Transcription

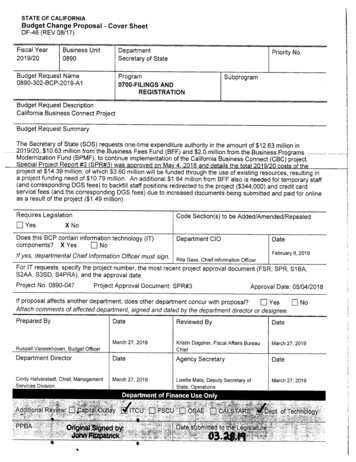

STATE OF CALIFORNIABudget Change Proposal - Cover SheetDF-46 (REV 08/17)Fiscal YearBusiness UnitDepartment2019/200890Secretary of StateBudget Request Name0890-302-BCP-2019-A1Priority No.ProgramSubprogram0 7 0 0 - F I L I N G S ANDREGISTRATIONBudget Request DescriptionCalifornia Business Connect ProjectjBudget Request SummaryThe Secretary of State (SOS) requests one-time expenditure authority in the amount of 12.63 million in 2019/20,- -10.63 million fromihe-Business-Fees F u n d (BFE) and n Fund (BPMF), to continue implementation of the California Business Connect (CBC) project.Special Project Report #3 (SPR#3) was approved on May 4, 2018 and details the total 2019/20 costs of theproject at 14.39 million; of which 3.60 million will be funded through the use of existing resources, resulting ina project funding need of 10.79 million. A n additional 1.84 million from BFF also is needed for temporary staff(and corresponding DGS fees) to backfill staff positions redirected to the project ( 344,000) and credit cardservice fees (and the corresponding DGS fees) due to increased documents being submitted and paid for onlineas a result of the project ( 1.49 million).Requires Legislation YesCode Section(s) to be Added/Amended/RepealedX NoDoes this BCP contain information technology (IT)components?X YesIf yes, departmentalODepartment CIODateNoChief InformationOfficer mustsign.Februarys, 2019Rita Gass, Chief Information OfficerFor IT requests, specify the project number, the most recent project approval document (FSR, SPR, S1BA,S2AA, S3SD, S4PRA), and the approval date.Project No. 0890-047Project Approval Document: SPR#3Approval Date: 05/04/2018If proposal affects another department, does other department concur with proposal?Attach commentsof affecteddepartment,Prepared Bysignedand dated by the departmentdirector or Yes Nodesignee.DateReviewed ByDateMarch 27, 2019Kristin Dagsher, Fiscal Affairs BureauChiefMarch 27, 2019Department DirectorDateAgency SecretaryDateCindy Halverstadt, Chief, ManagementServices DivisionMarch 27, 2019Lizette Mata, Deputy Secretary ofState, OperationsMarch 27,2019Russell Vaneekhoven, Budget OfficerDepartment of F i n a n c e U s e OnlyAdditional Revtew: i r f p i t a i OutlayPPBA[ TCUOrigbiaf gned by: FSCU OSAE C A L S T A R S ' ' ' [ i e p t . of Technologyd a t e Stbmitted to ffid Legisia'tUre - -

BCP Fiscal Detail SheetB C P Title: California B u s i n e s s Connect ProjectBR Name: 0890-302-BCP-2019-A1FY19Budget Request SummaryCYBYBY 2BY 1BY 3BY 4Salaries and WagesEarnings - PermanentEarnings - Temporary HelpTotal Salaries and Wages00 01,709344 2,05300 000 000 000 0Total Staff BenefitsTotal Personal Services0 0923 2,9760 00 00 00 0063000009,3120000Operating Expenses and Equipment5322 - Training5340 - Consulting and Professional Services External5340 - Consulting and Professional Services Interdepartmental5346 - Information TechnologyTotal Operating Expenses and Equipment06500000 0213 9,6530 00 00 00 0Total Budget Request 0 12,629 0 0 0 0Fund Source - State Operations0228 - Secretary of States Business Fees Fund3254 - Business Programs Modernization FundTotal State Operations Expenditures00 010,6292,000 12,62900 000 000 000 0Total All Funds 0 12,629 0 0 0 00 012,629 12,6290 00 00 00 0Fund SummaryProgram SummaryProgram Funding0700 - Filings and RegistrationsTotal All Programs

B C P Title: California B u s i n e s s Connect ProjectBR Name: 0890-302-eCP-2019-A1P e r s o n a l S e r v i c e s DetailsSalaries and WagesCYBYBY 1BY 2BY 3BY 4THOO - Temporary HelpVROO - VariousTotal Salaries and Wages00 03441.709 2,05300 000 000 000 0Staff Benefits5150900 - Staff Benefits - OtherTotal Staff BenefitsTotal Personal Services0 0 0923 923 2,9760 0 00 0 00 0 00 0 0"

A n a l y s i s of ProblemA.Budget Request SummaryT h e Secretary of State (SOS) requests one-time expenditure authority in the amount of 12.63 millionin 2019/20, 10.63 million from the Business Fees Fund (BFF) and 2.0 million from the BusinessPrograms Modernization Fund (BPMF), to continue implementation of the California Business Connect(CBC) project. Special Project Report #3 (SPR#3) was approved on May 4, 2018 and details the total2019/20 costs of the project, 14.39 million; of which 3.60 million will be funded through the use ofexisting resources, resulting in a project funding need of 10.79 million. A n additional 1.84 millionfrom BFF also is needed for temporary staff (and corresponding DGS fees) to backfill staff positionsredirected to the project ( 344,000) and credit card service fees (and the corresponding DGS fees) dueto increased documents being submitted and paid for online as a result of the project ( 1.49 million).B.Background/HistoryT h e S O S is constitutionally mandated to provide a significant number of services, which are critical forbusinesses operating in the State and to the overall economic expansion and health of the State ofCalifornia. The S O S has the responsibility for processing and filing important commerce and traded o c u m e n t s including business formations, changes, and terminations.Many business entityd o c u m e n t s and information requests are submitted to the SOS via mail or in-person in Sacramento andLos Angeles. This office currently relies on several antiquated electronic and "paper" database(including 3" x 5" index cards) systems in order to process more than two million business filings andrequests for information submitted on an annual basis.The fiscal effect of these antiquated systems is that payment of fees remains with the documentthroughout the filing process, which was taking weeks or months before receiving the additional fundingand temporary staff via the FY 2013/14 Finance Letter. Delays in processing the fees create a risk ofpayment loss and have been identified in previous audits as a high-level finding. This also results inchecks being stale-dated, which increases the number of dishonored checks, in addition, the lack of anautomated interface with the agency's fiscal system results in inadequate internal controls over moneycollected and deposited.This paper-intensive process and the cyclical nature of increased workloads (prior to the additionalfunding and temporary staff) led to processing times, at their peaks, of more than 50 calendar days forbusiness filings (e.g. business formations) and more than 90 calendar days for Statements ofInformation filings. Statements of Information identify the key players running each business and areused by businesses to open bank accounts and enter into contracts. Statements of Information (filedon an annual or biennial basis) specifically provide address and officer, director, manager, or memberinformation, which is valuable to state taxing and enforcement agencies, such as the Franchise TaxBoard, Board of Equalization and the Attorney General.In light of the previously long and unacceptable turnaround times, the Assembly sponsored A B 113(Chapter 3, Statutes of 2013, effective May 1, 2013) to augment the SOS's FY 2012/13 budget by 1.6million for overtime and temporary help to aid in reducing the turnaround times. Additionally, a FY2013/14 Finance Letter (Business Programs Division Backlogs) was approved in the May Revise to add56.0 limited-term positions and to provide temporary help and overtime in FY 2013/14 to assist the SOSin reducing the turnaround times for business filings to a historic low of an average of 5 business daysby November 30, 2013. The approved FY 2013/14 Finance Letter authorized the continuance of 54.0of the 56.0 positions, temporary help, and overtime in FY 2014/15 and FY 2015/16 to maintain theaverage 5 business day turnaround times. Funding was also approved for 52.0 positions, temporaryhelp, and overtime for FY 2016/17 and FY 2017/18. Due to recent and ongoing automation and onlineimprovements, the approved BCP for FY 2018/19, FY 2019/20 and FY 2020/21 reduced the funding to 5,108 million and the number of positions from 52.0 to 47.0 (a 1 0 % reduction). Without CBC, the SOSwould need to continue this temporary funding and staffing indefinitely to maintain the legislativelyrecommended average 5 business day turnaround.The S O S , as required by the California Corporations Code, Government Code, Business andProfessions Code, Civil Code, Commercial Code, Code of Civil Procedure, Family Code, Code ofRegulations and other codes;1) Authorizes businesses to operate in California by:l:\Unit\BCP\2018-19 BCPs\DF-46 Cover Sheet August 2017,doc

A n a l y s i s of Problem2)a)Registering and authenticating business entities;b)Enabling banks and lenders to protect their financial interests in personal property (UniformCommercial Code (UCC) filings) as well as securing the State's lien priority through the filing ofnotices of tax liens;c)Regulating notaries public;d)Registering trademarks;e)Registering business surety bonds;Protects individual rights by:a)Registering domestic partners; andb)Registering advance health care directives.To fulfill these purposes, the SOS reviews documents for statutory compliance that are submittedby businesses and government agencies for filing with the State. This process is known as "thefiling process" and a retained submission is known as a "filing." Upon request, this information isavailable to California businesses, government agencies, and other customers. There are twobroad categories of filings - business filings and other statutory filings.The business filings are used to: Provide evidence of the formation, registration, and modification of domestic and foreignbusiness entities such as corporations, limited liability companies (LLC), limited partnerships(LP), general partnerships (GP), limited liability partnerships (LLP), and other statutory businessentities; Provide evidence of the key persons or entities operating the corporations and LLCs by filingannual or biennial Statements of Information; Provide evidence of the registration and modification of Trademarks and Service Marks;Provide evidence of the registration of business surety bonds; Provide personal property lien notices (UCC filings) and State and Federal tax lien notices tosecure lien priority; Provide evidence for court cases and law enforcement investigations; Provide information to government agencies for taxing, licensing, and regulatory purposes;Provide proof of existence or good standing of businesses to open bank accounts, obtainlicenses, enter into contracts, and conduct other official business in California; Determine the availability or acceptability of a specific business name;Determine the status or public details of a business entity;Provide data to financial institutions for their assessment and approval of secured loans; and Determine lien priority for secured personal property collateral.The other statutory filings include: Domestic partners registration; Written advance health care directive registration; and Other filings required by statute.The S O S serves as the filing office for various statutorily authorized business-related documentscurrently is mandated to accept more than 250 different types of filing documents from businessesother filers. For each document, the SOS must, at a minimum, receive the document; routedocument to the staff trained to review it for legal compliance; maintain a record of the submission;l;\Unit\BCP\2018-19 BCPs\DF-46 Gover Sheet August 2017.docandandtheand

A n a l y s i s of Problemassess the legal acceptability of the filing. If the document is accepted, the SOS must then calculate,collect, and process fees and, in some cases, make copies of the filed document to return to thecustomer; distribute information about the filing; image the filing and store the original paper filing; andmake information available to businesses, government agencies, and the general public. These filingshave been grouped into 23 separate filing types according to processing, distribution, publication, andother requirements, and by the current level of automation (e.g. legacy computer systems, accessdatabases, 3"x 5" index cards). Although the general business processes for each filing are similar,separate application systems and processes have evolved over time for each filing type. As a result, atleast 23 separate automated systems are in use to support 15 of the filing types; the remaining 8 filingtypes are essentially paper-based manual systems supported only with basic office automation tools,such as Microsoft Access, W o r d and Excel or 3" x 5" index cards.Each of the different filing types has specific program and workload requirements that differ somewhat,and each of the different Information Technology (IT) systems provide a different level of qualityassurance for those requirements. There is no single filing type where the business requirements arefully automated. Other than UCC, support for the other filing types varies from incomplete, withessential and valuable functions poorly supported, to nonexistent, with no IT support provided. TheUCC system w a s the result of the 2001 Business Programs Automation (BPA) project, whichcustomized and modified a commercial off-the-shelf (COTS) product to support the statutory andbusiness requirements for UCC and other lien-related filings. As of January 1, 2010, the UCC supportvendor no longer provides maintenance and operational support for the UCC system. Due to the everchanging technology world, the UCC system has fallen behind. Additionally, the BPA project did notautomate the state and federal tax liens.O n April 1, 2 0 1 1 , the SOS was approved to conduct a business-based procurement to solicit a systemsintegration contractor for CBC. SPR #1 was approved by the Department of Technology on December17, 2013, and the systems integration contract was awarded to Bodhtree Solutions, Inc. on January 10,2014. With the concurrence of the Department of Technology, the SOS and Bodhtree Solutions, Inc.mutually agreed to terminate the systems integration contract on August 14, 2015. At the time ofcontract termination, the project was in the design phase, specifically requirements specification andtechnical architecture planning was in process. The SOS then conducted an internal planning review ofbusiness processes. SPR # 2 was submitted to the Department of Technology on December 28, 2015.SPR #2 w a s approved by the Department of Technology on April 1, 2016. While work towards thedocumentation of the Request for Proposal package was in process, the SOS's Information TechnologyDivision explored moving applications to a cloud-based environment. A s a result of this effort, the SOSre-planned the C B C project with a modified procurement plan and module implementation approach,addressed in SPR # 3 which was approved by the California Department of Technology on May 4, 2018.June 2018 marked the 1st Anniversary of Secretary of State's bizfile California Portal which supportsthe Secretary of State's digital initiative to automate the division thus making it easier to do business inCalifornia, bizfile California will grow as we add more California Business Connect online services. In a1 1/2 years, bizfile California provides the following online services:New C B C Online S e r v i c e sLLC Statements of InformationTrademark/Service Mark RegistrationLLC FormationsLLC TerminationsImplementation DateJune 2017January 2018May 2018December 2018Adoption Rate89 %75 %81 %46 %In addition, California Business Search (Enhanced May 2017) now has more than 13.7 million imagesof corporations, limited liability companies and limited partnership documents online for free. Secretaryof State has also introduced Eureka Chatbot (Implemented May 2018) utilizing Microsoft's ArtificialIntelligence Engine to provide an online search assistant currently answering Business Entities andTrademark questions. Secretary of State is the first State Agency to utilize Microsoft's ArtificialIntelligence Engine.l;\Unit\BCP\2018-19 BCPs\DF-46 Cover Sheet ALigust 2017.doc

A n a l y s i s of ProblemResource History(Dollars in thousands)Program res 40,175 53,217 50,376 47,255 51,442Revenues 51,099 71,898 73,042 78,085 87,138Authorized Positions327.8326.8325.8316.3314.3Filled Vacancies(a)ProjectedWorkload HistoryWorkload MeasureDocuments Processed ,900Name ReservationsTelephone CallsCopies IssuedCertificates Issued2018-19(3)Annual 23,691,100(a) Projected(b) Includes corporation, limited liability company, limited partnership, statement of Information, regional office, UCC,trademark and special filing documentsC.State Level C o n s i d e r a t i o n sC o m m e r c e and trade businesses must register their business entity with the SOS. Registration isrequired whether providing basic materials, capital goods, construction services, energy, financialservices, food, healthcare, technology, transportation, or utilities, and, most important of all, organicallygrown small businesses that sprout up in the heart of California and revolutionize global industry.It is anticipated that the CBC solution will enhance commerce in California by implementing technologyto standardize and simplify the processing of business, trademark and security interest filings, andprovide convenient public access to business information "24/7." The implementation of the CBCsolution also will ensure that payments are processed timely and securely and reduce some of thehurdles to starting a new business in California.Additionally, the C B C solution will benefit other state agencies, such as the Employment DevelopmentDepartment (EDD), Franchise Tax Board (FTB), Department of Fee and Tax Administration (CDFTA),and the Attorney General's office (AG), by making key information about businesses readily availablethrough automated interfaces. The interfaces will allow the agencies to obtain information from theS O S more quickly for taxing, enforcement, and other purposes, as well as file tax liens electronically topreserve the State's lien priority.D.JustificationC B C is a comprehensive technology solution that will increase online services for business filings andrequests for information. CBC will allow the SOS to process business formation documents within afew hours or days and avoid processing fluctuations that vacillate depending on the time of year.Because businesses cannot open their doors, create bank accounts, acquire loans, hire employees,generate income, or pay taxes until their formation documents are processed by our office, CBC willmake the State a friendlier business environment.This spending authority request is to enter into a contract for systems integration vendors, projectmanagement services including an Agile Coach (new requirement of Department of Technology perS P R #3), Independent Project Oversight, Independent Verification and Validation, OrganizationalChange Management, Testing and Quality Assurance vendor, temporary help to backfill behindl:\Unit\BGP\2018-19 BCPs\DF-46 Cover Sheet August 2017.doc

A n a l y s i s of Problemredirected staff, and other operating expenses related to the project. The consultants and the SOS staffwill work together, using the associated functional, non-functional, and project specific requirements torelease one to many Requests for Offer (RFO). The consultants will also work with SOS staff onorganizational change management planning and quality assurance planning.A s noted previously, much of the filing and information retrieval processes are manual; however,continued manual processing of paper-based filings and payments cannot be sustained. The manualprocessing of filings and requests for information does not provide the level of control and securityenvisioned by the. S O S . That vision includes integrated database(s) for tracking filings, informationrequests, and associated fees with permanent record processing and storage.T h e S O S , which is instrumental in helping businesses establish themselves in California by processingand filing more than 2 million documents and requests for information each year, is requesting tocontinue the CBC project to automate its labor-intensive manual processes. The current processesmake it increasingly difficult to comply with current mandates and implement new legislative mandates.In addition, current processes are prone to human error and continue to put vital State records at risk ofloss/theft/misplacement. Without the CBC solution, backlogs will only be maintained at the legislativelyr e c o m m e n d e d and the S O S established goal of an average of 5 business days by permanently fundingthe additional positions, overtime, and temporary help using the current manual processes.T h e C B C solution will allow the S O S to process business documents faster, thus helping businessescreate jobs faster and speeding up the collection of sales, property, and other taxes and fees. TheC B C solution will provide California businesses with the ability to file online and receive a responsefrom the SOS within a few hours or days.A fee increase is not required to support the CBC project. The money to support the project existsthrough the fees currently paid by businesses for filings and services. The S O S is requesting authorityto use these funds that businesses are currently paying.Effective July 1, 2014, all filing fees and service fees (special handling, expedited, and copy fees) paidby businesses are deposited into the BFF (in accordance with A B 554 (Chapter 364, Statutes of 2013).The law also requires the collection of a 5.00 disclosure fee (established in accordance with A B 55(Chapter 1015, Statutes of 2002) at the time domestic stock and foreign corporations file their annualStatements of Information. As required by California Corporations Code sections 1502 and 2117, onehalf of the disclosure fees must be utilized to enhance program services, including the development ofan online database to provide public access to all information contained in the Statement of Informationfiling. With the passage of A B 554 (Chapter 364, Statutes of 2013), effective January 1, 2014, one-halfof the disclosure fees submitted by corporations with their Statements of Information are deposited intothe B P M F as established by the legislation, which will be sufficient to cover the 2.0 million requestedspending authority from the BPMF authority. The excess collection of filing fees and service fees in theBFF is sufficient to cover the requested 10.63 million in additional spending authority.E.O u t c o m e s and AccountabilityThe C B C project includes Business Entities, Trademarks, and UCC filings. The internal workflowprocessing efficiencies gained will be measured against baseline paper-based metrics alreadyestablished for existing manual processing times.It is anticipated that the CBC solution will; Allow real-time filing and retrieval of certificates and copies of filings to permit businesses toopen bank accounts, obtain financing, and generate revenue more quickly, increasing taxbenefits to the State; Allow government agencies to acquire needed information in a timely manner to perform theirtaxing and enforcement responsibilities; Allow businesses to open their doors sooner and create jobs; Allow for more secure and timely processing of payments;Improve telephone customer service by allowing staff to have immediate access to records andinformation;l:\Unit\BGP\2018-19 BGPs\DF-46 Gover Sheet August 2017.doc

A n a l y s i s of Problem Reduce the number of documents being rejected by including built-in field edits for customersfiling online, which ultimately will reduce customer frustration ever the need to submit adocument multiple times;Reduce the number of staff necessary to process the work within the average 5 business days; Ensure confidential information is only accessible to authorized parties; Ensure confidential and private information is redacted from copies per statute; Ensure critical documents are recoverable in the event of a catastrophe;Decrease storage of paper and space requirements, allowing centralization of in-personservices; and Ensure the S O S technology complies with statutory and regulatory mandates.T h e information captured electronically and stored in a centralized database for automated workflowprocessing will benefit businesses, the economy, and the taxpayers, as well as the SOS and other stategovernment agencies. The benefits will include:Business BenefitsEliminate unnecessary delays; Provide a centralized and integrated single-point-of-service for business entities, notices offinancial tax liens and trademark filings;Ensure more secure and timely processing of payments; Provide online filing options and help in completing forms;Reduce the cost and time required to establish and maintain a business; Make services available 24 hours a day, seven days a week, and Allow users to see all filing activities related to the business over the long term.Economic Benefits Process business filings faster; Enable businesses to create jobs sooner; and Bring more revenue to the State sooner.Taxpayer/Public Benefits Provide reliable online research of entities doing business in California;Provide the names and addresses of the individuals running the businesses; and Provide online debtor information.The S O S BenefitsEnsure the agency will be in compliance with statutes and regulations; Allow for immediate processing of payments received; Provide flexibility to make changes necessary to comply with law;Protect physical assets of the State; Strengthen internal controls for cash management; Reduce data entry required;Provide consistency of data across the agency; Improve services paid for by businesses; andl:\Unit\BCP\2018-19 BCPs\DF-46 Cover Sheet August 2017.doc

A n a l y s i s of Probiem Provide staff, supervisors,measurement Other Government Benefits Maximize interest earnings by handling cash flow more efficiently; Provide automated interfaces with other government agencies, including EDD, CDTFA, FTB,and A G ; Potential savings to government agencies currently accessing data via labor intensive manualprocesses; and Provide online filings of public notice of tax liens.By implementing a single intake process for the paper filings and online filings with imaging andautomated workflow processes behind the scenes, business filings will take hours, allowing businessesto launch quickly, and generating jobs and tax revenue while providing services and products toCalifornians.F.A n a l y s i s of All F e a s i b l e AlternativesAlternative 1: Approve the request and increase the BFF authority by 10.63 million and the BPMFauthority by 2.0 million, each on a one-time basis, to proceed with the CBC project.Pros: Similar business problems within the BPD can be addressed at the same time with the CBCproject. This approach will facilitate the integration and consolidation of the BPD operations byproviding systems with similar applications and will provide necessary automated interfaceswith customers, including other government agencies (e.g., EDD, CDTFA, FTB, AG). Backlogs will not return once the limited term funded positions and associated temporaryfunding are eliminated, and the short turnaround times will help businesses reduce risk offailure by opening their doors faster and drawing additional businesses to California. Businesses, other government agencies, law enforcement agencies, and the general publicwill benefit from the implementation of the CBC solution, which will allow the SOS, with lessstaff, to maintain or even reduce processing times to file business documents and will allowcustomers to quickly obtain information and copies of documents electronically from theSOS. Fees paid by businesses for Secretary of State filing and request for information services willbe used for their intended purpose.Cons:There is some risk to doing a large IT project; however, designing, developing, testing anddeploying the project in smaller modules (see Implementation Plan below) helps mitigate therisk.Alternative 2: Deny funding request, and continue manual, archaic processes. Although the SOS hasbeen appropriated approximately 6.2 million per year for FY 2013/14, 2014/15 and 2015/16; and 5.5million per year for FY 2016/17 and 2017/18; and 5,108 million per year for FY 2018/19, 2019/20 and2020/21 for processing Business Entity filings and Statements of Information (Business ProgramsDivision Backlogs Finance Letter), in the absence of automation, the SOS only will be able to sustainan average 5 business day turnaround time as long as this funding is made available continuouslyusing its existing manual, staff-intensive paper processes.Pros:Higher revenue balances in excess of Business Fees Fund authority may be transferred tothe General Fund.l:\Unit\BCP\2018-19 BCPs\DF-46 Cover Sheet August 2017.doc

A n a l y s i s of ProbiemCons: The S O S will continue processing filing and information requests using archaic, laborintensive, manual processes that are slow and do not meet the needs of the business, legaland financial communities, government agencies, or the public.Staff needed/required to work overtime will burnout and may look for jobs elsewhere,possibly increasing backlogs and turnaround times.Fees paid by businesses for Secretary of State services will not be used for their intendedpurpose.G.implementation PlanApproved SPR#3 allows the project team focus on the largest annual volume of paper flings withdevelopment and

The SOS, as required by the California Corporations Code, Government Code, Business and Professions Code, Civil Code, Commercial Code, Code of Civil Procedure, Family Code, Code of Regulations and other codes; 1) Authorizes businesses to operate in California by: l:\Unit\BCP\2018-19 BCPs\DF-46_Cover_Sheet_August 2017,doc