Transcription

Summary ofBenefits2021Ascension Complete St. Vincent's Secure (HMO) H8225: 003Baker, Clay, Duval and Nassau counties, FLH8225 003 21 19017SB M Accepted 09012020

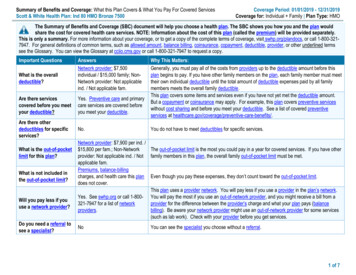

This booklet provides you with a summary of what we cover and the cost-sharingresponsibilities. It doesn’t list every service that we cover or list every limitation orexclusion. To get a complete list of services we cover, please call us at the numberlisted on the last page, and ask for the “Evidence of Coverage” (EOC), or you mayaccess the EOC on our website at http://www.ascensioncomplete.com.You are eligible to enroll in Ascension Complete St. Vincent’s Secure (HMO) if: You are entitled to Medicare Part A and enrolled in Medicare Part B. Membersmust continue to pay their Medicare Part B premium if not otherwise paid for underMedicaid or by another third party. You must be a United States citizen, or are lawfully present in the United States andpermanently reside in the service area of the plan (in other words, your permanentresidence is within the Ascension Complete St. Vincent’s Secure (HMO) service areacounties). Our service area includes the following counties in Florida: Baker, Clay,Duval and Nassau.The Ascension Complete St. Vincent’s Secure (HMO) plan gives you access to ournetwork of highly skilled medical providers in your area. You can look forward tochoosing a Primary Care Physician (PCP) to work with you and coordinate your care.You can ask for a current provider and pharmacy directory or, for an up-to-date list ofnetwork providers, visit http://www.ascensioncomplete.com. (Please note that, exceptfor emergency care, urgently needed care when you are out of the network, out-of-areadialysis services, and cases in which our plan authorizes use of out-of-networkproviders, if you obtain medical care from out-of-plan providers, neither Medicare norAscension Complete St. Vincent’s Secure (HMO) will be responsible for the costs.)This Ascension Complete St. Vincent’s Secure (HMO) plan also includes Part Dcoverage, which provides you with the ease of having both your medical andprescription drug needs coordinated through a single convenient source.

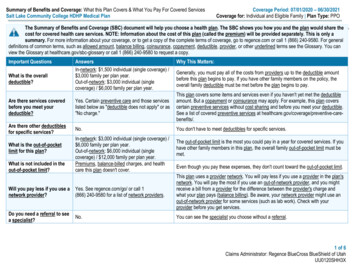

Summary of BenefitsJanuary 1, 2021 – December 31, 2021BenefitsAscension Complete St. Vincent's Secure (HMO)H8225: 003Premiums / Copays / CoinsuranceMonthly Plan Premium 0You must continue to pay your Medicare Part B premium.DeductiblesNo deductibleMaximum Out-of-Pocket 3,450 annuallyResponsibilityThis is the most you will pay in copays and coinsurance for(does not includecovered medical services for the year.prescription drugs)Inpatient HospitalCoverage*For each admission, you pay: 250 copay per day, for days 1 through 6 0 copay per day, for days 7 and beyondOutpatient HospitalCoverage* Outpatient Hospital: 200 copay per visitDoctor Visits (PrimaryCare Providers andSpecialists) Primary Care: 0 copay per visitPreventive Care 0 copay for most Medicare-covered preventive services(e.g. flu vaccine,diabetic screening)Other preventive services are available.Emergency Care 120 copay per visit Observation Services: 250 copay per visit Specialist: 25 copay per visitYou do not have to pay the copay if admitted to the hospitalimmediately.Services with an * (asterisk) may require prior authorization from your doctor.

BenefitsAscension Complete St. Vincent's Secure (HMO)H8225: 003Premiums / Copays / CoinsuranceUrgently NeededServices 25 copay per visitCopay is not waived if admitted to hospital.Diagnostic Services/Labs/Imaging*(includes diagnostictests and procedures,labs, diagnosticradiology, and X-rays)COVID-19 testing and specified testing-related services atany location are 0 Lab services: 0 copay Diagnostic tests and procedures: 0 copay Outpatient X-ray services: 0 copay Diagnostic Radiology Services (such as, MRI, MRA, CT,PET): 150 copayHearing Services Hearing exam (Medicare-covered): 25 copay Routine hearing exam: 0 copay (1 every calendar year) Hearing aid: 0 to 1,350 copay (2 hearing aids total, 1 perear, per calendar year)Dental Services Dental services (Medicare-covered): 25 copay per visit Preventive Dental Services: 0 copay (including oralexams, cleanings, fluoride treatment, and X-rays)Comprehensive dental services: Additional comprehensivedental benefits are available.There is a maximum allowance of 2,000 every calendaryear; it applies to all comprehensive dental benefits.Vision Services Vision exam (Medicare-covered): 0 to 25 copay pervisit Routine eye exam: 0 copay per visit (up to 1 everycalendar year) Routine eyewear: up to 250 allowance every calendaryearServices with an * (asterisk) may require prior authorization from your doctor.

BenefitsAscension Complete St. Vincent's Secure (HMO)H8225: 003Premiums / Copays / CoinsuranceMental Health Services Individual and group therapy: 25 copay per visitSkilled Nursing Facility* For each benefit period, you pay: 0 copay per day, days 1 through 20 184 copay per day, days 21 through 100Physical Therapy* 25 copay per visitAmbulance 250 copay (per one-way trip) for ground or air ambulanceservicesAmbulatory SurgeryCenter*Ambulatory Surgery Center: 150 copay per visitTransportation 0 copay (per one-way trip) Up to 50 one-way trips to plan-approved health-relatedlocations every calendar year. Mileage limits may apply.Medicare Part B Drugs* Chemotherapy drugs: 20% coinsurance Other Part B drugs: 20% coinsuranceServices with an * (asterisk) may require prior authorization from your doctor.

Part D Prescription DrugsDeductible StageThis plan does not have a Part D deductible.Initial Coverage StageAfter you have met your deductible (if applicable), the planpays its share of the cost of your drugs and you pay yourshare of the cost. You generally stay in this stage until theamount of your year-to-date “total drug costs” reaches 4,130. “Total drug costs” is the total of all payments madefor your covered Part D drugs. It includes what the plan paysand what you pay. Once your “total drug costs” reach 4,130 you move to the next payment stage (Coverage GapStage).(after you pay yourPart D deductible, ifapplicable)Standard RetailRx 30-day supplyMail OrderRx 90-day supplyTier 1: Preferred GenericDrugs 0 copay 0 copayTier 2: Generic Drugs 8 copay 16 copayTier 3: Preferred BrandDrugs 47 copay 141 copayTier 4: Non-PreferredDrugs 100 copay 300 copay33% coinsuranceNot available 0 copay 0 copayTier 5: SpecialtyTier 6: Select Care Drugs

Part D Prescription DrugsCoverage Gap StageDuring this payment stage, you receive a 70%manufacturer’s discount on covered brand-name drugs andthe plan will cover another 5%, so you will pay 25% of thenegotiated price and a portion of the dispensing fee onbrand-name drugs. In addition, the plan will pay 75% andyou pay 25% for generic drugs. (The amount paid by theplan does not count towards your out-of-pocket costs).You generally stay in this stage until the amount of youryear-to-date “out-of-pocket costs” reaches 6,550. “Out ofpocket costs” includes what you pay when you fill or refill aprescription for a covered Part D drug and payments madefor your drugs by any of the following programs ororganizations: “Extra Help” from Medicare; Medicare’sCoverage Gap Discount Program; Indian Health Service;AIDS drug assistance programs; most charities; and mostState Pharmaceutical Assistance Programs (SPAPs). Onceyour “out-of-pocket costs” reach 6,550, you move to thenext payment stage (Catastrophic Coverage Stage).Catastrophic CoverageStageDuring this payment stage, the plan pays most of the costfor your covered drugs. For each prescription, you paywhichever of these is greater: a payment equal to 5%coinsurance of the drug, or a copayment ( 3.70 for a genericdrug or a drug that is treated like a generic, 9.20 for allother drugs).Important Info:Cost-sharing may change depending on the level of help youreceive, the pharmacy you choose (such as Standard Retail,Mail Order, Long-Term Care, or Home Infusion) and whenyou enter any of the four stages of the Part D benefit.For more information about the costs for Long-Term Supply,Home Infusion, or additional pharmacy-specific cost-sharingand the stages of the benefit, please call us or access ourEOC online.

Additional Covered BenefitsBenefitsAscension Complete St. Vincent's Secure (HMO)H8225: 003Premiums / Copays / CoinsuranceAdditional TelehealthServicesThe cost share of Medicare-covered additional telehealthservices with primary care physicians, specialists,individual/group sessions with mental health andpsychiatric providers and other health care practitionerswithin these practices will be equal to the cost share ofthese individual services’ office visits.Opioid TreatmentProgram Services Individual setting: 25 copay per visitOver-the-Counter(OTC) Items 0 copay ( 70 allowance per quarter) for items available viamail and at participating CVS retail Pharmacy locations. Group setting: 25 copay per visitThere is a limit of 9 per item, per order, with the exception ofcertain products, which have additional limits. You areallowed to order once per quarter and any unused moneydoes not carry over to the next quarter.Please visit the plan’s website to see the list of covered over the-counter items.You can also purchase OTC products at participating CVSlocations. Participating locations vary by area. Refer to theStore Locator link on cvs.com/otchs/ascensioncomplete fora list of participating locations.Meals 0 copayPlan covers home-delivered meals (up to 3 meals per day for14 days) following discharge from an inpatient facility orskilled nursing facility. Services are contingent on medicalnecessity and Case Management review and priorauthorization to the vendor.Chiropractic CareChiropractic services (Medicare-covered): 20 copay pervisitServices with an * (asterisk) may require prior authorization from your doctor.

Additional Covered BenefitsBenefitsAscension Complete St. Vincent's Secure (HMO)H8225: 003Premiums / Copays / CoinsuranceAcupuncture Acupuncture services for chronic low back pain(Medicare-covered): 20 copay per visit in a chiropracticsetting Acupuncture services for chronic low back pain(Medicare-covered): 0 copay per visit in a Primary CarePhysician's office Acupuncture services for chronic low back pain(Medicare-covered): 25 copay per visit in a Specialist'sofficeMedical Equipment/Supplies* Durable Medical Equipment (e.g., wheelchairs, oxygen):20% coinsurance Prosthetics (e.g., braces, artificial limbs):20% coinsurance Diabetic supplies: 0 copayFoot Care(Podiatry Services) Foot exams and treatment (Medicare-covered): 25 copay Routine foot care: 25 copay per visit (Unlimited visitsevery calendar year)Services with an * (asterisk) may require prior authorization from your doctor.

Additional Covered BenefitsBenefitsAscension Complete St. Vincent's Secure (HMO)H8225: 003Premiums / Copays / CoinsuranceVirtual VisitOur plan offers 24 hours per day, 7 days per week virtualaccess to board certified clinicians to help address a widevariety of health concerns/questions. A virtual visit is a visitwith a clinician via the internet using a smart phone or acomputer's web cam. For more information, or to schedulean appointment, visit ascensiononlinecare.org or downloadthe Ascension Online Care app available in the App Store orGoogle Play store.Spiritual CareThe health plan offers 24 hours per day, 365 days a yearvirtual visits and access to professionally trained chaplainsthrough the Ascension On Demand Spiritual Care program.Using the Ascension Online Care platform, members whoare experiencing spiritual and emotional concerns canconnect to a chaplain to help address their needs and findlight in challenging times.Wellness Programs Fitness program: 0 copay Clinical Care Line: 0 copay Supplemental smoking and tobacco use cessation(counseling to stop smoking or tobacco use): 0 copayFor a detailed list of wellness program benefits offered,please refer to the EOC.Services with an * (asterisk) may require prior authorization from your doctor.

Additional Covered BenefitsBenefitsAscension Complete St. Vincent's Secure (HMO)H8225: 003Premiums / Copays / CoinsuranceWorldwide EmergencyCare 50,000 plan coverage limit for urgent/emergent servicesoutside the U.S. and its territories every calendar year.Routine Annual Exam 0 CopayServices with an * (asterisk) may require prior authorization from your doctor.

For more information, please contact:Ascension Complete St. Vincent’s Secure (HMO)PO Box 10420Van Nuys, CA 91410http://www.ascensioncomplete.comCurrent members should call: 1-833-603-2971 (TTY: 711)Prospective members should call: 1-877-831-9406 (TTY: 711)From October 1 to March 31, you can call us 7 days a week from 8 a.m. to 8 p.m. FromApril 1 to September 30, you can call us Monday through Friday from 8 a.m. to 8 p.m. Amessaging system is used after hours, weekends, and on federal holidays.If you want to know more about the coverage and costs of Original Medicare, look inyour current “Medicare & You” handbook. View it online at www.medicare.gov or get acopy by calling 1-800-MEDICARE (1-800-633-4227), 24 hours a day, 7 days a week.TTY users should call 1-877-486-2048.This information is not a complete description of benefits.Call 1-833-603-2971 (TTY: 711) for more information.“Coinsurance” is the percentage you pay of the total cost of certain medical and/orprescription drug services.The Formulary, pharmacy network, and/or provider network may change at any time.You will receive notice when necessary.This document is available in other formats such as Braille, large print or audio.Ascension Complete is contracted with Medicare for HMO plans. Enrollment inAscension Complete depends on contract renewal.SBS041107EK00 (6/20)

Baker, Clay, Duval and Nassau counties, FL H8225_003_21_19017SB_M_Accepted 09012020 . This booklet provides you with a summary of what we cover and the cost-sharing responsibilities. It doesn’t li st every service that we cover or list every limitation or .