Transcription

FIT103Payroll FundamentalsProcessing a Pay Run with One-TimeChanges and Corrections

Training Guide IconsIconUseComputer-based activity for the student to perform. Written steps are not included.Written activity for the student to perform.Instructor demonstrates a process.Where to find more information on the subject.TipComputer-based activity for the student to perform. Written steps are included.Failure to heed the warning can lead to loss of data.Question or problem for the student to think about and the class to discuss.Solution to a computer-based or written activity.E19A1001Copyright 2019 Ceridian HCM, Inc. All rights reserved.

FIT103 - Processing a Pay Run with One-Time Changes and CorrectionsContents3ContentsOverview .5Learning Objectives. 6Prerequisites . 6Available Resources . 6Our Training Scenario. 7Enter One-Time Changes in Payroll .8One-Time Deductions and Earnings. 10Dayforce Payroll Term: Check . 11Check Templates . 11Use Quick Entries .14Record a Quick Entry. 14Import Quick Entries . 18Issue Checks .20Record an Additional Check . 21Record Basic Information . 21Record the Check Details . 22Import Checks. 25Record a Manual Check. 26Record Mark as Pay Out Checks . 28Record an Onsite Check . 31Onsite Check Printed Locally . 31Onsite Check Loaded onto a Payroll Card . 33Audit Checks . 36Audit Payroll Changes .37Correct an Employee’s Hourly Rate or Salary. 39Void Payments .44Request Stop Payment or Direct Deposit Reversal. 45Add Auto Void. 46Correct HR Record Details . 48Reissue Check . 48Add Adjustments.50Record Prior Period Adjustments . 52Data Entry .54Use Off-Cycle Pay Runs.55Create an Off-Cycle Pay Run. 57Edit and Delete an Off-Cycle Pay Run . 58Decide on a Correction Method .61Overpaid. 62Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

4ContentsFIT103 - Processing a Pay Run with One-Time Changes and CorrectionsUnderpaid. 63Wrong Code. 64Glossary of Terms . 66Methods and Frequency of Payment . 66Earnings . 66Benefits. 67Deductions . 67Other Terms . 70Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Processing a Pay Run with One-Time Changes and CorrectionsOverview5OverviewWelcome to Processing a Pay Run with One-Time Changes and Corrections for the U.S. This course buildson the Processing a Simple Pay Run – US course where you learned how to process a basic payroll inDayforce. While it’s beneficial to begin by learning how to process a simple pay run, in a typical pay runpayroll administrators may also have to make one-time changes, such as additional payments andentries. As well, you may have to make corrections, such as voiding payments and making entries in anoff-cycle pay run. This course explains how to make several common one-time changes and correctionsin the Payroll feature. You will learn how to enter quick entries, checks, and adjustments in a pay run, aswell as how to process a pay run that is outside a regularly scheduled run.The following sections are included in this course:SectionDescriptionEntering One-Time Changes in PayrollIntroduces the Payroll functionality you will use to includeadditional payments and entries in a pay run, makeadjustments to prior pay runs, and create off-cycle pay runs.Quick EntryExplains how to use quick entry to record one-time earningsand deductions that should be included on an employee’spay and make payroll corrections.ChecksDescribes how checks are used to record additionalpayments or transactions that are not part of the employee’snormal pay in Dayforce. This module explains the three checktypes, as well as when and how you would record each.Audit Payroll ChangesHighlights the importance of performing a preview auditafter entering one-time changes and corrections in a pay run.Also, it describes how to correct an employee’s hourly rate orsalary in People and how to recalculate the rate associatedwith the employee’s time-driven earnings.Void PaymentsExplains the process you need to follow to stop an employeefrom receiving a check after it is committed.AdjustmentsExplains when and how you would record an adjustment toreclassify earnings, deductions, or wages from a prior payperiod that have already been committed.Data EntryIntroduces the Data Entry tab that provides a central locationwhere you can make one-time changes across pay runs, paygroups, and countries. It allows you the ability to workoutside of the context of a specific pay run.Off-Cycle Pay RunsExplains when and how to create pay runs outside of theregularly scheduled runs. Off-cycle pay runs are used to payemployees outside of their normal pay schedule.Decide on a Correction MethodPresents a series of flowcharts that help you decide theappropriate correction method for your situation.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

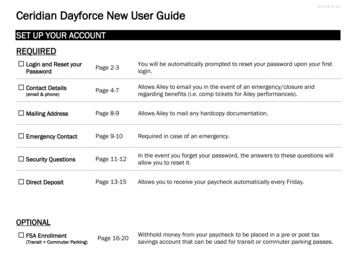

6OverviewFIT103 - Processing a Pay Run with One-Time Changes and CorrectionsSectionDescriptionGlossary of TermsThese terms define payroll concepts and commonly usedpayroll terminology. Many of these terms and concepts areused throughout the course and Dayforce.Learning ObjectivesBy completing this course, you will be able to: Define the terms “check” and “check template” as they are used in Dayforce Explain the difference between the three types of checks that can be processed in Dayforce Enter one-time deductions and earnings for a pay run as quick entries and checks Import quick entries and checks Enter corrections in a pay run Void payments Enter adjustments Correct an employee’s hourly rate or salary Process an off-cycle pay run Decide which correction method to usePrerequisitesCertain Dayforce courses are required as prerequisites prior to attending this course. The followingcourses will provide the foundational knowledge you need to understand the key Dayforce featuresdiscussed in this course. Understanding Deductions and Earnings in Dayforce – Explains when deductions and earningsare applied during the payroll process and where they are recorded in Dayforce Maintaining HR Records for Payroll – US – Discusses how changes to key information in an HRrecord impact payroll processing Processing a Simple Pay Run – US – Provides an introduction of the Payroll feature and explainshow to process a basic pay run without any additional payments or correctionsAvailable ResourcesA variety of supporting guides are available through support.ceridian.com. Talk to your organization’ssupport user or Implementation Consultant for help with obtaining these guides, depending on if youare in implementation or live. Admin and User Guides:o Payroll Administrator Guideo Pay Approval Guideo Reporting Reference GuideCopyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Processing a Pay Run with One-Time Changes and CorrectionsOverviewYou may also find it useful to review the following training, available in the Ceridian Education Center: Introduction to Source Tax Online (Video)o Ceridian Source Tax Online User’s GuideOur Training ScenarioThe best way to learn about Dayforce is to use the application. The following sample company is usedthroughout the class to reinforce concepts and processes.XYZ Company is a multinational company that is using Dayforce. Today you will act as a payrolladministrator at XYZ Company and make several routine changes to employee pay information in thePayroll feature to accurately pay your employees.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved7

8Enter One-Time Changes in PayrollFIT103 - Processing a Pay Run with One-Time Changes and CorrectionsEnter One-Time Changes in PayrollAs you know, a typical pay run involves much more than the basics you learned about in the Processinga Simple Pay Run – US course. To accurately pay your employees, you need to be able to add additionalentries to the current pay run as well as make one-time changes. Some common examples includepaying out a quarterly bonus or commission, decreasing an employee’s loan deduction amount for thecurrent pay run only, recording a check in Dayforce that was paid out of another account, and creating acheck on demand for an employee who lost theirs.The following items are changes can be made using the Payroll feature. This course explains how to useeach method, and also helps you decide which method may be best suited to a particular situation: Quick Entry – Used to create one-time deductions and earnings that should be included inemployee pay. This could include additional amounts or adjustments to existing amounts. Checks – Used to record additional payments that are not a part of the employee’s normal payor in situations that require corrections. Void Payments – Used to remove the amount and hours on the check from the employee’spayroll records in Dayforce to ensure that MTD, QTD, and YTD records are accurate for tax filingpurposes. Adjustments – Used to reclassify earnings, deductions, or wages from pay periods that havealready been committed and paid. Off-Cycle Pay Runs – Used to process a pay run that is outside a regularly scheduled run.Many one-time changes, such as Quick Entry, Checks, and Adjustments can be entered in two differenttabs within the Payroll feature. Pay Run Management – Allows you to load and work in a specific pay run to enter one-timechanges, in addition to previewing, auditing, and committing the pay run. Data Entry – Provides a central location to enter one-time changes across different pay runs,pay groups, and countries. It allows you to work outside of the context of a specific pay run.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Processing a Pay Run with One-Time Changes and CorrectionsEnter One-Time Changes in Payroll9During this course, we will complete a pay run that has one-time changes. We will focus on exploring theQuick Entry, Checks, Adjustments, Voids step of the Payroll Processing Diagram.If you are adding many one-time changes to the pay run, you will go through an iterative cycle, asoutlined below, to preview the changes using the auditing tools available in the Payroll feature to ensurethat all changes were entered accurately. Performing a Preview Audit helps to ensure that the pay run isaccurate prior to locking the pay run.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

10Enter One-Time Changes in PayrollFIT103 - Processing a Pay Run with One-Time Changes and CorrectionsActivity: Load and Calculate the Current Pay RunTime: 3 minutesYou will be working with the USA Hourly pay group for the current pay run. Commit Time andAttendance data for the USA Hourly pay group, using the Pay Admin Checklist. Then Load and Calculatethe pay run in the Payroll feature.Solution: Load and Calculate the Current Pay RunCommit Timesheets for the USA Hourly pay group:Path: Pay Admin Checklist1. Select the most recently completed USA Hourly pay period.2. Select the Locked checkbox for each location.3. Select the Committed checkbox for each location.4. Click Save.Load the pay run for the USA Hourly pay group:Path: Payroll Overview1. Select the checkbox for the most recently completed USA Hourly pay period (that you justapproved WFM for).2. Click Load Pay Run.Calculate the Pay Run in the Pay Run Management tab:Path: Payroll [Load Pay Run] Pay Run Management1. Click Calculate in the Process Job list.One-Time Deductions and EarningsOne-time deductions and earnings can be added to an employee’s pay as either a quick entry or a check.This topic explains the conceptual information that applies to both. You will learn how to enter thesetransactions in subsequent sections.In a typical pay run, employees may have one-time deductions or earnings that need to be included.Examples of one-time amounts that need to be applied to an employee’s pay are bonuses, commissions,and lump sum charitable donations.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Processing a Pay Run with One-Time Changes and CorrectionsEnter One-Time Changes in Payroll11Since one-time amounts are specific to a single pay run, and not recurring, they are not added to anemployee’s HR record. As a result, these amounts do not automatically appear in the preview when youcalculate the pay run in Payroll. Instead, one-time deductions and earnings are usually entered by anadministrator, as required, directly in Payroll prior to committing the pay run. These amounts are addedto an employee’s pay as either a quick entry or an additional check.The Quick Entry sub-tab in Payroll allows you to add or modify earnings, deductions, or taxes that shouldbe paid to or deducted from your employees.The Checks sub-tab allows you to process manual, onsite, and additional checks for employees.One-time amounts can be recorded at any time during payroll processing, even for future pay periods.For example, if you know the amount of bonuses that are being paid on next month’s pay run, you canload the appropriate pay run at any time and record the details of the bonuses.Once one-time deductions and earnings have been entered via quick entry or check, it is recommendedthat you perform a preview audit to ensure the entries are accurate prior to committing the pay run.To fully understand the process of how to enter these amounts, we must first discuss the Dayforceterms check and check template, as the appropriate check template must be selected.Dayforce Payroll Term: CheckOne of the most important terms to understand while processing pay in Dayforce is check because it canbe used to mean different things. When most people hear the word check, they think of a paper check.In Dayforce, when we say “check” we just mean a payment or payroll entry. For example, an employee’sbonus can be paid on his or her normal check, meaning that it is included with the employee’s regularpay. However, this does not mean that the bonus is necessarily paid using a paper check. Similarly,recording what we call an additional check means that the employee receives a separate payment witha separate earning statement that displays the details of this payment. It’s always going to be thedefined payment method that determines how that payment reaches the employee.Check TemplatesAll payments that employees receive are associated with a check template.A check template indicates which generated earnings, deductions, and taxes are to be automaticallyincluded on a particular employee payment.By default, the “Normal” check template has already been configured to apply any generated earnings,auto pay earnings, deductions, or taxes that would be applied by the employee’s payroll policy.Typically, this check template is used for all regular payroll payments in regular pay runs.When using a check template other than “Normal”, Dayforce automatically creates a second payment tothe employee. This second payment can be disbursed to an employee as a paper check, direct deposit,or payroll card.Additional check templates are created for specific scenarios to restrict which generated earnings,deductions, and taxes are applied to that particular payment so that they are not incorrectly applied.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

12Enter One-Time Changes in PayrollFIT103 - Processing a Pay Run with One-Time Changes and CorrectionsFor example, a parking fee or medical premium that is deducted from a regular check would notnecessarily be deducted from a bonus payment. Therefore, a “Bonus” check template should be createdand configured to prevent these certain scheduled deductions, but to still apply the appropriate taxesfrom being withheld when the Bonus check template is used.Check templates may be created as needed for situations such as bonus pay, commission pay, orreimbursements. Once check templates are created, they can be assigned when quick entries andchecks are recorded.Check templates can also be configured to ignore either direct deposit or payroll card options asdisbursement methods. If this is configured, the disbursement method specified in the check templatewill override the employee’s regular payment method set up in his or her HR record.In addition, you can configure separate check templates for the appropriate employment types. Thisallows you to pay employees both regular pay and contractor or pensioner pay simultaneously and issueeach type of tax form when appropriate. Based on the configuration of the check template, the earningswill be mapped to the corresponding US tax form.Let’s view an example of a 250.00 bonus entered as a Quick Entry using the Bonus check template.When the Bonus check template is selected, Dayforce knows which earnings, deductions, and taxes toapply. Since the template was configured to only deduct 401(k), and exclude all other scheduleddeductions, on Brad’s bonus check, only 401(k) will be deducted from his bonus payment. In addition,the template was configured to only apply the 401(k) Match generated earning and to use theSupplemental Flat Rate to calculate applicable taxes.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Processing a Pay Run with One-Time Changes and CorrectionsEnter One-Time Changes in Payroll13As you can see on the above earning statement for Brad’s 250.00 bonus payment, only 401(k) wasapplied as a deduction and the 401(k) Match as a generated earning. In addition, the Federal W/H taxeswere calculated using the 25% Supplemental Flat Rate.Understanding the difference between check templates is important in ensuring that the correctgenerated earnings, deductions, and taxes are applied. You need to select the appropriate checktemplate to be applied to payments entered as quick entries or checks.In addition to setting up supplemental taxation at the check template level, you can configuresupplemental taxation at the earning level so that earnings are taxed properly.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

14Use Quick EntriesFIT103 - Processing a Pay Run with One-Time Changes and CorrectionsUse Quick EntriesQuick entries are used to record one-time deductions and earnings for an employee that should beincluded on his or her pay. They can also be used to enter payroll corrections. These one-time amountsare recorded in Payroll since they are not recurring amounts which reside in the employee’s HR record,and they are not time-driven earnings from the timesheet.You can record a quick entry to: Add or subtract new earning or deduction amounts Modify the amount of an earning, deduction, or tax to allow the amounts to accurately reflectwhat the employee should earn, have deducted, or pay in taxes Replace amounts, the employees’ position, or the work location for existing earnings ordeductionsSome examples of quick entries you may need to include are earnings such as a bonus or commission,and deductions such as a one-time charitable donation. When you record a 250.00 bonus as a quickentry, the employee is paid this additional amount as part of his or her regular run once you commit thepay.Depending on your organization’s policy, time-driven earnings and generated earnings could berecorded as quick entries if necessary.Record a Quick EntryPath: Payroll [Load Pay Run] Pay Run Management Quick EntryTo add a new quick entry, click Add on the Quick Entry sub tab of Pay Run Management. At minimum,you must complete the Employee Name or Employee No., Code, and Hours or Amount fields to recordthe quick entry.Enter the Employee Name or Employee No. of the employee that is receiving the quick entry. OnlyActive and Inactive employees in the pay group you have open will be available to select from in thesetwo fields. Terminated employees need to be added to the pay run using the Terminated button.Enter the appropriate deduction, earning, or tax code to be applied in the Code field.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Processing a Pay Run with One-Time Changes and CorrectionsUse Quick Entries15Use either the Hours or Amount field to specify how much the employee will be paid for thecorresponding code entered. Depending on which earning, deduction, or tax code was entered,restrictions may apply. For example, if you enter a Medical deduction for the code, you will be unable toenter a value in the Hours field.The Replace checkbox allows a replacement of payroll election entered in the HR record with the detailsof this quick entry. When the Replace checkbox is cleared, the quick entry will be added or subtractedfrom any existing details in the employee’s pay run with a matching code. If the employee does not havea matching code on the given pay run, Dayforce adds it with the corresponding value. For example, if anemployee has a 20.00 parking subsidy as a payroll election and a 25.00 parking subsidy is alsorecorded as a quick entry with the Replace checkbox cleared, these two amounts will be combined for a 45.00 parking subsidy on the given pay run.Select the check template to be applied to the quick entry, if necessary, by typing the name of the checktemplate in the Check Template field. The Check Template field automatically populates the NormalTemplate unless the earning code is attached to a specific check template. As referenced earlier, thecheck template determines which earnings, deductions, and taxes are applied to the employee’s pay.The PPN field allows a different pay period number to be associated to the quick entry for recordkeeping purposes.Use the Pay Periods for Tax column to specify a number of pay periods over which to tax theemployee’s quick entry payment.When you have finished entering the details of the quick entry, click Save to apply it to the employee.Dayforce maintains a complete list of any quick entries that have been recorded for the pay run andsaved in the Quick Entry tab.To find out more information about who recorded a quick entry and when it was recorded or modified,click Audits in the toolstrip. This is beneficial when there are multiple administrators who are recordingentries or to confirm who recorded or modified a future entry.Once you have recorded your quick entries, you can edit them by selecting the applicable quick entryand: Clicking Delete to delete it. Clicking Copy to copy it. Double-clicking in any field to edit its value.After saving, you can review the results of your quick entries in the Preview sub-tab.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

16Use Quick EntriesFIT103 - Processing a Pay Run with One-Time Changes and CorrectionsYou can navigate the Quick Entry page more efficiently using your keyboard. Press TAB to move fromfield to field. Within the cells, begin typing to activate a menu of matching items. For example, in theEmployee Name field, typing “De” brings up a list of employees with “De” in their name.For more information, see the ”The Quick Entry Sub-tab” section of the Payroll Administrator Guide.Activity: Record Quick Entries for the Current Pay RunTime: 4 minutesYou were notified that there are certain one-time earning and deduction changes for the USA Hourlypay group for the current pay run. Two department managers, Charles Truman and Patty Peterson,earned a 250.00 bonus, while Kurt Morales earned a 300.00 bonus. Jessica Parker has made a 50.00lump sum charitable donation that needs to be deducted from her pay. Brad Cook is set up with a 50.00 Parking Subsidy each pay; however, for this pay period only, his Parking Subsidy amount needs tobe overridden to 35.00.Details: Award a 250.00 bonus to Charles Truman and Patty Peterson, and a 300.00 bonus to KurtMorales Deduct a one-time 50.00 charitable donation from Jessica Parker’s pay Replace the amount of Brad Cook’s Parking Subsidy to 35.00 Perform a Preview Audit using the Preview sub-tab to review the entries you madeDO NOT COMMIT, we will be using this pay run for the rest of the course.Copyright 2019 Ceridian HCM, Inc. All Rights Reserved

FIT103 - Processing a Pay Run with One-Time Changes and CorrectionsUse Quick EntriesSolution: Record Quick Entries for the Current Pay RunAdd bonuses for Charles Truman, Patty Peterson, and Kurt Morales:Path: Payroll [Load Pay Run] Pay Run Management Quick Entry1. Click Add.2. Type or select “Charles Truman” for the Employee Name.3. Type or select “Bonus” for the Code.4. Type “250.00” for the Amount.5. Click Copy.6. Type or select “Patty Peterson” for the Employee Name.7. Click Add.8. Type or select “Kurt Morales” for the E

Entering One-Time Changes in Payroll Introduces the Payroll functionality you will use to include additional payments and entries in a pay run, make adjustments to prior pay runs, and create off-cycle pay runs. Quick Entry Explains how to use quick entry to record one-time earnings and deductions that should be included on an employee's