Transcription

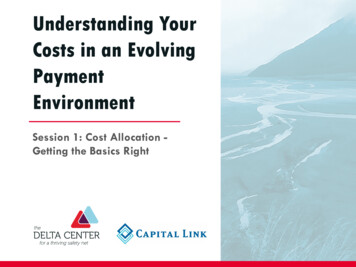

Indirect Costs: Possiblyyour biggest contractCost Driver!Robert (Bob) L. Gustavus, CPADefense Acquisition hop # 60 PDI 2019

Why this topic .1. Increase knowledge of indirect costs – whyhave them and how do they work2. Enhance understanding – why and howindirect cost rates can change3. Realize government decisions to delay orcancel programs can impact otherprograms4. Grasp why increased indirect cost rateshave a potential negative impact on manygovernment contractsASMC – PDI 20192

ImportanceVolume of government contracts – substantialpercentage of DoD dollars are used for contractsIndirect costs represent a large part of totalcontract costsIndirect costs are important to contractors on allcontracts, but most important to government on costreimbursement contractsIndirect cost rates can change—usually higherHigher indirect cost rates usually need morefor the contractASMC – PDI 20193

Indirect Cost Rates – Why have them? Indirect rates is the way of making sure that the total cost of whateverwe build includes its FAIR SHARE of all the costs incurred in thegeneral operation of the business and not specifically applicable toany one product line, program or contract. What are you paying for when you buy a candy bar? The specifically applicable, direct costs of the candy bar itself: sugar,cocoa, preservatives, paper, ink, packaging, etc. . . . What else is included in that price? Little pieces of . . . Machinery that makes many kinds of candy Shipping department Personnel and security departments CEO’s salary Environmental clean-up projects Research into new candy bars!ASMC – PDI 2019The Overhead and G&Arates determine howmuch to include in thetotal cost of making thecandy bar or tank orplane or ship. Its fairshare.4

Language of AccountingA few basic terms andconcepts .Key to focusing on IndirectCosts Rates and how theywork.To Earn the first dollar of profit, all costsmust be recovered .Totalcosts DirectIndirectCostsTotalcosts DirectCostsCosts IndirectCostsASMC – PDI 20195

Total Costs Direct Costs Indirect CostsOverheadDirect LaborCostsCostsDirect MaterialCostsIndirect CostsGeneral & Admin(G&A) CostsOther Direct CostsASMC – PDI 20196

ContractProductionLineA contract or other work unit forwhich cost data are desired andprovisions made in the accountingsystem to accumulate andmeasure costs.ProductASMC – PDI 20197

MaterialLaborProductASMC – PDI 2019SubcontractsA cost that can be trackeddirectly to one specific costobjective. Includes directmaterials, direct labor andother costs traceable directto that single cost objective.8

A cost not directly identifiedwith one specific cost objectbut identified with two ormore cost objectives.ASMC – PDI 20199

Indirect Cost CategoriesOverhead Cost (OH): Support costs having similar causal/beneficial (homogeneous)relationship to the production function (not product) beingsupported e.g. Engineering Overhead to Direct Engineering LaborGeneral and Administrative (G&A): Support costs of doing business as a whole e.g. Human ResourcesIntermediate (or Secondary) Service Pools: Contractor’s prerogative to aggregate cost separately as deemedappropriate Costs are subsequently distributed to direct charges or primaryindirect pool (OH or G&A) e.g. Facility Use & Occupancy, Computer ServicesASMC – PDI 201910

Definition:A collection of indirect costs that aresimilar to each other.Process:Determine what makes the indirectcosts similar; put similar costs in anamed “account” (in the financialaccounting records); and allocate costpool to the benefiting cost objectives onpro rata share.Why Havethem?Putting similar indirect costs together ina pool and spreading (allocating) thosecosts to cost objectives can be done withone mathematical calculation versusmany.ASMC – PDI 201911

Engineering Overhead (includes cost of indirectCost PoolExamples: engineering labor, fringe benefits relating to thatlabor, supplies for the engineers, etc.)Material Handling Overhead (includes cost ofequipment to move materials, warehouse laborstorage, etc.)Facilities Overhead (includes cost of buildingrent and maintenance, utilities, supplies for thebuilding, etc.)General and Administrative (G&A) (includescost for senior managers, HR office, IT,controller, etc.)ASMC – PDI 201912

Allocating Intermediate Service (Secondary)Pools: Use and OccupancyScenario: A company has a single 10M “Use and Occupancy” (U&O) secondary poolwhich accumulates the rent, utilities (one meter), and security (one guard). Having asingle pool provides management insight for cost control.Recall the bases available for Secondary Pools can typically be for: Payroll Dollars, HeadCount, or Square Footage.FenceConsider the following with respect to the squarefootage for each major part of the operation: The production operation uses 1/2 of the facility. The front office group (or FOG) sitting up frontgreeting customers takes up 1/2 of the remainingspace (a total of 1/4th of the plant space). The engineers sitting behind the FOG (so as to guardtheir proprietary secrets) take up 1/2 of the remainingspace (a 1/4th of the plant space).How would you logically allocate 10M U&Ocost to specific primary pools for production,engineering, and the FOG?BuildingSole UtilityMeterEngineeringProductionFront Office Group(FOG)Guard HouseASMC – PDI 201913

Projector ExerciseASMC – PDI 2019

Projector Cost Exercise: Identifying and ClassifyingCost into Homogeneous Cost PoolsDirectIndirect OHBulbLensLabelingCaseCircuit ngInventory controlPurchasingDesignTech documTestSpec configTest equipSuper & rsSuper & ClericalMfgTrainingJigs/fixtures OHASMC – PDI 2019Indirect G&AR&DMarketingMgt. (FOG)TravelLegalCustomer svcHRFringeClericalAccountingITOffice suppliesTransTrainingIntermediateService PoolMain Plant-Utilities-Bld. Mainframe-Maintenance-Security----------------15

The Equation(O/H G&A)[Indirect Costs]PR BPool costsBase costs[Direct costs](e.g. - Direct Labor)ASMC – PDI 201916

Calculation of Indirect Cost RateIndirect Cost Rate(For a Given CostPool)* Total Indirect Costs in Given Pool*Applicable Allocation BaseExamples*Cost Pool Types* Applicable Allocation Base:Manufacturing Overhead - Direct Manufacturing Labor DollarsManufacturing Overhead - Direct Manufacturing Labor HoursEngineering Overhead- Direct Engineering Labor DollarsEngineering Overhead- Direct Engineering Labor HoursMaterial HandlingG & A Costs- Direct Materials Costs- Total Cost Other than G&AASMC – PDI 201917

Calculate the rates for each pool – with G&A rate based ona Total Cost Input basisCompany XYZ has the following direct and indirect costs:Rate Pool / BaseMaterial Handling Expense Pool 500Direct Material Cost 5,000Engineering Overhead Expense Pool 320Engineering Direct Labor Cost 400Manufacturing Overhead Expense Pool 5,200Manufacturing Direct Labor Cost 1,600Other Direct Costs (ODC) 1,000Total Cost Input 14,020General & Administrative Expense Pool 1,680ASMC – PDI 2019 500 / 5,000 10 %Mtl Hdlg Rate 10% 320 / 400 80 %80%Eng O/H Rate 5,200 / 1,600 325 %325%Mfg O/H Rate 1,680 / 14,020 12%G & A Rate 12%18

Allocation of Indirect CostsUsing rates previously calculated, develop the total cost ofa program, project or product with indicated direct costsDirect and Allocated Indirect CostsDirect Material CostBase x Rate Allocation 25.00Allocated Material Handling Expenses 2.50Engineering Direct Labor Cost 60.00Allocated Engineering Overhead Expenses 48.00Manufacturing Direct Labor Cost 50.00Allocated Manufacturing Overhead Expenses 162.50Other Direct Costs (ODC) 10.00Total Cost Input 358.00Allocated General & Administrative Expenses 42.96Total Cost for Program 25 x 10 % 2.50 60 x 80 % 48.00 50 x 325 % 162.50 358 x 12 % 42.96 400.96Applying the company-level rates for a specific project.ASMC – PDI 201919

Computation of Total Cost of A ProjectCost Accounting for Direct and Indirect CostsDirect Materials 25Materials Handling 25 x 10%Project ADirect Labor Engineering 60Direct Labor Manufacturing 50Other DirectCosts 10Cost ObjectiveDirect MaterialsDL – EngineeringDL – ManufacturingOther Direct CostsTotal Direct CostsOverheadsMaterials HandlingIndirect EngineeringIndirect Manufacturing 25.060.050.010.0 145.0Total Cost Input 358.0 2.5 48.0 162.5General & Admin Costs 42.96Project Total Cost 400.96IndirectEngineering 60 x 80%ManufacturingOverhead 50 x 325%General &Administrative 358 x 12%Applying the company-level rates for a specific project.ASMC – PDI 201920

Management of Indirect CostsFor Cost Reimbursement Contracts: Contractor is responsible for setting up indirect cost poolaccounts and managing all indirect costs incurred on Defensecontracts. Contractors are required to set up a minimum of two typesof indirect cost pools for Defense contracts: “Overhead”:supports a specific part or function of company “G&A”:supports general operations of company rather than any onespecific part. No maximum number of indirect cost pools, but ASMC – PDI 201921

Considerations for establishing indirect cost pools and determiningcost allocation basis (i.e., rates): The FAR [31-203(b)] requires indirect costs be accumulated bylogical cost groupings. The CASB states “homogeneous costs” are to be aggregated in aseparate cost pool. EVMS guidelines address indirect cost management – it is one ofnine EVM business processes. Three of the thirty-two EVMSguidelines specially cover overhead management; recording andallocating indirect costs; and analyzing indirect cost variances. Allocation of cost pools should be done on a base common to allcost objectives to which the costs will be allocated.Note: CASB Cost Accounting Standards Board (unique to Federal Government)ASMC – PDI 201922

Government allows contractors to use one or more of the followingfactors as the base to determine their indirect cost allocation rates :BaseDirect Labor Dollars,Direct Labor HoursTo DetermineManufacturing andEngineering OverheadDirect Material Dollars Material HandlingTotal Cost Input (TCI) G&A Costs(All costs except G&A)ASMC – PDI 201923

Types of CostsDirect CostsIndirect Cost PoolsIndirect CostsCost ObjectivesTotal Costs Direct Costs Indirect CostsASMC – PDI 201924

Direct CostsABCIndirect CostsASMC – PDI 201925

AIndirect CostsASMC – PDI 2019BCIndirect Cost Rate Pool/Allocation Base26

Fixed Cost Example – Allocation Base: Square FootageRate 120,00060,000 2.00@sq.ftABC20,000SQ. FT30,000SQ. FT10,000SQ. FTIndirect CostsIndirect Cost Rate Pool/Allocation Base 120,000ASMC – PDI 201927

60,000 20,000 40,000Rate 120,00060,000 2.00@sq.ftABC20,000SQ. FT10,000SQ. FT30,000SQ. FTX 2.00 @ sq.ftIndirect Costs X 2.00 @ sq.ft 120,000ASMC – PDI 2019 40,000 20,000X 2.00 @ sq.ft 60,00028

ASMC – PDI 201929

On a Cost Reimbursement Contract,What Costs will theGovernment Reimburse the Contractor?Answer: The government will pay all “allowable” costs Direct costs are generally allowable if they arereasonable Allowability issues generally occur with indirectcostsThere is no commercial market equivalent tothe concept of “allowable” costsASMC – PDI 201930

Rate Sensitivity:A matter of the BaseSo how much to include in the base? Continued performance of firm existing contracts? How about known (identified), but not yet committedbusiness? Change proposals Options? will it get funded? Follow-ons? The likelihood they get funded and chancesof winning? Factor in anything that might just be out there? Economic growth in industry BluebirdsASMC – PDI 2019Cost (with Government Involved)31

Base Implications on RateOptimistic Base: that does NOT materialize.Estimated/ProjectedActual Materialized Optimistic Base likely used when submitting proposal for:Sole Source buys or Competitive Acquisitions? Influence of Contract Type:If FFP: the successful offeror must live with bid and the ratesused therein; base assumptions tend to be more realistic.If CPFF: should optimistic base not materialize, regardless offorward rates proposed, the billing/final rates will rise toincrease cost vouchers invoiced.ASMC – PDI 201932

Base Implications on RatePessimistic Base: that does NOT materialize.Estimated/ProjectedActual Materialized Pessimistic Base likely used when submitting proposal for:Sole Source buys or Competitive Acquisitions? Influence of Contract Type:If CPFF: pessimism in the base manifests only to increaseestimated or target cost at contract award; lower billing/finalrates for actual invoicesIf FFP: pessimism in the base increasing the forward rateresults in higher FFPs that will get paid even with lower ratesactually materializing after award.ASMC – PDI 20193333

Distortion in allocations(labor vs. labor hrs.)Scenario: The engineering supervisor making 300K/yr charges her salary to theengineering OH support pool. She supervises two teams. Each team works 12,480hrs (6 @ 2080 hrs/yr). The Senior team is working the high power project A makesan average of 100/hr. Junior team is working the low power project B makes onaverage 50/hr.How much of the engineering supervisor’s 300,000/yr salary charged to Eng. OH will getallocated (charged) to each projector project A and B for the year?High Power Projector ASenior Team A (avg. 100/hr.)Low Power Projector BJunior Team B (avg. 50/hr.)Direct Lbr. Hrs. (@2,080/year) 150,000 150,000Direct Lbr. Dollars ( )Charged 200,000 100,000Allocation Basis:With Team A lbr. cost twice that of Team B ( 100 avg. rate/hr. 50 avg. rate/hr.) IF you were to conduct a floor study, with which team might you expect the engineering supervisor to bespending the majority of her time with? The senior team? Or, the junior team? (circle one)Based on your answer to the question immediately above, which method yields less distortion than theother? Labor hours? Or labor ?ASMC – PDI 201934

Advisory & Assistance Services (A&AS)Are there really “normal” indirect cost rates?Scenario: An Advisory & AssistanceServices (A&AS) contract’s schedulestipulates a wrap-around rate (FBLR)of 181.50/hr. be billed for each hourworked by a regular engineer.Of the 181.50/hr. billing rate:– How much goes to payingthe individual supportengineer?– How much goes to payingthe indirect (OH/G&A) cost?– How much goes to payingthe contractor’s profit?ASMC – PDI 2019DL Rate 50.00/hrOH (200%) 100.00 /hrSubtotal 150.00 /hrG&A (10%) 15.00 /hrSubtotal 165.00 /hrProfit (10%) 16.50 /hrTotal 181.50 /hr35

A&AS Example (2 of 4)What if: You assert you perceived a standard OH rate should be 100%instead of 200%. Complete your logical expectations below DL Rate 50.00/hrDL Rate 50.00/hrOH (200%) 100.00/hrOH (100%) 50.00 /hrSubtotal 150.00/hrG&A (10%) 15.00/hrSubtotal 165.00/hrProfit (10%) 16.50/hrTotal 181.50/hrSubtotal 100.00 /hrG&A (10%) 10.00 /hrSubtotal 110.00 /hrProfit (10%) 11.00 /hrTotal 121.00 /hr 121.00You should logically expect the new billing rate to bebased on your perception that a “standard” OH rate should be 100%?ASMC – PDI 201936

A&AS Example (3 of 4)Consider this: Fringe benefit costs, traceable and trackable to the individualemployee, may permissibly be charged as a direct cost rather than an indirectcost.Supervision and Administrative 10 10Fringe on S&A at 50% 5Other 60 60Fringe on DL ( 50) at 50% 25 Total Pool 100 50The 25 Fringebenefit cost for the 50/hr. engineer canbe removed from thepool and chargeddirect.75 Base (DL at 50/hr) 50 25 75100Rate (Pool/Base) 200%%Without cutting any of their cost, the contractor can actually get to this100engineering overhead rate of %to satisfy the optics of a lower rate.ASMC – PDI 201937

A&AS Example (4 of 4)So a contractor can deliver on a challenge to reduce their overhead ratefrom 200% to 100%. But will the billings to the government actuallychange?No it will not!DL Rate 50.00/hrDL Rate 75.00/hr75.00OH (200%) 100.00/hrOH (100%) 75.00/hrSubtotal 150.00/hrG&A (10%) 15.00/hrSubtotal 150.00/hrG&A (10%) 15.00/hrSubtotal 165.00/hrSubtotal 165.00/hrProfit (10%) 16.50/hrProfit (10%) 16.50/hrTotal 181.50/hrTotal 181.50/hrASMC – PDI 201938

Different Circumstances, Different Support CostOff-site Test Support Rates (aka. Field Svc. Rates)Company Engineers After making designs behindglass window below. Now analyzing test data in ashack out on the desert right.China Lake anybody?Defense R UsCorp.Indirect support costs here?Indirect support costs here? With the engineers no longer occupying their corporate offices, do corporate home officeexpenses go down measurably? And with less labor at the home base, what happens to thebasic OH rates there?R P/B; Pool (P) remains (relatively) the same, Base (B) goes down, Rate (R) goes up.ASMC – PDI 201939

Off-site Rates (a.k.a. Field Service Rates)FAR 31.203(f): Separate cost groupings for costs allocable to offsitelocations may be necessary to permit equitable distribution of costs on thebasis of the benefits accruing to the several cost objectives. Originated on development acquisitions involving test/demonstration efforts. Contractor engineers sent to the desert for flight test (paid trip to China Lake). Different circumstances alters extent of company support (indirect cost) being provided tothe off-site test support effort. Reduced head count back at corporate increases home office indirect cost rates (akaBase goes down, Rates go up) Similar concept application to lower rates over time (e.g. A&AS contractedsupport). Company engineers placed in Government program offices, not company offices. Brick & mortar footprint of service company home offices reduced over time. Reduced fixed cost leaves mostly variable cost in the indirect pool costs. Considering the base is 100% variable, relatively more variable cost in pools makesthese rates more stable relative to changes in business volume. Not only reduced rates, but also rate stability is attractive to customers. To remain competitive on service contracts, traditional capital goods contractorsreorganize to spin off services sector operations avoid significant PP&E.ASMC – PDI 201940

Evolving Indirect Cost RatesRates Differ Depending on Phase of ContractProposalPhaseClose-outPhaseNote: This concept applies only tocost reimbursement contracts.ASMC – PDI 2019PerformancePhase41

These are “Future Indirect Rates” Contractor submits to the government – A contract proposal per RFP A Forward Pricing Rate proposal for:– Direct labor rates for various disciplines– Indirect cost rates based on total estimated revenues andindirect costs Government evaluates contractor proposals Government and contractor negotiate both the direct laborrates and indirect cost rates “Agreed to” rates become part of the contract Result is Forward Pricing Rate Agreement (FPRA)ASMC – PDI 201942

These are “End-of-Performance Actual Rates” Indirect cost pool accounts are audited to verify allowability ofcosts in that poolValid indirect costs actually incurred are compared to indirectcosts estimated during Proposal Phase and modified duringPerformance Phase“Actual” indirect rates computed based on “actual” indirect costsincurred – subject to negotiation between government andcontractorFinal contract price is based on actual direct costs incurred plusapplication of “actual” indirect rates usually, higher costsContract close-out takes at least 5 to 7 years after awardASMC – PDI 201943

These are “Billing Rates” Billing rates are: Applicable to only indirect costs Based on estimated indirect costs (e.g., overhead) Temporary and applicable during period of contractperformance Adjusted during contract performance to ref

contract costs Indirect costs are important to contractors on all contracts, but most important to government on cost . rent and maintenance, utilities, supplies for the building, etc.) General and Administrative (G&