Transcription

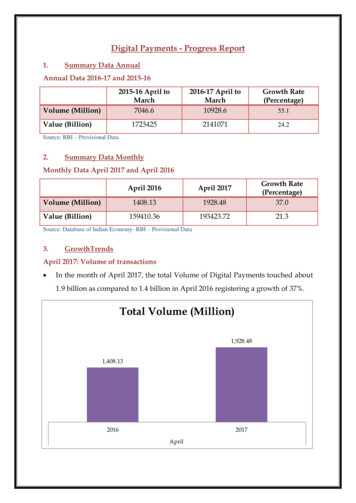

Digital Payments - Progress Report1.Summary Data AnnualAnnual Data 2016-17 and 2015-16Volume (Million)2015-16 April toMarch7046.62016-17 April toMarch10928.6Growth Rate(Percentage)1723425214107124.2Value (Billion)55.1Source: RBI – Provisional Data2.Summary Data MonthlyMonthly Data April 2017 and April 2016Volume (Million)Value (Billion)April 2016April 20171408.131928.48Growth Rate(Percentage)37.0159410.36193423.7221.3Source: Database of Indian Economy- RBI – Provisional Data3.GrowthTrendsApril 2017: Volume of transactions In the month of April 2017, the total Volume of Digital Payments touched about1.9 billion as compared to 1.4 billion in April 2016 registering a growth of 37%.Total Volume (Million)1,928.481,408.1320162017April

April 2017: Value of Transactions In the month of April 2017, the total value of Digital Payments touched Rs.193423.72 billion as compared to 159410.36 billion in the April 2016 registering agrowth of 21.3%.Total Value (Rupees al Payment Drivers 5.In April 2017, Pre-paid Payment Instrument (PPI) segment was the majordriver. During the month PPI’s recorded a growth of 408.3% in volume terms& 122% in value terms.Data Tables (April 2017) enclosed Table 1- Summary Data on Digital PaymentsTable 2 – Detailed Data on Digital Payment Legend EnclosedDefinition of Digital PaymentsCoverage of Data on Digital Payments6.Compiled by:Shri. B.N. Satpathy, Senior Consultant, NISG, MeitYShri. Suneet Mohan, Young Professional, NITI Aayog

Summary Table 1Payment System ElectronicClearing%Change2016 .38.1RTGSCCILOperatedSystems%Change2017 /2016CardsPrepaidPaymentInstruments (PPIs)GrandTotalSource: Database of Indian Economy, RBI

Table 2Payment System me(Million)Value(RupeesBillion)Item1 s1.3InterbankClearing2 CCILOperatedSystems2.1 CBLO2.2 Govt.SecuritiesClearing2.2.1Outright2.2.2 Repo2.3 ForexClearing2015April20162017% Change2017 / 2016% Change2016 / .512.1

00.003.3 116.6100.89210.44562.06167.1108.63 PaperClearing3.1ChequeTruncationSystem(CTS)3.2 MICRClearing3.2.1 RBICentres4 RetailElectronicClearing4.1 ECSDR4.2 ervice(IMPS)

5.827.2181.51230.11333.7645.026.85.1.1Usage 1.2Usage 5-12.67.419.7548.67106.18118.2146.45 Cards5.1 CreditCards5.2 DebitCards5.2.1Usage atATMs5.2.2Usage atPOS6 PrepaidPaymentInstruments (PPIs)6.1 mWallet6.2 PPICards6.3 PaperVouchers7 Mobile

.8–––564.64671.19867.0029.218.9–––9 Numberof ATMs(in actuals)1908132130732219594.211.7–––10 Numberof POS .1174.85222.1727.192.2585.39971.5066.0260.88 CardsOutstanding8.1 CreditCard8.2 DebitCard11 Grand1,142.11Total(1.1 1.2 2 1,47,409.883 4 5 62.23HouseBillion)(NACH)Source: Database of Indian Economy, RBI

Digital Payments – Legend1.Digital Payments – DefinitionThe Payment and Settlement Act, 2007 has defined Digital Payments. As per this any“electronic funds transfer” means any transfer of funds which is initiated by aperson by way of instruction, authorisation or order to a bank to debit or credit anaccount maintained with that bank through electronic means and includes point ofsale transfers; automated teller machine transactions, direct deposits or withdrawalof funds, transfers initiated by telephone, internet and, card payment.2.Real Time Gross Settlement (RTGS) which can be defined as the continuous(real-time) settlement of funds transfers individually on an order by order basis(without netting). 'Real Time' means the processing of instructions at the time theyare received rather than at some later time; 'Gross Settlement' means the settlementof funds transfer instructions occurs individually (on an instruction by instructionbasis). Considering that the funds settlement takes place in the books of the ReserveBank of India, the payments are final and irrevocable.3.Clearing Corporation of India Ltd (CCIL): CCIL is a Central Counterparty(CCP) which was set up in April 2001 to provide clearing and settlement fortransactions in Government securities, foreign exchange and money markets in thecountry. CCIL acts as a central counterparty in various segments of the financialmarkets regulated by the RBI viz. the government securities segment, collateralisedborrowing and lending obligations (CBLO) - a money market instrument, USD-INRand forex forward segments. Moreover, CCIL provides non-guaranteed settlementin the rupee denominated interest rate derivatives like Interest Rate Swaps/ForwardRate Agreement market. It also provides non-guaranteed settlement of crosscurrency trades to banks in India through Continuous Linked Settlement (CLS) bankby acting as a third party member of a CLS Bank settlement member. CCIL also actsas a trade repository for OTC interest rate and forex derivative transactions.4.Cheque Truncation System (CTS) is the process that obviates the need tomove the physical instruments across bank branches. This reduces the time requiredfor their collection and brings elegance to the entire activity of cheque ?Id 635.Electronic Clearing Service (ECS) is an electronic mode of payment / receiptfor transactions that are repetitive and periodic in nature. ECS is used by institutionsfor making bulk payment of amounts towards distribution of dividend, interest,salary, pension, etc., or for bulk collection of amounts towards telephone / electricity/ water dues, cess / tax collections, loan instalment repayments, periodic

investments in mutual funds, insurance premium etc. Essentially, ECS facilitatesbulk transfer of monies from one bank account to many bank accounts or vice versa.ECS includes transactions processed under National Automated Clearing House(NACH) operated by National Payments Corporation of India (NPCI).6.National electronic funds transfer (NEFT) is a nation-wide payment systemfacilitating one-to-one funds transfer. Under this Scheme, individuals, firms andcorporates can electronically transfer funds from any bank branch to any individual,firm or corporate having an account with any other bank branch in the countryparticipating in the Scheme. Under NEFT, the transactions are processed and settledin batches. There is no limit – either minimum or maximum – on the amount offunds that could be transferred using NEFT. However, for cash-based dto 50,000. https://rbi.org.in/Scripts/FAQView.aspx?Id 60.7.Immediate Payment Service (IMPS) offers an instant, 24X7, interbankelectronic fund transfer service through mobile phones. IMPS transfers moneyinstantly within banks across India through mobile, internet and ATMs. This h.http://www.npci.org.in/documents/IMPS FAQs.pdf.8.Pre-paid Payment Instruments (PPI) are payment instruments that facilitatepurchase of goods and services, including funds transfer, against the value stored onsuch instruments. The value stored on such instruments represents the value paidfor by the holders by cash, by debit to a bank account, or by credit card. The pre-paidinstruments can be issued as smart cards, magnetic stripe cards, internet accounts,internet wallets, mobile accounts, mobile wallets, paper vouchers and any suchinstrument which can be used to access the pre-paid amount (collectively calledPrepaid Payment Instruments hereafter). The pre-paid payment instruments that canbe issued in the country are classified under three categories viz. (i) Closed systempayment instruments (ii) Semi-closed system payment instruments and (iii) Opensystem payment instruments.

11 Value Volume (Million) 3 Paper Clearing 94.37 88.26 99.97 13.3 -6.5 (Rupees Billion) 12 Volume (Million) 3.1 Cheque Truncation System