Transcription

Legal Disclaimer: Investing in real estate can be risky! There is nopromise of income or profits with any investments with others orwe share in our workshop or in our discussions. These are examplecases for educational and demonstration purposes only. There isno promise that you will find a deal, even though the deals areplentiful in California. Dealing in real estate requires knowledge ofreal estate law and contracts; we recommend that you consult anattorney when you write a contract. There can also be taxconsequences, and we are not certified public accounts, andtherefore advise you to seek advice from a CPA. Pursue at yourown discretion. We highly recommend that you have a CPA orAttorney review all your transactions before signing any contracts.Copyright REI Fortunes, LLC, 20182

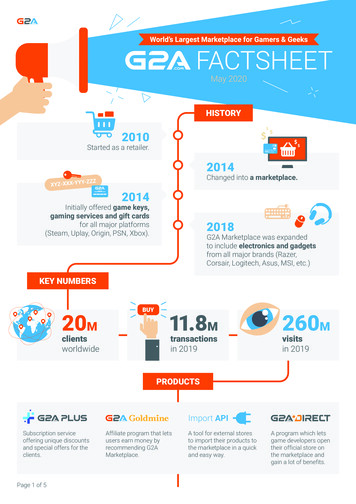

Foreword by Gary Massari, Founder of REI-Fortunes, LLCA group of very special caring investors came together to address a major need in the realestate investing industry and that need was hands-on mentorship and affordableeducation. We all agreed that this is a very important element that was marketed andsold by a lot of training companies. Yet we often hear complaints or see surveys, whichshow the promises of mentorship, were not being delivered to the expectations of thetrainees. We vowed to each other we would change that!All services for events and workshops now include ON-CALL COACHING, which meansour clients are entitled to coaching! It’s about implementation! Getting it done! Doing adeal and then several deals. Our goal for you, the attendee, is to use your workbook as aguide and reference to master the strategies we teach. We want you to do DEALS, lots ofthem! We need you to participate, learn and then implement! Our on-call coaching isabout implementing.Provided in your workbook, are pages dedicated to taking notes, and we encourage you totake notes, tons of notes. After each section is a quiz designed to help you learn andremember, so we the trainers, encourage you to take the quizzes and interact with theclass.We encourage questions after each lesson and quiz, but be careful not to take up valuabletime, so more people can participate, so limit your questions to one at a time please. Youwill also be asked to join the trainers in breakout sessions to learn valuable scripts androle play with other attendees.This live workshop is being recorded and will be available as an online course so pleasebe careful not to walk directly in front of our cameras.From REI Fortune Partners and Trainers we wish the best and have your best interest atheart. If you enjoy our workshop, and special gifts, please would you refer us to yourfriends and family who may be interested in real estate investing?Thank you for attending from your trainers, Frank Verni, Ginger Crystal Faith, Steve Halland Denise Patterson, and also from our special guest speakers, Kathy Fettke and JasmineWillios.The greatest investment one can make is in oneself Gary MassariCopyright REI Fortunes, LLC, 20183

Table of ContentsForeword by Gary Massari, Founder of REI-Fortunes, LLC. 3How To Find Distressed Properties And Owners Using State Of The Art Software . 6Wholesaling Definition Quiz . 8Types of Properties:. 9Distressed Properties . 9Distressed Owners . 9What is a Pre-Foreclosure? . 10Pre-Foreclosure Time Line . 10Properties and Pre-Foreclosure Quiz . 12How To Find Pre-Foreclosures Using County Records Research . 13How To Find Pre-Foreclosures Using Realtytrac.com . 14Comparable Values . 19How To Find Pre-Foreclosures Using Software Quiz . 20How To Find The Owners Names And Numbers . 21Unpaid Balance And Past Due Amounts . 22How To Search Public Records. 22Compile Your list of Targeted Pre-Foreclosure Properties. 25Review Your Search Criteria – Six Filters . 25Data That Is Required For Your Contact List . 25Downloadable Pre-Foreclosure Contact List Forms . 26Find Owners Names, and Phone Numbers To Compile Your Contact List Quiz . 27The Most Effective Way To Win At The Pre-Foreclosures Is Face-To-Face Marketing. 28Scripts: At The Door Greeting . 30Scripts: At The Table Presenting . 30Script Quiz . 32Making The Offer! . 33Making An Offer Quiz: . 34How To Calculate The Right Offer . 35Summary of all the Options a Homeowner In Pre-Foreclosure Has:. 36Purchase Agreement Clauses . 36Real Estate Purchase Agreement . 38Copyright REI Fortunes, LLC, 20184

Assignment of Real Estate Purchase and Sales Agreement . 44Addendum to Real Estate Purchase Contract . 46Notice of Cancellation. 47Residential Purchase Agreement Quiz . 48Creative Financing and Sources of Money . 49Creative Financing and Sources of Money Quiz . 51Marketing . 52Six Essentials to set up a viable business: . 52Website Example: . 537 Marketing Strategies That Work. 54Pre-Foreclosure Marketing Quiz . 54Post Card To Pre-Foreclosure Owner . 55Letter to Pre-Foreclosure Owner . 56Services We Offer To Help You Build A Great Investment Business Or Portfolio . 58Copyright REI Fortunes, LLC, 20185

How To Find Distressed Properties And Owners Using State Of TheArt SoftwareWholesaling DefinitionsFinding distressed properties and owners is a low cost way to start your real estatebusiness. It requires no money, no credit, and no real estate license. There is very littlerisk and offers a fast close. Finding distressed properties is great way to find discountedproperties at below market values. This gives you the option of selling the rights ofcontract or buying the property yourself or with a JV partner to rehab and sell it for aprofit.What is the definition of wholesaling real estate? In real estate investing, the termrefers to someone who spends their time trying to locate properties with substantialinvestment potential. Usually, the intent is to find properties that are distressed and selling ata discount that can be repaired or remodeled and sold for a sizable profit.What is a Wholesaler? Someone who buys distressed or discounted properties and sells therights of contract to an investor or homeowner. He really acts as the broker (middlemanwithout a t REI Fortunes, LLC, 20186

Notes:Copyright REI Fortunes, LLC, 20187

What is an Investor? A real estate professional who buys properties at a discount, thenmakes repairs and updates and sells for a profit.Types of Contracts:1. Assignment Contract is written by the Wholesaler and presented to the Seller withthe agreement to purchase the property using an assignment clause.2. An assignment clause allows the Wholesaler to assign the contract to an Investoror Homeowner without having to put up his/her funds or loan qualifications.The Wholesaler sells the rights of purchase to the Investor and/or homebuyer using apurchase contract with an assignment clause. The investor and/or Homebuyer close theescrow paying the seller and the assignment fee.Basically the Wholesaler is using the Investors and/or Homeowners funds to close theescrow.Some wholesalers use a double escrow so as not to reveal the purchase price and profitsthe wholesaler is making. The trick here is to find an escrow officer who will perform adouble escrow and use the funds of the end buyer to close the deal.Wholesaling Definition Quiz1. List the benefits of finding pre-foreclosures and wholesaling2. Explain wholesaling?3. Who is the Investor?4. What is an assignment?5. What does a double escrow do?Copyright REI Fortunes, LLC, 20188

Types of Properties:Single Family Residences for this workshop are one to four unit dwellings consisting ofsingle family, Duplex, Triplex and Fourplex.Single Family properties are usually more affordable and abundant and offer moreflexible financing. The market for single-family properties is the largest and the easiest toacquire and sell. Appreciation and tax benefits are the big attraction here.Duplexes offer the owner a unit to rent that usually covers the total mortgage payment,and for this reason are very popular. Duplexes have a high demand and come at apremium. However if you find one, and it is priced below market enough to wholesale it,then I would jump on it immediately!Triplex and Fourplex, are usually higher priced; however come with additional incomestreams like the laundry room and vending machines. They do not appreciate as well asthe single family or duplex properties. Usually have higher rent to price ratios.Distressed PropertiesDistressed properties are different than distressed owners, although both owners arestressed. The big difference here is the condition of the property; usually they areabandoned, and sometimes vandalized. Some of these properties are the result of acatastrophe. You often see them boarded up.They usually need major rehab work, however usually produce a great return whenpurchased right. Look for cosmetic work verses structural, foundation or roof, whichadds to the cost of rehab. Floods and fires present other issues to be careful of like, moldor burnt members in the roof and sides that are not visible on your initial inspection ofthe property.Distressed OwnersAre the result of a loss of job, divorce, disability, debt, mismanagement of funds, out ofarea owner, and death, which can result in probate or pre-foreclosure. Distress ownersare sometimes in denial and do not want to discuss their problems. Some of them arelooking for solutions or remedies to save their home and/or equity.In this workshop you will learn how to become a trusted advisor and offer solutions totheir problems.Copyright REI Fortunes, LLC, 20189

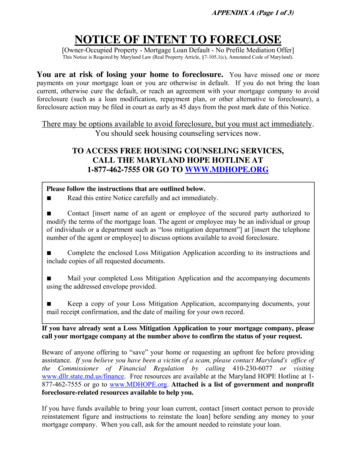

What is a Pre-Foreclosure?Someone who has fallen behind on his or her payments and lender has filed a notice ofdefault. A Notice of Default is the first step to Foreclose in California when someone fallsbehind two payments usually 60 days the lenders have a trustee send out 30-day letter ofintent to Foreclose.Pre-Foreclosure Time LineLender sends notices and files e ofIntentTrustee post- sets Court Date90-DayNotice tionIn California, lenders must then wait 90 days before they can file a Notice of Trustee Sale.Borrowers have the right to make up the back payments and reinstate the loan. After the 90 days have passed, the lender has the right to publish a Notice ofTrustee Sale for 21 days, Trustee Sale for 21 days, during which time which thehomeowner can stop foreclosure by making payments in arrears, payoff themortgage or file bankruptcy.After 21 days the lender may sell the property to highest acceptable bidder at thecourthouse.From the time the Notice of Default is filed the investor has 111 days to contact thehomeowner/borrower and offer them solutions.Time is of the essence the earlier you contact them to more options they have tocure the problem.If the property is not sold at the auction it reverts to an REO (Real Estate Owned)meaning Banked OwnedCopyright REI Fortunes, LLC, 201810

NotesCopyright REI Fortunes, LLC, 201811

Properties and Pre-Foreclosure Quiz1. What is the difference between a distressed property and distressed owner?2. What are the causes of a distressed owner?3. When is a notice of default filed?4. How many days after a notice of sale is posted is the property auctioned?5. What happens if the property does not sale at auction?Copyright REI Fortunes, LLC, 201812

How To Find Pre-Foreclosures Using County Records ResearchThere are several ways to find Pre-foreclosures; they are in EVERY town in United Statesand in California the average is around 80,000. Let’s take a look at few softwarecompanies that make it easy using Sacramento.Countyrecordsresearch.comCopyright REI Fortunes, LLC, 201813

How To Find Pre-Foreclosures Using Realtytrac.comTell us if you would buy this property?Here is the Flow for Pre-foreclosures in Sacramento County where there are 3853homes 1. Set search parameters for property2. Click on property address with equityCopyright REI Fortunes, LLC, 201814

Summary provides:1. Property address and Photo2. Est. of Value and ProfitsForeclosure Details provides the original loan amount and default amountCopyright REI Fortunes, LLC, 201815

Copyright REI Fortunes, LLC, 201816

Copyright REI Fortunes, LLC, 201817

School Ratings and Crime are important as they drive values Crime Ratings:Copyright REI Fortunes, LLC, 201818

Comparable ValuesCopyright REI Fortunes, LLC, 201819

Interactive Map allows you to like at like homes in the vicinityOther noted software to consider: Property Radar Real Flow Retran.net Default ResearchHow To Find Pre-Foreclosures Using Software Quiz1. What is the average sales price for 8011 Willy’s Court using RealtyTrac.com?2. What is the outstanding loan balance?3. How would you rate Mary Tsukamoto Elementary School?4. What is the over-all crime rating in the vicinity of subject home?5. Would you buy this home? (Would an investor buy this home?)Copyright REI Fortunes, LLC, 201820

How To Find The Owners Names And NumbersThe owner’s names appear on most software that integrates to public records. There arevarious online free services that can help you. Using the property at 8011 Willys CT,Sacramento let’s see how we do!Anywho.comName, address, and phone number – homerun!Copyright REI Fortunes, LLC, 201821

411.com works with white pages, however has a better search engineSkip Trace Services are not free, but can be helpful as a last resort:Lexisnexis.comSpokeo.comBeenverified.comYou can always Google the name and city. Be careful of monthly subscriptions.Unpaid Balance And Past Due AmountsRealtytrac.com and Propertyradar.com both give you the unpaid balance and past dueamounts. The addition of these two usually equals the opening bid amount when theproperty goes to auction.How To Search Public RecordsYou can search for the county assessor’s office online or pull a property profile. Thissearch is important as it will reveal any outstanding judgments and/or tax liens. On thenext page you will see how to access Public Records Copyright REI Fortunes, LLC, 201822

Check Tax Bill to make sure there are no unpaid tax liensCopyright REI Fortunes, LLC, 201823

Notes:Copyright REI Fortunes, LLC, 201824

Compile Your list of Targeted Pre-Foreclosure PropertiesReview Your Search Criteria – Six FiltersOnce you selected the properties based on your search criteria you want to put a contactlist together and keep accurate records for future follow up calls.Let’s review your search criteria:1. Single-family homes in (your selected area)2. 3 bedrooms 2 baths minimum3. 1500 SF or more4. 4000 SF lot size or more5. 30% Equity or more6. Notice of default filedData That Is Required For Your Contact List1.2.3.4.Property AddressFirst and Last name of Owner or ownersPhone numberProperty dataa. Bedrooms/bathroomsb. SF of homec. SF of lotd. Equitye. % Equity5. Estimate of value6. Loan balance7. Outstanding payments8. Liens and/or judgments (look for tax liens, source county assessor’s office, andpreliminary title report)9. Date of NOD (Notice of Default)10. Date of Trustee Sale if filedYou can make up a spreadsheet on Excel or as a free gift from the REI Partners you candownload our Contact list here:Copyright REI Fortunes, LLC, 201825

Downloadable Pre-Foreclosure Contact List FormsDownload Cont. List contact-list.zipThree very important things to remember when dealing with Pre-Foreclosures:1. NOD Date2. Trustee Sales Date3. Outstanding Loan balance, liens, and back paymentsCopyright REI Fortunes, LLC, 201826

Find Owners Names, and Phone Numbers To Compile Your ContactList Quiz1. Name Two Free Software services to help you find phone numbers?2. What are the names of the three Skip Trace Services?3. Why would you search Public Records?4. Why is it important to put a Contact List together?5. List three important things you need to know before knocking on doors!Copyright REI Fortunes, LLC, 201827

The Most Effective Way To Win At The Pre-Foreclosures Is Face-ToFace MarketingThis is a relationship business, and even though sending out letters, postcards, andmaking phone calls work, the most effective method is to knock on the front door with abig smile and warm greeting. This will separate you from the pack and give you thecompetitive edge.Your goal is to be their trusted advisor by sharing facts in a diplomatic way where theyperceive you to be their friend and not someone who is there to take their home away.Pre-foreclosures owners are usually very stressed and in denial, so be gentle andunderstanding.Your first impression is vital to building trust, so how you introduce yourself is extremelyimportant to your success.For beginners when you find the deal and make the appointment oneof our experienced coaches actually goes with you and handles it fromhere. We make the offer and write the contract. As you progress andmaster the technique then it converts to on-call coaching!Copyright REI Fortunes, LLC, 201828

Notes:Copyright REI Fortunes, LLC, 201829

Scripts: At The Door GreetingHello. Mrs. Sanchez, are you the owner? (With a big smile and warmhandshake)Greeting:My name is , and I am a real estate investor that works withpeople like you to help them save their homes and make them aware oftheir options. Are you aware of the many options that are available to you?It has come to my attention through public records, that you have somechallenges on your property. Are you aware of this? (Please listen to them,watch their body language)Two Important questions that give you control:Are you aware that you have a court date of and youmay lose your home? Are you aware of the pre-foreclosure timeline? Wehave some solutions you may not be aware of. Do you have a few minutesto sit down and review those options? Do you mind if I come inside and sitdown with you.Tip: Getting them to sit down with you is a big step to building trust. Besure you start the conversation by asking them to share their story)Scripts: At The Table PresentingBuild Rapport and Trust:Your goal is to build rapport and gain trust, remember they are going to fight to save theirhome. I use a method called REPEAT and APPROVE. It works like this; when you askthem a question like, “How did this happen?” and they say, “I lost my job!”. Your responseis, “You lost your job, that is unfortunate and I understand how you must be feeling.”Practice this method in our breakout session with your master coachStart by gaining their confidence I want you to know that everything you share with me is private andconfidential. Do you mind telling me how this happened? (Listen, nod,and agree!) Remember REPEAT and APPROVE!Copyright REI Fortunes, LLC, 201830

Many people are not aware of solutions that they may have. Did you knowthat 50% of the foreclosures could have been prevented if the owners hadbeen advised of their options? Are you aware of that?Always engage them by ending with a question The homes that were lost in 2007 – 2008, many of these families did notneed to lose their homes. With the education and knowledge that I have, itsaddens me to think that so many families’ lives were changed and did notneed to be. Don’t you think that’s sad?That’s why I am here. to try to help you with the challenges you arehaving with your home, and to explore all solutions that may help you toeither save your home, or help you walk away from it with the bestsoltuion for you. Would you like to know your possible solutions?Great let’s get started by asking them to take a tour of the property so youcan give them a reasonable assessment of their solutions.Do you mind if first, we take a quick tour of your home? As you tour the hometake notes especially if you see problems. Ask them, “Did you get an estimate onwhat it would cost to fix that?” (Repeat that question and write it down onevery item that needs fixing)Now that you finished the tour invite them to sit down with you. Ms.Sanchez, “What is important to you to save your home or sell it for thehighest dollar?”If save their home then go over these options after reviewing with themwhere they are in the foreclosure timeline.1. Timeline Owner is In 90 day notice of defaulta. You have the option of curing your default by paying the 8,125plus any late payment penalties. Are you able to do that now?Your not! Oh no!b. Are you able to raise the money by borrowing it from a friendor family that will help you? Oh no!a. Ms. Sanchez do you know that should the bank file a Notice ofCopyright REI Fortunes, LLC, 201831

Trustee Sale you would be required to pay off the entire loan,outstanding payments and any penalties? And you only have21 days to do it! Oh no!b. Are you aware that you could file a bankruptcy and courtswould take control over your equity? Oh no!c. Another option would be to file a loan modification with yourlender, however you would have to show you could make thepayments. Would you be able to make lower payments? Ohno!Script Quiz1. What are the two most important things you do to make the owner comfortable?2. What are the two things you make the owner aware of by asking questions?3. How do you build rapport and trust?4. How do you gain confidence with the owner?5. What technique do you use to engage them?BREAKOUT SESSION TO ROLEPLAYWITH COACHESCopyright REI Fortunes, LLC, 201832

Making The Offer!Leading and transitional question:1. There is another option I would like to share with you that I thinkwould be a better solution for you, would you like to hear about it?a. If I get you the maximum equity by saving you commissions,repair cost and dealing with the bank, would you sell me yourhouse for all cash? Oh yes!b. I will pay you all cash and buy your home “as is” with noInspections, or realtor commission, and close very quickly. Thisway we can get your cash to you quickly would that be great?(Motivated question to get them to say yes)c. There are a few things I need to know first.i. How old is the roof?ii. How old is the heating unit?iii. Any issues with plumbing?iv. Any issues with air conditioning?v. Any problems with drainage?d. Do you have an idea what you want for your home?i. A couple of things to know about selling your home inthis market!1. Realtors will want you to spend money to make allthe repairs and updates upfront! Based on theestimates of repairs and updates needed to sellyour home you would have to come upwith , do you have that kindof money? (One of our experienced coaches whoknow rehab cost goes on the appointment with you)2. Realtors will also deduct their commissions fromthe sale; we would rather save you the money!3. If you will give me a discount for an all-cash offer ICopyright REI Fortunes, LLC, 201833

will overlook the repairs and inspections and buy it“AS-IS” right now with no contingencies!4. All I need is time to clear title and close; how soondo you need the money?5. Can I write it up for you?e. The Owner wants more than you offer!i. You replay, “That’s to high and the risk is to great!”PAUSE and then say, “You do want to sell correct? Goodlet’s split the difference and be on with our lives.”Making An Offer Quiz:1. What is your transition and leading question to an offer?2. What is the motivating question to get them to say yes and why?3. What are the five things they need to know first?4. Four things you need to discuss with the owner before making an offer?5. What do you say to close the Offer (deal)?Copyright REI Fortunes, LLC, 201834

How To Calculate The Right OfferDownload your Calculator here zipNotes: Further research and (BPO) brokers price opinions show the Rehabvalue to be around 385,000.Copyright REI Fortunes, LLC, 201835

Summary of all the Options a Homeowner In Pre-Foreclosure Has:1. In the 90-day NOD (Notice of Default Stage)a. Sell the property as a FSBO (For Sale by Owner) this notrecommended as it attracts the lowest possible offers frompeople looking to save commissions.b. List the property with Realtor (recommended if the property isin good condition and up to date) and if there is more than 30days to market home)c. Loan modification if the bank is willing to work with the owner(Owner must show enough income and debt ratios to qualify atnew payment)d. Rent the property as a lease option as long as the optionrequirement covers the back payments and can give the ownerenough money to move and pay a few months of rent.e. Forbearance or Payment Plan, if the owner is in the military orunder special circumstances, such as a temporary loss of incomedue to death, unemployment, or natural disaster some banks willtake lower payments for a temporary amount of time.f. Bankruptcy allows a temporary means for the owner to stay intheir home, usually about 6 months. Bankruptcy is expensive,can only be declared every seven years and will ruin a person’scredit.g. Sell the property “AS IS” to an all cash investor with a fast close.2. In 21-Day Notice of Trustee Salea. Pay off the entire outstanding balance, loan penalties and anyliens.b. Let the property go to auction. (Not advisable great loss of equityand damaged credit).c. Sell property to Investor “AS IS” all cash with a fast close.Copyright REI Fortunes, LLC, 201836

Purchase Agreement ClausesFive Important Clauses:1.2.3.4.5.Offer from (Your Name and/or Assigns)Close of EscrowWalkthrough ContingencyCondition of PropertyClear TitleTwo Clauses To Be Aware Of:1. No sellers right to cancel clause (Must be NOD Contract)2. No non-refundable depositWe recommend you use a California Residential Purchase Agreement and Joint EscrowsInstructions, however other Purchase Contracts will work. If you are not a RE Brokerthen we advise you to use a Real Estate Attorney to write the contract.Review of important clausesOffer Clause: THIS IS AN OFFER FROM John and Susan Wholesalers and /or Assigns(Buyer) for the real property located at 8011 Willy’s CT, Sacramento, CA 95828,Assessor’s Parcel No. 11505900050000 TO Genov

Copyright REI Fortunes, LLC, 2018 3 Foreword by Gary Massari, Founder of REI-Fortunes, LLC A group of very special caring investors came together to address a .