Transcription

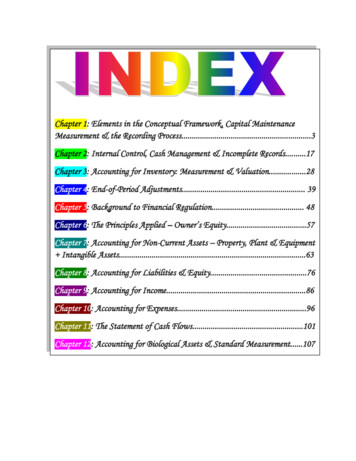

Introduction to Financial AccountingChapter 1: Elements in the Conceptual Framework, Capital Maintenance– SummaryBookMeasurement& the RecordingProcess.3Chapter 2: Internal Control, Cash Management & Incomplete Records.17Chapter 3: Accounting for Inventory: Measurement & Valuation.28Chapter 4: End-of-Period Adjustments. 39Chapter 5: Background to Financial Regulation. 48Chapter 6: The Principles Applied – Owner’s Equity.57Chapter 7: Accounting for Non-Current Assets – Property, Plant & Equipment Intangible Assets.63Chapter 8: Accounting for Liabilities & Equity.76Chapter 9: Accounting for Income.86Chapter 10: Accounting for Expenses.96Chapter 11: The Statement of Cash Flows.101Chapter 12: Accounting for Biological Assets & Standard Measurement.107

CHAPTER 1: Elements in the Conceptual Framework; Capital MaintenanceMeasurement; The recording processGENERAL NOTESAccounting regulationThere are three main sources of accounting regulation, including:Apply the broad principles to the many & varied transactions,1) Companies legislationevents and circumstances that arise in practice2) Stock exchange listing regulations3) Accounting standards Generally only deal with principles of accounting measurement anddisclosure at a broad levelIn Australia, a Conceptual Framework (see below), as well as an Australian Accounting Standards Board(AASB) regulate the practice of accounting. The CONCEPTUAL FRAMEWORK is comprised of thefollowing elements:PART 1: SAC (Statement of Accounting Concept) 1 - Defining a reporting entityIn determining whether a business is a reporting entity, and thereby obligated to propose general purposereports, the following factors must be considered:ooooThe existence of dependent users who rely on financial information and reports fordecision-making purposes – includes the owner and shareholders, who rely on financialinformation in reaching decisions as to whether, for example, they should invest in the businessor not.Separation of the owner from the entity/management – the greater the separation between theowners and management, there more likely it is that there exists users who are dependent upongeneral purpose financial reports as a basis for decision-making purposes.Economic/political influence – the greater the economic/political influence of an entity, the morelikely it is that there exists users who are dependent upon general purpose financial reports as abasis for decision-making purposes.Financial characteristics – the larger the size/indebtedness of the entity, the more likely it is thatthere exists users who are dependent upon general purpose financial reports as a basis fordecision-making purposes.PART 2: SAC 2 - Objectives of financial reporting and a reporting entityThe objective of financial reporting and the reporting entity is to provide users with decision-usefulinformation by collecting and collating financial information into general purpose reports, including the:-Income StatementStatement of Financial Position (Balance Sheet)Cash Flow StatementStatement of Changes in Equity

PART 3: THE AASB FRAMEWORKBrief history of regulationOver time, ‘Generally Accepted Accounting Principles’ (GAAP) have developed to guide the practice ofaccounting. But as entities grew in size and complexity, more formal rules were required – resulting in thestandards formed by the AASB (Australian Accounting Standards Board). These standards are mandatoryto many entities nowadays in the preparation of financial statements.As part of these standards, a CONCEPTUAL FRAMEWORK was developed to base these standardsupon. A set of inter-related concepts outlining the nature, scope & content of accounting and reporting,this framework covers the general theory of accounting in developing specific accounting rules andregulations in determining how information should be presented in financial statements.Need for the Conceptual FrameworkThe Conceptual Framework:Provides a logical and consistent outline and understanding of the nature, purpose & methods offinancial accounting.The complexity of businesses in today’s world requires in-depth guidelines for their propermanagement and reporting to dependent users.Resolves conceptual disputes with regards to accounting practice, outlining clearly how itemsshould be measured, recorded and disclosed.The CONCEPTUAL FRAMEWORK covers many areas of accounting, including (as well as SAC1&2):PART 3a: Assumptions underlying financial reports Going-concern principle – the life of the business is assumed to be continuous with anundetermined lifespan.Accrual assumption – income and expenses are recognised in the period in which they areearned/incurred, which is not necessarily when, or in the same period, as when money changeshands.PART 3b: Qualitative CharacteristicsThe two most essential characteristics of financial reports are: Relevance – to be useful, information must be relevant to the decision-making needs of users.Information is deemed relevant when it influences the economic decisions of users by helpingthem evaluate past, present or future events or confirming/correcting their past evaluations. Reliability – information is deemed reliable when it is free from material error and bias and canbe depended upon by users to faithfully represent that which it purports to represent, or couldreasonably be expected to represent.

PART 3c(i): Key elements – definitionsThe various elements of financial reports include:Assets A resource controlled by the entity – control regulates the capacity of the entity to benefit fromthe asset in pursuit of its objectives while denying/regulating the access of others to that benefit.As a result of past events – brought about through a previous economic event/transactionFrom which future economic benefits are expected to flow into the entity – the capacity ofassets to provide economic benefits, which can then be used to provide goods/services forexchange in generating positive cash flows.Liabilities A present obligation of the entity – includes both legally enforceable obligations, such ascontractual agreements, as well as equitable (i.e. moral/social/constructive) obligations.Arising from past eventsThe settlement of which is expected to resultIn the outflow of resources from the entity embodying economic benefitsEquityThe residual interest in the assets of the entity – subtracting liabilities from assetsAfter deducting all its liabilities – resulting in a net amount which constitutes the claim/rightowners have over the net assets of the entity.NOTE: Equity is increased by profitable operations (i.e. income exceeds expenses, owner contributions),and diminished by unprofitable operations (i.e. expenses exceed income, owner distributions)Income Increases in economic benefits – derived from the definition of assets During the accounting period – under the accrual accounting system, income is only recognisedwithin the period when it occurred, being closed off at the conclusion of the period. In the form of a) inflows/enhancements of assets, or b) decreases in liabilities That result in increases to equity Other than those relating to contributions from equity participants – owner’s contributionsdo not constitute revenueExpenses Decreases in economic benefits – derived from the definition of liabilitiesDuring the accounting period – same concept as income (see above)In the form of a) outflows/depletions of assets, or b) incurrences of liabilitiesThat result in decreases in equityOther than those relating to distributions to equity participants – owner’s, shareholdersdrawings/dividends do not constitute an expense

PART 3c(ii): Key elements – recognitionUnder the CONCEPTUAL FRAMEWORK two additional criteria are required for the recognition ofassets, liabilities, income and expense items, and thereby, their presentation within general purposefinancial reports: It is probable* that any future economic benefit associated with the item will flow to/fromthe entity The item has a cost/value that can be reliably measured (i.e. in dollar figures)*Probable refers to the notion of ‘more likely than less likely’ i.e. more than 50% chance of occurring.Has caused controversy as it contravenes the principle of conservatism, which requires income and/orassets be recognised only when there is a high degree of cash being received.This notion could lead to unscrupulous businesses adopting a level of probability which is too high,leading to business-wide occurrences of bad and doubtful income and assets.PART 3c(iii): Key elements – measurement‘Measurement’ refers to the process of determining monetary amounts at which assets and liabilities,and hence income and expenses, should be recognised and carried in financial reports. The valuationmethods adopted have an impact on the capital, and therefore wealth, of an entity (next topic). Valuationmethods include:Historical cost: Assets – recorded at the amount paid, or their fair value, at the time of their purchase/acquisition.Liabilities – recorded at the amount of proceeds received in exchange for the obligation, or insome cases, the amount expected to satisfy the liability.Current cost:ooAssets – are carried at the amount that would have to be paid if the same/equivalent assets werepurchased currently.Liabilities – are carried at the undiscounted amount that would be required to settle the obligationcurrently.Realisable (settlement) value: Assets – are carried at the amount that could currently be obtained by selling the asset. Liabilities – are carried at their undiscounted amounts expected to be paid to satisfy the liabilities.Present value: Assets – are carried at the present discounted value of future net cash inflows that the item isexpected to generate.Liabilities – are carried at the present discounted value of future net cash outflows that areexpected to be required to settle the liabilities.

A summary of Topic 1.1 is below:Topic 1.2: Capital MaintenanceMeasurementGENERAL NOTESPeople start businesses in order to earn a profit and gain wealth. The wealth of a business is determinedby its capital, the net worth of the business which is also the residual claim the owner has over theentity’s assets. It is assumed that business owner’s want their entity’s, and therefore their wealth andprofits to grow from period to period, but if not, to at least maintain their wealth and level of profits. Thisis the idea behind capital maintenance – the desire for a business to be as well off, if not better off, at theend of the period as they were at the start of the period.There are two forms of capital maintenance: Maintaining monetary capital – a business is said to have maintained its monetary capital if it isin the same financial position in dollar terms at the end of the period as it was at the start of theperiod, once contributions from/distributions to the owner have been excluded. Maintaining physical capital – a business is said to have maintained its physical capital if it isable to remain in the same operating capability at the end of the period as it was at the start of theperiod, once it has re-purchased assets sold and expensed during the year, and contributionsfrom/distributions to the owner have been excluded.Capital is calculated by deducting liabilities from assets. Hence, the valuation method applied to assetswill have a direct effect on the determination of net capital, and the overall net worth of firm. There areseveral ways in which to value assets (facing page):

Method of ValuationHistorical cost(Maintenance of monetarycapital use historical cost valuationas its basis)DescriptionStrengthsWeaknessesValuing assets at thecost incurred topurchase them at thetime of the originaltransaction.Facilitates reliability – thecost of the asset can easily bereferenced back to sourcedocumentation, verifying thatmaintained cost faithfullyrepresents the cost ofpurchase.Assumes money holds aconstant buying power. Dueto inflation, the value ofmoney changes over time,making the historical cost afair representation of theassets value at a particularpoint in time, only (at time ofpurchase).If a business distributes all of itsprofit as dividends/drawings,maintaining the monetary wealth atthe start, but the price ofsold/expensed assets have risen, thebusiness will be unable to purchasethe same quantity the followingperiod. Thus they have maintainedmonetary capital but erodedphysical capital.Current replacementcost/Current costInvolves valuing monetary assets atreplacement cost i.e. away fromhistorical cost, which willinevitably rise due to inflationAllFormsEconomic value/PresentvalueOfMakes the practice of addingassets purchased in differentperiods together, as thoseassets were purchased withdollar of differing buyingpower.Valuing assets at theamount that would haveto be paid at today’sprices to purchase asimilar/same item.Value of the expectedearnings from the item,discounted to give apresent-day value.Facilitates relevance –valuing at current prices isvery useful for users offinancial reports in theirdecision-making.This would be the most idealand accurate measure ofvalue and wealth if calculatedcorrectly.Physical/AdaptiveNet realisable valueCapitalMaintenanceFair value/Exit valueEstimated proceedsfrom selling the asset,less all costs incurred inmarketing, selling anddistributing it tocustomers.The amount that awilling buyer and sellerare prepared toexchange for an it

Introduction to Financial Accounting . GENERAL NOTES People start businesses in order to earn a profit and gain wealth. The wealth of a business is determined by its capital, the net worth of the business which is also the residual claim the owner has over the entity’s assets. It is assumed that business owner’s want their entity’s, and therefore their wealth and profits to grow from .