Transcription

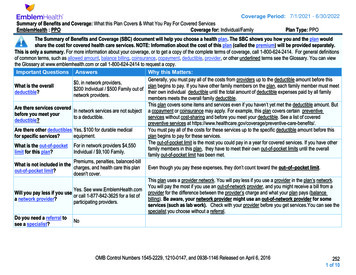

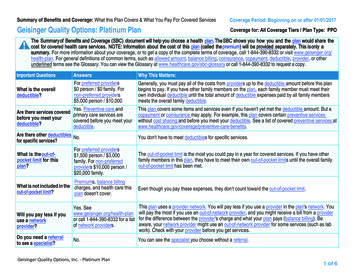

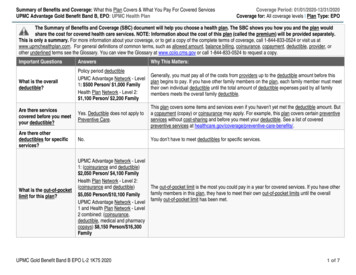

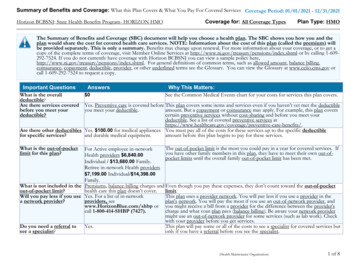

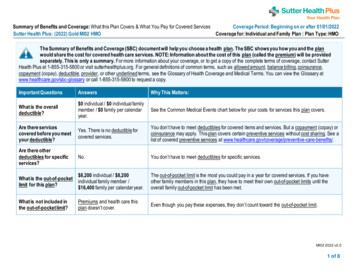

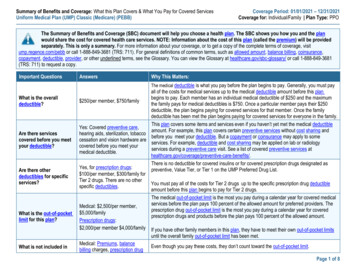

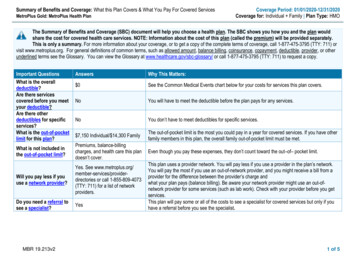

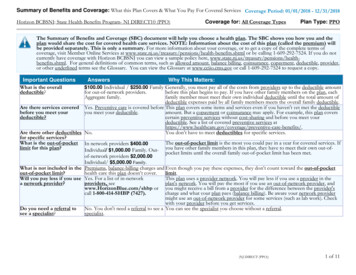

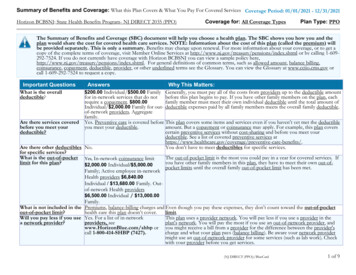

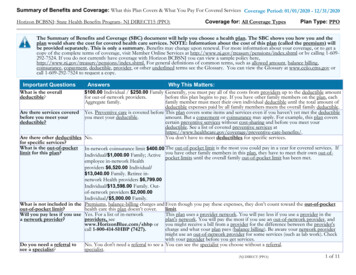

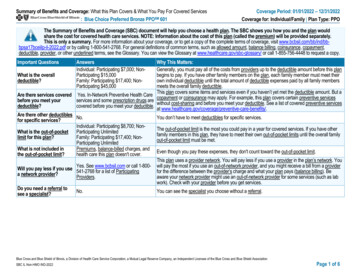

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered Services: Blue Choice Preferred Bronze PPOSM 601Coverage Period: 01/01/2022 – 12/31/2022Coverage for: Individual/Family Plan Type: PPOThe Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan wouldshare the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately.This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, visit www.bcbsil.com/bb/ind/bbbpsa17bceiilp-il-2022.pdf or by calling 1-800-541-2768. For general definitions of common terms, such as allowed amount, balance billing, coinsurance, copayment,deductible, provider, or other underlined terms, see the Glossary. You can view the Glossary at www.healthcare.gov/sbc-glossary/ or call 1-855-756-4448 to request a copy.Important QuestionsAnswersIndividual: Participating 7,000; NonParticipating 15,000Family: Participating 17,400; NonParticipating 45,000Why This Matters:Generally, you must pay all of the costs from providers up to the deductible amount before this planWhat is the overallbegins to pay. If you have other family members on the plan, each family member must meet theirdeductible?own individual deductible until the total amount of deductible expenses paid by all family membersmeets the overall family deductible.This plan covers some items and services even if you haven’t yet met the deductible amount. But aAre there services covered Yes. In-Network Preventive Health Carecopayment or coinsurance may apply. For example, this plan covers certain preventive servicesbefore you meet yourservices and some prescription drugs arewithout cost-sharing and before you meet your deductible. See a list of covered preventive servicesdeductible?covered before you meet your deductible.at ts/.Are there other deductiblesNo.You don’t have to meet deductibles for specific services.for specific services?Individual: Participating 8,700; NonThe out-of-pocket limit is the most you could pay in a year for covered services. If you have otherWhat is the out-of-pocketParticipating Unlimitedfamily members in this plan, they have to meet their own out-of-pocket limits until the overall familylimit for this plan?Family: Participating 17,400; Nonout-of-pocket limit must be met.Participating UnlimitedWhat is not included inPremiums, balance-billed charges, andEven though you pay these expenses, they don't count toward the out-of-pocket limit.the out-of-pocket limit?health care this plan doesn't cover.This plan uses a provider network. You will pay less if you use a provider in the plan’s network. YouYes. See www.bcbsil.com or call 1-800- will pay the most if you use an out-of-network provider, and you might receive a bill from a providerWill you pay less if you use541-2768 for a list of Participatingfor the difference between the provider’s charge and what your plan pays (balance billing). Bea network provider?Providers.aware your network provider might use an out-of-network provider for some services (such as labwork). Check with your provider before you get services.Do you need a referral toNo.You can see the specialist you choose without a referral.see a specialist?Blue Cross and Blue Shield of Illinois, a Division of Health Care Service Corporation, a Mutual Legal Reserve Company, an Independent Licensee of the Blue Cross and Blue Shield AssociationSBC IL Non-HMO IND-2022Page 1 of 6

All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.CommonMedical EventServices You May NeedWhat You Will PayParticipating ProviderNon-Participating Provider(You will pay the least)(You will pay the most)Primary care visit to treat an 40% coinsurance50% coinsuranceinjury or illnessIf you visit a health care Specialist visit50% coinsurance50% coinsuranceprovider’s office orclinicPreventive care/screening/ No Charge; deductible does not apply 50% coinsuranceimmunizationIf you have a testFacility: 40%Diagnostic test (x-ray, blood Freestandingcoinsurancework)Hospital: 50% coinsuranceFreestanding Facility: 40%Imaging (CT/PET scans,coinsuranceMRIs)Hospital: 50% coinsuranceLimitations, Exceptions, & OtherImportant InformationVirtual Visits: 50% coinsurance. See yourbenefit booklet* for details.NoneYou may have to pay for services thataren't preventive. Ask your provider if theservices needed are preventive. Thencheck what your plan will pay for.50% coinsurancePreauthorization may be required; see yourbenefit booklet* for details.50% coinsurancePreauthorization may be required; see yourbenefit booklet* for details.*For more information about limitations and exceptions, see the plan or policy document at Page 2 of 6

CommonMedical EventServices You May NeedWhat You Will PayParticipating ProviderNon-Participating Provider(You will pay the least)(You will pay the most)Retail - Preferred - 10/prescriptionNon-Preferred - 20/prescriptionPreferred generic drugsMail - 30/prescription; deductibledoes not applyRetail - Preferred - 20/prescriptionNon-preferred genericNon-Preferred - 30/prescriptionIf you need drugs todrugsMail - 60/prescription; deductibletreat your illness ordoes not applyconditionPreferred - 30% coinsuranceMore information about Preferred brand drugsNon-Preferred - 35% coinsuranceprescription drugcoverage is available at Non-preferred brand drugs Preferred - 35% coinsuranceNon-Preferred - 40% coinsurancewww.bcbsil.com/rx22Preferred specialty drugs 45% coinsuranceNon-preferred specialtydrugsIf you have outpatientsurgeryIf you need immediatemedical attentionIf you have a hospitalstay50% coinsuranceFreestanding Facility: 600/visit plusFacility fee (e.g.,40% coinsuranceambulatory surgery center) Hospital: 600/visit plus 50%coinsurancePhysician/surgeon fees 200/visit plus 50% coinsuranceLimitations, Exceptions, & OtherImportant InformationLimited to a 30-day supply at retail (or a 90Retail - 20/prescription; deductible day supply at a network of select retaildoes not applypharmacies). Up to a 90-day supply at mailorder. Specialty drugs limited to a 30-daysupply.Retail - 30/prescription; deductible Payment of the difference between the costof a brand name drug and a generic maydoes not applyalso be required if a generic drug isavailable.All Out-of-Network prescriptions are subjectRetail - 35% coinsuranceto a 50% additional charge after theapplicable copayment/coinsurance.Retail - 40% coinsuranceAdditional charge will not apply to anydeductible or out-of-pocket amounts.45% coinsuranceThe amount you may pay per 30-daysupply of a covered insulin drug, regardlessof quantity or type, shall not exceed 100,50% coinsurancewhen obtained from a PreferredParticipating or Participating Pharmacy. 2,000/visit plus 50% coinsurancePreauthorization may be required.For Outpatient Infusion Therapy, see yourbenefit booklet* for details.50% coinsuranceEmergency room care 1,000/visit plus 50% coinsurance 1,000/visit plus 50% coinsuranceEmergency medicaltransportation50% coinsurance50% coinsuranceUrgent care50% coinsurance50% coinsurancePer occurrence copayment waived uponinpatient admission.Preauthorization may be required for nonemergency transportation; see your benefitbooklet* for details.NoneFacility fee (e.g., hospitalroom) 850/visit plus 50% coinsurance 2,000/visit plus 50% coinsurancePreauthorization required. Preauthorizationpenalty: 1,000 or 50% of the eligiblecharge In-Network, 500 Out-of-Network.See your benefit booklet* for details.Physician/surgeon fees50% coinsurance50% coinsurancePreauthorization required.*For more information about limitations and exceptions, see the plan or policy document at Page 3 of 6

CommonMedical EventIf you need mentalhealth, behavioralhealth, or substanceabuse servicesIf you are pregnantIf you need helprecovering or haveother special healthneedsIf your child needsdental or eye careServices You May NeedWhat You Will PayParticipating ProviderNon-Participating Provider(You will pay the least)(You will pay the most)Limitations, Exceptions, & OtherImportant InformationOutpatient services40% coinsurance50% coinsurancePreauthorization may be required; see yourbenefit booklet* for details.Inpatient services 850/visit plus 50% coinsurance 2,000/visit plus 50% coinsurancePreauthorization required.Office visitsChildbirth/deliveryprofessional servicesChildbirth/delivery facilityservices40% coinsurance50% coinsurance50% coinsurance50% coinsurance 850/visit plus 50% coinsurance 2,000/visit plus 50% coinsuranceCost sharing does not apply for certainpreventive services. Depending on the typeof services, deductible or coinsurance mayapply. Maternity care may include tests andservices described elsewhere in the SBC(i.e., ultrasound).Home health care50% coinsurance50% coinsuranceRehabilitation servicesHabilitation servicesSkilled nursing careDurable medical equipmentHospice services50% coinsurance50% coinsurance50% coinsurance50% coinsurance50% coinsurance50% coinsurance50% coinsurance50% coinsurance50% coinsurance50% coinsurancePreauthorization may be required.Preauthorization may be required.Preauthorization may be required.Preauthorization may be required.Preauthorization may be required.One visit per year. Out-of-NetworkUp to a 30 reimbursement iswill not exceed the retailChildren’s eye examNo Charge; deductible does not apply available; deductible does not apply reimbursementcost. See your benefit booklet* (PediatricVision Care Benefits) for details.One pair of glasses per year up to age 19.Reimbursement for frames, lenses and lensUptoa 75reimbursementispurchased Out-of-Network isChildren’s glassesNo Charge; deductible does not apply available; deductible does not apply optionsavailable (not to exceed the retail cost). Seeyour benefit booklet* (Pediatric Vision CareBenefits) for details.Children’s dental check-up Not CoveredNot CoveredNoneExcluded Services & Other Covered Services:Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services.) Acupuncture Long-term care Routine eye care Dental care (Adult) Non-emergency care when traveling outside the U.S. Weight loss programs*For more information about limitations and exceptions, see the plan or policy document at Page 4 of 6

Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.) Abortion care Cosmetic surgery (only for the correction of congenital Private-duty nursing (with the exception of inpatientdeformities or conditions resulting from accidentalprivate duty nursing) Bariatric surgeryinjuries,scars,tumors,ordiseases) Routine foot care (due to systemic disease and in Chiropractic care (Chiropractic and Osteopathic Hearing aids (for children 1 per ear every 24 months,connection with diabetes)manipulation limited to 25 visits per calendar year)for adults up to 2,500 per ear every 24 months) Infertility treatment (covered for 4 procedures perbenefit period)Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for those agencies is: theplan at 1-800-541-2768. You may also contact your state insurance department at 1-877-527-9431. Other coverage options may be available to you, too, including buyingindividual insurance coverage through the Health Insurance Marketplace. For more information about the Marketplace, visit www.HealthCare.gov or call 1-800-318-2596.Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is called agrievance or appeal. For more information about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan documents also providecomplete information on how to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, or assistance, contact:Blue Cross and Blue Shield of Illinois at 1-800-541-2768 or visit www.bcbsil.com, or contact the U.S. Department of Labor's Employee Benefits Security Administration at 1866-444-EBSA (3272) or visit www.dol.gov/ebsa/healthreform. Additionally, a consumer assistance program can help you file your appeal. Contact the Illinois Department ofInsurance at (877) 527-9431 or visit http://insurance.illinois.gov.Does this plan provide Minimum Essential Coverage? YesMinimum Essential Coverage generally includes plans, health insurance available through the Marketplace or other individual market policies, Medicare, Medicaid, CHIP,TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage, you may not be eligible for the premium tax credit.Does this plan meet the Minimum Value Standards? Not ApplicableIf your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace.Language Access Services:Spanish (Español): Para obtener asistencia en Español, llame al 1-800-541-2768.Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-800-541-2768.Chinese (中文): � 1-800-541-2768.Navajo (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' 1-800-541-2768.To see examples of how this plan might cover costs for a sample medical situation, see the next section.*For more information about limitations and exceptions, see the plan or policy document at Page 5 of 6

About these Coverage Examples:This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will bedifferent depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost-sharingamounts (deductibles, copayments and coinsurance) and excluded services under the plan. Use this information to compare the portion ofcosts you might pay under different health plans. Please note these coverage examples are based on self-only coverage.Peg is Having a BabyManaging Joe’s Type 2 DiabetesMia’s Simple Fracture(9 months of in-network pre-natal care and ahospital delivery)(a year of routine in-network care of a wellcontrolled condition)(in-network emergency room visit and followup care) The plan’s overall deductible Specialist coinsurance Hospital (facility) copay/coins Other coinsurance 7,00050% 850 50%50%This EXAMPLE event includes services like:Specialist office visits (prenatal care)Childbirth/Delivery Professional ServicesChildbirth/Delivery Facility ServicesDiagnostic tests (ultrasounds and blood work)Specialist visit (anesthesia)Total Example Cost 7,00050% 850 50%50%This EXAMPLE event includes services like:Primary care physician office visits(including disease education)Diagnostic tests (blood work)Prescription drugsDurable medical equipment (glucose meter) 12,700In this example, Peg would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Peg would pay is The plan’s overall deductible Specialist coinsurance Hospital (facility) copay/coins Other coinsurance 7,000 900 900 60 8,760Total Example CostIn this example, Joe would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Joe would pay is The plan’s overall deductible Specialist coinsurance Hospital (facility) copay/coins Other coinsurance 7,00050% 850 50%50%This EXAMPLE event includes services like:Emergency room care (including medical supplies)Diagnostic test (x-ray)Durable medical equipment (crutches)Rehabilitation services (physical therapy) 5,600 5,100 100 0 20 5,220Total Example CostIn this example, Mia would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Mia would pay isThe plan would be responsible for the other costs of these EXAMPLE covered services. 2,800 2,400 400 0 0 2,800Page 6 of 6

Childbirth/delivery facility 850/visit plus 50% coinsurance 2,000/visit plus 50% coinsurance If you need help recovering or have other special health needs Home health care 50% coinsurance 50% coinsurance Preauthorization may be required. Rehabilitation services 50% coinsurance Preauthorization may be required. .