Transcription

Step-by-Step Instructions for Rollover ContributionsTheJPMorganChase401(k)SavingsPlan offersthe opportunityto “rolltheover”the avingsPlan offersyou theyouopportunityto "roll over"distributionyou receiveyourfrompreviouspreviousemployeror IRAthe JPMorganChase(after youtoterminateemploymentwith theIffirm).Theemployer'splan or ionsPlanare designedhelp you throughthis process.you havefollowinginformationinstructionsare designedto 1-866-360-1192,help you throughOptionthis process.If you have any questions, pleaseany questions,pleaseandcontacta dedicatedspecialist at3.contacty q the 401(k)p Savings Plan Call Center.ppDetermine Whether Your Contribution Is a Direct Rollover or a Regular 60-Day Rollover.IRAor annuitymakesthe distributionpayabledirectlyto JPMorganChase Direct Rollover: Your previous plan orannuitymakesthe distributioncheckcheckpayabledirectlyto JPMorganChase401k401(k)SavingsSavingsPlan. Plan.or annuitymakesthe distributioncheckpayableto you. Regular 60-Day Rollover: YourYour previousprevious planplan IRAor annuitymakesthe distributioncheckpayableto you.If You Are Electing a Direct Rollover Complete the Participant Information section of the Incoming Rollover Election form. Complete the Rollover Information section choosing Direct Rollover and the applicable Internal Revenue Code ("Code")plan type on the form. Complete the Previous Provider Information section.PleasePleaseattachattacha copyof yourmostaccountrecent statementaccount statementto the Complete the Requireda copyof mostrecentto the IncomingIncomingRolloverform.Electionform.If yourmostrecentstatementaccount statementdoes nottheindicatetype andPlanRollover ElectionIf yourmostrecentaccountdoes not indicateCode theplanCodetype planand PlanNameofNameof your employer'sdistributing eviousdistributingplan signyour previousemployersignthethe IncomingIncoming Rollover Election form.For an IRA, please verify the account statement indicates the account is an IRA. For a Direct Rollover from an IRA please note: The maximum amount eligible for rollover is the total amount of yourtaxable IRA contributions plus earnings. Non-taxable IRA contributions may not be rolled over. If your rollover amountwas held in a conduit IRA and you were born before January 1, 1936, you may be eligible for capital gains treatment.In this instance, you may want to track these rollover amounts in order to be eligible for favorable tax treatment. If theamounts were from a SIMPLE IRA, you would have had to participate in the SIMPLE IRA for a minimum of two years. If you have already received a rollover check, send this form and the check together to the appropriate addressshown in the Payment Instructions section. youOtherwise,if youadonot havea rollovercheck,have notinitiated a fromdistributionfromthe other provider, Ifdo not haverollovercheck,and havenotandinitiateda distributionthe otherprovider,Sendthisformwiththe appropriatedocumentationdescribedthis form.1. don ousprovidermustbecontactedand instructedinstructed toto distribute the2. In order to complete the rollover, the previous provider must be contacted andassets.youwouldhavelikequestions,pleasecontact atheClientRepresentativeat 1-866-JPMC401kassets. IfIf youassistancewith contactingotherServicecarrier, pleasecontact a dedicatedspecialist(1-866-576-2401).at 1-866-360-1192, Option 3. Send your completed Incoming Rollover Election form with required documentation attached to:DO NOT SEND PAYMENT TO THE ADDRESS BELOW.Empower RetirementPO Box 5520Denver, CO 80217Or fax to 1-888-241-8614EmpowerRetirementwill reviewrequestrequireddocumentationdetermineif ifyouryourrolloverrollovercancanbebe accepted Service Providerwill reviewyouryourrequestandandrequireddocumentationto todetermineinto the Plan. If information is missing, we will contact you for more information.If You Are Electing a Regular 60-Day Rollover Complete the Participant Information section of the Incoming Rollover Election form. Complete the Rollover Information section choosing Regular 60-Day Rollover and the applicable Code. Please send acopy of the check stub, showing the amount of the distribution and withholding, from the previous provider. Complete the Previous Provider Information section.mostrecentaccountstatementto theIncom CompleteComplete thethe RequiredRequired DocumentationDocumentation section.section. tementto PlanNameRollover Election form. If your most recent account statement does not indicate the Code plan type and Plan Nameofofyourdistributingplan, youmusthave yourplanemployersign the signIncomingRolloverRolloverElection Electionform. form.yourpreviousemployer'splan,youALSOmust ALSOhavedistributingyour previousthe Incomingyouarearemakingmakinga s,60 (sixty) PleasePlease Note: IfIf you youhavehave60 (sixty)days daysfromfromthe youdatereceiveyou receiveyour distributiona contribution.rollover contribution.After Service60 days,ProviderEmpowerRetirementthe dateyour distributionto maketoa makerolloverAfter 60 days,cannotacceptcannotacceptcontribution.your rolloverIt is yourresponsibilityto ensurethatreceivesEmpowerRetirementreceives allyour rolloverIt iscontribution.your responsibilityto ensurethat ServiceProviderall requireddocumentationrequiredAND yourrollovercontributionto theexpirationof the60-day period.arenoAND yourdocumentationrollover contributionprior tothe expirationof theprior60-dayperiod.There areno exceptionsto theThere60-dayrule.exceptionsto the 60-dayrule.incomeYou willresponsibleany incometax penaltiesfor failureto meetYou will be responsiblefor anytaxbeor taxpenalties for failureto meettaxtheor60-dayrule for rollovercontributionsthe60-dayrule foris rollovercontributionswhen informationis isnotand the 60-dayrolloverperiod.contribution is not madewheninformationnot providedand the rollovercontributionnotprovidedmade withinwithin the 60-day period.JPMSTF FRLCNT 01/29/21][)(150012-01CHG NUPARTNO GRPG 49728/ GP34MANUAL/DAES/SR8236567NO GRP/JTYL/ManualDOC ID: 27982840Page 1 of 2][

To avoid any income tax consequences, you must roll over your entire gross distribution (including any income taxwithholding). If you roll over less than your gross distribution, the amount not rolled over will be subject to income taxand may be subject to excise tax. Send the Incoming Rollover Election form to:DO NOT SEND PAYMENT TO THE ADDRESS BELOW.Empower RetirementPO Box 5520Denver, CO 80217Or fax to 1-888-241-8614 If you have already received a rollover check, send this form and the check together to the appropriate addressshown in the Payment Instructions section.EmpowerRetirementwill loverrollovercancanbebe acceptedaccepted ServiceProviderwill reviewyouryourrequestandandrequireddocumentationto todetermineif ifyourinto the Plan. If information is missing, we will contact you for more information.Endorse the rollover check to:401(k)SavingsSavingsPlan,Plan, FBO (your name and the last 5 digits of your Social Security number)JPMorgan Chase 401kORIf your rollover check has already been cashed, please send in a cashier's check or certified check made payable toJPMorgan Chase 401k Savings Plan. Do not send in a personal check or a money order.Some Important Rollover Facts All required documentation must be received in good order. We must review and confirm that the rollover contributioncan be accepted into your Plan before your rollover contribution will be invested in the Plan. In the event that a rollover contribution is mademade thatthat cannotcannot bebe accepted,accepted, thethe rolloverrollover contributioncontribution willwill bebe mademade payablepayableand returneddedicatedat 1-866-360-1192,Option3, ifanyyouquestionshave anyaboutquestionsreturned athe401(k) specialistSavings PlanCall Center if sfor this Plan.incomingoptionsfor thisPlan. If your distribution includes investments other than cash (for example, company stock) you can roll over proceeds fromthe sale of such investments. If you rollover the entire proceeds, no taxes will be currently due on any gains from thesale. Any portion of your proceeds that is not rolled over will be considered taxable income. Consult your attorney or taxadvisor regarding all of the options available to you. If you are the deceased participant’s surviving spouse, you can roll over the distribution into the JPMorgan Chase401(k) Savings Plan. A distribution from a qualified plan paid to a beneficiary other than the employee’s survivingspouse is not eligible to rollover to the JPMorgan Chase 401(k) Savings Plan. You can rollover a distribution you receive from a qualified retirement plan as alternate payee under a qualifieddomestic relations order (QDRO) to the JPMorgan Chase 401(k) Savings Plan as long as you are a former spousealternate payee. Examples of Contributions Which Cannot Be Rolled Over: Any "required minimum distribution" (i.e., amount being paid to you because you are age 70 1/2 or older). Distributions that are a series of periodic payments (made at least annually) and paid to you over your life expectancy(or the life expectancy of you and your beneficiary) or for a period of at least 10 years. Hardship Distributions Unforeseeable Emergency Distributions Excess Contributions Roth IRA Assets Dividends on employee securities in an Employee Stock Ownership Plan paid in cash directly to you P.S. 58 costs representing the taxable portion of any Life Insurance held by the Plan Defaulted loans declared as a distribution prior to your termination of employment Securities or outstanding loan balances An election to rollover to this Plan from another plan or IRA may result in significant tax consequences to you. You areresponsible for any income tax or penalties for the election made in this form. Review decisions related to your qualified plan distribution with your financial advisor or tax advisor.Read this information carefully.JPMSTF FRLCNT 01/29/21][)(150012-01CHG NUPARTNO GRPG 49728/ GP34MANUAL/DAES/SR8236567NO GRP/JTYL/ManualDOC ID: 279828406Page 2 of 2][)(

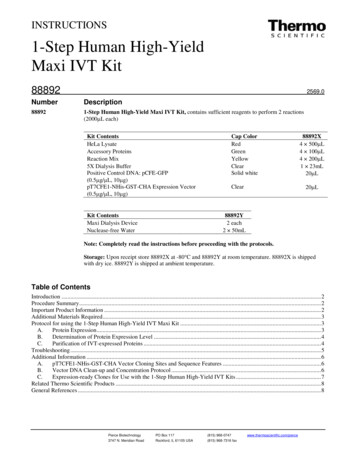

Incoming RolloverElectionr ElectionTransfer/RollovePlan Number: 150012-01JPMorgan Chase 401(k) Savings PlanIf you have already received a rollover check, send this form and the check together to the address shown in the PaymentInstructions section. Please see the Step-by-Step Instructions for Rollover Contributions for important details about theprocess to complete your incoming rollover before submitting your form and check.If youryour yalreadyissueda rollovercheck,wouldlike to learnmoreabout yourissueda rollovercheck,andandyou youwouldlike assistancewithcontactingaccountpleasecall yourthe 401(k)SavingsPlan CallCenterat 1-866-JPMC401k(1-866-576-2401),previous consolidationprovider or tooptions,learn moreaboutaccountconsolidationoptions,pleasecall 1-866-360-1192,Option 3. Aor1-303-737-7204if callingthe UnitedTTY number is 1-800-345-1833.) Clientdedicatedspecialist canhelp youfrominitiateoutsideyour incomingrolloverStates.over the(Thephone.Service Representatives are available from 8 a.m. to 10 p.m. Eastern time, Monday through Friday, except New York StockExchange holidays.Participant InformationLast NameFirst NameAddress - Number & StreetCity(p)StateMISocial Security NumberApartmentE-Mail AddressZip CodeMoDaytime PhoneDayYearDate of BirthRollover Information - A copy of the original distribution check stub must be attached if you are sendingin the check and this form together.All required documentation must be received in good order and we must review and confirmconfirm that the rollovercontribution can be accepted intoJPMorganChase401(k)SavingsPlan beforerolloverincontributioninto theyourPlan, beforeyourrollovercontributionwill yourbe investedthe Plan. If willthebeinvested.If the rollovercontributioncannotbe Plan,accepted,willbe returnedthe issuer.See attachedStep-byrollovercontributioncannotbe acceptedinto theit willitbereturnedto thetoissuer.See attachedStep-by-StepStepinstructionsfor RolloverContributions.you haveany questionsthe JPMorgan401(k) options,SavingsInstructionsfor RolloverContributions.If youIfhaveany questionsaboutaboutyour ion Optionoptions,please rollovercall 1-866-360-1192,3. please call the 401(k) Savings Plan Call Center.I am choosing a Direct Rollover from a:Qualified 401(a) plan (Profit Sharing or Money Purchase)Qualified 401(k) planNon-Roth(all contributions and earnings, excluding Roth contributions and earnings)Pre-tax: Roth (employee contributions and earnings)403(b) planGovernmental 457(b) planTraditional IRA (Only pre-tax amounts may be rolled over)I am choosing a Regular 60-Day Rollover from a:Qualified 401(a) plan (Profit Sharing or Money Purchase)Qualified 401(k) planNon-Roth(all contributions and earnings, excluding Roth contributions and earnings)Pre-tax: Roth (employee contributions and earnings)403(b) planGovernmental 457(b) planTraditional IRA (Only pre-tax amounts may be rolled over)JPMSTF FRLCNT 01/29/21][)(150012-01CHG NUPARTNO GRPG 49728/ GP34MANUAL/DAES/SR8236567NO GRP/JTYL/ManualDOC ID: 279828406Page 1 of 5][)(

IncomingRollover RolloverElection ElectionIncoming Transfer/Last NameFirst NameMISocial Security NumberPrevious Provider Information:Company NameAccount NumberMailing Address()Phone NumberCity/State/Zip CodeRequired DocumentationIf you are rolling over from an IRA, please provide a copy of the most recent account statement. If you are rolling over from aemployers plan,previous employer’splan, pleaseplease provideprovide aa copycopy ofof thethe mostmost recentrecent account statement showing the Internal Revenue Code("Code") plan type, plan name, and if applicable, Roth firstfirst contribution date and Roth contribution amounts.(“Code”)If you do not have this information on the statement, please have your Previousprevious Plan Administrator complete thefields pplicable e name of the distributing plan isThePlan Administratorcertifiesto the Thebest Planof theirknowledge ofthat:(hereinafterreferred to asthe "Plan").Administratorthe Plan certifies to the best of their knowledge that:Plan is designatedor intendedortobe tax qualifiedtheunderCodetheandmeetsrequirementsof a(1) The distributingplan is designatedintendedto be tax underqualifiedCodeandthemeetsthe requirementsof aQualified 401(a) or 401(k) plan403(b) plan457(b) for governmental plans(2) The amounts are eligible for rollover as described in Code section 402(c).(3) Employer/employee before-tax contribution and earnings: (4) For Rollovers from designated Roth accounts:Roth first contribution date:Roth contributions (no earnings):Roth earnings:(5) For In-plan Roth Transfers/Rollovers:Rollovers:Roth recapture amount:Roth recapture date(s):Roth contributions (no earnings):Roth earnings:(6) Signature of previous employer:the PlanAdministratorof thepreviousemployer.I am authorized to sign as PlanAdministratorof thepreviousemployer.“Plan Administrator”Signature of "PlanAdministrator"Printed Name of "Plan“Plan Administrator”Administrator"TitleCompany NamePhone NumberEmail AddressAmount of Transfer/Direct Rollover: JPMSTF FRLCNT 01/29/21][)(150012-01Date(Enter approximate amount if exact amount is not known.)CHG NUPARTNO GRPG 49728/ GP34MANUAL/DAES/SR8236567NO GRP/JTYL/ManualDOC ID: 279828406Page 2 of 5][)(

IncomingIncoming Transfer/Rollover RolloverElection ElectionLast NameFirst NameMISocial Security NumberJPMorgan Chase 401(k) Savings Plan Investment Option Information - Please carefully read all materials in yourJPMorgan Chase 401(k) Savings Plan Enrollment Kit, or the 401(k) Savings Plan Web Center before making any investmentelections. A prospectus for the Common Stock Fund is available upon request from the 401(k) Savings Plan Call Center.Investment Option Information - Please refer to your Plan materials for investment option designations.II understandunderstand thatthat fundsfunds maymay imposeimpose redemptionredemption feesfees onon certaincertain transfers,transfers, redemptionsredemptions oror exchangesexchanges ifif assetsassets areare heldheld lesslessthanthe periodperiod statedstated inin thethe fund'sfund’s prospectusInvestment orFundProfilesBrochure.I will referthe fund’sFund Profilesthan theotherdisclosuredocuments.I willtoreferto the Investmentfund's prospectusand/orBrochuremore information.disclosurefordocumentsfor more information.Select either existing ongoing allocations (A) or your own investment options (B).(A) Existing Ongoing AllocationsI wish to allocate this rolloverthe sametheassamemy existingallocations.transfer/rolloveras my ongoingexisting ongoingallocations.(B) Select Your Own Investment OptionsNAMEINVESTMENT OPTIONTICKER CODETarget Date Income Fund. N/ATarget Date 2025 Fund. N/ATarget Date 2030 Fund. N/ATarget Date 2035 Fund. N/ATarget Date 2040 Fund. N/ATarget Date 2045 Fund. N/ATarget Date 2050 Fund. N/ATarget Date 2055 Fund. N/ATarget Date 2060 Fund. N/ATarget Date 2065 Fund. N/AShort-Term Fixed Income Fund. N/AStable Value Fund. N/AGovernment Inflation-Protected Bond Fund. N/ACore Bond Fund. N/AIntermediate Bond Fund. VESTMENT OPTIONTICKER CODEHigh Yield Bond Fund. N/ALarge Cap Value Index Fund. N/ALarge Cap Value Fund. N/AS&P 500 Index Fund. N/ALarge Cap Growth Index Fund. N/ALarge Cap Growth Fund. N/AS&P MidCap 400 Index Fund. N/ASmall Cap Index Fund. N/ASmall Cap Core Fund. N/ASmall Cap Blend Fund. N/AInternational Large Cap Value Fund. N/AInternational Large Cap Index Fund. N/AInternational Small Cap Index Fund. N/AEmerging Market Equity Index Fund. N/AJPMorgan Chase Common Stock Fund. IJPMCSCJPMCSBJPMCIVJPMCILJPMCISJPMCEMJPMSTKMUST INDICATE WHOLE PERCENTAGES% 100%Participant AcknowledgementsGeneral Information - I understand that only certain types of distributions are eligible for transfer/rollover treatment andthat it is solely my responsibility to ensure such eligibility. By signing below, I affirm that the funds I am transferring/rollingover are in fact eligible for such treatment.I authorize these funds to be allocated into my employer's Plan and to be invested according to the information specifiedin the Investment Option Information section.I understand that I am permitted to direct the investment of my accounts in the Plan. I acknowledge that I have receivedand reviewed the information about my investment choices and have had an opportunity to freely choose how my accou

Endorse the rollover check to: JPMorgan Chase 401k Savings Plan,JPMorgan Chase 401(k) Savings Plan, FBO (your name and the last 5 digits of your Social Security number) OR If your rollover check has already been cashed, please send in a cashier's check or certified check made paya