Transcription

Current Outlook of Japanese TeaDecember 2020

[ I n d e x ]1. Characteristics of tea production in Japan . 12. Outlook of tea production . 33. Outlook of crude tea price . 44. Outlook of consumption / demand of tea . 55. Change in consumer market . 66. Current situation of tea producing regions (1) . . 77. Current situation of tea producing regions (2) . . 88. Efforts for improving productivity (Promotion of smart agriculture) . . 99. Outlook of tea import / export . . 1010. Results of tea export . 1111. Export of organic tea . . 1212. Development of new basic policy concerning promotion of tea industry andtea culture . 14

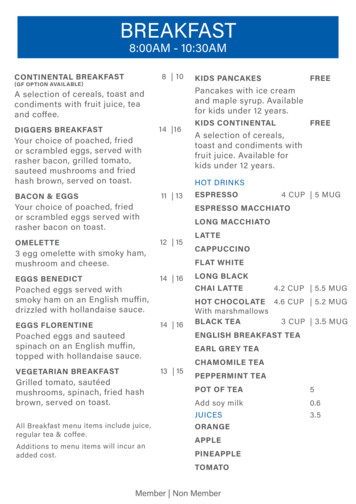

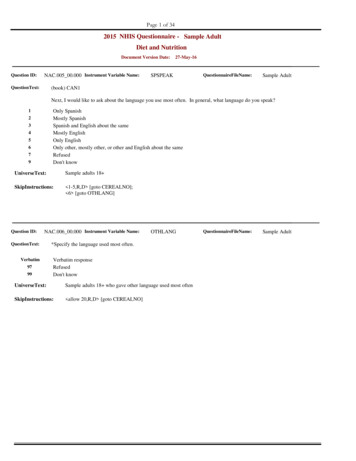

機密性 情報1. Characteristicsof tea production in Japan 限り Tea undergoes the following processes before being sold on the market: (i) harvesting fresh leaf, (ii) processing freshleaf into crude tea in tea-growing regions, and (iii) blending crude tea into final processed tea (refined tea) in teaconsumption regions. The industrial scale of crude tea is about JPY100 billion. Major tea-growing regions are: (1) Shizuoka, (2) Kagoshima, (3) Mie, (4) Kyoto and (5) Fukuoka. The top-threeprefectures constitute about 70% of the total tea-growing acreage in Japan. Tea production in each prefecture has different characteristics, for example, Shizuoka, Kagoshima and Miyazaki mainlyproduce "Sencha," Mie and Fukuoka "Kabusecha," Saga and Kumamoto "Tama-ryokucha," and Kyoto "Gyokuro" and"Matcha." Change of form of tea and industrial scaleFresh leafSteaming/rolling/DryingJPY97.2 billionCrude teaSource: 2018 Statistics of Agricultural IncomeCrude tea (non-trimmedtea leaf, before removingstems)Blending several types of crude tea produced indifferent regionsRefinedtea(Seicha)Refined tea (trimmed tea,after removing stems) Main tea-producing prefectures and characteristics of productionProductionvolume(in tons)Characteristics of production29,500Mainly produces Sencha (in particular,deep-steamed 028,000 Mainly produces various types of Sencha3Mie2,7805,910 Japan's largest producer of Kabusecha4Kyoto1,5602,9005Fukuoka1,5401,780 Mainly produces Kabusecha6Miyazaki1,3803,510 Mainly produces saki737693 Mainly produces Tama-ryokucha11Aichi517832 Mainly produces MatchaTotalTea fordrinkingGrowingAcreage(in ha)Rank40,600Japan's largest producer of Gyokuro andMatchaJapan's third largest producer ofTama-ryokucha881 Mainly produces Sencha1,240 Japan's largest producer of Tama-ryokucha81,700Source:MAFF "Statistics on Farmland and Crop Acreage"Note:Ranking is based on the growing acreage surveyed prefectures in 2019.1

(Reference) Types of teaTypesCharacteristics and main producing ha(Matcha)Tama-ryokucha Most popular type of tea.Processed by steaming, kneading and drying new shoots.[Main Production Regions] All regions in Japan[Characteristics] Cultivated under a sun-shielding covering made of straw orcheesecloth under “tana” (ceiling shelf) for about 20 days beforeharvesting. Processed in the same way as Sencha.[Main Production Regions] Kyoto and Fukuoka[Characteristics] Cultivated under a sun-shielding covering made of straw orcheesecloth for about one week before harvesting. Processed in thesame way as Sencha.[Main Production Regions] Mie and Fukuoka[Characteristics] Cultivated under a sun-shielding covering from three weeks to onemonth before harvesting (which is longer than that of Gyokuro).Processed by drying tea leaf without kneading. Matcha is a powdered tea made by grinding Tencha with a stone mill.[Main Production Regions] Kyoto, Aichi and Kagoshima[Characteristics] Unlike Sencha, a trimming process is not applied to Tama-ryokucha soTama-ryokucha leaf is round.[Main Production Regions] Kumamoto, Saga and NagasakiPercentage of crudetea production/crudetea price (2019)[Percentage of Production]53.6 %[Crude Tea Price]JPY 1,178 / kg[Percentage of Production]0.3 %[Crude Tea Price]JPY 4,928 / kg[Percentage of Production]4.2 %[Crude Tea Price]JPY 1,462 / kg[Percentage of Production]4.4 %[Crude Tea Price]JPY 2,498 / kg[Percentage of Production]2.5 %[Crude Tea Price]JPY 1,686 / kgSource:Percentage of crude tea production/crude tea price (for all crop seasons) is based on data from the Japanese Association of Tea Production.Reference:Gyokuro, Kabusecha and Tencha are collectively called "Ooicha."2

2. Outlook of tea production Growing acreage is declining slowly. The production volume exceeded 100,000 tons in 2004 due to the increase indemand for green tea beverages, but in recent years it has remained around 80,000 tons. Tea production per crop season, the first crop has decreased in recent years, the third crop and Autumn-winter Banchafor reasonable drinks has been on the rise. In addition, the Tencha which is in high demand, has also been on the rise.〇 Tea farmer's growing acreage are expanding, especially in Kagoshima Prefecture. Change in tea growing acreage/production volume60508040603040101 10092 94 96 86 8584 88 85 84 80 80 82 86 00420Production volume (in tons)100Production volumeGrowing acreage49 49 49 48 48 4747 46 46 4545 44 4342 42 41Growing acreage (in 1,000 ha)Production volume (in 1,000 tons)120 Change in Tencha (Matcha) production volumeSource:Data from the Japanese Association of Tea ProductionSource:MAFF "Statistics on Agricultural Production" Change in tea production volume per crop season(t)20152016201720182019First cropof tea32,53031,51530,19232,90029,786Second cropof tea20,54420,28520,96322,57720,869Third cropof tea5,8016,3127,0536,3845,862Autumnwinter Bancha18,53420,45822,02222,90622,851Source: Data from the Japanese Association of Tea Production Change in growing acreage per commercial tea farmin major tea-producing prefectures(ha)Shizuoka KagoshimaMieKyotoFukuokaMiyazaki .12.11.1Source:Census of Agriculture and Forestry; the growing acreage of commercial tea farmin 2010 is an estimate.3

3. Outlook of crude tea price Tea price was on an upward trend until 2004 due to increased demand in PET-bottle green teabeverages; however, after 2004, slowdown in demand is pushing the crude tea price downward. Tea price significantly differs depending on (i) price differences between types of tea and (ii) pricedifferences between crop seasons, in addition to tea quality, significant affecting tea farmers. Change in tea price per crop season(Crude tea produced in 2019) Change in tea price (crude tea and regular Sencha)JPY/kgFirst crop of teaThird crop of teaSecond crop of teaAverage for all crop 500KabusechaTenchaSenchaTamaryokuchaOthertype ofBancha greentea2,000First cropof tea4,928 1,782 3,048 1,872 2,230693 1,0771,500Secondcrop of tea-Third cropof tea----747 28 1,462 2,498 1,178 172019Source:Data from the Japanese Association of Tea ProductionAutumnwinterBanchaAveragefor all cropseasonSource:Data from the Japanese Association of Tea Production(Reference) Change in price of import Chinese green ��Ministry of Finance, Trade Statistics (CIF price)4

4. Outlook of consumption/demand of tea〇 Concerning the consumption of green tea (leaf tea) has been on a declining trend and consumptionof green tea beverages has been on an increasing. Annual spending per household for green tea (leaf tea) and tea beverage product is decreasing forleaf tea, but the total amount is increasing because tea beverage product are increasing. Consumerhas been to shift to convenient style of tea consumption, especially in the younger generation. Amount of annual expenditure for green tealeaf/tea beverage product per household Change in consumption volume of leaf tea per household(g)1,2001,000Green tea (leaf tea)(JPY)12,0001,14610,76511,0924,6275,802Tea beverage ,00006,138From 2007, amount of expenditurefor tea beverage product exceedsthat of green tea leaf.5,2907,8453,78002003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019Source:Ministry of Internal Affairs and Communications, Household StatisticsSource:Ministry of Internal Affairs and Communications, Household Statistics Change in consumption volume of soft drinks Consumption trends for green tea and teabeverage product by ageSoda30.0Coffee Beverage25.020.015.010.05.031.428.826.323.5Green Tea BeverageMineral WaterBlack Tea Beverage9.5Oolong Tea Beverage4.20.0Source:Japan Soft Drink AssociationAnnual expenditure per household(JPY)Consumption volume per person(liter/person)35.010,000Green TeaTea beverage product8,0006,0004,0002,0000AgeSource:Ministry of Internal Affairs and Communications, Household Statistics5

5. Change in consumer market General retailers including specialty tea stores were the largest source from which consumers boughtgreen tea in 1999, and subsequently purchase from supermarkets and others grew. The number of establishments of tea retailers almost halved during the period between 2002 and 2014. Change in the sources of green tea purchasePurchase by mail order has increased.General retailers1%一般小売店8%9%4%Convenience etsスーパー4%Department ��Discount stores26%10%ディスカウントストMail order1%35%ア通信販売29%OthersPurchase fromsupermarketshas increased.1%Source:"National Survey of Family Income and Expenditure", Ministry of Internal Affairs and Communications Changes in the numbers of establishments of tea retailers/wholesalersTea retailersNumber ofestablishments12,00011,8099,76910,00046% decline from 20028,0006,000Tea 1920072014H26Source:"Commercial Statistics", Ministry of Economy, Trade and Industry6

6. Current situation of tea producing regions (1) The number of core persons mainly engaged in farming declines year after year. Farmers are increasingly agingas the percentage of those aged 65 or older increased from 49% in 2000 to 56% in 2015. In hilly land where the use of agricultural machinery is difficult, working hours are uneven, depending on theseason, and the workload is strenuous particularly in the picking season. Some regions try to spread the pickingseason out by introducing early-cultivar and late-cultivar �2010Flat lands0平成27年2015 Change in number of commercial farm householdsproducing tea in major tea producing prefectures(Households)Shizuoka KagoshimaMieKyotoAllFukuoka Miyazaki ,6171,74496765398039952920,144Source:“Census of Agriculture and Forestry”, MAFFJan.1月Feb.2月Mar. Apr. May3月 4月 5月2015 Field size: 8ha10 Working hrs. : 41 hrs. / .6月Jul.7月74May5月Jun.6月43385Aug. Sep. Oct. Nov. Dec.8月 9月 10月 11月 12月Autumn-winterBancha05,0005515Third cropof tea10Field size: 3haWorking hrs. : 77 hrs. / 10aSecond cropof tea15Second cropof tea10,00020First cropof tea15,000First cropof tea(Hours/10a)Autumn-winterBancha Seasonally uneven working hoursHilly land(Persons) Number of core persons mainly engaged in farmingby age group (industrial crops)20,0005Jul.7月3242Aug. Sep. Oct. Nov. Dec.8月 9月 10月 11月 12月1 Proportion of tea varieties produced by major production Yutakamidori(Early-cultivar )Saemidori(Early-cultivar )Sayamakaori(Somewhat earlycultivar )Yabukita(Medium-cultivar)Samidori(Medium-cultivar )Okumidori(Late-cultivar MAFF survey (FY2019)7

7. Current situation of tea producing regions (2) Around 40% of tea fields in Japan are located in hilly and mountainous areas, and some regions havenot yet to introduced riding-type machines due to slopes and other obstacles. About 40% of trees of tea fields are aged 30 years or older, raising concern about a decline in yield andquality. Replanting and other methods are supported but have been done in only some 8% of the totalfield size. Situation of tea-growing acreage by farming region2015(ha)AllprefecturesFlat lands15,532Hilly & mountainous areas10,276Hilly & mountainous areas (%)Flat landsShizuokaHilly & mountainous areasHilly & mountainous areas (%)Flat landsKagoshimaHilly & mountainous areasHilly & mountainous areas (%)Flat landsKyotoHilly & mountainous areasHilly & mountainous areas (%)Flat landsAichiHilly & mountainous areasHilly & mountainous areas (%) Farm acreage categorized by tree age (FY2019)(ha)8,000Remarks37%6,00039.88,570 Half of hilly & mountainous areashave a gradient of 15 degrees or3,205 higher*, making it difficult tointroduce riding-type machines. *As27.2 of 19943,450 The gradient is small even in hilly &mountainous areas and the land has1,860 been improved, so most of theregions are suitable for riding-type35.0 machines.1774,0003,5002162,500Source:MAFF survey Use of riding-type tea picking machines (FY2019)No. of unitsMachine-using hectaresPercentageShizuoka pref.3,54710,46165.8Kagoshima pref.1,4138,19297.5Kyoto pref.11028818.4Aichi pref.7923946.3Total7,02624,50860.4Source:MAFF survey11-2021-306%Young tea未成園field-10 years 10年30 years or11 20年21年 30年30年以上yearsyearsolderSource:MAFF survey80% of land has a gradient of 10768 degrees or lower, and 6% of land hasa gradient of 15 degrees of higher.81.380% of land has a gradient of 566 degrees or lower, and 0% of land hasa gradient of 15 degrees of higher.23.422%13%2,000023%(ha) Total size of fields for which the tea replantingsupport project was rce:MAFF surveyTea replanting has the following benefits: Planting young tea trees is expected to improve quality and productivity. Planting good cultivars makes it possible to enhance added value. Combining cultivars prevents concentration of harvesting and processingwork by dispersing the cropping period.8

8. Efforts for improving productivity (Promotion of smart agriculture) Since FY2019, the smart agriculture demonstration project has been launched, which aims to accelerate socialimplementation of “smart agriculture” by introducing and testing advanced technologies including robots, AI,and IoT in production sites. The project for tea is underway in Shizuoka, Kagoshima and Kyoto prefectures.Shizuoka Pref. Smart Tea Production Demonstration Consortium (Shizuoka pref.) (FY2019)[Testing the tea production management integrated system which is centered on labor-saving management of dispersed tea fieldsand quality control of tea factories through the creation of tea field networks using LoRa]Test field size:127ha (Chamu Chamu Land Sugeyamaen, Eco Green Katsumata, Harada Tea Processing Co., Ltd.)Field serverWork recording toolDroneRemote sensing Dispersed tea fields necessitate work hourincreases and make it difficult to manage freshleaves in the same manner. For this reason, the project aims to stabilize farmmanagement by streamlining operationsthrough the introduction of work recording toolsand other methods and enabling tea plucking atthe right time for better quality through the useAI technology to analyze teaof AI technology to analyze tea growing stages.growing stagesHoriguchi Seicha Smart Demonstration Consortium (Kagoshima pref.) (FY2019)[Testing the large-scale smart tea business integrated system using IoT / robotization technologies]Test field size:116ha (Kagoshima Horiguchi Seicha) In the producing region facing serious issuesof aging and labor shortage, scale expansionis necessary for maintaining the tea industry. Accordingly, the project aims to realize a newform of tea business in large-scale tea fieldsthrough robotization of tea-fieldmanagement, multipurpose utilization offield irrigation facilities, and visualization ofbusiness management.Centralization andRobotized tea-fieldMultipurpose sprinklermanaging machinevisualization of informationSource:Pamphlet of the smart agriculture demonstration project9

9. Outlook of tea import/export Surged in 2004 due to green tea beverage materials demand, tea import turned to decline aspercentage of domestic tea increased. Recently, the import volume has been about 4,000 tons. Thanks to growing enthusiasm for Japanese food and health awareness in foreign countries includingthe U.S., export volume saw a three-fold increase in ten years. The U.S. accounts for about 30% ofJapanese tea exports. Change in import/export of green tea Major countries importing tea from Japan(top five countries/regions, 2019)(Volume of export from Japan by country)20,00015,000Export volume (t)Import volume 976002001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 ,24211,79015,18717,73916,995Source:Ministry of Finance, Trade Other Coutries7% Major countries exporting tea to Japan(top five countries/regions, 2019)(Volume of import to Japan by hre CountriesSource:Ministry of Finance, Trade Statistics10

10. Results of tea export In 2019, green tea export value was 14.6 billion yen, a 5% drop from 2018. Export value has been on the rise for the past five years both for the U.S. and EU. Green tea export (World) Green tea export (to the U.S.)(Tons)(100 million JPY)6,000180輸出量(トン)Export volume (tons)5,000153144輸出額(億円)Export value (100 million JPY)1401164,0001201013,0002,000211,5761,701474231 32 33 961,6251,958200520072009160100(100 million 1320152017H282016H292017輸出量Export volumeH3020182019R1輸出額Export value Green tea export (to EU)800(100 million 4205892320662252364823201540025152019102005 Change in export price of green urce:“Trade Statistics”, Ministry of ��(EU計)Export value(EU total)11

11. Export of organic tea As organic tea is not only in high demand overseas but is also able to meet Maximum Residue Limits, itis recognized as being suitable for export. The amount of tea certified as organic by JAS is increasing. Export volume of organic tea utilizing an organic equivalency recognition of organic certificationsystems is increasing. Such export accounts for a large part of total tea export especially for EU. Change in the amount of tea certifiedas organic JAS 7002,50050044001,5003001,00050002001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 28H29H30272010H2215%2%5%41%8%11%長崎県Nagasaki pref.三重県Mie pref.18%愛知県Aichi �Switzerland Percentage of organic JAS teain tea export(FY2019)Exportvolume (t)(A)鹿児島県Kagoshima pref.静岡県Shizuoka pref.宮崎県Miyazaki pref.83米国US緑茶(仕上げ茶)Green tea (refined tea) Percentage of JAS organic tea fields by prefecture(FY2019)44436020010054516002,0000900 Change in the export volume of organic teautilizing an organic equivalency recognitionof organic certification systemsOrganicallygrown* (t) (B)%(B/A)US1,48530220.3EU64854584.1* Export utilizing an organic equivalency recognition of organiccertification systemsSource:MAFF survey12

Reference World trends in tea In recent years, both production and export of green tea have been on the rise. The amount of global green tea trade is projected to increase 60% over the next 10 years. Change in production andexport of green tea in the worldProduction volume(Thousand tons)Export volume(Thousand tons)200045018004001600(10 thousandtons)400.0365.4350.0350300.01400Grow 2.1-fold300120025010002008001506001004002000 Outlook of the amount ofglobal green tea trade(FAO ��Indonesia201420152016H26 H27 H28ベトナムVietnamその他Others20172018H29 H30日本Japan輸出量Export volumeSource:“Annual Bulletin of Statistics”, International Tea Committee250.0200.0177.3150.0Grow tion volume2027貿易量International trade volumeSource:Material from FAO-IGG on Tea13

12. Development of new basic policy concerning promotion of tea industry and tea culture Based on the change in the situation facing the tea industry in recent years, the “basic policy concerningpromotion of tea industry and tea culture” was newly developed in April, 2020.Significance of the promotion oftea industry and tea culture Contributing to realizing rich andhealthy lifestyles of Japanese people Important core crop in hilly &mountainous area The tea industry is important also interms of local economy andemployment as it involves manysupporting industries.Issues facing tea For convenience, consumers havechanged to favor green teabeverage products over leaf tea.As the tea industry was slow torespond to this change, it hassuffered stagnating teaconsumption and sluggish prices. On the other hand, if we turn ourattention to outside of Japan, theamount of green tea tradedinternationally in the world isexpected to rise going forward.It is important to gain suchoverseas demand. In terms of production, there areconcerns that tea production maynot be sustainable in the futuredue to aging workers and laborshortage in the harvest season. Direction of measures Future basic direction concerning the promotion of tea industry and tea culturePromoting efforts of production, processing, and distribution of tea based on the characteristics andactual situation of each producing region not by simply repeating conventional approaches but by thinkingoutside the box while accurately grasping the needs of diversified consumers at home and abroad.Long-term perspective on domestic demand and production volume targetLong-term perspective on domestic demand for tea: 86,000 tons (2018) 79,000 tons (2030)Tea production volume target: 86,000 tons (2018) 99,000 tons (2030)(Including 5,000 tons for export) (Including 25,000 tons for export)Measures for the promotion of the tea industry Promoting the improvement of quality/added value to respond to theconsumer needs and advancing the processing and distribution・Responding to the diversifying consumer needs・Promoting the cooperative efforts between producers and distributors/users, Expanding export・Promoting the overseas market development・Developing production/distribution systems for substantial expansion of export・Meeting the import conditions set by export-destination countries and regions Stabilizing the management of producers・Promoting the production of tea according to the producing region’scharacteristics・Promoting the replanting/planting of tea trees・Promoting the research and development and demonstration/introduction ofsmart agriculture technologies, Promoting consumption・Spreading tea’s appeal to various consumer segments, Centralizing and utilizing information concerning teaMeasures for the promotion of tea culture Promoting the understanding tea culture Preserving/utilizing tea-related cultural assetsIncreasing profitability, strengthening sales force of tea producing regionsand improving the sustainability Current situation 14

Reference Act on Promotion of Tea Industry and Tea culture "Act on Promotion of Tea Industry and Tea culture" came into effect on April, 2011.1. Purpose of ActThe purpose of this Act is to provide for the development of basic policies by the Minister of Agriculture, Forestry and Fisheries,and to take various measures such as securing stable business management of tea producers, expanding consumption,promoting food education using tea to contribute to such consumption, promoting export and disseminating knowledge on teatradition, so as to contribute to the achievement of sound development of tea industry and healthy and affluent lives ofnationals.2. Summary of Act(1) Development of basic policy (Article 2)The Minister of Agriculture, Forestry and Fisheries shall provide for a basic policy on the following matters:(i) significance and basic policy for tea industry and promotion of tea culture;(ii) setting a target for production quantities according to long-term perspective on tea demands;(iii) measures for the promoting tea industry;(iv) measures for the promotion of tea culture; and(v) any other matters necessary for the promotion of tea industry and tea culture.(2) Development of promotion plans (Article 3)Prefectures shall make an effort to develop the promotion plan in accordance with the basic policy.(3) Assistance measures by the national and local governments (Articles 4 through 10)The national and local governments shall make an effort to implement the assistance measures in relation to thefollowing matters:(i) securing stable business management of tea producers (e.g. improving environment of tea fields, assistance in replanting oftea trees and promotion of disaster prevention);(ii) improvement of processing and distribution (assistance for projects for creating new added value through integralcollaboration of agriculture, manufacturing, retail and other sectors)(iii) promotion of quality improvement;(iv) promotion of consumption;(v) promotion of export;(vi) promotion of tea culture; and(vii) commendation of contributors to tea industry and tea culture.(4) Assistance of national government (Article 11)The national government must make an effort to implement necessary measures such as providing information, advice andfinancing to local governments.15

4. Outlook of consumption/demand of tea 〇Concerning the consumption of green tea (leaf tea) has been on a declining trend and consumption of green tea beverages has been on an increasing.