Transcription

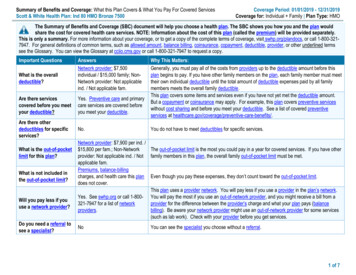

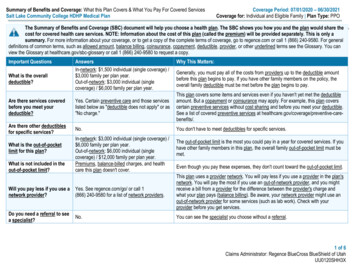

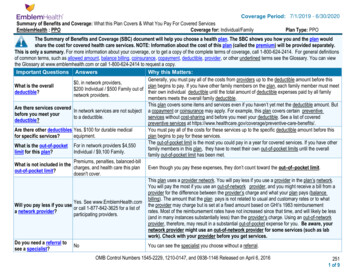

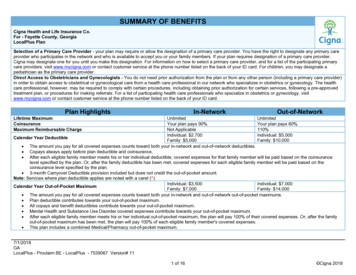

SUMMARY OF BENEFITSCigna Health and Life Insurance Co.For - Fayette County, GeorgiaLocalPlus PlanSelection of a Primary Care Provider - your plan may require or allow the designation of a primary care provider. You have the right to designate any primary careprovider who participates in the network and who is available to accept you or your family members. If your plan requires designation of a primary care provider,Cigna may designate one for you until you make this designation. For information on how to select a primary care provider, and for a list of the participating primarycare providers, visit www.mycigna.com or contact customer service at the phone number listed on the back of your ID card. For children, you may designate apediatrician as the primary care provider.Direct Access to Obstetricians and Gynecologists - You do not need prior authorization from the plan or from any other person (including a primary care provider)in order to obtain access to obstetrical or gynecological care from a health care professional in our network who specializes in obstetrics or gynecology. The healthcare professional, however, may be required to comply with certain procedures, including obtaining prior authorization for certain services, following a pre-approvedtreatment plan, or procedures for making referrals. For a list of participating health care professionals who specialize in obstetrics or gynecology, visitwww.mycigna.com or contact customer service at the phone number listed on the back of your ID card.Plan HighlightsIn-NetworkOut-of-NetworkLifetime MaximumCoinsuranceMaximum Reimbursable ChargeUnlimitedUnlimitedYour plan pays 90%Your plan pays 60%Not Applicable110%Individual: 2,700Individual: 5,000Calendar Year DeductibleFamily: 5,000Family: 10,000 The amount you pay for all covered expenses counts toward both your in-network and out-of-network deductibles. Copays always apply before plan deductible and coinsurance. After each eligible family member meets his or her individual deductible, covered expenses for that family member will be paid based on the coinsurancelevel specified by the plan. Or, after the family deductible has been met, covered expenses for each eligible family member will be paid based on thecoinsurance level specified by the plan. 3-month Carryover Deductible provision included but does not credit the out-of-pocket amount.Note: Services where plan deductible applies are noted with a caret ( ).Individual: 3,500Individual: 7,000Calendar Year Out-of-Pocket MaximumFamily: 7,000Family: 14,000 The amount you pay for all covered expenses counts toward both your in-network and out-of-network out-of-pocket maximums. Plan deductible contributes towards your out-of-pocket maximum. All copays and benefit deductibles contribute towards your out-of-pocket maximum. Mental Health and Substance Use Disorder covered expenses contribute towards your out-of-pocket maximum. After each eligible family member meets his or her individual out-of-pocket maximum, the plan will pay 100% of their covered expenses. Or, after the familyout-of-pocket maximum has been met, the plan will pay 100% of each eligible family member's covered expenses. This plan includes a combined Medical/Pharmacy out-of-pocket maximum.7/1/2018GALocalPlus - Proclaim BE - LocalPlus - 7539067. Version# 111 of 16 Cigna 2018

BenefitIn-NetworkOut-of-NetworkPhysician ServicesPhysician Office Visit – Primary Care Physician (PCP)After the plan deductible is met, 30 copay, then your plan pays 100%your plan pays 70% All services including Lab & X-rayPhysician Office Visit – SpecialistAfter the plan deductible is met, 40 copay, then your plan pays 100%your plan pays 70% All services including Lab & X-rayNOTE: Obstetrician and Gynecologist (OB/GYN) visits are subject to either the PCP or Specialist cost share depending on how the provider contracts with Cigna (i.e.as PCP or as Specialist)After the plan deductible is met,Surgery Performed in Physician’s Office - PCP 30 copay, then your plan pays 100%your plan pays 70%After the plan deductible is met,Surgery Performed in Physician's Office – Specialist 40 copay, then your plan pays 100%your plan pays 70% 30 copay, then your plan pays 100% orAfter the plan deductible is met,Allergy Treatment/Injections Performed in Physician's Office PCPyour plan pays 70%actual charge (if less) 40 copay, then your plan pays 100% orAfter the plan deductible is met,Allergy Treatment/Injections Performed in Specialist Officeyour plan pays 70%actual charge (if less)After the plan deductible is met,Allergy Serum - PCPYour plan pays 100%your plan pays 70%After the plan deductible is met,Allergy Serum - SpecialistYour plan pays 100%your plan pays 70% Dispensed by the physician in the officeCigna Telehealth Connection Services 30 copay, then your plan pays 100%Not Covered Includes charges for the delivery of medical and health-related consultations via secure telecommunications technologies, telephones and internet only whendelivered by contracted medical telehealth providers (see details on myCigna.com) Telehealth services rendered by providers that are not contracted medical telehealth providers (as described on myCigna.com) are covered at the samebenefit level as the same services would be if rendered in-person.Preventive CarePreventive CareBirth through age 5Plan pays 100%Plan pays 70%After the plan deductible is met,Plan pays 100%Ages 6 and olderyour plan pays 70% Includes coverage of additional services, such as urinalysis, EKG, and other laboratory tests, supplementing the standard Preventive Care benefit whenbilled as part of office visit.ImmunizationsPlan pays 100%Your plan pays 70%Birth through age 5After the plan deductible is met,Ages 6 and olderPlan pays 100%your plan pays 70%7/1/2018GALocalPlus - Proclaim BE - LocalPlus - 7539067. Version# 112 of 16 Cigna 2018

BenefitIn-NetworkOut-of-NetworkMammogram, PAP, and PSA TestsPlan pays 100%Plan pays 100% Coverage includes the associated Preventive Outpatient Professional Services. Diagnostic-related services are covered at the same level of benefits as other x-ray and lab services, based on place of service. In-Network Diagnostic-related and non-professional services are covered at 100%. Out of network Diagnostic Mammogram, PAP and PSA Tests are covered at 70% after the deductible.InpatientAfter the plan deductible is met,After the plan deductible is met,your plan pays 90%your plan pays 60%Semi-Private Room: In-Network: Limited to the semi-private negotiated rate / Out-of-Network: Limited to semi-private ratePrivate Room: In-Network: Limited to the semi-private negotiated rate / Out-of-Network: Limited to semi-private rateSpecial Care Units (Intensive Care Unit (ICU), Critical Care Unit (CCU)): In-Network: Limited to the negotiated rate / Out-of-Network: Limited to ICU/CCU dailyroom rateAfter the plan deductible is met,After the plan deductible is met,Inpatient Hospital Physician’s Visit/Consultationyour plan pays 90%your plan pays 60%Inpatient Professional ServicesAfter the plan deductible is met,After the plan deductible is met, For services performed by Surgeons, Radiologists, Pathologistsyour plan pays 90%your plan pays 60%and AnesthesiologistsInpatient Hospital FacilityOutpatientOutpatient Facility ServicesAfter the plan deductible is met,your plan pays 90%After the plan deductible is met,your plan pays 60%Outpatient Professional Services For services performed by Surgeons, Radiologists, Pathologistsand AnesthesiologistsAfter the plan deductible is met,your plan pays 90%After the plan deductible is met,your plan pays 60%Short-Term Rehabilitation - PCP 30 copay, then your plan pays 100%Short-Term Rehabilitation - Specialist 40 copay, then your plan pays 100%After the plan deductible is met,your plan pays 70%After the plan deductible is met,your plan pays 70%Calendar Year Maximums: Cognitive Therapy, Physical Therapy, Speech Therapy and Occupational Therapy – 90 days Pulmonary Rehabilitation - 60 days Limits are not applicable to mental health conditions for Physical, Speech and Occupational therapies.Note: Therapy days, provided as part of an approved Home Health Care plan, accumulate to the applicable outpatient short term rehab therapy maximum.After the plan deductible is met,Chiropractic Care - PCP 30 copay, then your plan pays 100%your plan pays 70%7/1/2018GALocalPlus - Proclaim BE - LocalPlus - 7539067. Version# 113 of 16 Cigna 2018

BenefitChiropractic Care - SpecialistIn-Network 40 copay, then your plan pays 100%Out-of-NetworkAfter the plan deductible is met,your plan pays 70% Chiropractic Care - 20 daysNote: Therapy days, provided as part of an approved Home Health Care plan, accumulate to the applicable outpatient short term rehab therapy maximum.Cardiac RehabilitationAfter the plan deductible is met, 40 copay, then your plan pays 100%your plan pays 70% Cardiac Rehabilitation – Unlimited daysNote: Therapy days, provided as part of an approved Home Health Care plan, accumulate to the applicable outpatient short term rehab therapy maximum.Other Health Care Facilities/ServicesHome Health CareAfter the plan deductible is met,After the plan deductible is met,(includes outpatient private duty nursing subject to medical necessity)your plan pays 90%your plan pays 60% 120 days maximum per Calendar Year (The limit is not applicable to mental health and substance use disorder conditions.) 16 hour maximum per daySkilled Nursing Facility, Rehabilitation Hospital, Sub-Acute FacilityAfter the plan deductible is met,After the plan deductible is met,your plan pays 90%your plan pays 60% 60 days maximum per Calendar YearDurable Medical EquipmentAfter the plan deductible is met,After the plan deductible is met,your plan pays 90%your plan pays 90% Unlimited maximum per Calendar YearBreast Feeding Equipment and Supplies Limited to the rental of one breast pump per birth as ordered orAfter the plan deductible is met,Your plan pays 100%prescribed by a physicianyour plan pays 70% Includes related suppliesAfter the plan deductible is met,After the plan deductible is met,External Prosthetic Appliances (EPA)your plan pays 90%your plan pays 60% Unlimited maximum per Calendar YearRoutine Foot DisordersNot CoveredNot CoveredHearing Aid After the plan deductible is met,your plan pays 90%Not CoveredMaximum of 2 devices (1 per ear) per 36 monthsIncludes testing and fitting of hearing aid devices.7/1/2018GALocalPlus - Proclaim BE - LocalPlus - 7539067. Version# 114 of 16 Cigna 2018

BenefitMedical Specialty DrugsInpatient This benefit applies to the cost of the Infusion Therapy drugsadministered in an Inpatient Facility. This benefit does not coverthe related Facility or Professional charges.Outpatient Facility Services This benefit applies to the cost of the Infusion Therapy drugsadministered in an Outpatient Facility. This benefit does not coverthe related Facility or Professional charges.Physician's Office This benefit applies to the cost of targeted Infusion Therapy drugsadministered in the Physician’s Office. This benefit does not coverthe related Office Visit or Professional charges.Home This benefit applies to the cost of targeted Infusion Therapy drugsadministered in the patient’s home. This benefit does not cover therelated Professional charges.In-NetworkOut-of-NetworkAfter the plan deductible is met,your plan pays 90%After the plan deductible is met,your plan pays 60%After the plan deductible is met,your plan pays 90%After the plan deductible is met,your plan pays 60%Your plan pays 100%After the plan deductible is met,your plan pays 70%After the plan deductible is met,your plan pays 90%After the plan deductible is met,your plan pays 60%Place of Service - your plan pays based on where you receive servicesBenefitLaboratoryRadiologyNote: Services where plan deductible applies are noted with a caret ( ).Emergency Room/ Urgent CarePhysician's OfficeIndependent n-NetworkNetworkNetworkNetworkCovered sameCovered sameCovered sameCovered sameas plan'sas plan'sas plan'sas plan'sPlan pays 100% Plan pays 70% rgentRoom/UrgentOffice ServicesOffice ServicesCare ServicesCare ServicesCovered sameCovered sameCovered sameCovered sameas plan'sas plan'sas plan'sas plan'sNot ApplicableNot ’sRoom/UrgentRoom/UrgentOffice ServicesOffice ServicesCare ServicesCare ServicesOutpatient FacilityIn-NetworkOut-ofNetworkPlan pays 90% Plan pays 60% Plan pays 90% Plan pays 60% 7/1/2018GALocalPlus - Proclaim BE - LocalPlus - 7539067. Version# 115 of 16 Cigna 2018

Place of Service - your plan pays based on where you receive servicesNote: Services where plan deductible applies are noted with a caret ( ).Emergency Room/ Urgent CarePhysician's OfficeIndependent LabOutpatient kNetworkNetworkCovered sameCovered sameCovered sameCovered sameCovered sameCovered sameAdvancedas plan'sas plan'sas plan'sas plan'sas plan'sas plan'sRadiologyNot ApplicableNot entOffice ServicesOffice ServicesFacility Services Facility ServicesCare ServicesCare ServicesAdvanced Radiology Imaging (ARI) includes MRI, MRA, CAT Scan, PET Scan, etc.In-Network Diagnostic-related Mammogram, PAP and PSA Tests are covered at 100%In-Network Diagnostic-related Colonoscopy or Early Cancer Detection tests are covered at 100%Out of network Diagnostic Mammogram, PAP and PSA Tests are covered at 70% after the deductible.Note: All lab and x-ray services, including ARI, provided at Inpatient Hospital are covered under Inpatient Hospital benefitEmergency Room / Urgent Care FacilityOutpatient Professional n-NetworkOut-of-NetworkIn-NetworkOut-of-Net

Private Room: In-Network: Limited to the semi-private negotiated rate / Out-of-Network: Limited to semi-private rate Special Care Units (Intensive Care Unit (ICU), Critical Care Unit (CCU)): In-Network: Limited to the negotiated rate / Out-of-Network: Limited to ICU/CCU daily room rate Inpatient Hospital Physician’s Visit/Consultation After the plan deductible is met, your plan pays 90% .