Transcription

The straight and narrow:Managing conduct risk in wholesale banks

Wholesale Conduct RiskContentsContentsExecutive summary1Spotlight on wholesale conduct2The emerging global regulatory response4Long term implications for wholesale banks7Immediate priorities for wholesale banks10Conclusion12

Executive summaryWholesale banks are in the spotlight once again. LIBOR-fixing, derivative mis-sellingand other scandals have reinforced supervisor attention on conduct standards. Theconduct of wholesale banks towards clients and trading counterparties is underscrutiny and will be subject to increasing regulatory supervision. This is underpinned,in part, by retail protection; retail consumers and investors can be harmed by poorconduct between sophisticated market participants. As such, this current focus onwholesale conduct of business is not just a passing fad. Banks cannot revert to the“everyone knows the rules of the game” mentality.Fines for poor conduct of business in wholesale banking total US 1.5 BN ( 0.5% ofpre-tax profits) a year and are ramping up as regulators take a tougher stance.These fines are in addition to the larger costs of litigation, compensation, reputationaldamage and management resources consumed in remediation.Emerging regulatory frameworks depart from the legalistic, compliance-drivenapproach of the past. Banks will have to focus on economically useful activity andensure that good conduct is led from the top, embedded in the frontline and drivenby ethical judgement. Today, most banks try to influence behaviour with rules andcontrols – with limited success. To achieve sustainable change, firms will have tomanage conduct by way of institutional values and culture.A conduct framework must cover four aspects of the wholesale banking business: (1)strategy and risk appetite, (2) governance, culture and incentives, (3) processes and(4) infrastructure. Frontline involvement will be critical to make this work becausechanges in conduct disciplines can ultimately affect customers’ experiences.To get proper engagement from the frontline, conduct risk management needs to bedescribed as good business practice rather than compliance with rules. The mediumterm prize for this fundamental shift is competitive differentiation. Banks can increasetheir share of clients’ wallets by demonstrating superiority in testing productsuitability, offering transparency and advice in the sales process and providingrobust post-sales servicing and issue resolution.There are four immediate priorities for wholesale banks. The first is to establish theright governance structure with well-defined accountabilities. The Board and theExecutive Committee must take the lead in defining values and principles and inproviding oversight. They will also have to define the roles and responsibilities ofdifferent participants in the first, second and third lines of defence and impose adefinitive separation between the three lines. Second, a diagnostic must beperformed to identify major gaps between the requirements of the local regulator(and where appropriate, Group-level priorities) and the existing framework. The thirdpriority is to embed good conduct into the bank’s culture. Finally, banks mustdevelop processes to address conduct risk. This will require reengineering existingprocesses as well as designing new ones.1

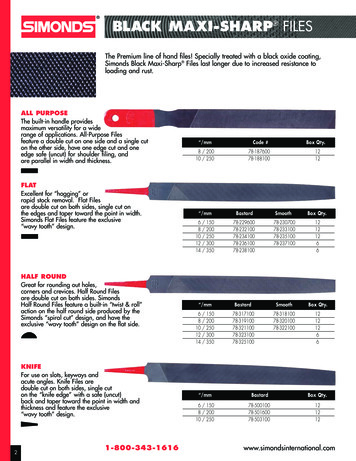

Spotlight on wholesale conductConduct in wholesale banking refers to the waywholesale banks behave towards other firms thatare clients and counterparties in the financialmarkets. Recent scandals in this area, such asLIBOR manipulation, mis-selling of derivatives andanti-money laundering/know-your-customer(AML/KYC) failures, have propelled conduct risk tothe top of the management agenda for the C-suiteof many wholesale banks, as well as drawing the ireof regulators, shareholders and clients.Financial repercussions for conduct infractions havebeen hefty. Many global wholesale banks (orwholesale banking divisions) have provisioned orpaid out US 0.5-1.0 BN each in fines, lawsuits orsettlements related to conduct issues over the lastfew years. These fines are merely the most obviouscost of misconduct. Greater cost can ultimately flowfrom the damage done to the bank’s reputation andbrand and from diverting management’s attentionaway from commercial endeavours and ontodealing with regulatory investigations, litigation andremediation.“An insurance company orpension fund may be itself alarge institution, but sittingbehind the company orpension fund are retailinvestors. Any poor practicewhich unreasonably shiftsincome to the industry is atthe expense of some endretail customer. There areno free lunches, andshoddy wholesale practiceis not a victimless act, evenin those cases where it isnot defined as a crime.”Adair TurnerChairman, UK FinancialServices AuthorityTable 1Examples of potential conduct risks across the wholesale bankCorporate banking AML/KYCMis-selling (derivatives, structured products, etc.)Inappropriate adviceFraudAnti-competitive behaviourInvestmentbanking/capitalmarkets Mis-selling (derivatives, structured products, etc.)Market abuse (e.g. LIBOR-fixing)‘Front-running’, ‘late trading’Insider tradingRogue tradingAggressive tax avoidance structuresFraudTransactionbanking AML/KYCOvercharging on captive FXTransactions with sanctioned counterpartiesFraud2

Conduct risk management at wholesale banks is at different stages of development.Some banks have done little more than AML/KYC. Others are setting upcomprehensive Group-led programmes. Most banks have many fragmented anduncoordinated initiatives and are only now looking at how to bring these together.The Conduct Risk Pyramid in Figure 1 illustrates some of the different approacheswe have observed.Figure 1Conduct Risk PyramidInstitutions typically move down the pyramid as they evolve their approach toconduct risk management. In the pyramid, each level drives the levels above it. Achange at a lower level will cause changes in the levels above, while making achange at a higher level may not affect the levels below.For example, a bank could identify matching products to client needs as a desiredbehaviour. But if the banker does not know enough about the product or the client’sneeds, it cannot be achieved. Similarly, if the banker over-values short-term profit, hemay ignore the needs of the client and instead sell a complex derivative that isunsuited to the client.Most banks will have already covered the environmental aspects; today they arelikely to be focused on behaviours. While they will have some initiatives at thecapabilities and values levels, few have a systematic approach. They aim to3

influence conduct with processes and controls rather than by addressing theunderlying capabilities and values that drive behaviour.Alas, control processes are ill-suited to wholesale banking, with its bespoke productsand constantly reconfiguring deal teams. Behaviour is ultimately what matters. But itdoes not follow that management can or should try to control it directly. Given thespeed, complexity and consequent opacity of wholesale banking, values and culturewill prove a more reliable foundation for good conduct than any set of rules can. Ashortage of rules at wholesale banks is not the problem. The problem is a culture of“mere compliance”, of following the letter of the law while having no genuinecommitment to honourable behaviour.The emerging global regulatory responseGlobally, regulators are increasing their powers andexpertise to impose stricter standards on marketparticipants. The caveat emptor approach to wholesaletransactions is on the wane, with broader systemicconcerns coming to the fore. There is also a sensethat the industry has lost its way and needs to focusmore on economically useful activity rather than therelentless focus on maximising short-term profits andreturns at the expense of clients. We do not expectwholesale conduct regulation to convergeinternationally in the way that it has for prudentialregulation. However, there are common policy threadsacross most jurisdictions. These include the fairtreatment of customers, product and service suitability,integrity of financial markets and the protection ofclient assets.“We need to turn thepage on an era ofirresponsibility. We needto put transparency,responsibility and ethicsat the heart of thefinancial system.”Michel BarnierEuropean Commissionerfor Internal and MarketServicesThe emerging regulatory frameworks mark a departure from the legalistic,compliance-driven approach of the past to one that will require supervised firms toadopt an approach that is: Led from the top Embedded in the frontline Driven by judgement4

Table 2Examples of regulations and supervisory approaches relating to wholesaleconduct in the UK, US and EUUKUSEUFinancial Conduct Authority(FCA) Must be driven by seniormanagement Strong emphasis onculture of placingconsumer “at heart ofbusiness” Consider impact of poorconduct in wholesalemarkets on retailconsumers More assertive supervisionof existing rules coveringwholesale participants More criminalprosecutions, tougherpenaltiesDodd-Frank Act (DFA) Internal business conductrequirements (robustcompliance/risk policies) External business conductrequirements (onboarding andpre-trade measures) Documentation requirementsFinancial Industry RegulatoryAuthority (FINRA) Standards of commercialhonour and principles of trade Assessment of suitability ofproducts for customersSecurities and ExchangeCommission (SEC) Developed formal agreementsto secure cooperation of“insiders”Markets in FinancialInstruments Regulation /Directive (MiFIR / MiFID) Role of board members incompliance, riskmanagement and internalaudit to be strengthenedCapital RequirementsRegulation / Directive (CRR /CRD) Corporate governanceinitiatives which aim toincrease the effectivenessof risk oversight by boardsMarket Abuse Directive(MAD) Contains provisions oninsider information andmarket manipulationThis new approach will create a material drag on wholesale market participants whocurrently generate US 300 BN a year in pre-tax profit. Conduct fines have grownsubstantially in the last two years and are currently running at US 1.5 BN per year(not including the as yet unknown level of LIBOR settlements) in the UK, US andEurope. On top of this, operational compliance costs will increase by US 10 BN peryear.5

Box 1Case study: UK Financial Conduct Authority’s approachThe FCA will commence operations in April 2013, with a focus on the conduct offinancial institutions. According to the document Journey to the FCA published by theFinancial Services Authority (FSA) on 16 October 2012, key features of the FCA’sapproach to conduct will include:Objectives DifferentiatedsupervisionSupervision will be differentiated, with four conduct supervision categories(C1-C4) based on their potential impact on the objectives of the FCA(broadly based on size and complexity) C1 and C2 firms will have nominated supervisors C3 and C4 firms will be supervised by teams of sector specialistsCulture andgovernance SupervisoryframeworkCurrent ARROW approach will be replaced by the Firm SystematicFramework (FSF), which will consist of: Business model and strategy analysis (BMSA) Assessment of how the firm embeds fair treatment of customers andensures market integrity through four modules Governance and culture Product design Sales or transaction process Post-sales/services and transaction handling Assessments will take place through interviews, with more detailedtesting only if it is the only wayWholesale vs. retail Deterrence Secure appropriate degree of protection for consumersProtect and enhance integrity of UK financial systemPromote effective competition in the interests of consumersConduct must be driven by senior management – “from the boardroomto the point of sale and beyond”No hard divide between wholesale and retail marketsEnsure customers, whether retail or wholesale, enjoy protection fromrisks arising, either directly or indirectly, from wholesale activitiesSophistication of parties involved in transactions not a reasonabledefence for poor conductMore criminal prosecutions, tougher penalties, senior management heldaccountable, compensation for consumers“Shoot first and ask questions later” – e.g. 12-month product banswithout consultation if suspected to be detrimental to consumers6

Long term implications for wholesale banksWholesale banks must place good conduct at theheart of their business models and corporateculture. To achieve this, firms will need to changetheir approach to conduct risk so that it moves upthe Conduct Risk Pyramid (see p3), focusing moreon values and capabilities than controls. Only thencan good conduct become embedded into thebusiness in a way that minimises risk and satisfiesregulatory expectations.“All these bankinginstitutions have finestatements of their ethicalpractices on paper, but howmuch it’s really enforced,how much is in the instinctsof staff, and particularly thetraders, up and down theranks, is difficult to say.”Table 3 illustrates some of the key elements thatneed to be addressed. While the specifics will varywith local regulations, the priorities will be similar formost banks.Paul VolckerChairman of the FederalReserve (1979-87)The language surrounding conduct will be important. It should be couched in termsof good business practice rather than compliance with rules. Many previous conductrelated initiatives, such as AML/KYC have been overly rules-focused andinsufficiently business-focused. The resulting disconnect with the business hasmeant that these processes have been less effective – and certainly less efficient –than they could have been. Frontline involvement is critical not only to get the buy-inbut also to strike the right balance between ensuring proper checks and controls andmaintaining a good customer experience. They are best-placed to identify problemsand they are also likely to be am

banking/capital markets Mis-selling (derivatives, structured products, etc.) Market abuse (e.g. LIBOR-fixing) ‘Front-running’, ‘late trading’ Insider trading Rogue trading Aggressive tax avoidance structures Fraud Transaction banking AML/KYC Overcharging on captive FX Transactions with sanctioned counterparties Fraud . 3 Conduct risk .