Transcription

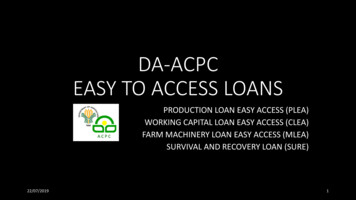

DA-ACPCEASY TO ACCESS LOANSPRODUCTION LOAN EASY ACCESS (PLEA)WORKING CAPITAL LOAN EASY ACCESS (CLEA)FARM MACHINERY LOAN EASY ACCESS (MLEA)SURVIVAL AND RECOVERY LOAN (SURE)22/07/20191

Created in 1986 by virtue of EO 113Attached agency of the DA (E0 116)Mandate Synchronize all agricultural and fisheries credit policies andprograms in support of the DA priority programs (E0 113) Oversee the implementation of the AFMA-AMCFP(ACPC Council Resolution No. 01-1999)AMCFP AMCFP (Sec 21-23 AFMA/RA 8435) ACPC GAA BUDGET FOR AMCFP22/07/20192

Republic Act No. 8435 Agriculture and Fisheries Modernization Act of 1997Section 21. Phase-out of the Directed Credit Programs (DCPs) and Provision for the AgroIndustry Modernization Credit and Financing Program (AMCPP). - The Department shall implementexisting DCPs; however, the Department shall, within a period of four (4) years from the effectivity ofthis Act, phase-out all DCPs and deposit all its loanable funds including those under theComprehensive Agricultural Loan Fund (CALF) including new funds provided by this Act for the AMCFPand transfer the management thereof to cooperative banks, ruralbanks, government financial institutions and viable NGOs for theAgro-Industry Modernization Credit Financing Program (AMCFP).Interest earnings of the said deposited loan funds shall be reverted to the AMCFP.Section 22. Coverage. - An agriculture, fisheries and agrarian reform credit and financing system shallbe designed for thefoodproduction,use and benefit of farmers, fisherfolk, those engaged in food and nonprocessingandtrading,cooperatives, farmers'/fisherfolk'sorganizations, and22/07/2019"beneficiaries"SMEs engaged in agriculture hereinafter referred to in this chapter as the3

REPUBLIC ACT NO. 11260GENERAL APPROPRIATIONS ACTFiscal Year 2019The amount appropriated herein for the Agro-Industry Modernization Credit and FinancingProgram includes the amount of P2.43 Billion which shall be used exclusively for theimplementation of fast, convenient, and affordable financing program throughGFIs, cooperative banks, rural banks, thrift banks, other private banks, for thebenefit of small farmers and fisherfolk and micro, small and medium scaleenterprises engaged in agriculture and fisheries.22/07/2019rcyedra4

EASY ACCESS LOANSPURPOSEProvide easy to access loans to MSFFHOW?Tap LENDING CONDUITS in extending loans to Marginal/Small Farmers Fisherfolk TYPE 1: Those with credit track records with Landbank, other GFIs TYPE 2: Those without credit track record with GFIs but are operating and withMSFF membersLENDING CONDUITS select, evaluate, approve and collect loans from borrowersunder agreed Guidelines with the ACPC.ACPC extends zero cost funds to Lending Conduits that in turn must extend noncollateralized loans at reduced interest rate.22/07/20195

WHAT TYPE OF CONDUITS CAN APPLY COOPERATIVES (CDA Registered)MULTIPURPOSE OR CREDIT COOPS NGOs/ASSOCIATIONSSEC/DOLE-BRW Registered RURAL BANKSCAMEL Rating of 3 or higher LENDING SYSTEM IN PLACE CAN LEND AND COLLECT LOANS ENDORSED BY DA REGIONALOFFICE, ATTACHED AGENCYand/or LGU COOPERATIVE BANKSCAMEL Rating of 3 or higher22/07/20196

ACPC Credit Program Process FlowZero InterestDA RFOM/P LGUsTYPE 1LENDINGCONDUIT/Bank2%-6% InterestEndorsementMSFF/COOPS or ASSOCIATIONS OF MSFF22/07/20197

PROCEDURES –LENDING CONDUITSStep 3: Loan ReleasesStep 2: Approval ofCredit FundStep 1: Application Submit applicationrequirements toACPC Work-out CreditProject Plan withACPC22/07/2019 ACPC evaluates conduit ACPC approves creditfund allocation ACPC transfers creditfund to Conduit’sdeposit account Lending Conduitrequests ACPC forfund release per batchof MSFF ACPC field staff checksEnrollment Forms andPromissory Notes ACPC approveswithdrawal of creditfund Conduit releases loans8

Application RequirementsLending Conduits1. Letter of Intent /Application for Funding withcontact person and contact number2. Notarized Board Resolution authorizing theSFF organizations to apply as LC withauthorized signatories3. Profile of the Organization4. Certified True-Copy of Certificate ofRegistration (CDA/SEC)5. Certificate of Compliance6. 3 years Audited Financial Statements andInterim FS7. Endorsement from LGU and DA-RFO22/07/2019Please address the letter of Intent to:JOCELYN ALMA R. BADIOLAExecutive DirectorAgricultural Credit Policy Council28th Floor, One San Miguel Ave.(OSMA) Building, San Miguel Ave.,Ortigas Center,Pasig City, 1605 Metro Manila9

PRODUCTION LOAN EASY ACCESS (PLEA)PURPOSE OF LOANFinance production of crops, poultry, livestock and fisheriesLOAN AMOUNTUp to P50,000 for short term crops/commoditiesUp to P150,000 for high value crops/long gestating cropsLOAN MATURITY: depends on crop/commodityLOAN PAYMENT SCHEDULELOAN INTEREST: Based on cash flow: 6% per annum not deducted in advanceINSURANCE COVERAGE: Free PCIC Crop Insurance22/07/201910

ELIGIBLE BORROWERS MUST BE MARGINAL/SMALL FARMERS AND FISHERFOLK (MSFF)Small farmer –own, amortize not more than 3 hectares, tenants,leaseholders, stewards or engaged in backyard poultry and livestock(Presidential AO 21- 2011, IRR of RA 8425).Farmworkers (as defined in Sec 3 RA 6657)Fisherfolk –directly or indirectly engaged in fishing, culture, takingprocessing fishery/aquatic resources (AO 21 0f 2011, RA 8425) MUST BE OF GOOD CHARACTER If new, must pass the CI/BI of the Conduit If existing borrower, must have good credit standing ONLY ONE BORROWER PER HOUSEHOLD22/07/201911

OTHER ELIGIBILITY REQUIREMENTSMUST BE REGISTERED/ENROLLED IN THE RSBSAIF BORROWING FROM COOPERATIVES MUST BE A MEMBER OF THE COOPERATIVE SHARE CAPITAL LOAN ORIENTATION/PREMEMBERSHIP SEMINAROTHER REQUIREMENT/S PCIC INSURANCE WHENEVER APPLICABLE22/07/201912

APPLICATION REQUIREMENTS FROM BORROWERS122/07/2019213

PROCEDURES –MSFF BORROWERSStep 3: Loan ReleaseStep 2: ProcessingStep 1: Application Attend orientationmeeting Fill up EnrollmentForm (EF) and LoanApplication (LA)22/07/2019 Lending Conduitevaluates borrower Loan staff conductsCI/BI (for new) Lending Conduitapproves/disapprovesloan Lending Conduitrequests ACPC forfund release for batchof MSFF ACPC staff checksEnrollment Forms andPromissory Notes ACPC approveswithdrawal of creditfund Conduit releases loans14

WORKING CAPITAL LOANLOAN FEATURESPURPOSEFinance working capital requirements oftrading, marketing, processing of agri-fisheriesproductsAMOUNTUp to P 5 MillionFinance ChargesInterest Rate - 6% pa diminishing balanceService Charge – 1% per transactionREPAYMENTELIGIBLE BORROWERSCOOPS/ASSOCIATIONS OF MSFF CDA/SEC/DOLE-BRW Registered No pending case or investigationagainst the organization, its Board andkey officers With management capability toimplement the project With established/firm market andwith existing facilities required for theproject Direct beneficiaries are MSFFAmortized based on cash flow up to 5 yrs22/07/201915

FARM MACHINERY LOANLOAN FEATURESPURPOSEFinance acquisition of machinery, equipmentand/or facilities from production, harvesting topost harvestStand alone – one type of machineryCombo package – set of machinery,equipment, facilitiesLOAN AMOUNTAcquisition cost of machine/equipmentINTEREST RATE2% pa based on diminishing balanceREPAYMENTAmortized based on cash flow up to 10 yrsLOAN SECURITYChattel mortgage of financed machineryPCIC insurance22/07/2019ELIGIBLE BORROWERS INDIVIDUAL BORROWERS (MSFF) ORGANIZATION BORROWERSCoops or Associations of MSFF(CDA/SEC registered) Must pass the following: Good credit standing No adverse finding (no derogatoryrecord with DA /other agencies) With sufficient coverage area Viable business plan (can pay offthe loan)16

SURVIVAL AND RECOVERY LOAN (SURE)LOAN FEATURESELIGIBLE BORROWERSPURPOSEFinance requirements inrehabilitating farming,fishing, livelihood activitiesMSFF affected by calamityLOAN AMOUNTfrom areas declared underP 25,000 per borrowerstate of calamityINTEREST RATEZero percentREPAYMENTBased on capacity up to 3 yrs22/07/201917

It’s our PLEA-SURE to serve you!Salamat po22/07/201918

INSURANCE COVERAGE : Free PCIC Crop Insurance 22/07/2019 10. ELIGIBLE BORROWERS MUST BE MARGINAL/SMALL FARMERS AND FISHERFOLK (MSFF) Small farmer –own, amortize not more than 3 hectares, tenants, leaseholders, stewards or engaged in backyard poultry and livestock