Transcription

VoIP:Short Report - Q4 2011April 2012Point Topic Ltd61 Gray’s Inn RoadLondon WC1X 8TL, UKTel. 44 (0) 20 3301 3303Email info@point-topic.com

2VoIP: Short Report Q4 2011ContentsIntroduction3Global and Regional3Leading VoIP countries5Conclusion8This analysis is taken from Point Topic’s Internet Video and Voice service.Users of this service can access profiles of all the leading IPTV and VoIP operators, aswell as historical databases of subscriber numbers.You can get more detail on the site or contact us on info@point-topic.com. Point Topic Ltd 2012. Unauthorised reproduction prohibited

3VoIP: Short Report Q4 2011IntroductionGrowth in VoIP subscribers has been consistent this year, with rates of increase largely similar tothose recorded in 2010. Considering all VoIP operators tracked by Point Topic around the globe, wesee a total growth rate of 13% for the year, just one percent less than in 2010. Our quarterlynumbers are up by 3%, an improvement of 1% on Q3 2011.Net additions for operators being examined totalled 3.6 million for the quarter and 15.1 million forthe year ending December 2011, bringing our total subscriber number to a considerable 135.4million.Point Topic defines VoIP in this report as a subscription service that does not require a PC tooperate. For this reason, Skype services are not included in the figures for subscribers, although wediscuss them in this report. But PSTN-style services are included.Global and RegionalFor each of the six regions in which we track VoIP progression, Point Topic has recorded growth.Once again, we have seen the more mature VoIP markets grow at a slower rate than moreestablished VoIP markets. For example, subscriber numbers in Western Europe increased by just 9%during 2011, whereas subscriber numbers in Eastern Europe increased by approximately 27%, albeitfrom a relatively low starting base. This 27% increase for Eastern Europe is up 7% on figuresrecorded in 2010, when an annual growth rate of 20% was observed.VoIP Subscribers (millions) by Region, 2010-2011Region2010Q42011Q32011Q4Quarterly% IncreaseAnnual %IncreaseWestern 132%11%North America30.8934.7635.753%16%South and East Asia7.338.619.126%24%Latin America4.384.985.164%18%Eastern al TotalOnce again, the South and East Asia region showed strong growth during 2011, although it has nowbeen surpassed by Eastern Europe. Advances in South and East Asia are partly due to sustainedgrowth in subscriber numbers in China. Licensed telecoms operators are allowed to operate VoIPservices in the country, and there is also a thriving market in illegal VoIP services. These are typically Point Topic Ltd 2012. Unauthorised reproduction prohibited

4VoIP: Short Report Q4 2011offered by small home-grown businesses. Skype’s service is allowed to operate in China for PC-to PCcalls only.Western Europe continues to hold the largest share of VoIP subscribers tracked by Point Topic, withclose to 34%. We expect to see this share decline over time as growth further accelerates in otherregions, especially in Asia. However, for now, market shares recorded for 2011 are largely consistentwith those found in 2010, give or take 1%.Regional VoIP Market Shares - Q4 2011Western EuropeAsia-PacificNorth America3.8%South and East AsiaLatin AmericaEastern Europe1.3%6.7%33.6%26.4%28.2%Source: Point Topic Point Topic Ltd 2012. Unauthorised reproduction prohibited

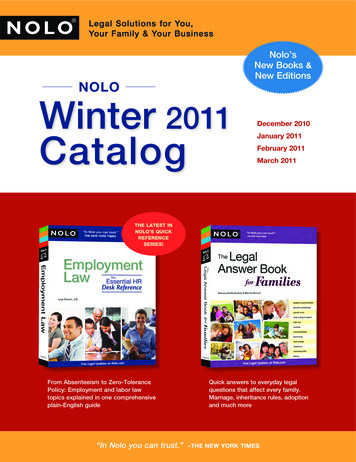

5VoIP: Short Report Q4 2011Leading VoIP countriesSubscriber numbersThe USA, Japan and France continue to dominate VoIP, with the third largest market, France, havingclose to twice as many subscribers as the next largest country, South Korea. Once again, the USA isthe leading VoIP country, now with close to 31 million subscribers. More than 30% of these are withcable company, Comcast. A further 15% are signed up with Time Warner Cable, whilst 10% receivetheir VoIP services from Cablevision. Other VoIP subscribers are using a VoIP-only provider such asVonage, with around 2.4 million subscribers, or a VoIP plan from a telco that also offers traditionalPSTN services.Our VoIP subscriber base for Japan now exceeds 26 million, with 27% and 24% held by NTT-East andNTT-West respectively. Growth has been contained at 1-2% per quarter throughout 2011,amounting to an average of 411,000 net additions every three months. In the USA quarterly growthhas been about 2-3% per quarter with the exception of Q1, when a rate of 8% was recorded. Netadditions for the USA averaged about 746,000 for the final three quarters of 2011.The country with the third largest number of VoIP subscribers is France, with over 20.5 millionrecorded at the end of 2011. France Telecom holds the lion’s share at 39%, with SFR and Freeaccounting for a further 24% each. In France, VoIP has enabled new entrant operators such as Freeto use unbundling or bitstream access to offer consumers an all-IP triple play for a low price.Incumbent France Telecom was relatively quick to launch its own VoIP products. The result has beena rapid shift away from PSTN.It follows that France has a very high penetration of VoIP services. By the end of 2011, around 90%of broadband subscribers in France also had a VoIP service. This is higher than both the USA andJapan, where the figures are 34% and 72% respectively.Top Ten VoIP Countries - Q4 2011 & Q4 20102011Q42010Q43530Subscribers (Millions)2520151050Source: Point Topic Point Topic Ltd 2012. Unauthorised reproduction prohibited

6VoIP: Short Report Q4 2011As is the case with IPTV, Italy has dropped out of our top ten rankings for 2011, replaced by Brazil,which recorded 19% growth for the year. The decline in Italy’s numbers is due to a reduction in VoIPsubscribers reported by Telecom Italia, one of the main Italian operators tracked by Point Topic.Growth ratesLooking at annual growth, we see newly emerging markets such as those of Poland and Romaniaposting impressive rates as VoIP begins to take off. The Polish VoIP market grew by 37% in 2011,pushing it into first position overall in terms of annual growth. This represents a 19% increase inannual growth rate for Poland. The Romanian market grew by 31% throughout the year (a 7%reduction on 2010), now with more than 180,000 subscribers.China continues to post steady annual growth, with 24% achieved for the year, pretty consistentwith the 25% growth recorded in 2010. There remains considerable scope for growth in the rest ofthe country.Growth in Spain has also been consistent throughout 2011, with quarterly growth averaging at 5%for the year. This follows a period of accelerated growth in 2010.Germany continues to make strides in the VoIP market, with annual growth up to 19% for 2011, anincrease of 9% on 2010 rates.Leading VoIP Countries by Annual Growth (million additions): Q4 2010 – Q4 2011CountryAdditions Additions Growthin Qtrin Yrin QtrGrowthin 7%Romania0.140.170.180.020.0410%31%China (All .140.150.010.036%23%South 63%17%1.121.221.300.080.186%16%Mexico*Countries which had not achieved 100,000 subscribers by 2010Q4 have been excluded Point Topic Ltd 2012. Unauthorised reproduction prohibited

7VoIP: Short Report Q4 2011Impact of Internet telephonyAll of the VoIP services that Point Topic has been tracking use IP technology to provide a PSTN-likeservice. In other words, the customer can simply pick up a telephone handset to make a call, and willreceive a bill from their service provider.But any discussion of VoIP needs to include Internet telephony. Luxembourg-registered Skype is byfar the most widespread of these services, although some IM platforms and online gaming networkssupport IP voice traffic. Initially, the majority of calls via Skype were made and received from the PC.For non-technical users, Skype still remains more complex to use.Calls can now be made via a mobile, connecting to the Internet using WiFi (usually free) or 3G (couldbe expensive depending on the tariff). Skype phones are also available, which plug directly into arouter and do not require the home PC to be switched on. But these have seen relatively low rate ofuptake.In 2011 Skype provided some operational data for 2010, in an amendment to an S1 filing with theSEC. An S1 filing is a general registration, which is the first step towards an initial public offering(IPO).Skype said that it had 663 million registered users at the end of 2010 (up 89 million over the year),with 145 million registrants using Skype at least once a month. However, only 8.8 million Skyperegistrants paid any money for the services, generating revenues of 859.8 million. That representsan ARPU of just over 8 per user per month assuming a constant rate of ARPU growth. Skype alsosaid that 42% of its minutes in Q4 2010 were video telephony. Skype also planned to launchadvertising on its services, perhaps to make up for the revenue it is not earning from telephony.Adverts were due to run in the USA, UK and Germany initially.What these numbers suggest is that the number of regular Skype users is at around the same levelas the number of ‘full-service VoIP’ users (135 million). ARPU is considerably lower, as only 8.8million Skype subscribers were paying anything at the end of 2010.The other obvious point to be made from the Skype data is that there is demand for video calls. ButSkype has created an expectation that this is a free service. This makes monetising video callsdifficult for other operators in the consumer video telephony space, and even for operators lookingat the low end business video telephony market. Point Topic Ltd 2012. Unauthorised reproduction prohibited

8VoIP: Short Report Q4 2011ConclusionThese numbers show that demand for VoIP services is continuing to grow at a steady pace. Quarterlygrowth on an international scale has been consistent for some time now, with no sign of publicappetite abating. VoIP offerings which are either free or available as a low-cost addition tobroadband services are attractive to consumers, and those with existing broadband lines in thehome can add on a VoIP service with relative ease.We are seeing a number of newly emergent VoIP markets, such as those of Poland and Romania,posting impressive subscriber growth rates as services begin to take off.By the end of 2011, markets in France, Japan and the USA totalled more than 20, 26 and 30 millionrespectively. Comparative figures from five years ago are 6, 13 and 10 million. The Japanese markethas doubled in that time, with subscribers in France and the USA trebling.Not every market has seen this level of VoIP growth, but a wide range of suppliers are targetingcustomers – often business customers – with VoIP products. Experience in the USA and France showthat consumers are unconcerned with the underlying technology behind voice calls. They do notcare that the service is provided over PSTN or VoIP, but that it works and is a reasonable price.The numbers can be difficult to measure, as this is a fairly fragmented market in many places. Ratherthan a monopoly or duopoly of telephone service suppliers, as was the case in the past, consumerscan choose from a far wider range of suppliers. Many will use VoIP, but some will use pre-selectionor calling cards to route calls onto lower-cost long distance or international services. Bundles andVoIP-over-WiFi further complicate the picture.Another impact of VoIP is to drive down average telephony costs within a market. This lowering ofprice expectations, combined with customer inertia, and a perception of complicated service set-up,could present the biggest challenges for future growth in VoIP numbers.Point Topic currently tracks 93 VoIP providers in 30 countries, with more added to the database asservices launch.This analysis is taken from Point Topic’s Internet Video and Voice service.Users of this service can access profiles of all the leading IPTV and VoIP operators, aswell as historical databases of subscriber numbers.You can get more detail on the site or contact us on info@point-topic.com. Point Topic Ltd 2012. Unauthorised reproduction prohibited

Once again, we have seen the more mature VoIP markets grow at a slower rate than more established VoIP markets. For example, subscriber numbers in Western Europe increased by just 9% during 2011, whereas subscriber numbers in Eastern Europe increased by approximately 27%, alb