Transcription

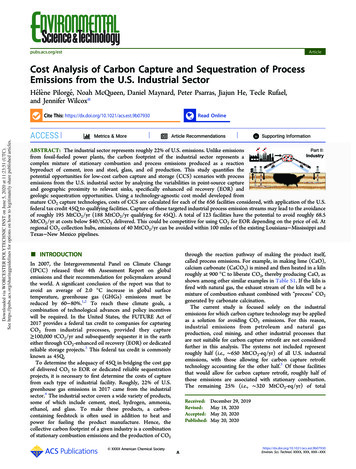

pubs.acs.org/estArticleCost Analysis of Carbon Capture and Sequestration of ProcessEmissions from the U.S. Industrial SectorHeĺ eǹ e Pilorge,́ Noah McQueen, Daniel Maynard, Peter Psarras, Jiajun He, Tecle Rufael,and Jennifer Wilcox*Downloaded via WORCESTER POLYTECHNIC INST on June 5, 2020 at 11:23:51 (UTC).See https://pubs.acs.org/sharingguidelines for options on how to legitimately share published articles.Cite This: trics & MoreRead OnlineArticle Recommendationssı Supporting Information*ABSTRACT: The industrial sector represents roughly 22% of U.S. emissions. Unlike emissionsfrom fossil-fueled power plants, the carbon footprint of the industrial sector represents acomplex mixture of stationary combustion and process emissions produced as a reactionbyproduct of cement, iron and steel, glass, and oil production. This study quantifies thepotential opportunities for low-cost carbon capture and storage (CCS) scenarios with processemissions from the U.S. industrial sector by analyzing the variabilities in point-source captureand geographic proximity to relevant sinks, specifically enhanced oil recovery (EOR) andgeologic sequestration opportunities. Using a technology-agnostic cost model developed frommature CO2 capture technologies, costs of CCS are calculated for each of the 656 facilities considered, with application of the U.S.federal tax credit 45Q to qualifying facilities. Capture of these targeted industrial process emission streams may lead to the avoidanceof roughly 195 MtCO2/yr (188 MtCO2/yr qualifying for 45Q). A total of 123 facilities have the potential to avoid roughly 68.5MtCO2/yr at costs below 40/tCO2 delivered. This could be competitive for using CO2 for EOR depending on the price of oil. Atregional CO2 collection hubs, emissions of 40 MtCO2/yr can be avoided within 100 miles of the existing Louisiana Mississippi andTexas New Mexico pipelines. INTRODUCTIONIn 2007, the Intergovernmental Panel on Climate Change(IPCC) released their 4th Assessment Report on globalemissions and their recommendation for policymakers aroundthe world. A significant conclusion of the report was that toavoid an average of 2.0 C increase in global surfacetemperature, greenhouse gas (GHGs) emissions must bereduced by 60 80%.1,2 To reach these climate goals, acombination of technological advances and policy incentiveswill be required. In the United States, the FUTURE Act of2017 provides a federal tax credit to companies for capturingCO2 from industrial processes, provided they capture 100,000 tCO2/yr and subsequently sequester it in the eartheither through CO2-enhanced oil recovery (EOR) or dedicatedreliable storage projects.3 This federal tax credit is commonlyknown as 45Q.To determine the adequacy of 45Q in bridging the cost gapof delivered CO2 to EOR or dedicated reliable sequestrationprojects, it is necessary to first determine the costs of capturefrom each type of industrial facility. Roughly, 22% of U.S.greenhouse gas emissions in 2017 came from the industrialsector.4 The industrial sector covers a wide variety of products,some of which include cement, steel, hydrogen, ammonia,ethanol, and glass. To make these products, a carboncontaining feedstock is often used in addition to heat andpower for fueling the product manufacture. Hence, thecollective carbon footprint of a given industry is a combinationof stationary combustion emissions and the production of CO2 XXXX American Chemical Societythrough the reaction pathway of making the product itself,called process emissions. For example, in making lime (CaO),calcium carbonate (CaCO3) is mined and then heated in a kilnroughly at 900 C to liberate CO2, thereby producing CaO, asshown among other similar examples in Table S1. If the kiln isfired with natural gas, the exhaust stream of the kiln will be amixture of combustion exhaust combined with “process” CO2generated by carbonate calcination.The current study is focused solely on the industrialemissions for which carbon capture technology may be appliedas a solution for avoiding CO2 emissions. For this reason,industrial emissions from petroleum and natural gasproduction, coal mining, and other industrial processes thatare not suitable for carbon capture retrofit are not consideredfurther in this analysis. The systems not included representroughly half (i.e., 650 MtCO2-eq/yr) of all U.S. industrialemissions, with those allowing for carbon capture retrofittechnology accounting for the other half.3 Of those facilitiesthat would allow for carbon capture retrofit, roughly half ofthose emissions are associated with stationary combustion.The remaining 25% (i.e., 320 MtCO2-eq/yr) of totalReceived:Revised:Accepted:Published:ADecember 29, 2019May 18, 2020May 20, 2020May 20, ron. Sci. Technol. XXXX, XXX, XXX XXX

Environmental Science & Technologypubs.acs.org/estindustrial emissions3 are process emissions to which a givenfacility may use carbon capture technology as a method ofreducing their on-site emissions.Figure 1 shows the distribution of process emissionsassociated with the various industrial sectors that areArticleammonia production. In the iron and steel industry, theauthors noted that the cost of postcombustion amine captureon the blast furnace (with a composition of 20 25% CO2)ranged from 65.1 to 119.2/tCO2 avoided.16,17 Similarly, forrefineries, the cost ranged from 68.2 to 83.9/tCO 2avoided18 20 for the fluid catalytic cracking (FCC) unit withassumed CO2 concentrations ranging from 10 to 20%. Highercosts were reported for capture from combined stacks.21 Forcement production, the authors reported costs ranging from 17.0 to 40.6/tCO2 avoided for oxy-combustion with calciumlooping,17,22,23 with an average cost of 39.4/tCO2 avoided.15The calcium looping systems proved more advantageous thantraditional amine scrubbing technology, which was noted tohave costs from 66.0 to 164.6/tCO2 avoided.17,24,25 Of thesetechnologies, postcombustion amine capture is the mostmature with previous application as a gas treating methoddating back to 1930s, whereas calcium looping processes forpostcombustion capture are relatively new.26 Additional costcomparisons from Leeson et al. were provided for hydrogenproduction and other high-purity industrial streams. Inhydrogen production, the reported costs ranged from 6.0 to 74.0/tCO2 avoided.15,27 29 This can vary widely, dependingon the inlet CO2 concentration and the hydrogen purificationprocess. For these economic analyses, the percent of capturedCO2 ranged from roughly 50% up to 94% capture (specific tooxycombustion capture with chemical looping for CO2 capturefrom the cement industry). With the exception of theaforementioned process, most analyses exhibited capturepercentages between 50 and 65%.When considering all emissions from the industrial sector(e.g., stationary combustion, process emissions, and emissionsfrom waste treatment), roughly 860 facilities out of 1529 couldqualify for 45Q, while only 555 facilities qualify when onlyprocess emissions are considered (Figure 2). Hence, whenconsidering emissions that the facilities can control today, overhalf of the industrial sector does not qualify for the federal taxcredit 45Q. This policy applies to a lower number of facilitieswhen considering that, in the case of facilities with multiplestreams (i.e., refining, hydrogen, ammonia, and iron & steelindustries), it is often uneconomical to apply carbon captureretrofit to each individual stream. Rather, the facility will likelyprioritize higher purity and higher volume streams, which mayrepresent only a fraction of the total facility emissions. Thisstudy quantifies the amount of CO2 that can be captured forthe major streams sourced from each of the sectors of theindustry where carbon capture retrofit is feasible.The primary focus of this study is to determine thecumulative costs of CO2 capture, compression, and transportfrom a given industrial facility to (1) geologic utilization viaEOR or (2) dedicated geologic sequestration of CO2, in thecontiguous United States, in light of the existing federal taxcredit 45Q. In order to determine these costs, a technologyagnostic cost model has been developed for CO2 captureacross gas streams of varying CO2 purity and flow rates.Careful mapping of each of the U.S. industrial facilitiesresponsible for emitting CO2 along with the potentialcorresponding CO2 sink is carried out, which is required foraccurate costing of CO2 transport. Transportation costs aredetermined through the lower cost route among options ofpipeline or trucking. Ultimately, low-end and averagecumulative costs are estimated to determine the remaininggap after application of the 45Q federal tax credit for qualifyingstreams to provide insight into what may be required forFigure 1. Distribution of process emissions associated with variousindustrial sectors, with cement production, bioethanol, refining, ironand steel production, and hydrogen production, collectivelyrepresenting the majority (i.e., 75%).5 9considered in this study. Table S1 lists the process emissionsassociated with each of the sectors represented in Figure 1,along with the corresponding chemical reaction that displaysthe carbon source of the process emissions.5In some cases, alternate pathways exist to lower processemissions but are hindered for technical or economic reasons.As an example, consider H2 production. Globally, 78% of H2 isproduced using steam methane reforming (SMR), while 18%is produced from coal gasification and 4% from waterelectrolysis.10 Of these routes, electrolysis can lower thecarbon intensity of hydrogen production significantly whenpaired with renewable energy. However, because of the highcosts of this route, which has a reported low-end cost of 2.8/kg H211 compared to the low-end cost of SMR at 1/kg H2,12the process is mostly carried out through the more costeffective yet carbon-intensive SMR path, which relies onnatural gas as a feedstock.12 More recently, there has beendevelopment toward the production of H2 through SMRcoupled to carbon capture, which may be cost-competitivewith the conventional approach if the H2 production facilitycan qualify for the federal tax credit 45Q.13In addition, many process emissions are “committed”because of the existing infrastructure associated with theindustrial sector. In the United States, committed emissionsassociated with industrial processes amount to 5800 MtCO2.14This value was determined using country-level emissions datafrom 2018, obtained from the IEA for all reported industrialfacilities. This further assumes a plant lifetime of 40 years,assuming that age distributions and survival curves for eachindustrial facility are the same as their electricity infrastructure.There have been a number of economic analyses carried outon CO2 capture from the industrial sector with costs varyingbroadly based upon the technology and percent capture foreach type of facility. Leeson et al. (2017)15 explored the cost ofcapturing CO2 from a variety of industrial sources based onprevious economic studies. This includes studies of iron andsteel, refineries, cement production, hydrogen production, ron. Sci. Technol. XXXX, XXX, XXX XXX

Environmental Science & Technologypubs.acs.org/estArticlewere collected from the EPA Greenhouse Gas ReportingProgram.4 Here, the major industry emitters include petroleumrefining, bioethanol production, hydrogen production, iron andsteel making, cement and lime production. For bioethanol,additional data were collected from the Nebraska EnergyOffice (NEO), the U.S. Energy Information Administration(EIA), the Ethanol Producer Magazine (EPM), and theRenewable Fuel Association (RFA).5 9In this analysis, only emissions from industrial processesmaking up 1 wt % of the total U.S. CO2 emissions wereconsidered. Additional industrial emissions making up 1 wt %of U.S. emissions were neglected if the emissions wereprimarily composed of a greenhouse gas other than CO2, asthey cannot be captured with the technology we consider. Thisreduces the number of facilities considered in this analysis to656 capture point sources. Further details on the distributionof CO2 emissions considered in this analysis among the variousindustrial sectors are given in Table S2. In addition, the unitsconsidered for capture along with their CO2 emission share atthe facility level and the CO2 purity of their exhaust stream aregiven in Table S3. On the processing units where point-sourcecapture is implemented, 90% capture of CO2 is assumed.The collected data were used to develop cost estimates forcapturing CO2 from the major process units and evaluate theability for these industrial emitters to qualify for the federal taxcredit 45Q. A technology-agnostic cost model is used in thecurrent work for estimating the costs of CO2 capture for singlestream systems and is based on a previous model that wasdeveloped by the authors.34 More details regarding this costmodel are given in the Supporting Information. Additionally,these point sources were mapped with the software ArcGIS(ArcMap 10.6) to determine the proximity to EOR operationsand opportunities for dedicated geological sequestrationprojects. Distances between all sources and the nearest sinkwere determined using straight lines for pipelines and theNetwork Analyst toolbox for trucking and are used in the costmodel. The overlay and proximity toolboxes were used toFigure 2. Industrial facilities that (a) qualify and (b) do not qualifyfor the federal tax credit 45Q, with (blue) and without (orange)stationary combustion, when considering that all process emissionscould be captured.5 9reducing further emissions from the industrial sector.Opportunities below 40/tCO2 are outlined for EOR enduses as the price range of CO2 may be favorable for EORdepending on the current price of oil.30 33 METHODSData were analyzed for major industrial emission sources todetermine the amount of overall process emissions that can becaptured and ultimately reliably sequestered in the earth. DataTable 1. Breakdown of the Number of Facilities and Their Emissions by Industrial Sector, Type of Emissions, and CO2Capture Potential for all Industrial Facilities in the Contiguous U.S. (Nonsupplier of CO2), Industrial Facilities Considered forCapture in This Study, and Facilities Qualifying for the 45Q Tax Creditrefininganumber of facilitiestotal emissions [MtCO2-eq/yr]SCb [MtCO2-eq/yr]PEb [MtCO2-eq/yr]Number of facilitiestotal emissions [MtCO2-eq/yr]SCb [MtCO2-eq/yr]PEb [MtCO2-eq/yr]captured emissions [MtCO2/yr]number of facilitiescaptured emissions [MtCO2/yr]chemicalsbioethanolmetalsAll Facilities in the Continuous U.S. Non-Suppliers of ies Considered for Carbon Capture 3719Facilities Qualifying for the 45Q Tax Credit75621553739243617mineralspulp & 8172000006564732252421951297100458188aRefining category includes the emissions from the refining process and the hydrogen production at refineries. bSC emissions from stationarycombustion; PE process emissions. cProcess emissions from the ethanol industry are not reported by the EPA, the total process emissionsreported by the EPA would thus equal to 256 MtCO2/yr. In addition, this number excludes emissions from wastewater treatment and landfills thatare not studied for point-source carbon capture in this work. Details are available in the Supporting 07930Environ. Sci. Technol. XXXX, XXX, XXX XXX

Environmental Science & Technologypubs.acs.org/estArticleperform a sensitivity analysis around pipelines and sedimentarybasins. RESULTSAreas of Opportunity Associated with Top EmittingIndustries. Emissions from refining (16.6%), bioethanol(14.4%), and cement manufacturing (22.5%) comprise justover half of the U.S. industrial process emissions of CO2considered in this study. In particular, cement production andbioethanol represent unique opportunities because theirprocess emissions are associated with a single reactor exhauststream. Others, such as refining, or iron and steel production,are significantly more complex, having multiple exhauststreams, each with varying levels of CO2 concentration.The total U.S. industrial emissions (including stationarycombustion units) analyzed in the current study isapproximately 606 MtCO2-eq/yr. Of these emissions, abouthalf occur from the chemical processes themselves, whereas theremaining half occur in stationary combustion units. Facilitiesconsidered for CO2 capture retrofit emit 473 MtCO2-eq/yr, ofwhich 242 MtCO2-eq/yr are process emissions. Each processhas a unique potential for capture based on the flow rate andconcentration of CO2 emitted. Capturing 90% of the emissionsfrom the major process unit(s) only has the potential to reduceemissions by 195 MtCO2/yr (Table 1 and Figure S8). Themajor process units associated with each of the primaryindustrial emitters (i.e., cement manufacturing, bioethanol,refining, hydrogen production, ammonia production, and ironand steel production) are described in detail in the SupportingInformation.Technology-Agnostic Cost Model for CO2 Capturefrom Streams of Varying Concentration and FlowRates. The cost of CO2 avoided, measured in dollars pertonne of CO2 separated, compressed, and transportedconsiders all fixed, variable, and capacity-related costs, inaddition to discount rates and the effect of corporate incometaxes that must be incurred in order to deliver one tonne ofpurified CO2. In general, the cost of separation represents 60 80% of the cost of CO2 avoided, with the transportation costhaving the greatest variability because of the varying distancesbetween source and sink. It is well-known that as the CO2concentration increases in a given gas mixture and that theenergy and related costs required for its separation at highpurity decreases. The cost model used in this work is calibratedusing well-known CO2 capture technology costs from powergeneration applications calculated from the IntegratedEnvironmental Control Module (IECM).35 Specifically,IECM provides capital and operating costs of CO2 capturefrom natural gas combined cycle (NGCC), subcriticalpulverized coal combustion (PC), and integrated gasificationcombined cycle (IGCC) systems of various capacities (i.e., netpower outputs), percent capture, and flow rates. Importantly,this approach allows for the adjustment of expected capturecosts for the smaller scale emissions encountered in industrialfacilities. As shown in Figure 3, the cost of CO2 capture isestimated for various industries, assuming 90% capture.Mapping Industrial Emission Sources and PotentialSequestration Opportunities. Figure 4 shows the geographical distribution and the magnitude of the 656 capturepoint sources and the underground injection opportunities,either for EOR or dedicated geologic sequestration. Sequestration opportunities in limestone and sandstone formations havecapacities in the range of 740 1,800,000 MtCO2, adding up toFigure 3. Cost model based upon IECM-generated CO2 capture costsfor NGCC, PC, and IGCC scenarios with varying capacity.Bioethanol is not shown as the exhaust streams of the fermenter ofbioethanol plants are 99 % CO2 pure;36 thus, capture costs forbioethanol are assumed to approach zero; costs reported in constant(2017) dollars.2,740,000 MtCO2 in the contiguous United States. Thefeasibility of CO2 sequestration in appropriate sedimentaryformations, however, relies on the injectivity, which has beennoted in prior work to be greater than 0.25 MtCO2/yr to avoidrisks associated with low-injectivity reservoirs.37 For theopportunities presented in the current work to be realized,the levels associated with industrial emission sources mustalign with the rates of injectivity of the sequestration reservoir

Dec 29, 2019 · 17.0 to 40.6/tCO 2 avoided for oxy-combustion with calcium looping,17,22,23 with an average cost of 39.4/tCO 2 avoided. 15 The calcium looping systems proved more advantageous than traditional amine scrubbing technology, which was noted to have costs from 66.0 to 164.6/tCO 2 avoided.