Transcription

HOCKING TECHNICAL COLLEGEATHENS COUNTYSINGLE AUDITFOR THE YEAR ENDED JUNE 30, 2000

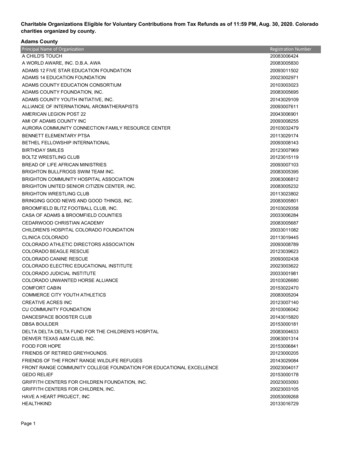

HOCKING TECHNICAL COLLEGEATHENS COUNTYTABLE OF CONTENTSTITLEPAGEReport of Independent Accountants . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1Balance Sheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4Statement of Changes in Fund Balances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8Statement of Current Funds Revenues, Expenditures, and Other Changes . . . . . . . . . . . . . . . . . . . . . 10Notes to the General Purpose Financial Statements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11Schedule of Current Revenues - Educational and General . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28Schedule of Current Expenditures - Educational and General . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29Schedule of Auxiliary Enterprises Revenues and Expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30Schedule of Federal Awards Receipts and Expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31Notes to Schedule of Federal Awards Receipts and Expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32Report of Independent Accountants on Compliance and on Internal ControlRequired by Government Auditing Standards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33Report of Independent Accountants on Compliance with Requirements Applicableto Each Major Federal Program and Internal Control over Compliancein Accordance with OMB Circular A-133 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35Schedule of Findings - OMB Circular A-133 §.505 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

This page intentionally left blank.

743 East State StreetAthens Mall, Suite BAthens, Ohio -594-2110www.auditor.state.oh.usREPORT OF INDEPENDENT ACCOUNTANTSHocking Technical CollegeAthens County3301 Hocking ParkwayNelsonville, Ohio 45764To the Board of Trustees:We have audited the accompanying financial statements of Hocking Technical College, Athens County, Ohio(the College), as of and for the year ended June 30, 2000, as listed in the table of contents. These financialstatements are the responsibility of the College’s management. Our responsibility is to express an opinionon these financial statements based on our audit.We conducted our audit in accordance with generally accepted auditing standards and the standardsapplicable to financial audits contained in Government Auditing Standards, issued by the ComptrollerGeneral of the United States. Those standards require that we plan and perform the audit to obtainreasonable assurance about whether the financial statements are free of material misstatement. An auditincludes examining, on a test basis, evidence supporting the amounts and disclosures in the financialstatements. An audit also includes assessing the accounting principles used and significant estimates madeby management, as well as evaluating the overall financial statement presentation. We believe that ouraudit provides a reasonable basis for our opinion.In our opinion, the financial statements referred to above present fairly, in all material respects, the financialposition of Hocking Technical College, Athens County, as of June 30, 2000, and the revenues, expenditures,and changes in fund balances for the year then ended in conformity with generally accepted accountingprinciples.In accordance with Government Auditing Standards, we have also issued our report dated December 6,2000, on our consideration of the College’s internal control over financial reporting and our tests of itscompliance with certain provisions of laws, regulations, contracts and grants. That report is an integral partof an audit performed in accordance with Government Auditing Standards and should be read in conjunctionwith this report in considering the results of our audit.Our audit was performed for the purpose of forming an opinion on the financial statements of the College,taken as a whole. The accompanying supplementary schedules listed in the table of contents, including theSchedule of Federal Awards Receipts and Expenditures required by U.S. Office of Management and BudgetCircular A-133, Audits of States, Local Governments, and Non-Profit Organizations, are presented forpurposes of additional analysis as, and are not a required part of the financial statements. Such informationhas been subjected to the auditing procedures applied in the audit of the financial statements and, in ouropinion, is fairly stated, in all material respects, in relation to the financial statements taken as a whole.Jim PetroAuditor of StateDecember 6, 20001

This page intentionally left blank.2

This page intentionally left blank.3

HOCKING TECHNICAL COLLEGEATHENS COUNTYBALANCE SHEETJUNE 30, 2000ASSETSCurrent FundsCurrent Unrestricted Funds:Educational and General:Equity in Pooled Cash and InvestmentsDue from Current Funds - Unrestricted - Auxiliary EnterprisesAccounts ReceivableIntergovernmental ReceivableDue from Quasi-Endowment FundInventory Available - At Cost 971,459571,5591,115,3087,38410,957123,597Total Educational and General Auxiliary Enterprises:Equity in Pooled Cash and InvestmentsAccounts Receivable/Accrued InterestInventory, At Cost and Other AssetsPrepaid Expenses and Book Credits2,800,2642,568224,164702,54576,542Total Auxiliary Enterprises1,005,819Total Current Unrestricted Funds3,806,083Current Restricted Funds:Equity in InvestmentsAccrued Interest ReceivableIntergovernmental Receivable405,36915,731145,024566,124Total Current Restricted FundsTotal Current FundsLoan FundEquity in InvestmentsNotes Receivable 13,419 2,367,3232,323,49543,828Total Quasi-Endowment FundThe notes to the financial statements are an integral part of this statement.44,372,20712,1951,224Total Loan FundQuasi-Endowment FundEquity in InvestmentsAccrued Interest Receivable

LIABILITIES AND FUND BALANCESCurrent FundsCurrent Unrestricted Funds:Educational and General:Reserve for Encumbrances and Incomplete OrdersAccrued Payroll LiabilitiesCompensated Absences PayableAccrued Faculty Payroll LiabilitiesAccounts PayableFund Balance - Unrestricted 31,864732,994566,794759,98070,756637,876Total Educational and General Auxiliary Enterprises:Accounts PayableDue to Current Funds - Unrestricted - Educational and GeneralFund Balance - Unrestricted2,800,26459,657571,559374,603Total Auxiliary Enterprises1,005,819Total Current Unrestricted Funds3,806,083Current Restricted Funds:Accounts PayableFund Balance - Reserved for EncumbrancesFund Balance - Restricted94,027176,325295,772566,124Total Current Restricted FundsTotal Current FundsLoan FundFund Balance - Unrestricted Total Quasi-Endowment Fund5 4,372,207 13,419 2,367,32313,419Total Loan FundQuasi-Endowment FundDue to Current Funds - Unrestricted - Educational and GeneralFund Balance - UnrestrictedFund Balance - Restricted 10,9571,076,7421,279,624

HOCKING TECHNICAL COLLEGEATHENS COUNTYBALANCE SHEETJUNE 30, 2000(Continued)ASSETSPlant FundsUnexpended Plant Fund:Equity in InvestmentsAccounts Receivable 10,03812,005Total Unexpended Plant Fund Investment in Plant:LandMovable EquipmentBuildingsLibrary HoldingsEquipment Held Under Capital 2746,6761,225,82243,363,954Total Investment in PlantTotal Plant FundsAgency FundsEquity in Pooled Cash 250,825 4,682,495381,48868,8794,232,128Total Hocking College Foundation, Inc.The notes to the financial statements are an integral part of this statement.643,385,997250,825Total Agency FundsHocking College Foundation, Inc.Cash and Investments in Segregated AccountsLandBuildings

LIABILITIES AND FUND BALANCESPlant FundsUnexpended Plant Fund:Fund Balance - Unrestricted 22,043Total Unexpended Plant Fund Investment in Plant:Capital Lease ObligationBond Anticipation Note PayableInterest PayableNet Investment in 954Total Investment in PlantTotal Plant FundsAgency FundsDeposits Held in Custody Total Hocking College Foundation, Inc.743,385,997 250,825 4,682,495250,825Total Agency FundsHocking College Foundation, Inc.Wolfe-Bennett Land Note PayableTaxidermy Lab & Store Note PayableDormitory Note PayableMotel Renovation Note PayableInterest PayableFund Balance - Unrestricted 114,80085,3351,597,299581,95510,3532,292,753

HOCKING TECHNICAL COLLEGEATHENS COUNTYSTATEMENT OF CHANGES IN FUND BALANCESFOR THE FISCAL YEAR ENDED JUNE 30, 2000Current FundsUnrestrictedEducationaland GeneralRevenue and Other AdditionsUnrestricted Current RevenuesState Appropriations - RestrictedFederal Grants and Contracts - Restricted (See Note 6)State Grants and Contracts - RestrictedPrivate Gifts, Grants and Contracts - RestrictedExpended for Library Acquisitions(including charges to Current Fund Expenditures)Expended for Plant Facilities(including charges to Current Fund Expenditures) 30,177,497AuxiliaryEnterprises 30,177,497Total Revenue and Other AdditionsExpenditures and Other DeductionsEducational and General Expenditures (See Note 6)Auxiliary Enterprises ExpendituresExpended for Plant FacilitiesRestricted5,784,737 5,784,73729,931,312 7364,321,99240,057,0405,803,73629,931,312Total Expenditures and Other DeductionsTransfers Among FundsNon-mandatory Transfers for Plant FundsTotal 000)Net Increase (Decrease) for Year(83,815)(18,999)37,775Fund Balance at the Beginning of the Year721,691393,602434,322Fund Balances at the End of the YearTotalCurrentFundsEducationaland General 637,876The notes to the financial statements are an integral part of this statement.8 374,603 472,097(65,039)1,549,615 1,484,576

Plant FundsQuasiEndowmentFundsLoanFunds 116,891Investmentin PlantUnexpended 298,1831,542,479 HockingCollegeFoundation, Inc. 27,720227,474000 ,246286,05038,615,8712,092,50722,043 41,490,450450,000(120,000)450,0002,359,475 186,495(120,000)(3,109)13,4192,554,6692,356,366 9 2,292,753

HOCKING TECHNICAL COLLEGEATHENS COUNTYSTATEMENT OF CURRENT FUNDS REVENUES, EXPENDITURES AND OTHER CHANGESFOR THE FISCAL YEAR ENDED JUNE 30, 2000Current FundsUnrestrictedEducationaland GeneralRevenuesTuition, Fees and Other Student ChargesState AppropriationsFederal Grants and ContractsState Grants and ContractsPrivate Gifts, Grants and ContractsSales and ServicesOther Sources 11,563,44117,446,362AuxiliaryEnterprises 4,50011,283252,460899,451ExpendituresEducational and GeneralInstruction and Departmental ResearchPublic ServiceAcademic SupportStudent ServicesInstitutional SupportOperation and Maintenance of PlantScholarships, Fellowships and ,3191,735,8893,642,259377,111340,397 803,736Auxiliary EnterprisesTotal 0,057,040(330,000)(330,000)Non-Mandatory Transfers to Plant FundsNet Increase (Decrease) in Fund Balances 18,531,625Total Educational and General ExpendituresTotalCurrentFundsEducationaland General5,784,73730,177,497Total RevenuesRestricted (83,815)The notes to the financial statements are an integral part of this statement.10 (18,999) 37,775 (65,039)

HOCKING TECHNICAL COLLEGEATHENS COUNTYNOTES TO THE FINANCIAL STATEMENTSJUNE 30, 20001.DESCRIPTION OF THE COLLEGE AND REPORTING ENTITYA.Description of the CollegeHocking Technical College is a body politic and corporate established for the purpose ofexercising the rights and privileges conveyed to it by the constitution and laws of the State ofOhio.The College was formed after the creation of a technical college district, as defined in Chapter3357 of the Ohio Revised Code. The College operates under the direction of an appointed ninemember Board of Trustees. Three members of this Board are appointed by the Governor of theState of Ohio. The remaining six members are appointed by a caucus of the county, city andexempted village school districts’ Boards of Education that operate in the technical college district.A President is appointed by the Board of Trustees to oversee day-to-day operations of theCollege. An appointed Vice President of Fiscal Operations is the custodian of funds andinvestment officer, and is also responsible for the fiscal control of the resources of the College,which are maintained in the funds described below.The College is an institution of higher learning dedicated to providing the residents of the technicalcollege district with a low-cost higher education in various academic and vocational technologies,leading to a two-year associate degree.B.Reporting EntityThe reporting entity is comprised of the primary government, component units, and otherorganizations that are included to insure that the financial statements of the College are notmisleading. The primary government consists of all funds, departments, boards, and agenciesthat are not legally separate from the College.Component units are legally separate organizations for which the College is financiallyaccountable. The College is financially accountable for an organization if the College appointsa voting majority of the organization’s governing board and (1) the College is able to significantlyinfluence the programs or services performed or provided by the organization; or (2) the Collegeis legally entitled to or can otherwise access the organization’s resources; the College is legallyobligated or has otherwise assumed the responsibility to finance the deficits of, or providefinancial support to, the organization; or the College is obligated for the debt of the organization.Component units may also include organizations that are fiscally dependent on the College in thatthe College approves the budget, the issuance of debt, or the levying of taxes.The following organizations are considered part of the reporting entity of the College and areincluded in the College’s financial statements as Auxiliary Enterprises: Ramada Inn-Hocking ValleyUniglobe TravelThe Hocking College Foundation, Inc., is not a part of the primary government of the College, butdue to its relationship with the College and the requirements of GASB Statement No. 14, it isdiscretely presented as a component unit within the College’s financial statements. TheFoundation is a nonprofit corporation fund-raising organization, dedicated solely to raisingscholarships and other funds for the benefit of the College. Specific disclosures relating to thecomponent unit can be found in Note 16.11

HOCKING TECHNICAL COLLEGEATHENS COUNTYNOTES TO THE FINANCIAL STATEMENTSJUNE 30, 2000(Continued)1.DESCRIPTION OF THE COLLEGE AND REPORTING ENTITY (Continued)B.Reporting Entity (Continued)The Southeast Ohio Probation Treatment Alternative Center (SEPTA) is a legally separateorganization, but is included as an Agency Fund in the financial statements, since the College isthe fiscal agent for them.2.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIESA.Basis of Accounting and PresentationThe financial statements of the College have been prepared in conformity with generally acceptedaccounting principles and the principles of fund accounting for educational institutions. Thestatement of current funds revenues, expenditures, and other changes is a statement of financialactivities of current funds related to the current reporting period. It does not purport to present theresults of operations or the net income or loss of the period as would a statement of income ora statement of revenues and expenses.Fund accounting is a concept in which legal and other restraints require the recording of specificrevenues and expenditures/expenses in separate funds according to those restrictions. Forreporting purposes, funds with similar characteristics are combined into fund groups, and financialtransactions are recorded and reported by such fund groups.Within each fund group, fund balances restricted by outside sources are so indicated and aredistinguished from internally designated and unrestricted funds. Restricted funds may only beutilized in accordance with the purpose established by the source of such funds. Internallydesignated funds are unrestricted funds that, at the discretion of the Board of Trustees, have beendesignated for specific purposes.Unrestricted and internally designated funds are accounted for initially in the unrestricted currentfunds group, and then in the group designated by the Board of Trustees. Restricted revenues areaccounted for in the appropriate restricted fund and are reported as revenues when utilized forcurrent operating purposes. All gains and losses arising from the sale, collection, or otherdisposition of investments and non-cash assets are accounted for in the fund owning such assets.Ordinary income derived from investments, receivables and the like is accounted for in the fundowning such assets.To the extent current funds are used to finance long-term assets, the amounts provided for normalreplacement of equipment, library books, and furniture are accounted for as expenditures.Fund GroupsThe following are descriptions of the College’s fund groups:Current Funds - UnrestrictedThe Current Unrestricted Funds include resources to be used for the primary operations of theCollege and have not been restricted by the Board of Trustees for other purposes. The funds areused to account for transactions relating to the primary and supporting objective of the College.12

HOCKING TECHNICAL COLLEGEATHENS COUNTYNOTES TO THE FINANCIAL STATEMENTSJUNE 30, 2000(Continued)2.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)A.Basis of Accounting and Presentation (Continued)Fund Groups (Continued)Current Fund - RestrictedThe Current Restricted Fund accounts for resources that are available to finance currentoperations of the College but whose use has been restricted by donors and other externalagencies to the specific activity for which they can be expended.Loan FundThe Loan Fund is used to account for loans to students. Loans granted are receivables of thefund until they are repaid. At that time, the money becomes available for new loans. Additionsto these funds are gifts, governmental grants, interest on loans outstanding, and appropriationsfrom other funds. Deductions are the result of notes canceled or written off and certainadministrative expenses related to the loan program.Endowment FundThe Endowment Fund is a fund with respect to which donors, the governing board or other outsideagencies have stipulated, as a condition of the gift instrument, that the principal is to bemaintained inviolate of the gift and in perpetuity and invested for the purpose of producing presentand future income which may be either expended or added to the principal. The College’s onlyendowment fund is a quasi-endowment fund.Plant FundsPlant funds are used to record transactions relating to the College’s plant assets. The Plant Fundgroup consists of (1) funds to be used for the acquisition of physical properties for institutionalpurposes but unexpended at the date of reporting; (2) funds set aside for the renewal andreplacement of institutional properties; and (3) funds expended for and thus invested ininstitutional properties. The Plant Fund group

Hocking Technical College Athens County 3301 Hocking Parkway Nelsonville, Ohio 45764 To the Board of Trustees: We have audited the accompanying financial statements of Hocking Technical College, At hens County, Ohio (the College), as of and for the year ended June 30,