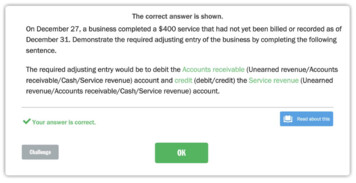

Transcription

Accounts ReceivableStudent ManualVantage/Vista Release 8.03.408Global business solutions for your expanding enterprise.

DISCLAIMERCopyright 2007 Epicor Software Corporation. All rights reserved. No part of this confidential copyrightedpublication may be reproduced or distributed in any form without the prior written consent of Epicor SoftwareCorporation.This document is for informational purposes only and is to subject to change without notice. The contents of thisdocument are believed to be current and accurate as of its date of publication. Epicor Software Corporation makesno representations or warranties, expressed or implied, with respect to the contents of this manual and specificallydisclaims any implied warranties of merchantability or fitness for any particular purpose.This document is considered Confidential Proprietary Information of Epicor Software Corporation. It shall not bedistributed in any way to any third party entity or person without the express prior written consent of EpicorSoftware Corporation.We welcome customer comments and reserve the right to revise this publication and/or make improvements orchanges to the products or programs described in this publication at any time, without notice.Epicor is a registered trademark of Epicor Software Corporation. All other trademarks, registered trademarks, names,or product names contained in this publication are the property of their respective owners and are acknowledgedherein.Item Code No. 10821-834-3048-584408Product No. ED807803408, Release 8.03.408Distribution: February 2008

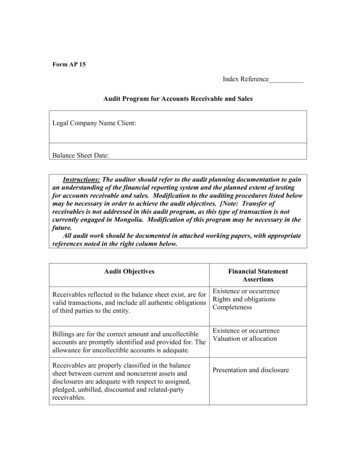

ContentsAccounts Receivable lication Setup11Company Configuration 12Workshop - Update the Accounts Receivable Module Configuration 16Maintenance Programs 17A/R Account 18Product Group 19Bank Account 21Work Force 24Terms 25Workshop - Create a Terms Record 27Freight on Board28Miscellaneous Charge 29Workshop - Add a Miscellaneous Charge Record 31Aging Report Format 32Customer 33Customer Detail Sheet 34Customer Billing Sheet 35Customer Ship To and Contact Sheets 39Workshop - Enter a New Customer Record 40Finance/Late Charge 42Develop a Finance Charge Code and Assign it to a Customer Record 44Accounts Receivable Sales Tax 46Sales Tax Category 47Sales Tax 48Tax Regions 51Link Tax Regions and Categories 52Delegate a Tax Region to a Customer 54Accounts Receivable Student Manual iii

ContentsAR Processes55Invoice Entry Process 56Advance Billing Invoices 58Workshop - Create Advance Billing Invoices for an Existing Sales Order 59Deposit Invoices 61Workshop - Enter a Deposit Invoice 62Advance Billing/Deposit Balance Report 63Workshop - View the Balance of Deposits and Advance Billings Made on Sales Orders64Order Tracker 65Workshop - Use the Order Tracker66Shipment Invoices 67Workshop - Ship a Customer's Order 68Workshop - Invoice a Shipment 69Credit Memos 72Workshop - Create Credit Memos 73Miscellaneous Invoices 75Workshop - Enter a Miscellaneous Invoice76Aged Receivables Report 78Workshop - Use the Aged Receivables Report 79Cash Receipt Process 80Invoice Payments 81Workshop - Apply Cash to Invoices 82Debit Notes 84Workshop - Add a Debit Note 85Deposit Payments 86Workshop - Create a Deposit Payment 87Miscellaneous Cash Payments 88Workshop - Enter a Miscellaneous Cash Payment 89Related Processes 90Process Finance/Late Charges 91Invoice Adjustments 92Workshop - Adjust an Open Invoice 93Apply Credit Memo 94Workshop - Apply a Credit Memo to an Open Invoice 95Customer Credit Manager 96Workshop - Use the Customer Credit Manager 97Credit Card Processing 99ivVantage/Vista Release 8.03.404

ContentsAdditional Reports and Trackers101Reports 102Trackers 103Workshop - Use the Invoice Tracker to Review Current Information About an Invoice 105Workshop - Use the Cash Receipts Tracker 106Course ConclusionAppendix109111AR Processing Tips 112Period-End Close Suggestions 113AR Transaction Hierarchy - Inventory Interfaced 114Accounts Receivable Student Manualv

ContentsviVantage/Vista Release 8.03.404

Accounts Receivable CourseWelcome to the Accounts Receivable course.This course is designed to review the Accounts Receivable (AR) module's concepts and reporting tools. Topicsof discussion include maintenance program setup, various AR processes and how to recognize the impact theseprocesses have on the General Ledger. Included are hands-on workshops to guide you through these topics.Accounts Receivable Student Manual1

2Vantage/Vista Release 8.03.404

PrerequisitesIn order to successfully complete this course, the following prerequisites must be met:1.Recommended Audience Controllers Accounts Receivable Staff2.Required Course: NavigationNavigation introduces you to the navigational aspects of the user interface. Designed for a “hands-onenvironment," the focus is on general navigation principles and techniques available at each level youinterface with the application. Workshops guide you through each navigational principle introduced.3.Required Course: System FlowSystem Flow introduces you to a basic quote to cash scenario including the basic processes necessary fromthe customer quote through the system to final cash receipts and payment of supplier invoices. This courseemphasizes the series of processes in the program that make up the quote to cash scenario. Bear in mind,this course uses a very simple scenario to highlight the various transactions.4.Recommended Course: Financial FoundationsThe Financial Foundations course introduces you to the building blocks that make up the financial foundationsof a company. It emphasizes the importance of understanding the key maintenance program configurationsteps required when establishing the groundwork for the financial setup of a company. Demonstrationsguide you through each maintenance program introduced.Accounts Receivable Student Manual3

4Vantage/Vista Release 8.03.404

SetupTo successfully complete this course, the 8.03.400 release (or later) must be installed and operational in a trainingenvironment.The workshops included in the Accounts Receivable course must be completed in a training environment usingthe Education database's Minneapolis company (VN10T). You may need to contact your manager for assistanceif this environment is unaccessible to you.Accounts Receivable Student Manual5

6Vantage/Vista Release 8.03.404

ObjectivesThe following objectives will be met upon successful completion of this course: Identify the company configuration and maintenance programs related to the AR processing cycle. Follow the process and transaction flow for the AR cycle. Differentiate between the seven types of AR invoices. Use debit notes, miscellaneous and deposit cash receipts appropriately. Understand the proper times to create and use AR Adjustments. Trace the AR hierarchy and flow of system-generated general ledger (GL) transactions. Recognize documents, reports and records necessary for tracking the AR cycle. Document period-end close procedures.Accounts Receivable Student Manual7

8Vantage/Vista Release 8.03.404

OverviewKey Concepts of Accounts Receivable Processing In an interfaced environment, AR and sales-related General Ledger accounts can be defined in severalmaintenance programs. Hierarchical logic is used to retrieve the correct account. Optional use of an AR Clearing account controls the timing of Cost of Sales posting. Invoices and cash receipts are posted to the GL using a group posting methodology.Typical Sales Order to Payment Process Flow1.Process a sales order2.Ship goods3.Invoice the customer4.Receive paymentAccounts Receivable Student Manual9

10Vantage/Vista Release 8.03.404

Application SetupThe Application Setup section of this course reviews the key company and maintenance program configurationfactors applicable to the Accounts Receivable Cycle. Not all programs and fields that contribute to every ARprocess are reviewed and/or discussed in this course. After completing this course, if you would still like tolearn more about programs and/or fields that were not mentioned, please visit your Manufacturing Software'sOnline Help application. All programs, fields and operations relating to every module contained within yourManufacturing Software are documented and defined within the Online Help application.Accounts Receivable Student Manual 11

Application SetupCompany ConfigurationMenu Path - System Management / Company Maintenance / CompanyThe Accounts Receivable Cycle relies greatly on certain configurations made within the Company Maintenanceprogram. The following information helps you to identify some essential items to define during theimplementation of your company's AR module.Accounts Receivable ConfigurationAccounts Receivable Default AccountMost general ledger accounts you select in the Company Maintenance program to populate the multipleaccount fields related to the AR cycle can also be defined somewhere else within your product. These placesinclude Product Groups, Customers, and alternate AR Accounts.The reason you must configure a default set of AR related accounts is because if an AR transaction posts,but the AR hierarchy can not find another maintenance program that contains an account to debit or creditfor that transaction, the accounts you define on this sheet are there to catch the data.Receivables, Pre-Payment, Unapplied Cash, Deferred Revenue, Payment Discount AccountsThese fields represent the default AR accounts to be used if no other AR account record(s)are definedin the AR module or linked to customers. AR accounts are typically defined here unless your internalbusiness processes require customer-specific AR accounts or inter-company AR accounts for specificcustomers.ReceivablesEnter the default GL account number for the majority of your company's receivables.PrepaymentsDown payment, or deposit invoices, entered in the Invoice Entry program use thisaccount to offset the Cash account. Deposit payments entered in the Cash Receipt Entryprogram use this account to offset the Receivables account.Unapplied CashIf cash receipts are entered and not applied to an AR invoice, this default GL accountnumber is used as the offset to cash.Payment DiscountIf discounts for early customer payments are allowed, this default account number isused during entry of cash receipts.AR Clearing AccountThis optional field is an intermediary account between WIP/Inventory and COS for goods that have beenshipped but not yet invoiced. If an AR Clearing account is identified here, cost dollars are directed to thisaccount at the time of shipment. After the shipment is invoiced and posted and the Capture COS/WIPActivity is run, the cost dollars are moved from the Clearing account to COS. If no account is entered here,12Vantage/Vista Release 8.03.404

Company Configurationcost dollars are moved directly to COS when running the Capture COS/WIP Activity function. Only oneAR Clearing account can be defined per company.Do not enter an account number here if it is preferred to have COS booked at time of shipmentrather than time of invoicing.RebatesThe account defined here is used when posting Rebates in the AR Invoice module. If you would like to learnmore about rebates and their process flow, it is recommended that you sign up for the Rebates, Promotionsand Royalties course at your convenience.Sales, Returns, Sales Discount AccountsAccounts defined here are hit with Debits and Credits if no other accounts are defined within the A/RAccount Maintenance program or on a product group linked to an applicable part. If you choose to defineproduct-specific Revenue and Expense accounts on a product group, the account numbers you wouldtypically elect to enter here are Suspense Accounts.SalesEnter the most common GL account number to contain your company's sales/revenue amounts.ReturnsEnter the most common GL account number for your company's returns and allowances. Whenentering a credit memo, this account offsets receivables account. If you prefer not to keep a separateReturns account for credit memos, you have the option to enter the Sales account here instead of aseperate returns account.Sales DiscountsEnter the most common GL account number for your company's sales discounts.Starting Invoice NumberDuring initial implementation, you must enter a starting invoice number. The number you enter representsthe first consecutive invoice number assigned during invoicing. The number you add must be higher thanany invoice previously entered via the Open Invoice Load process.Sales Tax Calculation OptionsYou have the option to decide and define how you would like sales tax to calculate on your company's ARInvoices. Your choices include, (Per Line) or (Per Invoice). If the former is selected, taxes are calculatedbased on each individual line entered on all invoices. The latter basis its calculation on the invoice's totalamount. The selection you make here is the default calculation for invoice taxes, but it can be changed ifever your company's needs change.Depending upon the option you select, the sales tax amounts will display differently on the AR Invoiceform. If you select Per Line, the line sales tax is displayed with each invoice detail line. If you select PerInvoice, the sales taxes will be totaled and displayed with the final totals on the invoice.Ready to Calculate CheckboxAccounts Receivable Student Manual 13

Application SetupIf this checkbox is available to enable in the AR module configuration, this means that your companyis licensed with Tax Connect, a program that calculates taxes automatically with the help of a thirdparty. If this checkbox is disabled, it holds no value to your company's AR process cycle.If enabled and selected, the Ready to Calculate checkbox located on all AR Invoice summary sheetsalways defaults in as checked. If Tax Connect is licensed to your company, invoices are only ableto post if the Ready to Calculate checkbox is turned on. This is because the checkbox tells the systemthat the invoice is ready to have its totals calculated by the third party and accurately posted. If youchoose to leave the Ready to Calculate checkbox unchecked in the company maintenance program,you must check the box on each AR invoice summary sheet before you attempt to post.Journal CodesJournal Codes match similar transactions together. They are used each time you post transactions to theGeneral Ledger. Journal Codes identify the source of each journal entry and aid in tracking entries to theiroriginal source on reports and trackers.Ten journal codes are delivered with your Manufacturing Software, including the Sales Journal (SJ) codeand the Adjustment Journal (AJ) code. These codes often populate the following default fields:InvoicingSelect the journal code that will describe your company's AR Invoice related postings to the GL.Adj./Apply CMSelect the journal code that will illustrate your company's invoice adjustments created within theAR Adjustments program and record each time a credit memo is applied to an invoice within theApply Credit Memo program.Journal codes are maintained in the GL module.Use Shipment Date for Invoice DateIf you checkmark the Use Ship Date for Invoice Date check box, it indicates that the Invoice date shouldalways reflect the shipment date of the order being invoiced. If that is your company's normal practice, thisbox should be marked. You can adjust the invoice date on an individual basis for any exceptions to the rule.This can be done on an invoice's header prior to its posting.Default Aging Report FormatYou are able to define multiple formats for Aging Reports within the AR Module. Having this option givesyou a chance to define different aging buckets for different reporting purposes. The format you enter in thisfield is what defaults when you execute the Aged Receivables report.You may define standard aging buckets for month-end reporting (30 days, 60 days, 90 days, 120days) and weekly aging buckets for analysis purposes.Sales Order ConfigurationAlthough the majority of AR-related settings are defined within the Finance sheet, some settings which affectAR are listed below.14Vantage/Vista Release 8.03.404

Company ConfigurationCredit Limit ActionsIf a customer has exceeded their established credit limit, these actions can be used to warn or stop salesorders and/or shipments from occurring.Counter Sales OrdersInvoice Group PrefixCounter sales automatically create invoice and AR invoice groups from the sales being processed.The AR invoice group ID that is created uses the prefix defined here followed by the current monthand day.Credit Card PaymentsCash Group PrefixWhen a Sales Order is paid by a Credit Card, the prefix entered in this field allows you to identifythe cash group that was created automatically at the time of shipment, which is the same time aswhen the payment was processed against the order.Invoice Group PrefixIn addition to a cash group being created at the time a credit card order is shipped, an invoice recordis also created to record the transaction. The prefix entered in this field allows you to identify andtrack the invoice group which was created by the transaction.Default Bank AccountThe bank account automatically used for any credit card transactions processed in the Order Entryprogram.Accounts Receivable Student Manual 15

Application SetupWorkshop - Update the Accounts Receivable ModuleConfiguration1.Navigate to the Company Maintenance Program using the following pathMenu Path - System Management / Company Maintenance / Company2.Update the Accounts Receivable Module's Settings2.1.Click on the Finance sheet.2.2.Click on the Accounts Receivable sheet.2.3.If it isn't already, enable the Ready to Calculate calculate check boxThe Ready to Calculate check box is related to a third party software available to customers knownas Tax Connect. Because our testing database has Tax Connect installed, this check box must beenabled to prevent additional steps that would have to be taken in order to process many transactionsin the Accounts Receivable module.16Vantage/Vista Release 8.03.404

Maintenance ProgramsMaintenance ProgramsIn this section of the Accounts Receivable course, review the most significant maintenance programs applicableto the AR processing cycle. In most cases, not all of the fields within each program are described, but if you areinterested in learning more, they are fully defined in the Online Help application.Accounts Receivable Student Manual 17

Application SetupA/R AccountMenu Path - Financial Management / Accounts Receivable / Setup / A/R AccountAR Trade and Revenue related accounts may be defined for specific customers or groups of customers andlinked to specified Customer maintenance programs. Used in conjunction with product groups (Expense/COSand WIP), part classes (Inventory), and/or specified AP Trade accounts, you can potentially create an entire setof financial statements for an indicated customer or business unit.By enabling the Inter-Company check box, unique COS accounts for inter-company eliminations may also bedefined.All account number fields in this screen must be populated, however, you may choose to repeat thedefaulted accounts defined in the Company Maintenance program.18Vantage/Vista Release 8.03.404

Product GroupProduct GroupMenu Path - Financial Management / Accounts Receivable / Setup / Product GroupProduct groups are used to classify the different types of parts sold. These classifications are used for GL andsales analysis purposes.Product groups can be defined in conjunction with business practices and could ultimately impact large portionsof the chart of accounts (COA).Use the Product Group Maintenance Accounts sheet to establish specific General Ledger accounts for eachproduct group. You can enter general accounts, accounts used for cost of sales (COS), and accounts for worksin process (WIP).Examples of Product Group Definitions:

Epicor Software Corporation makes no representations or warranties, expressed or implied, with respect to the contents of this manual and specifically . In an interfaced environment, AR and sales-related General Ledger accounts can be defined in several maintenance programs. Hi