CONTRABANDO DE ELETRONICOS NO OI930516-EI15607,00-%20PF e Receita prendem contrabandistas de ao-trf-hc-osni-arruda.pdfDisclaimers: Last pageDecember 18, 201410

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comA Czech distributr reportedtiny sales to thegovernment there and yetshould be doing USD 42mln per year for Ubiquiti.Discomp financials. Source: Ministry of Justice of the Czech RepublicFor those of you who flunked high-school Czech, the abovedocument is an income statement showing that Discomp’s entirerevenue in 2012 was 614,644 Korunas, or roughly 27,000 USD.South America revenueAccording to Ubiquiti’s most recent 10-K, the company should bedoing over USD 100 mln per year in sales to South America. But inmost of the Latin American data that is available, Ubiquiti’sshipments are surprisingly small. According to Import Genius, thecompany had only USD 2.6 mln in shipments into Ecuador and USD1.6 mln in shipments to Colombia for the year ending in July 2014.This makes USD 100 mln a year to South America, while notimpossible, seem far-fetched.Moreover, though Paraguay does show substantial shipments,there is something very odd about Ubiquiti’s sales to Paraguay.In the last year Ubiquiti shipped approximately 8 mln lbs ofproduct to the United States. It reported USD 120 mln in USrevenue, yielding a value of USD 15 per pound of product. This isidentical to Ubiquiti’s Colombian shipments, which, at USD 1.6 mlnand 50,000 lbs, also came out to roughly USD 15/lb.Disclaimers: Last pageDecember 18, 201411

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comTable 2.Bills of lading don’t show alot of revenue in SouthAmerica.Ubiquiti shipments to Paraguay (lbs)Gross EC COMPUTERS INC.1,032,54513%4NET NETWORKING CORP735,6499%SYSCOM707,4109%INGRAM MICROEL PASO COMMUNICATION SYSTEMS,INC.SOLUTION BOX LLC496,7836%458,7746%353,2314%MicromJOSHUA FARRELL MICROCOMFULFILLMENTHUTTON COMMUNICATIONS OFCANADANETKROM TECHNOLOGIES INC.266,4003%111,2331%81,4381%59,5921%SISTEMAS Y SERVICIOS DE40,1080%SCSC DISTRIBUTION CENTER SCAN23,1600%DESARROLLOS DE INTERNET SA16,8850%Wisp-Router16,7950%LANDATEL DE MEXICO S.A. DE C.V.DOUBLERADIUS, INC 2022 VAN 00%TotalSource: Import GeniusBut the Paraguayan shipments, worth USD 13 mln, weighed in at3.4 mln lbs of product. This comes to only USD 3 per pound.Perhaps the Paraguayan market is simply hungry for low-endrouters. Or perhaps not all Ubiquiti revenue comes fromelectronics.Other distributorsMicrocom Technologies, based in Calabasas, California, is listed asone of Ubiquiti’s Master Distributors. Microcom has virtually noonline presence, so it is difficult to know what business thecompany does. The products on the website are almost all fromUbiquiti. The only sign of sales are from government contracts,from the Department of Defense as listed on usaspending.gov. Butthese seem to have gone away after 2012.Still other distributors do not appear to have the size one wouldexpect for a “Master Distributor.” Wisp-router Inc., for example, isDisclaimers: Last pageDecember 18, 201412

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .coma bit of a fixer-upper:The size and weight of theproducts also don’t matchup.Source: Google Maps (Photo taken June 2014, accessed December 18, 2014)It seems hard to believe that significant volumes of wirelessproduct are being run out of this establishment.Iran problemsUbiquiti announced in its IPO prospectus that the company wasunder investigation for violating U.S. sanctions against Iran.Eventually, the company was let off after paying a USD 504,225fine. But according to a simple Google search, the same Iraniandistributor continues to sell Ubiquiti products.Source: http://www.activenet.ir/shop/Disclaimers: Last pageDecember 18, 201413

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comRevenue overstatedAll told, we are forced to conclude that the overseas revenue islikely to be substantially overstated. If we take Flytec and Discompas an indication, foreign sales could be overstated by as much as25%.Ubiquiti appears to hold significant cash, but we do not believeMicrocom doesn’t look like that the cash could comes entirely from sales of networkinga major networking player. equipment.Accounting issuesA close look at Ubiquiti’s filings reveals that Ubiquiti holdssurprisingly high balances of cash overseas.Table 3.Ubiquiti Cash LocationUSD '000sCash & equityOverseas cash &equityDomestic cash &equity% US201176,3612012122,0602013227,8262014347,0972015 9,26017,42639,49760,21661%16%8%11%15%Source: Company filingsConsidering Ubiquiti derives between 20% and 40% of its revenueThe company seems still to from the U.S., it is puzzling why so much cash should be offshore.Given Ubiquiti’s low capex, there is really no reason for it to movebe selling to Iran. cash overseas. Another explanation could be that Ubiquiti’s U.S.operations are simply not as cash-generative as its overseasoperations. But why this would be is difficult to guess.Tax-free overseas?Ubiquiti does not appear to pay taxes overseas.There is probably not a single country in the world whose effectivetax rate is as low as 2.5%, and, unless all of Ubiquiti’s overseascustomers are in the Cayman Islands, the Bahamas, and Bermuda,such a tax rate seems impossible. It is also worth taking a look atUbiquiti’s competitors.Disclaimers: Last pageDecember 18, 201414

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comChart 6.160,000UBNT Overseas taxesUSD '000sTax 0001.0%40,0000.5%20,00000.0%20122013Foreign taxable incomeForeign tax rate2014Foreign provision for taxesSource: Company filingsTable 4.Overseas taxbasis905Provision forforeign taxes1,006Foreign %n/a375n/aUSD '000sRuckusNo taxes offshoreCompetitor overseas tax paymentsAerohiveSource: Company filingsEvery company save Ubiquiti pays taxes on overseas profits. Oneis entitled to suppose that Cisco has savvy tax attorneys, and evenit pays taxes of 10% of overseas profits. Once again, we are led toquestion the nature of Ubiquiti’s business.Deferred RevenueAnother red flag crops up in relation to Ubiquiti’s payment termswith distributors. According to our research, distributors generallypay Ubiquiti up front in cash, often fully 90 days in advance offulfillment.Table 5.Days deferred Ruckus*Source: Company filings, J Capital Research (Ruckus data reflects years 2012 and 2013)Disclaimers: Last pageDecember 18, 201415

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comIt is not uncommon for product suppliers in this industry to enjoygenerous terms from distributors. What is uncommon is for thoseterms not to filter into the balance sheet by way of deferredrevenue. Ubiquiti shows far lower DDR than peers. This could be aresult of aggressive revenue recognition. Indeed, if Ubiquiti wereto have similar DDR as peers, its revenue would have been roughly18% lower in 2014.Product and TechnologyIn Ubiquiti’s most recent transcript, Pera told listeners, “We're verymuch an R&D-driven company. I'm a product CEO. I'm not a salesCEO or a business CEO.” We find this statement puzzling givenUbiquiti’s relatively low R&D spend.Table 6.R&D Spend vs. PeersUSD 294,0005,488,0005,942,000Aerohive Networks16,08125,742Aruba Networks109,448139,746Ruckus Wireless43,82161,783169,328Source: Company filings, J Capital Research (Ruckus and Aerohive data reflects years 2011-2013)Chart 7.But everyone else seemsto pay.R&D as a percentage of revenues35%30%25%20%15%10%5%0%UbiquitiCisco (mlns)2012Aerohive*2013ArubaRuckus*2014*Aerohive and Ruckus figures are for fiscal year 2011 to 2013, rather than 2012 to 2014.Source: Company filingsAccording to company filings, Ubiquiti actually spends almostnothing on R&D.Disclaimers: Last pageDecember 18, 201416

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comPerhaps more remarkably, apart from the antennae products,virtually all Ubiquiti products can be found more cheaply fromWhere is the deferred major companies such as CISCO or DLink.revenue?Source: Newegg.comOur talks with industry professionals seem to confirm ambivalenceIndustry professionals toward Ubiquiti’s products. One WISP operator in Europe told us:express a dim view of“A lot of Ubiquiti’s products look better than they are.” ForUbiquiti’s technologies.example, Ubiquiti uses different reporting standards thancompetitors in describing its decibels, and claims “carriergrade” equipment, which is an overstatement. Moreover,“They use a lot of 'plastic' stuff in their hardware. Overtime, especially in sunny climates, or really cold climates,'plastic' becomes brittle and indeed, I stopped working withtheir stuff because I had several failures of their hardwareonly because of that.”Others have explained that Ubiquiti essentially acquires productand so products are somewhat inconsistent. As a networkingsolutions provider highly regarded in the U.S. networking industryput it:Disclaimers: Last pageDecember 18, 201417

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .com“Edge router and edge switch is not in-house developed anddeveloped on other people’s technology. Router product comesout of open-source product from Diata that was acquired byanother company a year and a half ago. Diata was buildingopen-source, low-cost router product. Ubiquiti uses that in theirrouting product. This makes the user experience very differentfrom the switching project.”CompetitionAnd even if it were asgood as advertised, the Ubiquiti’s only real competency seems to be in antennae. But evenfield is becoming more here, the company is currently under threat from new entrants.competitive. Ruckus announced on October 29 that it was coming out with itsXClaim product series. This is essentially a high-powered Wi-Fisolution that will compete directly with Ubiquiti’s signature Unifyproduct. For example, Xclaim’s outdoor product is comparable tothe Ubiquiti Unifi AP Outdoor Series, retailing for USD 489, isroughly comparable to the Xclaim Xo-1, which retails for only USD299.MimosaMimosa is another up-and-coming networking company. Accordingto one industry professional, “Mimosa is looking at doing a UBNTtype business but at a higher quality point Looking atundercutting UBNT.” He added that barriers to entry in theindustry are quite low.Indeed, Mimosa’s “massive capacity” access point will retail forabout USD 1,000 and host 250 to 1,000 users at a time. Longterm, we believe higher-end technology providers such as Mimosa,who are dropping their own price points, will erode the margin inlow-end products such as Ubiquiti’s.We believe there will still be a market for lower-end, Ubiquiti andRuckus type products in areas with low population density. ButMimosa (and similar technologies) will make Ubiquiti completelyuncompetitive for networks designed for more than 40-50 users.Corporate governanceCEO Pera has a reputation According to Forbes, CEO Robert J. Pera is a “34-year-old wireless5for being erratic. broadband visionary.” But according to a complaint filed n-has-billion-dollar-day/Disclaimers: Last pageDecember 18, 201418

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comUbiquiti cofounder Rommohan Malasani, Pera was emotionallyunstable. Malasani claims Pera strong-armed him intosurrendering much of his equity to Pera. The complaint reads:“Pera sought to renegotiate down Malasani’s ownershipinterest with an increase in Pera’s. Pera threatened to ‘stopUbiquiti’ unless Malasani agreed to the reducedownership Malasani did not believe he had any choice Hegave up his H1B1 visa when he left Centellax and wasdependent upon [Ubiquiti] for the application for the newvisa.”6The directors have Then there is the company’s revolving door of senior managers.unusually short tenures. When the company listed, the CFO was John Ritchie. Ritchie leftabruptly in 2013 to be replaced by Craig Foster. General CounselJessica Zhou quit in 2013 as well.At the same time, not a single independent board member hasserved for more than three years. When the company listed, itsdirectors included Charles Fitzgerald, Ronald A. Sege, Robert MVan Buskirk, J William Gurley, John L Ocampo, and Peter Chung.Buskirk was chair of the audit committee.One by one, these directors have left. Fitzgerald, Ocampo, andBuskirk—the entire audit committee—left in 2013. The new auditcommittee consists of Sege (the longest-serving independentboard member), Steven Altman, and Rafael Torres. Torres is theaudit committee chairman.This is a veritable revolving door of corporate governors. It meansthat Pera is more or less unaccountable.Middle KingdomUbiquiti manufacturers and ships virtually all of its products fromChina. According to the most recent 10-K:“We generally forward products directly from ourmanufacturers to our customers via logistics distributionhubs in Asia. Beginning in the quarter ended December 31,2012, our products were predominantly routed through athird party logistics provider in China.”Ubiquiti’s use of OEMs and third-party logistics providers havehistorically made their production difficult to track. However,6Malasani v. PeraDisclaimers: Last pageDecember 18, 201419

Ubiquiti Networks Inc. (NASDAQ UBNT)Anne Stevenson-YangMatt Lowenstein 86 139 1082 0535 1 646 400 .comrecently Ubiquiti announced plans to do its own manufacturing. Inits most recent 10-Q, Ubiquiti made an oblique reference to amanufacturing facility of its own, saying, “we lease approximately93,000 square feet of space in Suzhou, China, which is beingWhat went on in leased through June 16, 2016. These facilities would house ourproposed manufacturing facility in China.” Management addedShenzhen? slightly more color to these comments in the most recent earningstranscript, saying that the new factory would be used to acceleratetime to market, or essentially for prototyping. Reports by thecompany did not specify at what point these factories would startproduction or how much investment would go into them.According to Chinese press releases, Ubiquiti has promised toinvest fully USD 99 mln. Investment agreements in China aretypically inflated for the benefit of local governments, butUbiquiti’s company has registered capital of USD 40 mln,indicating that its investment will be rather substantial.7We took a lo

Ubiquiti Networks Inc. (NASDAQ UBNT) Anne Stevenson-Yang 86 139 1082 0535 anne@jcapitalresearch.com Matt Lowenstein 1 646 400 1424 matt@jcapitalresearch.com Disclaimers: Last page December 18, 2014 5 build Company background Ubiquiti is a manufacturer and supplier of networking equipment.