Transcription

Sponsored byAccepting the challenge:Retailers embrace the need for changeWritten by

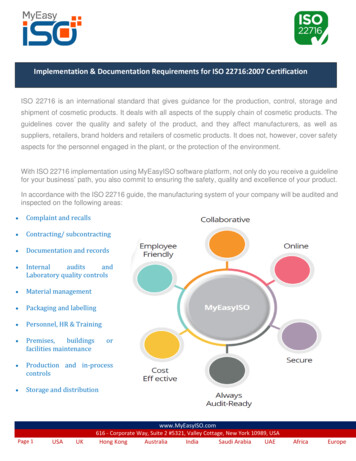

Commonwealth Bank viewpointJerry Macey, National Retail Lead, Commonwealth Bank of AustraliaTraditional retailers face a growing challenge in being able to generate profitablegrowth from online commerce as well as needing to incorporate new technologiesand big data to improve existing business capabilities in a digital market, accordingto Jerry Macey, National Retail Lead at the Commonwealth Bank of Australia, at theCommonwealth Bank of Australia. “We are living in an increasingly digital world.This generates a greater need for good quality information that management canuse to run their business in a tighter, faster and smarter manner,” he explains.For retailers to successfully take advantage of the data they currently possess,they need to effectively integrate the disparate functions within their organisation.Mr Macey explains that traditional business functions like finance, HR, accounting,merchandising and supply chain are independent areas that are typically looselyintegrated. “Cloud-based technology solutions can now bring these separate layerswithin a business together, even using a legacy system and transform it into arelational database,” he says. “When information is effectively integrated withinan organisation, the real value of data comes through.”However, Mr Macey cautions that data analytics alone is no instant fix and saysretailers must strive to make sense of the data and draw meaningful insights that willgenerate viable business change. He says that the Commonwealth Bank of Australia’sInnovation Lab helps businesses achieve this by bringing creative thinking techniquesto bear that help retailers draw actionable insights from data. The ideas generated canthen be tested on a small audience over the span of a few weeks to understand whatworks and what does not. “The goal is to test ideas first in the lab, making sure thatthey actually resonate with a client before they embrace it in their business model.”

Accepting the challenge: Retailers embrace the need for changeAbout the researchChange drivers is a series of articles from The Economist Intelligence Unit andcommissioned by the Commonwealth Bank of Australia, that examines howchange-oriented the entertainment, education and retail industries areby determining the extent to which organisations in them have changed theirproduct and service portfolios and their revenue models in recent years.The Economist Intelligence Unit bears sole responsibility for the editorial contentof this report. The findings do not necessarily reflect the views of the sponsor.Denis McCauley was the author of this report and Charles Ross was the editor.The research draws on a survey conducted in March 2018 of 420 seniorexecutives in Australia, Hong Kong, Japan, New Zealand, United Kingdomand United States. Interviews were also conducted and supplemented withwide-ranging desk research.Our thanks are due to the following interviewees for their time and insights: Russell Zimmerman, executive director, Australian Retailers Association,Australia Matt Newell, executive strategy director, The General Store, Australia A ngus McDonald, general manager for customer solutions, SuperCheapAuto, Australia The Economist Intelligence Unit Limited 20181

Accepting the challenge: Retailers embrace the need for changeIntroductionof the Australian Retailers Association.“They are laggards when it comes to onlinecommerce,” he says. According to MattNewell, executive strategy director withThe General Store, a retail consultancy,Australian retailers have barely begun to tapinto digital opportunities such as streamingor subscription services.Two decades on from the advent ofonline commerce, many traditionalretailers—those born in the offlineworld—are still coming to terms withdigital disruption. A case in point is theUK, where established high street chainssuch as Marks & Spencer, Debenhamsand House of Fraser, amongst others,have recently announced revenue andprofit declines as well as shop closures,which industry experts attribute at leastpartly to struggles against digital rivals1.Despite years-long efforts to implementmulti-channel strategies, many establishedUS retailers are similarly struggling withonline competition2.Open mindsAustralian retailers are just beginning tosquare up to the digital challenge, accordingto Russell Zimmerman, executive directorStruggling with digital does not meanretailers lack the will to change. Judgingby the responses of retail sector executivesto questions in a recent EIU survey3, theirpenchant for change—and the ability tobring it about—are stronger than in othersectors such as entertainment. For example,80% of retailers have increased the numberof products and services they offer in thepast three years (the corresponding figureFigure 1: Retailers are driving changeNew products and services, upgrades and time to market: selected indicators (% of respondents)80%78%80%68%59%71%70%39%We have moderately orWe have moderately orsignificantly increased our number significantly increased ourof new products or servicesnumber of upgradesOverall environmentAustralia27%On average, it takes us2 months or less to bringentirely new products orservices to marketOther countries1 See, for example, “Six reasons why Britain’s retailers can’t make ends meet”, The Guardian, May 26, 2018; and “M&S is finally coming to the online retail party —like it’s 1999”, FT.com, May 23, 2018.2 For recent examples from the fashion industry, see “Retail Woes: A Running List of Fashion Bankruptcies”, The Fashion Law, May 21, 2018.3 The survey of 428 respondents included 137 from the retail sector. Roughly one-quarter of this group hail from Australia, while the rest work in the US, UK,New Zealand, Japan, Singapore or Hong Kong.2 The Economist Intelligence Unit Limited 2018

Accepting the challenge: Retailers embrace the need for changein the entertainment group is 73%). Nearlyseven in 10 retail respondents (68%) alsosay their firms have increased the numberof product and service upgrades in recentyears (entertainment—47%).80%of retailers have increased thenumber of products and servicesthey offer in the past three yearsThe retailers in the survey also appear ableto act fast to bring new products to market.Nearly four in 10 (38%)-- twice the figurecited by entertainment companies—cando so in two months or less. And 18% ofretailers can do this in less than a month,compared with 6% of entertainment firms.Australian retail firms appear especially fastwhen it comes to time-to-market.Mr Newell attributes retailers’ ability to movequickly to highly efficient supply chains.“Retailers are very familiar with sourcingfrom developing economies and getting newproducts onto the shelves quickly,” he says.“Retail is probably better at this than evenconsumer goods brands, whose logisticsprocesses are generally not as strong.”Many retailers are also keen to experimentwith different aspects of their businessmodels. Over four in 10 respondents (43%)report, for example, that their firms havechanged their pricing model in the pastthree years. Of those who have done so,the most common steps have been tointroduce personalised pricing as wellas subscription pricing.Figure 2: New pricing modelsIf you changed your pricing model in the past three years, which of the following have been introduced?(Top responses of overall retail sample, % of respondents)42%Personalised pricing32%Subscription pricing29%Fee-based advertising24%Fee-for-service (“pay as you go”) pricing20%“Freemium”“Pay what you want”pricing12% The Economist Intelligence Unit Limited 20183

Accepting the challenge: Retailers embrace the need for changeSupercheap Auto tests the roadsOne digital advantage that physical retailers enjoy over their online-native rivalsis the ability to use technology to enhance the in-store customer experience.Management of Supercheap Auto needs little convincing of the benefits this canbring. In 2017 it established a sprawling “customer experience centre” in Penrith,New South Wales with the purpose of testing new retail concepts before rollingthem out to its nationwide network of 320 stores.A unique feature of the space is a grandstand seating area, along with large roofmounted video screens, where visitors can watch live demonstrations learn aboutcaring for their car. The centre’s digital features are designed to complementand enhance its physical ones. The former include interactive displays that helpcustomers locate the products they need, as well as “endless aisles”— digitalkiosks that customers use to browse and order products not available in-store. Alsopresent is a click-and-collect facility, enabling customers to order a product onlineand collect it in-store within 30 minutes.Such services are the additional, critical element to creating a better customerexperience, according to Angus McDonald, the company’s general manager forcustomer solutions. “In our business we can’t just think about selling someone aset of wiper blades; we have to think about the broader solution.” This, he says,means offering services in-store that fit the blades and top up the wiper fluid, orperform minor windscreen repairs or fit roof racks. The company has broughtin third-party providers to provide more complex services, such as replacingwindscreens and fitting tyres.All these points of interaction with customers serve another purpose, saysMr McDonald. “Along with our website, loyalty club and other digital channels,these provide more touch points where we can gather customer insights andbuild a much better picture about what people are looking for, and where ouropportunities are to improve and provide a better offer.”4 The Economist Intelligence Unit Limited 2018

Accepting the challenge: Retailers embrace the need for changeFigure 3: Technology driving changeWhich technologies or related developments have made the biggest difference in your organisation’sability to change its product and service offerings or revenue model in the past three years? (Topresponses, % of respondents)40% 41% %24%27%24%16%SmartphonesOverall environmentAustraliaAnother 29% of respondents report thattheir firm has entered a new product orservice market in which they had notpreviously competed. In Australia, accordingto Mr Newell, these are often adjacentmarkets for services that are close totheir existing businesses. As exampleshe cites equipment installation servicesof the type offered by Supercheap Auto,one of the country’s largest auto partsretailers (see “Supercheap Auto tests theroads”), and interior styling services offeredby furniture retailers.Moving targetsThere are few online challengers thatconcentrate traditional retailers’ mindsas much as Amazon. According to MrZimmerman, anticipation of the US onlineInternetof thingsCloudcomputingOther countriesAnticipation of (Amazon)the US online giant’s entryinto Australia has ledthe country’s traditionalchains to review their revenueand operating models.Russell Zimmerman, executivedirector, Australian RetailersAssociation, Australiagiant’s entry into Australia (formal launchoccurred in late 2017) has led the country’straditional chains to review their revenueand operating models, as well as to try andwring more efficiency out of their supplychains. (He believes Australian retailers The Economist Intelligence Unit Limited 20185

Accepting the challenge: Retailers embrace the need for changeFigure 4: Biggest barriers to InnovationWhat are your organisation’s biggest barriers to introducing new products or services? (% of respondents)34%32%27%Lack offunding29%32%28%Lack ofinnovative ideasOverall environmentshould also prepare for an eventual entry ofAlibaba, China’s e-commerce behemoth.)Retailers’ will to change models andproduct portfolios may be there, but otherobstacles often get in the way. Outside ofAustralia the survey respondents point toa lack of funding which, more than others,hinders their development of new products.Australian respondents mention this as well,but more emphasise a lack of innovativeideas. For some retailers, risk aversion andinternal cultural impediments also play arole, although these are minorities both inAustralia and globally.Australia24%22%Lack of people withthe requisite skillsOther countriessays, “trying to pin significant amounts ofmoney against moving targets is a hugechallenge. Do I put the investment againstsubscription? Against e-commerce or onlinemarketing? Or do I create amazing physicalstore experiences? Making the rightchoices is doubly daunting when you'vegot analysts breathing down your neckon a quarterly basis.” zMr Newell adds one more challenge tothe list: decision-making complexity.Changing products and markets oftenentail significant amounts of investment,he points out, especially for large retailers.In a rapidly changing environment, he623% The Economist Intelligence Unit Limited 2018

Accepting the challenge: Retailers embrace the need for changeKey takeaways erhaps motivated by the existential challenges they face from digital rivals,Ptraditional retailers display a considerable penchant for change, both in theirproduct and service portfolios as well as in their revenue and pricing models. ustralia’s large retailers may have been slow to take up the digital challenge,Abut some are moving ahead to experiment with new concepts such as“endless aisles” and adding services to their existing revenue models. ore than risk aversion or internal cultural impediments, making the rightMinvestment decisions amongst a plethora of strategic options may be agreater barrier to successful change for large retailers. The Economist Intelligence Unit Limited 20187

Sponsored byWritten byAUSTRALIASINGAPORELONDONHead Office38 Beach Road20 Cabot SquareDarling Park Tower 1#06-11 South Beach TowerLondon201 Sussex Street189767E14 4QWSydney NSW ?ei mv institutionalTower 1727 Collins StreetNEW ZEALAND12 Jellicoe StreetAucklandUNITED KINGDOMDocklands VIC 3008Level 2Level 14aLondonBankwest Place300 Murray Street60 Ludgate HillUNITED STATESPerth WA 6000Level 17CHINANew York 10022China World TowerRoom 4606No.1 Jian Guo Men Wai AvenueBeijing 100004599 Lexington Avenue811 Main StreetSuite 4675Houston TX 770021108 Azia Center1233 Lujiazui Ring RoadShanghaiHong KongLevel 12, One Exchange Square8 Connaught PlaceCentralJAPANLevel 8Toranomon Waiko Building5-12-1 Toranomon Minato-kuTokyo 105-0001This report has been prepared by The Economist Intelligence Unit solely for informational purposes andis not to be construed as a solicitation, an offer or a recommendation by the Commonwealth Bank ofAustralia. This information does not have regard to your financial situation or needs and must not be reliedupon as financial product advice or Investment Research. You should seek professional advice, includingtax advice, before making any decision based on this information. We believe that the information in thisarticle is correct and any opinions, conclusions or recommendations are reasonably held based on theinformation available at the time of its compilation but no representation or warranty, either expressed orimplied, is made or provided as to accuracy, reliability or completeness of any statement made in this article.Commonwealth Bank of Australia ABN 48 123 123 124.United KingdomTel: (44.20) 7576 8000Fax: (44.20) 7576 8500E-mail: london@eiu.comNEW YORK750 Third Avenue5th FloorNew York, NY 10017, USTel: (1.212) 554 0600Fax: (1.212) 586 0248HONG KONG1301 Cityplaza Four12 Taikoo Wan RoadTaikoo ShingHong KongTel: (852) 2585 3888Fax: (852) 2802 7638SINGAPORE8 Cross Street#23-01 Manulife TowerSingapore 048424Tel: (65) 6534 5177Fax: (65) 6428 2630E-mail: singapore@eiu.comGENEVARue de l’Athénée 321206 Geneva SwitzerlandTel: (41) 22 566 2470Fax: (41) 22 346 9347Whilst every effort has been taken to verify the accuracyof this information, neither The Economist IntelligenceUnit Ltd. nor the sponsor of this report can accept anyresponsibility or liability for reliance by any person on thisreport or any of the information, opinions or conclusionsset out herein.

2 The Economist Intelligence Unit Limited 2018 Acceptin the challene etailers embrace the need or change 1 See, for example, “Six reasons why Britain’s retailers can’t make ends meet”, The Guardian, May 26, 2018; and “M&S is finally coming to the online retail party — like it’s 1999”, FT.com, May 23, 2018. 2 For recent ex