Transcription

IBIMA PublishingJournal of Electronic Banking S/jebs.htmlVol. 2010 (2010), Article ID 592297, 21 pagesDOI : 10.5171/2010.592297Factors Affecting Customer Loyalty ofUsing Internet Banking in MalaysiaBeh Yin Yee and T.M. FaziharudeanFaculty of Business and Accountancy, University of Malaya, Kuala Lumpur, Malaysia,AbstractInternet banking (IB) has become one of the widely used banking services among Malaysianretail banking customers in recent years. Despite its attractiveness, customer loyalty towardsInternet banking website has become an issue due to stiff competition among the banks inMalaysia. As the development and validation of a customer loyalty model in Internet bankingwebsite context in Malaysia had not been addressed by past studies, this study attempts todevelop a model based on the usage of Information System, with the purpose to investigatefactors influencing customer loyalty towards Internet banking websites. A questionnaire surveywas conducted with the sample consisting of Internet banking users in Malaysia. Factors thatinfluence customer loyalty towards Internet banking website in Malaysia have beeninvestigated and tested. The study also attempts to identify the most essential factors amongthose investigated: service quality, perceived value, trust, habit and reputation of the bank.Based on the findings, trust, habit and reputation are found to have a significant influence oncustomer loyalty towards individual Internet banking websites in Malaysia. As compared totrust or habit factors, reputation is the strongest influence. The results also indicated thatservice quality and perceived value are not significantly related to customer loyalty. Servicequality is found to be an important factor in influencing the adoption of the technology, but didnot have a significant influence in retention of customers. The findings have provided an insightto the internet banking providers on the areas to be focused on in retaining their customers.Keywords: Internet banking, banking website, customer loyalty, reputation1. IntroductionInternet banking (IB) refers to the bankingservices provided via a secure websiteoperated by the bank provider, thusfacilitating the use of the Internet as aremote delivery channel. Internet bankingallows bank customers with appropriateaccess to manage their finances withminimal inconvenience as it provides a fastand convenient way to undertake variousbanking transactions via the Internetbanking website from home, office orelsewhere, 24 hours a day, 7 days a week. InMalaysia, Internet banking services havebeen operational since the year 2000.Currently, only banking institutions licensedunder the Banking and Financial InstitutionAct 1989 (BAFIA) and the Islamic BankingAct 1983 are allowed to offer Internetbanking services here. Table 1 provides alist of banks in Malaysia that now offer anInternet banking service.In 2002 about 25,000 Maybank customersand 10,000 HSBC customers subscribed toInternet banking in Malaysia (Yu, 2002;Bernama, 2002). By 2008 there were over4.5 million registered Internet bankingcustomers in Malaysia in, which accountsfor 85.5% of the total adult Internet userpopulation. Internet banking has a yearlygrowth rate of 40.6% compared to theprevious year that shows it is both growingCopyright 2010 Beh Yin Yee and Dr T.M. Faziharudean. This is an open access article distributed underthe Creative Commons Attribution License unported 3.0, which permits unrestricted use, distribution, andreproduction in any medium, provided that original work is properly cited. Contact author: Beh Yin Yee, email: vlrbeh@hotmail.com

Journal of Electronic Banking Systems 2popularity and rapidly becoming one of themost popular services utilized by Malaysianretail banking customers. Internet bankingproviders are working ceaselessly to add toor improve their Internet banking servicesin order to make their bank a better choiceprospective customer and to retain existingones.Table 1: List of Internet Banking in Malaysia by Banking ProvidersBank NameAl Rahji BankAffin BankAlliance BankAmBankCIMB BankCitibankEON BankHong Leong BankHSBC BankMalayan BankingOCBC BankPublic BankRHB BankStandard Chartered BankThe Royal Bank of ScotlandUnited Overseas Bank(Source: Bank Negara Malaysia)Malaysia is expected to see further globalgrowth and expansion in Internet banking(Ayny, 2008). Despite Internet banking'sattractiveness, website loyalty amongInternet banking consumers has become anissue as there are many competing Internetbanking website offerings in the Malaysianmarket. This is of concern to banks becausecustomer loyalty is important in that it has apositive effect on long-term profitability(Ribbink et al., 2004). According toReichheld et al. (2000) and Reichheld andSchefter (2000) the high costs of acquiringnew e-customers can lead to unprofitablerelationships with new customers for up tothree years. As a consequence, it is crucialfor online companies to create and maintaina loyal customer base, and to monitor theprofitability of each customer segment(Reinartz and Kumar, 2002). Furthermore,new channels for online communicationoffer a host of new and promisingopportunities for customer retention, whileat the same time intensifying competition(Vatanasombut et al., 2004). However, fewcompanies seem to succeed in creating eloyalty, and little is known about themechanismsinvolvedingeneratingcustomer loyalty on the Internet (Ribbink etInternet Banking (IB)Al Rahji Bank IBaffinOnline.comAlliance OnlineAmOnlineCIMB ClicksCitibank OnlineEON Bank IBHong Leong OnlineOnline@HSBCMaybank2u.comOCBC IBPBeBank.comRHB Bank IBStandard Chartered OnlineRBS Access OnlineUOB IBal., 2004). In the online environment thecost of obtaining and retaining a customer isusually higher than through traditionalchannels (Reichheld and Schefter, 2000)and the customer’s loyalty is relativelylower, as customers are more interested inconviniences and ease of use when usingInternet banking (Turban et al., 2000).While there is a rich body of literature ononline financial services and their adoption,little is known about how to keep customersloyal to an online bank (Floh andTreiblmaie, 2006), This applies to Malaysiaas well as to other countries and thereforesuggests a crucial need for research intowhich factors are responsible for keepingcustomers loyal in Internet bankingenvironment.Given that relevant research on loyalty inthe Internet banking context is limited, thepurpose of this study is to investigate thelevel of customer loyalty to Internet bankingwebsites in Malaysia with the followingresearch questions being addressed:1.What factors determine the loyalty ofexisting customers towards Internet

3 Journal of Electronic Banking Systems2.banking services among the consumersin Malaysia?Which factors are essential in formingloyalty among Malaysian consumers inthe Internet banking environment?2. Literature ReviewPrevious studies that have investigated theissues of customer retention and customerloyalty, including e-services, have relatedthe issues to the following factors:Service QualityService quality has become an issue thatbusinesses have focused up on with eservicesthatenableelectroniccommunication, information gathering,transaction processing and data interchangebetween online vendors and customersacross time and space (Featherman andPavlou, 2002). In online environments,service quality is defined as the extent towhich a website facilitates efficient andeffective shopping, purchasing, and deliveryof product and services (Zeithaml et al.,2002). Santos (2003) described e-servicequality in terms of overall customerevaluations and judgments regarding theexcellence and the quality of e-servicedelivery in the virtual marketplace.A study by Parasuraman et al. (2005) on theInternet service quality of online shoppingwebsites resulted in the development of aservice quality scale, the e-SQ scale,consisting of seven dimensions: efficiency,system availability, fulfilment, privacy,responsiveness, compensation and contact.It is slightly different from the e-SQ scaledeveloped by Zeithaml et al. (2001) whichhas 11 dimensions:reliability,responsibility, access, flexibility, and ease ofnavigation, efficiency, assurance, security,price knowledge, site aesthetics andcustomization / personalization.Furthermore, a study by Ribbink et al.(2004) in an e-commerce context (onlinebook and CD stores) the service qualitydimensions consisted of: ease of use, escape, responsiveness and customization.Cristobal et al. (2007) further developed aservice quality scale which consists ofmultidimensional constructs of web design,customer service, assurance and ordermanagement.Perceived ValueDelivering superior customer value is anessential strategy for firms to gaincompetitive advantage and long termsuccess (Parasuraman, 1997; Woodruff,1997). Various researchers have definedperceived value as the customer’s overallassessment of the benefits they receiverelative to the sacrifice they make (Dodds etal., 1991; Slater, 1997; Woodruff, 1997).According to Parasuraman and Grewal(2000), there are four distinct types ofperceived value in their proposed expandedmodel of customer loyalty: (1) acquisitionvalue, (2) transaction value, (3) in-usevalue, and (4) redemption value. Perceivedvalue is implied as a dynamic construct andmay change its central component(s) overtime. For instance, acquisition andtransaction value may be dominant duringand immediately after a purchase, while inuse and redemption value may emerge onlyduring later stages of using theproduct/service. According to Lin and Wang(2006), in their study on the determinantsof customer loyalty in mobile commercecontexts, the benefit components ofperceived value include intrinsic attributes(ie how a purchase makes one feel),extrinsic attributes (ie reputation of theproduct/service), perceived quality andother relevant high level abstractions. The'sacrifice' components of perceived valueinclude:monetary prices and nonmonetary costs (eg time, energy, effort).TrustBased on previous research, trust has beendefined as: (1) a set of specific beliefsdealing primarily with the integrity,benevolence, and ability of another party(Doney and Cannon, 1997; Gefen and Silver,1999); (2) a general belief that anotherparty can be trusted (Gefen, 2000; Hosmer,1995; Moorman et al., 1992), sometimesalso called trusting intentions (McKnight etal., 1998) or the willingness of a party to bevulnerable to the actions of another (Mayeret al., 1995); (3) affect reflected in “feelings”of confidence and security in the caring

Journal of Electronic Banking Systems 4response of the other party (Rempel et al.,1985). Some researchers have combined thefirst two conceptualizations into oneconstruct (Doney and Cannon, 1997). Otherresearchers have split the first twoconceptualizations, declaring the specificbeliefs as antecedents of the general belief(Jarvenpaa and Tractinsky, 1999; Mayer andDavis, 1999; Mayer et al. 1995).Despite the existence of different definitionof trust in previous literature, Gefen et al.(2003) adopted the conceptualization oftrust as a set of specific beliefs whichincludes integrity, benevolence, ability andpredictability to be applied in e-commerce,and specifically in the online shoppingcontext. The definition is aligned with thepast literature where it has been mostwidely used in studies related to ongoingeconomic relationships that deal withbuyer-seller and business interactions(Crosby et al. 1990; Doney and Cannon1997; Ganesan 1994; Gefen 2002; Jarvenpaaet al. 2000). Lin and Wang (2006) whoconducted their study in an m-commercecontext have adopted the same view bydefining trust as a set of specific beliefsdealing primarily with the integrity (trusteehonesty and promise keeping), benevolence(trustee caring and motivation to act in thetruster’s interest), competence (ability oftrustee to do what the truster's needs) ) of a particular m-vendor. Thedefinition of trust as a specific set of beliefsis adopted in this study as the Internetbanking website context is a part of ecommerce which deals with buyer-sellerand business transactions.HabitThe role of habit in predicting behavior hasbeen verified in previous studies (Gefen,2003, Ouellette & Wood, 1998; Trafimow,2000). Most habitual behavior arises andproceeds efficiently, effortlessly, andunconsciously (Aarts et al., 1998) and habitcan predict customers future behavior(Bamberg, Ajzen, & Schmidt, 2003). Gefen(2003) defined habit is what an individualusually does when there is a behavioralpreference in the present. Habitual behaviorleads to the continuation of the same type ofbehavior (Aarts et al., 1998; Gefen, 2003).This is aligned with Ouellette and Wood(1998) who stated that once a behavior hasbecome a habit or well-practised behavior,it becomes automatic and is carried outwithout conscious decision. This impliesthat habit is guided by automated cognitiveprocesses, rather than by elaborate decisionmaking processes. In Internet banking, theacquire skill to use a particular websiteresulting in habit. It will discourageswitching to use other websites that requirenew skill and familiarity.ReputationHerbig and Milewicz (1993) have definedreputation as an estimation of theconsistency over time of an attribute of anentity. An organization can therefore havenumerous reputations (ie price, productquality and innovativeness reputations)and/or global reputation. According toCasalo et al. (2008), reputation must beunderstood as referring not only to thewebsite, but also the entire organization.The website is simply the maincommunication channel between consumerand organization. Thus, this study considersa holistic perspective of reputation, notlimited to online services that the banks areoffering to their customers.Customer LoyaltyMany studies have acknowledged theimportance of loyalty in the electroniccontext and have analyzed this aspect indetail (Lynch et al., 2001; Reichheld et al.,2000; Srinivasan et al., 2002; Reichheld andSchefter, 2000). Customer loyalty has beendefined as a deeply held commitment to repurchase or re-patronize a preferredproduct/service consistently in the future,thereby causing repetitive same-brand orsame brand-setpurchasing, despitesituational influences and marketing effortshaving the potential to cause switchingbehavior (Oliver, 1999). SubsequentlyRibbink et al. (2004) stated that this generaldefinition applies to online loyalty as well.Ranaweera et al. (2003) explained thatloyalty consists of both behavioral andattitudinal dimensions - more specifically:

5 Journal of Electronic Banking Systemspurchase intentions (Boulding et al., 1993),word of mouth (Gremler et al., 2001) andcommitment (Moorman et al., 1992)dimensions. Purchase intentions weredefined as the propensity to purchase aproduct or service at some point in thefuture (Ranaweera et al., 2003). Customercommitment refers to the strength ofrelational ties and to the desire to maintaina relationship (Bansal et al., 2003). Word ofmouth is defined as oral, person to personcommunication between a communicatorand a receiver whom the receiver perceivesas non-commercial with respect to a brand,product or service (Arndt, 1967).The relationships between the previouslydescribed factors with respect to customerloyalty are further expanded upon in thefollowing paragraphs.Relationship between Service Quality andCustomer LoyaltyZahorik and Rust (1992) argued thatmodeling perceived quality as aninfluencing factor of customer loyalty willprovide significant diagnostic ability to anyframework that includes customer loyaltyas a dependent construct. Previous researchhas also confirmed that a relationshipbetween perceived quality and customerloyalty both exists and is positive (Andersonand Sullivan, 1993; Cronin and Taylor,1992; Harrison-Walker, 2001). According toZeithaml et al. (1996), the existence of arelationship between service quality andcustomer retention at a higher levelindicates that service quality has an impacton individual consumer behavior, wheresuperior service quality leads to favorablebehavioral intentions (ie customer loyalty),while unfavorable behavioral intentions area consequence of inferior service quality.Ruyter and Wetzels (1998) further positedthe importance of determining the natureand strength of the relationship betweenperceived service quality and loyalty for afirm and/or different industry levels.However, according to Manhaimer (2007),consumer loyalty is not significantlyinfluenced by perceived product quality inretail industry for product with low levels ofinvolvement, and the purchase decision isinfluence by other factors. This studyconcluded that perceived product quality isnot a predicting factor of customer loyalty;it is possible for consumers to be loyal todifferent products with different qualitiesaccording to their needs and economicability. Nevertheless, the author also statedthat high perceived quality may lead toloyalty if it involves high productinvolvement. Meanwhile, Cristobal et al.(2007) rejected the hypothesis that higherlevels of perceived quality in web siteservices foster higher levels of web siteloyalty as the findings show that perceivedservice quality does not has a significanteffect on loyalty.Relationship between Perceived Value andCustomer LoyaltyPast literature showed that perceived valuecontributed to customer loyalty (Dodds etal., 1991; Grewal et al., 1998; Voss et al.,1998). Chen and Dubinsky (2003)established a conceptual framework ofperceived value in a B2C e-commercesetting for elaborating the relationshipbetween perceived value and keydeterminants. The model supports thedefinite importance of perceived value indetermining a consumer's online purchaseintention (an aspect of customer loyalty).Anderson and Srinivasan (2003) alsosuggested that when perceived value waslow customers would be more inclined toswitch to competing products in order toincrease perceived value, thus a decline inloyalty. However, an investigation ofperceived value as a predictor of customerloyalty in the golf traveller market byPetrick and Backman (2002) found it not tobe predictive. Furthermore, a finding fromthe study by Omar et al. (2007) showed thatperceived value was not a predictor ofcustomer store loyalty in a retail marketcontext.Relationship between Trust and CustomerLoyaltyTrust is expected to affect customers’willingness to purchase online; onlinecustomers generally stay away fromelectronic vendors whom they do not trust(Jarvenpaa and Tractinsky, 1999; Reichheld

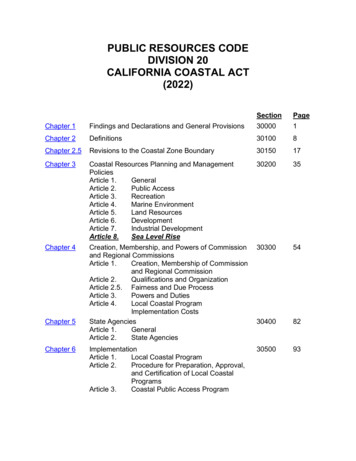

Journal of Electronic Banking Systems 6and Schefter, 2000). Conversely, Chiou(2004) found that perceived trust had directand positive impacts upon the loyalty ofcustomers. This was supported by a studyby Corbitt et al. (2003) on online firmswhich demonstrated there is a strongpositive effect of trust on loyalty. Moreover,Ribbink et al. (2004) investigated the role ofcustomer evaluations of electronic serviceand e-trust in explaining customer loyalty toonline retailers. The findings showed that etrust directly and positively affects e-loyalty.Additionally, Lee and Turban (2001)predicted that lack of trust is frequentlycited as a reason for not purchasing fromonline merchants. Although most of theliterature showed a positive impact of truston loyalty, Finn and Kayande (1997) foundthat in an online environment, trust is notconsidered as a major contributor to loyalty.Relationship between Habit and CustomerLoyaltyAbout 40–60% of customers' repeatpurchase from the same store through forceof habit (Beatty and Smith, 1987). Trafimow(2000) and Verplanken et al. (1998)highlighted that habit can directly affectbehavioral intentions more than do attitudeand social norms. Gefen (2003) found thathabit alone can explain a large proportion ofthe variance in the continued use of awebsite. The finding suggested thatcustomers’ intentions of repeat purchaseson a specific website (one they havehabitually used in the past), will increase,due directly to the reinforcement of thehabit of visiting that specific website. In theresearch done by Lin and Wang (2006), theyclaimed that customers visit websites out ofhabit, rather than through a consciousevaluation of the perceived benefits andcosts entailed. When habit is wellentrenched, people tend to ignore externalinformation or rational strategy. Such aneffect is a central element in Triandis'(1971) theory of attitude and attitudechange, in which behavioral intentions arethe product of attitude, social norms andaffect caused by habit. They concluded thathabitual prior preferences in the use ofspecific m-commerce systems directly andstrongly increased a consumer's intentionto continue using the same systems.Relationship betweenCustomer LoyaltyReputationandA more positive reputation tends to developsales and market share (Shapiro, 1982) andto establish greater customer loyalty(AndreassenandLindestad,1998;Robertson, 1993). When comparing on- andoffline exchange, Standifird et al. (1999)argued that the reputation of onlinesuppliers are significantly more importantto online consumers than any offline context(even catalog shopping). Eastlick andFeinberg (1999) argued that the behavioralintentions of catalog shopping customers (iecustomer loyalty) as compared to“conventional” brick-and-mortar shoppersare more influenced by the reputation of theorganization, since such a medium ofexchange requires consumers to purchasewithout immediate delivery or tangibleexchange. Resnick and Zeckhauser (2002)further suggested that the best-knownservice companies with good reputationssuch as eBay and Google are the ones withhealthiest profits and a loyal client base.3. Research MethodologyResearch ModelBased on the literature review, a conceptualmodel was developed which consisted ofthe determinants of customer loyalty as theindependent variables (IV), and ofcustomers’ loyalty behavior as thedependent variable (DV). The modelfocused on the factors influencing customerloyalty which consists of the relationship ofservice quality, perceived value, trust, habitand reputation with respect to customerloyalty towards Internet banking websites.The model is summarized in Figure 1.

7 Journal of Electronic Banking altyH3TrustH4HabitH5ReputationFig 1. Conceptual FrameworkResearch HypothesesAs discussed in the literature review,service quality is described as the overallcustomer evaluations and judgmentsregarding the excellence and the quality ofe-service delivery in the virtual marketplace(Santos, 2003) and is related to web design,customer service, assurance and ordermanagement dimensions (Cristobal et al.,2007). Dean (2002) in his study on thecontribution of service quality of callcentres to customer loyalty to the providingorganization in Australia has found thatperceived service quality is positivelyrelated to customer loyalty. Meanwhile,Wolfinbarger and Gilly (2002) showed thatperceived quality is the second mostimportant predictor of loyalty and intentionto repeat a purchase. Flavian et al. (2006)suggested aspects such as how user-friendlythe web site is (a part of the service quality)are determinants of web site loyalty levels.As a consequence, the first hypothesis isstated as follows:H1: Service quality has a positiveinfluence on customer loyalty towardsInternet banking websites.Referring to the literature review, perceivedvalue is related to the overall evaluation ofthe customer on the differences betweenthe benefits they received and the sacrificethey make (Woodruff, 1997). In the studyconducted by Lin and Wang (2006) on mcommerce, perceived value is a significantpredictor of customer loyalty. To discouragecustomers from switching to competitors, acompany must continuously work atenhancing perceived value in order toobtain higher customer loyalty. Thesignificant relationship between perceivedvalue and loyalty is also supported by otherresearchers such as Hsu (2007) andAnderson and Srinivasan (2003) asmentioned in the previous section.Therefore, a second hypothesis is proposed:H2: Perceived value has a positiveinfluence on customer loyalty towardsInternet banking websites.Trust, as previously discussed, refers to theconsumerbeliefsaboutcertaincharacteristics of the supplier e and predictability) (Gefen et al.,2003). As described in the literature review,it shows that there is an effect of trust oncustomer loyalty. Lin and Wang (2006) alsoproved that trust has a positive effect oncustomerloyaltyinm-commerce.Customers who cannot trust an m-vendorwill not be loyal to that m-vendor, eventhough they are satisfied with theproduct/servicesprovided.Wheninvestigating e-loyalty within an e-servicescontext, Cyr et al. (2007) showed thathigher levels of trust will result in higherloyalty towards e-services website. Lastly,Floh and Treiblmaier (2006) investigatedthe importance of antecedents of onlineloyalty such as trust, quality of the Web site,

Journal of Electronic Banking Systems 8quality of the service and overallsatisfaction in the online bankingenvironment. They found out that trust canbe seen as a major antecedent of customerloyalty. In light of the above research, thethird hypothesis is proposed as below:H3: Customer trust has a positiveinfluence on customer loyalty towardsInternet banking websites.Habit is what one usually does, that is it is abehavioral preference in the present andleads to the perpetuation of the same typeof behavior (Aarts et al., 1998; Gefen, 2003).Based on the literature described in Section2, past studies by researchers such as Linand Wang (2006) and Gefen (2003) havehighlighted that habit directly influencesloyalty. As an addition to the existingliteratures in this study, Liao et al (2006)described that habitual activity with a website will positively affect a user’s intentionto continue using that web site. That authoralso verified that a consumer’s habits were amajor predictor of loyalty. Following thestatement mentioned above, the forthhypothesis is presented as below:H4: Customer habit has a positiveinfluence on customer loyalty towardsInternet banking websites.The literature review discussed thatreputation relates to consistency over timeof an attribute of an organization such asreputation in term of price, product quality,innovativeness, or global reputation (Herbigand Milewicz, 1993). In the study conductedby Casalo et al. (2008), a more favourablewebsite reputation led to a greater degreeof loyalty. Goode and Harris (2007) alsodescribed that favorable interpretations ofthe online reputation of an online supplierare directly and positively associated withthe behavioral intentions of consumers suchas loyalty. It showed that online consumersare tend to be extremely cautious, distrust“new” online suppliers and use hiness. Other literature previouslymentioned also supports the relationshipbetween reputation and loyalty. As aconsequence, the fifth hypothesis is statedas follows:H5: Reputation has a positive influence oncustomer loyalty towards Internetbanking tA Structured questionnaire was developedto obtain the responses from Internetbanking users about their opinions onvariousresearchvariables.Thequestionnaire of this study consists of sevenvariables: service quality (17 items),perceived value (3 items), trust (5 items),habit (4 items), reputation (4 items) andcustomer loyalty (5 items). The sevenvariables mentioned above are used incurrent research with the measurementitems are totally adapted based on theprevious researches. The measurementitems are then rephrased so that all itemscan be applied to Internet banking context.In order to measure Internet banking users’perceptions of service quality, this studyadapted 17 questionnaire items from thePerceived e-Service Quality (PeSQ) scalewhich was developed for a study done byCristobal et al. (2007). These 17measurement items are grouped into fourdimensions: (1) web design, which isrelated to the design of the web site (egcontent layout, content updating and userfriendliness); (2) customer service, which isrelated to service performance, customersensitivity (willingness to help customers),personalised service and fast response tocomplaints; (3) assurance, which is relatedto security, privacy and reliability elements;(4) order management, which relates to thepossibility of modifying and/or postponingthe purchasing process at any givenmoment and with no obligation, and ofobtaininginformationonproductavailability at the moment of purchase.Then, perceived value, trust and habit areadapted from Lin and Wang (2006), witheach consisting of 3, 5 and 4 itemsmeasurement respectively. Lastly, tomeasure customer assessment of Internetbanking website provider reputation indetermining their choices of Internetbanking website, this study adapted a paststudy from Casalo et al. (2008) whichconsists of 4 items measurement. As for

9 Journal of Electronic Banking Systemscustomer loyalty, the construct isoperationalized into a total of 5 items whichare adapted from the research of Lin andWang (2006). All items were measured byseven-point Likert scales ranging fromstrongly disagree ( 1) to strongly agree( 7) and respondents were asked toindicate their level of agreement withrespect to each item. Respondents were alsorequired to indicate their usage of Internetbanking websites and provide demographicinformation.SamplingThe sampling procedure that was adoptedin this study for data collection was aconvenience sampling method throughquestionnaire survey with a pre-plannedsample size of 350 respondents. The targetsample in this study was experiencedInternet banking users. The questionnairesurvey was distributed in Klang Valley,which is the most populous, urbanized andin

Citibank Citibank Online EON Bank EON Bank IB Hong Leong Bank Hong Leong Online HSBC Bank Online@HSBC Malayan Banking Maybank2u.com OCBC Bank OCBC IB Public Bank PBeBank.com RHB Bank RHB Bank IB Standard Chartered Bank Standard Chartered Online The Royal Bank of Scotland RBS Access Online United Overseas Bank UOB IB (Source: Bank Negara Malaysia)