Transcription

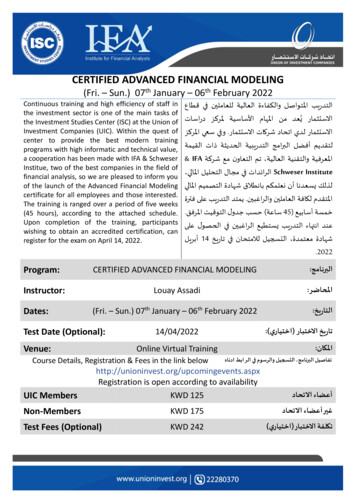

CERTIFIED ADVANCED FINANCIAL MODELING(Fri. – Sun.) 07th January – 06th February 2022Continuous training and high efficiency of staff inthe investment sector is one of the main tasks ofthe Investment Studies Center (ISC) at the Union ofInvestment Companies (UIC). Within the quest ofcenter to provide the best modern trainingprograms with high informatic and technical value,a cooperation has been made with IFA & SchweserInstitue, two of the best companies in the field offinancial analysis, so we are pleased to inform youof the launch of the Advanced Financial Modelingcertificate for all employees and those interested.The training is ranged over a period of five weeks(45 hours), according to the attached schedule.Upon completion of the training, participantswishing to obtain an accredited certification, canregister for the exam on April 14, 2022. التدريب املتواصل والكفاءة العالية للعاملين في قطاع االستثمار ُيعد من املهام األساسية ملركز دراسات وفي سعي املركز . االستثمار لدي اتحاد شركات االستثمار لتقديم أفضل البرامج التدريبية الحديثة ذات القيمة & IFA تم التعاون مع شركة ، املعرفية والتقنية العالية ، الرائدات في مجال التحليل املالي Schweser Institute لذلك يسعدنا أن نعلمكم بانطالق شهادة التصميم املالي يمتد التدريب على فترة . املتقدم لكافة العاملين والراغبين . ساعة) حسب جدول التوقيت املرفق 45( خمسة أسابيع عند انتهاء التدريب يستطيع الراغبين في الحصول على أبريل 14 التسجيل لالمتحان في تاريخ ، شهادة معتمدة .2022Program:CERTIFIED ADVANCED FINANCIAL MODELING: البرنامج Instructor:Louay Assadi: املحاضر (Fri. – Sun.) 07th January – 06th February 2022: التاريخ Dates:Test Date (Optional):Venue:: املكان Online Virtual TrainingCourse Details, Registration & Fees in the link belowUIC Members:) تاريخ االختبار (اختياري 14/04/2022 التسجيل والرسوم في الرابط ادناه ، تفاصيل البرنامج tion is open according to availabilityKWD 125 أعضاء االتحاد Non-MembersKWD 175 غيرأعضاء االتحاد Test Fees (Optional)KWD 242) تكلفة االختبار(اختياري

Course: Training OutlineCERTIFIED ADVANCED FINANCIAL MODELING(Fri. – Sun.) 07th January – 06th February 2022The Certificate of Advanced Financial Modeling (CAFM ) program offers finance professionals withsophisticated tools in Excel for better decision making. The certificate enables the candidates to useprogramming languages and create financial programs. A much-needed skill in the financial industryis to know how to use VBA (Visual Basic Applications) in Ms Excel to create a fully revolving financialmodel embedded with dozens of constraints.Our Detailed Approach:Principles of Financial Calculations Strengths and weaknesses of a spreadsheet Six important rules to remember in financial modeling Excel sheet shortcuts-A candidate should be able to become a professionalfinancial modeler who can limit the usage of the mouse to navigate the spreadsheet. Modeling andcomprehending the basics of financial functions- Combinations of financial functions will be used inmodeling the structure of taxation systems, valuation of publicly and privately held companies,investments, feasibility studies, credit analysis, portfolio management and project finance: The functions mentioned below will be used to address capital budgeting decisions using reallife cases that address additional capital expenditures during the life of the project, projectswith untimed cash flows, and comparing projects with unequal lives: Present Value (PV) Future Values (FV) Net Present Value (NPV) Internal Rate of Return (IRR) Discounting using dated cash flows (XIRR and XNPV) Multiple Internal Rate of Return Modified Internal Rate of Return (MIRR) Payback period Discounted Payback Modeling NPV profile and the crossover rate of mutually exclusive projects Replacement Chain or common life approach for projects with unequal lives and theEquivalent Annual Annuity (EAA) The functions mentioned below and the built-in commands will be used in the context ofmodeling: Income tax expense of a progressive taxing system1/5www.unioninvest.org 22280370

Loan amortization schedule with balloon payment Enterprise value using stress testing and in a valuation context PMT function Continuous Compounding Offset Function Conditional formatting Lookup Functions (Vlookup & Hlookup) Max, Min, Count, Sum, CountIf, SumIf, Concatenate Logical Function (If, AND, OR, Nested If) Yield & Price (i.e.: Calculating the yield and price using actual/actual, actual/360,actual/365, 30/360) Data tables (Column and Row Data Table embedded with logical functions that return astring text in the data table when the sensitivity analysis is illogical) Enterprise Value (EV) VBA user-friendly macros: Drop down Box, scroll bar, & List Box linked to an OffsetFunction HyperlinksPrinciples of the Cost of Capital Modeling Systematic risk: Beta CAPM (Cost of Equity) Expected returns using different approaches Dynamically linking the Cost of Debt using coverage ratios WACC analysis-Optimal Capital StructureCredit Analysis Credit Analysis model that reveals a dynamic report Financial Statements linked through Cash flow Statement Forecasting Scenarios Financial Analysis Ratios Bank Account Activity model (Application) Scenario Analysis & Stress Testing2/5www.unioninvest.org 22280370

Introduction to Valuation models Dividend Discount Model (DDM Model) –With VBA One-Stage Model Two Stage Model Three Stage Model- Creating public functions in Excel that does not exist which will be able to solve forone, two, or three stage models (i.e., THREESTAGE(G1,G2,Gc, N1, N2, D0,Ke))Free Cash Flow to the Equity (FCFE)Free Cash Flow to the Firm (FCFF)Introduction to Portfolio management Efficient Frontier Beta and Covariance Application Sorted Closing Prices and Return Graphs Determination of Efficient Assets using VBA with a newly embedded function that does notexist in Excel Efficient Portfolios using VBA- Creating public functions that does not exist in Excel which will be able to calculate thetotal risk of the portfolio. (i.e., STDEVPORT(Wa,Wb,Wc, STDEVa, STDEVb,STDEVc,Correla-b, Correla-c, Correlb-c))Advanced Project Finance Modeling (Manufacturing Companies) “Debt”, “Cash”, “Debt/Equity Ratio”, “Stock”, “Treasury stock” or any combination of thelisted above as a PLUG -Looping- The model will loop to balance the accounting equationsuch that that if the enterprise has excess cash, the model will allow debt repayment,repurchase of stocks, or payment of the excess cash as dividends. The model will be able toissue debt whenever cash is negative so as to rebalance the balance sheet dynamically. Pro Forma Financial Statements with constraints on: financial leverages ratios, debtrepayments schedules, and dividend policy. Modeling free Cash Flows when there are negative profits. Constructing flexible debt repayment functionality and ratio analysis. Stress testing the Terminal Value upon several assumption inputs. Setting the bid price using:- Goal Seek (Setting the optimal bid price by changing one assumption cell in the model)- Solver (Used in the context of setting the optimal bid price by implementing constraints onROE, EPS, and value of equity) Free Cash Flow, FCF to value a firm and its equity (Valuation Procedure). Modeling: FCFF, FCFE, DDM. Modeling the Projection of: Revenues Model, SG&A Model, Capex & Depreciation Model,COGS Model, Debt Model, Working Capital Model, and Equity Model (A Case on “Cemento”Cemento company is a manufacturing company located in the Gulf that produces mainlycement bags) . Modeling the valuation of a company that is cyclical in nature, is attractive interms of linking the market model to the firm’s value of equity. Line by line forecasting (i.e.: Linking A/R to DSO, A/P to DPO, and Inventory to DOH etc.) Usage of Statistical Data Analysis including regression analysis (Built-in Analysis tools in MsExcel) to forecast maintenance Capex and the total additional capital expenditures for aprivate equity firm.3/5www.unioninvest.org 22280370

VBA macro embedded in the dividend payout ratioBalance Sheet & Income Statement as output sheets without any manual input.The balance sheet will embed PLUGs to enable the user to change any of the assumptions inthe financial model, including the market model, revenue model, COGS model, working capitalmodel or equity model. The income statement and balance sheet will change in a revolvingmanner that is extremely logical (i.e., if the analyst decided to change the Days of PayablesOutstanding-DPO, the model will directly implement the payables financing effect on theincome statement. Consequently, it will impact the retained Earnings and Account Payables,rebalancing the accounting equation with a new equity value).VBA (Visual Basic Application) Usage in Financial Modeling VBA overview and Macros Purpose of Learning VBA Attributes of a Good VBA Model Project Explorer and VBE (Visual Basic Editor) Shortcut Keys in VBA Building a Macro with Constraints Debugging the Macro Running the Model with Different User Inputs Program Code Detailed Analysis Order of Statements Variables Naming and Calling them by the Code Recording Macros Coding Message boxes, Input Boxes, and Run buttons Coding Goal Seek Applications will be given through: Building a Financial Program (Loan Amortization) This is an advanced loan amortization model that is different than the traditional ones created using Ms Excel. What distinguishes this model is that when the user decides to run it, it will directly: Solve for balloon payments Calculate periodic payments Reckon the effective interest rate (EAR) earned by the bank Pop up input boxes and message boxes Stop whenever the user input illogical assumptions such as inputting a below thresholdinterest rate or negative loan life Pop up interactive charts that will show the total interest earned by the bank in dollaramount. Building an advanced Financial Program (Savings Retirement Plan) The output of the code will appear on Excel spreadsheet without any manual input (all thework will be done in Visual Basic Editor-VBE). The model will embed maximum constraints including different tax scheme on capital gainsand dividend income. Tax basis amount that is different from current account in the fund. Forecasting the amount of the fund at retirement in comparison with a target amount intoday’s dollars. A model that will calculate the periodic saving of the investor that grows a pre assumed rate in a way that it will assure the investor his target balance in today’s4/5www.unioninvest.org 22280370

dollars.The model will assure that the amount provided in the pension contribution plan by theinvestor will grow at a threshold return.The model will include an option of liquidation at retirement and by this the tax basis amountwill equate the actual amount, where in this case the capital gains earned by the fund will betaxed at their respective capital gains tax rate.The model will include pop up interactive charts, message boxes, input boxes that will makeit user-friendly for VBA illiterate user. Comparing an Excel Model with and without VBA.Advanced Financial Modeling Schedule- January 2022CumulativeTitleHrsPrinciples of Financial Calculations/ Investments/ Progressive TaxationFriday 07-Jan-22 06:00-09:003Saturday 08-Jan-22 06:00-09:006Principles of Financial Calculations/ Investments/ Progressive TaxationDayDateTimeFriday 14-Jan-22 06:00-09:00Saturday 15-Jan-22 06:00-09:00Sunday 16-Jan-22 04:00-09:00Friday9121721-Jan-22 06:00-09:0020Saturday 22-Jan-22 06:00-10:0024Friday28-Jan-22 06:00-09:0027Saturday 29-Jan-22 06:00-09:00Sunday 30-Jan-22 6:00-09:0004:00-09:0010:00-02:00Modeling the cost of capital and Advanced Capital Budgeting techniquesModeling the cost of capital and Advanced Capital Budgeting techniquesOptimal Capital Structure and Stress TestingIntroduction to Portfolio Management Modeling Techniques (With BasicVBA)Introduction to Portfolio Management Modeling Techniques (With BasicVBA)Introduction to Valuation Models and their Modeling Techniques (with BasicVBA)Modeling the Valuation of Private Equity Firms ( Manufacturing Companies)Modeling the Valuation of Special firms and Advanced Prohject FinanceModeling the Valuation of Special firms and Advanced Prohject FinanceAdvanced VBA ( Visual Basic Application) in Financial ModelingAdvanced VBA ( Visual Basic Application) in Financial ModelingExam Datewww.unioninvest.org 22280370

financial model, including the market model, revenue model, COGS model, working capital model or equity model. The income statement and balance sheet will change in a revolving manner that is extrem