Transcription

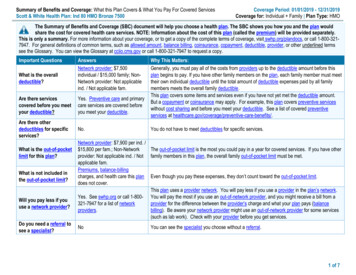

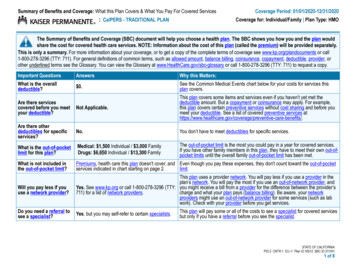

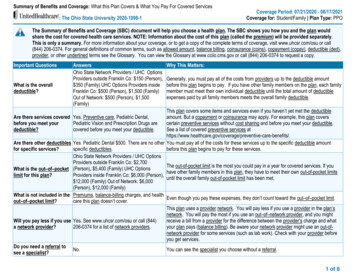

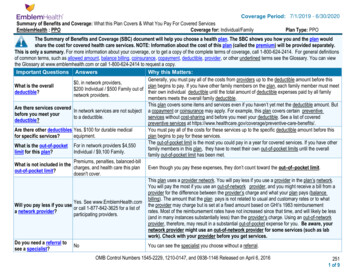

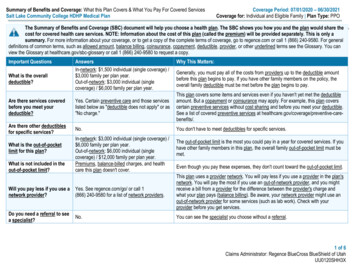

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered ServicesSalt Lake Community College HDHP Medical PlanCoverage Period: 07/01/2020 – 06/30/2021Coverage for: Individual and Eligible Family Plan Type: PPOThe Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan would share thecost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately. This is only asummary. For more information about your coverage, or to get a copy of the complete terms of coverage, go to regence.com or call 1 (866) 240-9580. For generaldefinitions of common terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider, or other underlined terms see the Glossary. You canview the Glossary at healthcare.gov/sbc-glossary or call 1 (866) 240-9580 to request a copy.Important QuestionsWhat is the overalldeductible?AnswersIn-network: 1,500 individual (single coverage) / 3,000 family per plan year.Out-of-network: 3,000 individual (singlecoverage) / 6,000 family per plan year.Why This Matters:Generally, you must pay all of the costs from providers up to the deductible amountbefore this plan begins to pay. If you have other family members on the policy, theoverall family deductible must be met before the plan begins to pay.Are there services coveredbefore you meet yourdeductible?Yes. Certain preventive care and those serviceslisted below as "deductible does not apply" or as"No charge."This plan covers some items and services even if you haven't yet met the deductibleamount. But a copayment or coinsurance may apply. For example, this plan coverscertain preventive services without cost sharing and before you meet your deductible.See a list of covered preventive services at re there other deductiblesfor specific services?No.You don't have to meet deductibles for specific services.What is the out-of-pocketlimit for this plan?What is not included in theout-of-pocket limit?In-network: 3,000 individual (single coverage) / 6,000 family per plan year.Out-of-network: 6,000 individual (singlecoverage) / 12,000 family per plan year.Premiums, balance-billed charges, and healthcare this plan doesn't cover.The out-of-pocket limit is the most you could pay in a year for covered services. If youhave other family members in this plan, the overall family out-of-pocket limit must bemet.Even though you pay these expenses, they don't count toward the out-of-pocket limit.Will you pay less if you use anetwork provider?Yes. See regence.com/go/ or call 1(866) 240-9580 for a list of network providers.This plan uses a provider network. You will pay less if you use a provider in the plan'snetwork. You will pay the most if you use an out-of-network provider, and you mightreceive a bill from a provider for the difference between the provider's charge andwhat your plan pays (balance billing). Be aware, your network provider might use anout-of-network provider for some services (such as lab work). Check with yourprovider before you get services.Do you need a referral to seea specialist?No.You can see the specialist you choose without a referral.1 of 6Claims Administrator: Regence BlueCross BlueShield of UtahUU0120SHH3X

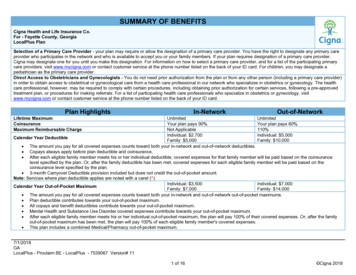

All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.Common MedicalEventServices You May NeedPrimary care visit to treatan injury or illnessIf you visit a healthcare provider's officeor clinicIf you have a testIf you need drugs totreat your illness orconditionMore information aboutprescription drugcoverage is available t ic test (x-ray,blood work)Imaging (CT/PET scans,MRIs)Preferred generic drugs &generic drugsPreferred brand drugsBrand drugsWhat You Will PayIn-network ProviderOut-of-network Provider(You will pay the least)(You will pay the most) 25 copay / office visit(including expandedservices);30% coinsurance10% coinsurance for allother services 35 copay / visit (includingexpanded services);10% coinsurance for allother services30% coinsuranceNo charge30% coinsurance10% coinsurance30% coinsurance10% coinsurance30% coinsuranceLimitations, Exceptions, & Other ImportantInformationCoverage includes primary care visits at a retail clinic.Copayment applies to each in-network office visit only,after deductible. All other services are covered at thecoinsurance specified, after deductible.Expanded services are medical services, surgicalprocedures and therapeutic injections received in aprofessional provider's office and billed as such. Allother services are covered at the coinsurancespecified, after deductible.You may have to pay for services that aren'tpreventive. Ask your provider if the services neededare preventive. Then check what your plan will pay for.None 7 copay / preferred retail prescription 7 copay / preferred mail order prescription 7 copay / retail prescription 7 copay / mail order prescription10% coinsurance for diabetic supplies.25% coinsurance up to 150 copay maximum / retailprescription25% coinsurance up to 300 copay maximum / mail orderprescription10% coinsurance for diabetic supplies30% coinsurance up to 175 copay maximum / retailprescription30% coinsurance up to 437.50 copay maximum / mailorder prescription10% coinsurance for diabetic suppliesCoverage includes compound medications, refer toyour plan for further information.Deductible does not apply for generic or preferredbrand drugs specifically designated as preventive fortreatment of certain chronic diseases that are on theOptimum Value Medication List.Limited to a 90-day supply retail (1 copayment per 30day supply), 90-day supply mail order or 30-day supplyspecialty drugs.No charge for certain preventive drugs, women'scontraceptives and immunizations at a participatingpharmacy.Specialty drugs (including preferred) are not availablethrough mail order.The first fill for designated specialty drugs may be2 of 6

Common MedicalEventServices You May NeedPreferred specialty drugs& specialty drugsIf you have outpatientsurgeryIf you need immediatemedical attentionIf you have a hospitalstayIf you need mentalhealth, behavioralhealth, or substanceabuse servicesIf you are pregnantWhat You Will PayIn-network ProviderOut-of-network Provider(You will pay the least)(You will pay the most)Limitations, Exceptions, & Other ImportantInformation10% coinsurance up to 250 copay maximum / preferredretail prescription15% coinsurance up to 300 copay maximum / retailprescriptionprovided at a retail pharmacy; additional fills and anyfills for other non-designated specialty drugs must beprovided by a specialty pharmacy.Medications used as part of an outpatient cancer drugtreatment regimen that is provided and dispensed in aprofessional setting will be subject to these prescriptionbenefits.Facility fee (e.g.,ambulatory surgerycenter)10% coinsurance30% coinsuranceNonePhysician/surgeon fees10% coinsurance30% coinsuranceNoneEmergency room services10% coinsurance10% coinsuranceNoneEmergency medicaltransportation10% coinsurance10% coinsuranceNoneUrgent care 35 copay / visit; otherservices 10% coinsurance30% coinsuranceCopayment applies to each in-network office visit only,after deductible. All other services are covered at thecoinsurance specified, after deductible.10% coinsurance30% coinsurance10% coinsurance 25 copay / visit; outpatientfacility services 10%coinsurance10% coinsurance10% coinsurance30% coinsurance30% coinsurance30% coinsurance10% coinsurance30% coinsuranceFacility fee (e.g., hospitalroom)Physician/surgeon feesOutpatient servicesInpatient servicesOffice visitsChildbirth/deliveryprofessional services30% coinsuranceNoneCopayment applies to each in-network office visit only,after deductible. All other services are covered at thecoinsurance specified, after deductible.Adoption coverage is paid at the in-network benefitlimited to 3,000 / pregnancy. The adoption indemnitybenefit is not exchangeable for infertility treatment3 of 6

Common MedicalEventIf you need helprecovering or haveother special healthneedsServices You May NeedWhat You Will PayIn-network ProviderOut-of-network Provider(You will pay the least)(You will pay the most)Childbirth/delivery facilityservices10% coinsurance30% coinsuranceHome health care10% coinsurance30% coinsuranceRehabilitation services10% coinsurance30% coinsuranceHabilitation services10% coinsurance30% coinsuranceLimitations, Exceptions, & Other ImportantInformationbenefits.Cost sharing does not apply for preventive servicesDepending on the type of services, copayment,coinsurance or deductible may apply. Maternity caremay include tests and services described elsewhere inthe SBC (i.e. ultrasound).NoneLimited to 60 inpatient days / year.Limited to 30 outpatient visits / year combined withoutpatient habilitation visit limit.Includes physical therapy, occupational therapy andspeech therapy services.Neurodevelopmental therapy is limited to 30 outpatientvisits / year combined with outpatient rehabilitation visitlimit.Neurodevelopmental therapy is limited to services forindividuals through age 18.Includes physical therapy, occupational therapy andspeech therapy services.Limited to 60 inpatient days / year.Skilled nursing care10% coinsurance30% coinsuranceDurable medical10% coinsurance30% coinsuranceNoneequipmentHospice services10% coinsurance30% coinsuranceNoneNot coveredNot coveredChildren's eye examNoneIf your child needsChildren's glassesNot coveredNot coveredNonedental or eye careChildren's dental checkNot coveredNot coveredNoneupExcluded Services & Other Covered Services:Exclusion ExamplesThe following examples of limitations and exclusions are included to illustrate the types of conditions, treatments, services, supplies or accommodations that may notbe covered under your plan, including related secondary medical conditions and are not all inclusive: charges in connection with reconstructive or plastic surgery that may have limited benefits, such as a chemical peel that does not alleviate a functionalimpairment; complications relating to services and supplies for, or in connection with, gastric or intestinal bypass, gastric stapling, or other similar surgical procedure tofacilitate weight loss, or for, or in connection with, reversal or revision of such procedures, or any direct complications or consequences thereof;4 of 6

complications by infection from a cosmetic procedure, except in cases of reconstructive surgery:- when the service is incidental to or follows a surgery resulting from trauma, infection or other diseases of the involved part; or- related to a congenital disease or anomaly of a covered child that has resulted in functional defect; or complications that result from an injury or illness resulting from active participation in illegal activities.Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services.) Abortion (except in cases of rape, rape of a child, Cosmetic surgery, except congenital anomalies Routine foot careincest or to avert the death of the mother) Dental care Vision hardware Acupuncture Long-term care Weight loss programs except for nutritional Bariatric surgerycounseling Private-duty nursingOther Covered Services (Limitations may apply to these services. This isn't a complete list. Please see your plan document.) Chiropractic care, spinal manipulations only Infertility treatment Non-emergency care when traveling outside theU.S. Hearing aidsYour Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for those agenciesis: the U.S. Department of Labor, Employee Benefits Security Administration at 1 (866) 444-3272 or dol.gov/ebsa/healthreform, or the U.S. Department of Health andHuman Services, Center for Consumer Information and Insurance Oversight at 1 (877) 267-2323 x61565 or cciio.cms.gov or your state insurance department. Youmay also contact the plan at 1 (866) 240-9580. Other coverage options may be available to you too, including buying individual insurance coverage through the HealthInsurance Marketplace. For more information about the Marketplace, visit HealthCare.gov or call 1 (800) 318-2596.Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is called agrievance or appeal. For more information about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan documents alsoprovide complete information to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, or assistance,contact the plan at 1 (866) 240-9580 or visit regence.com or the U.S. Department of Labor, Employee Benefits Security Administration at 1 (866) 444-3272 ordol.gov/ebsa/healthreform. You may also contact the Utah Department of Insurance by calling 1 (801) 538-3077 or the toll free message line at 1 (800) 439-3805; bywriting to the Utah Department of Insurance, State Office Building Suite 3110, Salt Lake City, UT 84114-6901; through the Internet at: www.insurance.utah.gov; or byE-mail at: healthappeals.uid@utah.gov.Does this plan provide Minimum Essential Coverage? YesIf you don't have Minimum Essential Coverage for a month, you'll have to make a payment when you file your tax return unless you qualify for an exemption from therequirement that you have health coverage for that month.Does this plan meet the Minimum Value Standards? YesIf your plan doesn't meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace.Language Access Services:NAVAJO (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' 1 (866) �––––––––To see examples of how this plan might cover costs for a sample medical situation, see the next ––––––––5 of 6

About these Coverage Examples:This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will bedifferent depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost sharingamounts (deductibles, copayments and coinsurance) and excluded services under the plan. Use this information to compare the portion ofcosts you might pay under different health plans. Please note these coverage examples are based on self-only coverage.Peg is Having a Baby(9 months of in-network pre-natal care and ahospital delivery) The plan's overall deductible Specialist copayment Hospital (facility) coinsurance Other coinsurance 1,500 3510%10%This EXAMPLE event includes services like:Specialist office visits (prenatal care)Childbirth/Delivery Professional ServicesChildbirth/Delivery Facility ServicesDiagnostic tests (ultrasounds and blood work)Specialist visit (anesthesia)Total Example CostIn this example, Peg would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn't coveredLimits or exclusionsThe total Peg would pay is 12,800 1,500 27 1,072 60 2,659Managing Joe's type 2 Diabetes(a year of routine in-network care of a wellcontrolled condition) The plan's overall deductible Specialist copayment Hospital (facility) coinsurance Other coinsurance 1,500 3510%10%This EXAMPLE event includes services like:Primary care physician office visits (includingdisease education)Diagnostic tests (blood work)Prescription drugsDurable medical equipment (glucose meter)Total Example CostIn this example, Joe would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn't coveredLimits or exclusionsThe total Joe would pay is 7,400 1,500 373 1,127 255 3,255Mia's Simple Fracture(in-network emergency room visit and followup care) The plan's overall deductible Specialist copayment Hospital (facility) coinsurance Other coinsurance 1,500 3510%10%This EXAMPLE event includes services like:Emergency room care (including medicalsupplies)Diagnostic test (x-ray)Durable medical equipment (crutches)Rehabilitation services (physical therapy)Total Example CostIn this example, Mia would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn't coveredLimits or exclusionsThe total Mia would pay isThe plan would be responsible for the other costs of these EXAMPLE covered services. 1,925 1,500 35 35 0 1,5706 of 6

NONDISCRIMINATION NOTICERegence complies with applicable Federal civil rights laws and does not discriminate on thebasis of race, color, national origin, age, disability, or sex. Regence does not exclude peopleor treat them differently because of race, color, national origin, age, disability, or sex.Regence:Provides free aids and services to people with disabilities to communicate effectivelywith us, such as: Qualified sign language interpreters Written information in other formats (large print, audio, and accessible electronicformats, other formats)Provides free language services to people whose primary language is not English,such as: Qualified interpreters Information written in other languagesIf you need these services listed above,please contact:Medicare Customer Service1-800-541-8981 (TTY: 711)Customer Service for all other plans1-888-344-6347 (TTY: 711)If you believe that Regence has failed toprovide these services or discriminated inanother way on the basis of race, color,national origin, age, disability, or sex, you canfile a grievance with our civil rights coordinatorbelow:Medicare Customer ServiceCivil Rights CoordinatorMS: B32AG, PO Box 1827Medford, OR 975011-866-749-0355, (TTY: 711)Fax: 1-888-309-8784medicareappeals@regence.comCustomer Service for all other plansCivil Rights CoordinatorMS CS B32B, P.O. Box 1271Portland, OR 97207-12711-888-344-6347, (TTY: eYou can also file a civil rights complaint with theU.S. Department of Health and Human Services,Office for Civil Rights electronically through theOffice for Civil Rights Complaint Portal athttps://ocrportal.hhs.gov/ocr/portal/lobby.jsf, orby mail or phone at:U.S. Department of Health and Human Services200 Independence Avenue SW,Room 509F HHH BuildingWashington, DC 202011-800-368-1019, 800-537-7697 (TDD).Complaint forms are available athttp://www.hhs.gov/ocr/office/file/index.html.

Language assistanceATENCIÓN: si habla español, tiene a su disposiciónservicios gratuitos de asistencia lingüística. Llame al1-888-344-6347 (TTY: 以免費獲得語言援助服務。請致電 1-888-344-6347 (TTY: 711)。ប្រយ័ត្ន៖ បរើសិនជាអ្ន កនិយាយ ភាសាខ្មែ ��សា បោយមិនគិត្ឈ្ន �ំប រ ើអ្ន ក។ ចូ រ ទូ រស័ព្ទ 1-888-3446347 (TTY: 711)។ਧਿਆਨ ਧਿਓ: ਜੇ ਤੁਸੀਂ ਪੰ ਜਾਬੀ ਬੋਲਿੇ ਹੋ, ਤਾਂ ਭਾਸ਼ਾ ਧ ਿੱ ਚCHÚ Ý: Nếu bạn nói Tiếng Việt, có các dịch vụ hỗtrợ ngôn ngữ miễn phí dành cho bạn. Gọi số 1-888344-6347 (TTY: 711).ਸਹਾਇਤਾ ਸੇ ਾ ਤੁਹਾਡੇ ਲਈ ਮੁਫਤ ਉਪਲਬਿ ਹੈ। 1-888-344-주의: 한국어를 사용하시는 경우, 언어 지원서비스를 무료로 이용하실 수 있습니다. 1-888344-6347 (TTY: 711) 번으로 전화해 주십시오.ACHTUNG: Wenn Sie Deutsch sprechen, stehenIhnen kostenlose Sprachdienstleistungen zurVerfügung. Rufnummer: 1-888-344-6347 (TTY: 711)PAUNAWA: Kung nagsasalita ka ng Tagalog, maaarikang gumamit ng mga serbisyo ng tulong sa wika nangwalang bayad. Tumawag sa 1-888-344-6347 (TTY:711).ВНИМАНИЕ: Если вы говорите на русском языке,то вам доступны бесплатные услуги перевода.Звоните 1-888-344-6347 (телетайп: 711).ATTENTION : Si vous parlez français, des servicesd'aide linguistique vous sont proposés gratuitement.Appelez le 1-888-344-6347 (ATS : �にてご連絡ください。ti’go DinéBizaad, saad1-888-344-6347 (TTY: 711.)FAKATOKANGA’I: Kapau ‘oku ke LeaFakatonga, ko e kau

Salt Lake Community College HDHP Medical Plan Coverage for: Individual and Eligible Family Plan Type: PPO 1 of 6 Claims Administrator: Regence BlueCross BlueShield of Utah UU0120SHH3X The Summary of Benefits and Coverage (SBC) document will help you choose a health pla