Transcription

STATE OF CONNECTICUTINSURANCE DEPARTMENTProperty Casualty Insurance Rate ReviewsFor Calendar Year 2019Andrew N. MaisInsurance Commissioner1

January 15, 2020To:Sen. Mathew Lesser, Co-Chair, Insurance and Real Estate CommitteeRep. Sean Scanlon, Co-Chair, Insurance and Real Estate CommitteeSen. Kevin Kelly, Ranking Member, Insurance and Real Estate CommitteeRep. Cara Pavalock-D’Amato, Ranking Member, Insurance and Real EstateCommitteeI am pleased to provide you with the Department’s annual report of our review ofproperty casualty rates in the state for calendar year 2019, pursuant to ConnecticutGeneral Statutes Section 38a-9(c).Maintaining a competitive market is essential to the Department’s mission of consumerprotection and Department reviews help ensure that products are priced fairly and areadequate for the coverage provided.Connecticut’s property casualty industry continues to be among the nation’s leaders.Our P&C industry ranks 5th in the nation for direct written premium. There arehundreds of carriers licensed to write P&C business in Connecticut, including some ofthe nation’s largest carriers, which are headquartered here.Some highlights of 2019 include: A decrease in workers’ compensation insurance rates for the 6th straight year. Continued efforts to hold down homeowner’s rate increases have savedpolicyholders 4.6 million in 2019 and 66 million since 2012.If you should have any questions or would like to discuss any items in the report,please do not hesitate to contact me.Respectfully,Andrew Mais, CommissionerCc: Office of Legislative Research2

CONNECTICUT INSURANCE DEPARTMENTPROPERTY & CASUALTY DIVISIONSUMMARY OF RATE REVIEWS FOR CALENDAR YEAR 2019Table of 4-4546-4748Exhibit AExhibit BExhibit CExhibit C-1Exhibit C-2Exhibit DExhibit E-1Exhibit E-2Exhibit FExhibit GExhibit HSummary of Rate ReviewsPrivate Passenger Auto Rate FilingsHomeowners Rate FilingsWorkers’ Compensation Filing Decision and OrdersWorkers’ Compensation Filings – 2019Workers’ Compensation Filings – 2020Commercial Automobile FilingsCommercial General Liability &Medical Malpractice FilingsCommercial Fire and Allied FilingsCommercial Multi-Peril and Business ownersAll Other Commercial3

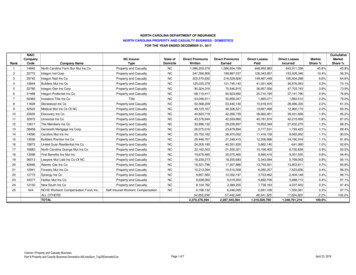

Summary of 2019 Rate ReviewsConnecticut Insurance DepartmentProperty & Casualty DivisionHow the rates were reviewedThe Department’s Property & Casualty (P&C) Division conducts actuarial reviewspursuant to competitive rating laws, which establish standards for regulation ofpersonal risk insurance. The statutes rely on a competitive marketplace to establish andmaintain reasonable rate levels. Rates may not be inadequate or unfairlydiscriminatory, e.g. charging different premiums for policyholders with similarexposures.Overall reviewsIn 2019, the P&C Division reviewed 5,724 rate, rule, form and guideline filings, ofthese 586 filings were extended warranty filings.Lines of business reviewed Personal Automobile Homeowners Workers’ Compensation Commercial Automobile Commercial General Liability Commercial Fire and Allied Commercial Multi-Peril/Business owners MiscellaneousA. Personal Automobile (Exhibit A)There was an average overall rate increase of 1.0 percent, down from 3.4 percentin 2018.Three (3) companies introduced new auto rating programs in Connecticut in2019: Plymouth Rock (Palisades), Root (A telematics only program) and Vault.Rate filings reviewed: The Department received and reviewed 84 rate filingsfrom companies’ actively writing private passenger automobile coverage in4

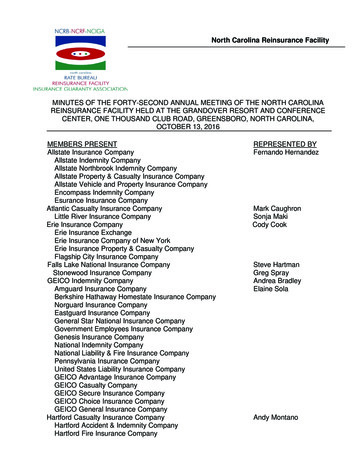

Connecticut. These companies varied in their distribution of drivers, policylimits, coverage types, prior rate filing dates, loss cost levels and cost trends.Flex rate filings: Of the 84 filings, there were 17 flex rate filings submittedunder the flex rating statutes 38a-688a in which prior approval is not required ifthe overall aggregate change is -6% to 6 %. Of the flex filings 9 filings werefor rate increases and 8 filings were for decreases.File and Use: Property damage liability and automobile physical damagecoverages are “file and use,” which means prior approval from the Departmentis not required.Statewide rate level change for 2019 Liability 2.9 percent (2.5 percentage points lower than 2018) Physical Damage -1.7 percent Combined Total 1.0 percentB. Homeowners (Exhibit B)Based on our reviews we were able to save consumers 4,623,303 million in 2019.Overall we have saved consumers 66 million since 2012 are the result of theDepartment’s increased scrutiny of rate requests.Rate Filings Reviewed in 2019 Homeowners rate filings recorded – 78 Average increase requested – 4.0 percent (3.1 percent in 2018) Average increase Department allowed – 3.5 percent Number of flex rate filings – 25Market GrowthIn 2019 four (5) companies introduced new homeowner rating tiers/programs:Liberty Mutual (rental program), Metropolitan Direct P&C, Bunker Hill, MainStreet America, and Liberty Mutual/Safeco.There were five (5) new homeowner market entries, Kingstone, Markel (rentersprogram), Vault (high value homes) and Spinnaker (renters program).C. Workers’ Compensation (Exhibit C)On Oct. 28, 2019, Commissioner Mais approved a reduction in overall workers’compensation Loss Costs and Assigned Risk rates for Connecticut. This markedthe sixth straight year that rates have decreased. The Commissioner’s order5

followed a 30-day public comment period on the filing and recommendationsproposed by the National Council on Compensation Insurance (NCCI) forworkers’ compensation Insurance. The order resulted in:- -2.9 percent overall decrease to loss costs (actual losses and claimadjustment expenses)- -4.5 percent overall decrease in assigned riskExhibit C-2 identifies each company adopting the rate changes. Companiesadjust the industry loss cost for expenses, investment income and competitivedeviations to the loss costs as permitted by state law – C.G.S. 38a-676. Sinceapproving the NCCI 2019 filing we have reviewed 201 filings and two (2)independent filings for CBIA Comp Services and CT Interlocal RiskManagement Agency (CIRMA).D. Commercial Automobile (Exhibit D)Commercial Automobile, filings from the Insurance Services Office (ISO), areprimary industry loss costs filings for both liability and physical damagecoverage. These are loss costs only, no expenses are included.In 2019, 78 companies or groups filed commercial automobile rates based onloss cost filings or independent rates. Companies adjust the industry loss cost forexpenses, investment income and competitive deviations to the loss costs aspermitted by state law – C.G.S. 38a-676.E. Commercial General Liability (Exhibit E)In 2019, 56 companies filed commercial general liability rates based on variousindustry loss costs documents to implement revised loss costs modifiers orindependent effective dates.Additionally, there was one (1) rate request and one (1) ISO Loss Costs filingin 2019 for rate change in Medical Malpractice for physicians and surgeons.(Medical Protective) increase of 7.4% and ISO Loss Costs 2.6%. There wereThree (3) miscellaneous rate requests for other medical malpracticeprofessional liability practices. None of the rate requests met the States Priorrate approval requirements as outlined under C.G.S 38a-676 (2) (A).There were Three (3) new companies that entered the market to write medicalmalpractice insurance, two are writing Physicians and Surgeons, and the other iswriting “other” medical professionals. Medical Malpractice insurance is a subline of Professional Liability.6

F. Other Commercial Lines (Exhibits F, G and H)During 2019, the Department reviewed 87 company or group filings to adoptvarious industry loss costs documents. The breakdown of those filings are:- 40 – Fire and Allied Lines- 38 – Commercial Multi-peril/Businessowners- 7 – Inland Marine- 1 – Burglary & Theft- 1 – Fidelity &Surety7

ExhibitsPages 9 - 488

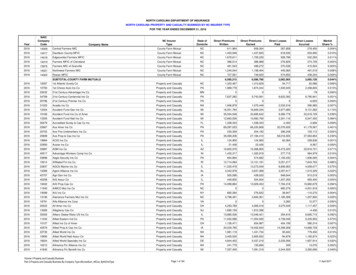

EXHIBIT – AStatus of Private Passenger Auto Rate Filings(2019 Effective Dates)Company NameAMtrust Integon National InsuranceCompanyPlymouth Rock Palisades InsuranceCompanyPlymouth Rock Palisades InsuranceCompanyOmni Ins CoUtica Mutual Insurance CompanyMapfre American CommerceInsurance CompanyProgressive Casualty InsuranceCompanyProgressive Casualty InsuranceCompanyProgressive Direct InsuranceCompanyProgressive Direct InsuranceCompanyUnited Ohio Insurance CompanyUnited Ohio Insurance CompanyOld Dominion Insurance CompanyProvidence Mutual Fire InsuranceCompanyKemper Independence InsuranceCompanyKemper Unitrin Insurance CompanyKemper Independence InsuranceCompanyHorace Mann Insurance CompanyHorace Mann Property & CasualtyInsurance CompanyHorace Mann Teachers InsuranceCompanyFarmers Mid-Century InsuranceCompanyFarmers Mid-Century InsuranceCompanyThe Cincinnati Insurance CompanyBerkley Insurance CompanyEffectiveDate 12,839,62117,5339********TotalPremiumWritten

ROOT Insurance CompanyROOT Insurance CompanyLM General Insurance CompanyLM Insurance CorporationHomesite Midvale Ins Co.Hanover Massachusetts BayInsurance CompanyThe Hanover Insurance CompanyHanover Citizens InsuranceCompany of AmericaPrivilege Underwriters ReciprocalExchangeMetropolitan Group P& C InsuranceCompanyMetropolitan Property and CasualtyInsurance CompanyMetropolitan Casualty InsuranceCompanyState Automobile Mutual InsuranceCompanyState Farm Mutual AutomobileInsurance CompanyGEICO Indemnity CompanyGEICO General Insurance CompanyGovernment Employees InsuranceCompanyMAPFRE- American CommerceInsurance CompanyMAPFRE- American CommerceInsurance CompanyAmica Mutual Insurance CompanyAmica Property and CasualtyInsurance CompanyNew South Insurance CompanyNew South Insurance CompanyCSAA Affinity Insurance CompanyMetropolitan Direct Property andCasualty Insurance CompanyEconomy Fire & Casualty CompanyAllstate Fire and Casualty InsuranceCompanyNew London County MutualInsurance CoOld Dominion Insurance CompanyUtica Mutual Insurance CompanyThe Hanover American -3.1%3.0%56,002,14410

Permanent General AssuranceCorporation - Renewal BookAIG Property Casualty CompanyUnited Ohio Insurance CompanyVault Reciprocal ExchangeNGM Insurance Company MVPProgram Renewals onlyCentury-National Insurance CompanyEsurance Insurance CompanyBankers Standard InsuranceCompanyCovenant Insurance CompanyChubb National Insurance CompanyGreat Northern Insurance CompanyPacific Indemnity CompanyVigilant Insurance CompanyFederal Insurance CompanyNGM Insurance Company - LEGACYBookQuincy Mutual Fire InsuranceCompanyStillwater Insurance 5/20199/6/20199/26/2019Foremost Insurance CompanyEsurance Insurance W10.0%10.0%10.0% 6,932,8582019 Averages8,295,90514,302,2782019 Weighted Averages# TotalFilings# FlexFilingsCompanies with non-0% ratechanges74177.0%2.2%1.3%2,410,656,019Companies with 0% filed ratechanges1020.0%0.0%0.0%488,813,200State 4%3.4%Totals:LiabilityPhysDamTotalPremium WrittenEXHIBIT – BStatus of CT Homeowners Rate Filings11

(2019 Effective CHANGE2019 FINALRATERECORDEDLiberty Mutual Insurance Company RentersprogramState Farm Fire and Casualty CompanyN01/21/19 00.0%0.0%0.0%N01/01/19 73,099,9836.7%1.0%1.0%Metropolitan Direct Property and CasualtyInsurance Co.Vermont Mutual Insurance CompanyN01/31/19 00.0%0.0%0.0%N02/01/19 14,453,2601.3%3.8%3.8%Farmers Truck Insurance ExchangeN04/27/19 13,929,0001.3%4.1%4.1%Kemper Independence Insurance CompanyN05/02/19 5,689,9780.5%0.3%0.3%Kemper Unitrin Insurance CompanyN05/02/19 1,557,9920.1%3.3%3.3%Kingstone Ins. CompanyThe Travelers Home and Marine Insurance CoNN03/01/1902/01/19 0 75,311,6750.0%6.9%0.0%3.1%0.0%3.1%Travelers Personal Security Insurance CompanyN02/01/19 9,931,4390.9%3.0%3.0%Narragansett Bay Insurance CompanyN02/01/19 3,128,0260.3%2.1%2.1%Utica National Republic-Franklin InsuranceCompanyUtica National Graphic Arts Mutual InsuranceCompanyCentral Mutual Insurance CompanyN03/20/19 6,581,3100.6%7.9%7.9%N03/20/19 875,2440.1%3.9%3.9%N04/01/19 9,544,8500.9%2.9%2.9%National General Integon National Insurance CoN01/22/19 25,095,4282.3%5.5%5.5%Bunker HillN02/15/19 00.0%0.0%0.0%Hartford Casualty Insurance CompanyN01/19/19 839,9360.1%-0.4%-0.4%Hartford Insurance Company of the SoutheastN01/19/19 6,640,8440.6%-0.2%-0.2%Trumbull Insurance CompanyN01/19/19 14,231,0101.3%-0.1%-0.1%Hartford Accident and Indemnity CompanyN01/19/19 3,016,2090.3%0.0%0.0%Markel State National Insurance CompanyN12/15/18 00.0%0.0%0.0%Stillwater P&C ins Co.N01/28/19 3,433,4110.3%4.4%4.4%Travelers Standard FireN03/01/19 1,583,4120.1%11.2%11.2%The Travelers Indemnity Company of AmericaN03/01/19 285,4970.0%10.3%10.3%Travelers Automobile Insurance Co of Hartford,CtBerkley Insurance CompanyN03/01/19 23,6340.0%12.9%12.9%N01/01/19 37,9340.0%-6.5%-6.5%Amica Mutual Insurance CompanyN05/01/19 72,434,6206.6%3.9%3.9%American Strategic Insurance CorpY02/05/19 19,575,8691.8%5.1%5.1%Vault Reciprocal ExchangeN04/03/19 00.0%0.0%0.0%Covenant Insurance CompanyN06/01/19 15,015,5541.4%4.2%4.2%State Automobile Mutual Insurance CompanyN04/27/19 477,0920.0%2.9%2.9%Bunker Hill Insurance CompanyY05/15/19 11,982,0391.1%5.0%2.7%12

Integon National Insurance CompanyN04/01/19 8,835,6530.8%7.5%5.5%Massachusetts Bay Ins. CoN07/15/19 30,878,7762.8%4.0%4.0%The Hanover Insurance CompanyN07/15/19 565,0650.1%3.6%3.6%Citizens Ins Co. of AmericaN07/15/19 3,695,1050.3%3.8%3.8%Liberty Mutual Insurance Company FireInsurance CoThe First Liberty Insurance CorporationY06/23/19 34,744,5413.2%3.0%3.0%Y06/23/19 00.0%0.0%0.0%Liberty Insurance CorporationY05/09/19 64,249,2005.8%2.9%2.9%LM Insurance CorporationY05/09/19 3,593,0670.3%2.4%2.4%Utica First Insurance CompanyN05/01/19 23,940,0112.2%3.8%3.8%CSAA General Insurance CompanyN11/01/19 10,094,5110.9%2.9%2.9%Allstate Indemnity CompanyY07/20/19 2,205,6460.2%6.0%6.0%Allstate Insurance Company CondoY07/04/19 4,236,3040.4%6.0%6.0%Allstate Insurance CompanyY07/20/19 69,850,0866.4%6.0%0.0%Homesite Insurance Co.N08/01/19 28,545,2532.6%11.8%11.8%Stillwater Property and Casualty Insurance CoN05/31/19 1,627,3110.1%5.7%5.7%Main Street America Assurance CompanyN10/10/19 00.0%0.0%0.0%Chubb National Insurance CompanyY07/15/19 10,143,7200.9%6.3%6.3%Great Northern Insurance CompanyY07/15/19 57,871,9715.3%3.8%3.8%Pacific Indemnity CompanyY07/15/19 4,431,9750.4%-0.5%-0.5%Vigilant Insurance CompanyY07/15/19 39,406,7333.6%2.2%2.2%Federal Insurance CompanyY07/15/19 18,827,0051.7%1.6%1.6%CSAA Fire & Casualty Insurance Company LegacyBookKemper Independence Insurance CompanyN10/01/19 20,307,5211.8%2.8%2.8%Y05/16/19 2,005,2390.2%2.5%2.5%AIG Property Casualty CompanyN09/15/19 41,604,9393.8%5.9%5.9%NGM Insurance CompanyN10/10/19 15,802,6341.4%6.5%6.5%AmGUARD Insurance CompanyN09/15/19 858,3300.1%14.6%15.0%Patrons Mutual Insurance Company ofConnecticutNationwide General Insurance CompanyN09/20/19 11,884,0581.1%9.4%9.4%Y8/11/2019 16,260,9251.5%3.0%3.0%Nationwide Property and Casualty Insurance CoY8/11/2019 22,020,8642.0%3.0%3.0%Nationwide Mutual Fire Insurance CompanyY8/11/2019 14,803,7621.3%2.1%2.1%Liberty Mutual Safeco Insurance Company ofAmericaLiberty Safeco General Insurance Company ofAmericaCentury-National Insurance CompanyY12/14/2019 12,627,5481.1%3.0%3.0%Y12/14/2019 40,721,8713.7%2.9%2.9%N9/2/2019 23,430,9952.1%8.0%8.0%Utica Mutual Insurance CompanyN7/29/2019 1,939,9510.2%5.0%5.0%Travelers Personal Insurance Company Quantum 2The Cincinnati Insurance CompanyN9/13/2019 7,910,7480.7%0.1%0.1%N10/1/2019 12,624,8071.1%5.0%5.0%United Property & Casualty Insurance CompanyN11/1/2019 6,551,3750.6%5.7%5.7%Liberty Safeco American Economy Insurance CoN9/21/2019 00.0%0.0%0.0%13

Spinnaker Insurance CompanyN8/15/2019 00.0%0.0%0.0%HARCO National Insurance CompanyN8/12/2019 453,7830.0%0.0%0.0%American Commerce Insurance CompanyN11/29/2019 4,236,2300.4%9.0%9.0%Privilege Underwriters Reciprocal Exchange(PURE)Electric Insurance CompanyY12/7/2019 26,121,4382.4%4.9%4.9%N11/23/2019 5,038,4520.5%-2.7%-2.7%Encompass Insurance Company of AmericaY9/22/2019 1,947,5710.2%5.5%5.5%Encompass Indemnity CompanyVault Reciprocal ExchangeYY9/22/201911/11/2019 2,808,755 91,7490.3%0.0%5.0%4.7%5.5%4.7%Total Filings78Total Flex Filings24Total 2019 - All Companies with nonzero rate Change 1,025,250,64693.3%4.252%3.801%Companies with no Rate Changes 73,320,0786.7%0.0%0.0%Total 2019 - All Companies 1,098,570,724 100.0%3.969%3.548%4.0%3.5%Compare to 2018Total 1,244,698,15984.4%3.7%3.5%companies with no rate change 229,587,84115.6%0.0%0.0%Total 1,474,286,000100.0%3.1%2.9%14

EXHIBIT – CIn the Matter of:The National Council on Compensation Insurance, Inc.’s Workers’ CompensationVoluntary Advisory Loss Costs, Assigned Risk Rates, and Rating Values Filing, EffectiveJanuary 1, M AND ORDERI.INTRODUCTIONOn September 18, 2019 the National Council on Compensation Insurance, Inc. (“NCCI”)filed a workers’ compensation insurance application with the Connecticut Insurance Department(the “Department”) for a change in Voluntary Market Advisory Pure Premium Loss Costs and achange in Assigned Risk Plan Rates for Workers’ Compensation Insurance pursuant to Conn.Gen. Stat. §38a-665(a) proposed to be effective January 1, 2020.The filing requests revisions of the current loss costs and assigned risk rates that theDepartment approved effective January 1, 2019. NCCI proposes an overall -2.9% change forpure premium loss costs and an overall -4.5% change in assigned risk plan rates. Changes toindividual classification costs have been limited to 20% of the industry group change.In order to give the public an opportunity to comment on NCCI’s filing, the Departmentpublished the filing and Executive Summary on its webpage on September 23, 2019 ng-Effective-2020 and provided a thirty (30) day period for the public andinterested parties to review and comment on the filing. The Department did not receive anypublic comments and did not hold a public hearing.15

The following sections are a review of the NCCI filing requests; Insurance Department Staff’srecommendations; and my determination regarding approval of the filing.II.1.NCCI FILING REQUESTSNCCI’s proposed changes in Voluntary Market Advisory Loss Costs reflects the followingpure premium level changes:Industry Group2.Voluntary Market PurePremium Advisory Loss CostAverage Change (%)Manufacturing-1.5%Contracting-5.9%Office & Clerical-2.5%Goods & Services-1.9%Miscellaneous-2.9%Overall ChangeRequested-2.9%The proposed change in Assigned Risk Plan Rates reflects the following rate level changes:Industry GroupAssigned Risk Plan RateAverage Change (%)Manufacturing-3.2%Contracting-7.5%Office & Clerical-4.1%Goods & Services-3.5%Miscellaneous-4.5%Overall Change Requested-4.5%16

3.The components of the Advisory Loss Costs and Assigned Risk Plan Rate changes arecomprised of the following elements:ComponentVoluntary MarketPure PremiumChange (%)Assigned Risk PlanPremium LevelChange (%)Experience and Development-5.3%-5.3%Trend 1.0% 1.0%Benefits 0.4% 0.4%Loss-based Expenses/Expenses 1.1%-0.6%Overall Change Requested-2.9%-4.5%4.The assessments due from employers for funding the cost of the Workers’ CompensationCommission are 3.20% of losses. Insurance carriers pass through these assessments toemployers. For the Voluntary Market and the Assigned Risk Plan, the assessment rateconverted to a percentage of premium is 2.3% of standard premium. The assessment ratefor “F” classifications, which provides coverage under the United States Longshore andHarbor Workers’ Compensation Act and its extensions, is increasing to 6.8% of totallosses, with a proposed assessment on assigned risk standard premium and voluntarymarket standard premium of 4.1%.5.The filing proposes a 100 increase to the maximum payroll for Executive Officers orMembers of Limited Liability Companies.6.The filing proposes a 50 increase to the maximum payroll for Athletic Teams.7.NCCI estimates that the changes to the Hospital and Ambulatory Surgical Center (ASC)Fee Schedule, effective April 1, 2019, will result in an impact of 0.4% on overallworkers compensation system costs in Connecticut.8.NCCI estimates that the changes to the Practitioner Fee Schedule, effective July 15, 2019,will result in a negligible increase (smaller than /-0.1%) on overall workerscompensation system costs in Connecticut.9.The filing proposes to increase the Permissible Loss Ratio for the Assigned Risk Ratefiling from 70.9% to 71.3%.10.The filing proposes no change to the currently approved expense constants.11.The filing proposes no change to the Uncollectible Premium Provision.17

12.The filing proposes no change to the minimum premium multiplier.13.The filing proposes no change to the currently approved Terrorism voluntary loss cost.The filing proposes no change to the currently approved assigned risk Terrorism rate.14.The filing proposes to increase the annual payroll for Partners and Sole Proprietors from 67,500 to 69,100.15.The filing proposes to increase the current voluntary loss adjustment expense (LAE)provision from 17.6% to 18.9%.16.The filing proposes a 0.6% decrease to the current assigned risk expense provision.17.The filing proposes to increase the United States Longshore and Harbor Workers’Compensation Coverage Percentage from to 25% to 50%.III.DISCUSSION AND RECOMMENDATIONSA.Overall Advisory Loss Costs and Assigned Risk Plan RatesConn. Gen. Stat. §38a-665 establishes the standards, methods and criteria for the makingand use of workers’ compensation insurance rates in Connecticut. Conn. Gen. Stat. §38a665 provides that no rates shall be excessive or inadequate, nor shall they be unfairlydiscriminatory. Conn. Gen. Stat. §38a-665(b) provides that consideration shall be given,to the extent possible, to: past and prospective loss experience; reasonable margin forprofit and contingencies; past and prospective expenses both countrywide and thosespecially applicable to this state; investment income earned or realized both fromunearned premium and loss reserve funds; and other relevant factors, including judgmentfactors.The Department’s staff determined that overall cost levels are decreasing for the assignedrisk rates and for the voluntary market advisory loss costs. The cost levels for this filingare based on Connecticut loss experience for policy years 2016 and 2017. NCCI adjustspast losses to current conditions using adjustment methods, which make the magnitude ofthe change very sensitive to their assumptions. Critical assumptions include those fortrend, loss development and experience period. Department staff reviewed theassumptions included in these filings for reasonableness including the changes below andconcluded the proposed voluntary loss cost and assigned risk rate changes in this filingare appropriate.18

B.Assigned Risk DifferentialThe filing proposes no change to the Assigned Risk Differential.C.Changes in NCCI Actuarial MethodologyNCCI made changes to the actuarial methodology which resulted in an immaterialoverall impact to the rate filing. Regarding loss adjustment expenses, CT specificpaid defense and cost containment expense data derived from an NCCI Call forPolicy Year data will be used replacing countrywide data allocated to CT.Regarding the US Longshore & Harbor Workers’ benefit percentage factor, after afull study was conducted this year, NCCI has set factors for each state with theexpectation that these factors will not be changed unless there is a significantchange to the state’s benefit system. Regarding the indemnity trend, NCCI hasconducted research concluding that an explicit adjustment for change in StateAverage Weekly Wage (SAWW) for maximum/minimum weekly benefits can bereplaced by a simpler approach as the changes in wages will sufficiently capturethe changes for workers at maximum/minimum weekly benefit levels just as itcaptures changes for all other workers. NCCI will be making this change inindemnity trend countrywide.IV.ORDEROn the basis of the foregoing recommendations and analysis by Department staff and my reviewof the filing, I hereby order that:A. NCCI’s Assigned Risk Plan rates and voluntary market advisory loss costs are acceptedas filed.B. The proposed Workers’ Compensation Commission industrial classification assessmentfund rate will be changed to 2.3% of standard premium and “F” classification assessmentfund rate will be changed to 4.1% of standard premium for voluntary market and assignedrisk plan insurers for policies effective on or after January 1, 2020.19

C. The proposed increase to the Permissible Loss Ratio for the Assigned Risk Rate filing from70.9% to 71.3% is approved.D. The proposed increase to the annual payroll for Partners and Sole Proprietors from 67,500to 69,100 is approved.E. The proposed increase to the current voluntary loss adjustment expense (LAE) provisionfrom 17.6% to 18.9% is approved.F. The proposed 0.6% decrease to the current assigned risk expense provision is approved.G. The proposed increase to the United States Longshore and Harbor Workers’ CompensationCoverage Percentage from 25% to 50% is approved.H. The thirty (30) day advance filing requirement set forth in Conn. Gen. Stat. §38a-676(b)for filings received prior to January 1, 2020 be waived in order to allow for the adoptionof the change in advisory pure premium loss costs effective January 1, 2020.Dated at Hartford, Connecticut this 28th day of October, 2019See Signature on fileAndrew N. MaisInsurance Commissioner20

EXHIBIT – C – ANY NAMECBIA COMP. SERVICES, INC.WORKERS COMP TRUSTCT Interlocal Risk Management AgencyYEAR2019RATECHANGE-16.3-7.4-1.1NCCIUTICA NATIONAL INS OF TEXASUTICA NATIONAL INS OF OHIOINITIALINITIALPREFERRED PROFESSIONAL INS CO-16.8PEERLESS INSURANCE COMPANYEXCELSIOR INSURANCE COMPANYNETHERLANDS INSURANCE COMPANYPEERLESS INDEMNITY INSURANCE COMPANY-3.0-3.8-4.8-3.3TRANSGUARD INS CO OF AMERICA INC-9.8FEDERATED MUTUAL INSURANCE COMPANYFEDERATED SERVICE INSURANCE COMPANYFEDERATED RESERVE INS CO-19.0-18.2-16.8VANLINER INS CONATIONAL INTERSTATE INSURANCE COTRIUMPHE CASUALTY COMPANY-11.2-14.2-26.9TRAVELERS INDEMNITY COMPANYTRAVELERS PROPERTY CASUALTY CO OF AMERICACHARTER OAK FIRE INSURANCE COTRAVELERS INDEMNITY CO OF AMERICATRAVELERS INDEMNITY CO OF CTPHOENIX INSURANCE COMPANYTRAVELERS CASUALTY AND SURETY COFARMINGTON CASUALTY COMPANYSTANDARD FIRE INSURANCE COMPANY-11.7LIBERTY MUTUAL INS COLIBERTY MUTUAL FIRE INS COLM INSURANCE CORPFIRST LIBERTY INSURANCE CORPLIBERTY INSURANCE CORPEMPLOYERS INS CO OF WAUSAU-16.8AMERICAN HOME ASSURANCE COAIG ASSURANCE COAIG PROPERTY CASUALTY COCOMMERCE AND INDUSTRY INS COGRANITE STATE INSURANCE CO-16.821

ILLINOIS NATIONAL INSURANCENATIONAL UNION FIRE INS CO OF PITTSBURGH, PANEW HAMPSHIRE INS COINSURANCE COMPANY OF THE STATE OF PAAIU INS COTHE OHIO CASUALTY INS COOHIO SECURITY INSURANCE COMPANYWEST AMERICAN INSURANCE COMPANYAMERICAN FIRE & CASUALTY COMPANY-2.6-14.7-4.4-4.1BERKLEY NATIONAL INS COBERKLEY REGIONAL INS COTRI-STATE INS CO OF MINNESOTARIVERPORT INS CO-13.01PHARMACISTS MUTUAL INS CO-8.0INS CO OF THE WEST-16.8CAROLINA CASUALTY INS CO-17.2MIDWEST EMPLOYERS CASUALTY CO-11.3STARNET INS CO-13.5FALLS LAKE NATIONAL INS CO-16.8SENTRY INS A MUTUAL COMIDDLESEX INS COPATRIOT GENERAL INS COSENTRY SELECT INS CO-17.7GREATGREATGREATGREATGREAT-21.5AMERICAN INS COAMERICAN

Commercial Automobile, filings from the Insurance Services Office (ISO), are primary industry loss costs filings for both liability and physical damage coverage. These are loss costs only, no expenses are included. In 2019, 78 companies or groups . filed commercial automobile rates based on loss cost filings or independent rates.