Transcription

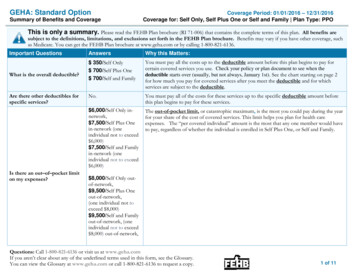

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered ServicesCoverage Period: 01/01/2021 – 12/31/2021Standard Option: GEHACoverage for: Self Only, Self Plus One or Self and Family Plan Type: PPOThe Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan wouldshare the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately.This is only a summary. Please read the FEHB Plan brochure (RI 71-006) that contains the complete terms of this plan. All benefits are subject to thedefinitions, limitations, and exclusions set forth in the FEHB Plan brochure. Benefits may vary if you have other coverage, such as Medicare. For generaldefinitions of common terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider, or other underlined terms see the Glossary.You can get the FEHB Plan brochure at www.geha.com, and view the Glossary at www.healthcare.gov/sbc-glossary. You can call 1-800-821-6136 to request a copyof either document.Important QuestionsAnswersWhat is the overalldeductible? 350 / Self Only 700 / Self Plus One 700 / Self and FamilyAre there services coveredbefore you meet yourdeductible?Yes. Preventive care, Office visits, UrgentCare visits, In-Network Maternity care andPrescription drugs.Are there other deductiblesNo.for specific services?For in-network providers 6,500 Self Only 13,000 Self Plus One or Self and Family(one individual not to exceed 6,500)What is the out-of-pocketlimit for this plan?For out-of-network providers 8,500 Self Only 17,000 Self Plus One or Self and Family(one individual not to exceed 8,500)Why This Matters:Generally, you must pay all of the costs from providers up to the deductible amountbefore this plan begins to pay. Copayments and coinsurance amounts do not counttoward your deductible, which generally starts over January 1. When a coveredservice/supply is subject to a deductible, only the Plan allowance for the service/supplycounts toward the deductible. If you have other family members on the plan, eachfamily member must meet their own individual deductible until the total amount ofdeductible expenses paid by all family members meets the overall family deductible.This plan covers some items and services even if you haven’t yet met the deductibleamount. But a copayment or coinsurance may apply. For example, this plan coverscertain preventive services without cost sharing and before you meet your deductible.See a list of covered preventive services are-benefits/.You don’t have to meet deductibles for specific services.The out-of-pocket limit, or catastrophic maximum, is the most you could pay in a yearfor covered services. If you have other family members in this plan, they have to meettheir own out-of-pocket limits until the overall family out-of-pocket limit has been met.1 of 8

Important QuestionsAnswersWhy This Matters:What is not included inthe out-of-pocket limit?Premiums, balance-billed charges, anypenalties, non-covered drugs, thedifference in price between generic andbrand name and services your health careplan does not cover.Even though you pay these expenses, they don’t count toward the out–of–pocket limit.Yes. See www.geha.com/find-care or callWill you pay less if you use1-800-296-0776 for a list of networka network provider?providers.Do you need a referral tosee a specialist?No.This plan uses a provider network. You will pay less if you use a provider in the plan’snetwork. You will pay the most if you use an out-of-network provider, and you mightreceive a bill from a provider for the difference between the provider’s charge and whatyour plan pays (balance billing). Be aware, your network provider might use an out-ofnetwork provider for some services (such as lab work). Check with your providerbefore you get services.You can see the specialist you choose without a referral.All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.CommonMedical EventServices You MayNeedPrimary care visit totreat an injury or illnessIf you visit a health careprovider’s office orclinicIf you have a testSpecialist ic test (x-ray,blood work)Imaging (CT/PETscans, MRIs)What You Will PayOut-of-Network ProviderNetwork Provider(You will pay the most,(You will pay the least)plus you may bebalance billed) 15 / visit35% coinsurance afterDeductible does not applydeductibleLimitations, Exceptions, & Other ImportantInformationNone 30 / visitDeductible does not apply35% coinsurance afterdeductibleNoneNo charge35% coinsurance afterdeductibleYou may have to pay for services that aren’tpreventive. Ask your provider if the servicesneeded are preventive. Then check what yourplan will pay for.15% coinsurance for bloodwork; 15% coinsurance afterdeductible for x-rays35% coinsurance afterdeductibleOutpatient lab work at Lab Card locations is available at no charge.15% coinsurance afterdeductible35% coinsurance afterdeductibleMust be pre-authorized. If not, paymentreduced by 100; or care may not be covered.For more information about limitations and exceptions, see the FEHB Plan brochure RI 71-006 at www.geha.com.2 of 8

CommonMedical EventServices You MayNeedGeneric drugsWhat You Will PayOut-of-Network ProviderNetwork Provider(You will pay the most,(You will pay the least)plus you may bebalance billed)Retail - 10 or the cost of thedrug, whichever is less.Mail order -- 20 or the costof the drug whichever is lessRetail – 50% not to exceed 200 per 30-day supplyPreferred brand drugsIf you need drugs totreat your illness orconditionMore information aboutprescription drugcoverage is available athttps://info.caremark.com/geha.Non-preferred branddrugsMail order – 50%, not toexceed 500 per 90-daysupply.Retail – 50% not to exceed 300 per 30-day supplyMail order – 50%, not toexceed 600 per 90-daysupplySame as in-networkpharmacy, plus you payexcess over our innetwork drug costSame as in-networkpharmacy, plus you payexcess over our innetwork drug costSame as in-networkpharmacy, plus you payexcess over our innetwork drug costFrom CVS Specialty PharmacySpecialty drugsGeneric and Preferred: 50%up to a maximum of 250 forup to a 30-day supplyNon-preferred: 50% up to amaximum of 400 for up to a30-day supply50% of the Planallowance, plus you pay 500 per fill and anydifference between ourallowance and the cost ofthe drugFor more information about limitations and exceptions, see the FEHB Plan brochure RI 71-006 at www.geha.com.Limitations, Exceptions, & Other ImportantInformation90 day supplies are available at a participatingExtended Day Supply (EDS) networkpharmacy or through mail order.You pay in full at an out-of-networkpharmacy and submit for reimbursement.Brand name when generic available – same asgeneric drugs, plus the difference in cost ofgeneric and brand name.When specialty drugs are not dispensed byCVS Specialty Pharmacy, the additional 500 copayment you pay applies to your outof-pocket limit.Copayment based on days of therapy.You pay in full at an out-of-networkpharmacy and submit for reimbursement.Brand name when generic available – sameas generic drugs, plus the difference in costof generic and brand name.3 of 8

CommonMedical EventIf you have outpatientsurgeryServices You MayNeed15% coinsurance afterdeductible35% coinsurance afterdeductibleSome services must be pre-authorized.If not, care may not be covered.Physician/surgeonfees15% coinsurance afterdeductible35% coinsurance afterdeductibleSome services must be pre-authorized.If not, care may not be covered.15% coinsurance afterdeductible for medicalemergencyNoneEmergency medicaltransportation15% coinsurance afterdeductible35% coinsurance afterdeductible for other15% coinsurance afterdeductible15% coinsurance afterdeductible 35 / visitDeductible does not apply35% coinsurance afterdeductibleFacility fee (e.g.,hospital room)15% coinsurance afterdeductible35% coinsurance afterdeductiblePhysician/surgeonfees15% coinsurance afterdeductible35% coinsurance afterdeductibleUrgent careIf you have a hospitalstayLimitations, Exceptions, & Other ImportantInformationFacility fee (e.g.,ambulatory surgerycenter)Emergency room careIf you need immediatemedical attentionWhat You Will PayOut-of-Network ProviderNetwork Provider(You will pay the most,(You will pay the least)plus you may bebalance billed)For more information about limitations and exceptions, see the FEHB Plan brochure RI 71-006 at www.geha.com.Air ambulance must be pre-authorized. If notmedically necessary, services will not becovered.Member is responsible for all charges over 100miles when medically necessary treatment isavailable within 100 miles.NoneSemi-private room.Must be pre-authorized. If not, paymentreduced by 500; or care may not be covered.None4 of 8

CommonMedical EventIf you need mentalhealth, behavioralhealth, or substanceabuse servicesServices You MayNeedOutpatient servicesPsychological testing requires preauthorization. If not, care may not be covered.Semi-private room.35% coinsurance afterdeductibleOffice visitsNo charge35% coinsurance afterdeductibleNoneChildbirth/deliveryprofessional servicesNo charge35% coinsurance afterdeductibleNoneChildbirth/deliveryfacility servicesNo charge35% coinsurance afterdeductibleNoneHome health careIf you need helprecovering or haveother special healthneedsLimitations, Exceptions, & Other ImportantInformation15% coinsurance afterdeductibleInpatient servicesIf you are pregnantWhat You Will PayOut-of-Network ProviderNetwork Provider(You will pay the most,(You will pay the least)plus you may bebalance billed) 15 / visit for office visitsDeductible does not apply35% coinsurance after15% coinsurance afterdeductibledeductible for other outpatientservicesRehabilitation servicesHabilitation services15% coinsurance afterdeductible15% coinsurance afterdeductible15% coinsurance afterdeductible35% coinsurance afterdeductibleMust be pre-authorized. If not, paymentreduced by 500; or care may not be covered.Must be pre-authorized.If not, care may not be covered.Limited to 50 2-hour visits/year with an RN,LPN or MSW.35% coinsurance afterdeductibleOutpatient services limited to 60 visits/yearcombined by qualifiedphysical/occupational/speech therapist perperson per year.35% coinsurance afterdeductibleOutpatient services limited to 60 visits/yearcombined by qualifiedphysical/occupational/speech therapist perperson per year.For more information about limitations and exceptions, see the FEHB Plan brochure RI 71-006 at www.geha.com.5 of 8

CommonMedical EventIf you need helprecovering or haveother special healthneedsWhat You Will PayOut-of-Network ProviderNetwork Provider(You will pay the most,(You will pay the least)plus you may bebalance billed)Limitations, Exceptions, & Other ImportantInformationNo charge, up to limit of 700/day for the first 21 daysNo charge, up to limit of 700/day for the first 21days. Subject to balancebilling.Facility only. Must be pre-authorized. If not,care may not be covered.Limited to 700 / day for the first 21 days aftertransfer from an acute care hospital.Durable medicalequipment15% coinsurance afterdeductible35% coinsurance afterdeductibleMust be pre-authorized.If not, equipment may not be covered.Hospice servicesNo charge, up to 15,000 limit.Deductible applies.No charge, up to 15,000limit. Deductible applies.Coverage limited to 15,000/period of care forcombined in-patient and out-patient care.No chargeNo chargeOne routine eye exam per calend

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered Services Coverage Period: 01/01/2021 - 12/31/2021 Standard Option: GEHA Coverage for: Self Only, Self Plus One or Self and Family Plan Type: PPO. 1 of 8. The Summary of Benefits and Coverage (SBC) document will help you choose a health plan.