Transcription

FIT103Payroll FundamentalsMaintaining HR Records for Payroll

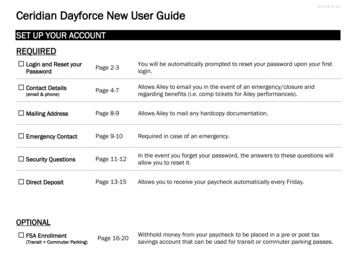

Training Guide IconsIconUseComputer-based activity for the student to perform. Written steps are notincluded.Written activity for the student to perform.Instructor demonstrates a process.Where to find more information on the subject.TipComputer-based activity for the student to perform. Written steps are included.Failure to heed the warning can lead to loss of data.Question or problem for the student to think about and the class to discuss.Solution to a computer-based or written activity.E19A1001Copyright 2019 Ceridian HCM, Inc. All rights reserved.

FIT103 - Maintaining HR Records for PayrollContents3ContentsTraining Guide Icons .2Overview .5Learning Objectives. 6Prerequisites . 6Available Resources . 6Our Training Scenario. 6Introduction to the HR Record .7Data Gate . 7View Employee Information in People. 8Using the Sidebar. 11Update Employment Status .13Pre-Start . 14Active . 14Inactive . 14Terminated . 14Update Employee Taxes .16Work Location . 16Work Location Change Example. 20Employee Address . 22Address Change Example . 25Tax Definitions . 27Add New Taxes . 28Defining Federal and State Tax Information . 29Employee Payroll Tax. 33Update Employee Deductions and Earnings .39Payroll Elections. 39Scheduled Deductions . 40Generated Earnings . 44Arrears & Balances . 46Prepaid Items. 52Prepaid Taxes . 52Prepaid Deductions . 53Prepaid Earnings . 53Wage Attachments . 53Payee Information . 54Wage Attachment Details . 55Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

4Training Guide IconsFIT103 - Maintaining HR Records for PayrollHow Employees Are Paid. 60Paper Check . 61Direct Deposit . 62General Details . 63Banking Details . 64Splitting Pay Among Multiple Accounts . 65Payroll Card. 68Issue Payroll Card to Employee . 69Define What to Deposit on Payroll Card . 70View Earning Statements . 71Compensation. 74Audit Employee Changes . 75Employee Changes Report. 75Glossary of Terms . 77Methods and Frequency of Payment . 77Earnings . 77Benefits. 78Deductions . 78Other Terms . 79Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Maintaining HR Records for PayrollOverview5OverviewWelcome to Maintaining HR Records for Payroll - US. This course is intended for payroll administrators. Thiscourse discusses HR record maintenance that is specific to payroll processing. It describes how to makecertain changes to an employee’s HR record and explains how those changes impact payroll. Updates toemployees’ HR records are typically performed by either Payroll Administrators or HR Administrators. It isimportant that you understand the impact of making changes to an employee’s HR record to ensureaccurate payroll processing.The following sections are included in this course:SectionDescriptionIntroduction to the HR RecordIntroduces the employee HR record as it relates topayroll. Also, introduces the People feature andexplains how it is used to view and updateemployee records.Update Employment StatusDiscusses how employment status is tied to statustype and how status type impacts an employee’spay.Update Employee TaxesExplains how taxes are viewed and modified in theTax Definitions screen. In addition, it describes howchanges to an employee’s primary residence andprimary work location can impact his or her taxes.Update Employee Deductions and EarningsDiscusses how scheduled deductions, generatedearnings, arrears and balances, and wageattachments are assigned to employees in the HRrecord.How Employees Are PaidDescribes the three different payment methodsused to pay employees. Also, explains whereadministrators can view earning statements andwhat details are displayed on them.Audit Employee ChangesExplains how to use the Employee Changes Reportto view and audit changes made to employeerecords.Glossary of TermsThese terms define payroll concepts and commonlyused payroll terminology. Many of these terms andconcepts are used throughout the course andDayforce.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

6OverviewFIT103 - Maintaining HR Records for PayrollLearning ObjectivesBy completing this course, you will be able to: Describe how the HR record impacts payroll processing Explain how employment status and status type impact employee pay Describe how changes to an employee’s primary work location or primary residence can impact hisor her taxes Modify employee taxes on the Tax Definitions screen Assign scheduled deductions and generated earnings to an employee Set up arrears and balances Enter prepaid taxes, earnings, or deductions Set up a wage attachment for an employee Change an employee’s payment method View an employee’s earnings Audit changes made to employee recordsPrerequisitesCertain Dayforce courses are required as prerequisites prior to attending this course. The following courseswill provide the foundational knowledge you need to understand the key Dayforce features discussed in thiscourse. Viewing HR Records – Discusses how to filter, open, and view employee HR records Administering Employee HR Information – Discusses the information found within employee HRrecords Understanding Deductions and Earnings in Dayforce – Provides an overview of deductions andearnings in Dayforce, including when they are applied and where they are recordedAvailable ResourcesA variety of supporting guides are available through support.ceridian.com. Talk to your organization’ssupport user or Implementation Consultant for help with obtaining these guides, depending on if you are inimplementation or live. Admin and User Guideso Payroll Administrator Guideo HR Admin GuideOur Training ScenarioThe best way to learn about Dayforce is to practice using it. You will be utilizing the following trainingscenario throughout the class to reinforce discussions and examples.XYZ Company is a multinational company that has started using Dayforce. Today you will act as anadministrator at XYZ Company as you update payroll-related information in employee HR records.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Maintaining HR Records for PayrollIntroduction to the HR Record7Introduction to the HR RecordEach employee at an organization has what is known as an ‘HR record’. This record contains the personaland work-related information for an employee and is utilized by all modules in Dayforce.Information recorded in an employee’s HR record often impacts how an employee’s pay is calculated. It isimportant to maintain this information in real time to ensure its accuracy. Data such as an employee’sprimary work assignment, primary residence, and tax definitions can impact the employee’s taxes. Payrollelections and the payroll policy can also impact what is included in the employee’s payroll calculation andultimately affect the employee’s net pay.Data GateYour organization may have set up a data gate, which is a timeframe during the pay period that Dayforcedelays workflows affecting employee information. When the data gate is closed, workflows that impact apay run are paused. Once the data gate is opened, these workflows are automatically resumed andprocessed appropriately. This is important to keep in mind for self-service changes that employees maysubmit using a form. For example, if an employee submitted a new address while the data gate was closed,the new address, and therefore any new applicable taxes, would not be recorded until the data gatereopens.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

8Introduction to the HR RecordFIT103 - Maintaining HR Records for PayrollView Employee Information in PeoplePath: People [Load Employee Profile]The People feature provides a central access point to quickly view and manage an employee’s HR record. Itincludes employee details, such as payroll elections, tax definitions, and earning statements for a singleemployee.People can be quickly accessed from any screen within Dayforce. Click the People icon in the ApplicationContainer to open the feature.You can use the Filter panel to search for employee records. Information pertaining to the employee orgroup of employees you are looking up can be entered. Enter the relevant search criteria and click ApplyFilter.Once opened, the address book appears in the lower panel of the screen. It lists the employee or employeesthat you can access and who meet the filter criteria. This list displays the employee’s name, employeenumber, primary address, primary work assignment, and employment status.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Maintaining HR Records for PayrollIntroduction to the HR Record9Select the relevant employee from the list, then click View Profiles to open the HR record.You can load one or more employee records within People. This allows you to navigate between employeerecords without closing the Profile screen or creating a new filter search.To open more than one employee record, select the checkbox to the left of the names of the employees youwant to view, then click View Profiles. This brings up the Profiles screen.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

10Introduction to the HR RecordFIT103 - Maintaining HR Records for PayrollThe Profile screen displays the record for the first employee in the list.You can use the left and right arrows to navigate between employee records.Another way to navigate between the screens is to click the drop-down arrow and select the employee’sname.If you need to return to an employee’s record after you’ve closed it, you can change your employee list fromSelected Employees to Recently Viewed.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Maintaining HR Records for PayrollIntroduction to the HR Record11A list of the most recently viewed employees will display.You can also load an employee record by typing the name or employee number in the Search Name,Employee Number search bar.Using the SidebarOn the left side of each profile, the employee’s information is grouped by section, across several tabs in thesidebar. The sidebar allows you to expand each section to quickly view or manage information in a specifictab.Dayforce continues to display the sidebar until you collapse it. To collapse the sidebar, click the collapsesidebar icon.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

12Introduction to the HR RecordFIT103 - Maintaining HR Records for PayrollClick Back to create a new Filter search, or click X to return to the previous screen in the application that youwere working on.Separate access authorizations can be enabled for employee garnishment, payroll election, and taxdefinition information, so that users can be assigned read-only access if necessary. This is controlled on theAuthorizations tab of System Admin Roles.Activity: Open an Employee Record in PeopleTime: 1 minuteOpen the Employee Record for Bruce Parker in People.Solution: Open an Employee Record in PeopleOpen Bruce Parker’s record:Path: People1. Click People.2. Type “Bruce Parker” in the Name field.3. Click Apply Filter.4. Select Bruce Parker from the search results.5. Click View Profiles.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Maintaining HR Records for PayrollUpdate Employment Status13Update Employment StatusThe employment status defines whether the employee is available for work. It can also describe why anemployee is not available for work.An employee’s status is indicated and updated in his or her HR record. It is maintained in the Employmentstatus section of the Employment Employment, Compensation and Policy Settings screen in the Peoplefeature.An employee’s employment status displays in the Employment Status list.Based on the configuration of your organization’s statuses in HR Admin Status, you could have multiplestatuses available to select from.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

14Update Employment StatusFIT103 - Maintaining HR Records for PayrollAs illustrated above, each status must be tied to one of four Status Types used in Dayforce: Pre-Start – Not available to work yet Active – Available to work Inactive – Not available to work Terminated – No longer employed by the organizationThe Status Type is important since it impacts several areas of payroll processing. Throughout this section,you will learn about the key impacts to payroll processing for employees who are assigned statuses with theActive, Inactive, and Terminated Status Type.Pre-StartA Pre-Start Status Type indicates that an employee has accepted an employment offer, but the employeehas not started working. This means the employee will have limited access to Dayforce prior to his or herfirst day.ActiveAn Active Status Type indicates that an employee is available and ready for work. This means that theemployee will be available on the schedule and on the timesheet. In addition, all applicable time-driven,generated earnings, and auto pay earnings will be paid to them, in addition to any entry made directly inPayroll.InactiveAn Inactive Status Type indicates that an employee is still employed by the organization but is not availablefor work.When an employee is Inactive, from the effective date of the Inactive status, the employee is removed fromthe schedule. The employee will still show up in the timesheet; however, you can only record a payadjustment in the timesheet for the date of the Inactive status moving forward. You cannot record any othertime or punches. Any days prior to that Inactive status date within that same pay period will still flow over topayroll. If required, you are still able to enter adjustments or quick entries in Payroll for the employee.Your organization’s set up of its Auto Pay Rule in the Payroll Policy determines if auto pay employeesstop receiving auto pay while inactive. This is based on the Consider inactive statuses as paytermination checkbox being selected in the Payroll Policy.TerminatedA Terminated Status Type indicates that an employee is no longer employed by your organization and istherefore no longer available for work. After the employee’s termination date, the employee is removedfrom the schedule and you cannot record anything for the employee in the timesheet.One of the most important fields in the Termination form is Last Pay Date. If the employee does not receiveauto pay, record the last day of the employee’s last pay period or a future date in the Last Pay Date field ifCopyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Maintaining HR Records for PayrollUpdate Employment Status15the employee should receive a check issued in Dayforce beyond the employee’s Termination Date. Withoutmanually adding terminated status employees, they are only included in a pay run if their last pay date is setto a date that occurs during or after the current pay period.For more information on managing terminated employees in Payroll, see the “Including TerminatedStatus Employees in Pay Runs” section of the Payroll Administrator Guide.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

16Update Employee TaxesFIT103 - Maintaining HR Records for PayrollUpdate Employee TaxesAn employee’s taxes are determined based on his or her primary work location and primary residence. Bothpieces of information are stored in the HR record, and if either location were to change, there could be animpact to the employee’s taxes. If taxes are impacted, Dayforce automatically applies any new taxes to theemployee’s record.All taxes that are applied to the employee are viewable in one central location in the Payroll TaxDefinitions screen of the People feature. The employee’s federal and state filing status, exemptions, andadditional withholding specified on the W-4 form are recorded here as well.Throughout this section you will learn how changes to an employee’s primary work location and primaryresidence can impact an employee’s taxes. In addition, you will view and maintain tax elections in the TaxDefinitions screen. Before we look at how to maintain this information, let’s first review how taxes arecalculated in Dayforce.Work LocationPath: People [Load Employee Profile] Work Work AssignmentsAn employee’s primary work location is stored in the HR record along with details of the work assignment.The work location can be updated directly in the HR record or, if Self Service is enabled, managers oradministrators can submit the change via the self-service Position Change form.Organizations that have multiple work locations may need to move an employee from one work location toanother in Dayforce. Moving an employee to a different work location allows the employee to display on thecorrect timesheet and schedule.The work location is important to payroll processing because it determines the employee’s tax jurisdiction,along with the employee’s primary residence address. If an employee’s primary work location changes to awork location in a different state, his or her taxes would be impacted. It is important to ensure that eachemployee’s work location is recorded accurately for the taxes to be calculated properly.Taxes could also be impacted if an employee moves to a different county within the same state, if there areapplicable county taxes. Also, taxes could be impacted if a virtual employee changes to working at a site, andvice versa.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Maintaining HR Records for PayrollUpdate Employee Taxes17The Work Assignments page is divided into three sections: General Payroll Pay InformationTo move an employee to a different work location, click Add to create a new work assignment with thefollowing fields required to be completed: Position, Location and Effective From.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

18Update Employee TaxesFIT103 - Maintaining HR Records for PayrollAll the mandatory fields are within the General section. The employee’s job position is selected from thePosition list.The employee’s work location is selected in the Location list. The Location options available in this listdepend upon the Position that was selected. If the Location is selected first when you create a new workassignment, only positions that are configured for the new work location display in the Position list.The Primary checkbox is used to set the employee’s main position and location. If the Primary checkbox iscleared, Dayforce considers this position a secondary work assignment. The employee’s taxes may or maynot be impacted by secondary work assignments depending on many factors, such as various reciprocityagreements between states associated to the work assignments, pay group settings for Pay ThroughPrimary Legal Entity and Multi-Jurisdictional defined in Pay Setup Pay Group Payroll Properties ortaxation settings defined at the employee allocation level. Override and virtual settings currently only applyto the primary work assignment; employees with these settings may need some creative settings if postedto multiple assignments.The Effective From field specifies the date when the new work location applies to the employee’s record. Ifthe employee’s taxes are updated because of the change in work assignment, the applicable taxes will beapplied as of the effective date.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Maintaining HR Records for PayrollUpdate Employee Taxes19The Virtual checkbox is within the Payroll section. It is used to create a work location override for employeeswhose physical work address differs from the location assigned to them in Dayforce. This is typically used forvirtual employees who work from home. When the Virtual checkbox is selected, the tax locator enginetreats the employee’s primary residence as his or her work address and all taxes are calculated based on thehome address, since it is the physical location where work is performed. When an employee does not workfrom home but works remotely from an address other than the location assigned, another address can beselected from the Work Location Overrides list.The Labor % field specifies the percentage amount by which to distribute the employee’s pay to this workassignment.After the appropriate information, has been recorded, click Save to save the new work assignment. This willtrigger any new taxes to be added to the employee. A notification will appear to inform you that theemployee’s taxes have been updated.Within People you can set up a separate primary Pennsylvania taxation worksite for employees incompliance with Pennsylvania Act 32. This configuration is recommended when multi jurisdictiontaxation is enabled for the employee’s pay group. Select the PA Taxation Worksite checkbox in People Work Assignments for one Pennsylvania worksite to configure it as the employee’s primary for localtaxation purposes. Once configured, Dayforce applies the local tax from the primary Pennsylvaniaworksite’s jurisdiction to all Pennsylvania-based pay within the pay run. The city of Philadelphiaremains exempt from this requirement and continues to be taxed separately.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

20Update Employee TaxesFIT103 - Maintaining HR Records for PayrollWork Location Change ExampleLet’s look at an example of how a change in work location can impact an employee’s taxes.Amy Butler is changing primary work assignments. She is moving from Plant 1 Management to Plant 3Management; and Plant 3 is located in a different state.Amy’s new work assignment is added to her HR record to reflect her change to Plant 3 Managementeffective 10/08/2017. Once the new work assignment is saved, the tax locator updates the tax informationfor the employee.A notification appears to inform you that the employee’s taxes were updated successfully. If there are anynew taxes added to the employee as a result of the primary work location change, the notification will tellyou how many new taxes were added. An employee’s new taxes can be reviewed in the Payroll TaxDefinitions screen of the People feature.If you add a primary work assignment for an employee and that employee has another workassignment with schedules already populated into the future, or containing future timesheet punches,Dayforce will maintain that secondary work assignment through the last dated punch or scheduled day.Amy’s taxes have been impacted because her new work location is in a different tax jurisdiction from her oldwork location. You can confirm the address of the new location in Org Setup Organization.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Maintaining HR Records for PayrollUpdate Employee Taxes21We can see that Amy’s original location, Plant 1 Management, is located in New Jersey.However, her new location, Plant 3 Management, is located in New York. This means that New York taxeswere added to Amy’s HR record when the new work location was saved.The new taxes that are applied to her record are viewable in the Employee Payroll Tax section of the Payroll Tax Definitions screen, located in the profile.Any new taxes applied as a result of the change in work location are illustrated with

FIT103 Payroll Fundamentals Maintaining HR Records for Payroll. Copyright 2019 Ceridian HCM, Inc. All rights reserved. Training Guide Icons