Transcription

FOR FACULTY AND STAFF ELIGIBLE ON OR AFTER JULY 1, 2016A CompleteGuide to YourUC Retirement BenefitsRETIREMENT PLAN SUMMARIES

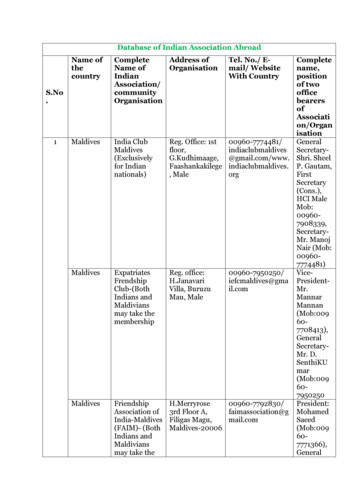

Listed below are telephone numbers and website andcorrespondence addresses for some of the resources UCemployees routinely use.FOLDUC EMPLOYEE WEBSITEucnet.universityofcalifornia.eduUC RETIREMENT ADMINISTRATION SERVICE CENTER800-888-8267Hours: 8:30 a.m.–4:30 p.m., Monday–FridayWritten correspondence should be sent to:UC Human ResourcesP.O. Box 24570Oakland, CA 94623-1570UC RETIREMENT AT YOUR SERVICE (UCRAYS)retirementatyourservice.ucop.eduSign in to your account to send a secure messageFOLDUC RETIREMENT CHOICE ANDRETIREMENT SAVINGS PROGRAMmyUCretirement.com866-682-7787 (Fidelity Retirement Services)LOCAL BENEFITS OFFICESUC Berkeley: 510-664-9000, option 3UC Davis: 530-752-1774UC Davis Health: 916-734-8099UC Irvine: 949-824-5210UC Irvine Health: 714-456-5736UCLA: 310-794-0830UCLA Health: 310-794-0500UC Merced: 209-355-7178UC Riverside: 951-827-4766UC San Diego: 858-534-2816UC San Diego Health: 619-543-3200UCSF: 415-476-1400FOLDUCSF Health: 415-353-4545UC Santa Barbara: 805-893-2489UC Santa Cruz: 831-459-2013ASUCLA: 310-825-7055Hastings College of the Law: 415-565-4703UC Office of the President: 855-982-7284Lawrence Berkeley National Lab: 510-486-6403

INVESTMENT OVERSIGHTUC Office of Chief Investment OfficerChief Investment Officer’s website: ucop.edu/investment-officeFOLDWritten correspondence should be sent to:Office of the Chief Investment Officer of The RegentsUniversity of CaliforniaOffice of the President1111 Franklin StOakland, CA 94607-9828BENEFITS FROM OTHER SOURCESFor information on plans and services that may have an impacton your retirement benefits, such as Social Security, CalPERS orother retirement plans and agencies, contact the appropriateagency.Social Security Administration: 800-772-1213Social Security website: socialsecurity.govCalPERS: 888-225-7377CalPERS website: calpers.ca.govCalSTRS: 800-228-5453CalSTRS website: calstrs.comIt is your responsibility to notify the Plan Administrator ofyour new mailing address. UC uses the address on file as theaddress of record for you and your beneficiaries.FOLDIF YOU MOVEFor the UC Retirement Plan: If you are an active UC employeeor retiree, you can change your address by signing in to yourUCRAYS account at retirementatyourservice.ucop.eduIf you’re no longer working for UC or do not have internetaccess, you can also notify UC Human Resources bycalling the UC Retirement Administration Service Center at800-888-8267. Or, if you have Internet access, select “HRForms & Publications” on UCnet and print and complete formUBEN 131 (UC Human Resources Address Change Notice) andmail it to UC Human Resources.FOLDFor Defined Contribution, 403(b) and 457(b) Plan accounts:If you are an active UC employee, you can change youraddress through your online benefits account, and Fidelity willbe notified automatically. If you are no longer working for UC,please notify Fidelity Retirement Services directly by calling866-682-7787 or by logging into netbenefits.com, yourFidelity website.

IntroductionThe University of California’s comprehensive benefits are amongthe ways UC recognizes its employees for their contributions, andare an important part of your compensation.It’s important to understand the pivotal role you have in shapingyour financial future. To make the most of your retirement andsavings benefits, you should read this booklet carefully and keep itwith your important papers for later reference. It containssummaries with comprehensive information about the primaryretirement benefit options and voluntary retirement savings plansthat make up the University of California Retirement System(UCRS) as well as information about health and welfare benefitscurrently available to eligible UC retirees.The chart below illustrates the basic structure of UCRS. Thesummaries in this booklet explain the plans’ provisions and thepolicies and rules that govern them. If a conflict exists betweenthese summaries and the plan documents, the plan documentsgovern. The Plan Administrator has the authority to interpretdisputed provisions.UNIVERSITY OF CALIFORNIA RETIREMENT SYSTEM (UCRS)University of CaliforniaRetirement Plan (UCRP):a defined benefit planDefined Contribution Plan(the DC Plan): a definedcontribution planTax-Deferred 403(b) Plan(the 403(b) Plan): a definedcontribution plan457(b) Deferred CompensationPlan (the 457(b) Plan): a deferredcompensation planA pension plan for Pension Choiceparticipants and existing and newlyeligible UCRP membersA retirement savings andinvestment plan for SavingsChoice participants, and forPension Choice participantseligible for the defined contribution supplemental benefitA retirement savings and investment plan for voluntary employeepretax contributions and rolloversA retirement savings and investment plan for voluntary employeepretax contributions and rollovers,and employer contributions foreligible employeesAlso includes voluntary after-taxcontributions and rollovers, andmandatory pretax employeecontributions for Safe HarboremployeesEffective Nov. 1, 2016, alsoincludes employer and mandatoryemployee pretax contributionsfor eligible summer academicappointeesPrimary Retirement Benefit Options.2Tax-Deferred 403(b) Plan.45University of California Retirement Plan (Pension Choice).3457(b) Deferred Compensation Plan.61Defined Contribution Plan (including Savings Choiceand supplemental Pension Choice accounts). .29Health and Welfare Benefits for Retirees.731

Primary Retirement Benefit OptionsPrimary RetirementBenefit OptionsAs an eligible UC employee hired, rehired, or newly eligible forbenefits on or after July 1, 2016, UC offers you two differentprimary retirement benefit options: Pension Choice or SavingsChoice.Please note that some rehired employees will not be eligible forthis choice, including those who:the fifth anniversary of the calendar year in which they madetheir initial election.See the Defined Contribution Plan summary on page 29 fordetails about Savings Choice, including UC’s and yourcontributions, distributions, the timing and rules for switchingfrom Savings Choice to Pension Choice, and more. Became members of UCRP prior to July 1, 1994, Were rehired without a tier break in service (see definition onpage 22), or Elected Pension Choice or Savings Choice, or were defaultedinto Pension Choice, during a prior period of UC employment.If you’re represented by a union, your retirement benefits aregoverned by your union’s contract with UC and may be differentthan the benefits outlined here. Please refer to your collectivebargaining agreement (available at ucal.us/agreements) fordetails.PENSION CHOICEThis option includes a pension benefit under the UC RetirementPlan (UCRP), providing a predictable level of lifetime retirementincome. Some faculty and staff may also be entitled to receivea supplemental benefit in a defined contribution account.MAKING YOUR CHOICEEnroll in Pension Choice or Savings Choice as soon as you’vechosen the option that is best for you. Your benefits areprospective from the date you enroll, so you can lose UCcontributions (and service credit under Pension Choice) bywaiting.Employees have up to 90 days from their retirement optioneligibility date (generally your hire date) to enroll. Your enrollmentwindow closes once you submit a choice. If you do notaffirmatively choose an option, you automatically will be enrolledin Pension Choice at the end of the 90-day selection period.RESOURCESRetirement Benefits Decision GuideOnline: ucal.us/retirementRetirement Decision Tool: myUCretirement.com/chooseEnrollment in Pension Choice is irrevocable.See the UCRP summary on page 3 for details about PensionChoice, including eligibility, vesting, contributions from you andUC, retirement income, disability benefits, benefits for eligiblesurvivors and more.If you are eligible for the defined contribution supplementalbenefit under Pension Choice, see the Defined Contribution Plansummary on page 29 for details, including UC’s and yourcontributions, distributions and more.SAVINGS CHOICEThis option is a defined contribution plan, with mandatorypretax contributions from you and contributions from UC. Thesecontributions and any investment earnings accumulate in atax-deferred retirement account. You select how to investcontributions to your account from a menu of available fundsand you assume the investment risk.Savings Choice participants have a window of opportunity toswitch prospectively from Savings Choice to Pension Choice,and become members of the UC Retirement Plan (UCRP). Thesecond choice window for Savings Choice participants opens on2The Sooner the Better: This is an important decision, somake sure you take advantage of UC’s resources to help youmake the choice that’s right for you. At the same time, itpays to enroll as soon as you’ve decided. Here’s why: If you wait 90 days to enroll or default into PensionChoice, you lose up to three months of UC RetirementPlan service credit—delaying vesting and decreasing yourbenefits. If you wait until the deadline to enroll in Savings Choice,you lose up to three months of UC and personal pretaxcontributions—reducing your retirement savingscontributions for the year.So make your choice and start building your retirementbenefits as soon as you can.

University of California Retirement Plan (Pension Choice)University of California Retirement Plan(Pension Choice) Plan SummaryFor eligible faculty and staff: Hired on or after July 1, 2016, or Rehired on or after July 1, 2016, after a break in service or Who became newly eligible for benefits on or after July 1, 2016Introduction.5Cost-of-Living Adjustments.15UCRP Membership. .6Collective Bargaining.6Social Security. .6Eligibility and Membership.6Vesting. .7Inactive Membership. .7Reciprocity.7Disability Benefits.15General Requirements.15Disability Definitions.15Disability Date.16Disability Income.16Maximum Disability Income. .16Applying for Disability Benefits.16Length of the Disability Income Period.16When Disability Income Stops.16Pensionable Earnings Maximums.8PEPRA Maximum.8Rehired, Newly Eligible and FormerCalPERS-Covered Employees.8Contributions. .9Funding the Plan.9University Contributions. .9Member Contributions. .9Reappointment After Retirement.17Internal Revenue Code Provisions.17Maximum Contribution and Benefit Limitations.17Minimum Distribution Incidental Benefit.17Minimum Required Distributions.18Rollovers.18Taxes on Distributions.18Service Credit.9Service Credit Purchase.11Refund of Accumulations.11Retirement Benefits. .12If You Leave UC and Don’t Retire.12Basic Retirement Income.12Alternate Monthly Payment Options.12Retirement Age Factors.13Plan Maximum Benefit.14Death Benefits.14Payments to Beneficiaries. .14Preretirement Survivor Income. .14Death While Eligible to Retire.14Additional Information. .19Claims Procedures.19Plan Administration.19Plan Changes.20Designation of Beneficiary. .20Designation of Contingent Annuitant.20Community Property. .20Assignment of Benefits.21Qualified Domestic Relations Orders (QDRO).21Further Information.21Plan Definitions.22Information for Members with Service Creditfrom a Previous Period of Employment.263

4

UCRP: IntroductionIntroductionThe University of California Retirement Plan (UCRP or the Plan)provides retirement benefits for eligible employees (and theireligible survivors and beneficiaries) of the University of Californiaand its affiliate, Hastings College of the Law. UCRP also providesdisability income and death benefits.UCRP is a tax-qualified governmental defined benefit plan. Eligibleemployees who are enrolled in Pension Choice as their primaryretirement benefit option become members of UCRP. Benefits aredetermined by formulas that vary according to the type of benefitspayable (for example, retirement, disability or survivor benefits).The formulas take into account a member’s salary, age, years ofservice credit and member class. The Plan is funded by employerand employee contributions.The provisions described here are for eligible UC employees who are Hired on or after July 1, 2016, Rehired on or after July 1, 2016, after a break in service, or Newly eligible for benefits on or after July 1, 2016.Are you in a domestic partnership?See page 23, or check out “Establishing a domestic partnership” on UCnet (ucal.

address through your online benefits account, and Fidelity will be notified automatically. If you are no longer working for UC, please notify Fidelity Retirement Services directly by calling 866-682-7787 or by logging in