Transcription

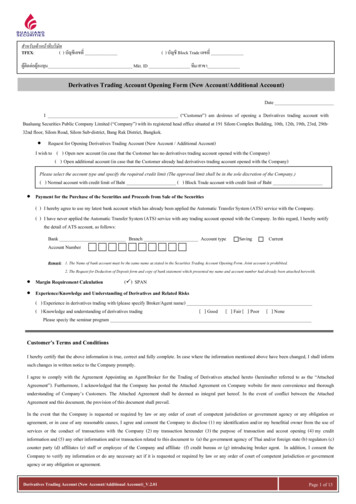

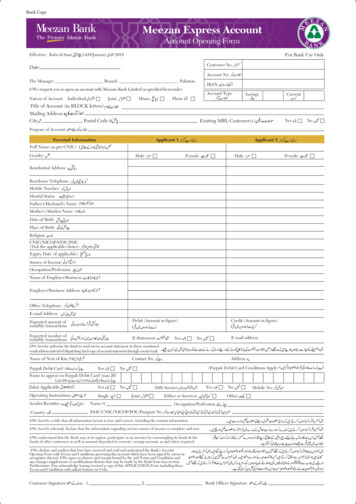

Meezan Express AccountAccount Opening FormEffective: Rabi-ul-Sani1438/JanuaryFor Bank Use Only2018Customer No.Date:Account No.The Manager Branch, , PakistanIBANI/ We request you to open an account with Meezan Bank Limited as specified hereunder.Nature of AccountIndividualJointAccount TypeSavingsPhotoMinorCurrentTitle of Account (in BLOCK letters)Mailing AddressCityPostal CodeExisting MBL Customer(s)YesPurpose of AccountPersonal InformationApplicant 1Applicant 2Full Name (as per CNIC)GenderMaleFemaleMaleFemaleResidential AddressResidence TelephoneMobile NumberMarital StatusFather’s/Husband’s NameMother's Maiden NameDate of BirthPlace of BirthReligionCNIC/NICOP/SNIC/POC(Tick the applicable choice)Expiry Date (if applicable)Source of IncomeOccupation/ProfessionName of Employer/BusinessEmployer/Business AddressOffice TelephoneE-mail AddressDebit (Amount in figure)Expected amount ofmonthly transactionsExpected number ofmonthly transactionsE-StatementYesCredit (Amount in figure)E-mail addressNoI/We hereby authorize the Bank to send me/us account statement at above mentionedemail address instead of dispatching hard copy of account statement through courier/mail.Name of Next of KinContact No.Paypak Debit CardYesAddress(Paypak Debit Card Conditions Apply)NoName to appear on Paypak Debit Card (max 20)Zakat ApplicableYesOperating InstructionsSingleNoSMS ServiceJointYesEither or POC/Passport No.NoOtherOccupation/ProfessionI/We hereby certify that all information herein is true and correct, including the contact information.I/We hereby solemnly declare that the information regarding my/our source of income is complete and true.I/We understand that the Bank may at its option, participate as an investor by commingling its funds & thefunds of other customers as well as amount deposited in current / savings account, as and when required.I/We declare and confirm that I/we have received and read and understood the Bank's AccountOpening Form with Terms and Conditions governing this account which have been signed by me/us inacceptance thereof. I/We agree to observe and remain bound by the said Terms and Conditions andany changes supplements or modifications thereto that may be made by the Bank from time to time.Furthermore, I/we acknowledge having received a copy of this APPLICATION Form including theseTerms and Conditions with salient features in Urdu.Customer Signature1.2.Bank Officer SignatureMobile No.No

Terms & Conditions:1)In Savings Account, the relationship between the Bank andthe customer shall be based on Mudarabah, where theCustomer is the Rab ul Maal and the Bank is the Mudarib.The Bank as the Mudarib may invest or disinvest, at its solediscretion, monies/funds received by it from the customers inany of the businesses of the Bank as it deems fit with theapproval of the Resident Shariah Board Member(RSBM)/Shariah Supervisory Board (SSB) of Meezan Bank.Funds deposited by the customer with the Bank under CurrentAccount of Meezan Express Account are to be on the basis ofQard and therefore shall be payable by the Bank upon demand.The Bank at its discretion may utilize such funds as it deemsfit. No profit shall be paid in Current Account.2) The Mudarib’s share in the profit shall be on the basis of apredetermined percentage of the distributable profit of theBusiness, defined as Gross Income of the Pool minus alldirect cost/expenses incurred in deriving that income as wellas minus the Bank’s share as an investor. The Mudarib Sharemay vary from time to time and can be obtained from theBank upon request as well as available on the Bank’s websiteat www.meezanbank.com3) The Bank may also participate in the Business at its option asan investor sharing the profit in proportion to its equitybefore distribution of profit between Rab-ul-Maal andMudarib. All the Customers shall be assigned weightages(profit distribution ratio for weighted average investment)based on the features of the Account held by them, such astenure, profit payment options and other applicable featuresfor the purposes of calculation of profit. The weightagesapplicable to the Account shall be announced three daysbefore the beginning of every month and shall be available atthe Bank upon request and at the website of the Bank atwww.meezanbank.com and shall not be changed during themonth. All accounts are finalized at the end of the month bythe Bank for calculation of profit or loss.4) Profit calculation shall be based on daily product basis (dayend balance calculated with respective weightagesapplicable).5) In the event of loss on either the capital or profit in respect ofthe business, all investor of the investment pool shall share insuch loss on a pro rata basis. However, if loss has beenincurred by the Business owing to gross negligence or willfuldefault of the Bank, the Customers will not be liable to sharein such loss.6) Redemption of any amount in the Savings Account by thecustomer shall mean the transfer of its respective share in theBusiness along with all related risks and rewards. Uponreceipt of the duly filled Account Opening Form and therequisite documentation and information requiredthereunder or otherwise by the Bank, the Bank may, at itssole discretion, open an account and/or agree to provide theServices to the Customer.7) The Bank shall issue Account statements or make themavailable through Internet Banking or Electronic Mail(e-mail) to the Account holder semiannually or at such otherintervals as required by SBP. In case of anyinconsistency/error in the statement the customer shall notifythe Bank within 45 days, otherwise the same would beconsidered correct and accepted by the Customer.8) In case of an e-Statement, the Bank will not be heldresponsible for any misuse of the information so relayed,incomplete information, statement gets bounced back/ couldnot be delivered due to any reason.9) The Bank may, without any further express authorizationfrom the Customer, debit any account of the Customermaintained with the Bank for all expenses, fees, commissionspayable by the customer, including charges mentioned inSchedule of Charges, unless exempted by Law, SBP/otherregulatory bodies.10) Withdrawals shall only be made through cheque forms anddebit cards supplied by the Bank. Cheques and otherpayment instructions are to be signed as per specimensignature supplied to the Bank and alterations therein are tobe authenticated by the Customer's signature.Customer Signature.2.1

11) In case of joint account, the balance shall belong to theCustomers jointly and they will jointly and severally be liablefor all liabilities incurred on the Account and the Services.12) In case of a Joint Account with ‘either or survivor operatinginstructions’ and in the event of the death of any of theCustomers, the amount of deposit to the credit of suchAccount, at the time of the death in question shall belong tothe survivors.13) Any account remaining inoperative for one (1) year shall bedesignated as Dormant Account. Debit/Credit entry by Bankgenerated transactions or by way of inward remittances,clearing, in such account shall not reactivate the DormantAccount. Withdrawals from such account shall be subject tothe approval of the relevant Branch Manager/ManagerOperations or in accordance with the prevailing policies ofthe Bank. A Customer can reactivate the Account by writingan application to the Bank as per the procedure/formprovided by the Bank. In case an Account remainsinoperative for ten (10) years, the funds lying to thecredit of the Dormant Account shall be surrendered tothe State Bank of Pakistan, in accordance with theapplicable rules and regulations.14) If the Bank receives notice of demise of an individualCustomer or becomes aware from any reliable source, theBank shall not be obliged to allow any operation orwithdrawal except on the production of evidence of title orright to operate the Account, which the Bank considerssufficient.15) The Bank may, at its sole discretion close the account withoutdisclosing the reason for closure. The credit balance in theCustomer Account will be sent through Pay Order on the lastavailable customer’s address on the Bank’s records.16) No Local credit shall be allowed in Meezan Express Account.17) Account will be fed through foreign inward remittance only.The account will be blocked for other types of deposits.18) No withholding tax shall be applied on cash withdrawal.19) Meezan Express Account will be opened in PKR and fed byHome Remittances only.20) Funds received in Meezan Express Account will be treated asnon-repatriable i.e. Outward remittances will not be allowedfrom the account.21) Meezan Express Account can only be opened by beneficiariesof home remittances.22) Debit Card issued in Meezan Express Account cannot beused outside Pakistan.23) The Bank is also entitled to market its products and servicesto its existing Customers via the SMS, e-mails and otherchannels.24) The Customer acknowledges that SMS facility is dependenton the telecommunications infrastructure, the Customeraccepts that timelines of Alerts sent by the Bank will dependon factors affecting the telecommunications. Neither theBank nor its Service Providers shall be liable for non-deliveryor delayed delivery of alerts, error, loss, distortion intransmission of and wrongful transmission of alerts to theCustomer.25) These terms and conditions may be revised or modified by theBank from time to time, subject to the laws of Pakistan, includingall pertinent communication by the State Bank of Pakistan,provided that such laws do not contradict the Islamic Shariah. Incase of any contradiction, the rules of Islamic Shariah as per thedirectives of the RSBM/SSB of the Bank or the SSB of the StateBank, in light of the IBD guidelines, will prevail. The revised ormodified terms will become effective upon 30 days of advancenotice given to the customer. Such notice shall be deemed tohave been given if displayed at the counters of the Bank orposted on its website.26) Customer will provide income proof of remitter/beneficialowner if required by the Bank.Customer Signature.2.1

Meezan Express Account

Customer CopyMeezan Express AccountAccount Opening FormEffective: Rabi-ul-Sani1438/JanuaryFor Bank Use Only2018Customer No.Date:Account No.The Manager Branch, , PakistanIBANI/ We request you to open an account with Meezan Bank Limited as specified hereunder.Nature of AccountIndividualJointAccount TypeSavingsPhotoMinorCurrentTitle of Account (in BLOCK letters)Mailing AddressCityPostal CodeExisting MBL Customer(s)YesPurpose of AccountPersonal InformationApplicant 1Applicant 2Full Name (as per CNIC)GenderMaleFemaleMaleFemaleResidential AddressResidence TelephoneMobile NumberMarital StatusFather’s/Husband’s NameMother's Maiden NameDate of BirthPlace of BirthReligionCNIC/NICOP/SNIC/POC(Tick the applicable choice)Expiry Date (if applicable)Source of IncomeOccupation/ProfessionName of Employer/BusinessEmployer/Business AddressOffice TelephoneE-mail AddressDebit (Amount in figure)Expected amount ofmonthly transactionsExpected number ofmonthly transactionsE-StatementYesCredit (Amount in figure)E-mail addressNoI/We hereby authorize the Bank to send me/us account statement at above mentionedemail address instead of dispatching hard copy of account statement through courier/mail.Name of Next of KinContact No.Paypak Debit CardYesAddress(Paypak Debit Card Conditions Apply)NoName to appear on Paypak Debit Card (max 20)Zakat ApplicableYesOperating InstructionsSingleNoSMS ServiceJointYesEither or POC/Passport No.NoOtherOccupation/ProfessionI/We hereby certify that all information herein is true and correct, including the contact information.I/We hereby solemnly declare that the information regarding my/our source of income is complete and true.I/We understand that the Bank may at its option, participate as an investor by commingling its funds & thefunds of other customers as well as amount deposited in current / savings account, as and when required.I/We declare and confirm that I/we have received and read and understood the Bank's AccountOpening Form with Terms and Conditions governing this account which have been signed by me/us inacceptance thereof. I/We agree to observe and remain bound by the said Terms and Conditions andany changes supplements or modifications thereto that may be made by the Bank from time to time.Furthermore, I/we acknowledge having received a copy of this APPLICATION Form including theseTerms and Conditions with salient features in Urdu.Customer Signature1.2.Bank Officer SignatureMobile No.No

Customer CopyTerms & Conditions:1)In Savings Account, the relationship between the Bank andthe customer shall be based on Mudarabah, where theCustomer is the Rab ul Maal and the Bank is the Mudarib.The Bank as the Mudarib may invest or disinvest, at its solediscretion, monies/funds received by it from the customers inany of the businesses of the Bank as it deems fit with theapproval of the Resident Shariah Board Member(RSBM)/Shariah Supervisory Board (SSB) of Meezan Bank.Funds deposited by the customer with the Bank under CurrentAccount of Meezan Express Account are to be on the basis ofQard and therefore shall be payable by the Bank upon demand.The Bank at its discretion may utilize such funds as it deemsfit. No profit shall be paid in Current Account.2) The Mudarib’s share in the profit shall be on the basis of apredetermined percentage of the distributable profit of theBusiness, defined as Gross Income of the Pool minus alldirect cost/expenses incurred in deriving that income as wellas minus the Bank’s share as an investor. The Mudarib Sharemay vary from time to time and can be obtained from theBank upon request as well as available on the Bank’s websiteat www.meezanbank.com3) The Bank may also participate in the Business at its option asan investor sharing the profit in proportion to its equitybefore distribution of profit between Rab-ul-Maal andMudarib. All the Customers shall be assigned weightages(profit distribution ratio for weighted average investment)based on the features of the Account held by them, such astenure, profit payment options and other applicable featuresfor the purposes of calculation of profit. The weightagesapplicable to the Account shall be announced three daysbefore the beginning of every month and shall be available atthe Bank upon request and at the website of the Bank atwww.meezanbank.com and shall not be changed during themonth. All accounts are finalized at the end of the month bythe Bank for calculation of profit or loss.4) Profit calculation shall be based on daily product basis (dayend balance calculated with respective weightagesapplicable).5) In the event of loss on either the capital or profit in respect ofthe business, all investor of the investment pool shall share insuch loss on a pro rata basis. However, if loss has beenincurred by the Business owing to gross negligence or willfuldefault of the Bank, the Customers will not be liable to sharein such loss.6) Redemption of any amount in the Savings Account by thecustomer shall mean the transfer of its respective share in theBusiness along with all related risks and rewards. Uponreceipt of the duly filled Account Opening Form and therequisite documentation and information requiredthereunder or otherwise by the Bank, the Bank may, at itssole discretion, open an account and/or agree to provide theServices to the Customer.7) The Bank shall issue Account statements or make themavailable through Internet Banking or Electronic Mail(e-mail) to the Account holder semiannually or at such otherintervals as required by SBP. In case of anyinconsistency/error in the statement the customer shall notifythe Bank within 45 days, otherwise the same would beconsidered correct and accepted by the Customer.8) In case of an e-Statement, the Bank will not be heldresponsible for any misuse of the information so relayed,incomplete information, statement gets bounced back/ couldnot be delivered due to any reason.9) The Bank may, without any further express authorizationfrom the Customer, debit any account of the Customermaintained with the Bank for all expenses, fees, commissionspayable by the customer, including charges mentioned inSchedule of Charges, unless exempted by Law, SBP/otherregulatory bodies.10) Withdrawals shall only be made through cheque forms anddebit cards supplied by the Bank. Cheques and otherpayment instructions are to be signed as per specimensignature supplied to the Bank and alterations therein are tobe authenticated by the Customer's signature.Customer Signature.2.1

Customer Copy11) In case of joint account, the balance shall belong to theCustomers jointly and they will jointly and severally be liablefor all liabilities incurred on the Account and the Services.12) In case of a Joint Account with ‘either or survivor operatinginstructions’ and in the event of the death of any of theCustomers, the amount of deposit to the credit of suchAccount, at the time of the death in question shall belong tothe survivors.13) Any account remaining inoperative for one (1) year shall bedesignated as Dormant Account. Debit/Credit entry by Bankgenerated transactions or by way of inward remittances,clearing, in such account shall not reactivate the DormantAccount. Withdrawals from such account shall be subject tothe approval of the relevant Branch Manager/ManagerOperations or in accordance with the prevailing policies ofthe Bank. A Customer can reactivate the Account by writingan application to the Bank as per the procedure/formprovided by the Bank. In case an Account remainsinoperative for ten (10) years, the funds lying to thecredit of the Dormant Account shall be surrendered tothe State Bank of Pakistan, in accordance with theapplicable rules and regulations.14) If the Bank receives notice of demise of an individualCustomer or becomes aware from any reliable source, theBank shall not be obliged to allow any operation orwithdrawal except on the production of evidence of title orright to operate the Account, which the Bank considerssufficient.15) The Bank may, at its sole discretion close the account withoutdisclosing the reason for closure. The credit balance in theCustomer Account will be sent through Pay Order on the lastavailable customer’s address on the Bank’s records.16) No Local credit shall be allowed in Meezan Express Account.17) Account will be fed through foreign inward remittance only.The account will be blocked for other types of deposits.18) No withholding tax shall be applied on cash withdrawal.19) Meezan Express Account will be opened in PKR and fed byHome Remittances only.20) Funds received in Meezan Express Account will be treated asnon-repatriable i.e. Outward remittances will not be allowedfrom the account.21) Meezan Express Account can only be opened by beneficiariesof home remittances.22) Debit Card issued in Meezan Express Account cannot beused outside Pakistan.23) The Bank is also entitled to market its products and servicesto its existing Customers via the SMS, e-mails and otherchannels.24) The Customer acknowledges that SMS facility is dependenton the telecommunications infrastructure, the Customeraccepts that timelines of Alerts sent by the Bank will dependon factors affecting the telecommunications. Neither theBank nor its Service Providers shall be liable for non-deliveryor delayed delivery of alerts, error, loss, distortion intransmission of and wrongful transmission of alerts to theCustomer.25) These terms and conditions may be revised or modified by theBank from time to time, subject to the laws of Pakistan, includingall pertinent communication by the State Bank of Pakistan,provided that such laws do not contradict the Islamic Shariah. Incase of any contradiction, the rules of Islamic Shariah as per thedirectives of the RSBM/SSB of the Bank or the SSB of the StateBank, in light of the IBD guidelines, will prevail. The revised ormodified terms will become effective upon 30 days of advancenotice given to the customer. Such notice shall be deemed tohave been given if displayed at the counters of the Bank orposted on its website.26) Customer will provide income proof of remitter/beneficialowner if required by the Bank.Customer Signature.2.1

I/We request you to open an account with Meezan Bank Limited as specified hereunder. Meezan Express Account Account Opening Form Effective: Rabi-ul-Sani 1438/January 2018 Customer No. Account No. IBAN Account Type For Bank Use Only Current Date: Debit (Amount in figure) Credit (Amount in figure) Full Name (as per CNIC) Residence Telephone