Transcription

July 2018Mystery shoppingin the luxury industryFrederic Renaldo Richard Korn Geert Samplonius

Mystery shoppingin the luxury industryFrederic Renaldo Richard Korn Geert SamploniusCustomer experience is of great importance in anyindustry, and it is increasingly being recognised assuch. This is arguably most evident in the high-endspectrum of the market where affluent consumersliterally spend billions of dollars, pounds, euros,yuan or yen, year in, year out.Ensuring luxurysales associates aretruly understandingcustomer needsIpsos Mystery Shopping uses panels of expert‘shoppers’ in more than 100 countries to collectobjective feedback from unbiased consumers.More than one million tasks are conducted everyyear, of which an increasing number are doneby dedicated, affluent mystery shoppers – theseindividuals don’t rely on mystery shopping as anincome, but rather enjoy the experience so muchthey consider it a pastime. Naturally, mysteryshopping in the luxury industry requires a verydifferent approach to regular high-street retailshops.Richard KornIn this paper, three highly experienced mysteryshopping experts share their knowledge andopinions on different aspects of mystery shoppingin the luxury industry, and how it is a vital ingredientin a holistic Customer Experience strategy.Understanding thediscount process in theluxury environmentFrederic RenaldoFrederic Renaldo is Customer Experience Directorand oversees mystery shopping activity for Ipsos inSwitzerland. In this role, he manages global mysteryshopping programmes for some of the world’s mostprestigious luxury brands.Prior to joining Ipsos in 2014, he held various seniorroles in the market research industry, most notably asCustomer Experience Lead at Synovate, Digital StrategyDirector at CSA and Senior Consultant at Fullsix, one ofthe largest Digital Marketing agencies in Europe.Frederic holds a master’s degree in Management fromSKEMA Business School, France.2With 14 years’ experience in the Customer Experienceindustry, spanning the UK, Asia and now Australia& New Zealand, Richard has significant expertise indesigning solutions that maximise insights and driveaction within client organisations. Richard has spentseveral years specifically working in mystery shopping,having delivered programmes around the world andhas direct experience within the luxury sector, includingWatch & Jewellery, Fashion and Beauty/Cosmetics.The importance of spendingtime with your client prior toclosing the dealWhat the high street can learn fromour research in the luxury industryGeert SamploniusGeert is a Customer Experience professional andcurrently leads mystery shopping activities for Ipsosin the Netherlands. He has more than a decade ofexperience in mystery shopping and has worked in bothEurope and Asia working with many of the world’s mostwell-known luxury brands in Watch & Jewellery, Fashion& Apparel and Automotive.Geert holds a Bachelor Degree in Business Administrationin Hotel Management from the renowned Hotelschool,The Hague.

Mystery shoppingin the luxury industryFrederic Renaldo Richard Korn Geert SamploniusUnderstanding thediscount process in theluxury environmentAffluent customers do not always pay retailprice for goods, even at the highest end ofthe luxury chain. Our research even suggeststhat consequent discounts can be obtainedby these customers. Here, Service DirectorFrederic Renaldo explains how Ipsos factors inthe discount process in its luxury MysteryShopping programmes.People unfamiliar to the world of luxury shoppingwouldn’t expect that you could pay less than the retailprice of a product by simply asking for a discount. Mostpeople would shy away from an attitude they believedoesn’t seem applicable when it comes to expensiveitems.Our experience conducting thousands of mysteryshopping visits around the world shows that, often, theprice of a high-end watch or handbag can be negotiated.For our clients in the luxury industry, however, discountssignificantly damage the image of their brand. The risklies with the perception of a decrease in value by thecustomer.So, when it comes to mystery shopping it is thereforecrucial to understand the discount process, includingthe extent of what is offered by retailers.Ipsos’s Mystery Shopping expertise helps our clientsto better control and prevent the damage caused byuncontrolled discounting. Here are four quick rules forluxury product manufacturers to live by when it comesto assessing the discount process.1. It’s all about contextA one-size-fits-all scenario does not always work.Bargaining or negotiating is highly influenced by thecultural context. Entering a negotiation in China canbe considered as standard, whereas in Japan it isusually inappropriate to question the price of a product.The scenario should therefore mirror the negotiationstyle for each market.3Another aspect to bear in mind in the luxury world is thata discount is usually a lengthy process. Several visitsare usually needed to reflect the real-world behaviour ofan affluent shopper, and expecting to get a discount onthe first visit can be unrealistic.2. Select the right people to play the roleIpsos takes extreme care in making sure the shopperprofile perfectly matches a client’s typical customer. Adetailed screening test helps us understand if they areup to the challenge.Demographics are key – only our most affluentshoppers are selected for this type of assignment, and aminimum age of 30 increases credibility when it comesto negotiation.When selecting a shopper for a luxury programme,shoppers are screened on their personal affinity orownership of luxury items. Ipsos goes one step furtherand factors in hobbies and activities connected toluxury. This is especially true if the shop is for somethingspecific, such as equipment-heavy sports like golf,sailing, scuba diving, etc.Usually, Ipsos sets a prerequisite of having previousexperience with similar mystery shopping projects,including a negotiation phase.3. Training, training, and retrainingSeveral levels of training are undertaken. In additionto online briefing, projects with a negotiation moduleoften require a face-to-face or telephone briefing totruly assess the shopper’s abilities. These sessionscan include role-playing exercises to make sure that,even under pressure in the poshest of posh stores, ourshoppers feel confident and ready to haggle!Our team often produces videos or animations to showexamples of in-store price negotiation based on thescenario of the specific project.4. Long-term performance monitoringPotential shoppers need to pass a strict certificationprocess to eventually qualify. But even after passing,validators evaluate and compare our shoppers basedon a series of strict criteria and keep in constant contactwith them throughout the project.

Mystery shoppingin the luxury industryFrederic Renaldo Richard Korn Geert SamploniusEnsuring luxury salesassociates truly understandcustomer needsWith the rising affluence of the Chinese middleclass and their increasing propensity to traveloverseas, luxury brands face new and particularchallenges to what they have traditionally beenused to. Mandarin-speaking sales advisers arenow commonplace in stores as far afield as Paris,New York and Sydney, but this is just one tool thatluxury brands must have at their disposal.Here, Richard Korn, Ipsos Mystery ShoppingANZManagingDirector,discussesinstore customer engagement and how salesadvisers must listen and understand theneeds and motivations of the customer.There are no accidental customersUnderstanding the needs of the customer is important forseveral reasons – one of which is that Chinese travellersspend a significant amount of time planning their tripsin advance. This of course includes destinations andtourist spots, but also store locations and prices ofluxury brands.The 2017 Ipsos Chinese International Travel Monitorfound that Chinese travellers spent an average of 12days researching online before travelling. This meanscustomers already possess a fair amount of informationand knowledge before arriving, so sales advisers mustbe able to engage appropriately and truly understandthe customers’ needs to ensure the brand and productinformation they share is relevant.It’s worth noting that there are still some customers whowalk into a store, point at different items and buy straightaway (classified as ‘status seekers’), however they makeup a smaller proportion of shoppers than those who areless objective. Trying to engage in a detailed way withthis type of consumer can be challenging, so adaptingthe approach is key. Less objective customers on theother hand are those who deliberate and shop aroundlonger, making more emotionally driven decisions whendeciding what to choose (‘appreciators’).4Customers are getting harder to pleaseIn the same way that Chinese shoppers are lookingfor more than just luxury shopping when they traveloverseas these days (the Ipsos Chinese InternationalTravel Monitor showed that it ranks as the third mostpopular thing to do, behind sightseeing tours anddining), they have also become more discerning whenengaging with luxury brands and their sales associates.At Ipsos, our aim when partnering with luxury brandsis to help them realign the in-store customer journey tomeet the expectations of consumers who require farmore ’wooing’ than ever before. Through partnering withluxury brands and undertaking Customer Experienceresearch (particularly Mystery Shopping), Ipsos cangather a detailed understanding of how sales associatestackle the engagement part of the conversation, andhow well they are able to understand the customers’needs and motivations. We therefore know what salesassociates need to do to maximise the likelihood ofsecuring a purchase and a memorable experience.While customers’ desires can vary acrossdemographics, geography and market sector, thereis one behaviour that invariably shines through asa powerful driver of both purchase intention andadvocacy: listening to and understanding customermotivations. Our research has shown that this phaseof the customer journey is highly influential in buildingrelationships between customers and brands.

Mystery shoppingin the luxury industryFrederic Renaldo Richard Korn Geert SamploniusAsk the right questionsThere’s no substitute for expertiseHowever, asking questions and gauging motivations isnot easy. Customers may be sceptical as to whetherthe sales associate will launch into a hard sell and sooften automatically respond to “May I help you?” witha dismissive “Just looking”. To inspire a more positiveresponse, the sales associate needs to lay the rightfoundations. Generally, this means offering the customera warm welcome followed by the freedom to browseindependently for a while.Relevant recommendations and the aura of expertise,in turn, lead to more advanced stages of the storeexperience: trying on, up-sales, cross-sales. In fact, weoften see that most – if not all – of the subsequent pointsof the customer journey are dramatically improved whenthe shopper feels that they were listened to and theirmotivations successfully identified.When the sales associate does approach, it shouldbe with specific information about items the customerhas shown interest in and thoughtful questionsabout the customer’s needs. This means asking openquestions about their preferences, personal style andthe context surrounding their visit to the store. Thegoal of the sales associate should not be to sell a specificitem, but rather truly understand the customer’s pointof view. Understanding means active listening, and thatmeans asking questions that encourage the customerto speak more than the sales associate.If the sales associate does this in a considerate andthoughtful manner, it is far more likely to lead to apleasant conversation where valuable information isexchanged, and therefore a positive experience for thecustomer. People like to be listened to. It makes themfeel that they’re being respected and taken seriously,and that the sales associate – and by extension thebrand – is genuinely interested in meeting their needs.Additionally, it ensures that the rest of the interactionproceeds well, as the sales associate will be more likelyto recommend and demonstrate products that suit thecustomer, thereby increasing the shopper’s impressionof the sales associate’s competence and expertise.5The situation faced by luxury retailers will only becomemore critical as time goes by. Chinese customers inparticular will continue to become more demandingof the experience they desire. They will becomeincreasingly more selective, more discerning, and moredifficult to please. The lessons that we’ve learned, andcontinue to learn, about the critical role of listening increating memorable store experiences and strongcustomer relationships will only become more relevantwith time.

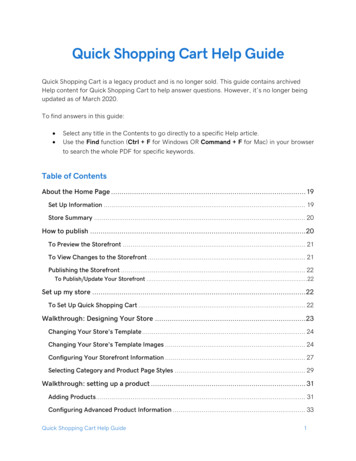

Mystery shoppingin the luxury industryFrederic Renaldo Richard Korn Geert SamploniusThe importance of spendingtime with your client priorto closing the deal — whatthe high street can learnfrom the luxury industryIpsos conducts thousands of mystery shopsaround the globe every day. We often see salesadvisers go to huge lengths to ‘sell’ the product,with the belief that time spent on ‘closing the deal’guarantees conversion.However, in the luxury industry, the approach isoften tactically softer, which high street retailerscan learn from. In short, most of the time spentwith affluent consumers happens early in the instore process, resulting in spending less timeand effort in closing the deal, resulting in higherconversion rates.Making a connectionWelcoming, building rapport and obtaining shopperinsights is all about connecting with the customer andcreating a sense of goodwill and trust. This doesn’t justmean the offer of a drink and some chit-chat, rather, thisperiod of interaction should see the sales adviser helpthe customer to touch/try/feel/wear the product and tellthem more about the brand story.Another tactic used by successful advisers is askingleading, open-ended questions. These can includesimple conversation such as how they are and whatbrought them to the store, to more personal and indepth questions such as who the product is for, thereason behind the purchase and when it will mostlybe used. This technique allows the adviser to steerthe conversation but have the client invested in it.The salesperson can obtain the right information toeventually recommend a product that most suits theclient’s needs, and because of the conversational tonethere is less room for objection.Now, let’s take that discipline and transplant it to moregeneral sales on the high street. Imagine walking intoa mobile phone retailer or another consumer electronicstore planning to buy a laptop. Ideally, the sales adviserwould take the customer through a similar journey to theone described above. However, retail industry researchshows that after welcoming the customer, attemptinga product demonstration and handling objections,sales advisers often move too quickly to the hard sell,immediately explaining the latest product specifications,trying to convince the customer why a particular productwill enrich their life and try to close the deal. Frequently,this full-on approach sees customers leave the storewithout making a purchase.Figure 1 isn’t particularly scientific, but it indicates whatis often seen in the frontline of retailers in a wide varietyof segments (automotive, telco, consumer electronics,fashion, etc). It also illustrates how customer journeyscan be improved by being more client-centric, while stillachieving higher conversion rates.6

Mystery shoppingin the luxury industryFrederic Renaldo Richard Korn Geert SamploniusFigure 1: The importance of spending time with your luxury client prior to selling/closing the deal.Current situationDesired situationWelcome &building rapportAllow the customerto browse aroundSales processStorytelling/Customised offer/Handling objectionsClosing the saleCheckout& farewellTime spent with clientClosing the dealIn conclusion, it’s worth repeating that spending moretime on welcoming and building rapport can allowbetter identification of customer insights. Following asimple script and asking the right questions can allowthe sales adviser to really get to know the buyer oruser and eventually recommend a product that bestsuits their needs. The other strategic point here is that itleaves little room for objections as the right insights wereobtained in the very beginning of the sales process.Closing the deal is then a very natural step in the processas the sales adviser basically only summarises theconversation; what the needs were, why this productwas the best choice and how potential objections wererefuted.Then, what’s left is checkout and farewell, an idealmoment to invite the customer back for their nextpurchase.7Luxury shopping is a different beast to everydayconsumerism – but that’s not to say that the high streetcannot learn from it. Mystery shopping unearths detailswhich other forms of research cannot. What’s more,it is not just about finding weak links, it allows yourorganisation to praise fantastic actions and results.There is no better way to ensure that your CustomerExperience initiatives are being adhered to and that yourstrategy is being executed consistently across everytouchpoint.With an increase in channels, this can become an evenmore daunting task – but mystery shopping allows forin-store, telephone and digital checks to guarantee thatyour brand story is being effectively told right acrossyour business.To find out more about how Ipsos Mystery Shoppingprogrammes could help your organisation, contact uson the details overleaf.

Mystery shopping in the luxury industryFrederic Renaldo, Client Services Director, Mystery Shopping, IpsosRichard Korn, Managing Director, Aus & NZ, Customer Experience, IpsosGeert Samplonius, Client Services Director, Mystery Shopping, IpsosIpsos is the largest Mystery Shopping agency in theworld. We help organisations achieve profitable growthby ensuring their Customer and Shopper Experience isdelivering on their Brand Promise, across all touchpointsand channels. Based across 35 countries, with shopperpanels in 100 countries, our expert teams deliverMystery Shopping, Mystery Audits and Micro-Shops,supported by a unique blend of research, technology,analytics and advisory solutions. We promise ‘betterdesign, better execution, better impact’.This paper is part of the Ipsos Views series.For more information contact the Ipsos Knowledge Centre at IKC@ipsos.comThis Ipsos Views paper isproduced by theIpsos Knowledge Centre. Game Changers is the Ipsos signature.At Ipsos we are passionately curious about people,markets, brands and society. We make our changing worldeasier and faster to navigate and inspire clients to makesmarter decisions. We deliver with security, simplicity,speed and substance. We are Game Changers.www.ipsos.com@IpsosIKC@ipsos.com

Naturally, mystery shopping in the luxury industry requires a very different approach to regular high-street retail shops. In this paper, three highly experienced mystery shopping experts share their knowledge and opinions on different aspects of mystery shopping