Transcription

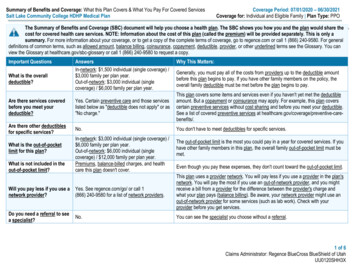

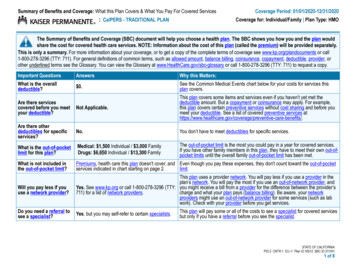

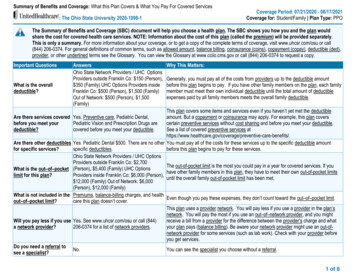

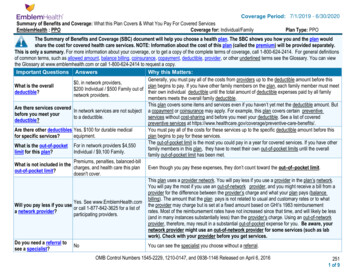

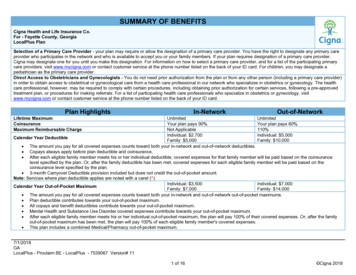

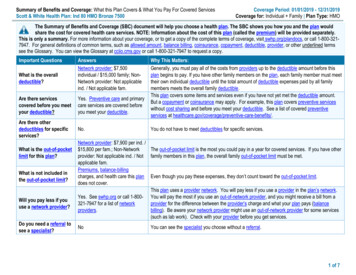

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered ServicesScott & White Health Plan: Ind 80 HMO Bronze 7500Coverage Period: 01/01/2019 - 12/31/2019Coverage for: Individual Family Plan Type: HMOThe Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan wouldshare the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately.This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, visit swhp.org/plandocs, or call 1-800-3217947. For general definitions of common terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider, or other underlined termssee the Glossary. You can view the Glossary at cciio.cms.gov or call 1-800-321-7947 to request a copy.Important QuestionsWhat is the overalldeductible?AnswersNetwork provider: 7,500individual / 15,000 family; NonNetwork provider: Not applicableind. / Not applicable fam.Are there servicescovered before you meetyour deductible?Yes. Preventive care and primarycare services are covered beforeyou meet your deductible.Are there otherdeductibles for specificservices?No.What is the out-of-pocketlimit for this plan?What is not included inthe out-of-pocket limit?Will you pay less if youuse a network provider?Do you need a referral tosee a specialist?Why This Matters:Generally, you must pay all of the costs from providers up to the deductible amount before thisplan begins to pay. If you have other family members on the plan, each family member must meettheir own individual deductible until the total amount of deductible expenses paid by all familymembers meets the overall family deductible.This plan covers some items and services even if you have not yet met the deductible amount.But a copayment or coinsurance may apply. For example, this plan covers preventive serviceswithout cost sharing and before you meet your deductible. See a list of covered preventiveservices at You do not have to meet deductibles for specific services.Network provider: 7,900 per ind. / 15,800 per fam.; Non-NetworkThe out-of-pocket limit is the most you could pay in a year for covered services. If you have otherprovider: Not applicable ind. / Not family members in this plan, the overall family out-of-pocket limit must be met.applicable fam.Premiums, balance-billingcharges, and health care this plan Even though you pay these expenses, they don’t count toward the out-of-pocket limit.does not cover.This plan uses a provider network. You will pay less if you use a provider in the plan’s network.Yes. See swhp.org or call 1-800- You will pay the most if you use an out-of-network provider, and you might receive a bill from a321-7947 for a list of networkprovider for the difference between the provider’s charge and what your plan pays (balanceproviders.billing). Be aware your network provider might use an out-of-network provider for some services(such as lab work). Check with your provider before you get services.NoYou can see the specialist you choose without a referral.1 of 7

All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.CommonMedical EventIf you visit a healthcare provider’s officeor clinicIf you have a testIf you need drugs totreat your illness orconditionMore information aboutprescription drugcoverage is available formation.If you have outpatientsurgeryIf you need immediatemedical attentionServices You May NeedPrimary care visit to treat aninjury or illnessWhat You Will PayOut-of-NetworkNetwork PROVIDERPROVIDER(You will pay the least)(You will pay the most) 35 copay first 2 visits, thendeductible, then 35 copay Not applicableSpecialist visitPreventive care/screening/immunizationDiagnostic test (x-ray, bloodwork)20% after deductibleNot applicableNo chargeNot covered20% after deductibleNot applicableImaging (CT/PET scans, MRIs)20% after deductibleNot applicableGeneric drugs 15 copay, deductible doesnot applyNot applicablePreferred brand drugs 50 copay after deductibleNot applicableNon-preferred Brand drugs 100 copay after deductibleNot applicableSpecialty Drugs 500 copay after deductibleNot applicable20% after deductibleNot applicable20% after deductible20% after deductibleNot applicable20% after deductible20% after deductible20% after deductible 35 copay first 2 visits, thendeductible, then 35 copay 35 copay first 2 visits, thendeductible, then 35 copayFacility fee (e.g., ambulatorysurgery center)Physician/surgeon feesEmergency room careEmergency medicaltransportationUrgent careLimitations, Exceptions, & OtherImportant InformationYou may have to pay for services thataren’t preventive. Ask your provider if theservices needed are preventive. Thencheck what your plan will pay for.For prior authorization requirements andpenalties see swhp.org/ind-fam/toolsresources. Failure to obtain PriorAuthorization will result in the lesser of 500 or 50% reduction in benefits.Copays are per 30-day supply. Twocopays apply for a 90-day supply if amaintenance drug is obtained through aBaylor Scott & White pharmacy OR whenusing the mail order prescription service.Specific preventative medications will becovered with no cost to the member.NoneNone2 of 7

CommonMedical EventIf you have a hospitalstayIf you need mentalhealth, behavioralhealth, or substanceabuse servicesIf you are pregnantIf you need helprecovering or haveother special healthneedsIf your child needsdental or eye careServices You May NeedWhat You Will PayOut-of-NetworkNetwork PROVIDERPROVIDER(You will pay the least)(You will pay the most)Limitations, Exceptions, & OtherImportant InformationFor prior authorization requirements andpenalties see swhp.org/ind-fam/toolsresources. Failure to obtain PriorAuthorization will result in the lesser of 500 or 50% reduction in benefits, ordenial in the case of Health Care Services,other than Emergency Care, provided byan In-Network provider.Facility fee (e.g., hospital room) 20% after deductibleNot applicablePhysician/surgeon fees20% after deductibleNot applicableOutpatient services20% after deductibleNot applicableNoneInpatient services20% after deductibleNot applicableNoneOffice visits20% after deductibleNot applicableChildbirth/delivery professionalservices20% after deductibleNot applicableCost sharing does not apply for preventiveservices. No charge for prenatal visits;postnatal visits are covered at thespecialist copay.20% after deductibleNot applicableNone20% after deductible20% after deductible20% after deductible20% after deductible20% after deductible20% after deductible20% after deductible20% after deductibleNot coveredNot applicableNot applicableNot applicableNot applicableNot applicableNot applicableNot applicableNot applicableNot covered60 visit limit per year.35 visit limit per year.35 visit limit per year.25 day limit per year.NoneNoneLimited to one visit per year.One pair of glasses (lenses and frames).NoneChildbirth/delivery facilityservicesHome health careRehabilitation servicesHabilitation servicesSkilled nursing careDurable medical equipmentHospice servicesChildren’s eye examChildren’s glassesChildren’s dental check-upDepending on the type of services, acopayment, coinsurance, or deductiblemay apply.3 of 7

Excluded Services & Other Covered Services:Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services.) Acupuncture Infertility treatment Private-duty nursing Bariatric surgery Long-term care Routine foot care Cosmetic surgery Non-emergency care when traveling outside U.S. Weight loss programs Dental care (Child and Adult)Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.) Chiropractic Care (35 visit limit per Calendar year) Hearing aids (limited to the cost of one hearing aid per hearing impaired ear every 36 months.) Routine eye care (Adult) (limited to annual eye exam conducted by a licensed ophthalmologist or optometrist)Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for thoseagencies is: Scott and White Health Plan, visit swhp.org , or call 1-800-321-7947; Department of Labor Employee Benefits Security Administration, visitdol.gov/ebsa/healthreform or call1-866-444-EBSA (3272); Texas Department of Insurance, visit tdi.texas.gov or call 1-800-578-4677. Other coverage options may beavailable to you too, including buying individual insurance coverage through the Health Insurance Marketplace. For more information about the Marketplace, visitHealthCare.gov or call 1-800-318-2596; Department of Labor Employee Benefits Security Administration, visit dol.gov/ebsa/healthreform, or call1-866-444-EBSA(3272).Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is called agrievance or appeal. For more information about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan documents alsoprovide complete information to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, or assistance,contact: Scott and White Health Plan, visit swhp.org , or call 1-800-321-7947; Texas Department of Insurance, visit tdi.texas.gov , or call 1-800-252-3439;Department of Labor Employee Benefits Security Administration, visit dol.gov/ebsa/healthreform , or call1-866-444-EBSA (3272).Does this plan provide Minimum Essential Coverage? YesIf you don’t have Minimum Essential Coverage for a month, you’ll have to make a payment when you file your tax return unless you qualify for an exemption from therequirement that you have health coverage for that month.Does this plan meet the Minimum Value Standards? YesIf your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace.Language Access Services:Spanish (Español): Para obtener asistencia en Español, llame al �––––––––––To see examples of how this plan might cover costs for a sample medical situation, see the next ––––––––4 of 7

About these Coverage Examples:This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will bedifferent depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost sharingamounts (deductibles, copayments and coinsurance) and excluded services under the plan. Use this information to compare the portion ofcosts you might pay under different health plans. Please note these coverage examples are based on self-only coverage.Peg is Having a Baby(9 months of in-network pre-natal care and ahospital delivery) The plan’s overall deductible Specialist copayment Hospital (facility) coinsurance Other coinsurance 7,50020%20%20%This EXAMPLE event includes services like:Sample Care CostsSpecialist office visits (prenatal care)Childbirth/Delivery Professional ServicesChildbirth/Delivery Facility ServicesDiagnostic tests (ultrasounds and bloodwork)Specialist visit (anesthesia)Total Example CostIn this example, Peg would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Peg would pay is 12,800 5,400 0 2,500 60 7,960Managing Joe’s type 2 Diabetes(a year of routine in-network care of a wellcontrolled condition) The plan’s overall deductible Specialist copayment Hospital (facility) coinsurance Other coinsurance 7,50020%20%20%This EXAMPLE event includes services like:Sample Care CostsPrimary care physician office visits(including disease education)Diagnostic tests (blood work)Prescription drugsDurable medical equipment (glucosemeter)Total Example CostIn this example, Joe would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Joe would pay is 7,400 1,710 1,400 430 60 3,600Mia’s Simple Fracture(in-network emergency room visit and followup care) The plan’s overall deductible Specialist copayment Hospital (facility) coinsurance Other coinsurance 7,50020%20%20%This EXAMPLE event includes services like:Sample Care CostsEmergency room care (includingmedical supplies)Diagnostic test (x-ray)Durable medical equipment (crutches)Rehabilitation services (physicaltherapy)Total Example CostIn this example, Mia would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Mia would pay isThe plan would be responsible for the other costs of these EXAMPLE covered services. 2,000 1,540 0 390 0 1,9305 of 7

6 of 7

7 of 7

Chiropractic Care (35 visit limit per Calendar year) Hearing aids (limited to the cost of one hearing aid per hearing impaired ear every 36 months.) Routine eye care (Adult) (limited to annual eye exam conducted by a licensed ophthalmologist or optometrist) Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The .