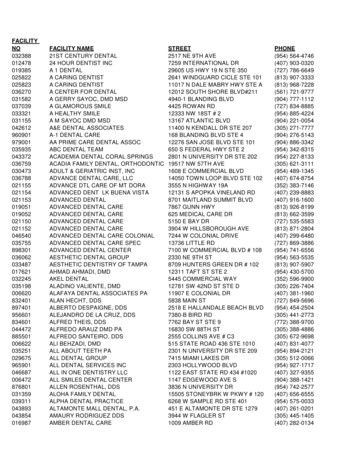

Transcription

North Carolina Reinsurance FacilityMINUTES OF THE FORTY-SECOND ANNUAL MEETING OF THE NORTH CAROLINAREINSURANCE FACILITY HELD AT THE GRANDOVER RESORT AND CONFERENCECENTER, ONE THOUSAND CLUB ROAD, GREENSBORO, NORTH CAROLINA,OCTOBER 13, 2016MEMBERS PRESENTAllstate Insurance CompanyAllstate Indemnity CompanyAllstate Northbrook Indemnity CompanyAllstate Property & Casualty Insurance CompanyAllstate Vehicle and Property Insurance CompanyEncompass Indemnity CompanyEsurance Insurance CompanyAtlantic Casualty Insurance CompanyLittle River Insurance CompanyErie Insurance CompanyErie Insurance ExchangeErie Insurance Company of New YorkErie Insurance Property & Casualty CompanyFlagship City Insurance CompanyFalls Lake National Insurance CompanyStonewood Insurance CompanyGEICO Indemnity CompanyAmguard Insurance CompanyBerkshire Hathaway Homestate Insurance CompanyNorguard Insurance CompanyEastguard Insurance CompanyGeneral Star National Insurance CompanyGovernment Employees Insurance CompanyGenesis Insurance CompanyNational Indemnity CompanyNational Liability & Fire Insurance CompanyPennsylvania Insurance CompanyUnited States Liability Insurance CompanyGEICO Advantage Insurance CompanyGEICO Casualty CompanyGEICO Secure Insurance CompanyGEICO Choice Insurance CompanyGEICO General Insurance CompanyHartford Casualty Insurance CompanyHartford Accident & Indemnity CompanyHartford Fire Insurance CompanyREPRESENTED BYFernando HernandezMark CaughronSonja MakiCody CookSteve HartmanGreg SprayAndrea BradleyElaine SolaAndy Montano

Hartford Insurance Company of the MidwestHartford Underwriters Insurance CompanyProperty & Casualty Insurance Company of HartfordSentinel Insurance Company, Ltd.Trumbull Insurance CompanyTwin City Fire Insurance CompanyIntegon General Insurance CorporationAgent Alliance Insurance CompanyAmTrust Insurance Company of Kansas, Inc.First Nonprofit Insurance CompanyImperial Fire & Casualty Insurance CompanyIntegon Casualty Insurance CompanyIntegon Indemnity CorporationIntegon National Insurance CompanyIntegon Preferred Insurance CompanyMilwaukee Casualty Insurance CompanyNational General Insurance CompanyNational General Insurance Online, Inc.New South Insurance CompanySecurity National Insurance CompanySequoia Insurance CompanyTechnology Insurance CompanyTower Insurance Company of New YorkWesco Insurance CompanyLiberty Mutual Insurance CompanyAmerican Economy Insurance CompanyAmerican Fire & Casualty CompanyAmerican States Insurance CompanyAmerican States Preferred Insurance CompanyColorado Casualty Insurance CompanyEmployers Insurance Company of WausauExcelsior Insurance CompanyFirst Liberty Insurance CorporationFirst National Insurance Company of AmericaGeneral Insurance Company of AmericaLiberty Insurance CorporationLiberty Insurance Underwriters, Inc.Liberty Mutual Fire Insurance CompanyLiberty Mutual Mid-Atlantic Insurance CompanyLM General Insurance CompanyLM Insurance CorporationLM Property & Casualty Insurance CompanyMidwestern Indemnity CompanyMontgomery Mutual Insurance CompanyNetherlands Insurance CompanyOhio Casualty Insurance CompanyOhio Security Insurance CompanyPeerless Indemnity Insurance CompanyPeerless Insurance CompanySafeco Insurance Company of AmericaSafeco Insurance Company of IndianaWausau Business Insurance CompanyArt LyonBrian RogersMichele Lapinski

Wausau Underwriters Insurance CompanyWest American Insurance CompanyNationwide Mutual Insurance CompanyAllied Insurance Company of AmericaAllied Property & Casualty Insurance CompanyAMCO Insurance CompanyCrestbrook Insurance CompanyDepositors Insurance CompanyFarmland Mutual Insurance CompanyFreedom Specialty Insurance CompanyHarleysville Mutual Insurance CompanyHarleysville Preferred Insurance CompanyHarleysville Worcester Insurance CompanyNational Casualty CompanyNationwide Affinity Insurance Company of AmericaNationwide Agribusiness Insurance CompanyNationwide General Insurance CompanyNationwide Insurance Company of AmericaNationwide Mutual Fire Insurance CompanyNationwide Property & Casualty Insurance CompanyScottsdale Indemnity CompanyTitan Indemnity CompanyVictoria Automobile Insurance CompanyVictoria Fire & Casualty CompanyPennsylvania National Mutual Casualty Ins. CompanyPenn National Security CompanyPermanent General Assurance Corporation of OhioAmerican Family Mutual Insurance CompanyAmerican Standard Insurance Company of WisconsinMidvale Indemnity CompanySentry Insurance A Mutual CompanyDairyland Insurance CompanyMiddlesex Insurance CompanyPeak Property & Casualty Insurance CorporationSentry Casualty CompanySentry Select Insurance CompanyState Farm Mutual Automobile Insurance CompanyTravelers Indemnity CompanyAutomobile Insurance Company of HartfordCharter Oak Fire Insurance CompanyCommercial Guaranty Insurance CompanyDiscover Property & Casualty Insurance CompanyFidelity & Guaranty Insurance CompanyFidelity & Guaranty Insurance Underwriters, Inc.Farmington Casualty CompanyNorthland Casualty CompanyNorthland Insurance CompanyPhoenix Insurance CompanySelect Insurance CompanySt. Paul Fire & Marine Insurance CompanySt. Paul Guardian Insurance CompanySt. Paul Mercury Insurance CompanyJoel BuckTerry CollinsMendi RiddleTom SouderLynette ProsserSondra CavanaughPeter SampsonAlan BentleyMolly Dunn

St. Paul Protective Insurance CompanyStandard Fire Insurance CompanyTravco Insurance CompanyTravelers Casualty & Surety CompanyTravelers Casualty & Surety Company of AmericaTravelers Casualty CompanyTravelers Casualty Company of ConnecticutTravelers Casualty Insurance Company of AmericaTravelers Commercial Casualty CompanyTravelers Commercial Insurance CompanyTravelers Constitution State Insurance CompanyTravelers Casualty & Surety Company of AmericaTravelers Home & Marine Insurance CompanyTravelers Indemnity Company of AmericaTravelers Indemnity Company of ConnecticutTravelers Personal Insurance CompanyTravelers Personal Security Insurance CompanyTravelers Property Casualty Company of AmericaTravelers Property Casualty Insurance CompanyUnited States Fidelity & Guaranty CompanyUSAA Casualty Insurance CompanyGarrison Property & Casualty Insurance CompanyUSAA General Indemnity Company UnitedServices Automobile AssociationUnitrin Auto & Home Insurance CompanyMerastar Insurance CompanyResponse Worldwide Insurance CompanyUnitrin Safeguard Insurance CompanyUnitrin Direct Property & Casualty CompanyUniversal Insurance CompanyThe Members Insurance CompanyDan PickensEd SpeichJim McCaffertyOTHERS PRESENTREPRESENTED BYYoung, Moore and HendersonRobert PaschalGlenn RaynorMickey SpiveyMike StricklandFred FullerRobert MackDave CummingsRob CurryChris HollemanEric TanakaJeff ButlerJohn E. Wooten, IIIRob McVayTim WardSteve SmithJannet BarnesJoanna BiliourisEdith DavisNorth Carolina Department of InsuranceInsurance Services OrganizationWellington ManagementAble Auto InsuranceGreen & Wooten InsurancePinehurst InsuranceSenn Dunn Marsh & RolandPublic Members – NCRF Board of GovernorsStaff

Linda DavisRay EvansVicki GodboldKeri JohnsonDonna KallianosLaura Lee LongestFrank LonnettTim LucasMike Ne wtonKa ren OttDavid SinkRebecca WilliamsOne-hundred and twenty-nine (143) other companies were represented byproxy.The meeting convened as scheduled, Mr. McCafferty presiding. Ms. Davis announced thatthere was a quorum.Reference was made to the Facility’s Antitrust Compliance Policy, Conflicts of InterestStatement, and Code of Ethics and Standard of Conduct Statements, copies of which wereincluded in the materials provided. Mr. Spivey briefly commented on the importance of theseguidelines.1.Minutes of the last meetingThere were no outstanding minutes to be approved.2.Plan of Operation AmendmentMs. Davis directed attention to an exhibit distributed in the meeting materials regardingproposed revisions to the Facility’s Plan of Operation, Article XV Hearings. She notedthat the Facility’s Board of Governors had previously approved these revisions onSeptember 27, 2016, and that upon member company approval these proposedrevisions would be filed with the Commissioner of Insurance for final approval.A motion was made, seconded, and unanimously passed to adopt the amendment toArticle XV in the Facility’s Plan of Operation.3.Annual ReportCopies of the Forty-Third Annual Report for the fiscal year ended September 30, 2016were distributed, a copy of which is attached and forms a part of the record. Themembers were also advised that the Report would be available on the Facility websiteunder its own link from the homepage. Mr. Evans offered general observations from thepast year and reported on progress made towards the current year’s goals, highlightingthe focus on managing members’ equity.

4.Chairman’s CommentsMr. McCafferty shared comments on the numerous activities and events of thepreceding year, especially noting the activity regarding the continued decline ofmembers’ equity balances and the associated implementation of a private passengerloss recoupment; the input provided in the development of commercial auto rate. Herecognized Ray Evans for his continued leadership, as well as the Board, the variousparticipating committees, staff, and counsel for their efforts on behalf of the Facility.5.AdjournmentThere being no further business, the meeting was adjourned.Respectfully submitted,Edith DavisChief Operating OfficerNorth Carolina Reinsurance FacilityETD/ladEnclosureRF-16-16

2016 ANNUAL REPORTNORTH CAROLINAREINSURANCE FACILITY

REINSURANCE FACILITYTABLE OF CONTENTSMANAGEMENT CONTACTSGeneral Manager’s Report . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2Ray Evans . . . . . . . . . . . . . . . . . . General Manager919-783-9790 . . . . . . . . . . . . . . . . . . . rfe@ncrb.orgMessage From the Chairman . . . . . . . . . . . . . . . . . . . . . . . . . . 2Board of Governors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3Standing Advisory Committees . . . . . . . . . . . . . . . . . . . . . . . . 3Management Report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4Edith Davis . . . . . . . . . . . . . . . Chief Operating Officer919-582-1006 . . . . . . . . . . . . . . . . . . etd@ncrb.orgJannet Barnes . . . . . . . . . . . . . . . Manager, Compliance919-582-1022 . . . . . . . . . . . . . . . . . . jbb@ncrb.orgShared Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7Management Staff . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8Balance Sheet & Income Statement . . . . . . . . . . . . . . . . . . . . . 9Special Purpose Balance Sheet . . . . . . . . . . . . . . . . . . . . . . . . 10Special Purpose Statement of Operations . . . . . . . . . . . . . . . . 10Tim Lucas . . . . . . . . . . . . . . . . Manager, Automobile919-582-1021 . . . . . . . . . . . . . . . . . . . ftl@ncrb.orgMike Newton. . . . . . . . . . . . . . . . . .Manager, Claims919-582-1018 . . . . . . . . . . . . . . . . . . rmn@ncrb.orgDavid Sink . . . . . . . . . . . . . . . .Chief Financial Officer919-582-1012 . . . . . . . . . . . . . . . . . . des@ncrb.orgGENERAL ORGANIZATIONAL INFORMATIONNCRF Main Phone Number . . . . . . . . . . . . . . . . 919-783-9790Facsimile . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 919-783-0355Vicki Godbold . . . . . . . . . Chief Human Resources Officer919-645-3170 . . . . . . . . . . . . . . . . . . vcg@ncrb.orgShelley Chandler . . . . . . . . . . . Chief Information Officer919-582-1057 . . . . . . . . . . . . . . . . . . .src@ncrb.orgWebsite Address . . . . . . . . . . . . . . . . . . . . . . www.ncrb.org/ncrf/Physical Address. . . . . . . . . . . . . . . . . . . . . . 2910 Sumner Blvd.Raleigh, NC 276162016 ANNUAL MEETINGThe annual meeting for member companies of the North CarolinaReinsurance Facility will be held October 13, 2016, at the GrandoverResort and Conference Center, Greensboro, North Carolina.2016 ANNUAL REPORT1

GENERAL MANAGER’S REPORTMESSAGE FROM THE CHAIRMANI read somewhere that, “There is no such thing asready; there is only willing.” We spend a considerableamount of time planning and preparing strategies, butit seems, in the end, while we do our best to be ready,we also have to be willing to change directions to reactto events as they unfold. The story of the last year is agood example of this flexibility.The Reinsurance Facility is unique within the country’sauto residual market. In past years, we have reportedthat the Facility has the majority of the auto residualRay EvansGENERAL MANAGERmarket premium in the country, and that hasn’t changed.In fact, for the latest available year’s data, the Facilityhas about 75% of the premium for that market. We have cautioned that this aloneis not the whole story. The North Carolina uninsured motorist rate is low; everydriver has access to insurance coverage, many willing carriers write auto insuranceand the percentage of business in the Facility has remained pretty constant over a40-year period. In the last year or so, this picture has begun to change. To be sure,the Facility continues to have the lion’s share of the countrywide residual market,but it now also has a near historical high percentage of North Carolina auto liabilitypremiums, approaching 30%. Several factors contribute to this change, includingthe declining cost of gasoline in the U.S., which has increased the miles driven andcorrespondingly increased claims, and member carriers are ceding more policies.That carriers are ceding more business is not really a problem, except much of thisbusiness, by design, generates significant losses, and the Facility is now incurringlosses of approximately 10,000,000 per month. As a result, staff and a numberof Facility committees and task forces have been laboring over solutions. Someavenues available to the Facility are in the form of surcharges. Before these can beused, data has to be accumulated to support any action, and, as the losses havebeen recent, data has been slow to catch up, so these changes just became effectivein October 2016, and the operating results should improve shortly thereafter.Another example of our willingness is our response to a growing problem withinsureds with questionable North Carolina residency seeking commercial autopolicies. The Facility’s book of commercial auto liability policies is only about 10%of ceded premium. However, it does present us with considerable exposure andpotential volatility as the number of risks is relatively low. The industry saw similarissues with personal auto policies a few years ago, illustrated by a series of NewYork television reports focused in New York neighborhoods where many vehiclesdisplayed North Carolina license plates. The problem was rectified by changes in theNorth Carolina private passenger eligibility and rate evasion statutes. Truckers andbus companies could now be taking similar advantage of loopholes in the law. TheFacility, in collaboration with the Department of Insurance, the Secretary of State,the Department of Motor Vehicles, the Federal Motor Carrier Safety Administrationenforcement folks and a number of member carriers, was able to suggest a legislativefix which became part of the 2016 Legislative short session DOI agency bill and hasbeen enacted. The Facility’s part in this action was providing a place for this groupto meet, scheduling and facilitating meetings, researching details for every discussionand helping to craft the legislation, all a part of being “willing” to resolve a problem.While we might not be ready for every eventuality, by diligently preparing andalways trying to be better, and by having associates, Board of Governor members,committee members, carriers and other external resources willing to tackle anyproblem, the Facility has been able both to comply with our governing statutes andrespond to a whole range of events in an effective manner.2“Really busy” has become the new normal. Over the past year, theFacility has been involved in many different types of initiatives andhas made every attempt to provide innovative solutions to variousissues. It has also been a year of great collaboration.Listed below are some of the highlights for the year: The Facility hosted forums designed to assist the Commissionerof Insurance and solicit input into the development of statutorylanguage, which became part of House Bill 287 to addresscommercial auto rate evasion. The Facility provided input related to modifications to House Bill148 – Insurance Required for Mopeds. Personal Auto program changes included the adoption of aTransportation Network Company (TNC) mandatory exclusionendorsement and a new limited TNC coverage program. Commercial Auto program changes included amendments to theFacility Commercial Auto Manual rules to address the rating ofout-of-state risks and the development of out-of-state base ratesto simplify the rating of these risks. A loss recoupment was implemented for private passengerpolicies to address a deficit in members’ equity resulting fromdeteriorating private passenger experience. The deployment of EDGE system changes allowed clean riskand loss recoupment surcharges on private passenger policiesto be reported to the Facility on a combined basis, resulting inprogramming cost savings for the member companies. Cession volume, premiums and paid losses continued to increaseover the same periods for the prior year. Private passengerpolicies-in-force continued to steadily increase while commercialauto policies declined significantly. 2015 operating expenses were less than the annual budget for thesame period and were followed by another decrease in the operatingbudget for 2016 over the prior year. The operating expensescontinue to be less than 1% of the Facility annual premium. Our investment portfolio continued to outperform thebenchmark despite the decline in account balance resulting fromthe distributions necessitated by net operating losses. A new independent audit firm was engaged for the 2014-2015fiscal year audit after several decades with another firm.The world is changing at a more rapid pace than ever before, and itis our responsibility to respond accordingly. This ability to respondrequires engagement and support from staff, counsel, the Boardof Governors and the committee members who met numeroustimes in the past year to address these important issues, and theydelivered. It has been a privilege to serve as Chair for these pasttwo years and work with these folks.Jim McCaffertyUniversal Insurance CompanyChairmanNORTH CAROLINA REINSURANCE FACILITY

BOARD OF GOVERNORSResponsibility for management is vested in a 15-member Board ofGovernors. The Board includes 12 voting members, seven memberinsurance companies and five agents appointed by the InsuranceCommissioner; two nonvoting public members appointed by theGovernor and the Insurance Commissioner, who is a member of theBoard ex-officio without vote. Eight meetings of the Board were heldduring the year, including four telephone conferences.Agent MembersRepresentativeApptd. by the Commissioner of InsuranceW. Hutson Wester, IIApptd. by the Commissioner of InsuranceJohn E. Wooten, IIIAuto Insurance Agents of North CarolinaJeffrey W. ButlerIndependent Insurance Agents of NCRobert M. McVayIndependent Insurance Agents of NCTim WardMembersRepresentativeAllstate Insurance CoFernando HernandezAtlantic Casualty Insurance CoRobbie StricklandGEICO Indemnity CoAndrea BradleyIntegon Indemnity CorporationArt LyonNationwide Mutual Insurance CoMendi RiddleTravelers Indemnity CoMolly DunnUniversal Insurance Co*Jim McCaffertyPublic MembersJ. David Walker, Lumberton, NCSteven Smith, Raleigh, NCEx-officio MemberWayne Goodwin, Commissioner of InsuranceSTANDING ADVISORY COMMITTEESThe Plan of Operation establishes a number of advisory committees.These committees oversee the activities of the Facility and formulaterecommendations for presentation to the Board of Governors. Inaddition, several other specialty advisory groups perform similar tasksfo

Oct 13, 2016 · Nationwide Property & Casualty Insurance Company Scottsdale Indemnity Company . Titan Indemnity Company . Victoria Automobile Insurance Company Victoria Fire & Casualty Company . Pennsylvania National Mutual Casualty Ins. Company Lynette Prosser . Penn National Security Company . Permanent General Assurance Corporation of Ohio Sondra Cavanaugh