Transcription

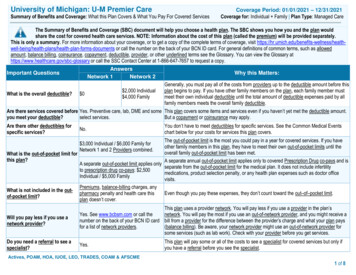

University of Michigan: U-M Premier CareSummary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered ServicesCoverage Period: 01/01/2021 – 12/31/2021Coverage for: Individual Family Plan Type: Managed CareThe Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan wouldshare the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately.This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, visit being/health-plans/health-plan-forms-documents or call the number on the back of your BCN ID card. For general definitions of common terms, such as allowedamount, balance billing, coinsurance, copayment, deductible, provider, or other underlined terms see the Glossary. You can view the Glossary athttps://www.healthcare.gov/sbc-glossary or call the SSC Contact Center at 1-866-647-7657 to request a copy.AnswersNetwork 1Network 2Important QuestionsWhy this Matters:Generally, you must pay all of the costs from providers up to the deductible amount before this 2,000 Individualplan begins to pay. If you have other family members on the plan, each family member mustWhat is the overall deductible? 0 4,000 Familymeet their own individual deductible until the total amount of deductible expenses paid by allfamily members meets the overall family deductible.Are there services covered before Yes. Preventive care, lab, DME and some This plan covers some items and services even if you haven’t yet met the deductible amount.you meet your deductible?select services.But a copayment or coinsurance may apply.Are there other deductibles forspecific services?No.You don’t have to meet deductibles for specific services. See the Common Medical Eventschart below for your costs for services this plan covers.The out-of-pocket limit is the most you could pay in a year for covered services. If you haveother family members in this plan, they have to meet their own out-of-pocket limits until theoverall family out-of-pocket limit has been met.What is the out-of-pocket limit forthis plan?A separate annual out-of-pocket limit applies only to covered Prescription Drug co-pays and isA separate out-of-pocket limit applies onlyseparate from the out-of-pocket limit for the medical plan. It does not include infertilityto prescription drug co-pays: 2,500medications, product selection penalty, or any health plan expenses such as doctor officeIndividual / 5,000 Familyvisits.Premiums, balance-billing charges, anyWhat is not included in the outEven though you pay these expenses, they don’t count toward the out–of–pocket limit.pharmacy penalty and health care thisof-pocket limit?plan doesn’t cover. 3,000 Individual / 6,000 Family forNetwork 1 and 2 Providers combined.Will you pay less if you use anetwork provider?This plan uses a provider network. You will pay less if you use a provider in the plan’sYes. See www.bcbsm.com or call thenetwork. You will pay the most if you use an out-of-network provider, and you might receive anumber on the back of your BCN ID card bill from a provider for the difference between the provider’s charge and what your plan paysfor a list of network providers.(balance billing). Be aware, your network provider might use an out-of-network provider forsome services (such as lab work). Check with your provider before you get services.Do you need a referral to see aspecialist?Yes.This plan will pay some or all of the costs to see a specialist for covered services but only ifyou have a referral before you see the specialist.Actives, POAM, HOA, IUOE, LEO, TRADES, COAM & AFSCME1 of 8

All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.CommonMedical EventServices You MayNeedPrimary care visit totreat an injury or illnessSpecialist visitIf you visit a health careprovider’s office orclinicOther practitioner agnostic test (x-ray,blood work)What You Will PayNetwork 1 Provider 25 copay/visit 30 copay/visitNot coveredCovered at 100% afterdeductible. Requires areferral from a Network 1Provider.Covered at 100% afterdeductible. Requires areferral from a Network 1Provider.Not coveredNo chargeNo chargeNo chargeCovered at 100% afterdeductible (seeexceptions.) Requires areferral from a Network 1Provider.No chargeCovered at 100% afterdeductible (seeexceptions.) Requires areferral from a Network 1Provider.If you have a testImaging (CT/PETscans, MRIs)Network 2 ProviderOut-of-NetworkProviderLimitations, Exceptions & OtherImportant InformationNot coveredNot coveredReferral required.Not coveredAcupuncture not covered. Chiropracticcare is not covered.Not coveredYou may have to pay for services thataren’t preventive. Ask your provider ifthe services you need are preventive.Then check what your plan will payfor.Not coveredMay require prior authorization. Note:Deductible does not apply to some labservices when provided by a Network2 Provider. Check with plan.Not coveredMay require prior authorization. Note:Deductible does not apply to someselect services when provided by aNetwork 2 Provider. Check with plan.2 of 8

Common Medical EventServices You May NeedGeneric drugsIf you need drugs to treatyour illness or conditionPreferred brand drugsNOTE: Magellan RXManagement administersthe University of MichiganPrescription Drug Plan.NoviXus PharmacyServices administers mailorder services.Non-preferred brand drugsMore information aboutprescription drug coverageis available athr.umich.edu/prescriptiondrug-plan.*Specialty drugsWhat You Will PayLimitations, Exceptions, & Other ImportantIn-Network ProviderOut-of-Network ProviderInformation(You will pay the least)(You will pay the most)Retail co-pay:- You will have to pay the- You may purchase up to 90 day supplies 10 (1-34 day supply)full cost of the drug andof medication from NoviXus mail order ora retail pharmacy. 20 (35-60 day supply)file a claim with MagellanRX for reimbursement. 30 (61-90 day supply)- Prescriptions cannot be refilled beforeMail order co-pay:75% use.- Claims must be filed 20 (61-90 day supply)within 90 days of fill.- Some drugs are subject to quantity limits.Specialty Drug* co-pay:- Non-network- Certain drugs and supplies are excluded 10 (1-34 day supply)reimbursement is limitedfrom the plan or require priorRetail co-pay:to a 34-day supply.authorization. 20 (1-34 day supply)- You will be reimbursed- Coverage is available for a select list of 40 (35-60 day supply)based on the contractedself-administered fertility agents (oral and 60 (61-90 day supply)price that a participatinginjectable) subject to a maximum of fiveMail order co-pay:pharmacy would chargeprescription fills per eligible family per 40 (61-90 day supply)for the same drug, minuslifetime.Specialty Drug* co-pay:your co-pay amount.- 0 co-pay for select insulin and 20 (1-34 day supply)preventive medications in complianceRetail co-pay:with the Affordable Care Act. Listing 45 (1-34 day supply)available at: hr.umich.edu/zero-copay 90 (35-60 day supply)drug-list 135 (61-90 day supply)Mail order co-pay: 90 (61-90 day supply)Specialty Drug* co-pay: 45 (1-34 day supply)Medications indicated asSpecialty drugs are limitedSpecialty on the U-Mto 34 day supplies.Prescription Drug PlanException: a 90-day supplyFormulary will only beis allowed forcovered when filled at aimmunosuppressives anddesignated Specialtyantiretroviral medications.pharmacy.hr.umich.edu/formulary3 of 8

CommonMedical EventIf you haveoutpatient surgeryIf you needimmediate medicalattentionServices You MayNeedWhat You Will PayNetwork 1 ProviderFacility fee (e.g.,ambulatory surgerycenter)No chargePhysician/surgeon feesNo chargeEmergency roomservicesEmergency medicaltransportationUrgent careFacility fee (e.g.,hospital room)Covered at 100% afterdeductible. Requires areferral from a Network 1Provider.Covered at 100% afterdeductible. Requires areferral from a Network 1Provider.Limitations, Exceptions & OtherImportant InformationNot coveredMay require prior authorization.Not coveredMay require prior authorization. 100 co-pay 100 co-pay 100 co-payCo-pay waived if admitted.No chargeNo chargeNo chargeNon-emergency transport is notcovered. 25 co-pay / visit 25 co-pay 25 co-payNo chargeCovered at 100% afterdeductible. Requires areferral from a Network 1Provider.If you have ahospital stayIf you need mentalhealth, behavioralhealth, or substanceabuse servicesNetwork 2 ProviderOut-of-NetworkProviderPhysician/surgeon feeNo chargeOutpatient services 25 co-pay/visitInpatient servicesNo chargePrenatal and postnatalcareNo chargeDelivery and allinpatient servicesNo chargeIf you are pregnantCovered at 100% afterdeductible. Requires areferral from a Network 1Provider.Covered at 100% afterdeductibleCovered at 100% afterdeductiblePrenatal visit: No chargePostnatal visit: Covered at100% after deductible andrequires a referral from aNetwork 1 Provider.Covered at 100% afterdeductible. Requires areferral from a Network 1Provider.Not coveredRequires prior authorization; 1,000co-pay for all fees associated withweight reduction procedure forNetwork 1 Providers. Weightreduction is not covered for Network2 Providers.Not coveredSame as Facility fee (e.g., hospitalroom) for hospital stay noted above.Not coveredRequires prior authorization.Not coveredRequires prior authorization.Not coveredNot coveredRequires prior authorization.4 of 8

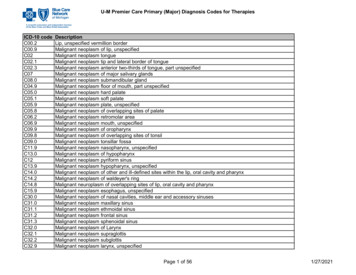

CommonMedical EventServices You MayNeedHome health careNetwork 1 ProviderNo chargeRehabilitation services 25 co-pay/visitHabilitation services 25 co-pay forphysicians, AppliedBehavioral Analysis(ABA), Physical,Occupational andSpeech therapySkilled nursing careNo chargeDurable medicalequipmentNo chargeHospice serviceNo chargeEye examNo chargeGlassesDental check-upNot coveredNot coveredIf you need helprecovering or haveother special healthneedsIf your child needsdental or eye careWhat You Will PayNetwork 2 ProviderCovered at 100% afterdeductible. Requires areferral from a Network 1Provider.Covered at 100% afterdeductible. Requires areferral from a Network 1Provider.Covered at 100% afterdeductible for AppliedBehavioral Analysis (ABA);Physical, Speech andOccupational Therapy.Requires a referral from aNetwork 1 Provider.Covered at 100% afterdeductible. Requires areferral from a Network 1Provider.Covered in full. Requires areferral from a Network 1Provider.Covered at 100% afterdeductible, Requires areferral from a Network 1Provider.Covered up to 40 perexamNot coveredNot coveredOut-of-NetworkProviderLimitations, Exceptions & OtherImportant InformationNot coveredServices must be provided by a BCNparticipating home health careagency.Not coveredRequires prior authorization.Physical, Occupational, Speechtherapy is limited to a combinedmaximum of 60 visits per episode percalendar year for Major Diagnoses;15 visits per episode per calendaryear for Minor Diagnoses.Not coveredRequires prior authorization.Treatment of Applied BehavioralAnalysis (ABA) for Autism throughage 18.ABA services not available outside ofMichigan.Not coveredRequires prior authorization. Limitedto a maximum of 120 days permember per calendar year.Not coveredRequires prior authorizationNot coveredRequires prior authorization.Covered up to 40per examNot coveredNot coveredLimited to one routine eye exam percalendar year.5 of 8

Excluded Services & Other Covered Services:Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services.) Acupuncture treatment Glasses Private-duty nursing Chiropractic care Long term care Routine foot care Cosmetic surgery Weight loss programs Dental care (Adult)Non-emergency care when traveling outside ofthe U.S.Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.) Bariatric surgery Hearing aids Habilitation Infertility treatment Routine eye care6 of 8

Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for those agencies is:Department of Labor’s Employee Benefits Security Administration at 1-866-444-3272 or www.dol.gov/ebsa/healthreform, or the Department of Health and Human Services,Center for Consumer Information and Human Services, Center for Consumer Information and Insurance Oversight, at 1-877-267-2323 x61565 or www.cciio.cms.gov or bycalling the number on the back of your BCBSM ID card. Other coverage options may be available to you too, including buying individual insurance coverage through theHealth Insurance Marketplace. For more information about the Marketplace, visit www.HealthCare.gov or call 1-800-318-2596.Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is called a grievanceor appeal. For more information about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan documents also provide completeinformation to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, or assistance, contact Blue Cross andBlue Shield of Michigan by calling the number on the back of your BCN ID card.Additionally, a consumer assistance program can help you file your appeal. Contact the Michigan Health Insurance Consumer Assistance Program (HICAP) Department ofInsurance and Financial Services, P. O. Box 30220, Lansing, MI 48909-7720 or http://www.michigan.gov/difs or difs-HICAP@michigan.govDoes this plan provide Minimum Essential Coverage? YesMinimum Essential Coverage generally includes plans, health insurance available through the Marketplace or other individual market policies, Medicare, Medicaid, CHIP,TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage, you may not be eligible for the premium tax credit.Does this plan meet the Minimum Value Standards? YesIf your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace.Language Access Services:For assistance in a language below please call the number on the back of your BCN ID card.SPANISH (Español): Para ayuda en español, llame al número de servicio al cliente que se encuentra en este aviso ó en el reverso de su tarjeta de identificación.TAGALOG (Tagalog): Para sa tulong sa wikang Tagalog, mangyaring tumawag sa numero ng serbisyo sa mamimili na nakalagay sa likod ng iyong pagkakakilanlan kard osa paunawang ito.CHINESE (中文): ��NAVAJO (Dine): Taa’dineji’keego shii’kaa’ahdool’wool ninizin’goo, beesh behane’e naal’tsoos bikii sin’dahiigii binii’deehgo eeh’doodago di’naaltsoo bikaiigii ��–––––––––––To see examples of how this plan might cover costs for a sample medical situation, see the next section. �–––––7 of 8

About these Coverage Examples:This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will be differentdepending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost sharing amounts (deductibles,copayments and coinsurance) and excluded services under the plan. Use this information to compare the portion of costs you might pay under differenthealth plans. Please note these coverage examples are based on self-only coverage. Peg is Having a Baby 0 30 0 0This EXAMPLE event includes services like:Specialist office visits (prenatal care)Childbirth/Delivery Professional ServicesChildbirth/Delivery Facility ServicesDiagnostic tests (ultrasounds and blood work)Specialist visit (anesthesia)Total Example Cost 17,800In this example, Peg would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Peg would pay isMia’s Simple Fracture(a year of routine in-network care ofa well-controlled condition)(9 months of in-network pre-natal careand a hospital delivery) The plan’s overall deductible Specialist copayment Hospital (facility) copayment Other copaymentManaging Joe’s Type 2 Diabetes 0 70 0 0 70(in-network emergency room visit andfollow up care) The plan’s overall deductible Specialist copayment Hospital (facility) copayment Other copayment 0 30 0 0This EXAMPLE event includes services like:Primary care physician office visits (includingdisease education)Diagnostic tests (blood work)Prescription drugsDurable medical equipment (glucose meter)Total Example CostIn this example, Joe would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Joe would pay is 5,600 0 800 0 0 800 The plan’s overall deductible Specialist copayment Hospital (facility) copayment Other copayment 0 30 0 0This EXAMPLE event includes services like:Emergency room care (including medicalsupplies)Diagnostic tests (x-ray)Durable medical equipment (crutches)Rehabilitation services (physical therapy)Total Example CostIn this example, Mia would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Mia would pay is 2,800 0 210 0 0 210The plan would be responsible for the other costs of these EXAMPLE covered services.8 of 8

U-M Premier Care Coverage Period: 01/01/2021 – 12/31 . Services must be provided by a BCN participating home health care agency. Rehabilitation services 25 co-pay/visit Covered at 100% after deductible. R