Transcription

Dollar Tree, Inc.April 2019Michael ZhuWill Smith

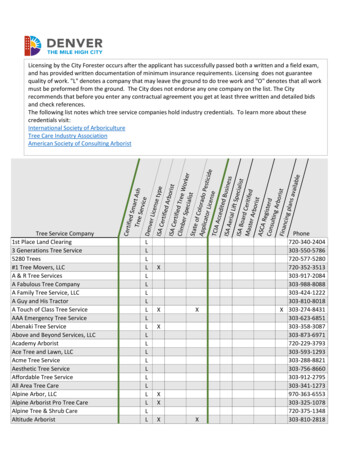

Company BackgroundCompany OverviewKey Trading Statistics Dollar Tree, Inc. operates discount retail stores under the brand namesDollar Tree, Dollar Tree Canada, and Family DollarTickerDatePriceMarket Cap52 Week High52 Week LowAdjusted EPSP/E RatioEV/EBITDABeta Closed acquisition of Family Dollar for 9.4 billion on July 6, 2015 Led by Executive Chairman Bob Sasser and Chief Executive Officer GaryPhilbin Operates more than 15,000 retail locations in 48 states and 5 Canadianprovinces 7,001 Dollar Tree stores 8,236 Family Dollar stores 225 Dollar Tree Canada stores Dollar Tree offers merchandise at a fixed price point of 1 while theFamily Dollar prices generally range from 1 - 10Dollar Tree LocationsFamily Dollar Locations2Source: Company website, Capital x0.54

Investment ThesisFamily DollarStrugglesThe market has grown weary of Family Dollar’s struggles and iscurrently ascribing little value to that segmentActivist InvestorsGiven recent activist involvement, Dollar Tree will be forced to eitherturn around Family Dollar and become more profitable, spinoff thesegment, or sell it to a private equity firm or strategic buyer – all ofthese options would create significant shareholder valueUniqueResistance to ECommerceInvestors have been worried about the effects of e-commerce on theretail industry, but Dollar Tree is uniquely insulated from this threatcompared to other retailers due to the nature of their products andcustomer base3

Recent Stock Performance5 Years Prior to the Merger1Since the Acquisition of Family 16Jul-17Jul-18-30%Jul-14DLTRDGSPYDGSegment BreakdownRevenueFamily Dollar49%EBITDAFamily Dollar18%Family Dollar28%Dollar Tree51%Source: Company filings, Yahoo Finance1 DLTR adjusted for “2 for 1” stock split on June 27, 2012; adjusted for “3 for 2” stock split on June 25, 20102 Closed acquisition of Family Dollar on July 6, 20153 EBIT breakdown based on FY’2018 adjusted operating profitOperating Profit (EBIT)3Dollar Tree72%4Dollar Tree82%

“Deep Discount” Retail IndustryIndustry Overview Demand is driven by consumer spending, primarily amonglower-to-middle class consumers “Deep discount” retailers provide a less diverse merchandise mixbut are able to offer their products at a much steeper discount Consistently outperformed department retailers in recent yearsand tends to perform significantly better through economicdownturns Dollar Tree and Dollar General represented two-thirds of all newstores in “food deserts” in 2015 and continue to undercutsmaller independent grocery storesRecent Retail BankruptciesMarket Share2.3% 3.4%5-Yr. Industry 40%20%Big Lots, Inc: BIGDollar General: DGDollar Tree: DLTRFive Below: FIVEFred's: FREDOllie's: OLLI0%Apr-14-20%Apr-15Apr-16Deep Discount5Source: Capital IQ, Institute for Local Self-Reliance (ILSR)10%Apr-17SPDR Retail IndexApr-18Apr-19SPY

Comparable Company AnalysisTEV / LTM EBITDA31.8x12.0x29.1x13.4x6.0xPrice / LTM EPS43.8x19.4x20.5x10.0x6Source: Capital IQ47.1x

Financial HistoryRevenueEBITDA Growth & Margins1 24,00020,71922,24622,823 3,00016%2,6162,346 18,00012%15,498 2,0001,721 12,0007,3957,8402,4621,0968,6021,1618%1,276 1,000 6,000 04%201220132014201520162017 0201820122013Operating Income Growth & Margins2014201520162017Free Cash Flow2 3,00016% 2,000FCFCapex1,7661,6732,005 2,000 1,0001,7099219711,07012%2012201320141,510 1,5005651,8418%1,234943 1,0006782015Source: Capital IQ, Company Filings1 Based on FY’2018 adjusted operating profit2 Free cash flow defined as operating cash flow less capex20168176324% 00%201820172018 5000% 172018322201420152016

Intrinsic ValuationFinancial Projections(in millions USD)Fiscal eRevenue growthGross ProfitGross marginEBITLess: taxesAdd: Depreciation and amortizationAdd: Stock based compensationLess: Change in net working capitalLess: Capital expendituresUnlevered Free Cash )1,909Inputs & ResultsValuation SummaryCost of debtCost of equityWeWdWACCExit EV / EBITDA MultiplePerpetuity growth rateEnterprise valueLess: Net debtEquity valueDiluted sharesEquity value per shareMarket premium / (discount) to fair ty41,4644,33637,128238.90 ,719238.90 urce: Company filings, Capital IQ, Yahoo Finance171.99170.0078.78DCF Value at 9x-13x Exit DCF Value at 1%-3%EBITDA RangePerpetuity Range52 Week High/Low

Family DollarCommentaryLeveraged Buyout AnalysisTerminal EBITDAExit MultipleEnterprise ValueLess: Net DebtEquity ValueSponsor Ownership at ExitSponsor Equity Value at ExitSponsor Required IRRSponsor Equity at ClosingNet Debt at ClosingImplied TEV at ClosingLTM EBITDA While most investors view Family Dollar as an anchor that isweighing down on Dollar Tree’s stock, we view it as a growthopportunity Recent renovations have shown comparable sales growth inexcess of 10%, indicating that management is executing well ontheir strategy Although the segment is currently underperforming, it stillmaintains a healthy cash flow profile, making it an attractivebuyout opportunity for a private equity firm We believe a large private equity fund would be able to payupwards of 12.1x LTM EBITDA for Family Dollar, which is almostdouble its current implied multiple of 6.2xImplied EV / EBITDASum of Parts 02500Dollar Tree EV16.0% premium122.62100Implied FD multiple: 6.2x21,00012.1xBuyout Stock Price Premium35,00028,000 1,57410.0x 15,739(2,618) 13,12190.0% 11,80925.0%3,8694,4568,325686Family Dollar EVSource: Capital IQ1 Uses an assumed multiple of 14x for the Dollar Tree segmentTEV9Current Share PriceShare Price in Buyout

Activist InvestorsBackgroundActivist Initiatives Carl Icahn disclosed a “significant” stake in DLTR in October 2018then exited the position in JanuaryAccelerate Family Dollar renovations Jana Capital Partners and Corvex Management both disclosed astake in DLTR in November 2018Change Dollar Tree’s 1 pricing strategy Starboard Value disclosed a 1.7% stake in DLTR in January 2019 Expressed intent to change DLTR’s 1 pricing strategy, considerthe sale of Family Dollar, and replace members of the boardExplore a sale of the Family Dollar segment Dropped proxy fight in early April because it has been pleasedwith the progress on key initiativesImprove operational efficiencies and margins Management announced intentions to perform a significanttest of multiple price points at Dollar Tree storesTake control of board seats to hold management accountable3-Yr. Returns after Starboard InvolvementSelect Case Studies250.0%233.3%Jana announced a 10% stake in Petsmart in 2014 and pushed a salemonths later for 8.7B200.0%150.0%144.1%62.1%50.0%Corvex accumulated a stake in Yum! Brands in 2015 andsuccessfully split Yum! Brands and Yum! China91.7%100.0%24.4%52.3%22.5%Starboard replaced the entire board of Darden and set changes toimprove food quality, diner experiences, and kitchen operations0.0%10Source: Capital IQ, Yahoo Finance; 13-F filings

E-CommerceCommentaryConsumer Spending Per Trip 136 Based on our customer survey, online shopping is increasinglycompetitive for infrequent purchases, but most people still visit astore for daily consumer goods The most popular items at Dollar Tree are generally unaffected bye-commerce 81 50 Average ticket sizes at Dollar Tree and Family Dollar are muchsmaller than traditional retailers, making them less vulnerable toe-commerce disruption 8 50 54 54 55 56 59 62 11 Investors have been concerned about Amazon’s entry into theretail space, but they are not a near to medium term threat todeep discount retailers, such as Dollar Tree and Family DollarCustomer Survey199%62%97%97%91%62%47%53%49% t paperOnlineSource: Perfect Price Industry Research1 Proprietary survey with sample size of 8211In-storeLaundry detergent3%Plastic cups andpaper plates3%Snacks/candy9%School supplies

ConclusionInvestment Thesis Our group has assigned a Strong Buy rating on DLTR stock While investors and analysts have many concerns with Dollar Tree, deeper digging reveals that many of these concernshave been overblown and could even serve as catalysts for further growth for the company The below are areas where we believe investors and analysts have been misguided: Family Dollar Struggles – The market has grown weary of Family Dollar’s struggles, and is currently ascribing littlevalue to that segment Activist Investors – Given recent activist involvement, Dollar Tree will be forced to either turn around Family Dollarand become more profitable, spinoff the segment, or sell it to a private equity firm or strategic buyer – all of theseoptions would create significant shareholder value Unique Resistance to E-Commerce – Investors have been worried about the effect of e-commerce on the retailindustry, but Dollar Tree is uniquely insulated to this threat compared to other retailers due to the nature of theirproducts and customer base As Dollar Tree management and activist investors execute a strategic turnaround or potential sale of the lagging FamilyDollar segment, we believe the market will react positively, and Dollar Tree will begin to trade at a multiple that reflectstheir status as a leader in the retail industry12

Appendix

Table of ContentsIntroCompany BackgroundInvestment ThesisRecent Stock PerformanceIndustry OverviewPublic CompsValuationFinancial HistoryIntrinsic ValuationInvestment ThesisFamily DollarActivist InvestorsE-commerceConclusionAppendixStock Trends with RetailLong-term DebtOperating ComparablesBalance sheet Comparables14

DLTR Stock Trends with RetailDLTR stock performance vs. SPDR Retail ug-18Sep-18Oct-18Nov-18-5%-10%-15%-20%-25%DLTRSPDR Retail Index15Source: Capital IQDec-18Jan-19Feb-19Mar-19Apr-19

Credit AnalysisLong-term DebtAs of February 2, 2019PrincipalInterest rate0.0L 1.125%300.05.00%750.0L anches 1.25 Billion Revolving Credit FacilitySenior NoteSenior Floating Rate NoteSenior NoteSenior NoteSenior NoteTotal Long-term DebtMaturityNA20212020202320252028Leverage MetricsDebt / EBITDANet Debt / EBITDAEBITDA / Interest1.75x1.55x11.48x“As a result of our successful progress with integration and free cash flow in excess of investment needs,we expect to pay down our variable rate outstanding debt” – CEO, Gary Philbin16Source: Company filings

Operating ComparablesOperating Statistics (5 Year Avg.)CompanyTickerProfitability (5 Year Avg.)Sales GrowthEPS GrowthEBITDA MarginROAROEROIC(%)(%)(%)(%)(%)(%)Deep Discount 1%10.3%7.5%OLLI1Source: Capital IQ1 Ollie’s includes 4 years of data due to the fact that they were private prior to 201517

Balance Sheet Comparables18Source: Capital IQ

7,001 Dollar Tree stores 8,236 Family Dollar stores 225 Dollar Tree Canada stores Dollar Tree offers merchandise at a fixed price point of 1 while the Family Dollar prices generally range from 1 - 10. Dollar Tree Locations. Key Trading Statistics. 2 Family Dollar Locations. Source: Company website, Capital IQ. Ticker DLTR Date 4/5/2019