Transcription

FOREIGN PREFERENCE, A family looks at foreign milk powder products at a supermarket in Beijing. REUTERS/KIM KYUNG-HOONCHINA MILKPOWDERHow big formulabought ChinaForeign companies have acquired a third of China’sbooming market for baby formula, often by floutingrules promoting breastfeeding.BY ALEXANDRA HARNEYSPECIAL REPORT 1

CHINA MILKPOWDER FLOUTING BREASTFEEDING RULESSHANGHAI, NOV 8, 2013In the two days after Lucy Yang gave birthat Peking University Third Hospital inAugust 2012, doctors and nurses toldthe 33-year-old technology executive thatwhile breast milk was the best food for herson, she hadn’t produced enough. They advised her instead to start him on infant formula made by Nestle.“They support only this brand, and theydon’t let your baby drink other brands,”Yang recalled. “The nurses told us not touse our own formula. They told us if we did,and something happened to the child, theywouldn’t take any responsibility.”For Nestle and other infant formulaproducers, there is one significant complication for their China business: a 1995Chinese regulation designed to ensurethe impartiality of physicians and protectthe health of newborns. It bars hospitalpersonnel from promoting infant formulato the families of babies younger than sixmonths, except in the rare cases when awoman has insufficient breast milk or cannot breastfeed for medical reasons. Nestletold Reuters it supports this code and hastried to strengthen its implementation.Peking University Third Hospital declinedrepeated requests for comment.Most women have enough breast milkto feed their infants, scientific studies show.The World Health Organization advocates exclusive breastfeeding for the firstsix months of life, starting within an hourof delivery. Breastfeeding leads to betterhealth for babies and mothers, includingprotection against infection for infants andlower rates of breast and ovarian cancer forwomen, WHO says.A Reuters examination reveals thatglobal infant formula companies havefound ways to skirt and violate the 1995code, which they support publicly. Reutersinterviewed nearly two dozen Chinesewomen who have delivered babies at hospitals around China over the last two years.MELAMINE TRAGEDY: Chinese dissident artist Ai Weiwei made this creative statement - a map ofChina made of baby formula cans – to commemorate the 2008 melamine scandal that affected300,000 infants, including his then 4-year-old son. REUTERS/ TYRONE SIUThe nurses told us not touse our own formula. They toldus if we did,and somethinghappened to the child, theywouldn’t take any responsibility.Lucy YangBeijing motherLike Lucy Yang, most experienced the aggressive tactics of formula makers.Until very recently, enforcement ofChina’s 1995 regulation had been rare.Neither WHO nor UNICEF can point toa single instance where fines had been imposed since it was introduced. Reuters contacted five prominent Chinese law firmsand – underlining the regulation’s obscurityin Chinese legal circles - not one was familiar with it.The National Health and FamilyPlanning Commission, one of the government bodies charged with enforcing theregulation, did not respond to a questionabout its enforcement. Neither did the StateAdministration for Industry and Commerce,which also has enforcement authority.But the enforcement climate may bechanging. The new Chinese governmentthat took office this year is in the midst of awidespread crackdown on corruption, andthe practices of big formula appear to bein its cross-hairs. On Oct. 14, Paris-basedDanone Corp said it would replace managers in China after state-owned CCTVbroadcast a report that the company’s formula unit — Dumex — had bribed doctorsin the northern city of Tianjin to gain better access for its product.Dumex China expressed “deep regret”over what it called “lapses” and promised“full accountability.”The same day, local officials said 13medical workers in Tianjin had been dealta range of punishments from warnings todismissals.Big formula’s practices in China havealso caught the attention of U.S. regulators.SPECIAL REPORT 2

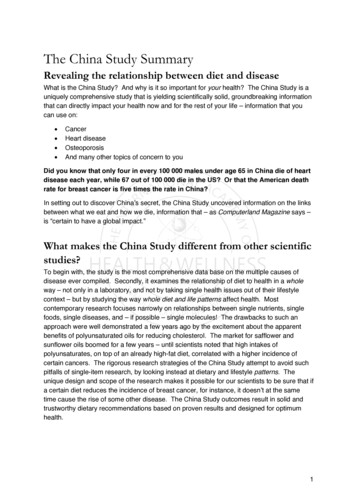

CHINA MILKPOWDER FLOUTING BREASTFEEDING RULESLand of milk and moneyThe top four foreign infant fomula makers in China spent more than 10 billion yuan ( 1.5 billion) on advertising in 2012 versus3 billion yuan ( 440 million) in 2008. Together they control almost 34 percent of market.ADVERTISING SPENDBillion yuanBRAND AWARENESS (TIER 1-2 CITIES)Percent*SHARE OF CHINA’S MARKETPercent of retail market6901520084 3.520Nestle80%2012Mead Danone AbbottJohnson60103050NestléMead Danone AbbottJohnson014%NestléMead Danone AbbottJohnsonNote: Nestlé acquired Pfizer Nutrition/Wyeth in April 2012. Advertising spend for Nestlé combines Nestlé and Wyeth; brand awareness for Nestlé refers to Wyeth;Share of China’s market for Nestlé refers to Pfizer Inc. Advertising spend and brand awareness for Danone refers to the Dumex brand.*Based on China Reality Research’s (CRR) August 2013 survey of 40 domestic retailers and 240 middle-class parents in China.Sources: International Monetary Fund; CRR/CLSA; Euromonitor International.In August 2012, Pfizer Inc and its unitWyeth agreed to pay more than 45 millioncombined as part of separate settlementswith the U.S. Securities and ExchangeCommission (SEC) over violations of theForeign Corrupt Practices Act (FCPA).In its complaint, the SEC charged thatbetween 2005 and 2010, Wyeth paid bribesto officials outside the United States, including those in Chinese state-owned hospitals, to encourage them to recommendWyeth’s nutritional products and to gainaccess to records of new births that couldbe used for marketing, and then disguisedthese payments as expense claims. Underthe terms of the settlement, Wyeth neitheradmitted nor denied the allegations.GLOBAL BOYCOTTInfant formula is controversial in manycountries, and China is no exception. Inthe 1970s, growing concern that formulamarketed to mothers in developing countries was contributing to malnutrition ledto a global boycott of Nestle products. Itprompted the World Health Assembly,the WHO’s decision-making body, to passa code curbing the marketing of baby formula. Since then, 103 countries, includingChina, have introduced legislation to implement parts of this code.While campaigns promoting the benefits of breastfeeding have tainted formula’simage in the West, in China, public debateabout formula is mostly about safety. In2004, at least 50 children died from malnutrition after drinking fake infant formulawith little nutritive value. Four years later,formula sold by local brand Sanlu - lacedwith the industrial chemical melamine- sickened nearly 300,000 infants and killedsix, fueling national outrage over government food safety controls.The stain of Sanlu has proven hard toerase. Because many Chinese parents stilldoubt the quality of domestic brands, international formula makers can charge apremium to domestic brands. Foreign formula firms now control about a third of theChinese market, according to consultancyEuromonitor International. In 2012, twoof the three best-selling brands were foreign. Mead Johnson has a 14 percent market share, Danone controls 9 percent andNestle 7.5 percent.China is fertile ground for formulamakers. A traditional Chinese belief thatwomen should rest for the first month afterdelivery gives older family members greatersay in the feeding and care of newborns.SPECIAL REPORT 3

CHINA MILKPOWDER FLOUTING BREASTFEEDING RULESRelatives often prefer formula as it helpsbabies sleep for longer stretches. Manyfamilies, moreover, prize pudgy babies, whoare seen as healthier. Formula-fed infantsgain weight more quickly, studies show.China’s high rate of cesarean sections the world’s second highest at 46 percent ofall deliveries - leads more mothers to starttheir babies on formula. Mothers fear drugsused in the operation will affect their breastmilk. There is also a common belief thatChina’s chronic air pollution is harmingmothers’ milk supply.Government surveys show a low breastfeeding rate - just 28 percent of Chinesewomen were exclusively breastfeedingat six months as of 2008, down from 51percent in 2003. Independent researcherssuggest the real figure is much lower. Onestudy published in the Journal of Health,Population and Nutrition in 2010 foundexclusive breastfeeding rates at six monthsin parts of China were as low as 0.2 percent.With infant formula sales in the UnitedStates declining because of a falling birthrate and a rise in breastfeeding, developingnations - China foremost among them are formula companies’ biggest opportunity.In 2008, China surpassed the UnitedStates to become the world’s largest formula market. Euromonitor expects salesof infant formula in China to double from 12 billion last year to 25 billion in 2017.FREE SAMPLESUnder China’s 1995 code, companies maynot distribute free formula or samples topregnant women, their families and hospitals. They can’t sell products at a discount.Nor may they offer hospitals funding,equipment or information in order to promote their product.The regulation bars hospitals and academic institutions from accepting gifts orhelp from formula companies or promotinginfant formula products. It requires medicalinstitutions to “actively advocate” the advantages of breastfeeding.POSTER CHILD: The Mead Johnson logo onthe wall of the Hangzhou Tianmushan hospital,Zhejiang province. REUTERS/ALEXANDRA HARNEYPenalties for violations, however, are lenient - the maximum fine is 30,000 yuan( 4,900). Enforcement is complicatedby its division across several governmentbodies: the National Health and FamilyPlanning Commission (NHFPC), theState Administration for Industry andCommerce, the State Administration ofRadio, Film and Television, and the GeneralAdministration of Press and Publication.Public awareness of the regulation is low.Chinese research firm Beijing ShennongKexin Agribusiness Consulting countshospitals as one of the four primary channels for sales of infant formula, alongsidesupermarkets, baby product stores, and theInternet.Doctors and their recommendations have the largest impact, it wrotein a November 2012 report. Consumersfind “organizing activities inside hospitals around nutrition more scientific andpersuasive.”Reuters found formula company advertising and promotion commonplaceinside hospitals. In August, visitors to thematernity ward at Hangzhou TianmushanHospital in eastern China were greetedwith banners from Mead Johnson thatread: “Healthy babies, happy mothers” and“Give baby the best start in life!”A picture of a baby drinking from a bottle and the Mead Johnson logo adorned thefloor guide. On the VIP maternity wing,nurse Xia Lingling – a new mother herself– said Mead Johnson representatives regularly visited to drop off samples for newmothers and to give talks to the staff.Xia explained that every patient whodelivers at the hospital and stays on theVIP wing receives a free container ofMead Johnson upon the baby’s birth.Mead Johnson “promotes their infant formula here . . . it’s a form of advertising,”said Zhang Yueqin, an obstetrician at thehospital.A Hangzhou Tianmushan spokesman,who would only give his name as Fan, denied the hospital touted Mead Johnsonformula to mothers. He said promotionalmaterials were intended to improve themedical knowledge of expectant and newmothers. The hospital displayed no branded posters from Mead Johnson, he said. Bylate September, the posters had been takendown, Reuters confirmed.In a statement emailed to Reuters, MeadJohnson said it does not provide formuladirectly to mothers in hospitals. It does givesamples to health care professionals “forthe purpose of professional evaluation orresearch, and all of them are clearly marked‘For medical use only – Not for Resale’ onthe label,” the statement said.Mead Johnson said it provided postersand “other materials to display in or aroundmaternity wings” if requested by hospitalstaff. These materials “fully comply with thelaws and regulations in China,” it said.PUSHING FORMULAMothers whom Reuters interviewed saidformula was pushed to them in myriadways: doctors gave them discount cards forinfant formula during prenatal checkups;SPECIAL REPORT 4

CHINA MILKPOWDER FLOUTING BREASTFEEDING RULEShospital staff strapped identity bandsbranded by formula companies to their babies’ limbs; formula representatives enteredtheir hospital rooms to distribute samplesas they recovered from giving birth.At Beijing Tiantan Hospital, representatives from companies, including Nestleand Wyeth, visited with formula samplesfor mothers and presents for doctors, saidDr. Yang, who worked as an obstetricianthere until 2009. “We weren’t given a commission, just small gifts.”She declined to elaborate on the nature of the gifts, or be identified by her fullname. Kuang Yuanshen, a hospital spokesman, said that without more detail, it wasimpossible to confirm Dr. Yang’s allegations. Wyeth said by email that companyrepresentatives were “strictly forbidden”from visiting hospitals to distribute freesamples.Four former formula company representatives, however, confirmed these kinds ofdealings take place. A former Nestle salesrepresentative said she brought samples toREUTERS TVdoctors and took them to dinner. A formerNestle marketing executive said it was standard industry practice in China to providefinancial incentives to doctors to recommend a certain brand of formula. Chinesedoctors, she said, expect it.In an emailed response to questions,Nestle confirmed it has “a medical-trainedteam who visits hospitals to provide factualinformation about our product features andup-to-date nutrition and health-relatedinformation to doctors.” Nestle “does notprovide any free supply to hospitals nor incentivize doctors to promote our products,”it said.Many underpaid and overworked doctors in China’s state-dominated healthcaresystem have no choice but to rely on incentives from companies, however, says JohnCai, director of the Centre for HealthcareManagement and Policy at the ChinaEurope International Business School inShanghai. The official annual take-homepay for an obstetrician with nearly two decades’ experience in a public hospital mightSee the video http://link.reuters.com/peb54vDairy kingsForeign brands hold sway in China’s babymilk formula market. 63 percent of parentswould recommend a foreign infantformula brand to other nursing mothers.TOP TEN BRANDS2012 share of total marketChineseForeignBeingmateHangzhou BeingmateDumexDanoneS-26NestléEnfamilMead JohnsonYiliInner Mongolia YiliBiostimeBiostime InternationalYashiliYashili InternationalEnfagrowMead JohnsonGainAbbott Labs.Wonder SunWondersun Dairy0510RECOMMENDED INFANT FORMULABRANDS FOR NURSING MOTHERSPercent of respondents*ChineseForeign100500Witness: Breaking the rules in China’s baby formula industryReuters’ Alexandra Harney investigates China’s multi-billion dollar infant formula businessand finds global brands going to extreme - sometimes illegal - lengths to push products tonew parents. See the video: http://link.reuters.com/peb54v63%80%47%All ChinaTier 1-2citiesTier 3-4cities*Based on China Reality Research’s (CRR) August2013 survey of middle-class parents in China. N 240Sources: Euromonitor International; CRR/CLSA.SPECIAL REPORT 5

CHINA MILKPOWDER FLOUTING BREASTFEEDING RULESFORMULA ONE: Exclusive breastfeeding rates for infants at the age of six months were as low as 0.2 percent in parts of China, one study found. REUTERS/KIM KYUNG-HOON AND DAVID GRAYbe only 5,000, depending on the servicesshe offers, doctors said.“A company might approach you andsay they’d like to support your work,” saysQiu Liqian, an obstetrician and associate professor at the Women’s Hospital atZhejiang University Medical School. “Ifyou’re organizing an academic conference,or you’re organizing an event on nutrition,or an event on preventing infection, theywould offer their assistance.” Formula companies pay for prominent Chinese doctorsto attend academic conferences, which shecalled “free holidays”.Bribery to obtain an unfair business advantage is illegal under both China’s AntiUnfair Competition and Criminal Laws.Bribery can include paying for sponsorship,scientific research and travel expenses under the Anti-Unfair Competition Law; under an interpretation of the Criminal Law,paying travel costs is one of many recognized forms of bribery.UNDERGROUND MARKETSome formula companies also utilize alarge underground market in hospital patient information. This gives them immediate access to the names, phone numbersand due dates of pregnant women and newmothers, according to a medical researcherand sales executive who have seen namelists of pregnant women for sale at hospitalsin Beijing and Shanghai.Under a 2009 amendment to China’sCriminal Law, it is illegal for employees inthe medical sector to sell patients’ personaldata. Stealing or acquiring such information illegally is also a crime.Contacting mothers through prenatalclasses is one way formula companies getaccess to expecting mothers. At one suchclass taught by Abbott at Shanghai EastInternational Medical Center, participants received a 400-gram (15-oz) tub ofAbbott formula, according to Gao Meng, a33-year-old office manager from Shanghaiwho attended.Shanghai East confirmed that Abbottrepresentatives had trained their nurses inLamaze breathing techniques and taughtprenatal classes at the hospital betweenApril and July this year, because of their“expertise” in Lamaze breathing. No infantformula was distributed at these classes,Follow Reuters Special Reportson Facebook:facebook.com/ReutersRevealsa spokeswoman said. A spokesman forAbbott declined to comment.Hospitals and doctors sell access to prenatal classes to third-party companies, including formula manufacturers, said a salesexecutive who uses Shanghai hospitals as amarketing platform for his company’s nanny services. That access allows companies tolead classes, distribute promotional materials or make an appearance to plug theirproducts, he said.Eighteen mothers in cities around Chinainterviewed by Reuters said infant formulacompanies contacted them by phone or textmessage, both during their pregnancies andstarting as soon as an hour after they haddelivered their babies.Yang Jing, a 33-year-old departmentstore manager in Beijing who had a babyin 2011, said formula companies includingWyeth called her to ask about her son’s development. Formula would help her son bestronger, they told her. Samples arrived ather home. She said she had never given aformula company her address.Wyeth said it “has clear guidelines forour sales activities to exclude any sales ormarketing activities relating to breast milksubstitutes that would target consumers,either by phone or face to face contact.” ItSPECIAL REPORT 6

CHINA MILKPOWDER FLOUTING BREASTFEEDING RULESpromised an investigation into this case.its training project as “philanthropic”.IT’S ACADEMICACCESS TO POLICYMAKERSMost of the major infant formula companies have cultivated ties with the government in China — including departmentsaffiliated with the National Health andFamily Planning Commission (NHFPC),one of the agencies tasked with enforcingthe 1995 regulation on formula marketing.Companies fund hospital research andawards for doctors, sponsor conferences andtrain state medical personnel - the samemedical professionals who are supposed tobe actively advocating breastfeeding.Nestle has been among the most activein the government relations area, breastfeeding advocates say. It has sponsoredtraining for officials from mother-and childclinics. It backed a Chinese academic studyanalyzing the composition of Chinesemothers’ breast milk. Peking UniversityThird, where Lucy Yang had her baby, wasamong the hospitals the Swiss food giantchose to conduct clinical trials on the use ofbreast milk “fortifier” for premature infantsbetween 2010 and 2011.Nestle said it “works with the Ministryof Health and healthcare institutions topromote public awareness and knowledgeof health and nutrition.”Last year, Mead Johnson launched athree-year training programme for medicalpersonnel in the southwestern province ofYunnan, working with a Chinese foundation. The programme focused on improving staff ’s understanding of nutrition and“scientific feeding” for children from birthto age three, according to company publicity materials.Training of medical personnel that is intended as a gift is a clear violation of boththe 1981 WHO code and China’s 1995regulation, said Beijing-based WHO technical officer Wen Chunmei.In a statement, Mead Johnson describedNestle and other foreign formula companies also enjoy direct access to Chinesepolicymakers. During discussions aboutrevising the 1995 regulation that began inDecember 2011, the Ministry of Health(now the NHFPC) solicited opinions frombig foreign formula brands as well as globalhealth and children’s organizations.Nestle sought to weaken some of theproposed provisions, some of which weremore stringent than the 1995 regulationand would have brought China closer inline with WHO regulations, according to acopy of its submission obtained by Reuters.Despite publicly supporting the WHOcode, Nestle objected to a proposed rulethat formula packaging should display ina conspicuous way the wording “breastfeeding is recommended”. The WHO codesays formula containers should clearly andconspicuously display a statement on thesuperiority of breastfeeding.Nestle told Reuters that the proposed labeling risked inconsistency with a Chineseinfant food safety standard “which provides clear guidelines to ensure that messages on labels are displayed in a standardized manner”.Nestle further opposed a proposed banin the revised code on formula companiesfunding hospital research into breast milkalternatives. In its statement to Reuters,Nestle said the research was “necessary forthe development of science-based products that can save the lives of those infantswho cannot have adequate breast feeding.”Nestle also sought to limit the proposedcode’s application to formula for “full term,healthy babies”, an exclusion not in theWHO code, though it says it did not try tomake an exception for specialty formulas.“Quite frankly,” Nestle wrote Reuters,“all our recommendations were meant tointroduce a stricter local code as well asimplementation.” Nestle added that it urgedextending the curb on promoting formulafrom infants’ first six months to their first 12.SIGNS OF CHANGEThe Chinese government is showing signsof taking the 1995 regulation more seriously. After the Chinese television story aboutDumex, the health ministry warned hospitals to strengthen enforcement of the code.Three government agencies jointly issued anotice reinforcing its main principles.But while the 1995 regulation is getting more attention, the attempt to revise itremains in limbo. The NFPHC, in a faxedresponse to questions, said the number ofgovernment departments involved andthe number of sectors the code covered, aswell as the reorganization of governmentdepartments, had slowed the process ofrevision.Wen, the WHO technical officer, saidthere may not have been sufficient publiceducation about the 1995 code. But shestressed that infant feeding was an issuethat “all of society” needed to address. “Iftraining is confined to the medical system,public education about the code will onlyhave a limited impact.”Additional reporting by Adam Rose, Li Huiand Megha Rajagopalan; Editingby Bill Tarrant and Bill PowellFOR MORE INFORMATIONAlexandra Harney, SpecialCorrespondent, Chinaalexandra.harney@thomsonreuters.comBill Tarrant, Enterprise Editorwilliam.tarrant@thomsonreuters.comMichael Williams, Global Enterprise Editormichael.j.williams@thomsonreuters.com Thomson Reuters 2013. All rights reserved. 47001073 0310. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent ofThomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks and trademarks of Thomson reuters and its affiliated companies.SPECIAL REPORT 7

In 2008, China surpassed the United States to become the world’s largest for-mula market. Euromonitor expects sales of infant formula in China to double from 12 billion last year to 25 billion in 2017. FREE SAMPLES Under China’s 1995 code, companies may not distribute free formula or