Transcription

USING CANDLESTICK CHARTSTO TRADE FOREXCONTENTSDisclaimer01Introduction02Candlestick Chart Origins03Candlestick Chart Definition04Single Candlestick Patterns05Multiple Candlestick Chart Patterns07Two Candlestick Pattern Formations08Three Candlestick Pattern Formations09Pros and Cons of Using Candlestick Charts11

USING CANDLESTICK CHARTSTO TRADE FOREXDISCLAIMERThe information contained in this eBook is provided for information purposesonly. The information is not intended to be and does not constitute financialadvice, is general in nature and is not specific to you. Before using theinformation contained in this eBook to make an investment decision, youshould seek the advice of a qualified and registered securities professionaland undertake your own due diligence. None of the information contained inthis eBook is intended as investment advice, as an offer or solicitation of anoffer to buy or sell or as a recommendation, endorsement or sponsorship ofany security. Orbex is not responsible for any investment decision made byyou. You are responsible for your own investment research and investmentdecisions.RISK DISCLOSUREThere is a substantial amount of risk in trading currencies and CFDs and thepossibility exists that you can lose all, most or a portion of yourcapital. Orbex does not, cannot and will not assess or guarantee thesuitability or profitability of any particular investment or the potential valueof any investment or informational source.The securities mentioned in this eBook may not be suitable for allinvestors. The information provided by Orbex, including but notlimited to its opinion and analysis, is based on financial models believed tobe reliable but it is not guaranteed, represented orwarranted to be accurate or complete.Your use of any information from this eBook or Orbex site is at your own riskand without recourse against Orbex, its owners, directors, officers,employees or content providers.01

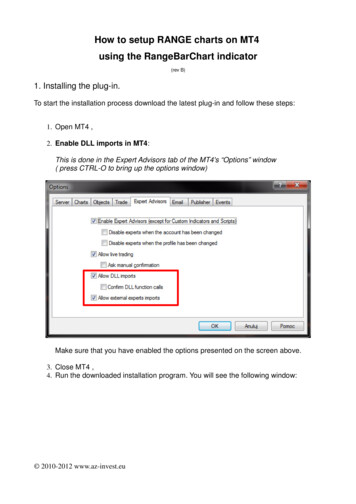

USING CANDLESTICK CHARTSTO TRADE FOREXINTRODUCTIONCandlestick charts have become an invaluable resource for traderssince their invention in Japan in the 1700’s. This type of chart hasprovided Western traders with insight into the future direction ofmarkets since becoming popular in the West in the early 1900’s.Candlestick charts can be an extremely valuable technical analysisresource when engaged in forex trading. Due to their accurategraphical representation, and the different types of patterns formed byjust one candlestick or a series of candlesticks, a forex trader that canrecognize and correctly interpret candlestick patterns definitely has anedge.Candlestick charts have unique characteristics that differ fromconventional open, high, low and close or OHLC charts. They conveythe same OHLC information, in addition to whether the asset orexchange rate had increased or sold off during the period of thecandlestick which is shown in color.Every candlestick on a chart is displayed in one of two colors, which areusually black and white, with black representing a down period andwhite representing an up period. Red and green are also sometimesused. The Metatrader 4 forex trading platform has an option to displayexchange rate movement as a candlestick chart.02

USING CANDLESTICK CHARTSTO TRADE FOREXCANDLESTICK CHART ORIGINSCandlestick charts were first devised and used by a legendary Japanesetrader named Homma Munehisa of Sakata, Japan in the 1700’s.Munehisa was one of the most successful traders of all time. Tradingprimarily in rice futures, Munehisa was reputed to have made as muchas the present day equivalent of 100 billion during his time trading,making as much as 10 billion over the course of a single year.By the early 1900s, this new charting technique was introduced in theWest and popularized by Charles Dow, who is a well-known technicalanalyst, famous for being one of the inventors of the Dow-JonesIndustrial Average. The charting technique has been used ever since inthe West, mainly by commodity and stock traders. Candlestick chartshave more recently become popular in the forex market and are nowcommonly used instead of the more traditional bar charts.03

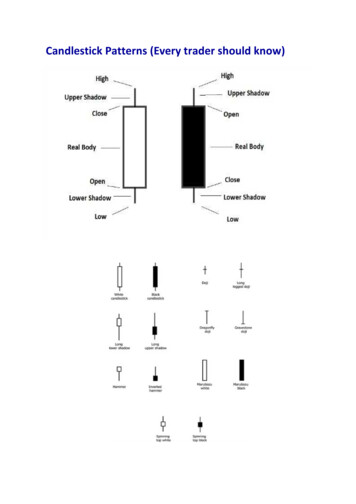

USING CANDLESTICK CHARTSTO TRADE FOREXCANDLESTICK CHART DEFINITIONA candlestick chart uses individual entries called “candles” forspecified time periods and they denote the direction of the currencypair’s exchange rate during that time period by color.The candle consists of two parts. The body of the candle indicates theopening and closing exchange rates. An up move is usuallyrepresented by a white candle and a down move is represented by ablack candle. The opening price of a white or up candle is on thebottom, and the closing price of a white candle is on top. This isreversed for black candles.The “shadows” or “wicks” of the candle consist of a line protruding upfrom the top that visually indicates the high point of the time period, aswell as a line protruding down from the bottom of the body that showsthe low point of the time period. These shadows show how much thecurrency pair’s exchange rate moved below the base of the candle bodyand above the top of the candle’s body.The wick on the top of the candle represents how high the instrumenttraded above the opening or closing price, depending on the candle’scolor. Similarly, the wick protruding from the bottom of the candleshows how low the instrument traded below the opening or closingprice, depending on the candle’s color. Long shadows indicate a wideprice fluctuation either up or down.If the candle is white, then the upper shadow or wick represents howmuch higher the instrument traded above the closing price for theperiod represented by the candle, while the lower wick represents howmuch lower the instrument traded from the opening price for the periodrepresented by the candle.The same is true but inverted for a black candlestick. The upper wickrepresents how much higher the instrument traded from the openingprice for the period, while the lower wick represents how much lowerthe instrument traded from the closing price for the period.04

USING CANDLESTICK CHARTSTO TRADE FOREXSINGLE CANDLESTICK PATTERNSCandlestick patterns fall into two categories: continuation patterns andreversal patterns. As their names imply, a continuation pattern showsthe prolonging of a trend, while a reversal pattern indicates aturnaround of a previously established trend.Depending on the number of candles that make up a particularconfiguration, candlestick patterns also fall into several different typesthat can convey useful market information to the trader looking toperform technical forex analysis. The simplest type of candlestickpattern consists of only one candlestick, while other patters are madeup of several candles.Single candlestick patter types include: Doji - a reversal candlestick pattern that has identical opening andclosing prices, with one or two shadows. Because the candle lacks abody, the Doji has the appearance of a cross, a T, or an upside downT. The Doji shaped like a T is known as a Dragonfly Doji, while theupside-down T is called a Tombstone Doji. The cross Doji, with anupper and lower shadow, is called a Star Doji. All of these patternssignal a market reversal is imminent.Doji Patterns05

USING CANDLESTICK CHARTSTO TRADE FOREXSINGLE CANDLESTICK PATTERNS Marubozu - this type of single candlestick pattern can be either acontinuation or reversal pattern, depending on the context and theadjacent candlesticks. The Marubozu is made up of a solid body withno shadows. It indicates either strong demand in the market if thepattern is white or abundant supply in the market if the candlestickis black. Spinning Top - this single candlestick pattern consists of long upperand lower shadows and a small body. A bearish spinning top has ablack body, while a bullish spinning top has a white body. Thispattern is often indicative of a lack of direction and indecision in themarket. Hammer or Hanging Man - this single candlestick reversal patternhas a small body, either above or below a long shadow. A HangingMan candle has a black body and a long lower shadow, while aHammer consists of a small white body with a long lower shadow.Both patterns signal a reversal of the previous trend is forthcoming.Marubozu PatternsSpinning Top PatternsHammer or Hanging ManPatterns06

USING CANDLESTICK CHARTSTO TRADE FOREXMULTIPLE CANDLESTICKCHART PATTERNSCandlestick patterns of more than one candlestick offer the trader aunique method of analyzing the market, with many well definedmultiple Candlestick patterns having been identified and studied overhundreds of years. These trading signals can be especially useful toforex traders trading the Japanese Yen.Japanese traders that invented the system gave their patterns colorfulnames. Each of these patterns incorporates sound trading principleswhich underline the classic interpretation of each particularcandlestick chart pattern.Having an ability to recognize and understand the interpretation ofmultiple candlestick patterns is a powerful trading tool for any financialmarket. Furthermore, for traders in the forex market, knowledge andunderstanding of Candlestick patterns adds extra depth to theirknowledge of technical analysis and their ability to use it effectivelywhile trading currencies.07

USING CANDLESTICK CHARTSTO TRADE FOREXTWO CANDLESTICKPATTERN FORMATIONSDark Cloud Cover PatternPatterns consisting of two Candlesticks are often bullish or bearishdepending on the underlying trend in the market. For example, anEngulfing pattern, which consists of a black candlestick with a smalllower shadow being engulfed by a white Marubozu candlestick, isbullish.Conversely, an Engulfing pattern showing a white candlestick with asmall upper shadow being engulfed by a black Marubozu is bearish.Other Candlestick patterns with two Candlesticks include the: Bearish Harami - a reversal pattern consisting of a long whitecandlestick with a large body engulfing a small black candlestick.Piercing Pattern Bullish Harami - a reversal pattern consisting of a large blackcandlestick engulfing a small white candlestick. Dark Cloud Cover - a bearish top reversal pattern consisting of awhite candlestick followed by a black candlestick that opened higherthan the previous candlestick’s opening. Piercing Pattern - this bullish bottom reversal pattern is an invertedDark Cloud Cover and consists of a black Candlestick followed by awhite candlestick that opened higher than the previous candle’sclosing price.Bullish Kicking PatternBearish Kicking Pattern Bullish Kicking Pattern - a two Candlestick reversal patternconsisting of two Marubozu Candlesticks. The first Candlestick isblack and closes at the low of the period, while the secondCandlestick is a white Marubozu that opens with the market gappinghigher than the previous Candlestick’s high and then continuing totrade higher. Bearish Kicking Pattern - a reversal pattern consisting of twoMarubozu candlesticks. The first candlestick is white closing at thehigh of the period, while the second candlestick is a black Marubozuthat opens with the market gapping lower than the previousCandlestick’s low and then continuing to decline.08

USING CANDLESTICK CHARTSTO TRADE FOREXTHREE CANDLESTICKPATTERN FORMATIONSSome Candlestick Patterns containing three Candlesticks include the:Morning Star Pattern Morning Star - this bullish reversal pattern generally occurs near amarket bottom and consists of a long black candlestick, followed bya small white candlestick with an opening below the previouscandlestick’s close, which is then followed by a white candlestick. Evening Star - an inverse Morning Star, this bearish reversal patterngenerally occurs near a market top and consists of a long whitecandlestick followed by a small black candlestick with an openingabove the previous candlestick’s close, which is then followed by ablack candlestick.Evening Star Pattern Morning Doji Star - this bullish reversal pattern generally signals amarket low and consists of a long black candlestick followed by aStar Doji with opening and closing prices below the previouscandle’s opening, which is then followed by a white candlestick. Evening Doji Star - an inverted Morning Star, this bearish reversalpattern generally signals a market top and consists of a long whitecandlestick followed by a Star Doji with opening and closing pricesabove the previous candle’s close, which is then followed by a blackcandlestick.Morning Doji Star PatternEvening Doji Star Pattern Shooting Star - a bearish reversal pattern consisting of a candlestickwith a long body followed by a Dragonfly Doji with opening andclosing prices above the previous candlestick’s closing or openingprice, followed by a black candlestick, the first candlestick can beeither black or white. This pattern is invalidated if the nextcandlestick after the first three is a black candlestick that gappedlower. Inverted Hammer - a bullish reversal pattern that generally occurs ina downtrend and consists of a long candlestick followed by aTombstone Doji with opening and closing prices above the previouscandlestick’s closing or opening price, followed by a whitecandlestick. The first candlestick of the pattern can be either blackor white, and this pattern is invalidated if the next candlestick afterthe first three is a white candlestick that gapped higher.09

USING CANDLESTICK CHARTSTO TRADE FOREXTHREE CANDLESTICKPATTERN FORMATIONSThree White Soldiers Pattern Three White Soldiers - a bullish reversal pattern consisting of threeascending Marubozus with higher opening prices. Three Black Crows - a bearish reversal pattern consisting of threedescending Marubozus with lower opening prices. Bullish Three Inside Up - this candlestick reversal pattern begins witha long black candlestick which closes at or near the low for theperiod. The following candlestick is a short bodied white candlestickthat forms the Bullish Harami Pattern. The third can

TO TRADE FOREX Candlestick charts have become an invaluable resource for traders since their invention in Japan in the 1700’s. This type of chart has provided Western traders with insight into the future direction of markets since becoming popular in the West in the early 1900’s. Candlestick charts can be an extremely valuable technical analysis