Transcription

WORK BOOKFINANCIAL ACCOUNTINGINTERMEDIATEGROUP – IPAPER – 5The Institute of Cost Accountants of India(Statutory body under an Act of Parliament)www.icmai.in

First Edition : March 2018Directorate of StudiesThe Institute of Cost Accountants of India12, Sudder Street, Kolkata – 700 016www.icmai.inCopyright of these study notes is reserved by the Institute of Cost Accountantsof India and prior permission from the Institute is necessary for reproduction ofthe whole or any part thereof.Directorate of Studies, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament)

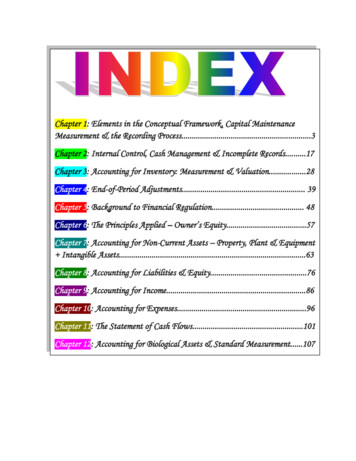

Work BookFINANCIAL ACCOUNTINGINTERMEDIATEGROUP – IPAPER – 5INDEXSl. No.Section-A : Accounting – Basics1.Fundamentals of Accounting2.Accounting for Special TransactionsPage No.1 – 3233 – 70Section-B : Preparation of Financial Statements3.4.5.6.Preparation of Financial Statements of Profit OrientedOrganizations71 – 81Preparation of Financial Statements of Not-for ProfitOrganizations82 – 97Preparation of Financial Statements from IncompleteRecords98 – 117Partnership118 – 162Section-C : Self Balancing Ledgers, Royalties, Hire Purchase& Installment System, Branch & Departmental Accounts7.Self Balancing Ledger163 – 1778.Royalties178 – 1879.Hire-Purchase and Installment System188 – 20010.Branch and Departmental Accounts201 – 228Section-D : Accounting in Computerised Environment andAccounting Standards11.Computerised Accounting SystemDirectorate of Studies, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament)229 – 236

Work Book : Financial AccountingChapter – 1FUNDAMENTALS OF ACCOUNTINGFUNDAMENTALS OF ACCOUNTING-BASICS1.Choose the correct alternative:1.The art of recording transactions in a set of books is referred to as .(a) Book Keeping(b) Accounting(c) Auditing(d) Writing2.Which of the following is/ are objective(s) of accounting?(a) To compare income against expenses, and know the net result thereof.(b) To assess the financial position of an entity.(c) To provide a record for compliance with statutes and applicable laws.(d) All of the above3.Gross working capital is equal to:(a) Total Capital(b) Total Assets(c) Total Current Assets(d) Current Assets – Current Liabilities4.The financial statement that reflects the financial position of an entity on a particular date isreferred to as the .(a) Cash Flow Statement(b) Income Statement(c) Balance Sheet(d) None of the above5.The amount invested by owners into business is called .(a) Asset(b) Liability(c) Capital(d) Cash flowDirectorate of Studies, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament)Page 1

Work Book : Financial AccountingAnswer:1.(a)2.(d)3.(c)4.(c)5.(c)2.Match the following:Column AColumn B1.Cash discountAObligation that may or may not materialise2.Credit transactionsBExcess of expenditure over income3.LiabilityCTransactions without immediate cash settlement4.Contingent liabilityDAmount owed by a business to external parties5.LossEAllowance by seller to buyer for prompt paymentAnswer:Column AColumn B1.Cash discountEAllowance by seller to buyer for prompt payment2.Credit transactionsCTransactions without immediate cash settlement3.LiabilityDAmount owed by a business to external parties4.Contingent liabilityAObligation that may or may not materialise5.LossBExcess of expenditure over income3.Fill in the blanks:1.is the branch of accounting that deals with the process of ascertaining costs.2.The main objective of accounting is to provide3.When complete sequence of accounting procedure is done which happens frequently andrepeated in same direction during an accounting period, it is called an .4.represents the excess of total assets over total liabilities of a business.5.A liability that is expected to be settled in an entity’s normal operating cycle is calledliability.information to the stakeholders.Answer:1.Cost Accounting2.financial3.Accounting Cycle4.Net worth5.CurrentDirectorate of Studies, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament)Page 2

Work Book : Financial Accounting4.State whether the following statements are True or False:1.The transactions of a business are recorded in the journal chronologically and in a classifiedmanner.2.Book keeping being a routine and repetitive work, in today’s world, it is taken over by thecomputer systems.3.Information about financial position of a business is primarily provided in the IncomeStatement.4.Trade discount is allowed by seller to buyer for making prompt payment.5.Management accounting is primarily based on the data available from Financial eACCOUNTING PRINCIPLES, CONCEPTS & CONVENTIONS5.Multiple choice questions:Choose the correct alternative:1.Which of the following is a basic assumption?(a) Business entity concept(b) Matching concept(c) Historical cost concept(d) All of the above2.Which of the following is not a Basic Principle?(a) Dual aspect concept(b) Revenue Realisation concept(c) Accounting period concept(d) Historical cost concept3.‘A business transaction be recorded only if it can be measured in terms of money’ is theprinciple of which concept?(a) Dual aspect concept(b) Revenue Realisation concept(c) Accrual conceptDirectorate of Studies, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament)Page 3

Work Book : Financial Accounting(d) Money measurement concept4.The modern approach of deciding debit and credit is also referred to as approach.(a) Canadian(b) American(c) Indian(d) British5.The accounts related to assets or properties or possessions are called .(a) Personal accounts(b) Representative Personal accounts(c) Nominal accounts(d) Real accountsAnswer:1.(a)2.(c)3.(d)4.(b)5.(d)6.Match the following:Column AColumn B1.Cash bookACredit note issued to debtors2.Sales bookBCash memos3.Sales return bookCDebit note issued to creditors4.Purchase bookDInward invoice5.Purchase return bookEOutward invoiceAnswer:Column AColumn B1.Cash bookBCash memos2.Sales bookEOutward invoice3.Sales return bookACredit note issued to debtors4.Purchase bookDInward invoice5.Purchase return bookCDebit note issued to creditors7.Fill in the blanks:1.concept treats a business as distinct from the individuals who own or manage it.2.The left hand side of an account is called the-side.account is called the-side while the right hand side of anDirectorate of Studies, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament)Page 4

Work Book : Financial Accounting3.The widely accepted set of rules, conventions, standards, and procedures for reportingfinancial information are called .4.basis of accounting is a method of recording transactions by which revenue, costs,assets and liabilities are reflected in the accounts of the period in which actual receipts andpayments are made.5.basis of accounting is recognised under the Companies statute.Answer:1.Business/Separate entity2.Debit, Credit3.GAAP4.Cash5.Accrual8.State whether the following statements are true or false:1.The Periodicity concept assumes that ‘a business will run for an indefinite period’.2.GAAP stands for Globally Accepted Accounting Practices.3.Under Hybrid Basis of accounting, incomes are recorded on cash basis while expenses arerecorded on accrual basis.4.The components of the Accounting Equation are Expenses, Incomes and Equity.5.All transactions are events, but all events are not ruePRACTICAL ILLUSTRATIONS:9.Recognise the accounting principle in the following cases:(a) Transactions are recorded at their original cost.(b) Inventories are valued at lower of its cost and realisable value.(c) Accounting treatment once decided should not changed from one period to another.(d) Unsold stock is deducted from the cost of goods available for sale to arrive at Cost of GoodsSold.(e) A business is assumed to run for an indefinite period.Directorate of Studies, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament)Page 5

Work Book : Financial AccountingSolution:(a) Historical cost concept(b) Prudence/ Conservatism concept(c) Concept of Consistency(d) Matching concept(e) Going Concern concept10. Ascertain the debit and credit for the following particulars under the Modern Approach:(a) Started business with cash.(b) Purchased goods for cash.(c) Purchased goods from Ms. B(d) Paid wages to workers.(e) Rent received from tenant.(f)Sold goods on cash to Mr. A.(g) Sold goods on credit to Mr. Z.(h) Withdrew cash from business.Solution:Effect of TransactionAccountTo be Debited / Credited(a)Increase in cashIncrease in capitalCash A/cCapital A/cDebitCredit(b)Increase in goodsDecrease in cashPurchases A/cCash A/cDebitCredit(c)Increase in goodsIncrease in liabilityPurchases A/cMs. B A/cDebitCredit(d)Increase in expenseDecrease in cashWages A/cCash A/cDebitCredit(e)Increase in cashIncrease in incomeCash A/cRent Received A/cDebitCredit(f)Increase in cashDecrease in goodsCash A/cSales A/cDebitCredit(g)Increase in assetDecrease in goodsMr. Z A/cSales A/cDebitCredit(h)Decrease in liabilityDecrease in cashDrawings A/cCash A/cDebitCredit11. Ascertain the debit and credit for the following particulars under the British Approach:(a) Started business with cash.(b) Purchased goods for cash.Directorate of Studies, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament)Page 6

Work Book : Financial Accounting(c) Purchased goods from Ms. B(d) Paid wages to workers.(e) Rent received from tenant.(f)Sold goods on cash to Mr. A.(g) Sold goods on credit to Mr. Z.(h) Withdrew cash from business.Solution:Name of AccountNature of AccountRuleTo be Debited /Credited(a)Cash A/cCapital A/cRealPersonalComes inGiverDebitCredit(b)Purchases A/cCash A/cNominalRealExpenseGoes outDebitCredit(c)Purchases A/cMs. B A/cNominalPersonalExpenseGiverDebitCredit(d)Wages A/cCash A/cNominalRealExpenseGoes outDebitCredit(e)Cash A/cRent Received A/cRealNominalComes inIncomeDebitCredit(f)Cash A/cSales A/cRealNominalComes inIncomeDebitCredit(g)Mr. Z A/cSales ings A/cCash A/cPersonalRealReceiverGoes outDebitCredit12. The following transactions relate to Mr. J for the month of January, 2018. You are required toprepare an accounting equation from these transactions:2018January1Started business with cash 48,000.4Purchased goods in cash from D Bros. for 8,000.6Bought furniture worth 14,000 in cash.9Sold goods costing 2,500 to Mr. X for 4,000 in cash.12Purchased goods in credit from B & Sons. worth 28,000.16Sold goods costing 4,800 to Mr. Y for 6,000 on credit.20Paid 5,000 cash to B & Sons., the supplier.22Paid Salaries 1,600.27Received interest 1,400.31Collected 6,000 from his customer, Mr. YDirectorate of Studies, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament)Page 7

Work Book : Financial AccountingSolution:DateTransactionAssets Liabilities Capital2018January1Started business with cash 48,000.48,000 --48,0004Purchased goods in cash from D Bros. for 8,000. 8,000– 8,000----48,000 --48,0006Revised Accounting EquationBought furniture worth 14,000 in cash. 14,000– 14,000----Revised Accounting EquationSold goods costing 2,500 to Mr. X for 4,000 incash48,000 --48,000 4,000– 2,500--1,50091216Revised Accounting Equation49,500 --49,500Purchased goods in credit from B & Sons. worth 28,000. 28,000 28,000--Revised Accounting EquationSold goods costing 4,800 to Mr. Y for 6,000 on77,500 28,000 49,500 6,000– 4,800--1,20078,700 28,000 50,700– 5,000– 5,000--23,000 50,700credit.Revised Accounting Equation20Paid 5,000 cash to B & Sons., the supplier.73,700 22Revised Accounting Equation Paid Salaries 1,600.– 1,600--– 1,60072,100 23,000 49,10027Revised Accounting EquationReceived interest 1,400. 1,400-- 1,400Revised Accounting Equation73,500 23,000 50,500 6,000– 6,000----73,500 23,000 50,50031Collected 8,000 from his customer, Mr. YRevised Accounting Equation13. Chandra runs a stationery business. From the following information relating to his business prepareIncome Statement under: (a) Cash Basis, (b) Accrual Basis, and (c) Hybrid Basis: Cash purchasesCredit purchases82,0001,35,000Salaries paid17,000Rent paid17,500Insurance paid18,500Cash sales2,20,000Credit sales3,00,000Outstanding Expenses: Salaries5,000Rent2,800Prepaid insurance3,000Directorate of Studies, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament)Page 8

Work Book : Financial AccountingSolution:(a) Under Cash BasisIncome StatementParticularsAmount ( )Incomes:Cash salesLess: ExpensesCash purchasesSalaries paidRent paidInsurance paidAmount ( )2,20,00082,00017,00017,50018,5001,35,000 Net Income85,000(b) Under Accrual BasisIncome StatementParticularsAmount ( )Amount ( )Incomes:Cash salesCredit sales2,20,0003,00,0005,20,000Less: ExpensesCash purchasesCredit purchasesSalaries paidAdd: Outstanding17,0005,00022,000Rent paidAdd: Outstanding17,5002,80020,300Insurance paidLess: Prepaid Net 200(c) Under Hybrid BasisIncome StatementParticularsAmount ( )Incomes:Cash salesLess: ExpensesAmount ( )2,20,00082,000Directorate of Studies, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament)Page 9

Work Book : Financial AccountingCash purchasesCredit purchasesSalaries paidAdd: Outstanding1,35,00017,0005,00022,000Rent paidAdd: Outstanding17,5002,80020,300Insurance paidLess: Pre paid18,5003,00015,5002,74,80054,800 Net LossCAPITAL & REVENUE TRANSACTIONS14. Multiple choice questions:Choose the correct alternative:1.Which of the following accounting concept is related to capital and revenue transactions?(a) Dual Aspect concept(b) Periodicity concept(c) Money measurement concept(d) Realisation concept2.The purpose of distinguishing transactions between capital and revenue are:(a) Ensuring proper accounting of transactions(b) Determination of true operating result(c) Proper disclosure of financial position(d) All of the above3.Which of the following is/are capital expenditure?(a) Rent & Rates(b) Salaries(c) Overhauling of machinery(d) Cost of goods sold4.Which one of the following is an example of loss suffered on acquisition of an existingbusiness ?(a) Capital(b) Revenue(c) Normal(d) None of the aboveDirectorate of Studies, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament)Page 10

Work Book : Financial Accounting5.Capital Profit is credited to Account.(a) Reserve Capital(b) General Reserve(c) Reserve Fund(d) Capital ReserveAnswer:1.(b)2.(d)3.(c)4.(a)5.(d)15. Match the following:Column AColumn B1.Revenue lossAProfit earned by selling goods above cost price2.Capital receiptBRaising of capital3.Capital ProfitCProfit on reissue of forfeited share4.Revenue receiptsDBad debts arising out of credit sale5.Revenue ProfitEFees received for services renderedAnswer:Column AColumn B1.Revenue lossDBad debts arising out of credit sale2.Capital receiptBRaising of capital3.Capital ProfitCProfit on reissue of forfeited share4.Revenue receiptsEFees received for services rendered5.Revenue ProfitAProfit earned by selling goods above cost price16. Fill in the blanks:1.An expenditure, the benefit from which can be enjoyed, consumed or used over multipleaccounting periods is referred to as Expenditure.2.Bad debt recovery is an example of receipt.3.expenditure is non-recurring in nature.4.The loss which does not arise to an entity in the regular course of its operations is known asloss.5.The profit which arises from the performance of regular operations of an entity is known asprofit.Directorate of Studies, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament)Page 11

Work Book : Financial tal5.Revenue17. State whether the following statements are true or false:1.Normally, capital expenditure involves heavy cash outlay2.Revenue Expenditures are recognized as Fixed Assets in the asset-side of the Balance Sheet.3.Revenue Profit is ascertained by preparing the Income Statement.4.Capital Receipts affect the operating result of an entity.5.Revenue transactions relate only to the current accounting STRATIONS:18. Classify the following expenses between capital and revenue:(a) A machine purchased for 1,80,000 and incurred 1,500 for its carriage and 1,600 for itsinstallation.(b) Repainting charges paid for the factory shed 12,000.(c) Amount paid as an advance to Creditors 20,500(d) Major repairs incurred on old machine 14,700.(e) Municipal tax paid 2,000 for the building.Solution:S.L.NoCapital/ RevenueExplanation(a)Capital ExpenditureThe purchase cost of machine is incurred for acquiring capital assetthat is expected to provide benefits of enduring nature, while thecarriage and installation expenses are incurred to put the capitalasset to use which will provide benefits of enduring nature.Directorate of Studies, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament)Page 12

Work Book : Financial Accounting(b)Revenue ExpenditureIt is incurred for maintaining the factory shed, an existing capitalasset.(c)Not an expenditureIt is a temporary payment made to the suppliers to be adjustedagainst future purchase of goods.(d)Capital ExpenditureIt is incurred for improving the productive capacity of an existingcapital asset and is expected to provide future economic benefitsof enduring nature.(e)Revenue ExpenditureIt is usually an annual outflow i.e. recurring in nature.19. State which item of expenditure would be charged to capital and which to revenue:a.Freight and cartage on the new machine 150, erection charges 200.b.Fixtures of the book value of 1,500 were sold off at 600.c.A sum of 1,100 was spent on painting the factory.Solution:S.L.No.a.NatureExplanationCapital ExpenditureIt is incurred to put the capital asset to use and provides benefits ofenduring nature.b.Revenue LossIt does not provide any economic benefit to the entity.c.Revenue ExpenditureIt is incurred for maintaining an existing capital asset.20. State whether the following expenditures are capital or revenue in nature?a.Purchase of a head office premise by A Ltd. , a real estate development firm.b.Purchase of investment for trading purpose by B Ltd., a wealth-management firm.c.D Ltd., an engineering firm undertook major repairs of its machinery for the purpose of makingit marketable.d.Purchase of second-hand motor car for resale purpose by E Auto, a car dealer.Solution:a.Since the head office premise will be used by A Ltd. for its own operations (and not resale) it is acapital expenditure.b.Even though B Ltd. is a wealth-management firm, since it has made the investments for tradingpurpose, it is a revenue expenditurec.Even though heavy repairing charges have been incurred, it is incurred for the purpose of makingthe machinery marketable. Hence, it is revenue expenditure.d.As the motor car is acquired by E Auto with the intension of resale, it will be treated as revenueexpenditure.Directorate of Studies, The Institute of Cost Accountants of India (Statutory Body under an Act of Parliament)Page 13

Work Book : Financial Accounting21. State instances when the following expenditures are considered to be as capital expenditure.a.Repairing Chargesb.Legal Expensesc.Interest expensesd.Transport Expensese.Wages paymentSolution:a.Repairing Charges: Major repairing charges paid for renovation of an old office building shouldbe capitalized and debited to the cost of Building.b.Legal Expenses: At the time of building acquisition, expenditure inc

2. GAAP stands for Globally Accepted Accounting Practices. 3. Under Hybrid Basis of accounting, incomes are recorded on cash basis while expenses are recorded on accrual basis. 4. The components of the Accounting Equation are Expenses, Incomes and Equity. 5. All transactions are events, bu