Transcription

5-Year Planning Round: Delivering Strategy Together 2025

DisclaimerThe following presentations contain forward-looking statements and information on the business development of the Volkswagen Group. These statements maybe spoken or written and can be recognized by terms such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “seeks”, “estimates”, “will” or words withsimilar meaning. These statements are based on assumptions, which we have made on the basis of the information available to us and which we consider to berealistic at the time of going to press. These assumptions relate in particular to the development of the economies of individual countries and markets, theregulatory framework and the development of the automotive industry. Therefore the estimates given involve a degree of risk, and the actual developments maydiffer from those forecast. The Volkswagen Group currently faces additional risks and uncertainty related to pending claims and investigations of VolkswagenGroup members in a number of jurisdictions in connection with findings of irregularities relating to exhaust emissions from diesel engines in certain VolkswagenGroup vehicles. The degree to which the Volkswagen Group may be negatively affected by these ongoing claims and investigations remains uncertain.Consequently, a negative impact relating to ongoing claims or investigations, any unexpected fall in demand or economic stagnation in our key sales markets, suchas in Western Europe (and especially Germany) or in the USA, Brazil or China, and trade disputes among major trading partners will have a corresponding impacton the development of our business. The same applies in the event of a significant shift in current exchange rates in particular relative to the US dollar, sterling,yen, Brazilian real, Chinese renminbi and Czech koruna.If any of these or other risks occur, or if the assumptions underlying any of these statements prove incorrect, the actual results may significantly differ from thoseexpressed or implied by such statements.We do not update forward-looking statements retrospectively. Such statements are valid on the date of publication and can be superseded.This information does not constitute an offer to exchange or sell or an offer to exchange or buy any securities.

5-Year Planning Round: Groundwork to Deliver Strategy Together 2025Frank WitterDr. Christian DahlheimOliver LarkinMember of the Board ofManagement, Volkswagen AGFinance and ControllingDirector Group SalesVolkswagen AGHead of Group Investor RelationsVolkswagen AG3

Setting the Stage PR 67EconomicsEmissions & Testing Trade-terms turmoil Currency volatility CO2 challenge & risk of penalties Resources WLTP, RDE Launch targetMargin pressureBattery cell supplyInfrastructureE-Mobility Powertrain Diesel demand Cost impacts Mix issuesDigitalization Connectivity & autonomous Resources & cost Agility4

Development Volkswagen Group Deliveries to Customersbf 20172018EuropeNorth AmericaSouth AmericaAsia PacificRest of the World20235

Strong increase in our Worldwide SUV MixSUV share in % of regional Group deliveries to 2020202120222023202420252026202720286

Strong Electrification of Product PortfolioBEV volume per region in thousand unitsVW ID. Lounge5.000Until 2025: 50 new BEVsVW ID. Vizzion4.000WorldVW ID. BuzzVW ID. CrozzAudi A SUVe3.0002.000ChinaVW ID. NeoPorsche TaycanEurope1.000Audi e-tron2019NAR2020202120222023202420252026202720287

BEV Growth mainly driven by SUV ModelsSUV share in % of regional BEV Group deliveries to 2120222023202420252026202720288

The Future Sales ModelRetail partnerships ready for the future – Customer is central to all itability &EfficiencyEfficient retail/servicenetwork (market areaconcept) and formatsIntegrated customerdata management fordirect customer accessSegment-specificcustomer orientationEfficient and leanprocesses and ITNew joint customerapproach between OEM,importer and dealerEcosystemDigital products, FunctionsSeamless online andfor moreon Demand and new services offline customer journeycustomer loyaltyfor additional businessto meet expectationsOver-the-Airdiagnosis and updatessales and serviceIntegrated, directonline channel forlean sales and service activities9

Improving Group Return on Sales despite significant headwindsReturn on Sales6.7%7.4%6.5 - 7.5%6.5 - 7.5%7.0 - 8.0%Industry transitionEmission costs / CO2Performanceimprovement t10

Delivering Strategy Together 2025Strategy:Remains unchangedOutcome PR 67:Increased Headwinds fully compensated by improvedOperational Performance!KPI’s:Still fully on track for Targets in 2020 and 2025!We are still on track!11

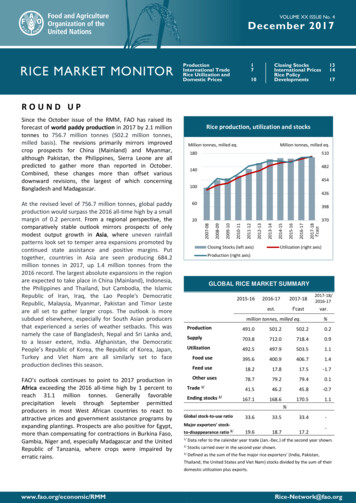

Group KPI’s confirmedKey financial 025TargetsOperating return on sales6.7%7.4%6.5-7.5%6.5-7.5%7-8%Return on investment13.9%14.4%12-14%13-15% 15%Capex ratio6.9%6.4%6.5-7%6%6%R&D cost ratio7.3%6.7%6.5-7%6%6% 7.2 bn 10.1bn 9 bn 10 bn 10 bn 27.2 bn 22.4 bn 20 bn 20 bn3) 10% of GroupturnoverBefore Special ItemsAutomotive Division before Special ItemsAutomotive DivisionAutomotive DivisonCasha) Net Cashflow2)Automotive Divisionb) Net Liquidity1) Asof 1st August, 2018. 2) Ex diesel payments; cash outflows of around 3 bn in 2016, 16.1 bn in 2017 and 3.3 bn in Q1-Q3 2018. 3) Including the negative IFRS 16 impact, effective from 1st January 2019.12

Better Earnings Quality & EPS growthBasis: Result 20162020 UpdatedCMDMarch 2017Sales revenue ( bn)PR 66217.3 20 %before Special Items14.6 25 % 25 %Profit before tax ( bn)14.8 25 % 30 %Earnings per Pref. Share10.3 25 %Operating profit ( bn) 25 % 25 PR 67 25 % 30 % 40 % 30 13

Brand Targets (RoS, RoE) confirmedReturn on Sales in %1)20162017Target 201820202025Volkswagen Group6.77.46.5-7.56.5-7.57.0-8.0Volkswagen Brand1.84.14-54-5 6AudiPorsche AutomotiveŠKODAVolkswagen Commercial Vehicles8.217.48.74.18.418.59.77.28-10 158-95-68-10 156-74-58-10 15 7 6TRATON2)20162017Target 20186.96-7Over the cycletarget of 9%3) Scania9.5 MAN Commercial Vehicles2.3Return on Equity (norm. 8%)20162017Target 201820202025Volkswagen Financial Services15.6%15.8%14-16%14-16%20%Before special items. 2) For peer-group analysis: Truck & Bus Business RoS is calculated as the sum of Scania and MAN Commercial Vehicles. 3) Strategic target the Truck and Bus Business wants to achieve overthe cycle1)14

Tasks and Counter-MeasuresTasksCounter-measuresClose the Gaps in OperatingProfit, CapEx, R&D !Push efficiency programs, discipline vs.securing the futureCash is King !Stick rigorously to cash generationtargetsSustain ICE margins & secure EVmargins !Reach CO2 requirementsTimely launches, attractive products andpricing strategiesReduce Complexity !Delete certain derivatives and enginecombustion combinationsRoI does matter, too !Prioritisation of projects, platformdiscipline and multi-brand factories15

Management, Volkswagen AG Finance and Controlling Dr. Christian Dahlheim Director Group Sales Volkswagen AG 5-Year Planning Round: Groundwork to Deliver Strategy Together 2025 Oliver Larkin Head o