Transcription

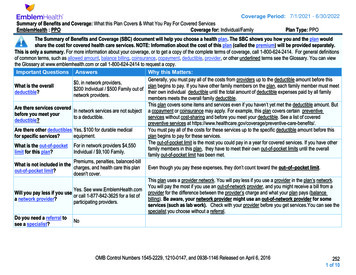

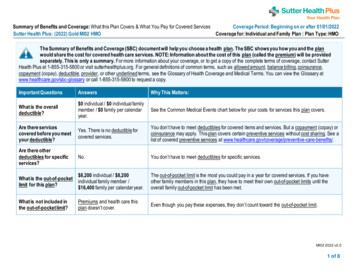

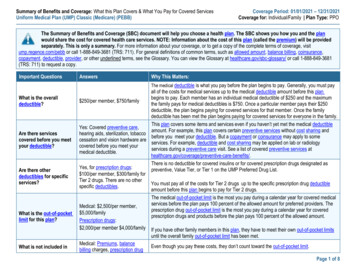

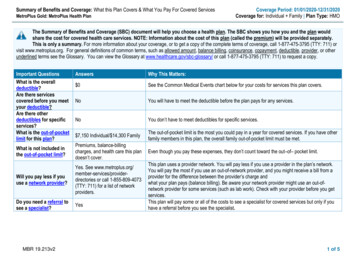

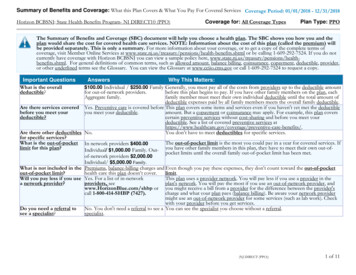

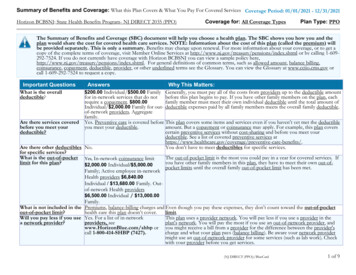

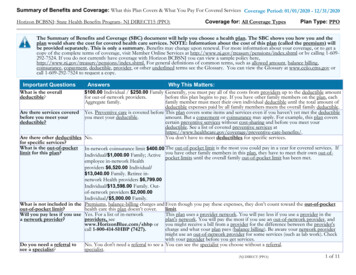

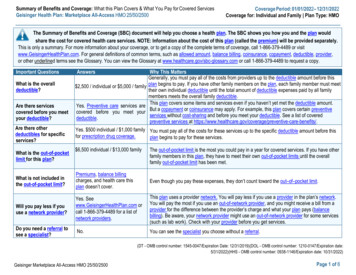

Summary of Benefits and Coverage: What this Plan Covers & What You Pay for Covered ServicesGeisinger Health Plan: Marketplace All-Access HMO 25/50/2500Coverage Period: 01/01/2022– 12/31/2022Coverage for: Individual and Family Plan Type: HMOThe Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan wouldshare the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately.This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, call 1-866-379-4489 or visitwww.GeisingerHealthPlan.com. For general definitions of common terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider,or other underlined terms see the Glossary. You can view the Glossary at www.healthcare.gov/sbc-glossary.com or call 1-866-379-4489 to request a copy.Important QuestionsWhat is the overalldeductible?Are there servicescovered before you meetyour deductible?Are there otherdeductibles for specificservices?What is the out-of-pocketlimit for this plan?AnswersWhy This MattersGenerally, you must pay all of the costs from providers up to the deductible amount before this 2,500 / individual or 5,000 / family plan begins to pay. If you have other family members on the plan, each family member must meettheir own individual deductible until the total amount of deductible expenses paid by all familymembers meets the overall family deductible.This plan covers some items and services even if you haven’t yet met the deductible amount.Yes. Preventive care services areBut a copayment or coinsurance may apply. For example, this plan covers certain preventivecovered before you meet yourservices without cost-sharing and before you meet your deductible. See a list of covereddeductible.preventive services at e-benefits/.Yes. 500 individual / 1,000 family You must pay all of the costs for these services up to the specific deductible amount before thisfor prescription drug coverage.plan begins to pay for these services. 6,500 individual / 13,000 familyThe out-of-pocket limit is the most you could pay in a year for covered services. If you have otherfamily members in this plan, they have to meet their own out-of-pocket limits until the overallfamily out-of-pocket limit has been met.What is not included inthe out-of-pocket limit?Premiums, balance billingcharges, and health care thisplan doesn’t cover.Even though you pay these expenses, they don’t count toward the out–of–pocket limit.Will you pay less if youuse a network provider?Yes. Seewww.GeisingerHealthPlan.com orcall 1-866-379-4489 for a list ofnetwork providers.Do you need a referral tosee a specialist?This plan uses a provider network. You will pay less if you use a provider in the plan’s network.You will pay the most if you use an out-of-network provider, and you might receive a bill from aprovider for the difference between the provider’s charge and what your plan pays (balancebilling). Be aware, your network provider might use an out-of-network provider for some services(such as lab work). Check with your provider before you get services.No.You can see the specialist you choose without a referral.(DT - OMB control number: 1545-0047/Expiration Date: 12/31/2019)(DOL - OMB control number: 1210-0147/Expiration date:5/31/2022)(HHS - OMB control number: 0938-1146/Expiration date: 10/31/2022)Geisinger Marketplace All-Access HMO 25/50/2500Page 1 of 6

All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.Common Medical EventServices You May NeedPrimary care visit to treat an injuryor illnessIf you visit a health careprovider’s office or clinicSpecialist visit 50 copay / visitNot coveredDeductible does not apply.None.Preventive care / screening /No chargeLimited to 1 routine exam per year.You may have to pay for services thataren’t preventive. Ask your providerif the services needed are preventive.Then check what your plan will pay for.immunizationIf you have a testWhat You Will Pay:Limitations, Exceptions, &Non-Participating ProviderParticipating ProviderOtherImportant Information(You will pay the most)(You will pay the least)None. 25 copay / visitNot coveredDeductible does not apply.Diagnostic test (x-ray, blood work)Imaging (CT/PET scans, MRIs)If you need drugs to treat Generic drugs:your illness or condition (Tier 1- Preferred)More information aboutprescription drug coverageis available atwww.GeisingerHealthPlan.(Tier 2- Non-Preferred)comPreferred brand drugs: (Tier 3)Geisinger Marketplace All-Access HMO 25/50/2500Not coveredDeductible does not apply. 50 copay / dayNot coveredDeductible does not apply.Not covered20% coinsuranceNot coveredRetail: 3 copayprescriptionMail Order: 3 copay /prescriptionDeductible does not apply.Retail: 20 copay /Not coveredprescriptionMail order: 20 copay /prescriptionDeductible does not apply.Not coveredRetail: 45 copay /prescriptionMail Order: 45 copay /prescriptionDiagnostic: None.Imaging: Precertification/priorauthorization required.Covers up to a 34-day supply (retailprescription); 102-day supply (mailorder prescription).Page 2 of 6

Common Medical EventIf you need drugs to treatyour illness or conditionMore information aboutprescription drug coverageis available atwww.GeisingerHealthPlan.comIf you have outpatientsurgeryWhat You Will Pay:Participating ProviderNon-Participating Provider(You will pay the least)(You will pay the most)Non-preferred brand drugs: (Tier 4) Retail: 80 copay /Not coveredprescriptionMail order: 80 copay /prescriptionServices You May NeedSpecialty drugs: (Tier 5)50% coinsurance up to 6,500Facility fee (e.g.,ambulatorysurgery center)20% coinsurancePhysician/surgeon fees20% coinsurance 300 copay / visitDeductible does not apply.Emergency room careIf you need immediatemedical attentionIf you have a hospitalstayEmergency medical transportation No chargeDeductible does not apply.Not covered 25 copay / visit 25 copay / visitDeductible does not apply. Deductible does not apply.Facility Fee (e.g.,hospital room)20% coinsurancePhysician/surgeon fees20% coinsuranceNot covered 25 copay / visitNot coveredDeductible does not apply.Office visits20% coinsuranceNo chargeDeductible does not apply.Not coveredNot coveredNot coveredChildbirth/delivery professionalservices20% coinsuranceNot coveredChildbirth/delivery facilityservices20% coinsuranceNot coveredGeisinger Marketplace All-Access HMO 25/50/2500Covers up to a 34-day supply (retailprescription); 102-day supply (mailorder prescription).Specialty drugs (Tier 5) have no mailorder option.Tier 6 is limited to 0 copay/prescription.Deductible does not apply.Precertification/prior authorization maybe required.Not covered 300 copay / visitEmergency services: Copay waived ifDeductible does not apply. admitted to the hospital.Emergency medical transportation: None.No chargeDeductible does not apply. Urgent care: None.Urgent careIf you need mental health, Outpatient servicesbehavioral health, orsubstance abuse services Inpatient servicesIf you are pregnantNot coveredLimitations, Exceptions, &Other Important InformationPrecertification/prior authorizationrequired.Outpatient Services: None.Inpatient Services: Precertification/prior authorization required.Pregnancy office visits: None.Cost sharing does not apply forpreventive services. Maternity care mayinclude tests and services as describedelsewhere in the SBC (i.e., ultrasound).Depending on the type of services, acopay, coinsurance or deductible mayapply.Inpatient professional and facilityservices; Precertification/priorauthorization required.Page 3 of 6

Common Medical EventServices You May NeedHome health careRehabilitation servicesIf you need help recoveringor have other special health Habilitation servicesneedsIf your child needs dentalor eye careWhat You Will Pay:Limitations, Exceptions, & OtherNon-Participating ProviderParticipating ProviderImportant Information(You will pay the least) (You will pay the most)No chargeLimited to 60 visits / member / benefitNot coveredDeductible does not apply.period. 50 copay / visitNot coveredNone.Deductible does not apply. 50 copay / visitNot coveredDeductible does not apply.Skilled nursing care 50 copay / dayNot covered120 days / benefit period / person.Durable medical equipment20% coinsuranceNot coveredNone.Hospice servicesResidential: 50 copay/visit Not coveredFacility: 100 copay/dayDeductible does not apply.None.Children’s eye exam 50 copayDeductible does not apply.Not coveredLimited to 1 exam/benefit period / upto age 19.Children’s glasses50% coinsuranceDeductible does not apply.No chargeDeductible does not apply.50% coinsuranceUp to age 19 only. 1 frame every 12Deductible does not apply. months.Children’s dental check-upNot covered1 exam per 6 months up to age 19.Excluded Services & Other Covered Services:Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services.) Abortion (except in case of rape, incest, or where Dental Care (Adult) Routine eye care (Adult)medically necessary to avert the death of the Hearing Aids Routine Foot Caremother) Weight Loss Programs Long Term Care Acupuncture Non-emergency care when traveling outside the Bariatric SurgeryU.S. Cosmetic Surgery Private Duty NursingGeisinger Marketplace All-Access HMO 25/50/2500Page 4 of 6

Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.) Chiropractic Care Infertility TreatmentYour Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for thoseagencies is: Pennsylvania Insurance Department at 1-877-881-6388 or www.insurance.pa.gov/Consumers, or PennieTM, Pennsylvania's health insurancemarketplace, at www.Pennie.com or 844-844-8040. Other coverage options may be available to you too, including buying individual insurance coverage throughthe Health Insurance Marketplace. For more information about the Marketplace, visit www.Pennie.com or call 844-844-8040.Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is calleda grievance or appeal. For more information about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan documents alsoprovide complete information on how to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, orassistance, contact: the Pennsylvania Insurance Department at 1-877-881-6388 or www.insurance.pa.gov/Consumers.Does this plan provide Minimum Essential Coverage? Yes.Minimum Essential Coverage generally includes plans, health insurance available through the Marketplace or other individual market policies, Medicare,Medicaid, CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage, you may not be eligible for thepremium tax credit.Does this plan meet the Minimum Value Standards? Not Applicable.If your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace.Language Access Services: To access our Language helpline, please call 1-800-447-4000.To see examples of how this plan might cover costs for a sample medical situation, see the next section.Geisinger Marketplace All-Access HMO 25/50/2500Page 5 of 6

About these Coverage Examples:This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will be differentdepending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost-sharing amounts(deductibles, copayments and coinsurance) and excluded services under the plan. Use this information to compare the portion of costs you mightpay under different health plans. Please note these coverage examples are based on self-only coverage.Managing Joe’s Type 2 DiabetesPeg is Having a Baby(9 months of in-network pre-natal care and ahospital delivery) The plan’s overall deductibleSpecialist copaymentHospital (facility) coinsuranceOther coinsurance 2,500 5020%20%Mia’s Simple Fracture(a year of routine in-network care of a wellcontrolled condition) The plan’s overall deductibleSpecialist copaymentHospital (facility) coinsuranceOther coinsurance(in-network emergency room visit and follow upcare) 2,500 5020%20% The plan’s overall deductibleSpecialist copaymentHospital (facility) coinsuranceOther coinsurance 2,500 5020%20%This EXAMPLE event includes services like:Specialist office visits (prenatal care)Childbirth/Delivery Professional ServicesChildbirth/Delivery Facility ServicesDiagnostic tests (ultrasounds and blood work)Specialist visit (anesthesia)This EXAMPLE event includes services like:Primary care physician office visits (includingdisease education)Diagnostic tests (blood work)Prescription drugsDurable medical equipment (glucose meter)This EXAMPLE event includes services like:Emergency room care (including medicalsupplies)Diagnostic test (x-ray)Durable medical equipment (crutches)Rehabilitation services (physical therapy)Total Example CostTotal Example CostTotal Example CostIn this example, Peg would pay:Cost SharingDeductibles 12,700 2,500In this example, Joe would pay:Cost SharingDeductibles 5,600 200 2,800In this example, Mia would pay:Cost SharingDeductibles 200Copayments 200Copayments 1,100Copayments 600Coinsurance 1,800Coinsurance 0Coinsurance 0What isn’t coveredLimits or exclusionsThe total Peg would pay is 0 4,500What isn’t coveredLimits or exclusionsThe total Joe would pay is 0 1,300What isn’t coveredLimits or exclusionsThe total Mia would pay is 0 800The plan would be responsible for the other costs of these EXAMPLE covered services.Geisinger Marketplace All-Access HMO 25/50/2500Page 6 of 6

Discrimination is against the lawGeisinger Health Plan, Geisinger Quality Options, Inc., andGeisinger Indemnity Insurance Company (the “Health Plan”)comply with applicable federal civil rights laws and do notdiscriminate on the basis of race, color, national origin, age,disability, sex, gender identity, or sexual orientation. TheHealth Plan does not exclude people or treat them differentlybecause of race, color, national origin, age, disability, sex,gender identity, or sexual orientation.The Health Plan: Provides free aids and services to people with disabilitiesto communicate effectively with us, such as: Qualified sign language interpreters Written information in other formats (large print,audio, accessible electronic formats, other formats) Provides free language services to people whose primarylanguage is not English, such as: Qualified interpreters Information written in other languagesIf you need these services, call the Health Plan at800-447-4000 or TTY: 711.If you believe that the Health Plan has failed to provide theseservices or discriminated in another way on the basis of race,color, national origin, age, disability, sex, gender identity, orsexual orientation, you can file a grievance with:Civil Rights Grievance CoordinatorGeisinger Health Plan Appeals Department100 North Academy Avenue, Danville, PA 17822-3220Phone: 866-577-7733, TTY: 711Fax: 570-271-7225GHPCivilRights@thehealthplan.comYou can file a grievance in person or by mail, fax, or email. Ifyou need help filing a grievance, the Civil Rights GrievanceCoordinator is available to help you.You can also file a civil rights complaint with the U.S.Department of Health and Human Services, Office for CivilRights electronically through the Office for Civil RightsComplaint Portal, available at https://ocrportal.hhs.gov/ocr/portal/lobby.jsf, or by mail or phone at:U.S. Department of Health and Human Services200 Independence Avenue SW., Room 509FHHH Building, Washington, DC 20201Phone: 800-368-1019, 800-537-7697 (TDD)Complaint forms are available TENTION: If you speak a language other than English, language assistance services, free of charge, are available to you. Call 800-447-4000 or TTY: 711.ATENCIÓN: si habla español, tiene a su disposición servicios gratuitos de asistencia lingüística. Llame al 800-447-4000 (TTY: 711).㲐シ烉 㝄ぐἧ䓐 橼ᷕ㔯炻ぐ ẍ 屣䌚 婆妨 㚵 ˤ婳农暣ġ800-447-4000㸦TTY㸸711㸧ˤCHÚ Ý: Nũu bįn nói Tiũng Viŭt, có các dƌch vǖ hƲ trƹ ngôn ngǜ miŬn phí dành cho bįn. Gƭi sƯ 800-447-4000 (TTY: 711).ġ ́ ̀ ́ ̴̺̱ ̪̈́ ̷̷̫̪̹̱̻̭ ̶̧ ̷̵̹̼̺̺̳ ͈̰̳̭̈́ ̷̻ ̵̧̪ ̷̸̶̬̺̻̼̈́ ̸̴̶̧̩̭̺̻̭̈́ ̴̼̺̼̫̱ ̸̷̧̭̹̭̪̬Ͷ ̷̶̪̱̻̭ 800-447-4000 ̴̸̧̻̭̭̻̲ͥ 711).ACHTUNG: Wenn Sie Deutsch sprechen, stehen Ihnen kostenlos sprachliche Hilfsdienstleistungen zur Verfügung. Rufnummer: 800-447-4000 (TTY: 711).㨰㢌aGG䚐ạ㛨 G 㟝䚌㐐 Gᷱ㟤SG㛬㛨G㫴㠄G Gⱨ ⦐G㢨㟝䚌㐘G G㢼 UG800-447-4000 (TTY: 711) ⶼ㡰⦐G㤸䞈䚨G㨰㐡㐐㝘UATTENZIONE: In caso la lingua parlata sia l'italiano, sono disponibili servizi di assistenza linguistica gratuiti. Chiamare il numero 800-447-4000 (TTY: 711).711 ϢϜΒϟ ϭ Ϣμϟ ϒΗΎϫ Ϣϗέ 800-447-4000 ϢϗήΑ ϞμΗ ϥΎΠϤϟΎΑ Ϛϟ ήϓ ϮΘΗ ΔϳϮϐϠϟ ΓΪϋΎδϤϟ ΕΎϣΪΧ ϥΈϓ ˬΔϐϠϟ ήϛΫ ΙΪΤΘΗ ΖϨϛ Ϋ· ΔυϮΤϠϣATTENTION : Si vous parlez français, des services d'aide linguistique vous sont proposés gratuitement. Appelez le 800-447-4000 (ATS : 711).ACHTUNG: Wenn Sie Deutsch sprechen, stehen Ihnen kostenlos sprachliche Hilfsdienstleistungen zur Verfügung. Rufnummer: 800-447-4000 (TTY: 711).k Wh: Ks S\p ȤKk hSj Zs Sh es, Ss iW:Ƀƣk D [hch deh] dpahB S\h h \hN ;X ƞV Jp . YsW D s 800-447-4000 (TTY: 711).ɅIHJ393 SDzS[X ]ƣgXck [cZe ] DzSck cZ bkicdNŕ k PSk ƗNd SY ] Qi YŤkiZ gSYͶ MNRkg Ɲ R e]Sb 800-447-4000 (TTY: 711).3G3AFLBA FX g N[S bSiƧ[ 3iXciS VS cŢfXc ŢR e [ang ki disponib gratis pou ou. Rele 800-447-4000 (TTY: 711).ȉ óǽƷĆŹřơșƇŞȥŞșȒ Ƅ ǶƴŚ éɇ ĆȄ Ƅ ŏȄ ƄơȽŬŐ 800-447-4000 (TTY: 711)ɇƅŞŻȽŅŚɉ ȒŞȋơǯřēƴŚ éřǯžŻ ŴƤȓîŷ Ƅ, ȒơƑĐșřȇŻȓŧŚéŴƤ ȒīŻŶǯřóǯŅĕśƉATENÇÃO: Se fala português, encontram-se disponíveis serviços linguísticos, grátis. Ligue para 800-447-4000 (TTY: 711).HPM 50 alb: Nondiscrimination dev. 9.12.16Y0032 16242 2 File and Use 9/2/16

Geisinger Health Plan: Marketplace All-Access HMO 25/50/2500 Coverage Period: 01/01/2022- 12/31/2022 Coverage for: Individual and Family Plan Type: HMO . Bariatric Surgery Cosmetic Surgery Dental Care (Adult) Hearing Aids Long Term Care Non-emergency care when traveling outside the U.S.