Transcription

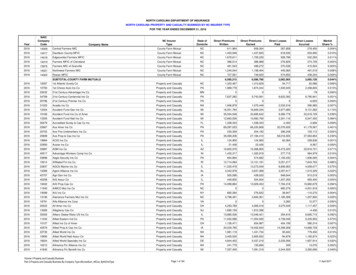

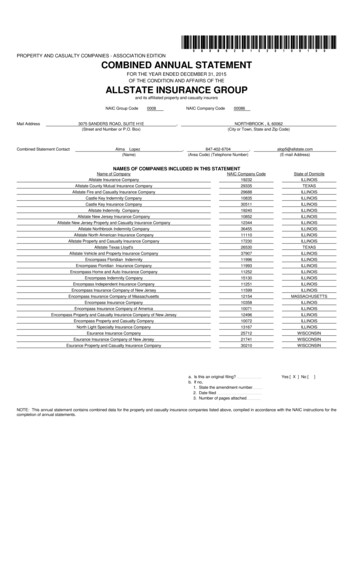

PROPERTY AND CASUALTY COMPANIES - ASSOCIATION EDITIONCOMBINED ANNUAL STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2015OF THE CONDITION AND AFFAIRS OF THEALLSTATE INSURANCE GROUPand its affiliated property and casualty insurersNAIC Group CodeMail Address00083075 SANDERS ROAD, SUITE H1E(Street and Number or P.O. Box)Combined Statement ContactNAIC Company Code,Alma Lopez(Name)00086NORTHBROOK , IL 60062(City or Town, State and Zip Code),847-402-6704,(Area Code) (Telephone Number)NAMES OF COMPANIES INCLUDED IN THIS STATEMENTName of CompanyAllstate Insurance CompanyNAIC Company Code19232alop5@allstate.com(E-mail Address)State of DomicileILLINOISAllstate County Mutual Insurance Company29335TEXASAllstate Fire and Casualty Insurance Company29688ILLINOISCastle Key Indemnity Company10835ILLINOISCastle Key Insurance Company30511ILLINOISAllstate Indemnity Company19240ILLINOISAllstate New Jersey Insurance Company10852ILLINOISAllstate New Jersey Property and Casualty Insurance Company12344ILLINOISAllstate Northbrook Indemnity Company36455ILLINOISAllstate North American Insurance Company11110ILLINOISAllstate Property and Casualty Insurance Company17230ILLINOISAllstate Texas Lloyd's26530TEXASAllstate Vehicle and Property Insurance Company37907ILLINOISEncompass Floridian Indemnity11996ILLINOISEncompass Floridian Insurance Company11993ILLINOISEncompass Home and Auto Insurance Company11252ILLINOISEncompass Indemnity Company15130ILLINOISEncompass Independent Insurance Company11251ILLINOISEncompass Insurance Company of New Jersey11599ILLINOISEncompass Insurance Company of Massachusetts12154MASSACHUSETTSEncompass Insurance Company10358ILLINOISEncompass Insurance Company of America10071ILLINOISEncompass Property and Casualty Insurance Company of New Jersey12496ILLINOISEncompass Property and Casualty Company10072ILLINOISNorth Light Specialty Insurance Company13167ILLINOISEsurance Insurance Company25712WISCONSINEsurance Insurance Company of New Jersey21741WISCONSINEsurance Property and Casualty Insurance Company30210WISCONSINa. Is this an original filing?b. If no,1. State the amendment number2. Date filed3. Number of pages attachedYes [ X ] No []NOTE: This annual statement contains combined data for the property and casualty insurance companies listed above, compiled in accordance with the NAIC instructions for thecompletion of annual statements.

COMBINED STATEMENT FOR THE YEAR 2015 OF THE ALLSTATE INSURANCE COMPANY AND ITS AFFILIATEDPROPERTY/CASUALTY INSURERSASSETS1.Bonds (Schedule D)2.Stocks (Schedule D):2.1 Preferred stocks2.2 Common stocks3.Mortgage loans on real estate (Schedule B):3.1 First liens3.2 Other than first liens4.Real estate (Schedule A):4.1 Properties occupied by the company (less encumbrances)4.2 Properties held for the production of income (less encumbrances)4.3 Properties held for sale (less encumbrances)5.Cash ( ( , Schedule E - Part 1), cash equivalents, Schedule E - Part 2) and short-terminvestments ( , Schedule DA)6.Contract loans (including 7.Derivatives (Schedule DB)premium notes)8.Other invested assets (Schedule BA)9.Receivable for securities10.Securities lending reinvested collateral assets (Schedule DL)11.Aggregate write-ins for invested assets12.Subtotals, cash and invested assets (Lines 1 to 11)13.Title plants less charged off (for Title insurersonly)14.Investment income due and accrued15.Premiums and considerations:15.1 Uncollected premiums and agents' balances in the course of collection15.2 Deferred premiums and agents' balances and installments booked butdeferred and not yet due (including earned but unbilled premiums)15.3 Accrued retrospective premiums ( ) andcontracts subject to redetermination ( 16.)Reinsurance:16.1 Amounts recoverable from reinsurers16.2 Funds held by or deposited with reinsured companies16.3 Other amounts receivable under reinsurance contracts17.Amounts receivable relating to uninsured plans18.1 Current federal and foreign income tax recoverable and interest thereon18.2 Net deferred tax asset19.Guaranty funds receivable or on deposit20.Electronic data processing equipment and software21.Furniture and equipment, including health care delivery assets22.Net adjustment in assets and liabilities due to foreign exchange rates23.Receivables from parent, subsidiaries and affiliates( )24.Health care ( 25.Aggregate write-ins for other than invested assets) and other amounts receivable26.Total assets excluding Separate Accounts, Segregated Accounts andProtected Cell Accounts (Lines 12 to 25)27.From Separate Accounts, Segregated Accounts and Protected CellAccounts28.Total (Lines 26 and 27)DETAILS OF WRITE-INS1199.Totals (Lines 1101 thru 1103 plus 1198)(Line 11 above)2599.Totals (Lines 2501 thru 2503 plus 2598)(Line 25 above)21Current Year2AssetsNonadmitted Assets3Net Admitted Assets(Cols. 1 - 2)Prior Year4Net AdmittedAssets

COMBINED STATEMENT FOR THE YEAR 2015 OF THE ALLSTATE INSURANCE COMPANY AND ITS AFFILIATEDPROPERTY/CASUALTY INSURERSLIABILITIES, SURPLUS AND OTHER FUNDS1Current Year1.Losses (Part 2A, Line 35, Column 8)2.Reinsurance payable on paid losses and loss adjustment expenses (Schedule F, Part 1, Column 6)3.Loss adjustment expenses (Part 2A, Line 35, Column 9)4.Commissions payable, contingent commissions and other similar charges5.Other expenses (excluding taxes, licenses and fees)6.Taxes, licenses and fees (excluding federal and foreign income taxes)7.1 Current federal and foreign income taxes (including on realized capital gains (losses))7.2 Net deferred tax liability8.Borrowed money 9.Unearned premiums (Part 1A, Line 38, Column 5) (after deducting unearned premiums for ceded reinsurance of and interest thereon and including warranty reserves of health experience rating refunds including and accrued accident andfor medical loss ratio rebate per the Public HealthService Act)10.Advance premium11.Dividends declared and unpaid:11.1 Stockholders11.2 Policyholders12.Ceded reinsurance premiums payable (net of ceding commissions)13.Funds held by company under reinsurance treaties (Schedule F, Part 3, Column 19)14.Amounts withheld or retained by company for account of others15.Remittances and items not allocated16.Provision for reinsurance (including 17.Net adjustments in assets and liabilities due to foreign exchange rates18.Drafts outstanding19.Payable to parent, subsidiaries and affiliates20.Derivatives21.Payable for securities22.Payable for securities lendingcertified) (Schedule F, Part 8)23.Liability for amounts held under uninsured plans24.Capital notes 25.Aggregate write-ins for liabilities26.Total liabilities excluding protected cell liabilities (Lines 1 through 25)27.Protected cell liabilities28.Total liabilities (Lines 26 and 27)29.Aggregate write-ins for special surplus funds30.Common capital stock31.Preferred capital stock32.Aggregate write-ins for other than special surplus funds33.Surplus notes34.Gross paid in and contributed surplus35.Unassigned funds (surplus)36.and interest thereon Less treasury stock, at cost:36.1shares common (value included in Line 30 )36.2shares preferred (value included in Line 31 )37.Surplus as regards policyholders (Lines 29 to 35, less 36) (Page 4, Line 39)38.TOTALS (Page 2, Line 28, Col. 3)DETAILS OF WRITE-INS2599.Totals (Lines 2501 thru 2503 plus 2598)(Line 25 above)2999.Totals (Lines 2901 thru 2903 plus 2998)(Line 29 above)3299.Totals (Lines 3201 thru 3203 plus 3298)(Line 32 above)32Prior Year

COMBINED STATEMENT FOR THE YEAR 2015 OF THE ALLSTATE INSURANCE COMPANY AND ITS AFFILIATEDPROPERTY/CASUALTY INSURERSSTATEMENT OF INCOMEUNDERWRITING INCOME1.Premiums earned (Part 1, Line 35, Column 4)2.Losses incurred (Part 2, Line 35, Column 7)3.Loss adjustment expenses incurred (Part 3, Line 25, Column 1)4.Other underwriting expenses incurred (Part 3, Line 25, Column 2)5.Aggregate write-ins for underwriting deductions6.Total underwriting deductions (Lines 2 through 5)7.Net income of protected cells8.Net underwriting gain or (loss) (Line 1 minus Line 6 plus Line 7)9.Net investment income earned (Exhibit of Net Investment Income, Line 17)DEDUCTIONS:INVESTMENT INCOME10.Net realized capital gains or (losses) less capital gains tax of (Exhibit of CapitalGains (Losses) )11.Net investment gain (loss) (Lines 9 10)12.Net gain (loss) from agents’ or premium balances charged off (amount recovered13.Finance and service charges not included in premiums14.Aggregate write-ins for miscellaneous income15.Total other income (Lines 12 through 14)16.Net income before dividends to policyholders, after capital gains tax and before all other federal and foreign income taxes(Lines 8 11 15)17.Dividends to policyholders18.Net income, after dividends to policyholders, after capital gains tax and before all other federal and foreign income taxes(Line 16 minus Line 17)19.Federal and foreign income taxes incurred20.Net income (Line 18 minus Line 19)(to Line 22)21.Surplus as regards policyholders, December 31 prior year (Page 4, Line 39, Column 2)22.Net income (from Line 20)23.Net transfers (to) from Protected Cell accountsOTHER INCOME amount charged off )CAPITAL AND SURPLUS ACCOUNT24.Change in net unrealized capital gains or (losses) less capital gains tax of 25.Change in net unrealized foreign exchange capital gain (loss)26.Change in net deferred income tax27.Change in nonadmitted assets (Exhibit of Nonadmitted Assets, Line 28, Col. 3)28.Change in provision for reinsurance (Page 3, Line 16, Column 2 minus Column 1)29.Change in surplus notes30.Surplus (contributed to) withdrawn from protected cells31.Cumulative effect of changes in accounting principles32.Capital changes:32.1 Paid in32.2 Transferred from surplus (Stock Dividend)32.3 Transferred to surplus33.Surplus adjustments:33.1 Paid in33.2 Transferred to capital (Stock Dividend)33.3 Transferred from capital34.Net remittances from or (to) Home Office35.Dividends to stockholders36.Change in treasury stock (Page 3, Lines 36.1 and 36.2, Column 2 minus Column 1)37.Aggregate write-ins for gains and losses in surplus38.Change in surplus as regards policyholders for the year (Lines 22 through 37)39.Surplus as regards policyholders, December 31 current year (Line 21 plus Line 38) (Page 3, Line 37)DETAILS OF WRITE-INS0599.Totals (Lines 0501 thru 0503 plus 0598)(Line 5 above)1499.Totals (Lines 1401 thru 1403 plus 1498)(Line 14 above)3799.Totals (Lines 3701 thru 3703 plus 3798)(Line 37 above)41Current Year2Prior Year

COMBINED STATEMENT FOR THE YEAR 2015 OF THE ALLSTATE INSURANCE COMPANY AND ITS AFFILIATEDPROPERTY/CASUALTY INSURERSCASH FLOWCash from Operations1.Premiums collected net of reinsurance2.Net investment income3.Miscellaneous income4.Total (Lines 1 through 3)5.Benefit and loss related payments6.Net transfers to Separate Accounts, Segregated Accounts and Protected Cell Accounts7.Commissions, expenses paid and aggregate write-ins for deductions8.Dividends paid to policyholders9.Federal and foreign income taxes paid (recovered) net of 10.Total (Lines 5 through 9)11.Net cash from operations (Line 4 minus Line 10)tax on capital gains (losses)Cash from Investments12.Proceeds from investments sold, matured or repaid:12.1 Bonds12.2 Stocks12.3 Mortgage loans12.4 Real estate12.5 Other invested assets12.6 Net gains or (losses) on cash, cash equivalents and short-term investments12.7 Miscellaneous proceeds12.8 Total investment proceeds (Lines 12.1 to 12.7)13.Cost of investments acquired (long-term only):13.1 Bonds13.2 Stocks13.3 Mortgage loans13.4 Real estate13.5 Other invested assets13.6 Miscellaneous applications13.7 Total investments acquired (Lines 13.1 to 13.6)14.Net increase (decrease) in contract loans and premium notes15.Net cash from investments (Line 12.8 minus Line 13.7 minus Line 14)Cash from Financing and Miscellaneous Sources16.Cash provided (applied):16.1 Surplus notes, capital notes16.2 Capital and paid in surplus, less treasury stock16.3 Borrowed funds16.4 Net deposits on deposit-type contracts and other insurance liabilities16.5 Dividends to stockholders16.6 Other cash provided (applied)17.Net cash from financing and miscellaneous sources (Lines 16.1 to 16.4 minus Line 16.5 plus Line 16.6)RECONCILIATION OF CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS18.Net change in cash, cash equivalents and short-term investments (Line 11, plus Lines 15 and 17)19.Cash, cash equivalents and short-term investments:19.1 Beginning of year19.2 End of period (Line 18 plus Line 19.1)Note: Supplemental disclosures of cash flow information for non-cash transactions:!20.0001.# !%!20.0002. " ! ! !20.0003. " ! !!%!20.0004. & !!20.0005.!!20.0006. '!20.0007. ( ) ! ! !512Current YearPrior Year

COMBINED STATEMENT FOR THE YEAR 2015 OF THE ALLSTATE INSURANCE COMPANY AND ITS AFFILIATEDPROPERTY/CASUALTY INSURERSNote: Supplemental disclosures of cash flow information for non-cash 0.0012."20.0013.!20.0014. ("20.0015. (20.0016. (!20.0017. (20.0018. (# # %&#'##% %% #%5.1

COMBINED STATEMENT FOR THE YEAR 2015 OF THE ALLSTATE INSURANCE COMPANY AND ITS AFFILIATEDPROPERTY/CASUALTY INSURERSUNDERWRITING AND INVESTMENT EXHIBITPART 1 - PREMIUMS EARNED1Line of Business1.Fire2.Allied lines3.Farmowners multiple peril4.Homeowners multiple peril5.Commercial multiple peril6.Mortgage guaranty8.Ocean marine9.Inland marine10.Financial guaranty11.1Medical professional liability - occurrence11.2Medical professional liability - claims-made12.Earthquake13.Group accident and health14.Credit accident and health (group and individual)15.Other accident and health16.Workers'compensation17.1Other liability - occurrence17.2Other liability - claims-made17.3Excess workers'compensation18.1Products liability - occurrence18.2Products liability - claims-madeNet PremiumsWritten perColumn 6, Part 1B19.1, 19.2 Private passenger auto liability19.3, 19.4 Commercial auto liability21.Auto physical damage22.Aircraft (all perils)23.Fidelity24.Surety26.Burglary and theft27.Boiler and insurance - nonproportional assumed property32.Reinsurance - nonproportional assumed liability33.Reinsurance - nonproportional assumed financial lines34.Aggregate write-ins for other lines of business35.TOTALSDETAILS OF WRITE-INS3499.Totals (Lines 3401 thru 3403 plus 3498)(Line 34 above)62Unearned PremiumsDec. 31 Prior Year per Col. 3,Last Year’s Part 13Unearned PremiumsDec. 31 CurrentYear - per Col. 5Part 1A4Premiums EarnedDuring Year(Cols. 1 2 - 3)

COMBINED STATEMENT FOR THE YEAR 2015 OF THE ALLSTATE INSURANCE COMPANY AND ITS AFFILIATEDPROPERTY/CASUALTY INSURERSUNDERWRITING AND INVESTMENT EXHIBITPART 1A - RECAPITULATION OF ALL PREMIUMSLine of Business1.Fire2.Allied lines3.Farmowners multiple peril4.Homeowners multiple peril5.Commercial multiple peril6.Mortgage guaranty8.Ocean marine9.Inland marine10.Financial guaranty11.1Medical professional liability - occurrence11.2Medical professional liability - claims-made12.Earthquake13.Group accident and health14.Credit accident and health (group andindividual)15.Other accident and health16.Workers'compensation17.1Other liability - occurrence17.2Other liability - claims-made17.3Excess workers'compensation18.1Products liability - occurrence18.2Products liability - claims-made123Amount Unearned(Running One Yearor Less from Dateof Policy) (a)Amount Unearned(Running More ThanOne Year fromDate of Policy) (a)Earned But UnbilledPremium19.1, 19.2 Private passenger auto liability19.3, 19.4 Commercial auto liability21.Auto physical damage22.Aircraft (all perils)23.Fidelity24.Surety26.Burglary and theft27.Boiler and insurance - nonproportional assumedproperty32.Reinsurance - nonproportional assumedliability33.Reinsurance - nonproportional assumedfinancial lines34.Aggregate write-ins for other lines of business35.TOTALS36.Accrued retrospective premiums based on experience37.Earned but unbilled premiums38.Balance (Sum of Line 35 through 37)DETAILS OF WRITE-INS3499.Totals (Lines 3401 thru 3403 plus 3498)(Line34 above)(a) State here basis of computation used in each case74Reserve for RateCredits andRetrospectiveAdjustments Basedon Experience5Total Reserve forUnearned PremiumsCols. 1 2 3 4

COMBINED STATEMENT FOR THE YEAR 2015 OF THE ALLSTATE INSURANCE COMPANY AND ITS AFFILIATEDPROPERTY/CASUALTY INSURERSUNDERWRITING AND INVESTMENT EXHIBIT1Line of Business1.Fire2.Allied lines3.Farmowners multiple peril4.Homeowners multiple peril5.Commercial multiple peril6.Mortgage guaranty8.Ocean marine9.Inland marine10.Financial guaranty11.1Medical professional liability occurrence11.2Medical professional liability claims-made12.Earthquake13.Group accident and health14.Credit accident and health (groupand individual)15.Other accident and health16.Workers'compensation17.1Other liability - occurrence17.2Other liability - claims-made17.3Excess workers'compensation18.1Products liability - occurrence18.2Products liability - claims-made19.1, 19.2Private passenger auto liability19.3, 19.4Commercial auto liabilityPART 1B - PREMIUMS WRITTENDirect Business (a)21.Auto physical damage22.Aircraft (all perils)23.Fidelity24.Surety26.Burglary and theft27.Boiler and insurance - nonproportionalassumed propertyXXX32.Reinsurance - nonproportionalassumed liabilityXXX33.Reinsurance - nonproportionalassumed financial linesXXX34.Aggregate write-ins for other lines ofbusiness35.TOTALSReinsurance Assumed23From AffiliatesFrom Non-AffiliatesReinsurance Ceded45To AffiliatesDETAILS OF WRITE-INS3499.Totals (Lines 3401 thru 3403 plus3498)(Line 34 above)(a) Does the company's direct premiums written include premiums recorded on an installment basis?If yes: 1. The amount of such installment premiums 2. Amount at which such installment premiums would have been reported had they been reported on an annualized basis 8To Non-Affiliates6Net PremiumsWrittenCols. 1 2 3-4-5

COMBINED STATEMENT FOR THE YEAR 2015 OF THE ALLSTATE INSURANCE COMPANY AND ITS AFFILIATED PROPERTY/CASUALTY INSURERSUNDERWRITING AND INVESTMENT EXHIBITPART 2 - LOSSES PAID AND 6.17.117.217.318.118.219.1, 19.219.3, .Line of BusinessFireAllied linesFarmowners multiple perilHomeowners multiple perilCommercial multiple perilMortgage guarantyOcean marineInland marineFinancial guarantyMedical professional liability - occurrenceMedical professional liability - claims-madeEarthquakeGroup accident and healthCredit accident and health (group and individual)Other accident and healthWorkers'compensationOther liability - occurrenceOther liability - claims-madeExcess workers'compensationProducts liability - occurrenceProducts liability - claims-madePrivate passenger auto liabilityCommercial auto liabilityAuto physical damageAircraft (all perils)FidelitySuretyBurglary and theftBoiler and machineryCreditInternationalWarrantyReinsurance - nonproportional assumed propertyReinsurance - nonproportional assumed liabilityReinsurance - nonproportional assumed financial linesAggregate write-ins for other lines of businessTOTALSDETAILS OF WRITE-INSTotals (Lines 3401 thru 3403 plus 3498)(Line 34 above)Direct BusinessXXXXXXXXXLosses Paid Less Net Losses UnpaidCurrent Year(Part 2A , Col. 8)Net Losses UnpaidPrior YearLosses IncurredCurrent Year(Cols. 4 5 - 6)4Net Payments(Cols. 1 2 -3 )8Percentage ofLosses Incurred(Col. 7, Part 2) toPremiums Earned(Col. 4, Part 1)

COMBINED STATEMENT FOR THE YEAR 2015 OF THE ALLSTATE INSURANCE COMPANY AND ITS AFFILIATED PROPERTY/CASUALTY INSURERSUNDERWRITING AND INVESTMENT EXHIBITPART 2A - UNPAID LOSSES AND LOSS ADJUSTMENT EXPENSES10Line of BusinessFireAllied linesFarmowners multiple perilHomeowners multiple perilCommercial multiple perilMortgage guarantyOcean marineInland marineFinancial guarantyMedical professional liability - occurrenceMedical professional liability - claims-madeEarthquakeGroup accident and healthCredit accident and health (group and individual)Other accident and healthWorkers'compensationOther liability - occurrenceOther liability - claims-madeExcess workers'compensationProducts liability - occurrenceProducts liability - claims-madePrivate passenger auto liabilityCommercial auto liabilityAuto physical damageAircraft (all perils)FidelitySuretyBurglary and theftBoiler and machineryCreditInternationalWarrantyReinsurance - nonproportional assumed propertyReinsurance - nonproportional assumed liabilityReinsurance - nonproportional assumed financial linesAggregate write-ins for other lines of businessTOTALSDETAILS OF WRITE-INS3499.Totals (Lines 3401 thru 3403 plus 3498)(Line 34 above)(a) Including for present value of life indemnity 7.117.217.318.118.219.1, 19.219.3, rted eRecoverableNet Losses Excl.Incurred But NotReported(Cols. 1 2 - 3)5Incurred But Not 89Net Losses Unpaid(Cols. 4 5 6 - 7)Net UnpaidLoss AdjustmentExpenses(a)(a)XXXXXXXXXXXXXXXXXX

COMBINED STATEMENT FOR THE YEAR 2015 OF THE ALLSTATE INSURANCE COMPANY AND ITS AFFILIATEDPROPERTY/CASUALTY INSURERSUNDERWRITING AND INVESTMENT EXHIBITPART 3 - EXPENSES1.1234Loss AdjustmentExpensesOther UnderwritingExpensesInvestmentExpensesTotalClaim adjustment services:1.1 Direct1.2 Reinsurance assumed1.3 Reinsurance ceded1.4 Net claim adjustment service (1.1 1.2 - 1.3)2.Commission and brokerage:2.1 Direct excluding contingent2.2 Reinsurance assumed, excluding contingent2.3 Reinsurance ceded, excluding contingent2.4 Contingent - direct2.5 Contingent - reinsurance assumed2.6 Contingent - reinsurance ceded2.7 Policy and membership fees2.8 Net commission and brokerage (2.1 2.2 - 2.3 2.4 2.5 - 2.6 2.7)3.Allowances to managers and agents4.Advertising5.Boards, bureaus and associations6.Surveys and underwriting reports7.Audit of assureds’ records8.Salary and related items:8.1 Salaries8.2 Payroll taxes9.Employee relations and welfare10.Insurance11.Directors’ fees12.Travel and travel items13.Rent and rent items14.Equipment15.Cost or depreciation of EDP equipment and software16.Printing and stationery17.Postage, telephone and telegraph, exchange and express18.Legal and auditing19.Totals (Lines 3 to 18)20.Taxes, licenses and fees:20.1 State and local insurance taxes deducting guaranty associationcredits of 20.2 Insurance department licenses and fees20.3 Gross guaranty association assessments20.4 All other (excluding federal and foreign income and real estate)20.5 Total taxes, licenses and fees (20.1 20.2 20.3 20.4)21.Real estate expenses22.Real estate taxes23.Reimbursements by uninsured plans24.Aggregate write-ins for miscellaneous expenses25.Total expenses incurred26.Less unpaid expenses - current year27.Add unpaid expenses - prior year28.Amounts receivable relating to uninsured plans, prior year29.Amounts receivable relating to uninsured plans, current year30.TOTAL EXPENSES PAID (Lines 25 - 26 27 - 28 29)(a)DETAILS OF WRITE-INS2499. Totals (Lines 2401 thru 2403 plus 2498)(Line 24 above)(a) Includes management fees of to affiliates and to non-affiliates.11

COMBINED STATEMENT FOR THE YEAR 2015 OF THE ALLSTATE INSURANCE COMPANY AND ITS AFFILIATEDPROPERTY/CASUALTY INSURERSEXHIBIT OF NET INVESTMENT .13.14.15.16.17.0999.1599.1Collected During Year(a)(a)(a)(a)(b)(b)U.S. Government bondsBonds exempt from U.S. taxOther bonds (unaffiliated)Bonds of affiliatesPreferred stocks (unaffiliated)Preferred stocks of affiliatesCommon stocks (unaffiliated)Common stocks of affiliatesMortgage loansReal estateContract loansCash, cash equivalents and short-term investmentsDerivative instrumentsOther invested assetsAggregate write-ins for investment incomeTotal gross investment incomeInvestment expensesInvestment taxes, licenses and fees, excluding federal income taxesInterest expenseDepreciation on real estate and other invested assetsAggregate write-ins for deductions from investment incomeTotal deductions (Lines 11 through 15)Net investment income (Line 10 minus Line 16)DETAILS OF WRITE-INSTotals (Lines 0901 thru 0903 plus 0998) (Line 9, above)Totals (Lines 1501 thru 1503 plus 1598) (Line 15, above)2Earned During Year(c)(d)(e)(f)(g)(g)(h)(i)(a) Includes accrual of discount less amortization of premium and less paid for accrued interest on purchases.(b) Includes accrual of discount less amortization of premium and less paid for accrued dividends on purchases.amortization of premium and less (c) Includes accrual of discount less (d) Includes for company’s occupancy of its own buildings; and excludes (e) Includes accrual of discount less amortization of premium and less (f) Includes accrual of discount less amortization of premium.investment expenses and (g) Includes .segregated and Separate Accounts.paid for accrued interest on purchases.interest on encumbrances.paid for accrued interest on purchases.investment taxes, licenses and fees, excluding federal income taxes, attributable to(h) Includes interest on surplus notes and (i) Includes depreciation on real estate and interest on capital notes.depreciation on other invested assets.EXHIBIT OF CAPITAL GAINS 0999.12345Realized Gain (Loss)On Sales or MaturityOther RealizedAdjustmentsTotal Realized CapitalGain (Loss)(Columns 1 2)Change inUnrealized CapitalGain (Loss)Change in UnrealizedForeign ExchangeCapital Gain (Loss)U.S. Government bondsBonds exempt from U.S. taxOther bonds (unaffiliated)Bonds of affiliatesPreferred stocks (unaffiliated)Preferred stocks of affiliatesCommon stocks (unaffiliated)Common stocks of affiliatesMortgage loansReal estateContract loansCash, cash equivalents and short-term investmentsDerivative instrumentsOther invested assetsAggregate write-ins for capital gains (losses)Total capital gains (losses)DETAILS OF WRITE-INSTotals (Lines 0901 thru 0903 plus 0998) (Line 9,above)12

COMBINED STATEMENT FOR THE YEAR 2015 OF THE ALLSTATE INSURANCE COMPANY AND ITS AFFILIATED PROPERTY/CASUALTY INSURERSSCHEDULE F - PART 1123420NAICCompanyIDDomiciliaryNumber CodeJurisdictionName of Reinsured0199999 Affiliates - U.S. Intercompany Pooling0299999 Affiliates - U.S. Non-Pool - Captive0399999 Affiliates - U.S. Non-Pool - Other0499999 Total - U.S. Non-Pool0599999 Affiliates - Other (Non-U.S.) - Captive0699999 Affiliates - Other (Non-U.S.) - Other0799999 Total - Other (Non-U.S.)0899999 Total - Affiliates0999998 Other U.S. Unaffiliated Insurers Reinsurance for which the total of Column 8 is lessthan 100,0000999999 Total Other U.S. Unaffiliated Insurers1099998 Pools and Associations - Reinsurance for which the total of Column 8 is less than 100,000 - Mandatory Pools1099999 Total Pools, Associations or Other Similar Facilities - Mandatory Pools1199998 Pools and Associations - Reinsurance for which the total of Column 8 is less than 100,000 - Voluntary Pools1199999 Total Pools, Associations or Other Similar Facilities - Voluntary Pools1299999 Total - Pools and Associations1399998 Other Non-U.S. Insurers - Reinsurance for which the total of Column 8 is less than 100,0001399999 Total Other Non-U.S. Insurers9999999 Totals5AssumedPremiumAssumed Reinsurance as of December 31, Current Year (000 Omitted)6Reinsurance On7Paid Losses andLoss AdjustmentKnown CaseExpensesLosses and LAE891011Cols. 6 ableUnearnedPremium12131415Amount of AssetsPledged orCompensatingFunds Held By orAmount ofBalances toDeposited WithAssets PledgedReinsuredor CollateralLetters of Credit Secure Letters ofCreditCompaniesHeld in TrustPosted

COMBINED STATEMENT FOR THE YEAR 2015 OF THE ALLSTATE INSURANCE COMPANY AND ITS AFFILIATEDPROPERTY/CASUALTY INSURERSSCHEDULE F - PART 21Premium Portfolio Reinsurance Effected or (Canceled) during Current Year2NAICComIDpanyNumberCode0199999 Total Reinsurance Ceded By Portfolio0299999 Total Reinsurance Assumed By Portfolio3456Name of CompanyDate ofContractOriginalPremiumReinsurancePremiumNONE21

COMBINED STATEMENT FOR THE YEAR 2015 OF THE ALLSTATE INSURANCE COMPANY AND ITS AFFILIATED PROPERTY/CASUALTY INSURERSSCHEDULE F - PART 31IDNumber2NAICCompanyCode3Name of Reinsurer4DomiciliaryJurisdiction5Ceded Reinsurance as of December 31, Current Year (000 Omitted)6ReinsuranceContractsCeding 75%or More 199999 Total Authorized - Affiliates - U.S. Intercompany Pool0299999 Total Authorized - Affiliates - U.S. Non-Pool - Captive0399999 Total Authorized - Affiliates - U.S. Non-Pool - Other0499999 Total Authorized - Affiliates - U.S. Non-Pool0599999 Total Authorized - Affiliates - Other (Non-U.S.) - Captive0699999 Total Authorized - Affiliates - Other (Non-U.S.) - Other0799999 Total Authorized - Affiliates - Other (Non-U.S.)0899999 Total Authorized - Affiliates0999998 Total Authorized - Other U.S. Unaffiliated Insurers (Under 100,000)0999999 Total Authorized - Other U.S. Unaffiliated Insurers1099999 Total Authorized - Pools - Mandatory Pools1199999 Total Authorized - Pools - Voluntary Pools1299998 Total Authorized - Other Non-U.S. Insurers (Under 100,000)1299999 Total Authorized - Other Non-U.S. Insurers1399999 Total Authorized1499999 Total Unauthorized - Affiliates - U.S. Intercompany Pooling1599999 Total Unauthorized - Affiliates - U.S. Non-Pool - Captive1699999 Total Unauthorized - Affiliates - U.S. Non-Pool - Other1799999 Total Unauthorized - Affiliates - U.S. Non-Pool1899999 Total Unauthorized - Affiliates - Other (Non-U.S.) - Captive1999999 Total Unauthorized - Affiliates - Other (Non-U.S.) - Other2099999 Total Unauthorized - Affiliates - Other (Non-U.S.)2199999 Total Unauthorized - Affiliates2299998 Total Unauthorized - Oth

Esurance Insurance Company of New Jersey 21741 WISCONSIN Esurance Property and Casualty Insurance Company 30210 WISCONSIN a. Is this an original filing? Yes [ X ] No [ ] b. If no, 1. State the amendment number 2. Date filed 3. Number of pages attached NOTE: This annual statement contains combined data for the property and casualty insurance .