Transcription

TRICKS OF THE TRADERDay Trading andSwing Trading PrinciplesBy Paul Janiak1

Disclaimer This presentation is composed of reports embodying a unique system ofstock analysis. All contents and recommendations are based on dataand sources believed to be reliable, but accuracy and completenesscannot be guaranteed. There is a very high degree of risk involved in trading. Users shouldbe aware of the risks involved in stock investments. It should not beassumed that future results will be profitable or will equal pastperformance, real, indicated or implied. The presenter assumes noresponsibility for your trading and investment results. The information presented here is for educational purposes only andshould not be construed as investment advice. Although everyprecaution has been taken in the preparation of this presentation, theauthor assumes no liability for errors or omissions. Use of this material constitutes your acceptance of these terms. You are completely on your own.Thank you 2

Day Trader (n):One who buys and sells an investmentwithin a very short time (minutes orhours), in order to take advantage ofrapid price changes PJ day trader qualificationsSlow LearnerToday’s Objective*Definition courtesy of www.morganstanleyindividual.com3

Day Trader Tax Advantages Links to articles about the tax advantagesof qualifying as a professional day trader http://www.bankrate.com/cbsmw/itax/tax adviser/20040826a1.asp?prodtype php4

Special Rules for Tradersin Securities According to IRS Publication No. 550Pattern Day TraderWash Sales RulesLosses are more tax advantageousDay Trading income is ordinary incomeThis year’s big change: Gain/Loss and Markto Market Election5

Qualities of a Good Day Trader90% of Day Traders lose money becausethey don’t have these qualities: Discipline and focus, PJ example Decisiveness Sophisticated risk-taking, withoutcompulsiveness Belief in technical analysis** Gene Ricci Motivation** Linda storyWritten goal settingConfidence without arroganceAnxiety control6Paigow Poker

Trading Tools & Resources Two high-speed Internet connections Cable and DSL line with own routerSeparate hard drive dedicated toswitchovers onlyPC with two monitors, plus Notebooklaptop w/ extra monitorSchwab / Think or Swim / Street SmartPro / Level 2 Platform / Trade Log / TeleChartsRates are negotiable7

Daily Market Commentary TV – CNBC, on low volumeThink or Swim – Shadow Trader – PeterReznicickRick Saddler at hitandruncandlesticks.comScott Redler at T3 at MinyanvilleDay Trading Partners, LLCTrading System8

What does it take to buildSuccessful Trading Strategies? Risk or Money Management (70%) Mental Motivation and Emotional Control(20%) Trading Systems or Strategies (10%)9

Books Introduction to Technical Analysis Day Trader’s Advantage by Howard AbellHit and Run Trading I and II by Martin Pringby Jeff CooperStreet Smarts by Linda Raschke and Lawrence Connors10

Books, continued The Complete Turtle Trader Life is Not a Game of Perfect by Michael Covelby Dr. Bob RotellaSecrets of a Pivot Boss by Frank Ochoa11

Paper Trading (n):Using “play dollars” to execute realistic trades Practice for three monthsSet up weekly and/or monthly benchmarks forprofitabilityRefrain from excusing big losses on the groundsthat “you won’t do that in the n.comwww.ThinkorSwim.com.Risk Control12

Howard Abell, The Day Trader’sAdvantage“I think most, if not all, of the traders we’ve interviewedhave recognized that if there’s any secret or Holy Grailattached to success in our business, it comes fromwithin. It has nothing to do with any specific indicator orsystem. It has to do with how you perceive the marketsand operate within that context of your ownpsychological makeup And if there’s anything thatwe’re trying to do, it is to remind people that they have tounderstand the inner workings of themselves in order tooperate in the day trader’s environment.”- Emotional Control13

Interview with Bill Williamsfrom The Day Trader’s Advantage by Howard Abell“Trading is like breathing. You inhale, and youtake in enough oxygen that you need andmaybe a little extra, and then you exhale and letsomebody else have the rest of that oxygen. [If]all you want to do is take every penny of yourprofits, and if you breathed like that, all youwould be doing is inhaling and you’d be dead infive minutes.”- Emotional Control14

Interview, continued“I know some S&P day traders who say they will never takeover a 100 point or a 500 loss. From my point of view,that’s stupid trading, because you’re trading your wallet,and you’re not trading the market. My wallet will not helpme trade the market profitably. I know that! The onlyway I can be profitable – and this may not work foreverybody – is to be so in tune with the market that I’mgoing to do what the market tells me and try not todictate to it by listening to my wallet.”Risk Control15

Interview with Toby Crabelfrom The Day Trader’s Advantage by Howard Abell“The real secret for success is that it’s a lot of hardwork, and if you want to do this over a longperiod of time successfully, then you’d better notthink about going in and making a lot of moneyfast. The common idea is let’s make a big killingand quit.”Risk Control16

The Essential Psychological Barriersto Successful Day Trading Not defining a lossNot taking a loss or profitGetting locked into a beliefTrading on “inside information” or taking a tipKamikaze tradingEuphoric tradingHesitating with your numbers(from Day Trader’s Advantage, by Howard Abell)Emotional and Risk Control17

Psychological Barrierscontinued Not catching a breakoutNot focusing on opportunitiesBeing more invested in being right than in makingmoneyTrying to be perfectNot consistently applying your trading systemNot having a well-defined money managementsystemNot being in the right state of mindEmotional and Risk Control18

Risk Managementor Loss Management Establish specific and rigid financial constraints. Having goals on theupside is important, but it is crucial to decide how much you are willingto lose—a decision requiring patience, discipline and, for many, belief ina higher power. My loss parameters are onesy and twoseys and five/ten. Onesey/twosey are 1000 and 2000 and represent ½ and a fullposition – Leo Durocher I use the loss parameter of 5/10 for 5000 and 10,000 for a “totaltransaction”. A total transaction uses two positions and “all-in” margin;i.e., being “all-in” with my day trading buying power.Risk Control19

Profit Goals Your real goal should be set at least 20 percentabove what you think you can make, in order to takeinto account the potential of having one day a weekas a losing day.Once you have made your daily goal, considerwalking away for the day or setting new rules forplaying with the house’s money. Poker TexasHold’emMy goals are: 2K per day 5K per week 20K per monthRisk Control20

Not Being in the Right State ofMind“It is our belief that continually elevating your state of mind byfocusing on internal and external phenomena that allow you tostay resourceful and true to your trading strategy is the answer.We have demonstrated how to do this through processingpositive beliefs and thoughts and by directing your physiology.When a negative thought comes into consciousness and beginsto distract your focus, don’t fight it. Acknowledge its existenceand go forward.”-Koppel and Abell, The Inner Game of TradingEmotional Control21

Not Being in the Right State ofMind, continued“Successful trading, in essence, comes down tothis: Formulate a day trading plan that works,overcome your own personal psychologicalbarriers and condition yourself to producefeelings of self-trust, high self-esteem andunshakable conviction and confidence.Doing this naturally leads to good judgmentand winning trades with a provenmethodology, based on probability.”Emotional Control22

Accountability The length of measurement periods is crucial. WTD and MTD is everythingMore than a month is too longA single day is too shortP.E.R.I.L. ScaleRisk Control23

Getting Started:Daily Preparation24

Homework Helpers and Timers StockTiming.comHarleyMarketLetter.comSchwab Market EdgeSy HardingJeff Cooper’s AlertsFinViz.comMinyanvilleT3 AlertsDaily WealthStansberry & AssociatesLarry Connors’ Daily Battle PlanVector VestChris WeberDayTradingPartnersLLC.com25

Rolling Timer26

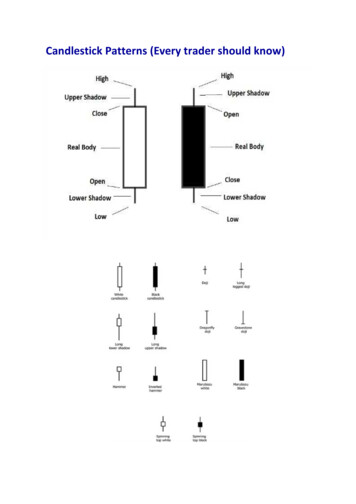

Common Homework Setups Expansion Breakouts – source Jeff Cooper1-2-3 Pullbacks – Trade Market/Jeff Cooper180’s – Trade Market/Jeff CooperLizards – Trade Market/Jeff CooperGilligans Island – Trade Market/Jeff CooperUnfilled Gap Reversals – Trade Market/Jeff CooperInside Day Narrow Range 4 – Linda Rasche and Lawrence ConnorTurtle Soup and Turtle Soup Plus One – Linda Rasche andLawrence ConnorUnfilled Gaps – Linda Rasche and Lawrence ConnorSpike and Ledge Patterns – Linda Rasche and Lawrence ConnorBasic T.A.27

Expansion Breakout28

ID NR429

Important Dates The last day of the month, quarter and year Option expiration weeks Employment data – weekly and monthly Fed Open Market meeting days When financial news is announced30

The News It is important to keep apprised of the news,particularly when its announcement time isprearranged. Try to be flat prior to the announcement. Unless the news is extremely significant, be contrarian,or let the market run a little bit and try to get the pushback. Cramer fan31

Daily Market Commentary TV – CNBC, on low volumeThink or Swim – Shadow Trader – PeterReznicickRick Saddler at hitandruncandlesticks.comScott Redler at T3 at MinyanvilleDay Trading Partners, LLCTrading System32

Mental Edge Trading The Mental Edge Newsletter ispublished by Nazy Massoud, Founderand CEO of Mental Edge Trading, Inc. You can go towww.mentaledgetrading.com., sign upfor the free report, and you areautomatically signed up for thenewsletter. Emotional ControlSample PacketCome to Play33

Daily Market Commentary TV – CNBC, on low volumeThink or Swim – Shadow Trader, PeterReznicickRick Saddler at hitandruncandlesticks.comT3 at Minyanville, Scott RedlerDay Trading Partners, LLC34

Prepare to Trade Do what it takes to get yourself into a positiveframe of mind each morning, as a positiveattitude is the single best indicator of success.My records have shown me that I consistentlytrade better when I begin my day reading My trading journalMental Edge NewsletterSomething spiritual – Daily Bread from RBCMinistries @ www.rbc.orgEmotional Control35

ConfidenceIn any endeavor I’ve ever studied, from playinggolf to selling lipstick, confidence is the singlemost important and least understood factor.Without confidence, an individual is like anairplane without wings. No matter how powerfulthe engines are, the wingless airplane is notgoing to get off the ground. If you lackconfidence, you’re probably going to be nervous,tight, and hesitant in anything you try. You won’teven try some things you could have succeededat. And your preparation for performance is likelyto be halfhearted. Why practice hard if you don’tthink you’re going to succeed in the end?36

Confidence, continuedIf you don’t prepare, if you perform hesitantly andif you give up easily, you can’t expect to succeed.But that’s the way people who lack confidenceoperate.Such people probably believe, mistakenly, thatconfidence can only come from a history ofsuccesses. They say they’re only being realisticif they lack confidence. Unwittingly, they use“realism” as a justification for thinking negativelyand limiting themselves. How can they believethey can accomplish something if they’ve neverdone it before? Particularly if they’ve tried andfailed in the past?37

Confidence, continuedThe answer goes back to free will. Confidence isnothing more than what you think about yourselfin relation to a given challenge. It’s not aboutwhere you’ve been. It’s about where you’regoing. It’s not about what you’ve done. It’sabout what you perceive you will do. You canchoose what you think about yourself. Peoplewith real talent choose to think they can succeed.They prepare themselves to succeed.Life Is Not a Game of Perfect, by Dr. Bob Rotella38

Trading Strategies39

Three Types of Markets1.Trending markets2.Trend-changing markets3.Markets that swing more than two times in one day40

Stocks We GDUGFASFAZSSGSSOTNATSA41

Four Main Intraday Strategies Holy Grail, which we primarily use in trendingmarkets (Linda Raschke) Turtle Soup (Raschke and Connors), which we usein choppy markets Recross-over of the 8/34 (Rick Sadler) A successful retest of the high or low42

Holy Grail Bull and BearsFor Buys (Sells are Reversed) The 14-period ADX must initially be greater than 30 and rising. This willidentify a strongly trending market. Look for a retracement in price to the 20-period exponential movingaverage. Usually the price retracement will be accompanied by aturndown in the ADX. When the price touches the 20-period exponential moving average, puta buy stop above the high of the previous bar. Once filled, enter a protective sell stop at the newly formed swing low.Trail the stop as profits accrue and look to exit at the most recent swinghigh and tighten stops on the balance. If stopped out, reenter this trade by placing a new buy stop at theoriginal entry price. After a successful trade, the ADX must once again turn up above 30before another retracement to the moving average can be traded. Substitute 8 or 34 EMA for the aboveRORO43

44

Turtle Soup Bulls and BearsFor Buys (Sells are Reversed) Today must make a 20-day or period low – the lower the better. T

Trading on “inside information” or taking a tip . Larry Connors’ Daily Battle Plan Vector Vest Chris Weber DayTradingPartnersLLC.com. 26 Rolling Timer. 27 Common Homework Setups Expansion Breakouts – source Jeff Cooper 1-2-3 Pullbacks – Trade Market/Jeff Cooper 180’s – Trade Market/Jeff Cooper Lizards – Trade Market/Jeff Cooper Gilligans Island – Trade Market/Jeff Cooper .