Transcription

Fashion & LuxuryThe luxury opportunityThe evolving UK luxury consumer –and how luxury brands can respond

Having navigated significant volatility over the pastdecade, luxury brands have an exceptional opportunityto continue to capture growth over the next.In order to do so, they must truly understand theirconsumers – and recognise how they are changing. Theyare evolving in terms of their purchasing behaviours, thedrivers of their decisions, and the way in which they wantto be engaged with – most notably in digital channels.In the ultra-competitive world of luxury goods, deeperinsight on your consumers is an essential component tocreating value, and protecting the brand heritage.2

Executive summary3ChannelsDecision driversThe inevitable flow of the digital tide continues,and the real risk for luxury brands is that they areleft behind if they cannot find the right place fore-commerce in their business strategyImpulse is still the dominant driver of luxurypurchasing decisions. But behind this are additionaldrivers around trend, routine, and the change incircumstance of the high-earning consumerMake the virtual window as luxurious asthe physical windowBuild excellence in customer insight and serviceChallenge your existing consumersegmentation assumptionsDigital & SocialAs the high-earning consumer continues tobe digitally engaged, and the cohort of millennialluxury consumer grows, the use of digital marketingis an essential tool in the luxury brand armouryDevelop and innovate the ‘digital frame’ to delivertrue value in the experienceEnsure alignment between brand andsocial strategyThe evolving UKluxury consumer –and how luxury brandscan respondFind mechanisms to make omni-channelvalue accretive and brand protectiveGiftingBuying for others is an essential component of theluxury consumer’s share-of-wallet. Gifting offers luxurybrands new entry-point opportunities and greatersales potentialMake the gifting strategy year-round –not just seasonalAim to develop one-to-one gift marketingto specific customers

The luxury opportunity ContentsDigital Influencein Retail 20145Decision drivers – how luxury consumers make their purchasing decisions8Bespoke markets – luxury consumers differ across markets11Brand awareness – luxury consumers are shifting ‘awareness channels’ and embracing digital14Omni-channel – the generational wave approaching luxury brands17Social media – how consumers engage with luxury brands20Luxury gifting – scaling the gifting opportunity23Survey details24Contacts25Our wardrobe4

Decision driversBespoke marketsBrand awarenessOmni-channelSocial mediaLuxury giftingSurvey detailsContactsOur wardrobeDecision drivers5How luxury consumers make their purchasing decisionsDigital Influencein Retail 2014Impulse is still the dominant driverof luxury purchasing decisions.But behind this are additional driversaround trend, routine, the changein circumstance of the high-earningconsumer, and (whisper it )the offer.What it means for luxury brands Understand what you know, and recognisewhat you don’t know, about the preferences ofyour evolving customer base – and serve themas uniquely as possible Invest in the capabilities and technology thatwill enable you to use data to improve yourperformance in specific areas (e.g. conversion,loyalty, desire)Knowing what drives your customers’ purchasing decisions can bea key source of competitive advantage for luxury brands. Leveragingthe available, and often untapped, pool of data on your customers’behaviours, habits and decisions drivers can ensure that you knowwhat your customers want, when they want it and how they wantto experience it.The challenge for luxury retailers is subtly different from fastfashion and mass market consumer business – to drive futuresales, while remaining unobtrusive, discrete and scarce. An examplewould be the increasing preference (and expectation) within theluxury consumer’s brand engagement for sustainable businesspractices (e.g. Kering, L’Oreal, Stella McCartney).Coupling the existing customer and consumer insights withadditional, behavioural information on how the luxury consumersare evolving can help luxury brands build deeper understanding,and enable more tailored marketing – and ultimately improvelonger-term value creation.

Decision driversBespoke marketsBrand awarenessOmni-channelSocial mediaIn luxury consumption, millenials arethree times more likely to be driven bytrend than older consumers.Luxury giftingSurvey detailsContactsOur wardrobe6

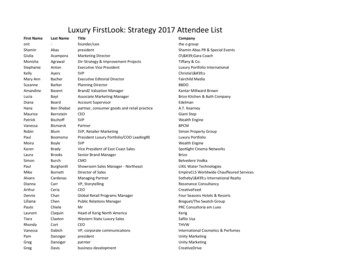

Decision driversBespoke marketsBrand awarenessOmni-channelSocial mediaLuxury giftingSurvey detailsContactsOur wardrobeDecision drivers7Main reason for purchasingThe UK luxury consumer has a strong impulsive purchasing driver – morepronounced for female consumers, and for older generations. The millennialsare markedly more trend driven and less defined by routineWhat is the main reason luxury consumers purchase new items? (UK luxury consumers, cross category)18-3436%40%35 5%7%35%17%9%11%12%13%14%10% 9%25%20%15%7%27%10% 10%18% 18%10%5%14% e e ofcircumstance

Decision driversBespoke marketsBrand awarenessOmni-channelSocial mediaLuxury giftingSurvey detailsContactsOur wardrobeBespoke markets8How luxury consumers differ across marketsDigital Influencein Retail 2014The shopping habits of highearning consumers differ notablyacross the major European markets,reflecting the need for luxurybrands to position accordinglyin different geographies.What it means for luxury brands For international brands with UK operations,the UK leadership team should aim to understandwhat incremental insight and action could helpthe market outperform other developed markets In the UK, and London in particular, the luxurytourist is a fast growing one – and having clearstrategy to capture the share-of-wallet willbe essentialIt has long been appreciated that luxury consumers are not ahomogenous group – they operate differently across cultures, regionsand demographics. However, as the luxury consumer continues tobecome more international, and global travel numbers increase,developing an appreciation of how markets and consumers differby region is vital.The increasingly varied cultural and national desires and buyingpreferences within ‘home markets’ – driven by the internationalconsumer – means it is increasingly challenging to target marketing,trends, and triggers at the optimal time, or ensure the brand is‘front of mind’ the next time a prospective consumer goes onan impulsive luxury shopping spree.For UK-market executives, part of this will involve building a richerunderstanding of the local, domestic market – as it evolves. But anequally important part is to learn from other markets: what is working(or not working) in those markets and why, so that the learningscan be applied to the international consumer in the ‘home market’.

Decision driversBespoke marketsBrand awarenessOmni-channelSocial mediaLuxury giftingSurvey detailsContactsOur wardrobe9The UK consumer is the least likelyto shop for new collections comparedwith the rest of Europe.

Decision driversBespoke marketsBrand awarenessOmni-channelSocial mediaLuxury giftingSurvey detailsContactsOur wardrobeBespoke markets10Retail market structures help to shape awareness and purchasingThe UK luxury consumer is driven less by new collections compared to theEuropean consumer – and new brand awareness (in non-digital channels) is morelikely to come from department store presence than mono-brand storesWhen do luxury consumers buy luxury/premium products (for themselves)?Where do luxury consumers tend to discover new ermanyUK0%0%5%Italy50%I visit their brand storeOnly when new collections are released35%10%15%20%Only during seasonal zerland25%Germany40%30%35%0%0%10%20%30%40%50%I notice them at a store/department store60%

Decision driversBespoke marketsBrand awarenessOmni-channelSocial mediaLuxury giftingSurvey detailsContactsOur wardrobeBrand awareness11How luxury consumers are shifting ‘awareness channels’ and embracing digitalDigital Influencein Retail 2014As the high-earning consumercontinues to be digitally engaged,and the cohort of millennial luxuryconsumer grows, the use of digitalmarketing is an essential tool inthe luxury brand armoury.What it means for luxury brands Luxury brands will need to carefully develop their‘digital frame’ to ensure it offers the luxury consumera truly valuable experience to create desire The opportunity to build a digital strategy whichaligns with other components of the strategy(e.g. CRM, marketing strategy, etc.) is possiblythe most essential step to get rightIn the world of art and performance, it has long been realised thatthe value of the art is intrinsically linked to the context under which itis ‘consumed’. For example, there is a rapid drop in the perceived valueof a concert which is performed on the street versus a symphony hall.This concept has been described as ‘art without a frame’.The consumption experience around luxury retail has the same requirementfor the frame. The frame helps create the value. They go hand in hand.For luxury brands, the physical experience has always been the coreof that frame (beautiful flagships, religious experiences). The ability totouch-and-feel the product, the relationship consumers have with staff,and in particular the knowledge and service that sales associatesprovide, are all part of that frame.But as the frame itself becomes increasingly digital, luxury brandsmust consider what bold, innovative, and luxurious approaches canbe adopted – e.g. Burberry, Gucci – balanced against protectingthe core and the heritage of the brand.

Decision driversBespoke marketsBrand awarenessOmni-channelSocial mediaLuxury giftingSurvey detailsContactsOur wardrobe12Half of luxury consumers becomeaware of new brands when shoppingaround.

Decision driversBespoke marketsBrand awarenessOmni-channelSocial mediaLuxury giftingSurvey detailsContactsOur wardrobeBrand awareness13The adoption of digital is a generational shiftAmong European luxury consumers, magazines remain thedominant channel for consumers to become aware of newbrands – but for the millennials, online is edging aheadWhere do luxury consumers hear about new %10%0%18-3435-44Consumer segment: AgeData above – UK only45-5455

Decision driversBespoke marketsBrand awarenessOmni-channelSocial mediaLuxury giftingSurvey detailsContactsOur wardrobeOmni-channel14How purchasing channels are changing digitalDigital Influencein Retail 2014The inevitable flow of the digitaltide continues, and the real risk forluxury brands is that they are leftbehind if they cannot find the rightplace for e-commerce in theirbusiness strategy.What it means for luxury brands The luxury consumer will direct more share-ofwallet to the e-commerce channel – findingmechanisms to make this value accretive (notcannibalising the core) is vitalIn many ways, it is an unfair – but popular – criticism to suggest thatluxury brands have been too slow to adapt to include e-commerce in theirbusiness. Whilst specific instances may indicate this, the need to protectbrand heritage and to move with care and caution to ensure sustainable,long-term value creation, means this slower adoption has its basis.However, it is absolutely clear that the consumer – the UK consumer inparticular – is shifting their engagement and buying habits to online ata rapid pace (e.g. own brand websites, Net-a-Porter / Yoox, Farfetch).And so the time to respond is now.An integrated omni-channel model can build wider brand reach,richer customer insight (from data) deepens, and – if executed well –can add supply chain efficiencies. If non-luxury markets are any guide,a joined-up channel approach will also drive more footfall in-store,higher conversion rates, bigger order values, and – crucially for luxurybrands – improved brand loyalty1. However, regardless of whethere-commerce is the right choice (and for many luxury brands it maynot be), using the internet to sell the dream is certainly a requirement. Treating e-commerce as a distinct business riskscreating a wider divide, and making it harder tobridge – the consumer expects a connected andcoherent experience, regardless of channel1) Source: Deloitte: The Digital Influence in UK Retail

Decision driversBespoke marketsBrand awarenessOmni-channelSocial mediaLuxury giftingSurvey detailsContactsOur wardrobe1558%of millennial luxury consumersin the UK most often buy luxuryproducts through online channels.

Decision driversBespoke marketsBrand awarenessOmni-channelSocial mediaLuxury giftingSurvey detailsContactsOur wardrobeOmni-channel16Millenials are driving the growth of luxury omni-channelThere is a clear generational shift occurring in luxury goods channelconsumption – but the desire to see and touch products remainsa key element of the purchasing ‘value case’Where do luxury consumers most often buy luxury products? (UK only)100%What are the main benefits of buying luxury products in a store? (All Europe)78%80%91%78%70%87%83%75%76% 75%60%49% 47%58%50%26%47%45% 45% 46%53%40%30%25%54%30%18%0%21%20%23% 24%0%18-34In-store35-4445-54OnlineIn-store – summary of department stores, mono-brand stores and other physical (excluding airports)Online – summary of brand-own websites and online market-place channels(Customer segments can add to more than 100% as multiple options were available for answer)55 Seeing and touching product18-34%Being able to immediatelytake items away35-44Receiving in store service45-54Relationship with staff55

Decision driversBespoke marketsBrand awarenessOmni-channelSocial mediaLuxury giftingSurv

luxury consumer grows, the use of digital marketing is an essential tool in the luxury brand armoury Develop and innovate the ‘digital frame’ to deliver true value in the experience Ensure alignment between brand and social strategy Gifting Buying for others is an essential component of the luxury consumer’s share-of-wallet. Gifting offers luxury