Transcription

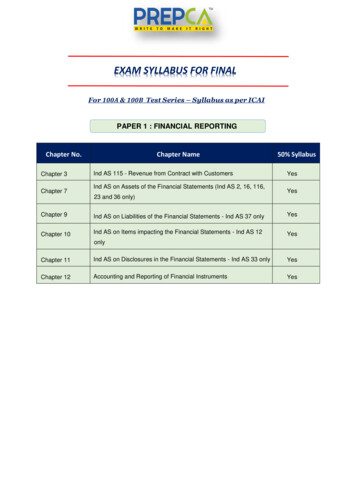

EXAM SYLLABUS FOR FINALFor 100A & 100B Test Series – Syllabus as per ICAIPAPER 1 : FINANCIAL REPORTINGChapter No.Chapter 3Chapter 7Chapter NameInd AS 115 - Revenue from Contract with CustomersInd AS on Assets of the Financial Statements (Ind AS 2, 16, 116,50% SyllabusYesYes23 and 36 only)Chapter 9Ind AS on Liabilities of the Financial Statements - Ind AS 37 onlyYesChapter 10Ind AS on Items impacting the Financial Statements - Ind AS 12YesonlyChapter 11Ind AS on Disclosures in the Financial Statements - Ind AS 33 onlyYesChapter 12Accounting and Reporting of Financial InstrumentsYes

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENTChapter No.Chapter Name50% SyllabusChapter 1Financial Policy and Corporate StrategyYesChapter 5Portfolio ManagementYesChapter 6SecuritizationYesChapter 7Mutual FundsYesChapter 8Derivatives Analysis and ValuationYesChapter 9Foreign Exchange Exposure and Risk ManagementYesChapter 10International Financial ManagementYesChapter 11Interest Rate Risk ManagementYesChapter 14Startup FinanceYes

PAPER 3 : ADVANCED AUDITING AND PROFESSIONAL ETHICSChapter No.Chapter Name50% SyllabusChapter 1Auditing Standards, Statements and Guidance NotesAn OverviewYesChapter 2Audit Planning, Strategy and ExecutionYesChapter 3Risk Assessment and Internal ControlYesChapter 5Company Audit CAROYesChapter 6Audit ReportsYesChapter 12Audit under Fiscal LawsYesChapter 14Liabilities of AuditorYesChapter 18Professional EthicsYes

PAPER 4 : CORPORATE LAWSChapter No.Chapter Name50% SyllabusSection A : Company LawChapter 1Appointment and Qualifications of DirectorsChapter 2Appointment and Remuneration of Managerial PersonnelChapter 3Meetings of Board and its PowersChapter 5Compromise, Arrangement and AmalgamationChapter 6Prevention of Oppression and MismanagementYesYesYesYesYesSection B : Economic LawsChapter 1Foreign Exchange Management Act 1999Chapter 6Insolvency and Bankruptcy Code 2016YesYes

Paper 5 : Strategic Cost Management and Performance EvaluationChapter No.Chapter Name50% SyllabusPart A : Strategic Cost ManagementChapter 3Lean System and InnovationYesChapter 4Cost Management TechniquesYes(i) Cost control and Cost Reduction, Target Costing, ValueEngineering & Value Chain.(vi) Environmental Management AccountingYesYesPart B Strategic Decision MakingChapter 5Decision MakingYesChapter 8Divisional Transfer PricingYesChapter 11Standard CostingYesPart C Case StudyChapter 12Case StudyYes

PAPER 7 : Direct Tax Laws and International TaxationChapter No.Chapter Name50% SyllabusPart A : Direct Tax LawsChapter 2Residence and Scope of Total IncomeYesChapter 3Income which do not form part of Total IncomeYesChapter 4SalariesYesChapter 5Income from House PropertyYesChapter 6Profits and Gains from Business or ProfessionYesChapter 7Capital GainsYesIncome from Other SourcesYesDeductions from Gross Total IncomeYesChapter 15Deduction Collection and Recovery of TaxYesChapter 17Assessment ProcedureYesChapter 8Chapter 11Part B : International TaxationChapter 2(i) Non Resident TaxationYesChapter 3(ii) Double Taxation ReliefYes

PAPER 8 : Indirect Tax LawsChapter No.Chapter Name50% SyllabusPart I: Goods and Services TaxChapter 2Supply under GSTYesChapter 3Charge of GSTYesChapter 4Exemptions from GSTYesChapter 5Place of SupplyYesChapter 7Value of SupplyYesChapter 8Input Tax CreditYesPart-II Customs & FTPChapter 4Chapter 5Chapter 8Valuation under the Customs Act, 1962YesImportation, Exportation and Transportation of GoodsYesForeign Trade PolicyYes

EXAM SYLLABUS FOR FINAL For 100A & 100B Test Series - Syllabus as per ICAI Chapter No. Chapter Name 50% Syllabus Chapter 3 Ind AS 115 - Revenue from Contract with Customers Yes Chapter 7 Ind AS on Assets of the Financial Statements (Ind AS 2, 16, 116, 23 and 36 only) Yes