Transcription

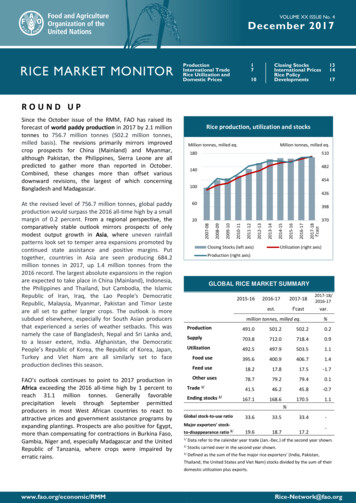

VOLUME XX ISSUE No. 4December 2017ProductionInternational TradeRice Utilization andDomestic Prices17Closing StocksInternational PricesRice PolicyDevelopments10131417ROUND UPSince the October issue of the RMM, FAO has raised itsforecast of world paddy production in 2017 by 2.1 milliontonnes to 756.7 million tonnes (502.2 million tonnes,milled basis). The revisions primarily mirrors improvedcrop prospects for China (Mainland) and Myanmar,although Pakistan, the Philippines, Sierra Leone are allpredicted to gather more than reported in October.Combined, these changes more than offset variousdownward revisions, the largest of which concerningBangladesh and Madagascar.Rice production, utilization and stocksMillion tonnes, milled eq.510482140454100426At the revised level of 756.7 million tonnes, global paddyproduction would surpass the 2016 all-time high by a smallmargin of 0.2 percent. From a regional perspective, thecomparatively stable outlook mirrors prospects of onlymodest output growth in Asia, where uneven rainfallpatterns look set to temper area expansions promoted bycontinued state assistance and positive margins. Puttogether, countries in Asia are seen producing 684.2million tonnes in 2017, up 1.4 million tonnes from the2016 record. The largest absolute expansions in the regionare expected to take place in China (Mainland), Indonesia,the Philippines and Thailand, but Cambodia, the IslamicRepublic of Iran, Iraq, the Lao People's DemocraticRepublic, Malaysia, Myanmar, Pakistan and Timor Lesteare all set to gather larger crops. The outlook is moresubdued elsewhere, especially for South Asian producersthat experienced a series of weather setbacks. This wasnamely the case of Bangladesh, Nepal and Sri Lanka and,to a lesser extent, India. Afghanistan, the DemocraticPeople’s Republic of Korea, the Republic of Korea, Japan,Turkey and Viet Nam are all similarly set to faceproduction declines this season.FAO’s outlook continues to point to 2017 production inAfrica exceeding the 2016 all-time high by 1 percent toreach 31.1 million tonnes. Generally favorableprecipitation levels through September permittedproducers in most West African countries to react toattractive prices and government assistance programs byexpanding plantings. Prospects are also positive for Egypt,more than compensating for contractions in Burkina Faso,Gambia, Niger and, especially Madagascar and the UnitedRepublic of Tanzania, where crops were impaired byerratic rains.Million tonnes, milled eq.18060398Closing Stocks (left tion (right axis)Production (right axis)GLOBAL RICE MARKET astvar.million tonnes, milled 8.40.9Utilization492.5497.9503.51.1Food use395.6400.9406.71.4Feed use18.217.817.5-1.7Other 1.1Trade1/Ending stocks2/%Global stock-to-use ratio33.633.533.419.618.717.2Major exporters' stockto-disappearance ratio 3/-1/Data refer to the calendar year trade (Jan.-Dec.) of the second year shown.2/Stocks carried over in the second year shown.3/Defined as the sum of the five major rice exporters’ (India, Pakistan,Thailand, the United States and Viet Nam) stocks divided by the sum of theirdomestic utilization plus rg

FAO RICE MARKET MONITOR / DECEMBER 2017Paddy production in Latin America and the Caribbean ispredicted to recover by 7 percent in 2017 to a new high of28.4 million tonnes. Conducive growing conditionsboosted yields to all-time records in South America, morethan offsetting area retrenchments triggered by tightproducer margins. Production recovered the most inBrazil, but Colombia, Guyana and Uruguay all gatheredmore, offsetting reductions in Argentina, Bolivia, Chile,Ecuador and Peru. In Central American and Caribbean,growth prospects were partly undermined by hurricanedamages this season, although Haiti, Honduras, Mexico,the Dominican Republic and Panama may end the seasonwith positive results.Elsewhere in the world, the latest figures confirm thenegative outlook for the United States, where 2017production is set to fall to its lowest since 1997, owing tocompetition with other crops and weather disruptions. InEurope, area cuts instigated by prospects of reducedmargins are similarly set to depress production in theEuropean Union and the Russian Federation, while ampleand less costly water supplies for irrigation enabled 2017output to stage a strong rebound in Australia.Following a 1.2 million tonne upward revision, world tradein rice in calendar 2017 is now expected to stage an 11percent annual rebound to an all-time record of 46.2million tonnes. The more buoyant outlook primarily stemsfrom expectations of a strong upturn in Asian imports,sustained by a record pace of purchases by Bangladesh,along with greater imports by the Islamic Republic of Iran,Iraq, the Philippines and Sri Lanka. Attractive internationalprices are also set to raise deliveries to Africa and LatinAmerica and the Caribbean to new heights, while importshold broadly elsewhere in world. On the export side, therecovery in global demand is mainly expected to be met bylarger shipments from India, Myanmar and Thailand,although significant export recoveries are also envisagedto concern China (Mainland) and Viet Nam. Combined withgreater exports by the European Union, the United Statesand Uruguay, these gains would more than compensatefor export retrenchments in Argentina, Brazil, Egypt,Pakistan and Paraguay.FAO’s forecast of world rice deliveries in 2018 now standsat 45.8 million tonnes, just 340 000 tonnes below the 2017level and marginally above October forecasts. Thecomparatively upbeat outlook chiefly mirrors expectationsthat import demand will remain firm in Asia, owing tolarger purchases by Indonesia, the Philippines and SaudiArabia, in particular. Imports are instead seen stabilising inEurope and the United States, while they fall in Africa andLatin America and the Caribbean, deterred by ample localsupplies and somewhat higher international prices. Amongsuppliers, India and Thailand are predicted to incur thesharpest export reductions in 2018, as tighter exportableavailabilities could hinder their ability to compete nextyear. The outlook is also negative for Argentina, UruguayPRODUCTIONand the Russian Federation, in view of expected outputshortfalls. Conversely, deliveries by Viet Nam and Pakistanare seen making strong headways next year, withAustralia, Brazil, Cambodia, China (Mainland) andMyanmar also envisaged to count on sufficient supplies tostep-up shipments in 2018.A total of 503.5 million tonnes (milled basis) of rice areforecast to be consumed around the world over the courseof the 2017/18 season, up from 498.0 million tonnes in2016/17. The 1 percent expansion is expected to be drivenby higher food use, of around 406.7 million tonnes. On aper caput basis, this volume would put worldconsumption of rice as food at 53.9 kilos per person, up0.2 kilos from 2016/17. Quantities destined to animal feedare projected to decline by 2 percent to 17.5 milliontonnes, with another 79.4 million tonnes are used forseed, non-food industrial uses and post-harvest losses,unchanged from the previous season.Consistent with the improved outlook for 2017 globalproduction, FAO has raised its forecast of world riceinventories at the close of 2017/18 marketing years by 1.4million tonnes to 170.5 million tonnes (milled basis). Thislevel would represent a 1.1 percent increase from the2016/17 record volume, resulting in a largely stable worldstocks-to-use ratio of 33.4 percent. Rice importingcountries remain forecast to account for all of theprojected growth in global rice inventories. This would benamely be the case of China (Mainland), althoughBangladesh, the Islamic Republic of Iran, Nigeria and thePhilippines are all similarly envisaged to end theirrespective marketing years with larger reserves. Stockexpansions in these countries would more thancompensate for drawdowns in the major rice exporters,driven by cuts in Thailand and the United States, and forstock reductions in the Republic of Korea, Madagascar andSri Lanka.Although the last quarter of the year normally marks theonset of harvesting activities across major northernhemisphere suppliers, international rice prices havecontinued to gain ground since October. This was reflectedby the FAO All Rice Price Index (2002-2004 100), whichpassed from an October average of 216 points to 221points in mid-December. Higher quality Indica andJaponica rice led the advance, rising by 3 percent, each,owing to stern import demand from South Asian and FarEastern buyers, along with currency appreciations in somemajor rice exporters. Gains were in the order 2 percent forAromatica supplies and of 1 percent for lower qualityIndica rice, mirroring some downward pressure exerted inthese segments by tepid buying interest and harvestprogress. From an annual stance, these latest tendenciespositioned the annual average FAO All Rice Price Index at207 points, 7 percent higher than in 2016 and just short ofits 2015 average of 211 points.Information update as of 12 December 2017

FAO RICE MARKET MONITOR / DECEMBER 2017At the revised level of 756.7 million tonnes (502.2 milliontonnes, milled basis), global paddy production wouldsurpass the 2016 all-time high by a small margin of 0.2percent. From a regional perspective, the forecast mirrorsprospects of modest output gains in Asia, where unevenrainfall patterns look set to temper area expansionspromoted by continued state assistance and positivemargin. Record crops are anticipated gathered in Africaand Latin America and the Caribbean, while ample and lesscostly water supplies for irrigation also enabled 2017production in Australia to stage a strong rebound. Instead,2017 output is set to contract in the United States andThe 2017 rice production season normally includes rice from themain paddy crops whose harvests fall in 2017, to which rice from allsubsequent secondary crops, if any, is added. In the case of northernhemisphere countries, this principle implies that production in 2017comprises the main rice crop, which is usually collected in the latterpart of the year, plus the volume obtained from the successivesecondary crops, commonly harvested in the first half of 2018. In thecase of southern hemisphere countries, production in 2017 normallycomprises rice from the main paddy crops assembled in the first partof 2017, plus rice from the secondary crops, generally gathered inthe latter part of 2017. This approach to assess rice production isapplicable to any given season.1ProductionGlobalet paddysuperficieproductionmondialesanddeareariz paddyMillion tonnesMillion 152201566820141592013724201216620117802010With harvests of main paddy crops drawing to a close innorthern-hemisphere producers,1 FAO has raised itsOctober forecast of world paddy production in 2017 by 2.1million tonnes to 756.7 million tonnes (502.2 milliontonnes, milled basis). At a country level, the upwardadjustment primarily mirrors more buoyant prospects forChina (Mainland), based on December assessments by theNational Bureau of Statics, which showed higher plantingsin the country and record yield outcomes. Next to China,the largest upward revision concerned Myanmar, given agenerally normal unfolding of the 2017 main croppingcycle, along with expectations that attractive local priceswill lead to more pronounced expansions in secondarycrop acreage. Evidence of greater plantings and favourableyield outcomes also boosted the outlook for Pakistan, thePhilippines and Sierra Leone. These changes more thanoffset various downward revisions, the largest of whichconcerning Bangladesh, as Government assessments ofthe country’s main (Boro) harvest pointed to larger thanearlier anticipated damages to April flash floods.Production forecasts were also downgraded forMadagascar following the release of a FAO/WFP cropassessment indicating more significant crop lossesincurred as a result of severe precipitation deficits andstorm damages. In the case of Viet Nam, slight downwardadjustments to yield expectations were mostly reflectiveof overly wet conditions during the last (winter) crop cycle.2009Global production forecast upgraded by 2.1 milliontonnesEurope, depressed by area retrenchments instigated byprospects of reduced margins.2008PRODUCTIONPRODUCTIONAreaAsiaAsian output to outstrip 2016 record by 1.4 million tonnesAlthough the 2017 season in Asia has been characterisedby uneven rainfall patterns, FAO’s latest forecast suggeststhat aggregate output in the continent is likely to exceedthe 2016 all-time high by a small margin of 0.2 percent to684.2 million tonnes (454.0 million tonnes, milled basis).The relatively favourable outcome would rely on a 0.5million hectare expansion in plantings to 145.3 millionhectares, a reflection of continued state assistanceprogrammes and positive margins. Looking at the majorproducers, the 2017 outlook has improved for China(Mainland), as December estimates by the NationalBureau of Statics dispelled earlier expectations a mild areacontraction. Instead, 2017 plantings are said to havestabilised at 30.2 million hectares, mirroring the stillattractive margins fetched by paddy producers,notwithstanding this year’s cut to government purchaseprices. Combined with record-breaking yields, this lifted2017 production in China (Mainland) to 208.6 milliontonnes (142.9 million tonnes, milled basis), up 1.5 milliontonnes from 2016 and matching the 2015 all-time high.In Indonesia, conducive rains, combined with adequatewater supplies for irrigation and state supportprogrammes, are assessed to have underpinned a 2percent output expansion in 2017 to 74.2 million tonnes(46.6 million tonnes, milled basis). Larger plantings t

VOLUME XX ISSUE No. 4 December 2017 ROUND UP Since the October issue of the RMM, FAO has raised its forecast of world paddy production in 2017 by 2.1 million tonnes to 756.7 million tonnes (502.2 million tonnes, milled basis). The revisions primarily mirrors improved crop prospects for China (Mainland) and Myanmar, although Pakistan, the Philippines, Sierra Leone are all predicted to gather .