Transcription

MARKET FORCESPEO MEGATRENDS:THE WAVE OF CONSOLIDATIONAND ITS IMPACT14/ SEPTEMBER 2019Reproduced with permission of the National Association of Professional Employer Organizations

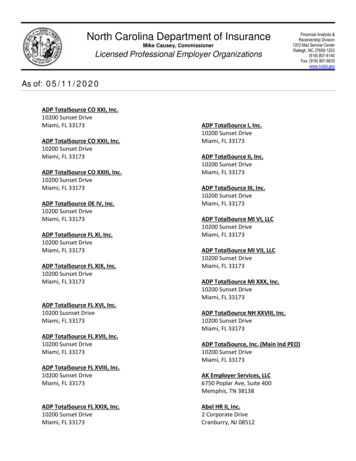

BY DAN MCHENRY AND MATT CLAUSIt has been a historic year for the PEO industry with the completionof the two largest transactions in the history of the industry. The twoblockbuster transactions were the Paychex (NASDAQ: NYSE) acquisitionof Oasis Outsourcing, Inc., which was announced in the fourth quarterof 2018, a deal purportedly valued at 1.2 billion, and the AquilineCapital Partners acquisition of CoAdvantage from Morgan Stanley in athird quarter 2019 transaction, expected to be valued near 800 million,although that information was unavailable at the time of this writing.So, how large has the wave of consolidation been over the last severalyears? The PEO market is filled each year with a large number oftransactions from players large and small across the country. Let’s takea look at some of the largest PEO players in the industry by worksiteemployee (WSE) count. Those in Table 1 below have completed PEOtransactions within the last decade.Reproduced with permission of the National Association of Professional Employer OrganizationsSEPTEMBER 2019 /15

MARKET FORCESWHAT MAY NOTBE EVIDENT ISTHE INDIVIDUALSTORY THAT EACHTRANSACTION HOLDS.MANY TIMES, THEASSETS TRANSACTEDARE THE RESULT OFA CAREER’S WORTHOF WORK.The impact of consolidation in the PEOindustry could be viewed as positive ornegative. Some of the positive impactconsolidation has had on the PEOindustry includes: The successful completion and monetization of an entrepreneur’s life work; Increased sophistication in the PEOvalue proposition and evolution tobetter insulate the industry fromencroaching business service models(such as Namely and BambooHR); Additional innovations in technologyand automation; Greater interest from private equityand the capital markets, bringingmore professionals into the industrywith more diverse backgroundsand experience; Greater market awareness of the PEOmodel by the business communityand, more importantly, small andmid-size businesses; An offsetting number of new entrantsfilling the vacuum created by consolidation, even though the speed ofconsolidation has accelerated; and Rising gross profit per WSE amongall participants in recent years;Some of the negative impact consolidation has had on the PEO industry includes: A reduction of NAPEO revenue tosupport the mission and lobbyingefforts of the PEO industry due to itsgraduated dues structure; A reduction of accredited PEOs andthe corresponding Employer ServicesAssurance Corporation (ESAC)revenue to support the mission ofaccrediting PEOs; and As a byproduct of consolidation andthe process of synergizing thecombined entities, the potential lossof jobs (although acquiring entitiesoften desire highly skilled personnelto bring within the transaction).THE IMPACT OF A FEW COMPANIES ONTHE INDUSTRYIn sports, a coach’s success is oftenmeasured based on how many headcoaches are produced from his stable ofassistant coaches. In the same vein, weTABLE 1. SOME OF THE LARGEST PEOS BY ESTIMATED WSE COUNT.PEO16OwnershipEstimated WSEs1ADP TotalSource Inc.NASDAQ: ADP500,000 2Paychex Business Solutions, LLC (including Oasis acquisition)NASDAQ: PAYX400,000 3TriNet Group, Inc.NYSE: TNET300,000 4Insperity, IncNYSE: NSP200,000 5Vensure Employer Services, IncPrivate: Solamere Capital200,000 6Barrett Business Services, Inc.NASDAQ: BBSI200,000 7Southeast PersonnelPrivate100,000 8CoAdvantagePrivate: Aquiline Capital Partners90,000 Total of the listed PEOs2,000,000 Estimated total of PEO industry4,000,000Marketshare of the listed PEOs50% / SEPTEMBER 2019Reproduced with permission of the National Association of Professional Employer Organizations

FIGURE 1. THE PAYCHEX PEOCONSOLIDATION TREE.PaychexNBSHROIOasisFortune BusinessSolutionsA-1 StaffingAdvantecAureonDiversifiedHRDohertyKelly StaffLeasingKing CompaniesPEMPEPSharp PersonnelSmart PayrollSolutionsStaff OneHR LogicLMCResourcesFIGURE 2. THE TRINET PEOCONSOLIDATION upSOITeamstaffDigitalSolutionsSynadyneFIGURE 3. THE VENSURE EMPLOYERSERVICES PEO CONSOLIDATION nsNationalPMIReproduced with permission of the National Association of Professional Employer OrganizationsQBSWorklogicSEPTEMBER 2019 /17

MARKET FORCESFIGURE 4. THE COADVANTAGE PEO CONSOLIDATION TREE.CoAdvantageGlobal LCOPEMCORemedysTotal HRManagementSEMCODEMOGRAPHICS, TECHNOLOGY,COMPETITIVE INNOVATION, ANDMANY OTHER FACTORS WILL DRIVETHIS ACTIVITY.introduce the concept of the “PEOConsolidation Tree” for four of theconsolidators we highlight in Table 1.Please keep in mind that we may misssome of the historical acquisitions of thesegroups in our review of our archives, butthe Consolidation Tree is only meant togive you a visualization of the impact thata few companies can have on the landscapeof an industry. These only represent theactivity of four consolidators. There arealso many regional, middle market, andeven local PEOs that have been activemergers and acquisition (M&A) transactors in the PEO space.Those considering adopting an acquisition strategy to supplement their organicgrowth strategy must develop and refinea simple, smooth, and efficient process offinding, closing, and integrating these18/ SEPTEMBER 2019PEO properties. This must include theability to: Retain the clients of theacquired entity; Protect the culture of theacquirer; and Have a scalable human resourcesinformation system (HRIS) platformthat has the capacity to accommodate the additional scale.From the above perspective, it isinteresting to see how many entities areimpacted by M&A activity. What may notbe evident is the individual story thateach transaction holds. Many times, theassets transacted are the result of acareer’s worth of work. These are truelife-changing events for the humanbeings involved.It is most likely that the activity levelrelating to M&A will continue and theselife-changing events will continue.Demographics, technology, competitiveinnovation, and many other factors willdrive this activity.When considering entering into thisactivity (either buying or selling), it isimportant to choose wisely, as it issomeone’s career culmination (possiblyyours). A multitude of considerations canmake or break the process for yourspecific event. As we have said in otherpublished articles, “Measure twice andcut once.” It will pay dividends (literallyand figuratively)!DAN MCHENRYBusiness Advisory GroupPractice LeaderMcHenry Consulting, Inc.Orlando, FloridaMATT CLAUSM&A Group Practice LeaderMcHenry Consulting, Inc.Orlando, FloridaReproduced with permission of the National Association of Professional Employer Organizations

It has been a historic year for the PEO industry with the completion of the two largest transactions in the history of the industry. !e two blockbuster transactions were the Paychex (NASDAQ: NYSE) acquisition of Oasis Outsourcing, Inc., which was announced in the fourth quarter of 2018, a deal purportedly valued at 1.2 billion, and the Aquiline