Transcription

Advanced CandlestickCharting Techniques:Secrets to Becoming aSamurai Trader11

“He who is wellprepared has wonhalf the battle”2

Slide 3New refinements and enhancements for high successtrading with candle chartsSee when to ignore a candle signalSpecial section on on intraday chartsUncover the one rule every candlestick trader ignores attheir own perilThe P.R.O.F.I.T.S methodologyLearn the six principles every candlestick trader mustknowUncloak new uses for the most potent candle pattern - thewindowEffective money management concepts to maximize theeffectiveness of candle chartsInteractive practice sessions33

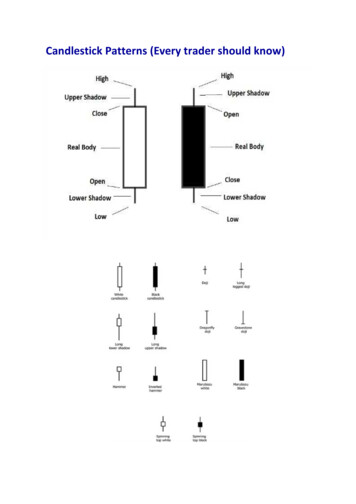

Constructing the Candle Line44

Candle or noses555

Candles shine at Preserving CapitalA tall white candle pierces this resistance in early March.For those who already are long this index, this was a greenlight to remain long. But observe what unfolded the nextsession—the doji. This doji line hinted the bulls had lost fullof the market (note: it does not mean that the bears has takencontrol).6

Warren Buffet’s Rules ofMoney ManagementRule 1 – Not to lose moneyRule 2 – Don’t forget rule 17

Nison TradingPrincipleCandlesticks do not giveprice targets.8

Gravestone DojiThis doji takes on extra significancebecause it confirms a resistance level9

Nison TradingPrincipleA candlestick line or patternrequires two criteria: The shape of the line or pattern The preceding trend10

Doji and TrendConcept:To use a northern doji as asignal we need to have anuptrend to reverse11Doji in a “Box Range” isnot a trading signal

Doji and trendA doji in the middleof a trading range hasno trend changeimplications“Box Range”12Doji

Northern and Southern DojiA doji in an uptrendis a “Northern Doji”A doji in adowntrendis a“SouthernDoji”13

Southern Doji14

Nison TradingPrincipleCandle signals must beevaluated and acted uponwithin the market’s context15

Doji in ContextConcept:If a doji makes a newhigh close for the move,wait for bearishconfirmation with a closeunder the doji’s close16Need acloseunderhere toturnbearish

Doji in ContextWhich of thesescenarios is a morelikely top reversal?Scenario 117Scenario 2

Doji, but New High Close18

Doji, but New High close19

Flexibility with Candles (and Confluence)20

For those who already are long this index, this was a green light to remain long. But observe what unfolded the next session—the doji. This doji line hinted the bulls had lost full of the market (note: it does not mean that the bears has taken control).