Transcription

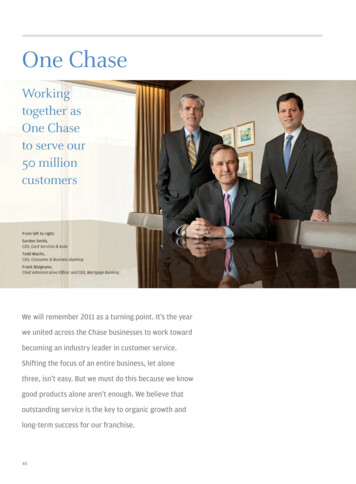

One ChaseWorkingtogether asOne Chaseto serve our50 millioncustomersFrom left to right:Gordon Smith,CEO, Card Services & AutoTodd Maclin,CEO, Consumer & Business BankingFrank Bisignano,Chief Administrative Officer and CEO, Mortgage BankingWe will remember 2011 as a turning point. It’s the yearwe united across the Chase businesses to work towardbecoming an industry leader in customer service.Shifting the focus of an entire business, let alonethree, isn’t easy. But we must do this because we knowgood products alone aren’t enough. We believe thatoutstanding service is the key to organic growth andlong-term success for our franchise.40

Why now? Chase has alwaysoffered a broad range of financialproducts and services. In fact, 50million customers rely on us fortheir banking needs. There are morethan 23 million households withconsumer and business bankingrelationships, and we have 65 millioncredit card accounts and 8 millionmortgage and home equity loans.But historically, while consumerssaw one sign out front – Chase –inside we sometimes operated likethree separate businesses. We offerwhat we believe are the best products in the industry, but we weren’talways getting the service part right.Our customer service scores werein the middle of the pack, and that’snot nearly good enough.So in 2011, we began the hard workof moving from a company organized around products to a companyfocused on our customers first.We are on a journey to create anoutstanding customer experiencein everything we do, and we arecalling this effort One Chase. Whatthat means is always running Chaseas one business for our customers,providing consistently greatcustomer service at every contact.We are 100% certain that exceptional customer service is the key togrowing revenue. We have a tremen-Every day, our 160,000 Chase employeesare working to provide exceptionalservice to make sure our customers havethe products and advice they need.“We know we’re only at the beginning ofa large-scale effort to improve customerservice. It will be a challenge, but wethink it’s ours to win.”dous opportunity to earn more business from our current customers.Chase customers who live within ourbranch network have more than 10trillion in deposits and investmentswith our competitors. And theyspend more than 300 billion annually on non-Chase-issued credit cards.Customers who say they arecompletely satisfied are 60% morelikely to increase the number ofChase products they use, 26% lesslikely to switch banks and 61%more likely to recommend us to afriend. Affluent customers who arecompletely satisfied give us 52%more deposits and investments thanthose who aren’t.We’re proud to say we’ve alreadymade significant progress. Here’show we have gone about it.First, we spent more time listeningto customers’ comments andcomplaints. Leaders, including ourmarket, district and region managers,gathered for a two-day meeting inMay during which they pored overcomplaint letters and listened tocalls. We also launched “Begin YourDay with Our Customer,” where theExecutive Leadership team startsevery day listening to customer calls.We learned a lot. We found thatcustomers want to interact withpeople who genuinely care abouthelping them and are empowered todo so. When customers have issuesthat need to be resolved, they wantto do so quickly and easily. Also, itbuilds lasting customer loyalty whenan employee goes above and beyondwhat is needed.We sought out other companiesrenowned for service and askedthem how they do it. We visitedsome of the best service providerswe know, like The Container Store,The Home Depot, SouthwestAirlines, Zappos, and EnterpriseHoldings, the parent company ofEnterprise Rent-A-Car, many ofwhich are great clients of the firm.Even though their industries andregulatory frameworks are differentfrom ours, we saw a commonality intheir approach to customer servicethat was eye opening.41

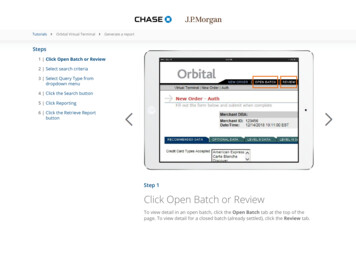

Estimated Growth OpportunitySatisfaction Rating for Chase Businesses Increasedacross the BoardThe business that customers are not doing with Chase represents ahuge opportunity( in billions)(score in percentage)( in billions)80Deposit & InvestmentBalances*Credit Card Spending* Card1 Consumer banking 2 Mortgage originations27570 10,000 3006560 With Chase With competitors55Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11* Numbers are for 23 states with Chase branchesSource: Internal JPMorgan Chase dataWe learned that great customerservice starts with great employees.You have to hire people who have aheart for service and truly care abouthelping people. Then you have togive them the power to do what theyknow is right for the customer. Wealso learned that common policiesand processes, while important, aren’tthe only things that create consistency in large organizations. Having aset of clear values and behaviors letsemployees know where they standand customers know what quality ofservice they will receive.From that, we defined a consistentset of behaviors across our businessesthat will help every employee interacting with customers, no matter thesituation. We are calling these Chase’s“Five Keys to a Great CustomerExperience.” The Five Keys include421 Satisfaction represents a top ranking of a 4 or 5 on a five-point scale2 Satisfaction represents a top ranking of a 9 or 10 on a 10-point scaleSource: Based on internal survey processthings like “exceed expectations” and“own customer issues from start tofinish.” For the first time, all 160,000Chase employees understand what’sexpected of them and how they canprovide the best possible experiencefor all our customers.Next we hit the road to hear fromemployees in person. No one knowsbetter what customers are thinkingthan the people who see and speakwith them every day. So we went onbus tours and road shows, holdingtown halls, barbecues and evenrallies to meet as many people aspossible across all of Chase. Everywhere we went, we asked employeesto tell us what we can do to make theplace better. And they did.We kept a log of everything weheard from employees – the good,the bad and the ugly. That kickedoff the most important phase ofour work, taking all the suggestionsand using them to transform ourcustomer service. We’re tracking 160suggestions that we’ve gotten fromthe road. That’s in addition to themore than 400 changes we’ve madeto improve the customer experiencebased on feedback from customersand employees.While we were on the road, we wereinspired by our employees’ dedication and integrity and by their heartfelt desire to make their customers’lives better.We’re also working to make sure wecontinue to get the right people inthe door by integrating customerservice into our hiring process. In2011, we created a net 18,000 jobsacross Chase. Everyone understandsthe important role service plays inour business. We’ve also changedthe way we reward people to betteralign our incentives aroundcustomer service.

Chase customers can use more than 5,500bank branches and more than 17,200ATMs in 23 states, as well as online andmobile banking services.And it’s not just the three of us whoare engaged in this effort. All oursenior managers are excited aboutthe changes we’re making and arepitching in to get the work done.We’ve created a combined ChaseExecutive Committee that meets regularly and two cross-Chase councils tosolve problems quickly and put moresenior focus on two critical areas:Customer Experience and Brand &Marketing. These two councils aim totake the best practices of each of ourbusinesses and apply them to all.For example, we’re working to makesure experiences in our telephoneCustomer Service Centers are consistent. In 2011, we simplified our automatic voice menus and the processto reach an agent. We have implemented new training on culturalawareness and communication skillsand are hiring people who genuinelywant to help others.We’re also simplifying how we talkwith customers. Building on workstarted in Card Services, we adoptedan industry-leading standard to createsimple, easy-to-understand productdisclosures. It sounds simple, and weshould have done it earlier. But we’redoing it now, leading the industry andcreating happy customers.Customers are also benefiting fromnew technology. Our mobile applications are making it easier for ourcustomers to do business with usacross channels. Our ATMs now speak14 languages and accept deposits ofmultiple checks and cash without anenvelope or deposit slip. We’ve alsoset up a Twitter feed to help solvecustomer issues in real time.We are even more enthusiastic aboutwhat’s ahead with technology. Weare piloting self-serve teller machineswith bigger screens and greater functionality. They’ll be able to dispensecash in multiple denominations forcustomers who simply want to get inand out of a branch quickly. We alsoplan to upgrade chase.com, incorporating feedback from customers onwhat they want to see.We’re only at the beginning of thisjourney, but we’ve already maderemarkable progress. Overall,customer satisfaction scores are up,in some cases significantly, acrossChase. Turnover is down, and thenumber of customer letters wereceive commending our employees has increased dramatically.The next great frontier in ourindustry is creating an outstandingcustomer experience, and no bankhas really conquered it. We plan todo so. And we will. As a firm, whenwe set our minds to doing something, we do it. We’re all consumers.We know what a great customerexperience feels like and the loyaltyit inspires in us. If we think likecustomers and focus on deliveringthe kind of experience we would liketo have ourselves, we will build lifelong relationships. And stronger relationships will lead to more revenueand future earnings.So stop by a branch, give us a call orlog on to chase.com. We think you’llbe excited by the changes you see andthe outstanding service you’ll receive.GordonToddFrank43

Retail Financial ServicesConsumer & Business BankingIt’s an exciting time to be a part ofChase. I became CEO of Consumer& Business Banking (CBB) this pastJuly after almost 10 years as CEOof Commercial Banking. There weworked closely with the consumerside of the business and relied onour outstanding branch network andterrific consumer bankers to serveour commercial clients. After morethan eight months in this new rolelearning about the operations andproducts and meeting the dedicated people in this business, I morefully appreciate the power of ournetwork. Our talented, caring andhard-working people, together withgreat products and channels, makeConsumer & Business Banking atruly special part of the firm.2011 Results: Solid Results in aChallenging YearEven in a difficult year for theindustry, Consumer & BusinessBanking produced a strong returnon equity of 40% in 2011. We hadnet income of 3.8 billion, a 4%increase from 2010 on revenue of 18.0 billion, up 2% from 2010. Ourtotal average deposits increased 6%to 360.7 billion.Last year brought many changes toour business. One of the biggest wasthe implementation of the DurbinAmendment in the fourth quarter.This legislation, part of the broaderDodd-Frank financial reform bill,caps the amount of money banks cancollect from merchants who acceptdebit cards. We expect these changesto lower net income by 600 millionon an annualized basis. While that’sa big hit to our bottom line, I am notworried. I know we have a strongplan to grow the business by44focusing on serving our customersexceptionally well and providinggreat products that meet all of theirfinancial needs. Over the long term,we’ll gain a larger share of theirbusiness by serving them better thanour competitors, becoming the mosttrusted advisor to many. We willcapture an increased share of ourcustomers’ banking activities andcontinue to grow our business.A key to our progress has been ourcontinued investment in branches,people, products and technology.And we never stopped investing,even during the darkest days of thefinancial crisis. For this reason,we are well-positioned today. CBB’sstrong results in 2011 allow us tocommit more resources to serveour customers. We hired more than6,500 people in 2011, bringing ourtotal number of employees to 88,540.We also promoted nearly 14,000 ofour colleagues, giving them new skillsand long-term career opportunities.We added 260 Chase branches,mostly in California and Florida.These new locations allow us toincrease our lending to small businesses, offer more mortgages andrefinancings, and help more peoplemanage their money through savingsand investments. We also do ourpart to create economic growth byhiring local architects, contractors,builders and staff to assist us.Our Business Banking expansion isanother way we’re supporting ourcommunities with more loans andbanking services. In 2011, the firmmade 17 billion in new loans tosmall businesses, 52% more than theprevious year. We were the #1 SmallBusiness Administration lender forthe second year in a row. Our averagebusiness deposits grew 12%, to 63billion. Since the start of 2009, wehave hired more than 1,200 BusinessBankers to serve our more than 2.2million small business customers.2012 Priorities: Improve Service,Work to Become One ChaseWe set ourselves apart from thecompetition with strong leadership, careful risk managementand continuous investment in ourbusinesses. Our plan in 2012 is toexcel at customer service, puttingus further ahead of our competitors.We intend to be the first nationalbank to be known for exceptionalcustomer service. Our 160,000 Chaseemployees are fully committed tothis goal and are already workinghard to get us there.In my experience, good service alwaysleads to more customers and revenuegrowth. If you are happy with theservice you receive, it stands to reasonthat you will do more business withthat company. In fact, the most profitable hotels, airlines and retail storesare usually those that have a higherstandard of service integrated intotheir culture, creating both satisfiedemployees and loyal customers whoseek them out again and again.In a short time, we’ve made dramaticprogress on providing customerswith a great experience. AcrossCBB, customer satisfaction is up,complaints are down and ourcustomers are moving more moneyto Chase. This is all great news, but itis a journey, and we still have a longroad to travel.In addition to providing betterservice, we are developing morecustomized products that meet thedifferent needs of our customers.

Some people are looking for a lowercost product for basic banking,while others are looking for complexinvestment advice or help with theirbusinesses. Delivering an experiencethat “wows,” no matter what type ofproduct or service, means getting toknow each of our customers individually and learning what’s important to them. For some people, itmeans making it easy to do transactions through technology and mobiledevices. For others, it means offeringexperienced and proven investmentadvice to help grow savings.We’ll do this across a broad spectrum of products and channels.One example is our acceleratedexpansion of Chase Private Client(CPC), our banking and investmentplatform for affluent customers.Since we launched the first phase ofCPC expansion in July of 2011, thenumber of CPC households we servehas nearly quadrupled, and thosehouseholds have grown theirdeposit and investment balancesby 80,000 on average.In 2012, we will introduce a moreaffordable banking alternativedesigned for low- and middle-incomecustomers. We see a great opportunity to provide a low-cost bankingsolution with tangible benefits,such as lower fees compared withthe industry.We remain committed to expandingour branch network thoughtfullyand strategically. We will continueto open locations in our key expansion markets, mainly California andFlorida. The average Chase household visits a branch more than 15times a year. And branches are goodinvestments. Most break even withinthree years and contribute 1 millionin pretax earnings after 10 years.They also expand our distributionfor nearly all of JPMorgan Chase’slines of business. For example: C ommercial Banking clientsaccount for 16 million branchtransactions each yearWhile the banking industry facesmany short-term challenges, at Chasewe feel strongly that no other bankis as well positioned to have thesuccesses we will have in the longterm. We have a strong brand, morethan 5,500 community branches,industry-leading online and mobileofferings, and exceptional people.This solid foundation will allow usto create a great experience, invest inour business, become more efficientand develop customized products.Thank you for your investmentin our company and for yourconfidence in us all. A bout 50% of retail mortgagesare originated in branches 4 5% of Chase-branded credit cardsare sold through branches I n Treasury & Securities Services,about 30% of commercial dollarsare deposited in branchesTodd MaclinCEO, Consumer & BusinessBanking Branches bring in about 20% ofU.S. retail assets under management2011 Highlights and Accomplishments More than 5,500 branches andmore than 17,200 ATMs across23 states serving 23 millionhouseholds: More than 17 million active onlinecustomers; active mobile usersincreased 57% from last year tomore than 8 million Chase Private Client:— Opened 246 Chase PrivateClient locations for a total of262 nationwide— #2 ATM network— More than 500 CPC bankersand advisors now serve nearly22,000 clients— #3 in deposit market share— #3 in branches Overall customer satisfactionimproved to 67% from 57%during 2011 Firmwide, we made 17billion in new loans to smallbusinesses in 2011, up 52%from the previous year. Wewere the #1 Small BusinessAdministration lender forthe second year in a rowOverall Satisfaction with ChaseCustomers who rate Chase a 9 or 10 on a 10-point scale(score in percentage)7567%7065605557%Jan2011Source: ChaseRelationship g2011Sep2011Oct2011Nov2011Dec201145

Retail Financial ServicesMortgage BankingWe view 2011 as a defining yearfor the mortgage business. Thereis no question that the past severalyears have been extremely challenging for the industry and Chase,but I couldn’t be more proud of theprogress we’re making. In MortgageBanking, we remind ourselves everyday that every mortgage represents acustomer and a home.2011 Results: Improving Performancedespite Continued ChallengesWhile market conditions remainedchallenging for the mortgageindustry, we made progress inseveral areas of our businesses andcontinued to tackle regulatory issues.Although credit losses and higherexpenses continue to weigh onearnings, our new Production business made money for the year onstrong refinancing activity and lowerrepurchase losses. We also increasedmarket share, becoming the #2originator at the end of 2011, up from#3. Core Servicing (excluding legacyportfolio) was firmly profitable.Real Estate Portfolio performancewas better than the past two yearsas credit improved. This counteredlower revenue from portfolio run-off.Our first priority for 2011 was gettingthe best team we could on the field.We recruited top talent from acrossthe firm and the industry to makesure we had the right controls,processes, systems and technology.To help manage our portfolios, wetapped experts in risk management46and capital markets from the Investment Bank. We also hired financeindustry veterans with deep mortgage experience to ensure we meetall new regulations to the full letterof the law.these issues behind us is good for thehousing market recovery and good forChase. We can now redirect the focusand resources consumed by the settlement toward growing our businessand serving customers.With the right team in place, wemade improving the customerexperience a priority for all areasof Mortgage Banking. Customercomplaints declined more than 60%from their May 2011 peak, and overallsatisfaction improved to 67% from58%. Chase was the top-ranked largebank in overall satisfaction in theJ.D. Power and Associates 2011

Deposit & Investment Balances* Credit Card Spending* With Chase With competitors * Numbers are for 23 states with Chase branches Source: Internal JPMorgan Chase data 55 60 65 70 75 80 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov