Transcription

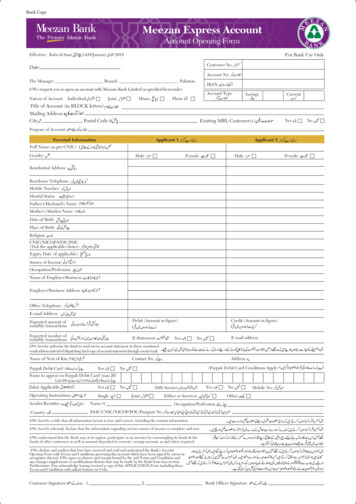

Account Opening FormFor Individuals481-Ver 1.1-March 2014DCB Bank LimitedM026 / Nov 16 / 2.1

Indicative List of Documents that can be provided to open a Bank AccountDescription of Document Can be obtained forIdentityAddressPAN CardPassportPassportVoter's Id issued by Election Commission of IndiaVoter's Id issued by Election Commission of IndiaDriving LicenseDriving LicenceLetter issued by UIDAI containing details of name , address and Aadhaar number orany other document as notified by the Central Govt in consultation with RBI or‘Aadhaar’ Letter or ‘Aadhaar CardLetter issued by UIDAI containing details of name , address and Aadhaar number orany other document as notified by the Central Govt in consultation with RBI or‘Aadhaar’ Letter or ‘Aadhaar CardJob card issued by NREGA duly signed by officer of the State GovernmentJob card issued by NREGA duly signed by officer of the State GovernmentPassbook with attested photograph from any Scheduled Commercial Bank,Post Office (latest 2 months)**Identity card with applicant's photograph issued by Central/ State GovernmentDepartments, Statutory / Regulatory, Public Sector Undertakings, ScheduledCommercial Banks and Public Financial Institutions (Low Risk customers)Address card issued by India Post *Letter from Block Development Officer/ Revenue Official**Letter issued by a gazetted officer with a duly attested photograph of the person.Letter from scheduled bank as per Annexure K **Senior Citizen Card issued by any State GovernmentSocial security card issued by State Govt. **Letter with attested photograph issued by recognized public authority such asCollector / Tehsildar / MagistrateCertificate issued by Gram Panchayat *Legal Guardianship Certificate issued by the Local Level Committees set up underthe National Trust for the Welfare of Persons with Autism, Cerebral Palsy, MentalRetardation and Mental Disabilities Act, 1999 and under the Mental Act, 1887appointing Legal Guardians for persons with disability can be accepted to open anaccount (for accounts of people with disability)Declaration from joint holder to consider the address as proof of address along withproof of relationship*Passbook with attested photograph from any Scheduled Commercial Bank withlatest completed 3 months account statement *Utility bill which is not more than two months old of any service provider (electricity ,telephone, postpaid mobile phone, piped gas, water)*Letter from Block Development Officer/ Revenue Official *Letter of allotment of accommodation from employer issued by State or CentralGovernment departments, statutory or regulatory bodies, public sectorundertakings, scheduled commercial banks, financial institutions and listedcompanies. Leave and license agreements with such employers allotting officialaccommodation can also be obtained.*Property or Municipal tax receipt (not more than one year old)*Letter from Scheduled Bank as per Annexure K *Social security card issued by State Govt.*Documents issued by Government departments of foreign jurisdictions and letterissued by Foreign Embassy or Mission in India.*Certificate issued by Gram Panchayat **Accepted only for Low Risk CustomersPlease Note:1. Customer must sign the Account Opening Form (AOF) in the presence of Bank Officials2. The cheque provided as the initial Account Opening Amount (AOA) must be signed by the prospective customer and this signature should match with the signature on the AOF.Instruction for filling Account Opening FormPlease fill the form preferably in ‘BLACK’ ink onlyACBPlease use in CAPITAL LETTERS onlyHint boxes give tips and highlight important points across the formPlease tick the appropriate boxesPlease write your NAME as it appears in all your support documentsSpecify the addresses along with City, State and PIN CodePlease countersign in full for any overwriting / alterationALL PHOTOCOPIES of documents to be SELF-ATTESTED by the applicant

Bank Use only (* Fields are Mandatory)Application No.: INDCustomer ID:Account No.:Please specify the occupation code as mentioned by customer in the form.*Occupation Code: Applicant 1:Joint Applicant 1:Joint Applicant 2:*Segment CodeRM / CSE / RO / CBE (Code):Date:D D M M Y Y Y YValue Date:D D M M Y Y Y YSOL Code:Branch:Funding:Txn. / ID No.:D D M M Y Y Y YDate:Relationship Form“I / We hereby apply for a relationship with your Bank under which I / we wish to open an account.”SavingsClassicShubh-LabhFixed DepositCash BackBSBDAMr.Mrs.Ms.EliteCorporate Payroll (Basic)Corporate Payroll (Plus)Others (please specify including Personal Current A/c.)Personal Details: Primary Applicant*Name:PrivilegeDr.(* Fields are Mandatory)Prof.Capt.Existing Customer ID:Others(If applicable)Maximum32 characters.(First Name)(Middle Name)(Last Name)Maximum19 characters.This namewouldappear on theDebit Card*Short Name:*Status:Minor*Date of Birth:Sr. CitizenPensionerD D M M Y Y Y Y*Nationality:IndianStaff, if yes, Employee No.Other General*Gender:MaleFemaleThird GenderOther (pl. specify)*Country of Birth:*Place of Birth:*Citizenship:*Residence for Tax Purposes:U.S. se fillFATCADeclarationForm if you areU.S.A. or othercountry citizen/ residentSTOthers*Mother’s Full Name:Marital Status:*Mother’s Maiden Name:*Card: Debit Card requiredYesNoInternational Debit Card requiredATM Card requiredYesNoType of card & cheque book issuance would be basedupon the product.*Permanent Account Number (PAN):YesNoYesNoVisaYesNoType of cardwould bebased uponthe productIf PAN numberis not availableplease fill inForm 60Form 60Aadhaar Number:RupayYour 12 digit unique identification numberCurrent Address:City:Pin:*Landmark:State:All alerts will besent to thepreferredMobile Numberand E-mail ID.Mobile Numberwill be used forSMS Bankingregistration foreligibleaccounts.Country:Telephone:*Preferred Mobile No.:(with STD Code)*Preferred Email Id:Permanent Address:Same as Current AddressCity:Pin:*Landmark:Telephone:State:(with STD Code)Office Address:City:Pin:3

*Landmark:State:Telephone:Extn.:Fax:(with STD Code)Address proofof mailingaddress ismandatory.Otherwise,default addresspicked would beCurrentAddress(with STD Code)Mailing Address:Current AddressOfficePermanent(You must tick mark one option)Customer Profile*Occupation:Education:GraduatePost GraduateGross Annual Income ( ):ProfessionalLess than 50K50K - 1.5 Lakhs5 Lakhs - 10 LakhsResidence:Self OwnedExisting Credit Facility:Vehicle:House LoanJoint Applicant 1Mr.Mrs.RentedBoth3 Lakhs - 5 Lakhs50 Lakhs and aboveCompany LeaseVehicle LoanFour WheelerConsumer LoanEducation LoanBusiness LoanCredit CardNone(* Fields are Mandatory)(Guardian to fill a Minor Declaration Form separately)*Name:1.5 Lakhs - 3 Lakhs10 Lakhs - 50 LakhsFamily OwnedTwo WheelerOthersMs.##If applicable, please attach age proofDr.Prof.Capt.* Fields are MandatoryExisting Customer ID:Others(If applicable)Maximum32 characters(First Name)(Middle Name)(Last Name)*Mother’s Full Name:*Date of Birth:D D M M Y Y Y Y*Mother’s Maiden Name:Marital Status:Relationship with Primary Applicant:*Gender:MaleFemaleThird Gender*Country of Birth:*Nationality:IndianPlease fillFATCADeclarationForm if you areU.S.A. or othercountry citizen/ residentOther (pl. specify)*Place of Birth:*Citizenship:*Residence for Tax Purposes:U.S. Person:*Card: Debit Card requiredYesNoInternational Debit Card requiredATM Card requiredYesNoType of card & cheque book issuance would be basedupon the product.YesNoYesNoRupayYesNoVisaYesNoType of cardwould bebased uponthe productMaximum 19 characters.This name would appear on the Debit Card*Short Name:*Status:MarriedSingleSr. CitizenPensionerOther GeneralStaff, if yes, Employee No.*Permanent Account Number (PAN):If PAN numberis not availableplease fill inForm 60Form 60Aadhaar Number:Your 12 digit unique identification number*Occupation:Current :*Preferred Mobile No.:(with STD Code)*Preferred Email Id:Permanent Address:Same as Current AddressCity:Pin:*Landmark:State:Telephone:(with STD Code)4

Joint Applicant 2*Name:Mr.Mrs.(* Fields are Mandatory)Ms.Dr.Prof.Capt.Existing Customer ID:Others(If applicable)Maximum32 characters(First Name)(Middle Name)(Last Name)*Mother’s Full Name:*Date of Birth:D D M M Y Y Y Y*Mother’s Maiden Name:Marital Status:Relationship with Primary Applicant:*Gender:MaleFemaleThird Gender*Country of Birth:*Nationality:IndianPlease fillFATCADeclarationForm if you areU.S.A. or othercountry citizen/ residentOther (pl. specify)*Place of Birth:*Citizenship:*Residence for Tax Purposes:U.S. Person:*Card: Debit Card requiredYesNoInternational Debit Card requiredATM Card requiredYesNoType of card & cheque book issuance would be basedupon the product.YesNoYesNoRupayYesNoVisaYesNoType of cardwould bebased uponthe productMaximum 19 characters.This name would appear on the Debit Card*Short Name:*Status:MarriedSingleSr. CitizenPensionerStaff, if yes, Employee No.Other General*Permanent Account Number (PAN):If PAN numberis not availableplease fill inForm 60Form 60Aadhaar Number:Your 12 digit unique identification number*Occupation:Current :*Preferred Mobile No.:(with STD Code)*Preferred Email Id:Permanent Address:Same as Current AddressCity:Pin:*Landmark:Telephone:State:(with STD Code)Mode of OperationSelfJointlyEither or SurvivorFormer or SurvivorGuardianAnyone or SurvivorOthers:(Please Specify)Initial Payment DetailsPayment ByCash (To be deposited by the customer at teller counter only)Cash Deposited on:D D M M Y Y Y YCheque No.:Cheque Dated:D D M M Y Y Y YDrawn on:(Bank)Amount :Please note: Allcheques shouldbe CROSSEDand in favour of‘DCB BankLimited’A/c(Your Name)’Amount in words:Debit to DCB Bank A/c No.:5

ServicesSMS Banking & Alert Facility:Alerts facility enables you to receive alerts on your Email and / or Mobile regarding large debit, large credits, Standing Instruction failure, balance below Account Quarterly Balance and balanceupdate. New alerts may be added from time to time.Please Note: Authorised signatory/ies of the Firm / Company / Trust / Association / Society are eligible for free Mobile alert facility subject to compliance of terms and conditions as stipulated bythe Bank from time to time.I / We don’t wish to receive any Bank relatedpromotional calls, SMS alerts or emails.DCB – On The Go (Mobile Banking)I / We don’t wish to link my/our Aadhaar Number to this account.(Please Note: Any 1 Aadhaar Number is linked to 1 Account Number to receive subsidy on the account)Email Account StatementPhone BankingPreferred Language Options:PassbookInvestment:EnglishLife Insurance2-Way Sweep Deposit Details: Facility required:YesInternet BankingUtility BillsHindiGujaratiMarathiMutual FundTamilWealth ManagementTeluguPlease fill aseparate MobileBankingRegistrationForm forJoint AccountHolderGeneral InsuranceNo (please tick appropriate options)Please Note: Reverse Sweep to Fixed Deposit account shall happen only, if the balance in the account exceeds threshold limit and Sweep shall happen if the balance in the account goes belowthe threshold limit. All deposits will be under Re-investment scheme with Auto Renewal Facility, this facility may differ from product to product and from time to time.Account Statement: Frequency of statement would be as per the product feature.Tax Deduction at SourceYesTDS to be deducted if applicable:NoTDS Exemption submission date :D D M M Y Y Y YIf No, TDS Exemption Reference No.Enclose TDS Certificate for exemption.Term Deposit DetailsType of DepositAmount of DepositForm 15G / 15H,etc. to besubmitted at thebeginning ofevery financialyear and whilemaking freshdeposits duringthe year.(* Fields are Mandatory)Monthly Interest Payout (MIC)Quarterly Interest Payout (QIC)Quarterly Compounded (RIC)Half Yearly Interest PayoutSimple Interest (for deposits less than 6 months)Tax SaverONLY SimpleInterestpayable fordeposits of lessthan 6 monthstenorPlease issue Fixed Deposit in the name(s) ofby Cash / Debit to Account No.:Amount (RupeesDeposit Periodonly)DaysSenior CitizenInterest PaymentInstructionsMonthsYesDate of Birth(DOB) proofrequired toavail benefitsfor SeniorCitizens.Years (Minimum 7 days maximum 10 years)NoInterest Rate.% per annumThroughNEFTTransfer to DCB Bank A/c. No.:Issue Demand Draft Payable at*Maturity InstructionsAuto Renew Principal and InterestAuto Renew Principal and Pay Interest(Tick any one)Repay Principal and InterestMode of Operation*Payment Instructions(upon closure)SelfEither or SurvivorGuardianBy anyone or SurvivorFormer or SurvivorJointlyThroughNEFTTransfer to DCB Bank A/c. No.:Issue Demand Draft Payable atPlease tick if you wish to receive hard copy of the Deposit Confirmation Advice (DCA) otherwise the DCA will be sent at your registered email IDwith the Bank.Instructions for payment of interest & maturity proceeds through NEFTThis facility isnot availablefor fixeddeposits withmaturityinstruction as“Auto RenewPrincipal &Pay Interest”1. Mandatory to attach a cancelled cheque of the bank account mentioned below2. Beneficiary Name (As per Beneficiary’s Bank record - should be same as applicant name):Bank Name:Branch Name:Account Number:IFS Code:Account Type:OverdraftSavingsCurrentOthers (please specify)Terms and conditions:I/We abide by the following terms and conditions: 1. It is being understood that the remittance is to be sent at my/our own risk and responsibility and on the distinct understanding that no liabilitywhatsoever is to be attached to the Bank for any loss or damages arising or resulting from delay in transmission, delivery or non-delivery of the message or for any mistake, exchange or error intransmission or delivery thereof or in deciphering the message for whatsoever cause or from its misinterpretation when received or the action of the destination Bank or due to RBI (Reserve Bankof India) RTGS / NEFT system not being available or failure of internal communication system at the recipient bank/branch or incorrect information provided by me/us or any incorrect creditaccorded by the recipient bank/branch due to information provided by me/us or any act or event beyond control or from failure to properly identify the person’s name. 2. I/We understand that theRTGS / NEFT request is subject to the RBI regulations and guidelines governing the same. 3. I / We agree that the credit will be effected solely on the beneficiary account number information andbeneficiary name particulars will not be used for the same.6

DCB Diamond Khushiyali Deposit DetailsMonthly InstalmentAmount Deposit PeriodDaysMonthsSenior CitizenMonthly Instalments tobe collected throughYesYears (Deposit period is minimum 14 days and maximum 10 years)NoInterest Rate.Date of Birth(DOB) proofrequired toavail benefitsfor SeniorCitizens.%Debit to Account No.onMaturity InstructionsDKD can becreated in thename of thePrimaryApplicant onlyD Dof every monthTransfer to DCB A/c No.:Mode of OperationSelfJointlyEither or SurvivorFormer or SurvivorGuardianOthers:(Please Specify)Declaration where Applicant is MinorI hereby declare that I am the natural guardian / lawful guardian appointed by the Court order datedD D M M Y Y Y Y(copy enclosed) ofMaster / MissMinor's NameI shall represent the said minor in operating the Bank Account till he / she attains majority. I agree to indemnify the Bank against any claims for any transactions madein the account(s).I undertake and confirm that I shall avail various services of the Bank (wherever applicable) like Phone Banking, Mobile Banking, Internet Banking, Bill Pay only for thebenefit of the minor and I shall abide by all terms and conditions governing the various services and shall intimate the Bank in writing immediately upon the Minorattaining majority.*Customer id:* Incase Father / Mother / Guardian is an existing customerName of Father / Mother / GuardianSignature of Father / Mother / GuardianNomination Details (Form DA 1)Yes, I want to nominate the following personPreferable forSingle & JointAccount holdersNo, I do not want to nominate anyoneI / we nominate the following person to whom in the event of my / our / minor’s death the amount of the deposit / in the account may be returned byDCB Bank LimitedNominee Name:Address:Age:Relationship with Applicant, if anyYearsDate of Birth:D D M M Y Y Y YNominationunder Section45ZA of theBankingRegulationAct, 1949and Rule 2(1) ofthe BankingCompanies(Nomination)Rules 1985 inrespect of bankdeposits.* As the nominee is a minor on this date, I / we appoint (Name & Address)to receive the amount of the deposit / in the account on behalf of the nominee in the event of my /our death during the minority of the nominee.In case you have specified a nominee above, please indicate if you wish to make mention of thenominee name on the passbook, statement & DCA issued in respect of your account and / or thepassbook issued to youYesNoI / We do hereby declare that what is stated above is true to the best of my / our knowledge andbelief.Signature(s) / Thumb Impression(s) of depositor(s)Witness(es):Name:Name:Signature :Signature :Address :Address :Place:Date:Place:Thumbimpression isrequired to beattested by2 witnesses.In case ofsignature, nowitness isrequired.Date:*Strike out if nominee is not a minor. ** Where deposit is made / account is held in the name of the minor the nomination should be signed by a person lawfully entitled to act on behalf of the minor.7

Group Personal Accident InsuranceYes, I wish to enrollfor Group Personal Accident InsuranceYes, I wish to enroll for the auto renewal ofGroup Personal Accident Insurance for additionalSourcing Staff Name:5 years3 years10 yearsHRMS Number:Group Personal Accident (GPA) Plan (Please tick any one of the below 7 options)Sum Insured Coverage OptionsStandard VariantDeath Permanent Total DisabilityDouble benefit VariantDeath Permanent Total Disability Double benefit for salaried person for accidenton duty by Rail / Road / AirNet Premium*500000 (AIB n Chosen (þ)The maximumSum Insuredallowed for anyone customer,across one ormore policies,should notexceed 30 Lakhs(standardvariant only).*Exclusive of Service Tax.*Nominee:*Mention Guardian / Appointee Name in case Nominee is a minor:*Relationship of Nominee with Applicant:*Nominee Gender:MaleFemaleThird Gender*PLEASE TICK (ü) AGAINST THE APPLICABLE DESCRIPTION, IF YOU FALL UNDER ANY OF THE BELOW LISTED CATEGORIES. IF YOU FALL UNDERMORE THAN ONE OF THE LISTED TITLES BELOW, PLEASE TICK AGAINST ALL THE APPLICABLE HEADS.Head of Stateor Central GovernmentSenior PoliticianSenior Government / Judicial / Military OfficerSenior Executive of State or Central-Owned CorporationImportant Political Party OfficialAny other Politically Exposed Person (PEP) /Related to PEPList of hazardous occupation which are not covered in GPA: Aircraft pilots and crew, Armed Forces personnel, Artistes engagedin hazardous performances, Aerial crop sprayer, Bookmaker (for gambling), Demolition contractor, Explosives users, Fisherman(seagoing), Jockey, Marine salvager, Miner and other occupations underground, Off-shore oil or gas rig worker, Policeman (Fulltime), Pop Musicians, Professional sports person, Roofing contractors and all construction, maintenance and repair workers atheights in excess of 50ft / 15m, Saw miller, Scaffolder, Scrap metal merchant, Security guard (armed), Steeplejack, Stevedore,Structural steelworker, Tower crane operator, Tree feller, Ship crew, Travel agency business, Air coupon & ticket business.Signature of the Applicant8

A worldwide personal accident cover plan that is specially designed to give comprehensive protection to help you / your family against financecrises due to Accidental Death or Permanent Total Disablement.Key Features: Worldwide Cover No Waiting PeriodSum Insured Options:Coverage OptionsStandard VariantDeath Permanent Total DisabilityDouble benefit VariantDeath Permanent Total Disability Double benefit for salaried person for accidenton duty by Rail / Road / AirSum Insured Net Premium*5,00,000 (AIB ,00,0002937Option Chosen (þ)The maximumSum Insuredallowed for anyone customer,across one ormore policies,should notexceed 30 Lakhs(standardvariant only).*Exclusive of Service Tax.Key Benefits:Death Benefit: In the unfortunate event of a fatal accident, the Sum Insured shall be paid to the nominee of the Insured Person.In the unfortunate event of an accident resulting in Permanent Total Disability, the Insured Person shall be paid the following % of Sum Insured.a) 100% sum insured in case of loss of sight of both eyes, or of the actual loss by physical separation of two entire hands or two entire feet, or of one entire hand and one entire foot, of such lossof sight of one eye and such loss of one entire hand or one entire foot.b) 100% sum insured in case of loss of use of two hands or two feet or of one hand and one foot, or of such loss of sight of one eye and such loss of use of one hand or one foot.c) 50% sum insured in case of loss of sight of one eye, or of the actual loss by physical separation of one entire hand or of one entire foot.d) 50% sum insured in case of total and irrecoverable loss of use of a hand or a foot without physical separation.e) 100% sum insured in case of permanent and total disability which absolutely disables insured person from engaging in any employment or occupation.For those opting for Double benefit for Death & Permanent Total Disability cover: Claim will be paid for salaried persons who are involved in an accident on duty while traveling by Rail / Road / Air.Who can be Insured Person?This insurance is available to persons who are aged between 18 and 70 years at the commencement date of the Policy and are Account holders of DCB Bank Limited (DCB Bank).This is an insurance plan underwritten by Royal Sundaram General Insurance Co. Limited (IRDAI Registration No. 102, CIN-U67200TN2000PLC045611) for customers of DCB Bank. Yourparticipation in this insurance product is purely on a voluntary basis. DCB Bank will be the Group Manager for this insurance product and will only be responsible for distributing the insuranceproduct to all members of this group. All Claims under the policy will be solely decided upon by Royal Sundaram General Insurance Co. Ltd.This application shall be processed and the premium amount as per option chosen by you shall be debited if it is found acceptable by Royal Sundaram General Insurance Co. Ltd. The insurancecover shall start on 1st day of succeeding month of the premium amount debit in your DCB Bank Account (“commencement date”). This insurance cover will be valid for a period of 1 (one) yearfrom the commencement date, provided you continue to remain a DCB Bank account holder during this period. This insurance cover will cease to exist in case the DCB Bank Account is dormant,freezed or lien marked for any reason whatsoever. The application will not be accepted till the time such account related disputes are resolved and the said DCB Bank Account is reactivated.Renewal reminders for this policy will be conveyed through SMS alerts and Email by DCB Bank on the Mobile No. and Email respectively as indicated by the Applicant in this Application.If for any reason you need to communicate with Royal Sundaram General Insurance Co. Ltd., it is adequate that you mention the Master Policy number, DCB Bank account number and the branchdetails. Claim intimation can also be made to Royal Sundaram General Insurance Co. Ltd., by contacting them on 1860 425 0000.This is only a brief summary of the insurance product. Please refer to Master Policy No. PADCB00001 (available on DCB Bank’s website www.dcbbank.com) issued to DCB Bank by RoyalSundaram General Insurance Co. Ltd. for complete information on terms, conditions and exclusions.Royal Sundaram General Insurance Co. Limited, Vishranthi Melaram Towers 2/319, Rajiv Gandhi Salai, Old Mahabalipuram Road, Karapakkam, Chennai - 600097.ACKNOWLEDGMENTName of the Applicant:DCB Bank Account Number:DCB Bank Account Opening Form Number:Date:D D M M Y Y Y YInstruction received to debit from DCB Bank Account towards Group Personal Accident Insurance Premium.(Note: Certificate of Insurance will be couriered at your mailing address / emailed on your registered Email ID post issuance of the policy. Insurance cover will start on 1st day of succeeding month of the premiumamount debit from your Account with DCB Bank Limited)This application is for Group Personal Accident Insurance Cover only. It is not a cover for Life Insurance or Mediclaim.Applicant’s Signature:Authorized signatory for DCB Bank Limited:List of hazardous occupation which are not covered in GPA:Aircraft pilots and crew, Armed Forces personnel, Artistes engaged in hazardous performances, Aerial crop sprayer, Bookmaker (for gambling), Demolition contractor, Explosivesusers, Fisherman (seagoing), Jockey, Marine salvager, Miner and other occupations underground, Off-shore oil or gas rig worker, Policeman (Full time), Pop Musicians, Professionalsports person, Roofing contractors and all construction, maintenance and repair workers at heights in excess of 50ft / 15m, Saw miller, Scaffolder, Scrap metal merchant, Securityguard (armed), Steeplejack, Stevedore, Structural steelworker, Tower crane operator, Tree feller, Ship crew, Travel agency business, Air coupon & ticket business.Royal Sundaram General Insurance Co. Ltd.DCB 24-Hour Customer CareCall 1860 425 0000Write customer.services@royalsundaram.inVisit www.royalsundaram.inCall Toll Free: 1800 209 5363Email: customercare@dcbbank.comWeb: www.dcbbank.com

Experience banking like never beforeDCB Elite AccountDCB NRI ServicesNow choose your lucky numberas your savings or current accountnumber along with a host of freebenefits and services.DCB Bank offers a bouquet of productsand services ranging from DCB NRE /NRO Accounts and Term Deposits toDCB Wealth Management Solutions.DCB CashBack AccountDCB Investment ServicesA unique savings account thatpays you cash every time you spendusing your Debit Card.Experience state-of-the-artpersonalised financial planning alongwith the best investment products thatsuit your risk appetite.Free access to Visa ATMsin IndiaUse your DCB Debit Card for cashwithdrawals and balance enquiries atany Visa ATM in India at no cost.DCB Diamond KhushiyaliDepositA small deposit every month leads toa large assured amount for the future.You can deposit as low as 1000per month.DCB Gold LoanAvail instant loan against your goldjewellery / ornaments. The loanamount can be as high as 80% of theappraised gold value.DCB Business LoanYour property can now fund yourbusiness expansion. Avail of termloans for your business against thesecurity of your residential orcommercial property.DCB Bank launches India'sFirst Aadhaar ATMEasy to use withAadhaar Number &your Finger PrintATM Card & your Finger PrintATM Card & PINDCB Bank Limited

Risk Classification for Primary Applicant* Kindly fill the following details:Expected Annual Turnover ( ):Upto 1 LakhUpto 10 LakhsUpto 50 LakhsUpto 1 CroreUpto 5 CroresUpto 10 CroresUpto 25 CroresMore than 25 CroresExpected number of transactions in a month:Basis of Categorisation:High Risk ProfessionUp to 2021 to 50Politically Exposed PersonMore than 50Domiciled in Risk CountryTrustSleeping PartnerOthers (Please specify):Information: Politically Exposed Person due to position / status as:If Domiciled in Risk Country - Country Name:Nature of Business / Occupation:*Details of Customer’s Source of Funds & Estimated Net Worth:Income from EmploymentIncome from BusinessIncome from InvestmentsInherited FundsOthers (Please specify):Risk Classification of Account (L / M / H):Risk Classification for Joint Applicant 1* Kindly fill the following details:Expected Annual Turnover ( ):Upto 1 LakhUpto 10 LakhsUpto 50 LakhsUpto 1 CroreUpto 5 CroresUpto 10 CroresUpto 25 CroresMore than 25 CroresExpected number of transactions in a month:Basis of Categorisation:High Risk ProfessionUp to 2021 to 50Politically Exposed PersonMore than 50Domiciled in Risk CountryTrustSleeping PartnerOthers (Please specify):Information: Politically Exposed Person due to position / status as:If Domiciled in Risk Country - Country Name:Nature of Business / Occupation:*Details of Customer’s Source of Funds & Estimated Net Worth:Income from EmploymentIncome from BusinessIncome from InvestmentsInherited FundsOthers (Please specify):Risk Classification of Account (L / M / H):Risk Classification for Joint Applicant 2* Kindly fill the following details:Expected Annual Turnover ( ):Upto 1 LakhUpto 10 LakhsUpto 50 LakhsUpto 1 CroreUpto 5 CroresUpto 10 CroresUpto 25 CroresMore than 25 CroresExpected number of transactions in a month:Basis of Categorisation:High Risk ProfessionUp to 20Politically Exposed Person21 to 50More than 50Domiciled in Risk CountryTrustSleeping PartnerOthers (Please specify):Information: Politically Exposed Person due to position / status as:If Domiciled in Risk Country - Country Name:Nature of Business / Occupation:*Details of Customer’s Source of Funds & Estimated Net Worth:Income from EmploymentIncome from BusinessIncome from InvestmentsInherited FundsOthers (Please specify):Risk Classification of Account (L / M / H):11

Declaration Regarding Signingin Vernacular Language / By Illiterate / Blind PersonI, Mr./Ms. (the Declarant - either Bank Official or customer of Bank) have read out andexplained the contents of this Account Opening Form of DCB Bank Limited (the Bank) to the Applicant(s) Mr. / Ms.in language and he / she / they have confirmed that he / she / they has / have und

1. Customer must sign the Account Opening Form (AOF) in the presence of Bank Officials 2. The cheque provided as the initial Account Opening Amount (AOA) must be signed by the prospective customer and this signature should match with the signature on the AOF. PAN Card Passport Voter's Id issued by Election Commission of India Driving Licence