Transcription

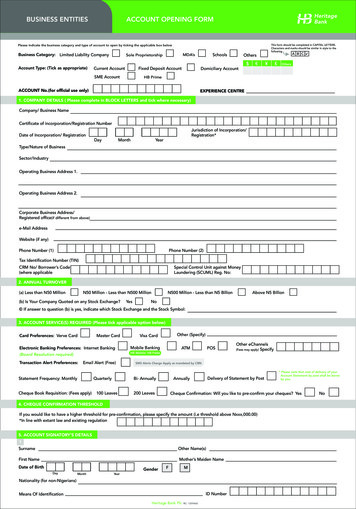

BUSINESS ENTITIESACCOUNT OPENING FORMThis form should be completed in CAPITAL LETTERS.Characters and marks should be similar in style to thefollowingPlease indicate the business category and type of account to open by ticking the applicable box belowBusiness Category: Limited Liability CompanySchoolsMDA’sSole Proprietorship Account Type: (Tick as appropriate)Current AccountFixed Deposit AccountSME AccountA B COthersOthersDomiciliary AccountHB PrimeACCOUNT No.(for official use only)EXPERIENCE CENTRE1. COMPANY DETAILS ( Please complete in BLOCK LETTERS and tick where necessary)Company/ Business NameCertificate of incorporation/Registration NumberJurisdiction of Incorporation/Registration*Date of Incorporation/ RegistrationDayMonthYearType/Nature of BusinessSector/IndustryOperating Business Address 1.Operating Business Address 2.Corporate Business Address/Registered office(if different from above)e-Mail AddressWebsite (if any)Phone Number (1)Phone Number (2)Tax Identification Number (TIN)CRM No/ Borrower’s Code(where applicableSpecial Control Unit against MoneyLaundering (SCUML) Reg. No:2. ANNUAL TURNOVER(a) Less than N50 MillionN50 Million - Less than N500 Million(b) Is Your Company Quoted on any Stock Exchange?YesN500 Million - Less than N5 BillionAbove N5 BillionNo If answer to question (b) is yes, indicate which Stock Exchange and the Stock Symbol:3. ACCOUNT SERVICE(S) REQUIRED (Please tick applicable option below)Card Preferences: Verve CardMaster CardElectronic Banking Preferences: Internet BankingMobile Banking(Board Resolution required)HB Mobile/ HB PadieTransaction Alert Preferences:Email Alert (Free)Statement Frequency: MonthlyQuarterlyCheque Book Requisition: (Fees apply)Other (Specify)Visa CardOther eChannels(Fees may apply) SpecifySMS Alerts Charge Apply as mandated by CBNBi- Annually100 LeavesPOSATMDelivery of Statement by PostAnnually200 LeavesCheque Confirmation: Will you like to pre-confirm your cheques? Yes4. CHEQUE CONFIRMATION THRESHOLDIf you would like to have a higher threshold for pre-confirmation, please specify the amount (i.e threshold above Nxxx,000.00)*In line with extant law and existing regulation5. ACCOUNT SIGNATORY’S DETAILS1SurnameOther Name(s)First NameMother’s Maiden NameDate of BirthGenderDayMonth* Please note that cost of delivery of yourAccount Statement by post shall be borneby you.FMYearNationality (for non-Nigerians)ID NumberMeans Of IdentificationHeritage Bank PlcRC: 1259460No

BUSINESS ENTITIESACCOUNT OPENING FORMID Issue DateID Expiry DateDayMonthDayYearYearMonthBANK VERIFICATION NUMBEROccupationStatus/ Job TitlePosition/Office of the OfficerResidential AddressHouse NumberStreet NameNearest Bus Stop/ LandmarkCity/ TownLocal Govt. AreaStatePhone Number (1)e-Mail AddressPhone Number (2)DateSignatureDayMonthClass of Signatory(Please indicate class in the box provided)YearABCBC2SurnameOther Name(s)First NameMother’s Maiden NameDate of BirthGenderDayMonthFMYearNationality (for non-Nigerians)ID NumberMeans Of IdentificationID Issue DateID Expiry DateDayMonthDayYearYearMonthBANK VERIFICATION NUMBEROccupationStatus/ Job TitlePosition/Office of the OfficerResidential AddressHouse NumberStreet NameNearest Bus Stop/ LandmarkCity/ TownLocal Govt. AreaStatePhone Number (1)e-Mail AddressPhone Number (2)DateSignatureDayMonthClass of Signatory(Please indicate class in the box provided)3SurnameOther Name(s)First NameMother’s Maiden NameDate of BirthGenderDayNationality (for non-Nigerians)MonthFMYearID NumberMeans Of IdentificationID Issue DateID Expiry DateDayMonthDayYearMonthBANK VERIFICATION NUMBEROccupationStatus/ Job TitleHeritage Bank PlcRC: 1259460YearYearA

BUSINESS ENTITIESACCOUNT OPENING FORMPosition/Office of the OfficerResidential AddressHouse NumberStreet NameNearest Bus Stop/ LandmarkCity/ TownLocal Govt. AreaStatePhone Number (1)e-Mail AddressPhone Number (2)DateSignatureDayMonthClass of Signatory(Please indicate class in the box provided)6A. DETAILS OF THE DMINISTRATOR/PRINCIPAL OFFICERS1SurnameOther Name(s)First NameMother’s Maiden NameDate of BirthGenderDayMonthFMYearNationality (for non-Nigerians)ID NumberMeans Of IdentificationID Issue DateID Expiry DateDayMonthDayYearMonthYearBANK VERIFICATION NUMBEROccupationStatus/ Job TitleResidential AddressHouse NumberStreet NameNearest Bus Stop/ LandmarkCity/ TownLocal Govt. AreaStatePhone Number (1)e-Mail AddressPhone Number (2)2SurnameOther Name(s)First NameMother’s Maiden NameDate of BirthGenderDayMonthFMYearNationality (for non-Nigerians)ID NumberMeans Of IdentificationID Issue DateID Expiry DateDayMonthDayYearMonthBANK VERIFICATION NUMBEROccupationStatus/ Job TitleResidential AddressHouse NumberStreet NameNearest Bus Stop/ LandmarkCity/ TownLocal Govt. AreaStatePhone Number (1)e-Mail AddressPhone Number (2)Heritage Bank PlcRC: 1259460YearYearABC

BUSINESS ENTITIESACCOUNT OPENING FORM3SurnameOther Name(s)First NameMother’s Maiden NameDate of BirthFGenderDayMYearMonthNationality (for non-Nigerians)ID NumberMeans Of IdentificationID Issue DateID Expiry DateDayDayYearMonthYearMonthBANK VERIFICATION NUMBEROccupationStatus/ Job TitleResidential AddressHouse NumberStreet NameNearest Bus Stop/ LandmarkCity/ TownLocal Govt. AreaStatePhone Number (1)e-Mail AddressPhone Number (2)6 B. DETAILS OF A SOLE PROPRIETORI. PERSONAL INFORMATIONTitleSurnameFirst NameOther NameMarital Status(Please tick as appropriate)SingleDate of BirthOthersMarriedGender(Please Specify)DayMonthYearFMPlace of BirthMother’s Maiden NameResidentPermit No.Nationality(for Non Nigerian)Permit Issue DatePermit Expiry DateDayMonthDayYearL.G.AMonthYearState of OriginTax Identification Number (TIN)II. CONTACT DETAILSBusiness/ Residential AddressStreet NumberStreet NameNearest Bus Stop/ LandmarkCity/ TownLocal Govt. AreaStatePhone Number (1)e-Mail AddressPhone Number (2)III. MEANS OF IDENTIFICATIONNational ID CardNational Driver’s LicenseInternational PassportID issue DateID No.Valid INEC Voter’s CardDayMonth* Others (Please specify)YearID Expiry DateDayYearMonthBANK VERIFICATION NUMBER* People in peculiar circumstances - Artisans, Petty Traders, Students who may not have the prescribed ID’sIV. DETAILS OF NEXT OF KINSurnameFirst NameOther Name(s)RelationshipTitle (Specify)Date of BirthGenderDayHeritage Bank PlcRC: 1259460MonthYearFM

BUSINESS ENTITIESACCOUNT OPENING FORMe-Mail AddressMobile Number (2)Contact DetailsMobile Number (1)House NumberStreet NameNearest Bus Stop/ LandmarkCity/ TownStateLocal Govt. Area7. ADDITIONAL DETAILS:1. Name of affiliated company/Body:1.2.3.2. Parent Company’s Country ofIncorporationIII. DETAILS OF ACCOUNT HELD WITH OTHER BANKS BY THE PROSPECTIVE COMPANY/PARTNERSHIP/SOLE PROPRIETORSHIPS/NNAME AND ADDRESS OFBANK/BRANCHACCOUNT NAMEACCOUNT NUMBERSTATUS:ACTIVE/ DORMANTACCOUNT NUMBERSTATUS:ACTIVE/ DORMANT1.2.3.4.IV. DETAILS OF OTHER HERITAGE BANK ACCOUNTS HELD (PREVIOUS OR EXISTING)S/NEXPERIENCE CENTREACCOUNT NAME8. ACCOUNT OPENING MANDATE(Please tick as appropriate)a. Account Type:Current Account Fixed Investment AccountOthersDomiciliary AccountOthersb. Account Name:c. Account No:(for official use only)d. Mandate authorisation/ Combination rule (Please tick as appropriate): Sole SignatoryEither to SignBoth to SignOthersspecifye. SignatoriesiFull Name:Telephone Number:BVN No.:AffixPassportPhotographhereClass of Signatory:Signature and DateFOR BANK USE ONLYFOR BANK USE ONLYNameNameSignatureSignatureHeritage Bank PlcRC: 1259460

BUSINESS ENTITIESACCOUNT OPENING FORMii Full Name:Telephone Number:BVN No.:AffixPassportPhotographhereClass of Signatory:Signature and DateFOR BANK USE ONLYFOR BANK USE ONLYNameNameSignatureSignatureiii Full Name:Telephone Number:BVN No.:AffixPassportPhotographhereClass of Signatory:Signature and DateFOR BANK USE ONLYFOR BANK USE ONLYNameNameSignatureSignature9. AUTHORITY TO DEBIT ACCOUNT FOR SEARCH FEEHeritage Bank PlcDear Sir,AUTHORITY TO DEBIT OUR CURRENT ACCOUNT FOR SEARCH FEEWe hereby authorize you to debit our account with the applicable charges for the legal search conducted on our account atthe Corporate Affairs Commission or relevant agency/authority.Thank you.Yours faithfully,Authorized Signature of the Customer /Representative & DateAuthorized Signature of the Customer /Representative & DateHeritage Bank PlcRC: 1259460

INDIVIDUALACCOUNT OPENING FORM9. TERMS AND CONDITIONSI/We confirm and agree that my/our account(s) and all banking transactions between me/us (“theCustomer”, “I”, or “me” or “we”) and Heritage Bank Plc(“the Bank) shall be governed by theconditions specified below and/or the terms of any specific agreement between me/us and theBank or where not regulated by either the conditions or such agreement, by customary bankingpractices in Nigeria.1.The Bank will not establish or operate the requested account(s) unless and until it has receivedthe required supporting documents for the account, a list of which has been provided to me/us andis included with this application form.2.The Bank is hereby authorized to undertake all “Know Your Customer” (KYC) proceduresspecified by applicable law/regulations and/or Bank policies including the confirmation of my/ourdetails and legal status at the appropriate government registry. I/We hereby authorize you to debitmy/our account without further notice to me/us for the costs attendant to such KYC procedures.3.The Bank may, without prior notice, impose or change the minimum balance requirements formy/our account(s) or alter the applicable interest rate(s) or the charges relating to suchaccounts(s) or any of them.4.The bank is authorized, where the balance standing to the credit of my/our accounts is below therequired minimum balance, to either amend the rate(s) of interest payable or close the account(s).5.The Bank is authorized to transfer money from any deposit account, I/We maintain to any otheraccounts(s), I/We maintain with the Bank whose balance is below the required minimum.6.The Bank shall, in addition to any right of set-off or similar right prescribed by law, be entitled,without notice, to combine and consolidate all or any of my/our Accounts with the Bank (withoutany liabilities to the Bank) and/or to set off or transfer any or all amounts owed by me/us or either ofus or a related party to the Bank against any and all money which the Bank may hold for my/ouraccount or any other credit be it cash, cheques, valuables deposits securities account orotherwise and whether in Naira or any other currency (hereinafter referred to as “foreigncurrency”).7.The Bank shall be entitled to retain and not repay any amount whatsoever that it owed to me/us orwhich it holds on my/our behalf and until all amounts owed by me/us or the related party to theBank have been repaid or discharged in full and, for so long as such amounts so owed to me/us orheld on my/our behalf towards the payment and discharge of the amounts owed by me/us or eitherof us or the related party to the Bank.8.When effecting any set-off the Bank shall be entitled at its absolute discretion, with or withoutnotice to me/us to convert any Naira or foreign currency into the currency in which the amountowed was incurred at the applicable official exchange rate for the currencies in question prevailingin Nigeria at the date and time of such conversion.21.I/We understand and acknowledge that electronic mail, facsimile and verbal communicationsare insecure transmission media where I/We advise the Bank to accept the instruction in suchmanner, I/We however undertake to indemnify the Bank in full for any loss it may suffer or incur byreason of its honoring my/our Letters, electronic mail, facsimile or verbal instructions, irrespectiveof whether same are erroneous, fraudulent or issued otherwise than in accordance with theMandate for my/our Accounts(s), any and all payment instructions issued in accordance with theMandate for my/our account(s) and which bears or purports to bear the facsimile or electronicBank by me/us. The Bank is hereby authorized to honor and to debit my/our account, for any andall payment instructions/confirmations issued or provided by me/us using a pre-agreed format forsame which may include but is not limited to electronic or written instructions/confirmations andwhere given electronically such instruction may if previously agreed involves the use of specificpasswords(s) and when given in writing may be given by handwritten or typed letter, delivered byhand or post or by fascimile with authorized signature appended thereon,22.I/We hereby authorize the Bank to debit my/our account with the cost incurred in respect of theissuance of the cheque book(s) for the above account.23.Honour all cheques or other orders/instruments which may be drawn on the said accountprovided such cheques or orders/instruments are signed by me/us and to debit such cheques ororders/instruments to the said account whether such debit without prejudice to your right torefuse or allow any overdraft or increase of overdraft and in consideration, I/we agree:a. To assume full responsibility for the genuineness or correctness and validity of allendorsements appearing on all cheques, orders, bills, notes, negotiable instruments, receiptsand/or other documents deposited in my/our account.b. To be responsible for any repayment of any overdraft with interest and to comply with theBank's rules and new rates as advised by the bank from time to time.c. To free the Bank from any responsibility for any loss or damage of funds deposited with thebank due to any future government order; law, tax, embargo, moratorium, exchange restrictionand/or all other causes beyond the Bank's control.d. That all funds standing to my/our credit are payable on demand only on such local currency asmay be in circulation.e. To be bound by any notification of change in the conditions governing the account directed tomy/our last known address and any notice or letter sent to my/our last known address shall beconsidered as duly delivered and received by me/us at the time it would be delivered in theordinary course of post.f.Customers should not write out cheques in staff's name, save customer's spouse and orchildren who are staff of the Bank. All cheques should be made out in customer's name.9.I/We shall be responsible for all costs, expenses and liabilities arising from the purchase,retention and sale of investments made on my/our behalf by the Bank which includes but are notlimited to all taxes, statutory fees, duties and levies.g. Customers should desist from transferring money from their accounts into staff's accounts.Impromptu cash pick ups at the customer's premises by staff should not exceed N500, 000.00(Five Hundred Thousand Naira Only)10.The bank is hereby authorized, in the absence of any written instruction to the contrary, to placemy/our funds in any appropriate investment (which for the purpose of this clause shall include butnot be limited to investments in Commercial Paper whether guaranteed by the Bank orOtherwise) or on deposit and to renew/reinvest at maturity any investments or deposit made inmy/our name(s) on the same terms and conditions that applied to such investment/depositimmediately prior to its maturity or on such other terms and conditions as the Bank may, in itsabsolute discretion, consider appropriate under the circumstances.h. Customers who wish to enjoy cash pick up services should make a formal request whichwould be handled in accordance with the laid down procedure for cash pick up. Cash in excessof N500,000.00 (Five Hundred thousand Naira Only) should be paid over the counter by thecustomer.11.The bank may, unless otherwise instructed by me/us, retain on my/our behalf, on a safe custodybasis, any investment instruments issued in respect of any investment made on my/our behalfand unless otherwise specifically agreed, I/We will not have recourse to the Bank for the value orworth of such investments.12.Where the Bank, in the absence of any previous agreement as to rate of interest and costs andcharges that will apply if my/our accounts or any of them becomes overdrawn, in its absolutediscretion allows me/us to make any drawing that results in my/our account(s) or any of thembecoming overdrawn, the Bank shall be entitled to charge such rate of interest and impose suchcharges as, in its absolute discretion, it considers appropriate in the circumstances and I/Weagree to pay such interest and charges to the Bank on demand.13.I/We agree that where I/We give any instruction for a payment(s) that in aggregate exceed(s) theamounts standing to the credit of my/our account(s) against which payment is to be made, theBank reserves the right to decline to carry out such instruction or where there is more than onetransaction, to select the transaction that shall be executed without reference to the date ofdispatch or time or receipt of my/our instructions, if the Bank in its discretion makes any suchpayment for which my/our account is not funded I/We confirm my/our obligation to repay the bank(whether or not the Bank makes a demand) any outstanding sum in addition to charges andinterest accrued thereon.14.Where I/We maintain a credit account with the bank in any foreign currency, the credit balance ofsuch account may be held by the Bank with any bank or financial institution it considers first ratelocated in any country in which such foreign currency is legal tender. Such credit balance willaccordingly be subject to all laws and applicable regulations in Nigeria and in the country in whichsuch credit balance is held and the Bank shall not be held liable if the credit balance or any partthereof becomes unavailable as a result of any of the laws and regulations to which such creditbalance is subject.15.Where any un-cleared effects credited to my/our account(s) by the Bank are subsequentlydishonoured and/or the Bank for any reason is required to repay to the paying bank of any otherparty all or any part of any amount credited to our account, the Bank will be entitled to debit my/ouraccount(s) with the amount of such uncleared effects and/or repaid amounts plus accruedinterest and applicable bank charges.16.No failure or delay in exercising any right, power or privilege vested in the Bank by theseconditions shall operate as a waiver thereof nor shall any partial exercise of such right, power orprivilege preclude any other or further exercise thereof.17.If any of the Conditions or the provisions specified herein are invalid, illegal or unenforceable inany respect under the law of validity, legality, the enforceability of the remaining conditions and/orprovisions contained herein shall not in any manner be affected or impaired thereby.I. That if a cheque credited to me/our individual account is returned dishonoured, the same maybe transmitted to me/us through my/our last known address either by bearer or by post.j. I/we note that the Bank will accept no liability whatsoever for funds handed to members of thestaff outside banking hours or outside the bank's premises.k. That my/our attention has been drawn to the necessity of safe guarding my/our passwords andaccess codes to the bank's non-branch channels including, but not limited to ATM, InternetBanking, Telephone Banking, Mobile banking and SMS banking, so that unauthorized personsare unable to gain access to it and any neglect of this precaution may be a ground for anyconsequential loss being charged to my/our account.l. That the Bank is under no obligation to honour any cheque(s) drawn on my/our account unlessthere are sufficient funds in the account to cover the value of the said cheques(s) and I/weunderstand and agree that any such cheque(s) may be returned to me/us unpaid, but if paid, weare obliged to repay the bank on demand.m.That any disagreements with entries on my/our bank statements will be communicated byme/us to the Bank within 5 working days of the dispatch of the bank statements. Failure tocommunicate any such disagreement in the entries on bank statement to the Bank within 5working days from the date of dispatch of my/our bank statements shall automatically meanthat the content of the bank statement is correct.n.That any sum standing to the debit of the current account shall be liable to interest charges atthe rate fixed by the bank from time to time. The bank is authorized to debit from my/our accountthe usual banking charges, interest, commission, and any service charge set by Managementfrom time to time.Electronic BankingI/We confirm and agree that the following terms and conditions shall govern my/our ElectronicBanking transactions with the Bank. The following terms and conditions shall govern the Bank's eBanking Services.1)Definitions“Customers” means a customer of the Bank who operates an account with the Bank and is namedin the application form. Where two individuals are named, either or both of them are customers.“The Bank” means Heritage Bank Plc.“Card Holders” means a customer who has been issued the Bank's debit and/or credit card. Thecard is the property of the Bank and will be returned unconditionally and immediately to the bankupon request by the Bank.”“Service” means the Heritage Bank Limited Internet Banking, eMail and SMS Alert, IVR Solutionand other electronic products that will be provided by the Bank.“Access code, Pass code, User name and Password” means the enabling code with which youaccess the system for the Banking service and which is known to you only.“Account” means a current or savings account or other account maintained with the bank at any ofthe bank's branches in Nigeria.18.Commission and charges shall be levied in accordance with the bank's standard scale ofcharges in force from time to time and copies of which are available on request. The Bankreserves the right to amend its rates of interest in accordance with its standard scale of chargesand/or conditions from time to time.“PIN” means the Personal Identification Number.19.Where these conditions are signed by or on behalf of more than one person as the Customer, allof such persons are bound by these terms and conditions.“ATM” means Automated Teller Machine that dispenses cash to account holders via the use ofdebit/credit cards or accept cash deposits20.Any communication by the bank shall be deemed to have been made as soon as it is sent to themost recent address provided by me/us and the date indicated on the duplicate copy of such letteror on the Bank's mailing list will constitute the date on which the communication was sent. Anystatement or confirmation of any transaction between me/us or either of us and Bank shall bedeemed to have been examined by me/us and to be conclusive and binding unless within 5 (five)working days from the date specified on such statement/confirmation, I/We or either of us advisethe Bank in writing that an item contained therein is being disputed, whether or not such item wasmade in accordance with the mandate from time to time given by me/us to the Bank.“Debit and Credit Card” means the card used by a customer for initiating transactions on the variouselectronic payment channels e.g. ATM, POS, and Internet.2)The service allows the customers to give the Bank Instructions by use of:(a)Telephone, ATM, PIN, Password, Access code, Username and secure message (e-mail, sms),Internet banking for the following:(I)Obtain Information regarding customer's balances as at the last date of business with the Bank.(II)Obtain Information with regards to any instrument in clearing or any balance standing in thecustomer's account as at the last date of transaction on the customer's account.Heritage Bank PlcRC: 1259460

INDIVIDUALACCOUNT OPENING FORM9. TERMS AND CONDITIONS(III)Authorize the Bank to debit customer's account to pay specified utility bills such as FIRS, NITEL, PHCN, WATER RATE and/or any other bills as specified by the customer subject however to available of such bill paymentunder this service.(IV)Authorize the Bank to effect a transfer of funds from the customer's account(s) to any other account with the Bank.(V)Authorize the Bank to effect a transfer of funds from the customer's account(s) to any account within the country.(VI)Authorize the Bank to effect a transfer of funds from the customer's account(s) to any international bank(VII) Authorize the Bank to effect/stop any payment order.(VIII)Authorize the Bank to debit customers account and load same into a designated card.(IX)Authorize the Bank to produce a cheque book for the customer based on request(X)Authorize the bank to purchase or sell securities and interests in mutual fundsb)On receipt of instruction, the Bank will endeavor to carry out the customer's instruction promptly, except in the event of any unforeseen circumstances such as Act of God, Force Majeure and other causes beyond the Bank'scontrol.3) Before the service can be availed to any customer, he/she must have one or a combination of the following:(I) An account with the bank & (ii) a valid email address(iii)A Pass code, Access code, User name, Password or token authenticator.(iv)A personal Identification Number “PIN”(v)Valid GSM/ land line number.4)The Pass code/Access code/Password/E-mail Security.The Customer understands that his/her Pass code, Access code/Password E-mail is used to give instructions to the bank and accordingly undertakes.(I) That under no circumstances shall the Pass code, Access code/Password be disclosed to any body.(ii)Not to write the Pass code/Access code/Password in an open place in order to avoid third party access.(iii)The customer instructs and authorizes the bank to comply with any instructions given to the bank or through the use of the service.(iv)Once the bank is instructed by means of the customer's Pass code/Access code and PIN the bank is entitled to assume that those are the instructions given by the customer and to rely on same.(v)The customer's Pass code must be changed immediately it becomes known to someone else.(vi)The Bank is exempted from any form of liability whatsoever for complying with any or all instruction(s) given by means of the customer's Pass code/Access code if by any means the Pass/Access code becomes known to athird party.(vii)Where a customer notifies the bank of his/her intention to change the Pass code/Access code arising from loss of memory of same, or that has come to the notice of a third party, the bank shall, with the consent of thecustomer, delete same and thereafter allow the customer to enter a new Pass code/Access code PROVIDED that the bank shall not be responsible for any loss that occurs between the period of such loss of memory of thePass/Access code or knowledge of a third and the time the report is lodged with the Bank.(viii)Once a customer's Pass code/Access code is given, it shall be sufficient confirmation of the authenticity of the instruction given.(ix)The customer shall be responsible for any instruction given by means of the customer's Pass code/Access code. Accordingly, the bank shall not be responsible for any loss or consequences suffered by the customer from useof the customer's Pass code/Access code.5) Customer's Responsibilities.(I)The customer undertakes to be absolutely responsible for safeguarding his/her/its user name, Access code/Pass code, PIN, Password, and under no circumstance shall the customer disclose any or all of these to any person.(II)The bank is expressly exempted from any liability arising from unauthorized access to the customer's account and/or data as contained in the bank's records via the service, which arises as a result of inability and/or otherwiseof the customer to safeguard his/her/its PIN, Pass code/Access code and/or password and/or failure to log out of the system completely by allowing on screen display of his/her/its account information.(III)The bank is further relieved of any liability as regards breach of duty of secrecy arising out of customer's inability to scrupulously observe and implement the provisions of clause 4 above, and/or instances of breach of suchduty by hackers and other unauthorized access to the customer's account via the service.6)Under no circumstances will the Bank be liable for any damages, including without limitation, direct or indirect, special, incidental or consequential damages, losses or expenses arising in connection with this service or usethereof or inability to use by any party, or in connection with any failure of performance, error, omission, interruption, defect, delay in operation, transmission, computer virus or line or system failure, even if the bank or itsrepresentatives thereof are advised of the possibility of such damages, losses or Hyperlink to other Internet resources are at the customers risk.7)Copyright in the cards and other proprietary information relating to the service including the screens displaying the pages, the information and material therein and agreement is owned by the Bank.8)For the benefit and security of our customers and to comply with applicable laws, we have a few mandatory guidelines that we call “rules of the road”. Conducts that violates the rules of the road is grounds for termination of thisservices and the bank for whatsoever reason vary these terms and conditions. For this reason, the customer undertakes to:(I)Provides accurate information: Agree to provide true, accurate and complete information about themselves as requested in our registration/account opening forms and the customer agree not to misrepresent his/her identityor information, which may include user names, password or other access devices for such accounts.(II)Obey the law:. Customer agrees not to use the service for illegal purposes or for the transmission of material that is unlawful, harassing, libelous (untrue and damaging to others), invasive of another's privacy, abusive,threatening, or obscene, or that infringe the right of others.(III)Restrictions on commercial use or resale:. Customer's right to use the service is personal therefore customer agrees

BUSINESS ENTITIES ACCOUNT OPENING FORM 9. AUTHORITY TO DEBIT ACCOUNT FOR SEARCH FEE Heritage Bank Plc Dear Sir, AUTHORITY TO DEBIT OUR CURRENT ACCOUNT FOR SEARCH FEE We hereby authorize you to debit our account with the applicable charges for the legal search conducted on our account at the Corporate Affairs Commission or relevant agency/authority.